Key Insights

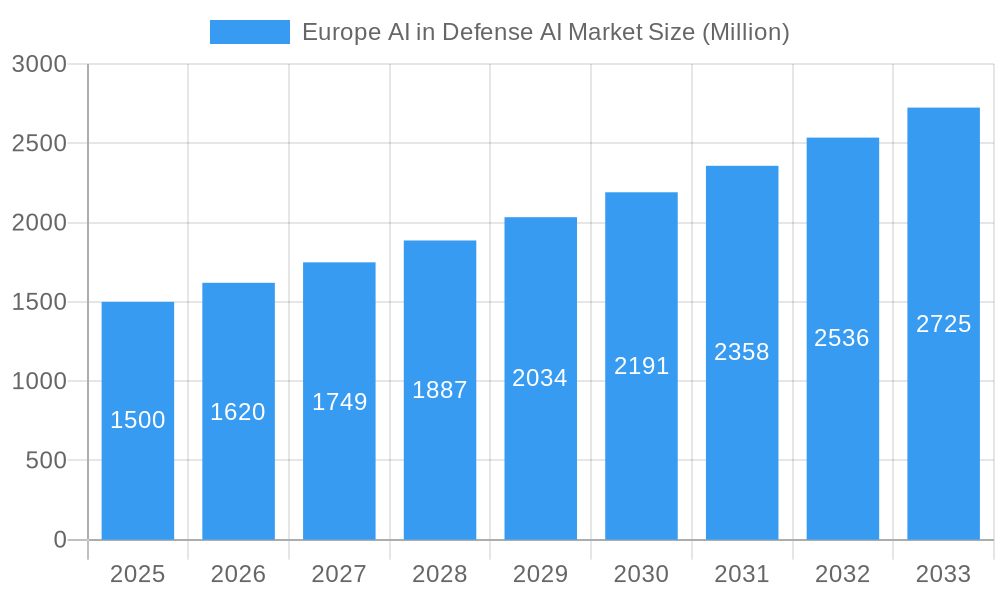

The European AI in Defense market, projected to reach 3.28 billion in 2025, is set for significant expansion, anticipating a compound annual growth rate (CAGR) of 16% from 2025 to 2033. This robust growth trajectory is fueled by escalating geopolitical tensions and the imperative for advanced defense capabilities, driving substantial investment in AI-driven solutions. Technological breakthroughs in machine learning, computer vision, and natural language processing are enabling sophisticated defense applications, including enhanced cybersecurity, predictive analytics for battlefield healthcare, and autonomous warfare systems. Market segmentation indicates considerable potential across hardware, software, and various platforms (land, air, naval), alongside diverse applications. While the United Kingdom, Germany, and France are leading markets, other European nations are accelerating AI adoption in defense. The presence of major defense contractors such as BAE Systems, Thales Group, and Airbus, alongside technology firms like IBM and Lockheed Martin, further supports market expansion. Key challenges include data privacy concerns, ethical considerations surrounding autonomous weaponry, and the necessity for resilient cybersecurity infrastructure.

Europe AI in Defense AI Market Market Size (In Billion)

The forecast period (2025-2033) anticipates substantial market growth, potentially surpassing 3.28 billion by 2033. Germany's technological prowess and defense expenditure position it as a primary market driver. France's defense modernization initiatives and the UK's focus on AI development will also significantly contribute. The increasing integration of AI across applications, from improving battlefield situational awareness and intelligence analysis to optimizing logistics, will accelerate market expansion. Despite potential restraints, the European AI in Defense market exhibits a positive long-term outlook, propelled by continuous innovation and the growing demand for cutting-edge defense solutions in a dynamic global security environment.

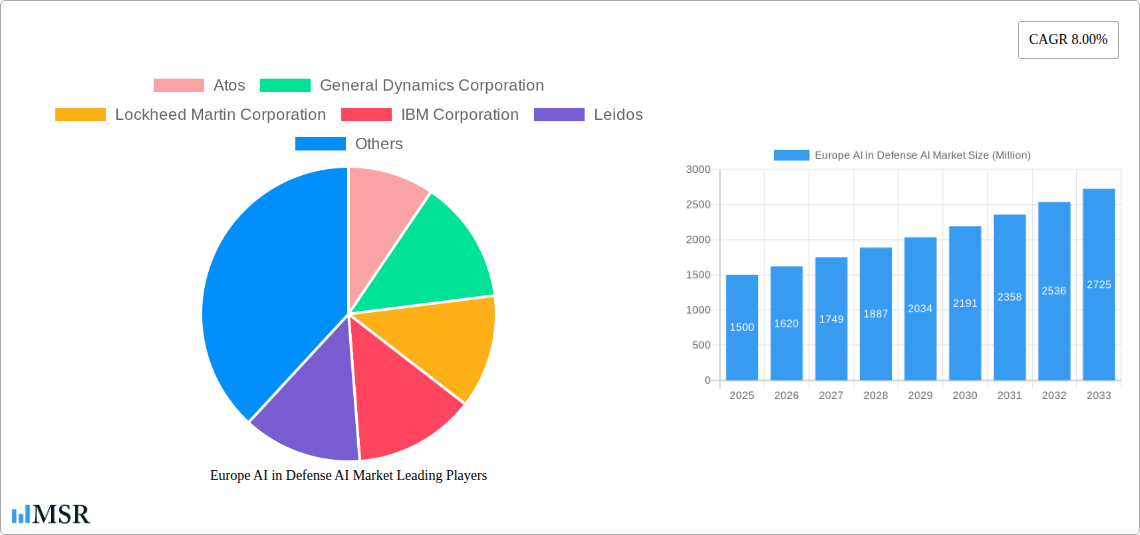

Europe AI in Defense AI Market Company Market Share

Europe AI in Defense AI Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Europe AI in Defense AI Market, offering invaluable insights for stakeholders across the defense and technology sectors. Covering the period 2019-2033, with a base year of 2025, this report meticulously examines market dynamics, key segments, leading players, and future growth potential. The report uses USD Million for all financial values.

Europe AI in Defense AI Market Market Concentration & Dynamics

The European AI in defense market exhibits a moderately concentrated landscape, with a handful of major players—including Atos, General Dynamics Corporation, Lockheed Martin Corporation, IBM Corporation, Leidos, Thales Group, BAE Systems PLC, Airbus S, and Raytheon Technologies Corporation—holding significant market share. However, a vibrant ecosystem of smaller, specialized firms fuels innovation and competition.

- Market Concentration: The top 5 players likely hold approximately xx% of the market share in 2025, while the remaining share is distributed among numerous smaller companies.

- Innovation Ecosystems: Robust research and development initiatives by both governmental and private organizations drive technological advancements, fostering a dynamic and competitive market. Collaborative projects, such as the Athea joint venture between Thales and Atos, exemplify this trend.

- Regulatory Frameworks: The regulatory landscape is evolving, impacting data privacy, cybersecurity, and the ethical implications of AI in defense. Compliance requirements present both challenges and opportunities for market players.

- Substitute Products: The absence of readily available perfect substitutes for AI-powered defense systems highlights the market's growth potential.

- End-User Trends: Increasing demand for autonomous systems, improved situational awareness, and enhanced cybersecurity drives market growth. The military branches across Europe are increasingly adopting AI-driven solutions to enhance their operational capabilities.

- M&A Activities: The number of mergers and acquisitions in this sector has been steadily increasing in recent years, with an estimated xx M&A deals in 2024. This signifies consolidation within the industry and the ongoing search for technological advancement and market expansion.

Europe AI in Defense AI Market Industry Insights & Trends

The Europe AI in Defense market is experiencing substantial growth, driven by increasing defense budgets, technological advancements in artificial intelligence, and the growing demand for enhanced defense capabilities. The market size reached approximately xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors:

The increasing adoption of AI in various defense applications, such as cybersecurity, battlefield healthcare, and warfare platforms, is a major driver. Technological disruptions like advancements in deep learning, computer vision, and natural language processing are continuously improving the performance and capabilities of AI-powered defense systems. Furthermore, the evolving geopolitical landscape and the need for enhanced national security are driving demand. Consumer behavior, in this context, refers to the adoption rate of AI-powered technologies by various defense organizations, which shows a significant positive trend.

Key Markets & Segments Leading Europe AI in Defense AI Market

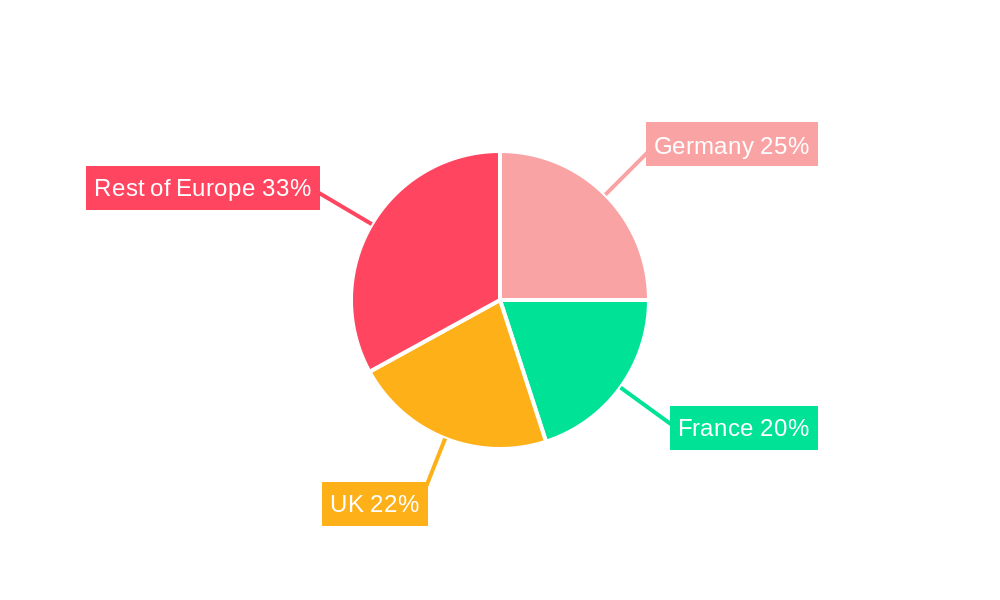

The United Kingdom, Germany, and France are the leading markets within Europe, driven by substantial defense budgets and active participation in NATO initiatives. However, Russia and the "Rest of Europe" segments are also contributing to the market's overall growth.

Dominant Segments:

- Component: Software is currently the leading segment, owing to the rapid development and increasing sophistication of AI algorithms. However, Hardware is also experiencing robust growth.

- Platform: Land-based systems currently hold the largest market share, driven by applications like autonomous vehicles and surveillance systems. However, Air and Naval platforms are showing substantial growth.

- Application: Cybersecurity is currently the dominant application, given the increasing reliance on digital infrastructure within defense operations. Battlefield Healthcare and Warfare Platform applications are showing rapid growth.

Country-Specific Drivers:

- United Kingdom: Strong government investment in defense technologies and a robust technology sector.

- Germany: Emphasis on technological innovation and collaboration within the European Union.

- France: Strategic focus on developing national AI capabilities and partnerships with leading technology providers.

- Russia: Investment in advanced military technologies, including AI and autonomous systems.

- Rest of Europe: Growing adoption of AI in defense among smaller European nations.

Europe AI in Defense AI Market Product Developments

Significant advancements in AI algorithms, improved sensor technologies, and increased computing power are driving product innovation. This includes the development of more sophisticated autonomous systems, enhanced situational awareness tools, and more effective cybersecurity solutions. Companies are focusing on developing AI systems with improved explainability and reduced bias to enhance trust and reliability. This focus on innovation drives competitive advantages.

Challenges in the Europe AI in Defense AI Market Market

The Europe AI in Defense market faces several challenges:

- Regulatory Hurdles: Navigating complex data privacy regulations and ethical considerations related to autonomous weapons systems.

- Supply Chain Issues: Securing reliable sources of components and expertise to develop and deploy AI-powered systems.

- Competitive Pressures: Intense competition among established players and the emergence of new entrants. This pressure impacts pricing and profitability. An estimated xx% reduction in profit margins has been observed in the past 2 years due to intense competition.

Forces Driving Europe AI in Defense AI Market Growth

Several factors are driving growth:

- Technological Advancements: Continuous improvements in AI algorithms and computing capabilities, enhancing the effectiveness and capabilities of AI-powered defense systems.

- Economic Growth: Increased defense budgets in several European countries are fueling demand.

- Geopolitical Factors: Rising geopolitical tensions and the need for enhanced national security are encouraging the adoption of AI in defense.

Long-Term Growth Catalysts in Europe AI in Defense AI Market

Long-term growth will be driven by:

Continued innovation in AI algorithms, the development of more robust and reliable autonomous systems, and increased collaboration between government agencies and private companies are critical for sustaining long-term growth. Expansion into new markets and applications within the defense sector will also fuel growth in the coming years.

Emerging Opportunities in Europe AI in Defense AI Market

Emerging opportunities lie in:

- New Markets: Expanding into less developed defense markets within Europe.

- New Technologies: Exploring the potential of quantum computing and other advanced technologies to enhance AI capabilities.

- New Applications: Developing AI-powered solutions for novel defense applications, such as predictive maintenance and logistics optimization.

Leading Players in the Europe AI in Defense AI Market Sector

Key Milestones in Europe AI in Defense AI Market Industry

- July 2022: The French Defense Ministry authorized the final phase of an AI and big data project by Athea (Thales/Atos joint venture), aiming to create secure, sovereign AI platforms for analyzing military data. This signifies a commitment to national AI development and enhances France's defense capabilities.

- May 2022: Palantir Technologies secured a USD 12.5 Million contract with the UK Ministry of Defence, providing its Foundry platform for data processing automation and cost reduction. This highlights the growing adoption of commercial AI solutions in defense applications.

Strategic Outlook for Europe AI in Defense AI Market Market

The future of the Europe AI in Defense AI market looks bright, fueled by ongoing technological advancements, increased defense spending, and a rising demand for enhanced defense capabilities. Strategic opportunities exist for companies that can successfully navigate the regulatory landscape, develop innovative AI solutions, and forge strong partnerships with government agencies. The market is poised for continued expansion and consolidation, creating significant opportunities for growth and profitability in the coming years.

Europe AI in Defense AI Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

-

2. Platform

- 2.1. Land

- 2.2. Air

- 2.3. Naval

-

3. Application

- 3.1. Cybersecurity

- 3.2. Battlefield Healthcare

- 3.3. Warfare Platform

Europe AI in Defense AI Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe AI in Defense AI Market Regional Market Share

Geographic Coverage of Europe AI in Defense AI Market

Europe AI in Defense AI Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Investments In Artificial Intelligence Will Drive The Market During The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe AI in Defense AI Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Land

- 5.2.2. Air

- 5.2.3. Naval

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Cybersecurity

- 5.3.2. Battlefield Healthcare

- 5.3.3. Warfare Platform

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Atos

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 General Dynamics Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lockheed Martin Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 IBM Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Leidos

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Thales Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BAE Systems PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Airbus S

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Raytheon technologies Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Atos

List of Figures

- Figure 1: Europe AI in Defense AI Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe AI in Defense AI Market Share (%) by Company 2025

List of Tables

- Table 1: Europe AI in Defense AI Market Revenue billion Forecast, by Component 2020 & 2033

- Table 2: Europe AI in Defense AI Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 3: Europe AI in Defense AI Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Europe AI in Defense AI Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe AI in Defense AI Market Revenue billion Forecast, by Component 2020 & 2033

- Table 6: Europe AI in Defense AI Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 7: Europe AI in Defense AI Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Europe AI in Defense AI Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe AI in Defense AI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe AI in Defense AI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe AI in Defense AI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe AI in Defense AI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe AI in Defense AI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe AI in Defense AI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe AI in Defense AI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe AI in Defense AI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe AI in Defense AI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe AI in Defense AI Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe AI in Defense AI Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe AI in Defense AI Market?

The projected CAGR is approximately 16%.

2. Which companies are prominent players in the Europe AI in Defense AI Market?

Key companies in the market include Atos, General Dynamics Corporation, Lockheed Martin Corporation, IBM Corporation, Leidos, Thales Group, BAE Systems PLC, Airbus S, Raytheon technologies Corporation.

3. What are the main segments of the Europe AI in Defense AI Market?

The market segments include Component, Platform, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.28 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Investments In Artificial Intelligence Will Drive The Market During The Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

Jul 2022: The Defense Ministry of France announced that it had authorized the go-ahead for the final phase of new artificial intelligence and big data processing capability, which is being developed by the company Athea, a joint venture between Thales and Atos. The main aim of such a project will be to provide France with secure and sovereign artificial intelligence and big data platforms that can analyze massive data generated by military equipment as well as other sensors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe AI in Defense AI Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe AI in Defense AI Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe AI in Defense AI Market?

To stay informed about further developments, trends, and reports in the Europe AI in Defense AI Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence