Key Insights

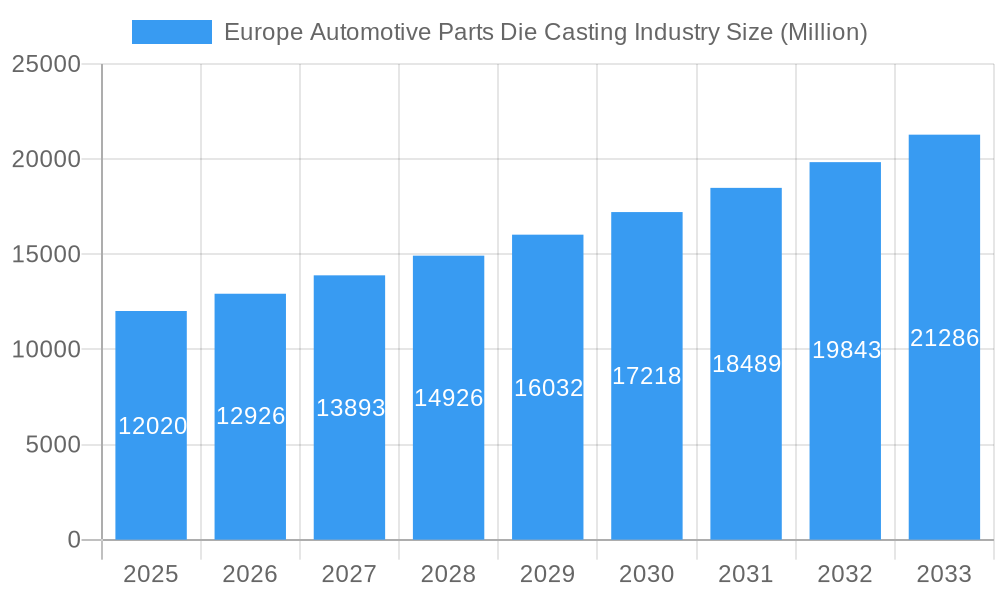

The European automotive parts die casting market, valued at €12.02 billion in 2025, is projected to experience robust growth, driven by the increasing demand for lightweight vehicles and the rising adoption of electric vehicles (EVs). The market's Compound Annual Growth Rate (CAGR) of 7.28% from 2025 to 2033 indicates a significant expansion. Key drivers include stringent fuel efficiency regulations pushing automakers towards lighter vehicle designs, the increasing complexity of automotive components requiring advanced die casting techniques, and the growing preference for aluminum and zinc die castings due to their superior properties. The segment breakdown reveals a strong demand for aluminum die castings due to their lightweight and high strength characteristics, particularly within the engine parts and transmission components applications. Major players like Ryobi Die Casting, Georg Fischer Limited, and Nemak are strategically investing in advanced technologies and expanding their production capacities to meet this growing demand. However, fluctuating raw material prices and potential supply chain disruptions pose challenges to market growth. The German, French, and Italian markets are expected to lead the regional growth, benefiting from established automotive manufacturing hubs and strong government support for technological advancements in the sector.

Europe Automotive Parts Die Casting Industry Market Size (In Billion)

The forecast period (2025-2033) suggests a steady market expansion driven by continued innovation in die casting processes, particularly vacuum die casting, which offers improved dimensional accuracy and surface finish. The market's segmentation by metal type (aluminum, zinc, others) and application type (engine parts, transmission components, structural parts, others) reflects the diversity of the automotive industry’s requirements. Further growth opportunities lie in the exploration of new materials and the development of sustainable die casting processes to minimize environmental impact. Competition is intense, with established players and emerging companies vying for market share through technological innovation, strategic partnerships, and geographic expansion. A thorough understanding of these market dynamics is crucial for both manufacturers and investors to navigate this dynamic landscape successfully.

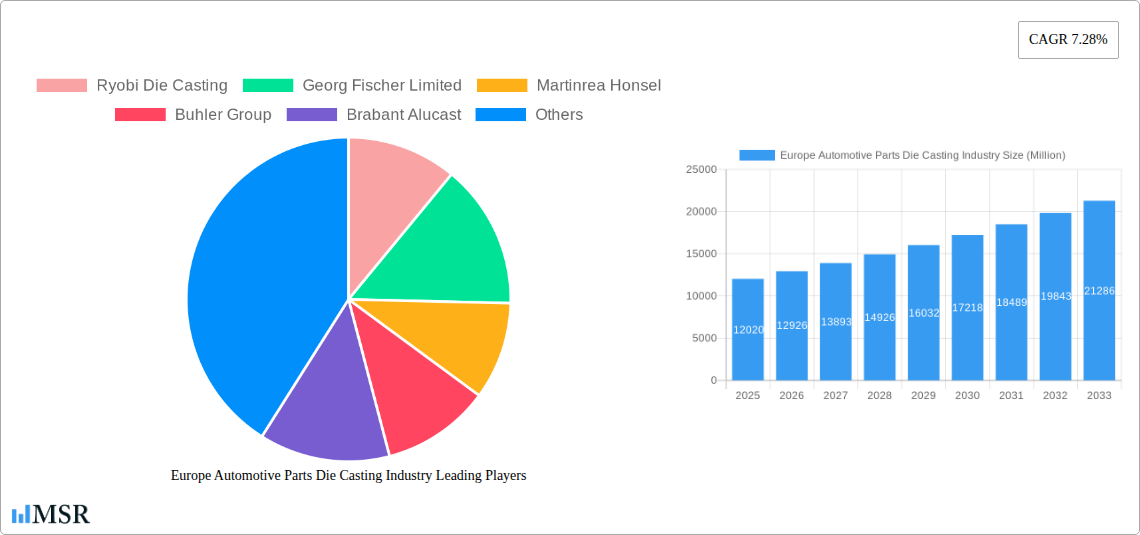

Europe Automotive Parts Die Casting Industry Company Market Share

Europe Automotive Parts Die Casting Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe automotive parts die casting industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report delves into market dynamics, key segments, leading players, and future opportunities. The report leverages extensive data analysis to offer actionable intelligence, facilitating strategic decision-making. The total market size is estimated to reach xx Million by 2025, with a CAGR of xx% during the forecast period.

Europe Automotive Parts Die Casting Industry Market Concentration & Dynamics

This section analyzes the competitive landscape, innovation, regulations, and market trends within the European automotive parts die casting industry. The market is characterized by a moderately concentrated structure, with key players such as Ryobi Die Casting, Georg Fischer Limited, Martinrea Honsel, Buhler Group, Brabant Alucast, DGS Druckguss Systeme, Nemak, Dynacast, and Rheinmetall Automotive holding significant market share. However, the presence of numerous smaller players indicates a dynamic competitive environment.

- Market Share: The top five players collectively hold approximately xx% of the market share in 2025, while the remaining share is distributed among numerous smaller participants.

- M&A Activity: The historical period (2019-2024) witnessed xx M&A deals, indicating a consolidated market with ongoing consolidation. The forecast period is expected to see further M&A activity driven by a need for scale and technological advancements.

- Innovation Ecosystems: Significant investments in research and development (R&D) are driving innovations in materials, processes (like vacuum die casting), and automation, impacting market competitiveness and sustainability.

- Regulatory Frameworks: Stringent emission standards and regulations related to material composition are shaping industry practices, favoring lightweight and eco-friendly materials like aluminum.

- Substitute Products: The industry faces competition from alternative manufacturing processes, but the superior strength-to-weight ratio and cost-effectiveness of die casting continue to secure its prominent position.

- End-User Trends: The increasing demand for lightweight vehicles to improve fuel efficiency and the rising adoption of electric vehicles (EVs) are key drivers shaping the demand for die-cast automotive parts.

Europe Automotive Parts Die Casting Industry Industry Insights & Trends

The European automotive parts die casting market is experiencing robust growth, fueled by several factors. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033. Several factors are driving this growth:

- The rising demand for lightweight vehicles, driven by stricter fuel efficiency regulations.

- The increasing adoption of electric vehicles (EVs), which rely heavily on die-cast components for battery housings and other critical parts.

- Technological advancements in die casting processes, leading to improved product quality and reduced production costs.

- The growing demand for high-strength, lightweight materials, such as aluminum alloys, in automotive applications.

- Increased automation in die casting processes, enhancing production efficiency and reducing labor costs.

- The shift towards sustainable manufacturing practices, with a focus on reducing carbon emissions and waste generation.

Technological disruptions, such as the adoption of Industry 4.0 technologies and the application of artificial intelligence (AI) in design and production optimization, are further enhancing the efficiency and capabilities of the industry. Evolving consumer preferences towards more fuel-efficient and environmentally friendly vehicles continue to bolster demand.

Key Markets & Segments Leading Europe Automotive Parts Die Casting Industry

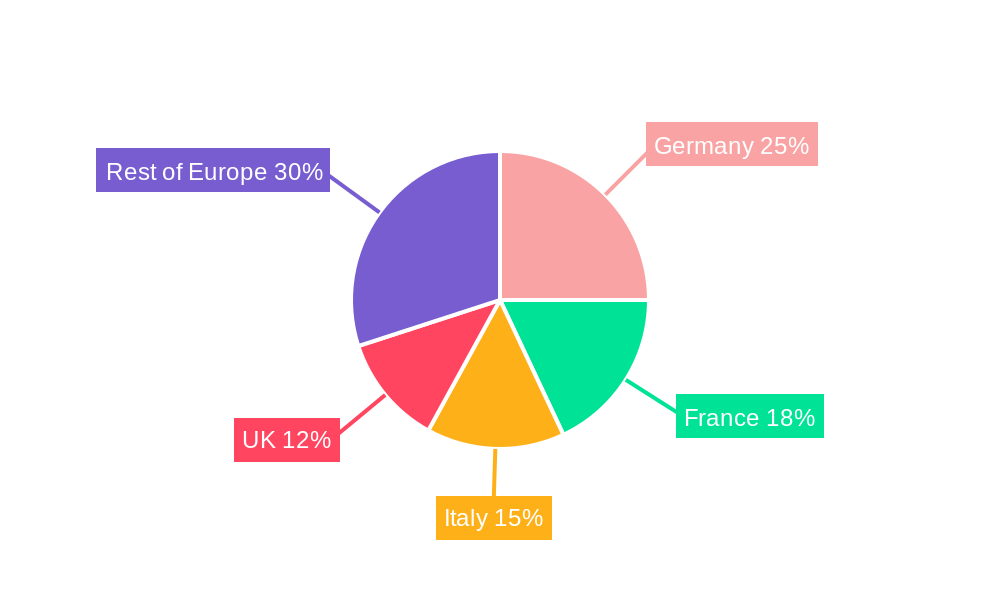

The European automotive parts die casting market demonstrates regional variations in growth rates. Germany and France are the leading markets, driven by strong automotive manufacturing hubs. Other key regions include the UK, Italy, and Spain. Segment analysis reveals the following:

By Production Process Type:

- Pressure Die Casting: This segment dominates, representing approximately xx% of the market in 2025 due to its cost-effectiveness and high production rates.

- Vacuum Die Casting: This segment is experiencing strong growth, driven by the demand for high-quality, defect-free components, particularly in critical applications.

- Other Production Process Types: This segment constitutes a smaller portion of the market.

By Metal Type:

- Aluminum: Aluminum dominates the market due to its lightweight nature and excellent mechanical properties.

- Zinc: Zinc is used for smaller components due to its cost-effectiveness and excellent surface finish capabilities.

- Other Metal Types: Magnesium and other alloys comprise a smaller part of the market.

By Application Type:

- Engine Parts: This segment represents a significant portion of the market due to the crucial role of die-cast components in engine performance and durability.

- Transmission Components: This segment is experiencing growth driven by advancements in transmission technologies.

- Structural Parts: The demand for lightweight structural parts is driving growth in this segment.

- Other Application Types: This includes smaller components and various other applications.

Market Drivers:

- Strong automotive production in Europe.

- Investments in new manufacturing facilities and technologies.

- Government incentives promoting the adoption of fuel-efficient and electric vehicles.

- Favorable economic conditions in key European markets.

Europe Automotive Parts Die Casting Industry Product Developments

Recent product innovations focus on lightweighting and improved material properties to enhance fuel efficiency and performance. Advancements in die casting technology, including high-pressure die casting and thin-wall casting, are creating components with enhanced strength and reduced weight. The integration of smart sensors and data analytics in die casting processes is improving quality control and predictive maintenance. These advancements enhance the competitive edge of European manufacturers in the global automotive parts market.

Challenges in the Europe Automotive Parts Die Casting Industry Market

The industry faces several challenges, including stringent environmental regulations impacting material choices and production processes. Supply chain disruptions, particularly for raw materials like aluminum, pose significant risks. Furthermore, intense competition from Asian manufacturers, offering lower production costs, puts pressure on profit margins. The overall impact of these challenges is estimated to reduce market growth by approximately xx% in the short term.

Forces Driving Europe Automotive Parts Die Casting Industry Growth

Several factors drive the industry's long-term growth, including continued advancements in die casting technologies that enhance production efficiency and reduce costs. Government incentives supporting electric vehicle adoption and the growing demand for lightweight automotive components due to stricter fuel efficiency regulations continue to boost growth. The shift towards sustainable manufacturing practices and the development of innovative materials also contribute to market expansion.

Long-Term Growth Catalysts in Europe Automotive Parts Die Casting Industry

Long-term growth will be fueled by strategic partnerships between die casting companies and automotive manufacturers to develop innovative, lightweight components. Expansion into new markets and applications, as well as investments in R&D to improve existing die casting processes and explore new materials, are crucial catalysts for sustaining future growth.

Emerging Opportunities in Europe Automotive Parts Die Casting Industry

Emerging opportunities include the growing demand for die-cast components in electric vehicles (EVs) and hybrid electric vehicles (HEVs). The development of innovative materials, such as high-strength aluminum alloys and magnesium alloys, presents significant opportunities. The adoption of advanced manufacturing technologies, such as additive manufacturing and 3D printing, is poised to transform the industry, offering potential for customization and reduced production lead times.

Leading Players in the Europe Automotive Parts Die Casting Industry Sector

- Ryobi Die Casting

- Georg Fischer Limited

- Martinrea Honsel

- Buhler Group

- Brabant Alucast

- DGS Druckguss Systeme

- Nemak

- Dynacast

- Rheinmetall Automotive

Key Milestones in Europe Automotive Parts Die Casting Industry Industry

- September 2022: Rheinmetall AG secured a EUR 20 million (USD 23.6 million) order for its Turbo Bypass Valve (TBV) Gen 6, highlighting the strong demand for advanced automotive components.

- May 2022: GF Casting Solutions committed to enhancing EV product development using AI, signifying the industry's focus on electric mobility.

Strategic Outlook for Europe Automotive Parts Die Casting Industry Market

The European automotive parts die casting industry is poised for continued growth, driven by the increasing demand for lightweight and high-performance automotive components. Strategic partnerships, technological advancements, and expansion into new markets will be key drivers of future success. The focus on sustainability and the adoption of Industry 4.0 technologies will further shape the competitive landscape and unlock new growth opportunities.

Europe Automotive Parts Die Casting Industry Segmentation

-

1. Production Process Type

- 1.1. Vacuum Die Casting

- 1.2. Pressure Die Casting

- 1.3. Other Production Process Types

-

2. Metal Type

- 2.1. Aluminum

- 2.2. Zinc

- 2.3. Other Metal Types

-

3. Application Type

- 3.1. Engine Parts

- 3.2. Transmission Components

- 3.3. Structural Parts

- 3.4. Other Application Types

Europe Automotive Parts Die Casting Industry Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. United Kingdom

- 1.3. France

- 1.4. Italy

- 1.5. Russia

- 1.6. Rest of Europe

Europe Automotive Parts Die Casting Industry Regional Market Share

Geographic Coverage of Europe Automotive Parts Die Casting Industry

Europe Automotive Parts Die Casting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Use of Aluminum in Die Casting Equipment to Increase Market Demand

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Commercial Vehicle Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Parts Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Vacuum Die Casting

- 5.1.2. Pressure Die Casting

- 5.1.3. Other Production Process Types

- 5.2. Market Analysis, Insights and Forecast - by Metal Type

- 5.2.1. Aluminum

- 5.2.2. Zinc

- 5.2.3. Other Metal Types

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Engine Parts

- 5.3.2. Transmission Components

- 5.3.3. Structural Parts

- 5.3.4. Other Application Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ryobi Die Casting

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Georg Fischer Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Martinrea Honsel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Buhler Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Brabant Alucast

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DGS Druckguss Systeme*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nemak

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dynacast

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rheinmetall Automotive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Ryobi Die Casting

List of Figures

- Figure 1: Europe Automotive Parts Die Casting Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Automotive Parts Die Casting Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Automotive Parts Die Casting Industry Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 2: Europe Automotive Parts Die Casting Industry Revenue Million Forecast, by Metal Type 2020 & 2033

- Table 3: Europe Automotive Parts Die Casting Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 4: Europe Automotive Parts Die Casting Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Automotive Parts Die Casting Industry Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 6: Europe Automotive Parts Die Casting Industry Revenue Million Forecast, by Metal Type 2020 & 2033

- Table 7: Europe Automotive Parts Die Casting Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 8: Europe Automotive Parts Die Casting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Germany Europe Automotive Parts Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Europe Automotive Parts Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Automotive Parts Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Automotive Parts Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Russia Europe Automotive Parts Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of Europe Europe Automotive Parts Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Parts Die Casting Industry?

The projected CAGR is approximately 7.28%.

2. Which companies are prominent players in the Europe Automotive Parts Die Casting Industry?

Key companies in the market include Ryobi Die Casting, Georg Fischer Limited, Martinrea Honsel, Buhler Group, Brabant Alucast, DGS Druckguss Systeme*List Not Exhaustive, Nemak, Dynacast, Rheinmetall Automotive.

3. What are the main segments of the Europe Automotive Parts Die Casting Industry?

The market segments include Production Process Type, Metal Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Use of Aluminum in Die Casting Equipment to Increase Market Demand.

6. What are the notable trends driving market growth?

Increasing Demand from the Commercial Vehicle Segment.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

September 2022: Rheinmetall AG (Rheinmetall) secured a new EUR 20 million (USD 23.6 million) order for its cutting-edge air-divert valve, the Turbo Bypass Valve (TBV) Gen 6, further solidifying its position as a key player in the industry. This order adds to the series of recent successful orders received by the Group subsidiary. Production of the TBV Gen 6 will be carried out at Pierburg's Neuss, Germany, plant.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Parts Die Casting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Parts Die Casting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Parts Die Casting Industry?

To stay informed about further developments, trends, and reports in the Europe Automotive Parts Die Casting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence