Key Insights

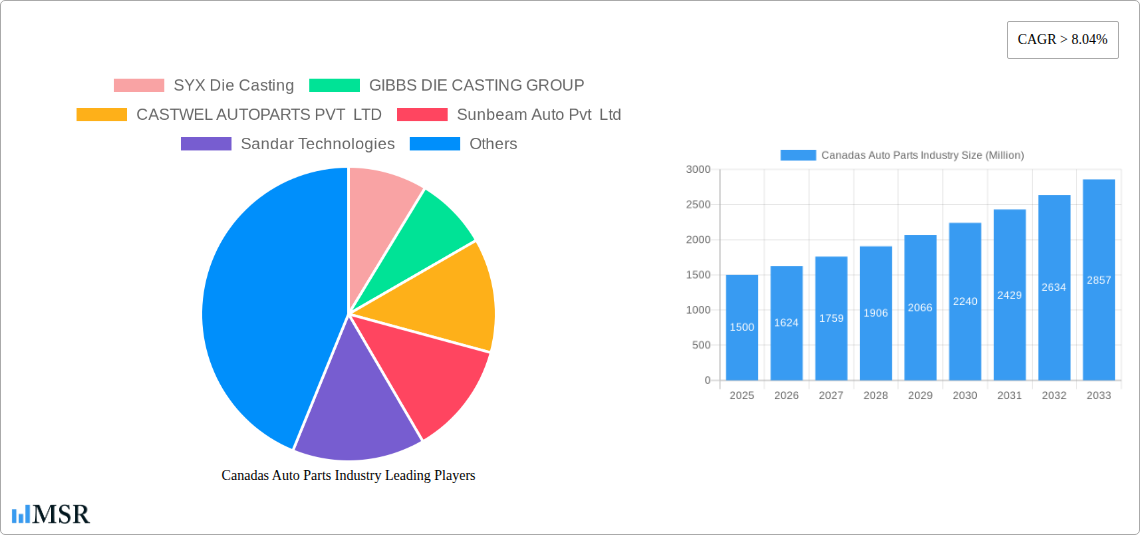

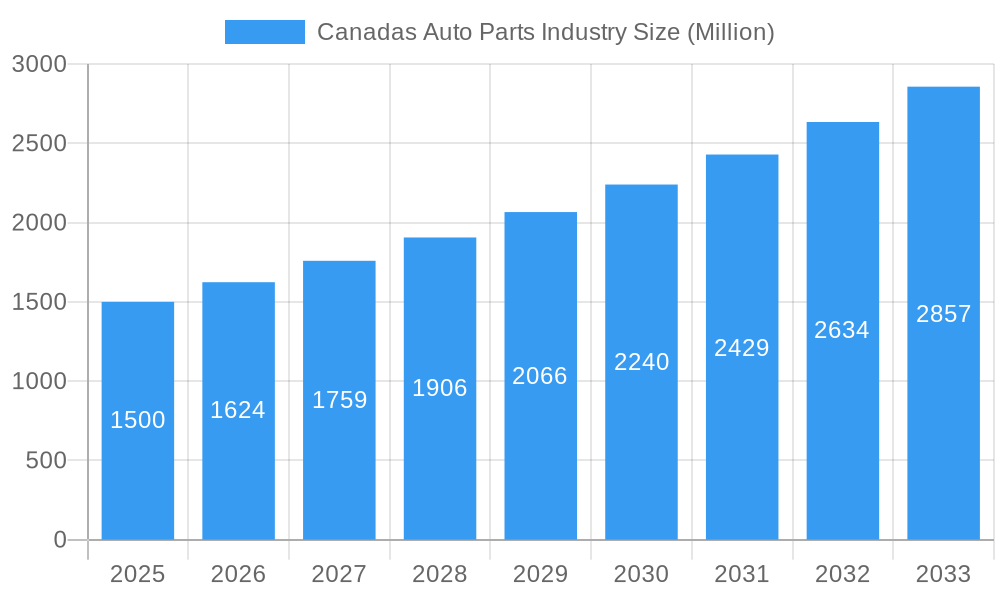

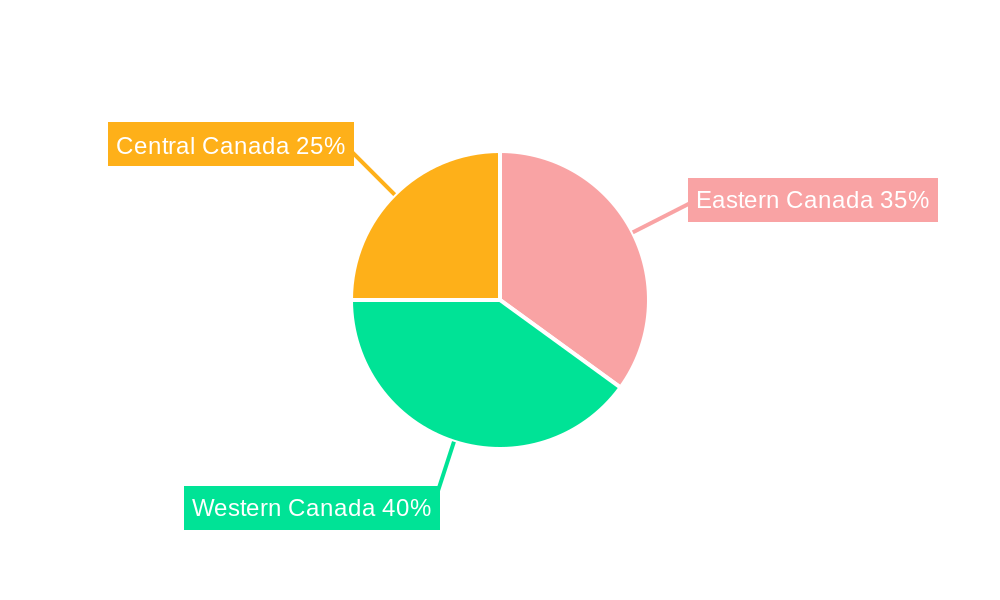

The Canadian automotive parts industry is experiencing robust growth, projecting a Compound Annual Growth Rate (CAGR) of 3.2%. The market size is estimated at 16152.4 million in the base year 2025, indicating a significant and expanding market opportunity. Key growth drivers include increased vehicle production, a rising demand for lightweight materials driven by fuel efficiency mandates, and the widespread adoption of advanced driver-assistance systems (ADAS). The industry is segmented, with aluminum die casting leading raw material adoption due to its superior strength-to-weight ratio. Engine parts and body assembly represent the primary application segments, underscoring the critical role of die casting in essential vehicle components. Pressure die casting is the prevailing manufacturing method, with a gradual increase in sophisticated techniques like vacuum die casting to meet demands for enhanced precision and surface quality. Leading companies such as SYX Die Casting, GIBBS DIE CASTING GROUP, and CASTWEL AUTOPARTS PVT LTD are instrumental in market development through innovation and strategic collaborations. Geographic distribution across Eastern, Western, and Central Canada reflects diverse automotive manufacturing landscapes and consumer preferences, offering targeted market entry possibilities.

Canadas Auto Parts Industry Market Size (In Billion)

Despite challenges like volatile raw material costs and potential supply chain interruptions, the long-term industry outlook remains highly positive. The integration of electric vehicles (EVs) and hybrid electric vehicles (HEVs) is opening new growth sectors, particularly for lightweight components optimized for electric powertrains. Government incentives promoting sustainable transport and advanced manufacturing technologies will further accelerate industry expansion. A thorough grasp of these market dynamics, combined with strategic investments and innovation, is crucial for stakeholders to leverage the anticipated market growth throughout the forecast period (2025-2033). Historical data (2019-2024) confirms a consistent upward trajectory, reinforcing the positive outlook and highlighting the Canadian auto parts sector's strategic importance within the North American automotive industry.

Canadas Auto Parts Industry Company Market Share

Canada's Auto Parts Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of Canada's auto parts industry, offering valuable insights for stakeholders, investors, and industry professionals. The report covers market size, segmentation, key players, industry trends, and future growth opportunities, using data from 2019 to 2024 (Historical Period), with projections extending to 2033 (Forecast Period). The base year for the analysis is 2025, and the estimated year is also 2025. The report utilizes high-ranking keywords to ensure maximum search visibility, including "Canada auto parts market," "Canadian automotive industry," "die casting," "aluminum die casting," and more. Discover actionable insights and strategic recommendations to navigate the dynamic landscape of Canada's automotive parts sector.

Canada's Auto Parts Industry Market Concentration & Dynamics

Canada's auto parts industry exhibits a moderately concentrated market structure, with a few dominant players and numerous smaller specialized firms. The market is characterized by a dynamic interplay of innovation, stringent regulatory frameworks, and the increasing influence of electric vehicle (EV) technology. Substitute products, such as recycled materials and alternative manufacturing processes, are gaining traction, impacting market share. End-user trends towards lighter, more fuel-efficient vehicles and the increasing adoption of advanced driver-assistance systems (ADAS) are reshaping industry dynamics. Mergers and acquisitions (M&A) activity has been moderate, with xx deals recorded between 2019 and 2024, leading to shifts in market share among leading players. For example, the consolidation of xx Million in market share by Company A through acquisition of Company B significantly altered the competitive landscape.

- Market Share: Dominant players hold approximately xx% of the market share.

- M&A Activity: An average of xx M&A deals per year were observed during the historical period (2019-2024).

- Innovation: Significant investments in R&D are driving innovation in lightweight materials and advanced manufacturing techniques.

- Regulatory Framework: Strict environmental regulations and safety standards influence manufacturing processes and material choices.

Canada's Auto Parts Industry Insights & Trends

Canada's auto parts market is expected to witness significant growth, with a CAGR of xx% during the forecast period (2025-2033). This growth is primarily driven by increasing vehicle production, rising consumer spending on automobiles, and the expanding adoption of advanced automotive technologies. The market size is projected to reach xx Million by 2033. Technological disruptions, such as the shift towards EVs and autonomous vehicles, are creating both challenges and opportunities. Evolving consumer preferences for fuel efficiency, safety, and connected car features are further influencing the demand for innovative auto parts. The increasing integration of software and electronics in vehicles is leading to the growth of the electronics segment.

Key Markets & Segments Leading Canada's Auto Parts Industry

The Canadian auto parts market demonstrates regional variations in growth, with Ontario remaining the dominant region due to a high concentration of automotive manufacturing facilities. Within the segmentation analysis:

By Raw Material: Aluminum die casting holds a significant market share due to its lightweight properties and high demand for fuel-efficient vehicles. Other raw materials such as Zinc and Magnesium also contribute significantly. The market size for aluminum is estimated at xx Million in 2025.

By Application Type: Engine parts and body assembly constitute the largest segments, driven by the constant demand for replacement and new vehicle production. Transmission parts and other applications also contribute significantly to the market.

By Production Process Type: Pressure die casting is the dominant production process due to its cost-effectiveness and ability to produce complex shapes. However, the adoption of other processes such as vacuum die casting is increasing, driven by the demand for higher quality and precision.

Drivers for Growth:

- Economic growth and rising disposable incomes.

- Increasing vehicle production and sales.

- Government initiatives promoting the automotive industry.

- Technological advancements in automotive components.

Canada's Auto Parts Industry Product Developments

Recent advancements in materials science and manufacturing processes have led to the development of lighter, stronger, and more fuel-efficient auto parts. The integration of advanced sensors and electronics into parts is also a major trend. Innovations in die casting technologies are enabling the production of complex and intricate components with improved precision. These advancements enhance vehicle performance, safety, and fuel economy, giving manufacturers a competitive edge.

Challenges in the Canada's Auto Parts Industry Market

The Canadian auto parts industry faces several challenges, including fluctuating raw material prices, supply chain disruptions impacting production and delivery timelines, and intense competition from both domestic and international players. Trade policies and environmental regulations add to the complexity of the market. These factors can impact profitability and market share. For instance, a xx% increase in raw material costs in 2022 resulted in a xx Million loss for some industry players.

Forces Driving Canada's Auto Parts Industry Growth

The Canadian auto parts industry is poised for growth due to several factors: increasing vehicle production, particularly in the electric vehicle (EV) sector; government initiatives to support domestic manufacturing; and technological advancements driving innovation in lightweight materials and advanced manufacturing techniques. The growing demand for sophisticated safety features and advanced driver-assistance systems further fuel this growth.

Long-Term Growth Catalysts in Canada's Auto Parts Industry

Long-term growth will be driven by continuous innovation in materials science, leading to lighter and stronger components; strategic partnerships between automakers and parts suppliers; and expansion into new markets, both domestically and internationally. The ongoing shift towards EVs and the associated need for specialized parts presents substantial opportunities.

Emerging Opportunities in Canada's Auto Parts Industry

Emerging opportunities include the growing demand for EV components, the increasing adoption of ADAS, and the development of lightweight materials to improve fuel efficiency. The integration of advanced electronics and software within vehicles also presents significant growth avenues. The focus on sustainability and the circular economy is opening up opportunities for recycled and sustainable materials in auto part manufacturing.

Leading Players in the Canada's Auto Parts Industry Sector

- SYX Die Casting

- GIBBS DIE CASTING GROUP

- CASTWEL AUTOPARTS PVT LTD

- Sunbeam Auto Pvt Ltd

- Sandar Technologies

- Amtek Group

- ECO Die Castings

- Endurance Technologies Ltd

- ALUMINIUM DIE CASTING (CHINA) LTD

- Dynacast Inc

Key Milestones in Canada's Auto Parts Industry

- May 2023: Linamar Corporation announces a new giga casting facility in Welland, Ontario, signifying a significant investment in high-pressure die casting technology and job creation.

- April 2023: Rheinmetall AG and Xiaomi partner to manufacture auto parts using high-pressure die casting, indicating a shift towards advanced manufacturing techniques and international collaborations.

Strategic Outlook for Canada's Auto Parts Industry Market

The Canadian auto parts market presents significant growth potential driven by technological advancements, evolving consumer preferences, and government support. Strategic partnerships, investments in R&D, and a focus on sustainability will be crucial for success. Companies that can adapt to the changing landscape of the automotive industry, particularly the shift towards EVs, will be best positioned to capitalize on future opportunities.

Canadas Auto Parts Industry Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-Solid Die Casting

-

2. Raw Material

- 2.1. Aluminum

- 2.2. Zinc

- 2.3. Magnesium

- 2.4. Other Raw Materials

-

3. Application Type

- 3.1. Body Assembly

- 3.2. Engine Parts

- 3.3. Transmission Parts

- 3.4. Other Applications

Canadas Auto Parts Industry Segmentation By Geography

- 1. Canada

Canadas Auto Parts Industry Regional Market Share

Geographic Coverage of Canadas Auto Parts Industry

Canadas Auto Parts Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Automotive Industry to Drive Demand in the Die Casting Market; Growing Focus Toward Fuel Efficiency of IC Engine Vehicle to Drive Demand

- 3.3. Market Restrains

- 3.3.1. High Processing Cost May Hamper Market Expansion

- 3.4. Market Trends

- 3.4.1. Automotive Segment will Drive The Market In Coming Year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canadas Auto Parts Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-Solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Raw Material

- 5.2.1. Aluminum

- 5.2.2. Zinc

- 5.2.3. Magnesium

- 5.2.4. Other Raw Materials

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Body Assembly

- 5.3.2. Engine Parts

- 5.3.3. Transmission Parts

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SYX Die Casting

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GIBBS DIE CASTING GROUP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CASTWEL AUTOPARTS PVT LTD

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sunbeam Auto Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sandar Technologies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amtek Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ECO Die Castings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Endurance Technologies Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ALUMINIUM DIE CASTING (CHINA) LTD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dynacast Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SYX Die Casting

List of Figures

- Figure 1: Canadas Auto Parts Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Canadas Auto Parts Industry Share (%) by Company 2025

List of Tables

- Table 1: Canadas Auto Parts Industry Revenue million Forecast, by Production Process Type 2020 & 2033

- Table 2: Canadas Auto Parts Industry Revenue million Forecast, by Raw Material 2020 & 2033

- Table 3: Canadas Auto Parts Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 4: Canadas Auto Parts Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Canadas Auto Parts Industry Revenue million Forecast, by Production Process Type 2020 & 2033

- Table 6: Canadas Auto Parts Industry Revenue million Forecast, by Raw Material 2020 & 2033

- Table 7: Canadas Auto Parts Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 8: Canadas Auto Parts Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canadas Auto Parts Industry?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the Canadas Auto Parts Industry?

Key companies in the market include SYX Die Casting, GIBBS DIE CASTING GROUP, CASTWEL AUTOPARTS PVT LTD, Sunbeam Auto Pvt Ltd, Sandar Technologies, Amtek Group, ECO Die Castings, Endurance Technologies Ltd, ALUMINIUM DIE CASTING (CHINA) LTD, Dynacast Inc.

3. What are the main segments of the Canadas Auto Parts Industry?

The market segments include Production Process Type, Raw Material, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 16152.4 million as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Automotive Industry to Drive Demand in the Die Casting Market; Growing Focus Toward Fuel Efficiency of IC Engine Vehicle to Drive Demand.

6. What are the notable trends driving market growth?

Automotive Segment will Drive The Market In Coming Year.

7. Are there any restraints impacting market growth?

High Processing Cost May Hamper Market Expansion.

8. Can you provide examples of recent developments in the market?

May 2023: Linamar Corporation unveiled plans for a cutting-edge giga casting facility in Welland, Ontario. Spanning approximately 300,000 square feet, the plant will create employment for around 200 workers. The facility will house three 6,100-ton high-pressure die-cast machines, with the first installation scheduled for January 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canadas Auto Parts Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canadas Auto Parts Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canadas Auto Parts Industry?

To stay informed about further developments, trends, and reports in the Canadas Auto Parts Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence