Key Insights

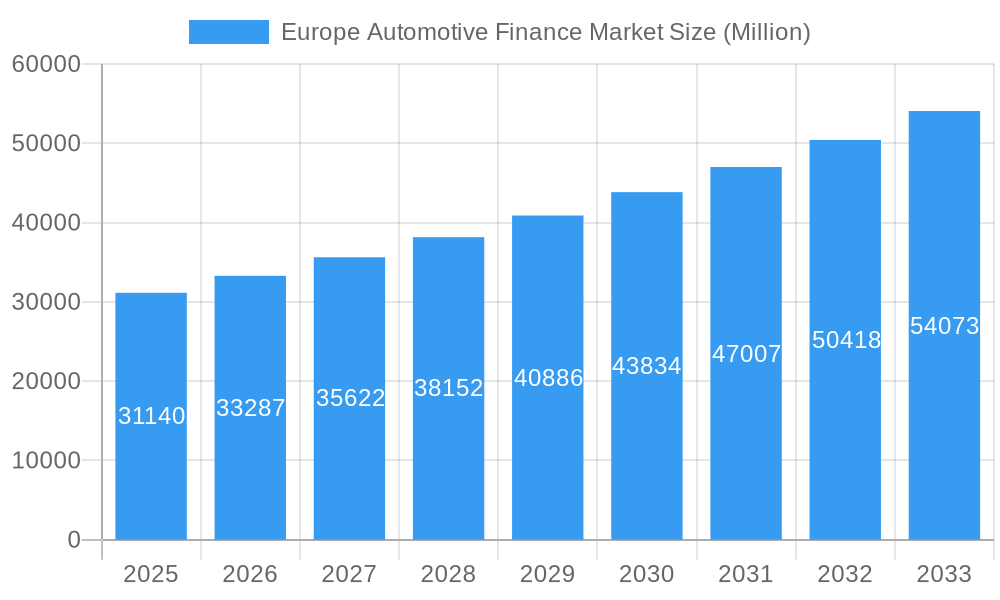

The Europe Automotive Finance Market, valued at €31.14 billion in 2025, is projected to experience robust growth, driven by several key factors. Rising vehicle sales, particularly in the burgeoning electric vehicle (EV) segment, are fueling demand for financing options. Increased consumer preference for leasing and financing, rather than outright purchase, coupled with attractive financing schemes offered by manufacturers and banks, further contribute to market expansion. The market benefits from a strong and stable automotive industry in Europe, with established players and a diverse range of vehicle models. Competitive lending rates and innovative financial products tailored to meet diverse customer needs, like balloon payments and flexible lease terms, also play a significant role in market growth. Furthermore, the increasing adoption of digital platforms and online financing solutions enhances convenience and accessibility for consumers, facilitating market expansion.

Europe Automotive Finance Market Market Size (In Billion)

However, the market faces some challenges. Economic fluctuations and potential interest rate hikes could dampen consumer spending and impact demand for automotive financing. Stringent regulatory frameworks regarding consumer protection and lending practices also pose a constraint. The shift towards electric vehicles, while a driver of growth, also presents complexities in terms of longer-term financing options due to higher initial purchase prices and potential battery degradation concerns. Competition among established players and the emergence of fintech companies further influences market dynamics, requiring constant adaptation and innovation to maintain market share. Nevertheless, given the ongoing demand for vehicles and the sustained need for financing solutions, the European automotive finance market is poised for continued, albeit potentially moderated, growth throughout the forecast period (2025-2033). The CAGR of 6.73% indicates a positive outlook, although careful management of economic and regulatory risks will be crucial for continued success.

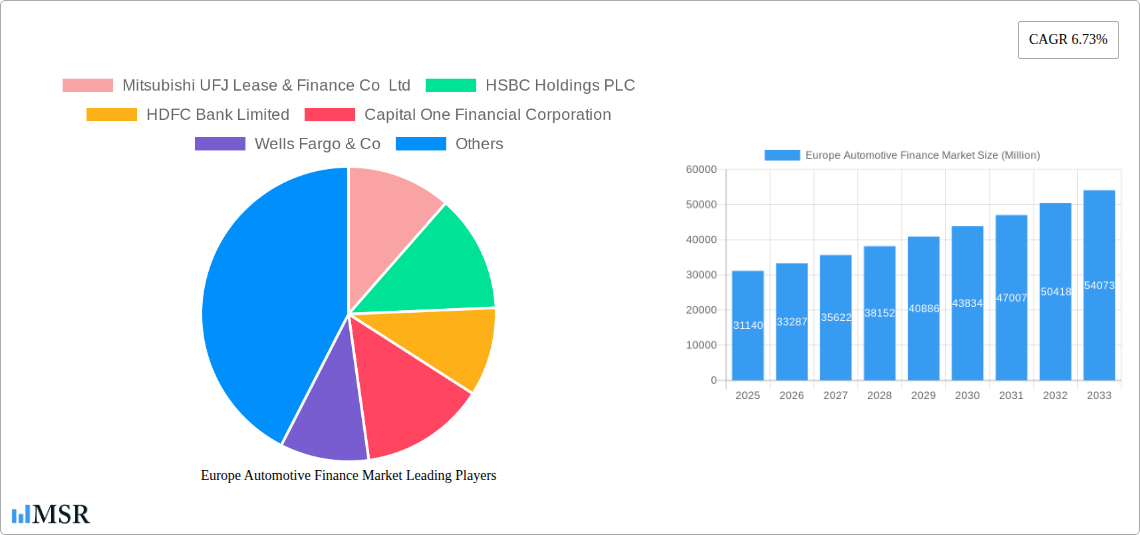

Europe Automotive Finance Market Company Market Share

Europe Automotive Finance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Automotive Finance Market, offering crucial insights for investors, industry stakeholders, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, key trends, leading players, and future growth prospects. Discover actionable strategies and informed predictions to navigate the complexities of this dynamic market.

Europe Automotive Finance Market Market Concentration & Dynamics

The European automotive finance market exhibits a moderately concentrated landscape, with several large players commanding significant market share. However, the market is also characterized by a dynamic interplay of factors influencing its structure and evolution. Key aspects driving market dynamics include:

Market Share: While precise market share figures for individual players require further analysis within the full report, key players like Mitsubishi UFJ Lease & Finance Co Ltd, HSBC Holdings PLC, and HDFC Bank Limited (where applicable, regional websites were selected) are anticipated to hold substantial positions. Precise figures are detailed within the full report. Smaller, niche players also contribute significantly to market dynamism.

Innovation Ecosystems: The market is witnessing significant innovation, particularly in areas like digital lending platforms, embedded finance, and the integration of open banking technologies. This fuels competition and reshapes market dynamics.

Regulatory Frameworks: Stringent regulations related to consumer protection, data privacy (GDPR), and lending practices impact operational strategies and require adaptation by market players. The report details the key regulatory frameworks at play and their implications.

Substitute Products: The emergence of alternative financing models, including peer-to-peer lending and subscription-based car ownership models, presents a challenge to traditional automotive financing, the degree of which is analyzed in detail within the report.

End-User Trends: The report considers evolving consumer preferences – a growing preference for electric vehicles, for example, alongside a demand for flexible payment options and personalized financing solutions. The analysis of these consumer trends comprises a significant section of the full report.

Mergers & Acquisitions (M&A) Activity: The level of M&A activity varies, yet consolidations and strategic partnerships drive market growth and influence competitive dynamics. The full report provides a breakdown of M&A deal counts during the study period. The full report will include specific numbers for the period 2019-2024.

Europe Automotive Finance Market Industry Insights & Trends

The European automotive finance market is projected to experience significant growth throughout the forecast period (2025-2033). The market size in 2025 is estimated at xx Million, with a compound annual growth rate (CAGR) projected at xx% for the forecast period. This growth is propelled by multiple factors, including:

Rising Vehicle Sales: Growth in new vehicle sales, particularly in key European markets, directly fuels the demand for automotive financing. This trend is intrinsically linked with economic conditions and consumer sentiment.

Technological Disruptions: The emergence of fintech solutions, open banking, and AI-driven credit scoring mechanisms is transforming the efficiency and reach of automotive finance. Bumper's recent USD 48 Million Series B funding is a testament to investor interest in this sector, and this example is further developed in the full report.

Evolving Consumer Behavior: A shift towards personalized financing options, digitalization of the customer journey, and increasing demand for electric vehicles (EVs) are reshaping market dynamics. The full report includes an in-depth analysis and projection for EV adoption and associated financing demands. The reported surge in Irish car loan values in Q3 2023, reaching Euro 189 Million (USD 204 Million) and a 25.5% increase year-over-year, exemplifies this evolving market landscape.

Government Incentives: Policies supporting sustainable transportation, including incentives for electric vehicles, impact both vehicle sales and the associated finance market growth.

Key Markets & Segments Leading Europe Automotive Finance Market

Germany, the United Kingdom, and France are anticipated to remain the dominant markets within the European automotive finance landscape. This dominance is attributed to factors including:

Strong Automotive Industries: The presence of established automotive manufacturers and a large consumer base contribute to robust market demand.

Developed Financial Infrastructure: Sophisticated banking and financial systems facilitate effective and efficient lending.

High Vehicle Ownership Rates: Higher vehicle ownership rates in these countries directly translate into higher demand for financing services.

Other key European markets are also expected to witness substantial growth, driven by factors like:

Economic Growth: Economic expansion increases disposable incomes, fostering higher vehicle purchases and financing requirements.

Infrastructure Development: Improved infrastructure enhances the convenience of owning and operating vehicles, further stimulating demand.

The full report provides a detailed regional breakdown, including granular analysis of specific country markets.

Europe Automotive Finance Market Product Developments

Recent innovations include the integration of open banking capabilities, personalized digital lending platforms, and the rise of flexible payment plans tailored to individual customer needs. These developments provide enhanced customer experiences, streamlined processes, and competitive advantages to financial institutions. Fintech solutions are also driving considerable product development and market disruption, and these trends are analyzed in the full report.

Challenges in the Europe Automotive Finance Market Market

The European automotive finance market faces challenges such as:

Economic Downturns: Recessions impact consumer spending, reducing the demand for automotive financing. The full report includes an analysis and projection for economic impacts on the market.

Regulatory Scrutiny: Strict regulations and compliance requirements place constraints on lending practices and can affect profitability.

Intense Competition: The presence of numerous established players and emerging fintech companies creates a highly competitive landscape.

Supply Chain Disruptions: Global supply chain disruptions affect the availability of vehicles, impacting the demand for finance.

Forces Driving Europe Automotive Finance Market Growth

Several forces are driving the market's expansion, including:

Technological Advancements: Fintech innovations and digitalization are boosting operational efficiencies and customer experiences.

Economic Growth: Positive economic conditions in key European markets contribute to increased consumer spending on vehicles.

Favorable Regulatory Environment: Policies encouraging sustainable transportation and investments in automotive infrastructure support market growth.

Challenges in the Europe Automotive Finance Market Market (Long-Term Growth Catalysts)

Long-term growth is anticipated to be fueled by continuous technological innovations, strategic partnerships between traditional automotive finance players and fintech companies, and expansion into underserved markets within Europe. The emergence of new mobility solutions and sustainable vehicle technologies will create further long-term growth opportunities.

Emerging Opportunities in Europe Automotive Finance Market

The market presents lucrative opportunities in areas such as:

Electric Vehicle Financing: The growing adoption of EVs presents a significant market opportunity.

Subscription Models: Subscription-based financing options are gaining popularity among consumers.

Data Analytics and AI: The use of data analytics and artificial intelligence for risk assessment and personalized offers is creating new avenues for growth.

Expansion into Eastern Europe: Untapped markets in Eastern Europe offer substantial growth potential.

Leading Players in the Europe Automotive Finance Market Sector

- Mitsubishi UFJ Lease & Finance Co Ltd

- HSBC Holdings PLC

- HDFC Bank Limited

- Capital One Financial Corporation

- Wells Fargo & Co

- Toyota Financial Services (Toyota Motor Corporation)

- BNP Paribas SA

- Volkswagen AG

- Mercedes-Benz Group AG

- Standard Chartered PLC

- BMW AG (Alphera Financial Services)

- Ford Motor Company

- Banco Santander SA

- Societe Generale Grou

Key Milestones in Europe Automotive Finance Market Industry

- March 2024: BMW's financial arm partnered with CRIF to launch open banking services in the UK, streamlining auto financing.

- February 2024: BPFI reported a significant increase in Irish car loan values (USD 204 Million) in Q3 2023, driven by EV adoption.

- January 2024: Bumper secured USD 48 Million in Series B funding for its flexible car repair payment platform.

Strategic Outlook for Europe Automotive Finance Market Market

The future of the European automotive finance market appears promising, driven by technological advancements, evolving consumer preferences, and the increasing adoption of sustainable vehicles. Strategic partnerships and innovations in areas like open banking and embedded finance will play a key role in shaping the industry's future. The market presents significant potential for growth and profitability for companies that can adapt to the changing landscape.

Europe Automotive Finance Market Segmentation

-

1. Type

- 1.1. New Vehicles

- 1.2. Used Vehicles

-

2. Source Type

- 2.1. Original Equipment Manufacturers (OEMs)

- 2.2. Banks

- 2.3. Credit Institutions

- 2.4. Non-banking Financial Institutions

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

Europe Automotive Finance Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

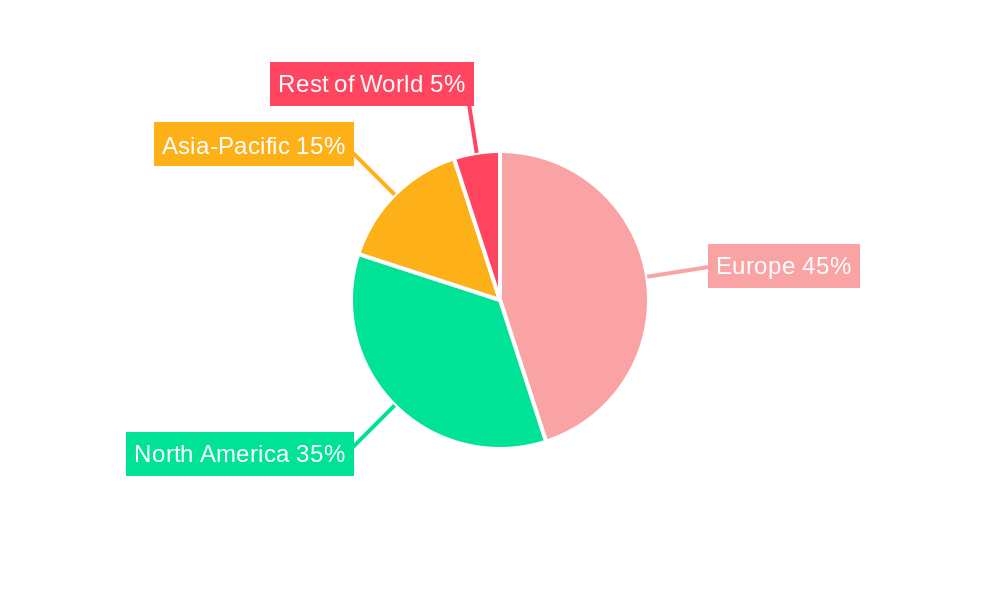

Europe Automotive Finance Market Regional Market Share

Geographic Coverage of Europe Automotive Finance Market

Europe Automotive Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Electric Vehicles Fosters the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Electric Vehicles Fosters the Growth of the Market

- 3.4. Market Trends

- 3.4.1. The Passenger Cars Market Segment to Witness Surging Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. New Vehicles

- 5.1.2. Used Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Source Type

- 5.2.1. Original Equipment Manufacturers (OEMs)

- 5.2.2. Banks

- 5.2.3. Credit Institutions

- 5.2.4. Non-banking Financial Institutions

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mitsubishi UFJ Lease & Finance Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 HSBC Holdings PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HDFC Bank Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Capital One Financial Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wells Fargo & Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Toyota Financial Services (Toyota Motor Corporation)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BNP Paribas SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Volkswagen AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mercedes-Benz Group AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Standard Chartered PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 BMW AG (Alphera Financial Services)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ford Motor Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Banco Santander SA

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Societe Generale Grou

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Mitsubishi UFJ Lease & Finance Co Ltd

List of Figures

- Figure 1: Europe Automotive Finance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Automotive Finance Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Automotive Finance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Automotive Finance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Europe Automotive Finance Market Revenue Million Forecast, by Source Type 2020 & 2033

- Table 4: Europe Automotive Finance Market Volume Billion Forecast, by Source Type 2020 & 2033

- Table 5: Europe Automotive Finance Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Europe Automotive Finance Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 7: Europe Automotive Finance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Europe Automotive Finance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Europe Automotive Finance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Europe Automotive Finance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Europe Automotive Finance Market Revenue Million Forecast, by Source Type 2020 & 2033

- Table 12: Europe Automotive Finance Market Volume Billion Forecast, by Source Type 2020 & 2033

- Table 13: Europe Automotive Finance Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 14: Europe Automotive Finance Market Volume Billion Forecast, by Vehicle Type 2020 & 2033

- Table 15: Europe Automotive Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Automotive Finance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Germany Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: France Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: France Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Italy Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Spain Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Spain Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Netherlands Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Netherlands Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Belgium Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Belgium Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Sweden Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Sweden Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Norway Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Norway Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Poland Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Poland Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Denmark Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Denmark Europe Automotive Finance Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Finance Market?

The projected CAGR is approximately 6.73%.

2. Which companies are prominent players in the Europe Automotive Finance Market?

Key companies in the market include Mitsubishi UFJ Lease & Finance Co Ltd, HSBC Holdings PLC, HDFC Bank Limited, Capital One Financial Corporation, Wells Fargo & Co, Toyota Financial Services (Toyota Motor Corporation), BNP Paribas SA, Volkswagen AG, Mercedes-Benz Group AG, Standard Chartered PLC, BMW AG (Alphera Financial Services), Ford Motor Company, Banco Santander SA, Societe Generale Grou.

3. What are the main segments of the Europe Automotive Finance Market?

The market segments include Type, Source Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 31.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Electric Vehicles Fosters the Growth of the Market.

6. What are the notable trends driving market growth?

The Passenger Cars Market Segment to Witness Surging Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Adoption of Electric Vehicles Fosters the Growth of the Market.

8. Can you provide examples of recent developments in the market?

March 2024: BMW's financial arm partnered with CRIF to introduce open banking services in the United Kingdom, targeting prospective car buyers. The collaboration aims to streamline auto financing across all UK retailers, enhancing BMW's financial arm's access to crucial creditworthiness data.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Finance Market?

To stay informed about further developments, trends, and reports in the Europe Automotive Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence