Key Insights

The European commercial aircraft cabin interior market is poised for robust expansion, propelled by escalating air passenger volumes, an amplified emphasis on passenger comfort and experiential travel, and ongoing advancements in cabin design and technology. The market, valued at $12 billion in the base year of 2024, is projected to achieve a Compound Annual Growth Rate (CAGR) of 3.3% between 2024 and 2033. Key growth drivers include the sustained expansion of low-cost carriers, directly correlating with increased demand for cabin interior components. Furthermore, airlines are prioritizing enhanced passenger comfort and advanced in-flight entertainment (IFE) systems to bolster customer acquisition and retention. Technological innovations, such as the adoption of lightweight materials, advanced noise reduction, and cutting-edge connectivity solutions, are actively shaping market trends and stimulating demand for modern cabin interiors. The narrowbody aircraft segment is anticipated to lead market share due to its widespread deployment by both low-cost and legacy carriers. Concurrently, the widebody segment presents substantial growth prospects, particularly for long-haul routes and the increasing demand for premium cabin classes. Leading market participants, including Panasonic Avionics Corporation, Astronics Corporation, and Safran, are committed to continuous innovation to address the dynamic requirements of airlines and passengers.

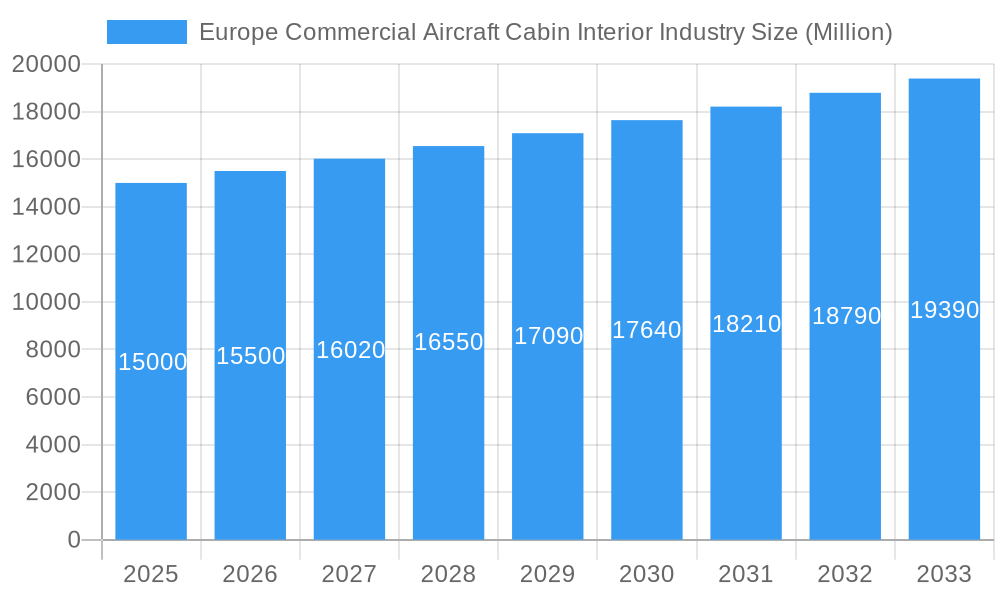

Europe Commercial Aircraft Cabin Interior Industry Market Size (In Billion)

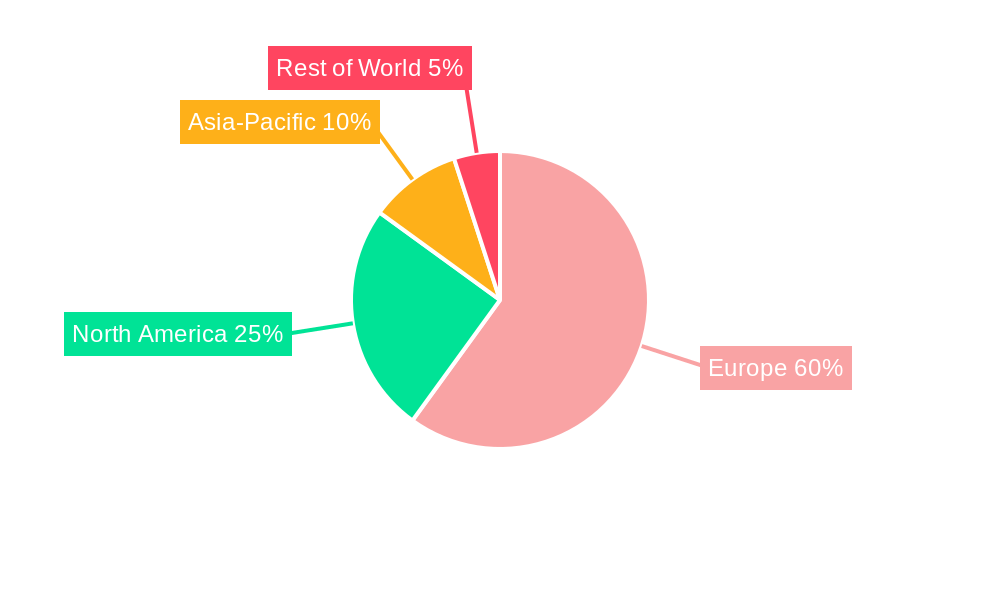

Segment analysis indicates that passenger seating and in-flight entertainment systems represent significant revenue contributors. Germany, France, and the United Kingdom emerge as the leading national markets, supported by strong aviation sectors and high air travel volumes. Emerging European economies also offer notable growth potential as their aviation industries develop. While supply chain volatility and economic uncertainties may present challenges, the long-term outlook for the European commercial aircraft cabin interior market remains favorable, driven by the evolving landscape of air travel and the persistent focus on elevating the passenger journey. The integration of sustainable materials and technologies within cabin interiors is also expected to be a significant factor influencing market trajectory.

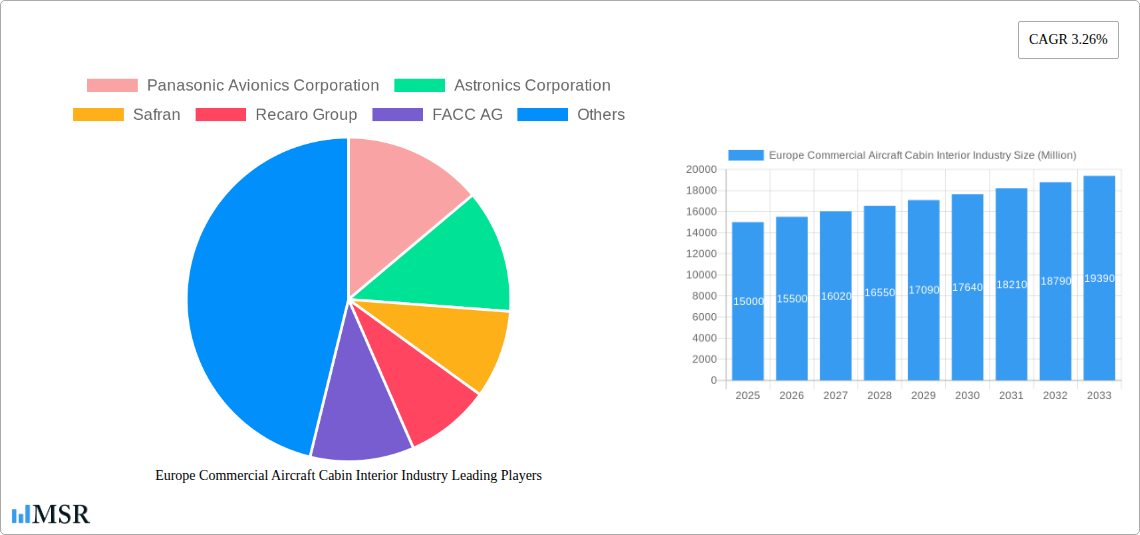

Europe Commercial Aircraft Cabin Interior Industry Company Market Share

Europe Commercial Aircraft Cabin Interior Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Commercial Aircraft Cabin Interior Industry, offering crucial insights for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report analyzes key market segments, including Product Type (Cabin Lights, Cabin Windows, In-Flight Entertainment Systems, Passenger Seats, Other Product Types), Aircraft Type (Narrowbody, Widebody), Cabin Class (Business & First Class, Economy & Premium Economy Class), and key European countries (France, Germany, Spain, Turkey, United Kingdom, and Rest of Europe). The report also profiles leading players such as Panasonic Avionics Corporation, Astronics Corporation, Safran, Recaro Group, FACC AG, Thompson Aero Seating, Thales Group, Diehl Aerospace GmbH, SCHOTT Technical Glass Solutions GmbH, GKN Aerospace Service Limited, Jamco Corporation, and Collins Aerospace. Expect detailed market sizing (in Millions), CAGR projections, and actionable insights to guide your business strategies.

Europe Commercial Aircraft Cabin Interior Industry Market Concentration & Dynamics

The European commercial aircraft cabin interior market exhibits a moderately concentrated landscape, with a handful of major players holding significant market share. However, the presence of several smaller, specialized companies fosters competition and innovation. Market share estimates for 2025 place the top five players at approximately xx Million in combined revenue, representing xx% of the total market. The industry is characterized by a dynamic innovation ecosystem, driven by ongoing advancements in materials science, electronics, and design. Stringent safety regulations and certification processes imposed by the European Union Aviation Safety Agency (EASA) shape the competitive landscape. Substitute products, such as improved in-seat entertainment options on personal devices, pose a challenge, while M&A activity remains relatively frequent, with an estimated xx M&A deals concluded between 2019 and 2024.

- Market Concentration: Moderately concentrated, top 5 players holding approximately xx% market share in 2025.

- Innovation Ecosystem: Strong, driven by advancements in materials, electronics, and design.

- Regulatory Framework: Stringent, governed by EASA regulations.

- Substitute Products: Growing competition from personal devices.

- M&A Activity: Significant, with xx deals estimated between 2019 and 2024.

- End-User Trends: Increasing demand for enhanced comfort, personalization, and connectivity.

Europe Commercial Aircraft Cabin Interior Industry Insights & Trends

The European commercial aircraft cabin interior market is projected to experience robust growth during the forecast period (2025-2033), driven primarily by the resurgence in air travel post-pandemic and the continuous expansion of airline fleets. The market size in 2025 is estimated at xx Million, with a projected CAGR of xx% from 2025 to 2033, reaching xx Million by 2033. Technological disruptions, such as the adoption of advanced in-flight entertainment systems, lightweight materials, and sustainable cabin design, are reshaping the industry. Evolving consumer behaviors, particularly a preference for enhanced comfort and personalized experiences, are influencing product development and design. The growing focus on sustainability is further impacting the industry, with manufacturers actively seeking to reduce the environmental impact of their products.

Key Markets & Segments Leading Europe Commercial Aircraft Cabin Interior Industry

The market is segmented by product type, aircraft type, and cabin class. While all segments show growth, passenger seats represent the largest revenue segment in 2025. The UK and Germany represent the largest national markets. The widebody aircraft segment demonstrates significant growth potential due to increasing long-haul travel demand.

- Dominant Region: Western Europe, particularly the UK and Germany.

- Dominant Product Type: Passenger Seats

- Dominant Aircraft Type: Widebody Aircraft

- Dominant Cabin Class: Economy and Premium Economy.

Growth Drivers:

- Economic Growth: Increased disposable income leads to higher air travel demand.

- Infrastructure Development: Expansion of airports and air traffic management systems.

- Technological Advancements: Innovation in materials, design, and in-flight entertainment.

- Airline Fleet Expansion: Airlines investing in new aircraft to meet growing passenger demand.

Europe Commercial Aircraft Cabin Interior Industry Product Developments

Recent product innovations focus on enhanced passenger comfort, improved connectivity, and sustainable materials. Technological advancements include the integration of advanced lighting systems, interactive entertainment platforms, and lightweight seating designs. These improvements provide airlines with a competitive advantage by attracting passengers and increasing revenue. For example, the introduction of 4K OLED screens and high-fidelity audio systems in in-flight entertainment systems has significantly enhanced the passenger experience.

Challenges in the Europe Commercial Aircraft Cabin Interior Industry Market

The industry faces several challenges, including supply chain disruptions impacting raw material availability and production timelines. Stringent regulatory compliance requirements and intense competition among manufacturers also add complexity. These factors can lead to cost increases and delays in product delivery, ultimately affecting profitability and market share. Estimated impacts are difficult to quantify precisely but could lead to a xx Million decrease in market value by 2033 in worst case scenarios.

Forces Driving Europe Commercial Aircraft Cabin Interior Industry Growth

The growth of the European commercial aircraft cabin interior industry is primarily driven by technological advancements, such as the development of lighter and more durable materials, advanced in-flight entertainment systems, and improved passenger comfort features. Increasing air travel demand fueled by economic growth and expanding airline fleets also contribute significantly to market expansion. Favorable regulatory environments promoting safety and innovation further stimulate industry growth.

Challenges in the Europe Commercial Aircraft Cabin Interior Industry Market

Long-term growth catalysts include strategic partnerships and collaborations among manufacturers, airlines, and technology providers, which foster innovation and accelerate the adoption of new technologies. Continued investment in research and development to improve product functionalities and sustainability and expansion into new markets are crucial to drive sustained industry growth.

Emerging Opportunities in Europe Commercial Aircraft Cabin Interior Industry

Emerging opportunities exist in the development and adoption of sustainable cabin interiors and the integration of advanced technologies, such as augmented reality and artificial intelligence, to enhance the passenger experience. The increasing focus on personalized in-flight entertainment and connectivity solutions also presents significant growth opportunities. New markets in developing economies with growing air travel demand also represent promising avenues for expansion.

Leading Players in the Europe Commercial Aircraft Cabin Interior Industry Sector

- Panasonic Avionics Corporation

- Astronics Corporation

- Safran

- Recaro Group

- FACC AG

- Thompson Aero Seating

- Thales Group

- Diehl Aerospace GmbH

- SCHOTT Technical Glass Solutions GmbH

- GKN Aerospace Service Limited

- Jamco Corporation

- Collins Aerospace

Key Milestones in Europe Commercial Aircraft Cabin Interior Industry Industry

- June 2023: United Airlines announces the adoption of Panasonic's Astrova in-flight entertainment system, featuring 4K OLED screens and high-fidelity audio.

- June 2023: Air New Zealand unveils new cabin interiors featuring Safran Seats' Business Premier seats, designed specifically for 787 aircraft.

- July 2023: Jamco Corporation installs its Venture reverse herringbone premium class seats on KLM Royal Dutch Airlines' B777 fleet.

Strategic Outlook for Europe Commercial Aircraft Cabin Interior Industry Market

The European commercial aircraft cabin interior market is poised for continued growth, driven by technological innovation, increasing passenger demand, and strategic partnerships. Companies focusing on sustainability, personalized experiences, and advanced connectivity solutions will be well-positioned to capitalize on future opportunities. Market expansion into emerging economies and the development of new materials and designs will further drive market growth in the coming years.

Europe Commercial Aircraft Cabin Interior Industry Segmentation

-

1. Product Type

- 1.1. Cabin Lights

- 1.2. Cabin Windows

- 1.3. In-Flight Entertainment System

- 1.4. Passenger Seats

- 1.5. Other Product Types

-

2. Aircraft Type

- 2.1. Narrowbody

- 2.2. Widebody

-

3. Cabin Class

- 3.1. Business and First Class

- 3.2. Economy and Premium Economy Class

Europe Commercial Aircraft Cabin Interior Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Commercial Aircraft Cabin Interior Industry Regional Market Share

Geographic Coverage of Europe Commercial Aircraft Cabin Interior Industry

Europe Commercial Aircraft Cabin Interior Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Commercial Aircraft Cabin Interior Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cabin Lights

- 5.1.2. Cabin Windows

- 5.1.3. In-Flight Entertainment System

- 5.1.4. Passenger Seats

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.2.1. Narrowbody

- 5.2.2. Widebody

- 5.3. Market Analysis, Insights and Forecast - by Cabin Class

- 5.3.1. Business and First Class

- 5.3.2. Economy and Premium Economy Class

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Panasonic Avionics Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Astronics Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Safran

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Recaro Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FACC AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Thompson Aero Seatin

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thales Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Diehl Aerospace GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SCHOTT Technical Glass Solutions GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GKN Aerospace Service Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Jamco Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Collins Aerospace

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Panasonic Avionics Corporation

List of Figures

- Figure 1: Europe Commercial Aircraft Cabin Interior Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Commercial Aircraft Cabin Interior Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Commercial Aircraft Cabin Interior Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Europe Commercial Aircraft Cabin Interior Industry Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 3: Europe Commercial Aircraft Cabin Interior Industry Revenue billion Forecast, by Cabin Class 2020 & 2033

- Table 4: Europe Commercial Aircraft Cabin Interior Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Commercial Aircraft Cabin Interior Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Europe Commercial Aircraft Cabin Interior Industry Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 7: Europe Commercial Aircraft Cabin Interior Industry Revenue billion Forecast, by Cabin Class 2020 & 2033

- Table 8: Europe Commercial Aircraft Cabin Interior Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Commercial Aircraft Cabin Interior Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Commercial Aircraft Cabin Interior Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Commercial Aircraft Cabin Interior Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Commercial Aircraft Cabin Interior Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Commercial Aircraft Cabin Interior Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Commercial Aircraft Cabin Interior Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Commercial Aircraft Cabin Interior Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Commercial Aircraft Cabin Interior Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Commercial Aircraft Cabin Interior Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Commercial Aircraft Cabin Interior Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Commercial Aircraft Cabin Interior Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Commercial Aircraft Cabin Interior Industry?

The projected CAGR is approximately 3.3%.

2. Which companies are prominent players in the Europe Commercial Aircraft Cabin Interior Industry?

Key companies in the market include Panasonic Avionics Corporation, Astronics Corporation, Safran, Recaro Group, FACC AG, Thompson Aero Seatin, Thales Group, Diehl Aerospace GmbH, SCHOTT Technical Glass Solutions GmbH, GKN Aerospace Service Limited, Jamco Corporation, Collins Aerospace.

3. What are the main segments of the Europe Commercial Aircraft Cabin Interior Industry?

The market segments include Product Type, Aircraft Type, Cabin Class.

4. Can you provide details about the market size?

The market size is estimated to be USD 12 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2023: Jamco Corporation announced that through a collaboration with KLM Royal Dutch Airlines (KLM), its premium class seats, Venture reverse herringbone, were installed in the World Business Class (WBC) of KLM's B777 Fleet.June 2023: United will be the first US airline to offer Panasonic's Astrova system, giving customers exclusive features like 4K OLED screens, high fidelity audio, and programmable LED lighting, starting in 2025.June 2023: Air New Zealand unveiled its brand new cabin interiors featuring its latest Business Premier seats, designed and manufactured with Safran Seats. In co-creation with Safran Seats, the seat is specifically designed for 787 aircraft by maximizing the available space for this aircraft type.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Commercial Aircraft Cabin Interior Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Commercial Aircraft Cabin Interior Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Commercial Aircraft Cabin Interior Industry?

To stay informed about further developments, trends, and reports in the Europe Commercial Aircraft Cabin Interior Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence