Key Insights

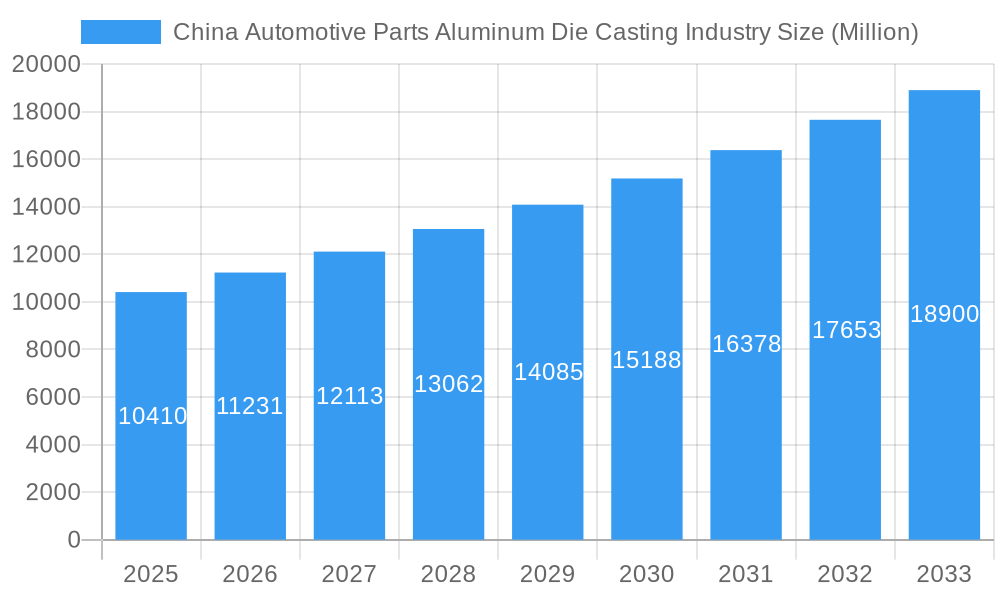

The China automotive parts aluminum die casting industry is experiencing robust growth, projected to reach a market size of $10.41 billion in 2025, exhibiting a compound annual growth rate (CAGR) of 8.26% from 2019 to 2033. This expansion is fueled by several key drivers. The burgeoning Chinese automotive sector, driven by increasing domestic demand and government initiatives promoting electric vehicles (EVs) and hybrid vehicles (HEVs), is a primary catalyst. Aluminum die casting's lightweight nature, superior strength-to-weight ratio, and corrosion resistance make it an ideal material for automotive components, particularly in engine parts, transmission components, and body parts, further boosting market demand. Technological advancements in die casting processes, such as pressure die casting and vacuum die casting, are enhancing production efficiency and improving component quality, further contributing to market growth. Leading players like KSPG AG, Montupet SA, and Nemak are capitalizing on these trends, investing in advanced manufacturing capabilities and strategic partnerships to maintain their competitive edge. However, the industry faces challenges including fluctuating raw material prices, stringent environmental regulations, and intense competition. Despite these restraints, the long-term outlook for the China automotive parts aluminum die casting market remains positive, driven by sustained growth in the automotive sector and ongoing technological innovation. The industry segmentation shows a balanced distribution across various production processes and application types, with engine and transmission parts currently commanding a significant market share. This dynamic market promises substantial opportunities for both established and emerging players in the coming years.

China Automotive Parts Aluminum Die Casting Industry Market Size (In Billion)

The forecast period from 2025 to 2033 anticipates continued strong growth, reflecting the ongoing expansion of the Chinese automotive industry and the increasing adoption of aluminum die casting in automotive components. While precise figures for future years require detailed market research, a conservative estimate suggests a continued CAGR of around 7-8% throughout the forecast period, leading to a substantial market size by 2033. This projection takes into consideration potential fluctuations in the global automotive market, as well as the ongoing technological improvements and investments made by major players in the industry. The geographical concentration in China reflects the country's dominant position in global automotive production, and this is expected to continue influencing the overall market dynamics for the foreseeable future. Understanding the key segments, both by production process and application type, is critical for informed business strategy and investment decisions within this sector.

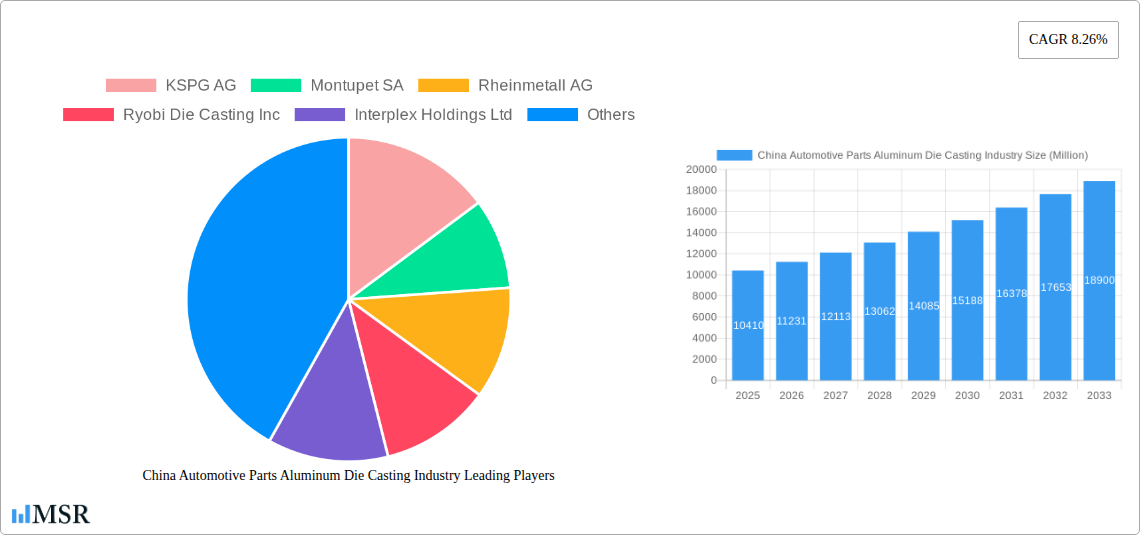

China Automotive Parts Aluminum Die Casting Industry Company Market Share

China Automotive Parts Aluminum Die Casting Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China automotive parts aluminum die casting industry, offering crucial insights for stakeholders, investors, and industry professionals. The report covers market dynamics, leading players, technological advancements, and future growth projections, encompassing the period from 2019 to 2033, with a focus on 2025. The study includes detailed segmentation by production process (pressure die casting, vacuum die casting, squeeze die casting, semi-solid die casting) and application (engine parts, transmission components, body parts, other).

China Automotive Parts Aluminum Die Casting Industry Market Concentration & Dynamics

The China automotive parts aluminum die casting market exhibits a moderately concentrated landscape, with several major players holding significant market share. However, the presence of numerous smaller, regional players contributes to competitive dynamics. Innovation is driven by the need for lighter, stronger, and more cost-effective components, particularly within the burgeoning electric vehicle (EV) sector. Stringent government regulations regarding emissions and fuel efficiency are further shaping the market. Substitute materials, such as plastics and composites, pose some competitive pressure, although aluminum die casting retains advantages in strength and heat dissipation. End-user trends strongly favor lightweighting initiatives to improve vehicle fuel economy and performance. M&A activity is moderate, driven by strategic expansions and technology acquisitions.

- Market Share: The top 5 players hold approximately xx% of the market share in 2025.

- M&A Deal Count: An estimated xx M&A deals occurred within the industry between 2019 and 2024.

- Key Regulatory Frameworks: Focus on emission standards and material efficiency directives significantly impact the industry.

China Automotive Parts Aluminum Die Casting Industry Industry Insights & Trends

The China automotive parts aluminum die casting market is experiencing robust growth, fueled by the country's expanding automotive sector and the increasing demand for lightweight vehicles. The market size reached USD xx Million in 2024 and is projected to reach USD xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as advancements in die casting technology (e.g., high-pressure die casting for larger, complex components) and automation, are driving efficiency gains and enabling the production of intricate parts. Evolving consumer preferences towards fuel-efficient and technologically advanced vehicles are further boosting market demand. Growth is significantly influenced by government incentives for EV adoption and the expansion of charging infrastructure. The increasing adoption of aluminum die casting in EVs further accelerates market expansion. The shift towards larger, more complex castings is also a notable trend.

Key Markets & Segments Leading China Automotive Parts Aluminum Die Casting Industry

The market is predominantly driven by the high demand for automotive parts in the passenger car segment, with the Eastern region showing particularly strong growth. Within production processes, pressure die casting dominates, followed by semi-solid die casting. Engine parts and body parts constitute the major application segments.

- Drivers for Growth:

- Rapid growth of the automotive industry in China.

- Government support for electric vehicle manufacturing.

- Increasing demand for lightweight vehicles.

- Advancements in die casting technology.

- Dominance Analysis: Pressure die casting holds the largest market share due to its cost-effectiveness and suitability for mass production. The engine parts segment leads in application due to the critical need for lightweight, high-strength components in engine blocks and cylinder heads.

China Automotive Parts Aluminum Die Casting Industry Product Developments

Recent product innovations are significantly enhancing the strength, reducing the weight, and refining the surface finish of aluminum die castings. This is achieved through the adoption of advanced high-performance aluminum alloys, the implementation of sophisticated die designs that optimize melt flow and solidification, and the application of cutting-edge surface treatment technologies. These advancements collectively contribute to superior component performance, increased durability, and improved aesthetic appeal. The ongoing development and refinement of high-pressure die casting techniques are enabling the production of larger, more intricate, and structurally integrated parts. This not only reduces the need for multi-component assembly and subsequent joining processes, but also substantially boosts manufacturing efficiency and lowers overall production costs. These continuous innovations are providing manufacturers with significant competitive advantages, allowing them to readily meet and exceed the increasingly stringent performance, safety, and environmental standards mandated by the global automotive industry.

Challenges in the China Automotive Parts Aluminum Die Casting Industry Market

The China automotive parts aluminum die casting industry is currently navigating a complex landscape of challenges. These include the persistent issue of rising raw material costs, particularly for aluminum, and the volatility of energy prices, which directly impact production expenses. Intense domestic and international competition further squeezes profit margins. Sporadic supply chain disruptions, exacerbated by global events, have occasionally hampered production schedules and impacted timely delivery. Furthermore, the intensifying global focus on environmental sustainability necessitates substantial and continuous investment in cleaner, more energy-efficient production processes and advanced waste management systems to comply with evolving environmental regulations regarding emissions and material disposal. These combined factors, alongside the unwavering requirement for consistent, high-quality output and stringent quality control measures, pose significant obstacles to profitability and maintaining a strong market share.

Forces Driving China Automotive Parts Aluminum Die Casting Industry Growth

Several powerful forces are propelling the growth of the China automotive parts aluminum die casting industry. Foremost among these are continuous technological advancements in die casting equipment and process automation, leading to enhanced precision and efficiency. Robust economic growth within China fuels domestic demand for vehicles. A particularly significant driver is the accelerating global adoption of electric vehicles (EVs), which inherently demand lightweight, high-performance aluminum components for battery casings, motor housings, and structural parts. Government support for the automotive sector, coupled with favorable national policies that actively promote vehicle lightweighting to improve fuel efficiency and reduce emissions, further stimulates market expansion. The increasing complexity and sophistication of modern automotive designs, requiring integrated and precisely manufactured components, naturally create a greater demand for the specialized capabilities offered by aluminum die casting.

Challenges in the China Automotive Parts Aluminum Die Casting Industry Market

The China automotive parts aluminum die casting industry is currently navigating a complex landscape of challenges. These include the persistent issue of rising raw material costs, particularly for aluminum, and the volatility of energy prices, which directly impact production expenses. Intense domestic and international competition further squeezes profit margins. Sporadic supply chain disruptions, exacerbated by global events, have occasionally hampered production schedules and impacted timely delivery. Furthermore, the intensifying global focus on environmental sustainability necessitates substantial and continuous investment in cleaner, more energy-efficient production processes and advanced waste management systems to comply with evolving environmental regulations regarding emissions and material disposal. These combined factors, alongside the unwavering requirement for consistent, high-quality output and stringent quality control measures, pose significant obstacles to profitability and maintaining a strong market share.

Emerging Opportunities in China Automotive Parts Aluminum Die Casting Industry

The landscape of emerging opportunities within the China automotive parts aluminum die casting industry is particularly promising, especially within the rapidly expanding electric vehicle (EV) market. This sector presents a significant demand for lightweight, high-strength, and thermally efficient components such as advanced battery enclosures, lightweight structural elements, and integrated motor housings. The ongoing development and application of novel aluminum alloys with enhanced mechanical properties, improved corrosion resistance, and superior thermal conductivity will unlock new application potential and allow for more demanding designs. Furthermore, the adoption of advanced surface treatments, including specialized coatings for wear resistance, thermal management, and aesthetic appeal, offers further avenues for product differentiation and value creation. Strategic diversification by expanding into adjacent high-growth sectors like aerospace, where lightweighting is critical, and the consumer electronics industry, which increasingly utilizes aluminum for its premium feel and thermal dissipation properties, can provide significant diversification opportunities and buffer against market fluctuations.

Leading Players in the China Automotive Parts Aluminum Die Casting Industry Sector

- KSPG AG

- Montupet SA

- Rheinmetall AG

- Ryobi Die Casting Inc

- Interplex Holdings Ltd

- Nemak

- Sandhar Group

- Linamar Corporation

- Shiloh Industries

- Alcoa Inc

- Faist Group

- George Fischer Ltd

- Koch Enterprises

Key Milestones in China Automotive Parts Aluminum Die Casting Industry Industry

- August 2023: Dongfeng Electronic Technology Co., Ltd. announced plans to invest USD 192.4 Million in 3-in-1 and 5-in-1 die-casting technology for EV powertrains.

- April 2023: Rheinmetall AG partnered with Xiaomi to produce high-pressure die-cast suspension components for EVs.

- March 2022: Georg Fischer Casting Solutions opened a new plant in Shenyang, China.

Strategic Outlook for China Automotive Parts Aluminum Die Casting Industry Market

The strategic outlook for the China automotive parts aluminum die casting industry is exceptionally bright, underpinned by sustained, robust growth in the global and domestic automotive sectors and relentless technological advancements. Key strategic opportunities reside in proactively embracing and integrating innovations across the entire value chain, from advanced materials and intelligent manufacturing to sustainable practices. Fostering deep, collaborative strategic partnerships with key stakeholders, including raw material providers, equipment manufacturers, and automotive OEMs, will be vital for navigating market complexities and unlocking synergistic growth. Capitalizing on the escalating global demand for lightweight, high-performance, and increasingly complex components, particularly in EVs and other emerging transportation and technology sectors, is paramount. Companies that prioritize substantial investment in cutting-edge research and development, demonstrably adopt and promote sustainable manufacturing practices, and proactively build resilient and agile supply chain networks are exceptionally well-positioned for enduring long-term success and market leadership in this dynamic industry.

China Automotive Parts Aluminum Die Casting Industry Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-solid Die Casting

-

2. Application Type

- 2.1. Engine Parts

- 2.2. Transmission Components

- 2.3. Body Parts

- 2.4. Other Application Types

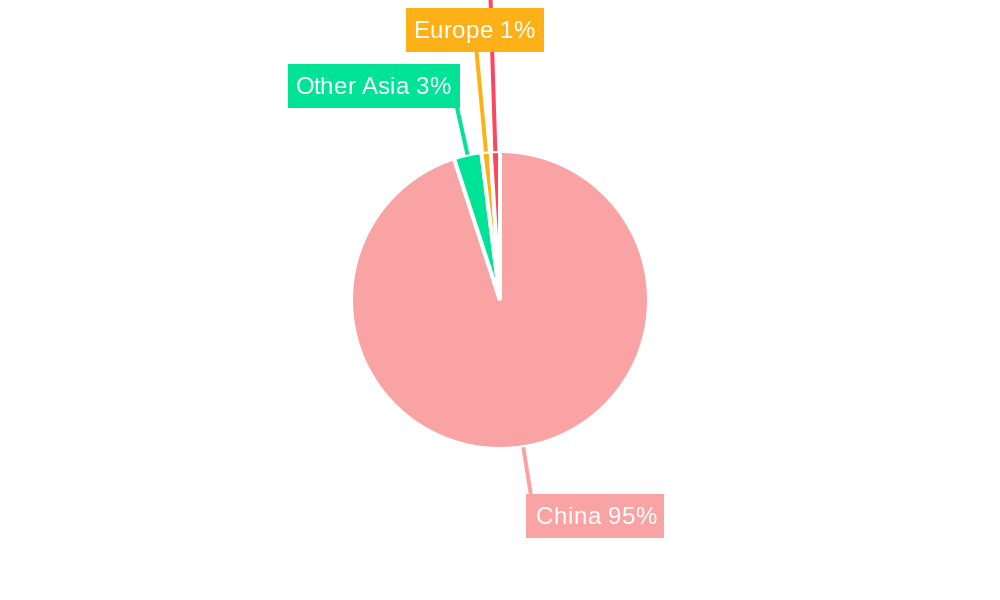

China Automotive Parts Aluminum Die Casting Industry Segmentation By Geography

- 1. China

China Automotive Parts Aluminum Die Casting Industry Regional Market Share

Geographic Coverage of China Automotive Parts Aluminum Die Casting Industry

China Automotive Parts Aluminum Die Casting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Use of Lightweight Material in the Automotive Industry to Drives the Market

- 3.3. Market Restrains

- 3.3.1. Rising Aluminum Prices Hindering the Market Growth -

- 3.4. Market Trends

- 3.4.1. Body Parts Segment is Expected to Register High Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Automotive Parts Aluminum Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Engine Parts

- 5.2.2. Transmission Components

- 5.2.3. Body Parts

- 5.2.4. Other Application Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 KSPG AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Montupet SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rheinmetall AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ryobi Die Casting Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Interplex Holdings Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nemak

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sandhar Group*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Linamar Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shiloh Industries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Alcoa Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Faist Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 George Fischer Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Koch Enterprises

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 KSPG AG

List of Figures

- Figure 1: China Automotive Parts Aluminum Die Casting Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Automotive Parts Aluminum Die Casting Industry Share (%) by Company 2025

List of Tables

- Table 1: China Automotive Parts Aluminum Die Casting Industry Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 2: China Automotive Parts Aluminum Die Casting Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 3: China Automotive Parts Aluminum Die Casting Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Automotive Parts Aluminum Die Casting Industry Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 5: China Automotive Parts Aluminum Die Casting Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 6: China Automotive Parts Aluminum Die Casting Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Automotive Parts Aluminum Die Casting Industry?

The projected CAGR is approximately 8.26%.

2. Which companies are prominent players in the China Automotive Parts Aluminum Die Casting Industry?

Key companies in the market include KSPG AG, Montupet SA, Rheinmetall AG, Ryobi Die Casting Inc, Interplex Holdings Ltd, Nemak, Sandhar Group*List Not Exhaustive, Linamar Corporation, Shiloh Industries, Alcoa Inc, Faist Group, George Fischer Ltd, Koch Enterprises.

3. What are the main segments of the China Automotive Parts Aluminum Die Casting Industry?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Use of Lightweight Material in the Automotive Industry to Drives the Market.

6. What are the notable trends driving market growth?

Body Parts Segment is Expected to Register High Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

Rising Aluminum Prices Hindering the Market Growth -.

8. Can you provide examples of recent developments in the market?

August 2023: Dongfeng Electronic Technology Co., Ltd. announced its plans to raise CNY 1.4 billion (USD 192.4 million). The fund is scheduled to transform 3-in-1 and 5-in-1 die-casting technology and improve the manufacturing capacity of EV powertrain and core components.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Automotive Parts Aluminum Die Casting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Automotive Parts Aluminum Die Casting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Automotive Parts Aluminum Die Casting Industry?

To stay informed about further developments, trends, and reports in the China Automotive Parts Aluminum Die Casting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence