Key Insights

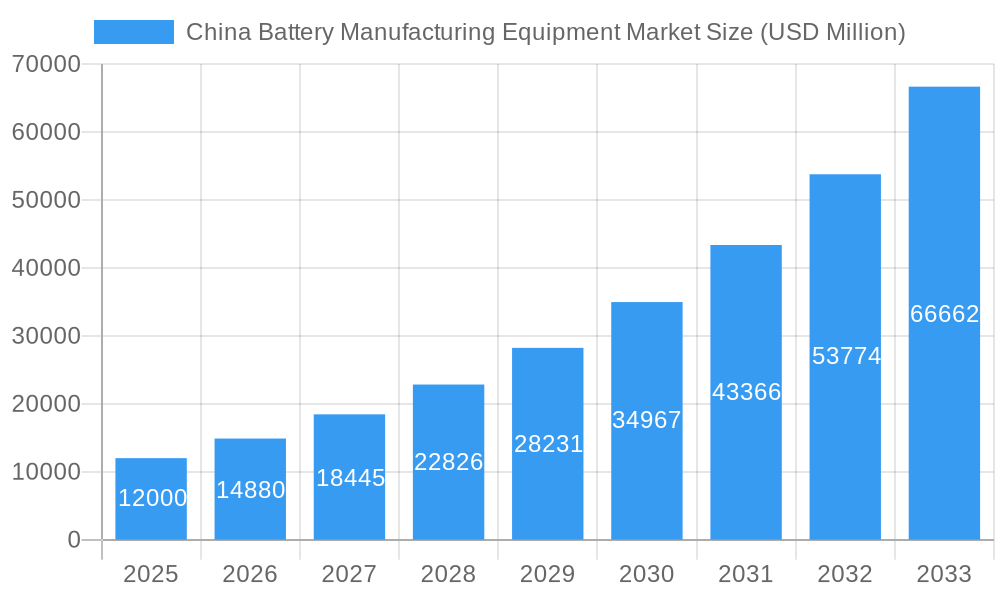

The China battery manufacturing equipment market is experiencing robust growth, projected to reach USD 12,000 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 24% from 2025 to 2033. This expansion is fueled by the booming electric vehicle (EV) sector and the increasing demand for energy storage solutions within China. Key drivers include government initiatives promoting renewable energy and stringent emission regulations driving the adoption of EVs. Technological advancements in battery production, such as improved automation and higher energy density battery chemistries, are further accelerating market growth. The market is segmented by machine type, encompassing coating & drying, calendaring, slitting, mixing, electrode stacking, assembly & handling, and formation & testing equipment. End-user applications span the automotive, industrial, and other sectors, with the automotive industry currently dominating the demand. Leading players like Xiamen TOB, Xiamen Lith Machine, Hitachi, Schuler AG, and Durr AG are shaping the competitive landscape through continuous innovation and strategic partnerships. While specific challenges regarding supply chain disruptions and raw material costs exist, the overall market outlook remains overwhelmingly positive, indicating substantial long-term growth potential.

China Battery Manufacturing Equipment Market Market Size (In Billion)

The significant market size and high CAGR suggest considerable investment opportunities for both established players and new entrants. However, success hinges on adaptability to evolving technological demands and the ability to navigate potential supply chain constraints. Companies focused on automation, efficiency improvements, and the development of equipment compatible with next-generation battery technologies will be best positioned for sustained growth within this dynamic and competitive market. The concentration of market activity in China underscores the nation's role as a pivotal hub for battery manufacturing and innovation. Future growth will be influenced by advancements in battery technology, evolving government policies, and the overall trajectory of the global EV and renewable energy markets.

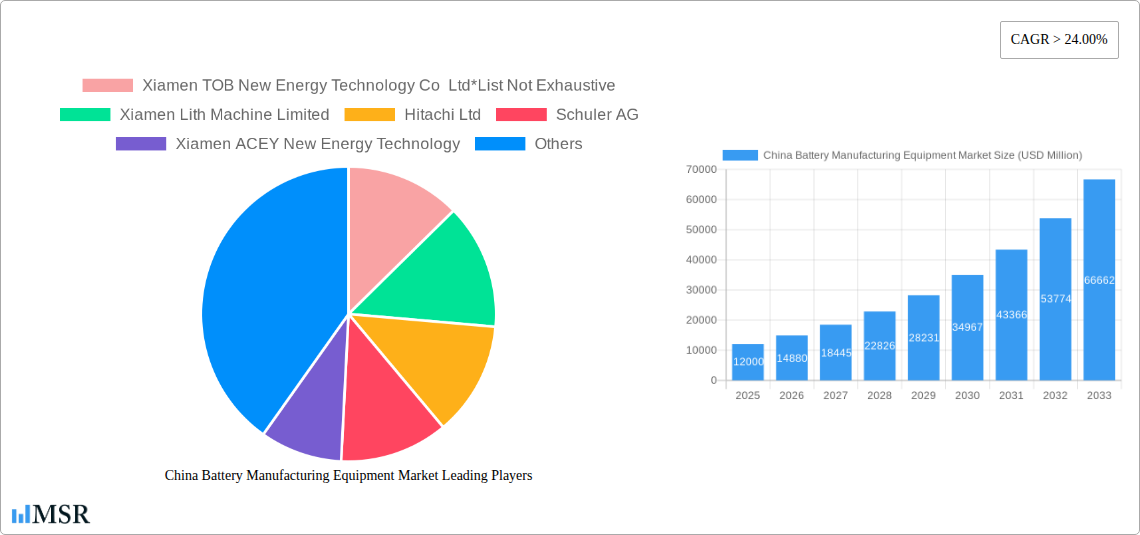

China Battery Manufacturing Equipment Market Company Market Share

China Battery Manufacturing Equipment Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning China Battery Manufacturing Equipment Market, offering crucial insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025, this study unveils market dynamics, growth drivers, and future opportunities within this rapidly evolving sector. The market is segmented by machine type (Coating & Dryer, Calendaring, Slitting, Mixing, Electrode Stacking, Assembly & Handling Machines, Formation & Testing Machines) and end-user (Automotive, Industrial, Other End Users). Key players analyzed include Xiamen TOB New Energy Technology Co Ltd, Xiamen Lith Machine Limited, Hitachi Ltd, Schuler AG, Xiamen ACEY New Energy Technology, Durr AG, Wuxi Lead Intelligent Equipment Co Ltd, Andritz AG, Xiamen Tmax Battery Equipments Limited, and Manz AG. The report projects a market value of xx USD Million in 2025, with a CAGR of xx% during the forecast period (2025-2033).

China Battery Manufacturing Equipment Market Concentration & Dynamics

The China Battery Manufacturing Equipment market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller, specialized companies fosters a dynamic competitive environment. Innovation is a key driver, with continuous advancements in automation, precision, and efficiency shaping the market. The regulatory framework, while supportive of the EV industry, is constantly evolving, impacting equipment standards and safety regulations. Substitute products are limited, primarily focusing on alternative manufacturing processes rather than direct replacements. End-user trends are heavily influenced by the rapid growth of the electric vehicle (EV) sector and the increasing demand for energy storage solutions. Mergers and acquisitions (M&A) activity is relatively high, reflecting industry consolidation and the pursuit of technological capabilities.

- Market Share: Top 5 players hold approximately xx% of the market share in 2025.

- M&A Activity: An estimated xx M&A deals occurred between 2019 and 2024.

- Innovation Ecosystem: Strong government support for R&D in battery technology fuels innovation.

- Regulatory Landscape: Stringent safety and environmental standards influence equipment choices.

China Battery Manufacturing Equipment Market Industry Insights & Trends

The China Battery Manufacturing Equipment market is experiencing phenomenal growth, fueled by the explosive demand for electric vehicles (EVs) and energy storage systems (ESS). The market size reached xx USD Million in 2024 and is projected to reach xx USD Million by 2025, exhibiting a strong compound annual growth rate (CAGR) of xx% during the historical period (2019-2024) and xx% during the forecast period (2025-2033). Technological advancements, such as automation and AI-powered process optimization, are driving efficiency and reducing production costs. Consumer preferences for environmentally friendly vehicles and energy solutions further underpin market expansion. Government incentives and supportive policies are also significantly impacting growth. The rising adoption of lithium-ion batteries across various sectors, including renewable energy storage, contributes to the market's expansion. Challenges such as supply chain disruptions and price volatility for raw materials present headwinds, yet the overall growth trajectory remains strongly positive.

Key Markets & Segments Leading China Battery Manufacturing Equipment Market

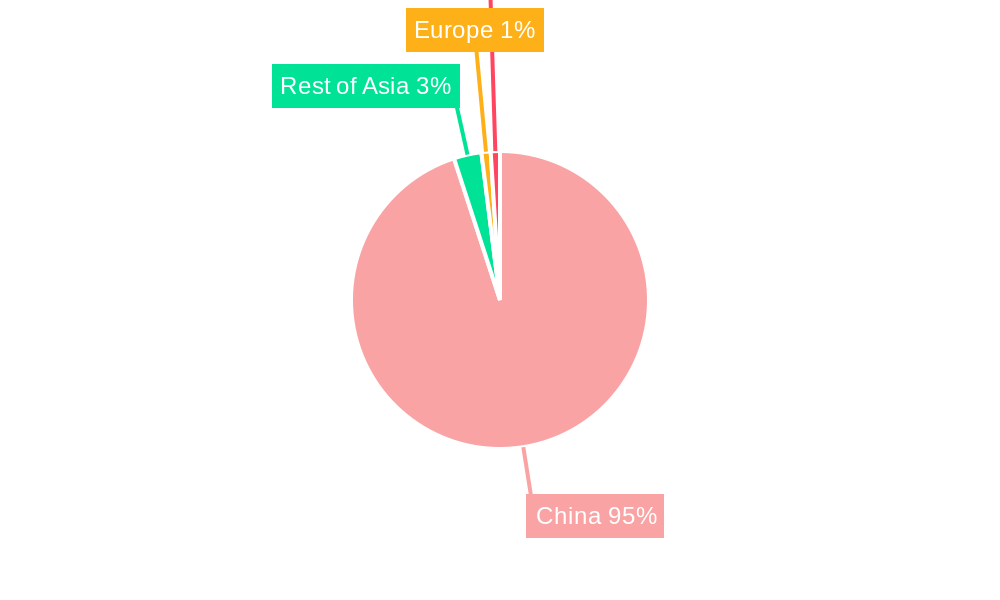

The Automotive segment dominates the end-user market, driven by the rapid expansion of the EV industry in China. The Coating & Dryer, and Assembly & Handling Machines segments are the leading machine types, reflecting the critical role these play in battery production. Geographically, the market is concentrated in key manufacturing hubs, with provinces like Guangdong and Zhejiang leading due to their established automotive and technology industries.

- Dominant Segment: Automotive end-user segment accounts for over xx% of the market.

- Leading Machine Type: Coating & Dryer machines hold the largest market share.

- Key Regional Drivers:

- Guangdong: Strong automotive industry presence and government support.

- Zhejiang: Thriving EV manufacturing sector and advanced technology clusters.

- Other Regions: Significant growth is expected in other regions with developing EV manufacturing bases.

China Battery Manufacturing Equipment Market Product Developments

Significant advancements are being witnessed in battery manufacturing equipment, focusing on increased automation, precision, and efficiency. Innovations include AI-powered quality control systems, high-speed assembly lines, and advanced materials handling systems. These developments contribute to reduced production costs, enhanced output, and improved battery performance. The market is witnessing a trend toward modular and flexible equipment designs to accommodate diverse battery chemistries and production scales. The integration of Industry 4.0 technologies enhances data analytics and predictive maintenance, leading to improved operational efficiency and reduced downtime.

Challenges in the China Battery Manufacturing Equipment Market

The market faces challenges including supply chain disruptions impacting the availability of crucial components, intense price competition among manufacturers, and the potential for regulatory changes affecting equipment standards. These factors can result in production delays, increased costs, and reduced profitability for companies in the sector. The need for skilled labor and technical expertise also represents a constraint on growth.

Forces Driving China Battery Manufacturing Equipment Market Growth

Several factors contribute to the growth of the China Battery Manufacturing Equipment market. The government's strong push for electric vehicle adoption and the expansion of renewable energy infrastructure create significant demand for battery manufacturing capabilities. Technological advancements leading to increased automation, improved efficiency, and reduced production costs further boost the market. Furthermore, substantial investments by both domestic and international companies in battery manufacturing facilities are fueling equipment demand.

Long-Term Growth Catalysts in China Battery Manufacturing Equipment Market

Long-term growth will be driven by continued innovation in battery technology, leading to higher energy density, longer lifespan, and improved safety. Strategic partnerships between equipment manufacturers and battery producers will ensure the development and deployment of cutting-edge solutions. Expansion into new markets and applications, such as grid-scale energy storage, will also fuel market growth.

Emerging Opportunities in China Battery Manufacturing Equipment Market

Emerging opportunities lie in the development of equipment for next-generation battery technologies like solid-state batteries and advanced materials processing. The integration of digital technologies and data analytics for predictive maintenance and optimized production processes presents significant opportunities. Expanding into international markets and servicing the growing global demand for battery manufacturing equipment also offers substantial potential.

Leading Players in the China Battery Manufacturing Equipment Sector

- Hitachi Ltd

- Schuler AG

- Durr AG

- Andritz AG

- Manz AG

- Xiamen TOB New Energy Technology Co Ltd

- Xiamen Lith Machine Limited

- Xiamen ACEY New Energy Technology

- Wuxi Lead Intelligent Equipment Co Ltd

- Xiamen Tmax Battery Equipments Limited

Key Milestones in China Battery Manufacturing Equipment Industry

- December 2022: GAC announces USD 1.561 billion investment in a new 6 GWh electric car battery production facility in Guangzhou, scheduled to begin operations in March 2024.

- November 2022: BYD announces expansion of battery production capacity with a new 20 GWh plant in Wenzhou, Zhejiang province, starting production in 2024.

Strategic Outlook for China Battery Manufacturing Equipment Market

The China Battery Manufacturing Equipment market is poised for sustained growth, driven by the continued expansion of the EV industry and the increasing demand for energy storage solutions. Strategic opportunities exist for companies that can innovate and adapt to the evolving technological landscape, focusing on automation, efficiency, and sustainability. Partnerships and collaborations will play a key role in unlocking new markets and developing advanced technologies. The market’s future success hinges on the ability of companies to meet the rising demand while navigating challenges related to supply chain management, cost pressures, and regulatory compliance.

China Battery Manufacturing Equipment Market Segmentation

-

1. Machine Type

- 1.1. Coating & Dryer

- 1.2. Calendaring

- 1.3. Slitting

- 1.4. Mixing

- 1.5. Electrode Stacking

- 1.6. Assembly & Handling Machines

- 1.7. Formation & Testing Machines

-

2. End User

- 2.1. Automotive

- 2.2. Industrial

- 2.3. Other End Users

China Battery Manufacturing Equipment Market Segmentation By Geography

- 1. China

China Battery Manufacturing Equipment Market Regional Market Share

Geographic Coverage of China Battery Manufacturing Equipment Market

China Battery Manufacturing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 24.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Lithium Batteries4.; Increased Adoption of Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Mismatch in Demand and Supply of Raw Materials for Battery Manufacturing

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 5.1.1. Coating & Dryer

- 5.1.2. Calendaring

- 5.1.3. Slitting

- 5.1.4. Mixing

- 5.1.5. Electrode Stacking

- 5.1.6. Assembly & Handling Machines

- 5.1.7. Formation & Testing Machines

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Industrial

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Xiamen TOB New Energy Technology Co Ltd*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xiamen Lith Machine Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schuler AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Xiamen ACEY New Energy Technology

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Durr AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wuxi Lead Intelligent Equipment Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Andritz AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Xiamen Tmax Battery Equipments Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Manz AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Xiamen TOB New Energy Technology Co Ltd*List Not Exhaustive

List of Figures

- Figure 1: China Battery Manufacturing Equipment Market Revenue Breakdown (USD Million, %) by Product 2025 & 2033

- Figure 2: China Battery Manufacturing Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by Machine Type 2020 & 2033

- Table 2: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Machine Type 2020 & 2033

- Table 3: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by End User 2020 & 2033

- Table 4: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 5: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by Region 2020 & 2033

- Table 6: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 7: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by Machine Type 2020 & 2033

- Table 8: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Machine Type 2020 & 2033

- Table 9: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by End User 2020 & 2033

- Table 10: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by End User 2020 & 2033

- Table 11: China Battery Manufacturing Equipment Market Revenue USD Million Forecast, by Country 2020 & 2033

- Table 12: China Battery Manufacturing Equipment Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Battery Manufacturing Equipment Market?

The projected CAGR is approximately > 24.00%.

2. Which companies are prominent players in the China Battery Manufacturing Equipment Market?

Key companies in the market include Xiamen TOB New Energy Technology Co Ltd*List Not Exhaustive, Xiamen Lith Machine Limited, Hitachi Ltd, Schuler AG, Xiamen ACEY New Energy Technology, Durr AG, Wuxi Lead Intelligent Equipment Co Ltd, Andritz AG, Xiamen Tmax Battery Equipments Limited, Manz AG.

3. What are the main segments of the China Battery Manufacturing Equipment Market?

The market segments include Machine Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 12000 USD Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Lithium Batteries4.; Increased Adoption of Renewable Energy.

6. What are the notable trends driving market growth?

Automotive Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Mismatch in Demand and Supply of Raw Materials for Battery Manufacturing.

8. Can you provide examples of recent developments in the market?

In December 2022, the Chinese car company GAC announced that they had started building a production facility for electric car batteries in Guangzhou. With a total investment of USD 1.561 billion, the new factory is scheduled to operate in March 2024 with an annual production capacity of 6 GWh.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in USD Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Battery Manufacturing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Battery Manufacturing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Battery Manufacturing Equipment Market?

To stay informed about further developments, trends, and reports in the China Battery Manufacturing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence