Key Insights

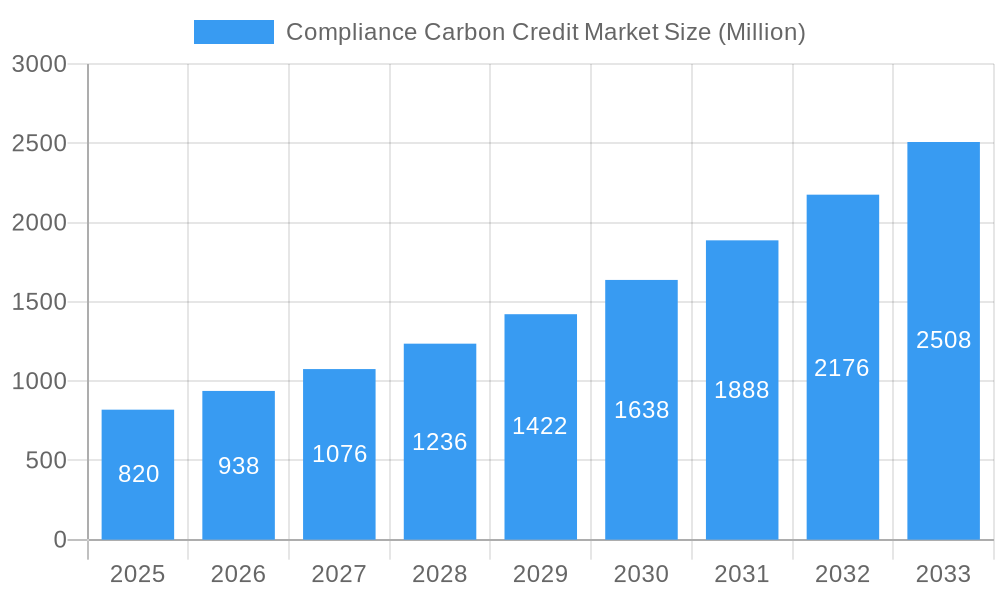

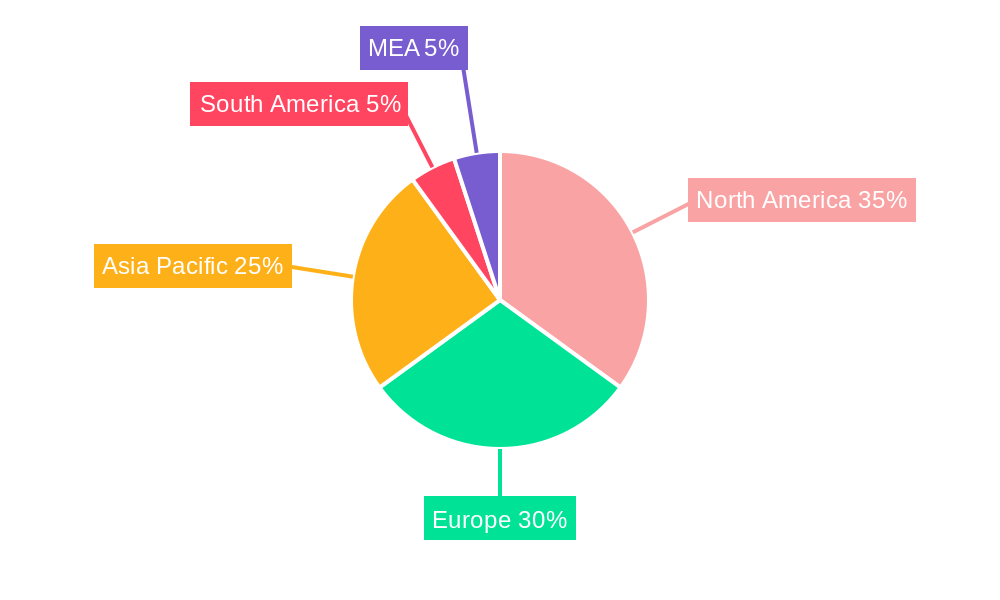

The Compliance Carbon Credit Market, valued at $820 million in 2025, is projected to experience robust growth, driven by increasing regulatory pressure to reduce greenhouse gas emissions and a rising awareness of environmental sustainability. A Compound Annual Growth Rate (CAGR) of 14.81% from 2025 to 2033 indicates a significant expansion of the market, reaching an estimated value exceeding $3 billion by 2033. Key drivers include the implementation of carbon pricing mechanisms like cap-and-trade systems and carbon taxes globally, growing corporate sustainability initiatives and commitments to net-zero emissions targets, and increasing investment in renewable energy projects and other carbon reduction initiatives. The market is segmented by credit type (renewable energy, forestry, energy efficiency, industrial process improvements) and sector (energy, transportation, industrial, agriculture/forestry), offering diverse investment and compliance opportunities. North America and Europe currently represent significant market shares, but rapid growth is anticipated in Asia-Pacific and other regions as environmental regulations strengthen and carbon markets mature. The competitive landscape includes established players like Shell New Energies and ClimateCare, alongside numerous specialized firms focusing on specific credit types or sectors. While challenges remain, such as the complexities of carbon accounting and verification, the long-term outlook for the Compliance Carbon Credit Market remains exceptionally positive, fueled by the global imperative to combat climate change.

Compliance Carbon Credit Market Market Size (In Million)

The significant growth trajectory is supported by increasing corporate demand for carbon offsets to meet emissions reduction targets and comply with stringent environmental regulations. The expanding range of carbon credit projects, coupled with advancements in monitoring, reporting, and verification (MRV) technologies, further enhance market transparency and trust. However, market volatility related to carbon price fluctuations and potential risks associated with the quality and permanence of carbon credits present ongoing challenges. Government policies and regulations, particularly the development and implementation of robust carbon market frameworks, will play a crucial role in shaping the market's future growth. The increasing sophistication of carbon credit methodologies and the rise of innovative solutions, including nature-based solutions and technological advancements in carbon capture, utilization, and storage (CCUS), will contribute to market expansion and diversification.

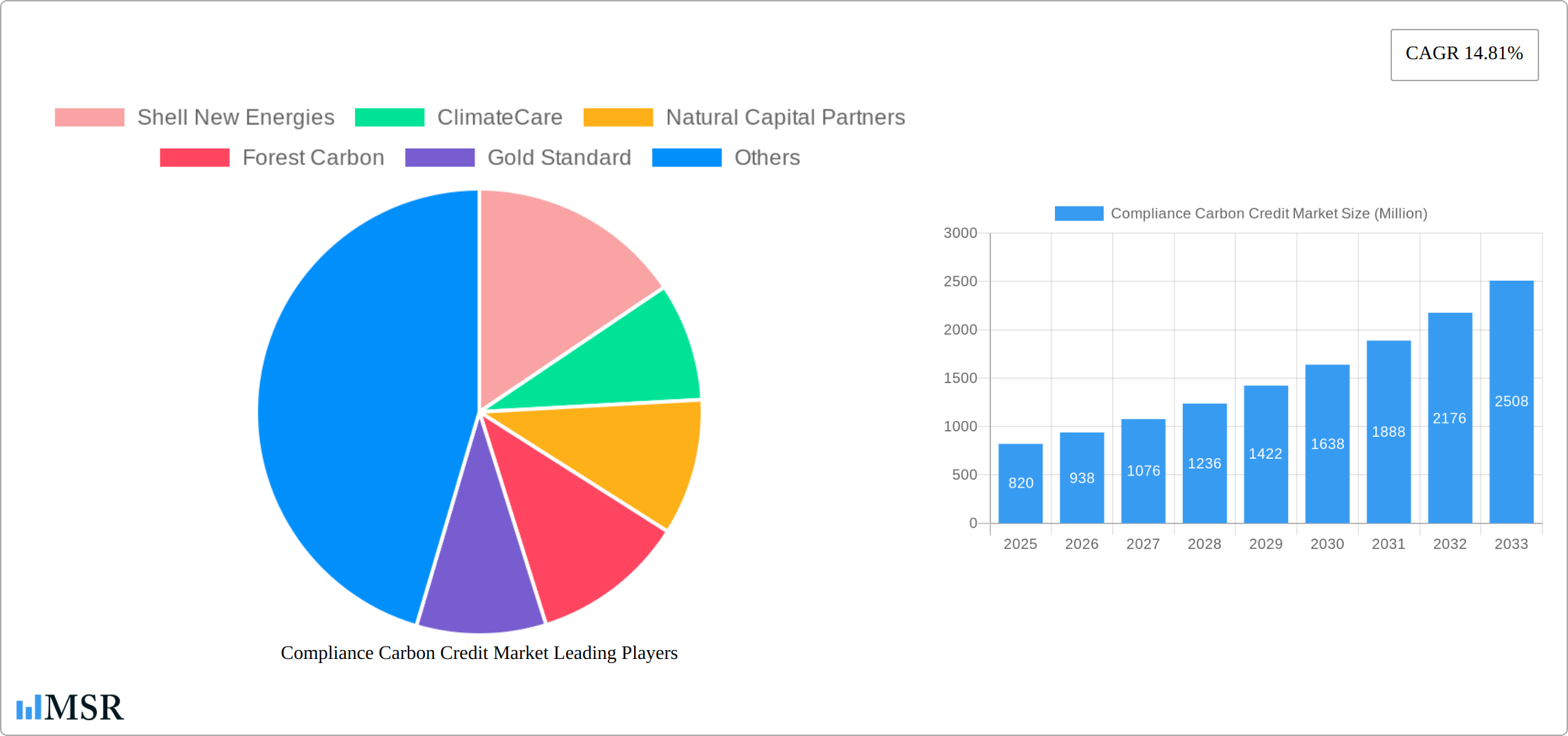

Compliance Carbon Credit Market Company Market Share

Dive Deep into the Booming Compliance Carbon Credit Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Compliance Carbon Credit Market, offering invaluable insights for stakeholders across the industry. With a focus on market dynamics, key players, and future trends, this report covers the period from 2019 to 2033, featuring a base year of 2025 and a forecast period of 2025-2033. The study uses data from the historical period (2019-2024) to project future market growth and opportunities, covering key segments and geographies. This report is essential for investors, businesses, policymakers, and anyone interested in understanding the complexities and potential of this rapidly evolving market. The global market is projected to reach xx Million by 2033.

Compliance Carbon Credit Market Market Concentration & Dynamics

This section provides a comprehensive analysis of the competitive landscape within the Compliance Carbon Credit Market, encompassing market concentration, innovation ecosystems, regulatory frameworks, substitute products, end-user trends, mergers and acquisitions (M&A) activities, and emerging challenges and opportunities.

Market Concentration and Competitive Dynamics: The market displays a moderately concentrated structure, with several key players holding substantial market share. Prominent participants such as Shell New Energies, ClimateCare, Natural Capital Partners, and Forest Carbon collectively control an estimated xx% of the market in 2024. However, a significant number of smaller players also contribute to a dynamic and intensely competitive environment. This competitive landscape is characterized by ongoing consolidation and strategic expansion, as evidenced by the xx M&A deals recorded between 2019 and 2024. This trend is expected to persist, further shaping market concentration in the coming years.

Innovation and Technological Advancements: The market is witnessing significant innovation driven by technological advancements in carbon accounting, monitoring, and verification. These advancements are leading to more precise and efficient carbon credit generation and trading. The integration of blockchain technology is enhancing transparency and traceability, thereby improving market integrity and trust. Further innovation is expected in areas such as remote sensing, AI-driven monitoring, and improved methodologies for carbon quantification.

Regulatory Landscape and Policy Influence: Government regulations and policies are pivotal in shaping the market's trajectory. Stringent emission reduction targets and the implementation of carbon pricing mechanisms are key growth drivers. However, variations in regulatory frameworks across different jurisdictions present complexities and challenges for market participants, necessitating a nuanced understanding of regional regulations.

Substitute Products and Competitive Pressures: While direct substitutes for compliance carbon credits are limited, alternative strategies such as internal carbon pricing and investments in renewable energy sources represent indirect competition. The market also faces pressure from evolving methodologies and the development of new carbon credit standards.

End-User Trends and Market Demand: The burgeoning awareness of environmental, social, and governance (ESG) factors among corporations and consumers is a significant driver of demand for compliance carbon credits. Growing regulatory pressure and the increasing adoption of corporate sustainability initiatives across various sectors further fuel this demand.

Compliance Carbon Credit Market Industry Insights & Trends

The Compliance Carbon Credit Market is experiencing substantial growth, driven by several factors. The market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Several key drivers contribute to this growth: increasing regulatory pressure to reduce carbon emissions, growing corporate commitments to sustainability goals, and advancements in carbon credit verification methodologies. Technological advancements, such as remote sensing and AI-based monitoring systems, are streamlining carbon credit generation and trading, enhancing efficiency and transparency. This market expansion is also boosted by increasing consumer demand for sustainable products and services, prompting companies to invest in carbon offsetting strategies. However, challenges remain, such as the need for robust standardization and the potential for market manipulation.

Key Markets & Segments Leading Compliance Carbon Credit Market

The Compliance Carbon Credit Market spans several key geographical regions and segments.

By Type of Credits:

- Renewable Energy Projects: This segment dominates the market due to the increasing adoption of renewable energy sources and supportive government policies. Drivers include government subsidies, decreasing renewable energy costs, and growing energy demand.

- Forestry and Land Use: This segment displays significant growth potential fueled by reforestation and afforestation projects, along with improved land management practices. Drivers include carbon sequestration potential, biodiversity benefits, and land-use policy changes.

- Energy Efficiency: Strong growth is expected in this segment due to increasing focus on industrial energy efficiency and energy conservation measures. Drivers include cost savings, reduced emissions, and technological advancements.

- Industrial Process Improvements: This segment is experiencing steady growth as industries implement cleaner production technologies. Drivers include regulatory compliance, cost optimization, and technological advancements in emission reduction technologies.

By Sector:

- Energy Sector: This sector is the largest consumer of compliance carbon credits due to stringent emission regulations and large carbon footprints.

- Transportation: The transportation sector is a significant consumer of credits, driven by regulations on vehicle emissions and the expansion of electric vehicles.

- Industrial Sector: Industrial activities represent a substantial carbon source, prompting substantial demand for compliance carbon credits.

- Agriculture and Forestry: This sector is experiencing growth in carbon credit demand due to the increasing recognition of its role in carbon sequestration and emission reduction.

The European Union and North America currently represent the leading regions in the Compliance Carbon Credit Market, driven by robust regulatory frameworks and a high concentration of large corporations committed to carbon neutrality goals. Asia-Pacific is anticipated to demonstrate robust growth in the coming years.

Compliance Carbon Credit Market Product Developments

Significant advancements in carbon credit verification technologies and methodologies are driving product innovation. Blockchain technology is improving transparency and traceability, enhancing the credibility of carbon credits. Furthermore, the development of new carbon credit project methodologies for various sectors contributes to the expansion of the market, enhancing the available options for carbon offsetting initiatives. The integration of AI and machine learning is improving monitoring and quantification of carbon emissions, allowing for more precise carbon credit generation and verification. These advancements are fostering a more efficient and transparent carbon credit market, driving increased investor confidence and facilitating expansion into new segments and geographies.

Challenges in the Compliance Carbon Credit Market Market

Several challenges hinder the growth of the Compliance Carbon Credit Market. These include:

- Lack of Standardization: The absence of universally accepted standards for carbon credit generation and verification creates market fragmentation and uncertainty.

- Supply Chain Issues: Ensuring the integrity and traceability of carbon credits along the supply chain is crucial for building trust and maintaining market integrity.

- Competitive Pressures: The market is highly competitive, with numerous players vying for market share.

Forces Driving Compliance Carbon Credit Market Growth

Several key factors are driving the growth of the Compliance Carbon Credit Market:

- Stringent Environmental Regulations and Policies: Governments worldwide are increasingly implementing stricter emission reduction targets, creating a significant demand for carbon credits to meet compliance obligations.

- Corporate Sustainability Initiatives and ESG Investing: Companies are integrating sustainability goals into their strategies and embracing carbon offsetting as a key component of their ESG reporting and investment strategies.

- Technological Advancements and Data-Driven Solutions: Innovations in carbon accounting, monitoring, and verification technologies are streamlining processes, improving data accuracy, and enhancing market efficiency.

- Growing Awareness and Consumer Demand: Increasing consumer awareness of climate change and environmental issues fuels demand for sustainable products and services, including carbon-neutral options.

- Expanding Market Accessibility and Liquidity: Efforts to standardize methodologies and enhance market liquidity are facilitating greater participation and investment.

Long-Term Growth Catalysts in the Compliance Carbon Credit Market

Long-term growth hinges on several key factors:

The development of robust and transparent carbon markets with clear regulatory frameworks will significantly influence future market growth. Further innovation in carbon reduction technologies and methodologies, along with expanding partnerships between businesses, governments, and non-governmental organizations, will unlock significant potential. Expansion into new and emerging markets, especially developing economies undergoing rapid industrialization, will contribute to long-term growth.

Emerging Opportunities in Compliance Carbon Credit Market

Emerging opportunities include:

- Expansion into New Markets: Developing economies present significant growth potential as they grapple with industrialization and environmental challenges.

- Technological Innovation: Advancements in AI, blockchain, and remote sensing will continue to enhance efficiency and transparency.

- New Carbon Credit Methodologies: Development of methodologies for emerging sectors and innovative carbon reduction projects.

Leading Players in the Compliance Carbon Credit Market Sector

- Shell New Energies

- ClimateCare

- Natural Capital Partners

- Forest Carbon

- Gold Standard

- 3Degrees

- Carbon Trust

- South Pole

- Atmosfair

- 7 3 Other Companies

- Sustainable Travel International

Key Milestones in Compliance Carbon Credit Market Industry

- January 2024: The Commodity Futures Trading Commission (CFTC) issued proposed guidance on the listing of voluntary carbon credit (VCC) derivatives contracts on designated contract markets. This action holds the potential to significantly impact market liquidity, standardization, and price discovery.

- April 2024: Regional efforts to link carbon markets in California, Quebec, and Washington gained momentum, potentially creating a larger, more liquid, and integrated market, influencing trading dynamics across North America and setting a precedent for future market linkages.

- [Add other key milestones as needed]

Strategic Outlook for Compliance Carbon Credit Market Market

The Compliance Carbon Credit Market holds significant potential for growth, driven by increasing regulatory pressure, corporate sustainability commitments, and technological advancements. Strategic opportunities lie in capitalizing on emerging markets, fostering innovation in carbon credit methodologies, and building strong partnerships across the value chain. The market's future success will hinge on creating a robust, transparent, and standardized system that builds trust and ensures the integrity of carbon credits. The continued development of a comprehensive and unified regulatory framework globally is essential for fostering long-term growth.

Compliance Carbon Credit Market Segmentation

-

1. Type of Credits

- 1.1. Renewable Energy Projects

- 1.2. Forestry and Land Use

- 1.3. Energy Efficiency

- 1.4. Industrial Process Improvements

-

2. Sector

- 2.1. Energy Sector

- 2.2. Transportation

- 2.3. Industrial Sector

- 2.4. Agriculture and Forestry

Compliance Carbon Credit Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Middle East and Africa

- 5. Latin America

Compliance Carbon Credit Market Regional Market Share

Geographic Coverage of Compliance Carbon Credit Market

Compliance Carbon Credit Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Regulatory Mandates and Policies; Growing Corporate Sustainability Initiatives

- 3.3. Market Restrains

- 3.3.1. Market Complexity and Uncertainty

- 3.4. Market Trends

- 3.4.1. Charting the Course of Carbon Pricing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Compliance Carbon Credit Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Credits

- 5.1.1. Renewable Energy Projects

- 5.1.2. Forestry and Land Use

- 5.1.3. Energy Efficiency

- 5.1.4. Industrial Process Improvements

- 5.2. Market Analysis, Insights and Forecast - by Sector

- 5.2.1. Energy Sector

- 5.2.2. Transportation

- 5.2.3. Industrial Sector

- 5.2.4. Agriculture and Forestry

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type of Credits

- 6. North America Compliance Carbon Credit Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Credits

- 6.1.1. Renewable Energy Projects

- 6.1.2. Forestry and Land Use

- 6.1.3. Energy Efficiency

- 6.1.4. Industrial Process Improvements

- 6.2. Market Analysis, Insights and Forecast - by Sector

- 6.2.1. Energy Sector

- 6.2.2. Transportation

- 6.2.3. Industrial Sector

- 6.2.4. Agriculture and Forestry

- 6.1. Market Analysis, Insights and Forecast - by Type of Credits

- 7. Europe Compliance Carbon Credit Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Credits

- 7.1.1. Renewable Energy Projects

- 7.1.2. Forestry and Land Use

- 7.1.3. Energy Efficiency

- 7.1.4. Industrial Process Improvements

- 7.2. Market Analysis, Insights and Forecast - by Sector

- 7.2.1. Energy Sector

- 7.2.2. Transportation

- 7.2.3. Industrial Sector

- 7.2.4. Agriculture and Forestry

- 7.1. Market Analysis, Insights and Forecast - by Type of Credits

- 8. Asia Pacific Compliance Carbon Credit Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Credits

- 8.1.1. Renewable Energy Projects

- 8.1.2. Forestry and Land Use

- 8.1.3. Energy Efficiency

- 8.1.4. Industrial Process Improvements

- 8.2. Market Analysis, Insights and Forecast - by Sector

- 8.2.1. Energy Sector

- 8.2.2. Transportation

- 8.2.3. Industrial Sector

- 8.2.4. Agriculture and Forestry

- 8.1. Market Analysis, Insights and Forecast - by Type of Credits

- 9. Middle East and Africa Compliance Carbon Credit Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Credits

- 9.1.1. Renewable Energy Projects

- 9.1.2. Forestry and Land Use

- 9.1.3. Energy Efficiency

- 9.1.4. Industrial Process Improvements

- 9.2. Market Analysis, Insights and Forecast - by Sector

- 9.2.1. Energy Sector

- 9.2.2. Transportation

- 9.2.3. Industrial Sector

- 9.2.4. Agriculture and Forestry

- 9.1. Market Analysis, Insights and Forecast - by Type of Credits

- 10. Latin America Compliance Carbon Credit Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Credits

- 10.1.1. Renewable Energy Projects

- 10.1.2. Forestry and Land Use

- 10.1.3. Energy Efficiency

- 10.1.4. Industrial Process Improvements

- 10.2. Market Analysis, Insights and Forecast - by Sector

- 10.2.1. Energy Sector

- 10.2.2. Transportation

- 10.2.3. Industrial Sector

- 10.2.4. Agriculture and Forestry

- 10.1. Market Analysis, Insights and Forecast - by Type of Credits

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Shell New Energies

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ClimateCare

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Natural Capital Partners

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Forest Carbon

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Gold Standard

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 3Degrees

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Carbon Trust

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 South Pole

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Atmosfair**List Not Exhaustive 7 3 Other Companie

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sustainable Travel International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Shell New Energies

List of Figures

- Figure 1: Global Compliance Carbon Credit Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Compliance Carbon Credit Market Revenue (Million), by Type of Credits 2025 & 2033

- Figure 3: North America Compliance Carbon Credit Market Revenue Share (%), by Type of Credits 2025 & 2033

- Figure 4: North America Compliance Carbon Credit Market Revenue (Million), by Sector 2025 & 2033

- Figure 5: North America Compliance Carbon Credit Market Revenue Share (%), by Sector 2025 & 2033

- Figure 6: North America Compliance Carbon Credit Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Compliance Carbon Credit Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Compliance Carbon Credit Market Revenue (Million), by Type of Credits 2025 & 2033

- Figure 9: Europe Compliance Carbon Credit Market Revenue Share (%), by Type of Credits 2025 & 2033

- Figure 10: Europe Compliance Carbon Credit Market Revenue (Million), by Sector 2025 & 2033

- Figure 11: Europe Compliance Carbon Credit Market Revenue Share (%), by Sector 2025 & 2033

- Figure 12: Europe Compliance Carbon Credit Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Compliance Carbon Credit Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Compliance Carbon Credit Market Revenue (Million), by Type of Credits 2025 & 2033

- Figure 15: Asia Pacific Compliance Carbon Credit Market Revenue Share (%), by Type of Credits 2025 & 2033

- Figure 16: Asia Pacific Compliance Carbon Credit Market Revenue (Million), by Sector 2025 & 2033

- Figure 17: Asia Pacific Compliance Carbon Credit Market Revenue Share (%), by Sector 2025 & 2033

- Figure 18: Asia Pacific Compliance Carbon Credit Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Compliance Carbon Credit Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Compliance Carbon Credit Market Revenue (Million), by Type of Credits 2025 & 2033

- Figure 21: Middle East and Africa Compliance Carbon Credit Market Revenue Share (%), by Type of Credits 2025 & 2033

- Figure 22: Middle East and Africa Compliance Carbon Credit Market Revenue (Million), by Sector 2025 & 2033

- Figure 23: Middle East and Africa Compliance Carbon Credit Market Revenue Share (%), by Sector 2025 & 2033

- Figure 24: Middle East and Africa Compliance Carbon Credit Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Compliance Carbon Credit Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Compliance Carbon Credit Market Revenue (Million), by Type of Credits 2025 & 2033

- Figure 27: Latin America Compliance Carbon Credit Market Revenue Share (%), by Type of Credits 2025 & 2033

- Figure 28: Latin America Compliance Carbon Credit Market Revenue (Million), by Sector 2025 & 2033

- Figure 29: Latin America Compliance Carbon Credit Market Revenue Share (%), by Sector 2025 & 2033

- Figure 30: Latin America Compliance Carbon Credit Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Compliance Carbon Credit Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Compliance Carbon Credit Market Revenue Million Forecast, by Type of Credits 2020 & 2033

- Table 2: Global Compliance Carbon Credit Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 3: Global Compliance Carbon Credit Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Compliance Carbon Credit Market Revenue Million Forecast, by Type of Credits 2020 & 2033

- Table 5: Global Compliance Carbon Credit Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 6: Global Compliance Carbon Credit Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Compliance Carbon Credit Market Revenue Million Forecast, by Type of Credits 2020 & 2033

- Table 10: Global Compliance Carbon Credit Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 11: Global Compliance Carbon Credit Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Compliance Carbon Credit Market Revenue Million Forecast, by Type of Credits 2020 & 2033

- Table 17: Global Compliance Carbon Credit Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 18: Global Compliance Carbon Credit Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Compliance Carbon Credit Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Compliance Carbon Credit Market Revenue Million Forecast, by Type of Credits 2020 & 2033

- Table 25: Global Compliance Carbon Credit Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 26: Global Compliance Carbon Credit Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Global Compliance Carbon Credit Market Revenue Million Forecast, by Type of Credits 2020 & 2033

- Table 28: Global Compliance Carbon Credit Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 29: Global Compliance Carbon Credit Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Compliance Carbon Credit Market?

The projected CAGR is approximately 14.81%.

2. Which companies are prominent players in the Compliance Carbon Credit Market?

Key companies in the market include Shell New Energies, ClimateCare, Natural Capital Partners, Forest Carbon, Gold Standard, 3Degrees, Carbon Trust, South Pole, Atmosfair**List Not Exhaustive 7 3 Other Companie, Sustainable Travel International.

3. What are the main segments of the Compliance Carbon Credit Market?

The market segments include Type of Credits, Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Regulatory Mandates and Policies; Growing Corporate Sustainability Initiatives.

6. What are the notable trends driving market growth?

Charting the Course of Carbon Pricing: UK-ETS Post-Brexit.

7. Are there any restraints impacting market growth?

Market Complexity and Uncertainty.

8. Can you provide examples of recent developments in the market?

April 2024: Regional efforts in the Western United States and Canada are gaining momentum as the urgency of combating climate change increases. Plans to link their carbon markets are being drawn up in California, Quebec, and Washington, which could significantly affect trading dynamics. The three authorities intend to work together to create a more extensive carbon credit market as soon as their proposed alliance takes effect.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Compliance Carbon Credit Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Compliance Carbon Credit Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Compliance Carbon Credit Market?

To stay informed about further developments, trends, and reports in the Compliance Carbon Credit Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence