Key Insights

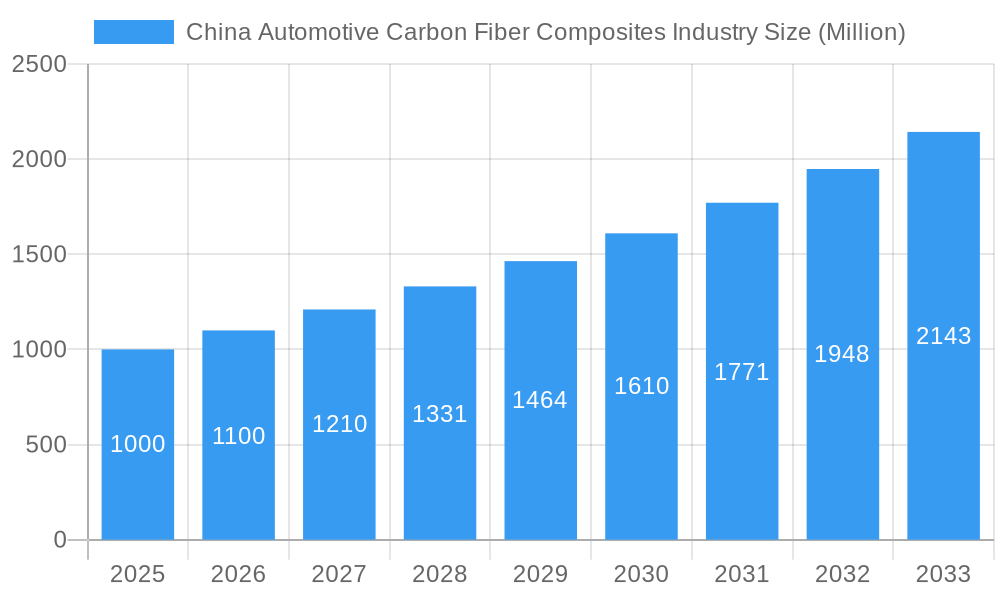

The China automotive carbon fiber composites market is experiencing substantial growth, driven by the increasing adoption of lightweight vehicles to improve fuel efficiency and reduce emissions. The market is projected to reach $11.1 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 14.5% from the 2025 base year. Key growth drivers include China's expanding automotive sector, supportive government policies for sustainable transportation, and advancements in carbon fiber manufacturing that lower costs and enhance performance. Carbon fiber composites are finding diverse applications across automotive structural assemblies, powertrain components, interiors, and exteriors, contributing to market dynamism.

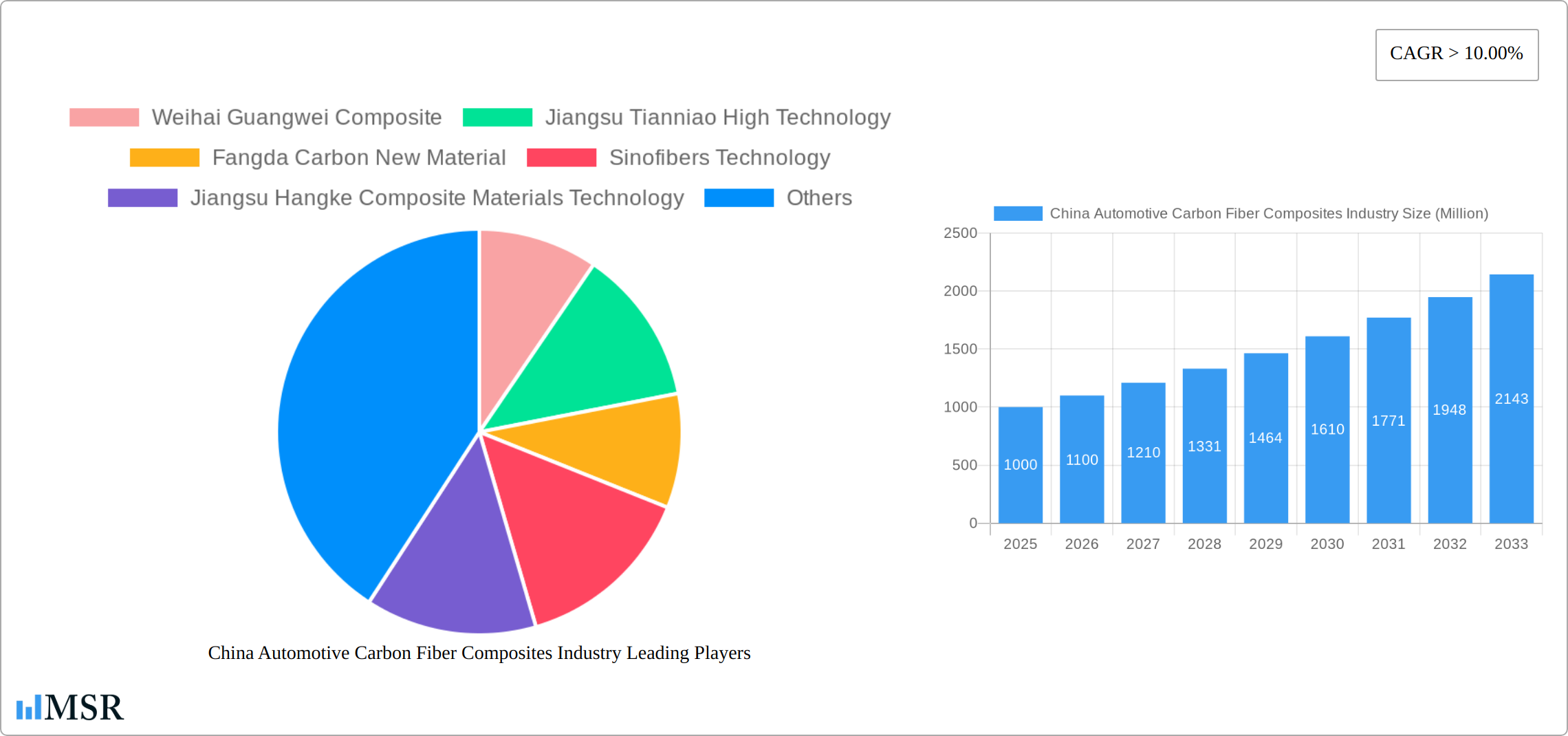

China Automotive Carbon Fiber Composites Industry Market Size (In Billion)

While the market demonstrates significant potential, challenges such as high initial material costs and complex manufacturing processes persist. The availability of skilled labor and the development of robust supply chains are crucial for sustained growth. Intense competition among key players, including Weihai Guangwei Composite, Jiangsu Tianniao High Technology, and Fangda Carbon New Material, fosters innovation and price competitiveness. The long-term outlook remains positive, especially with China's commitment to electric vehicle development and its integral role in the global automotive supply chain. Continued technological advancements are expected to mitigate current restraints throughout the 2025-2033 forecast period, with growth concentrated in high-volume applications where lightweighting benefits are paramount.

China Automotive Carbon Fiber Composites Industry Company Market Share

China Automotive Carbon Fiber Composites Market: Comprehensive Analysis (2025-2033)

This comprehensive report offers in-depth analysis of the China automotive carbon fiber composites market, providing critical insights for stakeholders and investors. Covering the 2025-2033 forecast period with 2025 as the base year, this report meticulously examines market dynamics, key segments, leading players, and future growth opportunities. It delivers actionable intelligence on market size, CAGR, and pivotal trends shaping this evolving sector, with detailed breakdowns of application types (Structural Assembly, Powertrain Components, Interiors, Exteriors), production methods (Hand Layup, Resin Transfer Molding, Vacuum Infusion Processing, Injection Molding, Others), and leading manufacturers.

China Automotive Carbon Fiber Composites Industry Market Concentration & Dynamics

The China automotive carbon fiber composites market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Weihai Guangwei Composite and Jiangsu Tianniao High Technology are amongst the key players, collectively accounting for an estimated xx% of the market in 2025. The industry is characterized by a dynamic innovation ecosystem, with ongoing research and development in advanced materials and manufacturing processes. Stringent government regulations regarding emissions and fuel efficiency are driving demand for lightweight and high-strength carbon fiber composites. Substitute materials like aluminum and steel continue to compete, but carbon fiber's superior performance advantages in certain applications are steadily increasing its adoption rate. End-user preferences are shifting toward higher-performance vehicles, further fueling demand for carbon fiber composites. M&A activity in the sector has been moderate, with approximately xx deals recorded during the historical period (2019-2024), indicating consolidation trends within the industry.

- Market concentration: Moderately concentrated, with top players holding xx% market share in 2025.

- Innovation ecosystem: Active R&D in advanced materials and manufacturing.

- Regulatory framework: Stringent regulations driving demand for lightweight materials.

- Substitute products: Competition from aluminum and steel, but carbon fiber offers performance advantages.

- End-user trends: Growing preference for high-performance vehicles.

- M&A activity: Approximately xx deals during 2019-2024.

China Automotive Carbon Fiber Composites Industry Industry Insights & Trends

The China automotive carbon fiber composites market is experiencing a period of dynamic expansion, primarily propelled by the escalating demand for lighter, more fuel-efficient, and performance-oriented vehicles. While specific market figures are subject to ongoing analysis, the trajectory indicates substantial growth. Technological breakthroughs in both carbon fiber production and intricate composite processing methodologies are continuously driving down costs while simultaneously elevating the performance capabilities of these advanced materials. The accelerated adoption of Electric Vehicles (EVs) is a significant catalyst, as the inherent lightweight nature of carbon fiber composites directly contributes to extended battery range and optimized overall vehicle efficiency. Furthermore, a confluence of evolving consumer preferences for enhanced safety, superior fuel economy, and cutting-edge technological integration is profoundly influencing market expansion. This robust upward trend is intrinsically linked to the prodigious growth of China's automotive sector and is further bolstered by proactive government policies that champion the transition towards sustainable transportation solutions.

Key Markets & Segments Leading China Automotive Carbon Fiber Composites Industry

The China automotive carbon fiber composites market is characterized by a multifaceted landscape of key segments, each exhibiting unique growth drivers and market penetration. A granular analysis reveals a discernible concentration of activity within regions that serve as major automotive manufacturing powerhouses, underscoring the symbiotic relationship between production hubs and material adoption. While comprehensive data on precise regional dominance is continually being refined, preliminary indicators point towards significant market influence in these industrially advanced areas.

Dominant Segments:

- Application Type: The Structural Assembly segment is poised to maintain its leadership position, driven by the critical need for enhanced vehicle integrity, crashworthiness, and substantial weight reduction. Complementing this, Powertrain Components and Exterior Body Panels are also demonstrating robust growth trajectories as manufacturers increasingly leverage carbon fiber composites for their performance and aesthetic benefits.

- Production Type: Manufacturing processes such as Resin Transfer Molding (RTM) and Vacuum Infusion Processing (VIP) are widely adopted due to their proven efficacy in producing intricate, high-quality composite parts with remarkable efficiency and consistency. Emerging techniques are also being explored to further optimize production cycles and material utilization.

Growth Drivers:

- Sustained Economic Growth in China: The nation's continued economic dynamism fuels higher automotive production volumes and robust consumer demand, creating a fertile ground for advanced material adoption.

- Proactive Government Initiatives: Strategic governmental support for sustainable transportation, coupled with increasingly stringent fuel efficiency and emissions standards, directly incentivizes the use of lightweight materials like carbon fiber composites.

- Pioneering Technological Advancements: Ongoing innovations in carbon fiber manufacturing, resin formulation, and composite processing techniques are making these materials more accessible and enhancing their overall performance characteristics for automotive applications.

China Automotive Carbon Fiber Composites Industry Product Developments

The forefront of innovation in the China automotive carbon fiber composites sector is keenly focused on the creation of materials that offer an unparalleled combination of reduced weight, enhanced strength, and improved cost-effectiveness. This relentless pursuit of advancement is manifested in breakthroughs across several critical areas: the development of novel high-performance resin systems that offer superior matrix properties, the design of advanced fiber architectures for optimized load-bearing capabilities, and the refinement of sophisticated manufacturing processes. Techniques like Automated Fiber Placement (AFP) and advanced Tape Laying are being widely implemented, enabling the precise and efficient fabrication of complex components. These collective advancements are instrumental in elevating the performance envelope and broadening the applicability of carbon fiber composites across a diverse range of automotive components. The ultimate benefit for manufacturers lies in their ability to engineer vehicles that are not only lighter and more durable but also exhibit superior performance metrics and significantly improved fuel efficiency, thereby securing a competitive edge in a demanding market.

Challenges in the China Automotive Carbon Fiber Composites Industry Market

The China automotive carbon fiber composites market faces challenges, including high material costs, a complex supply chain, and intense competition from established players and emerging entrants. Stringent regulatory approvals can also pose a hurdle for new product introductions. The high initial investment required for carbon fiber composite manufacturing and the skilled workforce needed represent further hurdles. These factors can collectively limit market penetration and profitability.

Forces Driving China Automotive Carbon Fiber Composites Industry Growth

Several factors drive the growth of the China automotive carbon fiber composites industry. Technological advancements in carbon fiber production and processing lead to lower costs and improved performance. Government support for sustainable transportation through incentives and regulations is crucial. The burgeoning automotive sector in China, with its ever-increasing demand for lightweight vehicles, is a major driver. The growing adoption of electric vehicles adds further impetus to the market.

Long-Term Growth Catalysts in the China Automotive Carbon Fiber Composites Industry

Long-term growth in the China automotive carbon fiber composites industry hinges on continued innovation in materials science and manufacturing. Strategic partnerships between carbon fiber producers, automotive manufacturers, and technology providers will be key. Expansion into new automotive segments and markets, both domestically and internationally, will be crucial for sustained growth. Focus on reducing production costs and improving the recyclability of carbon fiber composites is essential for long-term sustainability.

Emerging Opportunities in China Automotive Carbon Fiber Composites Industry

The landscape of opportunities within the China automotive carbon fiber composites industry is rich and expanding, with significant potential lying in the research and development of novel high-performance carbon fiber materials meticulously engineered for specialized automotive applications. The integration of cutting-edge manufacturing technologies, such as additive manufacturing (3D printing) and advanced automation, presents a compelling avenue for achieving substantial cost reductions and enhancing overall production efficiency. Furthermore, the exploration of new application frontiers within the automotive sector, particularly in the realm of electric vehicles—including their battery packs and lightweight structural elements—promises substantial growth prospects. A critical and increasingly important area of opportunity lies in the development and adoption of sustainable and recyclable carbon fiber composite materials, aligning with global environmental imperatives and circular economy principles.

Leading Players in the China Automotive Carbon Fiber Composites Industry Sector

- Weihai Guangwei Composite

- Jiangsu Tianniao High Technology

- Fangda Carbon New Material

- Sinofibers Technology

- Jiangsu Hangke Composite Materials Technology

- Jiyan High-tech Fibers

- Jiangsu Kangde Xin Composite Material

- Beijing Kangde Xin Composite Material

- Jilin Tangu Carbon

- Jiangsu Hengshen

- Jilin Carbon

- Shandong Weihai Guangwei Composite Co., Ltd.

- Wuxi K-Strong Composites Co., Ltd.

- Zhejiang Kangde Composite Technology Co., Ltd.

- Shenzhen New Great Wall Composite Material Co., Ltd.

- Shanghai Jinze Composite Material Co., Ltd.

Key Milestones in China Automotive Carbon Fiber Composites Industry Industry

- 2020: Introduction of a new high-strength carbon fiber by Jiangsu Tianniao High Technology.

- 2021: Successful completion of a major expansion project by Weihai Guangwei Composite.

- 2022: Partnership between a major automotive manufacturer and a carbon fiber composite supplier for electric vehicle development.

- 2023: Government announcement of new incentives for the adoption of lightweight materials in vehicles. (Further milestones require specific data)

Strategic Outlook for China Automotive Carbon Fiber Composites Industry Market

The future of the China automotive carbon fiber composites market looks promising. Continued innovation, strategic partnerships, and government support will drive sustained growth. The focus on sustainable and cost-effective production methods will be crucial. Expansion into new applications within the automotive sector and exploring export opportunities present a vast potential for market expansion. The industry is poised for significant growth, driven by technological advancements, increasing demand for lightweight and fuel-efficient vehicles, and supportive government policies.

China Automotive Carbon Fiber Composites Industry Segmentation

-

1. Production Type

- 1.1. Hand Layup

- 1.2. Resin Transfer Molding

- 1.3. Vacuum Infusion Processing

- 1.4. Injection Molding

- 1.5. Others

-

2. Application Type

- 2.1. Structural Assembly

- 2.2. Powertrain Components

- 2.3. Interiors

- 2.4. Exteriors

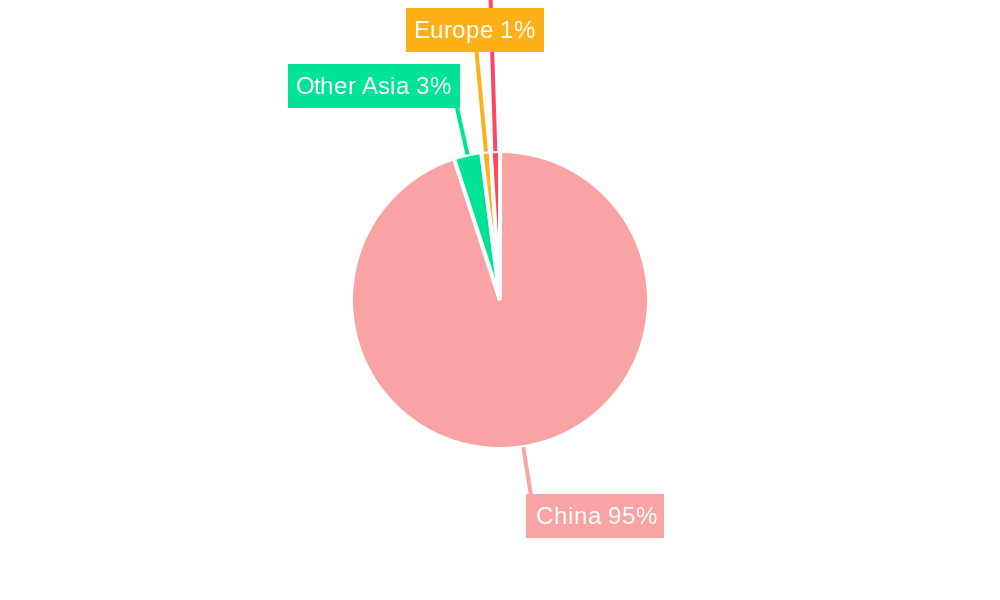

China Automotive Carbon Fiber Composites Industry Segmentation By Geography

- 1. China

China Automotive Carbon Fiber Composites Industry Regional Market Share

Geographic Coverage of China Automotive Carbon Fiber Composites Industry

China Automotive Carbon Fiber Composites Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ease of Steering

- 3.3. Market Restrains

- 3.3.1. Cost and Price Sensitivity

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Carbon Fiber for Greater Fuel Efficiency

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Automotive Carbon Fiber Composites Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 5.1.1. Hand Layup

- 5.1.2. Resin Transfer Molding

- 5.1.3. Vacuum Infusion Processing

- 5.1.4. Injection Molding

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Structural Assembly

- 5.2.2. Powertrain Components

- 5.2.3. Interiors

- 5.2.4. Exteriors

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Weihai Guangwei Composite

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jiangsu Tianniao High Technology

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fangda Carbon New Material

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sinofibers Technology

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jiangsu Hangke Composite Materials Technology

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jiyan High-tech Fibers

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jiangsu Kangde Xin Composite Material

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Beijing Kangde Xin Composite Material

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Jilin Tangu Carbon

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Jiangsu Hengshen

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Jilin Carbon

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Weihai Guangwei Composite

List of Figures

- Figure 1: China Automotive Carbon Fiber Composites Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Automotive Carbon Fiber Composites Industry Share (%) by Company 2025

List of Tables

- Table 1: China Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Production Type 2020 & 2033

- Table 2: China Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: China Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Production Type 2020 & 2033

- Table 5: China Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: China Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Automotive Carbon Fiber Composites Industry?

The projected CAGR is approximately 14.5%.

2. Which companies are prominent players in the China Automotive Carbon Fiber Composites Industry?

Key companies in the market include Weihai Guangwei Composite, Jiangsu Tianniao High Technology, Fangda Carbon New Material, Sinofibers Technology, Jiangsu Hangke Composite Materials Technology, Jiyan High-tech Fibers, Jiangsu Kangde Xin Composite Material, Beijing Kangde Xin Composite Material, Jilin Tangu Carbon, Jiangsu Hengshen, Jilin Carbon.

3. What are the main segments of the China Automotive Carbon Fiber Composites Industry?

The market segments include Production Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Ease of Steering.

6. What are the notable trends driving market growth?

Increasing Adoption of Carbon Fiber for Greater Fuel Efficiency.

7. Are there any restraints impacting market growth?

Cost and Price Sensitivity.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Automotive Carbon Fiber Composites Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Automotive Carbon Fiber Composites Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Automotive Carbon Fiber Composites Industry?

To stay informed about further developments, trends, and reports in the China Automotive Carbon Fiber Composites Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence