Key Insights

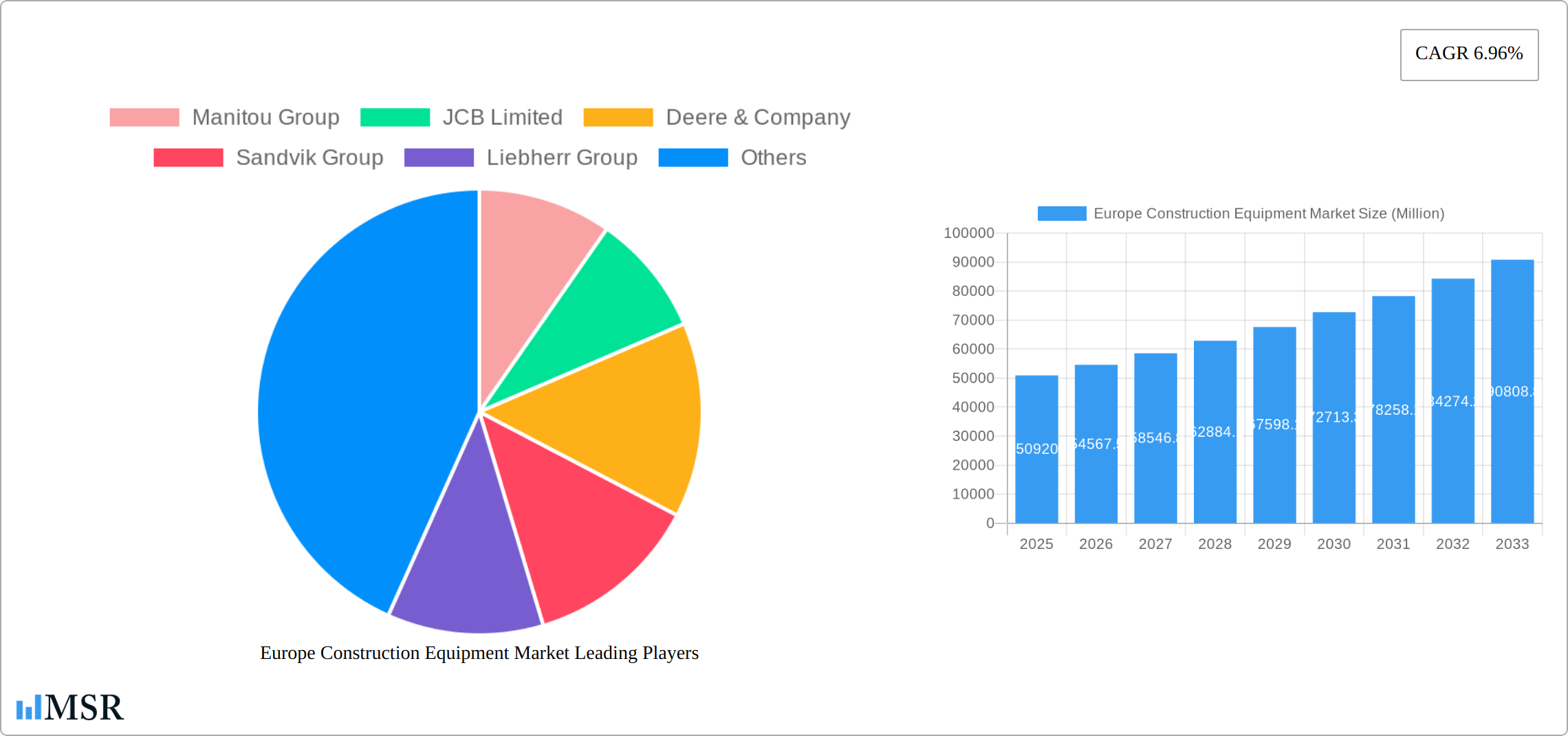

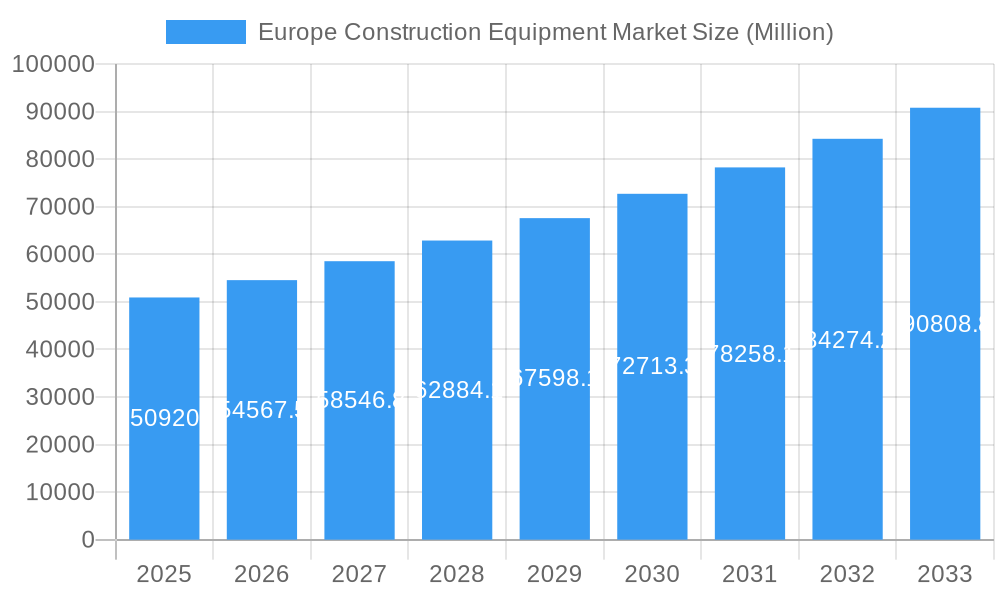

The European construction equipment market, valued at €50.92 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.96% from 2025 to 2033. This expansion is fueled by several key factors. Increased infrastructure development across major European nations like Germany, the UK, and France, spurred by government investments in transportation and renewable energy projects, is a significant driver. Furthermore, the ongoing trend towards urbanization and the resulting need for new residential and commercial buildings are bolstering demand. The rising adoption of technologically advanced equipment, such as electric and hybrid machinery, is contributing to market growth, driven by environmental concerns and stricter emission regulations. While rising raw material costs and potential supply chain disruptions pose challenges, the overall market outlook remains positive, with strong growth expected across segments such as cranes, excavators, and loaders. The market is further segmented by drive type, with IC engine-powered machinery still dominating but facing increasing competition from electric and hybrid alternatives as technology advances and environmental regulations tighten.

Europe Construction Equipment Market Market Size (In Billion)

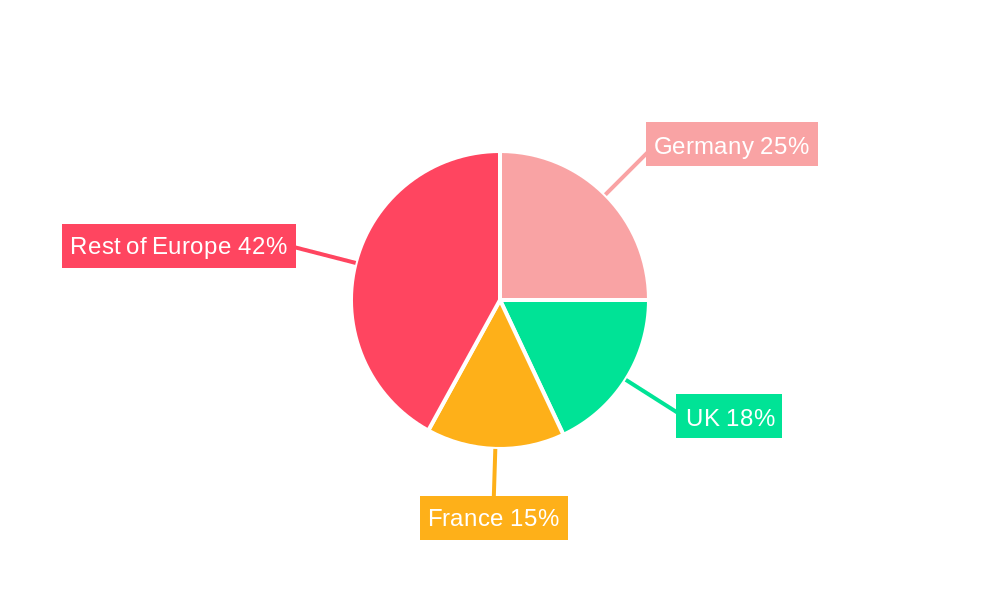

The competitive landscape is characterized by the presence of major global players including Manitou Group, JCB Limited, Deere & Company, and Caterpillar Inc., alongside regional manufacturers. These companies are focusing on innovation, product diversification, and strategic partnerships to maintain their market share. The market is expected to witness increased consolidation as companies seek to expand their geographical reach and product portfolios. Germany, the UK, and France are currently the largest national markets within Europe, but growth opportunities exist across other regions as infrastructure development accelerates. The forecast period of 2025-2033 suggests continued positive growth trajectory for the European construction equipment market, offering significant opportunities for both established players and new entrants. However, adapting to the evolving technological landscape and navigating economic uncertainties will be crucial for long-term success.

Europe Construction Equipment Market Company Market Share

Europe Construction Equipment Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Construction Equipment market, offering invaluable insights for industry stakeholders, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, trends, key players, and future growth prospects. The report leverages rigorous research methodologies to deliver actionable intelligence, enabling informed decision-making in this dynamic sector.

Europe Construction Equipment Market Concentration & Dynamics

The Europe construction equipment market exhibits a moderately concentrated landscape, with key players like Caterpillar Inc, Liebherr Group, Volvo Construction Equipment, and JCB Limited holding significant market share. However, the presence of several regional and specialized players fosters competition. Innovation is driven by a robust R&D ecosystem, focused on enhancing efficiency, sustainability, and automation. Stringent environmental regulations, particularly concerning emissions and noise levels, are shaping product development and market trends. Substitute products, such as specialized attachments and alternative construction methods, pose a moderate competitive threat. End-user preferences are shifting towards technologically advanced, fuel-efficient, and environmentally friendly equipment. The market has witnessed a moderate level of M&A activity in recent years, with approximately xx deals concluded between 2019 and 2024, mostly focused on consolidating market share and expanding geographical reach. Market share for the top 5 players is estimated at xx% in 2025.

Europe Construction Equipment Market Industry Insights & Trends

The European construction equipment market is projected to reach xx Million by 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is primarily driven by robust infrastructure development initiatives across several European countries, particularly in Germany, the UK, and France, fueled by government spending and private investments. The increasing adoption of sustainable construction practices, coupled with technological advancements in automation and digitization, further propels market expansion. The transition towards electric and hybrid drive types is gaining momentum, driven by environmental concerns and government incentives. However, economic fluctuations, raw material price volatility, and supply chain disruptions pose potential challenges to sustained growth. Consumer behavior is shifting towards equipment-as-a-service (EaaS) models, emphasizing operational efficiency and reduced capital expenditure. Overall, the market displays significant growth potential, driven by a confluence of favorable factors, despite facing inherent economic and logistical headwinds.

Key Markets & Segments Leading Europe Construction Equipment Market

- By Country: Germany, the United Kingdom, and France represent the dominant markets within Europe, accounting for approximately xx% of the total market value in 2025. Strong economic activity, extensive infrastructure projects, and a well-established construction sector contribute to this dominance. Russia and Spain also contribute significantly, though subject to greater economic variability. Drivers for these markets include:

- Robust infrastructure development programs (e.g., road construction, railway upgrades).

- Increasing urbanization and industrialization.

- Government initiatives to modernize infrastructure.

- By Machinery Type: Excavators hold the largest market share, followed closely by Loaders and Backhoe Loaders and Cranes. The demand for excavators is driven by their versatility in various construction applications. The growth of telescopic handlers is fueled by their efficiency in material handling.

- By Drive Type: IC Engine-powered equipment currently dominates the market, but the segment for Electric and Hybrid equipment is witnessing rapid growth driven by emission regulations and sustainability concerns.

Europe Construction Equipment Market Product Developments

Recent product innovations focus on enhancing efficiency, safety, and sustainability. The integration of advanced technologies such as telematics, GPS, and automation is becoming increasingly prevalent. Manufacturers are actively developing hybrid and electric-powered equipment to meet stringent environmental regulations. These advancements aim to provide improved operational performance, reduced emissions, and enhanced operator comfort, thus creating a significant competitive edge.

Challenges in the Europe Construction Equipment Market

The Europe construction equipment market faces several challenges, including:

- Regulatory hurdles: Stringent emission and safety standards impact production costs and product development cycles.

- Supply chain disruptions: Global supply chain vulnerabilities, particularly in the sourcing of critical components, pose a significant threat to timely project completion and profitability.

- Economic uncertainty: Economic downturns can lead to reduced investment in construction projects, thereby impacting equipment demand.

- Intense Competition: The presence of numerous established players and new entrants creates intense price competition.

Forces Driving Europe Construction Equipment Market Growth

The Europe construction equipment market is experiencing significant growth propelled by several key factors:

- Robust Government Infrastructure Spending: Ambitious governmental investments across the continent in modernizing and expanding transportation networks (roads, railways, airports), upgrading energy infrastructure, and developing public utilities are creating substantial demand for a wide array of construction machinery. This sustained public funding forms a bedrock for market expansion.

- Pioneering Technological Advancements: The industry is witnessing a rapid adoption of cutting-edge technologies. Innovations in intelligent automation, IoT-enabled fleet management, advanced telematics for predictive maintenance, and the development of increasingly fuel-efficient and lower-emission engines are not only boosting operational efficiency but also aligning with the continent's strong commitment to environmental sustainability, attracting discerning buyers.

- Accelerated Urbanization and Industrialization: Continuous population growth and the subsequent expansion of urban centers across Europe necessitate ongoing construction for residential, commercial, and public facilities. Simultaneously, ongoing industrial development and the modernization of existing facilities further fuel the demand for construction equipment, ensuring a consistent market presence.

Long-Term Growth Catalysts in the Europe Construction Equipment Market

Long-term growth will be fueled by continued investments in sustainable infrastructure, the adoption of innovative technologies like AI and IoT in construction, and strategic partnerships between equipment manufacturers and construction companies to optimize project execution. The expansion into new markets and the development of customized solutions for specific construction applications will also contribute significantly to market growth.

Emerging Opportunities in Europe Construction Equipment Market

The evolving landscape of the Europe construction equipment market presents exciting new avenues for growth and innovation:

- Surging Demand for Sustainable and Eco-Friendly Equipment: With a heightened global and European focus on environmental protection and carbon footprint reduction, there's a significant and growing market preference for construction equipment powered by electricity, hybrid technologies, and those offering substantially reduced emissions. This presents a prime opportunity for manufacturers to lead in green innovation.

- Expanding Adoption of Equipment-as-a-Service (EaaS) Models: The shift towards EaaS is revolutionizing how construction companies access and utilize machinery. This flexible model, which includes rental, leasing, and subscription-based services, significantly reduces the upfront capital investment for businesses, enhances fleet adaptability, and offers predictable operational costs, thereby boosting its appeal.

- Thriving Rental Market Growth: The construction equipment rental sector is experiencing a substantial uplift. It democratizes access to a diverse range of specialized and advanced equipment, making it financially feasible for smaller contractors and project-specific needs without the burden of ownership. This accessibility is a key driver for market penetration.

Leading Players in the Europe Construction Equipment Market Sector

Key Milestones in Europe Construction Equipment Industry

- 2020: Introduction of stricter emission regulations across several European countries.

- 2021: Several major manufacturers launch new lines of electric and hybrid construction equipment.

- 2022: Significant increase in M&A activity, driven by consolidation and expansion strategies.

- 2023: Adoption of digital technologies like building information modeling (BIM) accelerates.

- 2024: Several key players invest heavily in R&D for autonomous construction equipment.

Strategic Outlook for Europe Construction Equipment Market

The Europe construction equipment market is exceptionally well-positioned for a period of sustained and significant growth. This positive trajectory is underpinned by consistent and substantial infrastructure development initiatives, the relentless pace of technological innovation, and a deeply ingrained commitment to integrating sustainable construction practices. Strategic success in this market will hinge on a focused approach to pioneering new technologies, a dedicated effort in developing and promoting eco-friendly equipment solutions, and the adept utilization of digital transformation to optimize operational efficiency and elevate customer experiences. The long-term prospects for the market are undeniably robust, demanding a forward-thinking and agile strategy to not only navigate emerging trends but also to seize and capitalize on the numerous growth opportunities as they arise.

Europe Construction Equipment Market Segmentation

-

1. Machinery Type

- 1.1. Cranes

- 1.2. Telescopic Handling

- 1.3. Excavators

- 1.4. Loaders and Backhoe

- 1.5. Motor Graders

- 1.6. Other Machinery Types

-

2. Drive Type

- 2.1. IC Engine

- 2.2. Electric and Hybrid

Europe Construction Equipment Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Construction Equipment Market Regional Market Share

Geographic Coverage of Europe Construction Equipment Market

Europe Construction Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Investments in Infrastructure Deployment

- 3.3. Market Restrains

- 3.3.1. Rapid Expansion of Construction Equipment Rental Services Across the Region

- 3.4. Market Trends

- 3.4.1. The Electric Drive Type is Expected to Drive the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Cranes

- 5.1.2. Telescopic Handling

- 5.1.3. Excavators

- 5.1.4. Loaders and Backhoe

- 5.1.5. Motor Graders

- 5.1.6. Other Machinery Types

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. IC Engine

- 5.2.2. Electric and Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Manitou Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JCB Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Deere & Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sandvik Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Liebherr Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hitachi Construction Machinery Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Volvo Construction Equipment

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Caterpillar Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CNH Industrial NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Atlas Copco Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Manitou Group

List of Figures

- Figure 1: Europe Construction Equipment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Construction Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Construction Equipment Market Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 2: Europe Construction Equipment Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 3: Europe Construction Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Construction Equipment Market Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 5: Europe Construction Equipment Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 6: Europe Construction Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Construction Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Construction Equipment Market?

The projected CAGR is approximately 6.96%.

2. Which companies are prominent players in the Europe Construction Equipment Market?

Key companies in the market include Manitou Group, JCB Limited, Deere & Company, Sandvik Group, Liebherr Group, Hitachi Construction Machinery Co Ltd, Volvo Construction Equipment, Caterpillar Inc, CNH Industrial NV, Atlas Copco Group.

3. What are the main segments of the Europe Construction Equipment Market?

The market segments include Machinery Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 50.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Investments in Infrastructure Deployment.

6. What are the notable trends driving market growth?

The Electric Drive Type is Expected to Drive the Growth of the Market.

7. Are there any restraints impacting market growth?

Rapid Expansion of Construction Equipment Rental Services Across the Region.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Construction Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Construction Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Construction Equipment Market?

To stay informed about further developments, trends, and reports in the Europe Construction Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence