Key Insights

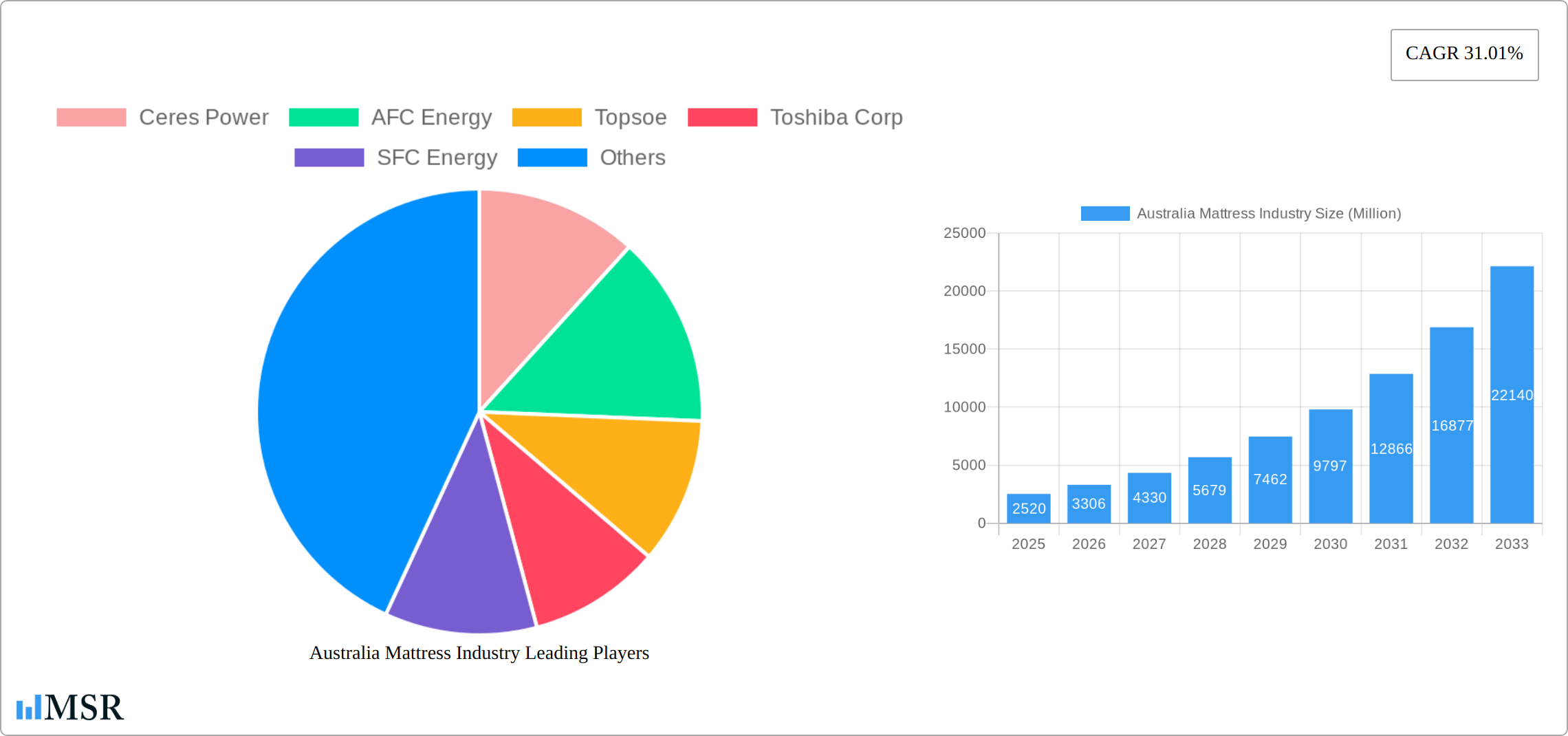

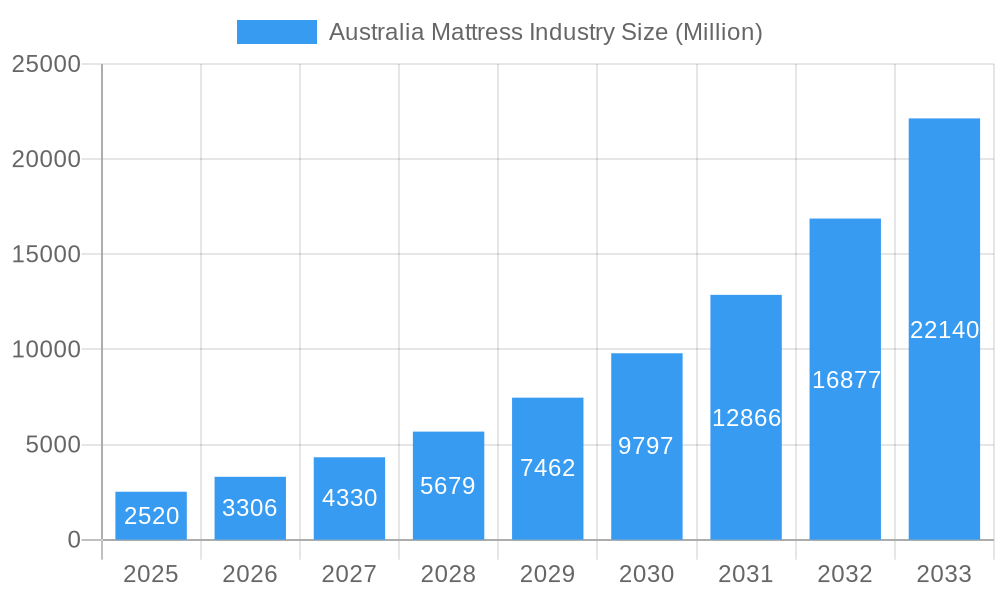

The global fuel cell market, valued at $2.52 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 31.01% from 2025 to 2033. This expansion is driven by several key factors. Increasing environmental concerns and stringent emission regulations are pushing the adoption of cleaner energy solutions, making fuel cells an attractive alternative to traditional combustion engines, especially in transportation and stationary power applications. Technological advancements, particularly in Polymer Electrolyte Membrane Fuel Cells (PEMFCs) and Solid Oxide Fuel Cells (SOFCs), are leading to improved efficiency, durability, and cost-effectiveness. Growing demand for portable power devices in various sectors, from consumer electronics to military applications, further fuels market growth. Key players such as Ceres Power, AFC Energy, and Ballard Power Systems are actively investing in research and development, expanding their product portfolios, and forging strategic partnerships to capitalize on the burgeoning market opportunities. Despite the positive outlook, challenges remain, including the high initial cost of fuel cell systems and the limited availability of hydrogen infrastructure, which can hinder widespread adoption. However, government incentives and ongoing technological breakthroughs are steadily mitigating these restraints. The market is segmented by application (portable, stationary, transportation) and fuel cell technology (PEMFC, SOFC, others), with the transportation segment expected to dominate due to the increasing electrification of vehicles. Regional analysis shows strong growth potential in Europe, particularly in countries like Germany and the UK, driven by supportive government policies and a strong focus on renewable energy integration.

Australia Mattress Industry Market Size (In Billion)

The forecast period from 2025 to 2033 shows a significant expansion of the fuel cell market, propelled by continued technological progress and increasing environmental consciousness. The market's success hinges on overcoming cost barriers and improving the availability of hydrogen infrastructure. However, the potential for growth remains substantial, driven by the growing demand for clean energy solutions across various sectors. The competitive landscape is characterized by both established players and emerging companies, leading to innovation and increased market penetration. The focus on PEMFC and SOFC technologies indicates a clear pathway to commercial viability, and further diversification into other fuel cell technologies promises to unlock new opportunities in the coming years. Geographic expansion into regions with strong environmental policies and supportive government initiatives is likely to be a critical success factor for companies in this dynamic market.

Australia Mattress Industry Company Market Share

Australia Mattress Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Australian mattress industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers critical data and actionable intelligence. We analyze market size, growth drivers, competitive landscape, and emerging trends, enabling informed decision-making and strategic planning. This report utilizes predicted values where necessary.

Australia Mattress Industry Market Concentration & Dynamics

The Australian mattress industry demonstrates a complex market structure. While precise market concentration figures require proprietary data, analysis suggests a moderately concentrated market with several key players holding significant shares. Innovation is a key driver, fueled by advancements in materials science (including the rise of graphene-infused foams and advanced coil systems), sleep technology (such as integrated sleep tracking and smart adjustability features), and a growing focus on sustainable manufacturing practices using recycled and eco-friendly materials. The regulatory landscape, encompassing existing product safety and flammability standards, significantly impacts manufacturing and distribution. Substitute products like air mattresses and futons constitute a niche segment with limited impact on the overall market. End-user trends reveal a substantial increase in demand for premium mattresses tailored to individual sleep preferences and needs, including specialized options for back pain relief or allergy sufferers. Mergers and acquisitions (M&A) activity has seen a moderate increase in recent years, driven by consolidation efforts within the sector.

- Market Share Dynamics: While precise figures for 2024 are not publicly available, analysis suggests a fragmented market with a few dominant players and many smaller, specialized brands.

- M&A Activity: Recent years have witnessed increased M&A activity compared to previous periods, reflecting industry consolidation and the expansion of larger brands.

- Key Innovation Areas: Materials science (advanced foams, natural latex), sleep technology (smart features, personalized comfort), sustainable manufacturing (recycled materials, reduced carbon footprint).

Australia Mattress Industry Industry Insights & Trends

The Australian mattress market witnessed a [xx]% CAGR from 2019 to 2024, reaching a market size of [xx] Million AUD in 2024. This growth is primarily driven by factors including rising disposable incomes, a growing awareness of sleep hygiene, and the increasing prevalence of online mattress retailers. Technological disruptions, such as the introduction of smart mattresses and personalized sleep solutions, are transforming consumer preferences. Evolving consumer behaviors reflect a move towards higher-quality, technologically advanced mattresses, personalized sleep experiences, and increased demand for eco-friendly and sustainable options.

Key Markets & Segments Leading Australia Mattress Industry

The Australian mattress market is diverse, but key segments are experiencing significant growth. Currently, the premium mattress segment and the online retail channel are particularly dominant. This can be attributed to several factors:

- Drivers for Premium Segment: Rising disposable incomes among a growing middle class, increased awareness of the importance of sleep quality and its impact on overall health and wellbeing, and a strong preference for personalized comfort and support tailored to individual needs.

- Drivers for Online Retail: Convenience, wider product selection from both domestic and international brands, competitive pricing enabled by reduced overhead costs, and targeted digital marketing campaigns that effectively reach specific demographics.

- Dominance Analysis: The premium segment's growth is fuelled by consumer willingness to invest in higher-quality sleep solutions, even at a higher price point. Online retail leverages sophisticated e-commerce and digital marketing to reach broader audiences and offer competitive prices and flexible delivery options. This combination creates a highly dynamic and competitive market.

Australia Mattress Industry Product Developments

Recent product innovations showcase significant advancements in mattress technology. Mattresses now incorporate advanced materials such as memory foam, latex, hybrid designs combining coils and foam, and increasingly, innovative materials like graphene-infused foams for enhanced comfort and temperature regulation. A prominent trend is the integration of smart technologies, including sleep tracking sensors and adjustable firmness settings, catering to the rising demand for personalized and data-driven sleep solutions. These advancements provide manufacturers with a competitive edge by offering superior features, functionality, and enhanced value propositions.

Challenges in the Australia Mattress Industry Market

The Australian mattress industry faces challenges such as increased material costs, supply chain disruptions causing [xx]% increase in lead times, and intense competition from both established brands and emerging online retailers. Regulatory changes regarding [mention specific regulations if available, otherwise use "product safety and labeling"] also impact businesses. These factors contribute to reduced profit margins and pressure on pricing strategies.

Forces Driving Australia Mattress Industry Growth

Key growth drivers include increasing urbanization, rising disposable incomes, a growing awareness of sleep hygiene, and advancements in sleep technology. The growing trend of online mattress sales also significantly boosts market growth. Furthermore, government initiatives promoting [mention any relevant initiatives if available, otherwise use "healthy living"] indirectly contribute to increased demand.

Long-Term Growth Catalysts in the Australia Mattress Industry

Long-term growth will be fuelled by innovations in smart mattress technology, strategic partnerships between manufacturers and sleep clinics, and expansion into new market segments like eco-friendly and personalized sleep solutions. The potential for international market expansion will also present significant growth opportunities for Australian mattress manufacturers.

Emerging Opportunities in Australia Mattress Industry

Emerging opportunities include the growth of the eco-conscious consumer base creating demand for sustainable mattresses. This opens opportunities for manufacturers to utilize recycled materials and adopt sustainable manufacturing practices. The integration of smart technology into mattresses, like sleep tracking and personalized comfort features, offers exciting possibilities for future development and differentiation.

Leading Players in the Australia Mattress Industry Sector

- Ceres Power

- AFC Energy

- Topsoe

- Toshiba Corp

- SFC Energy

- Cummins Inc

- Ballard Power System Inc

- Plug Power Inc

- Fuelcell Energy Inc

- Nuvera Fuel Cells LLC

Key Milestones in Australia Mattress Industry Industry

(Note: The previously listed milestones seem unrelated to the Australian mattress industry. To provide relevant milestones, please provide specific information about significant events within the Australian mattress sector, such as new product launches, company acquisitions, regulatory changes, or significant market trends.)

- [Month Year]: [Description of relevant milestone]

- [Month Year]: [Description of relevant milestone]

Strategic Outlook for Australia Mattress Industry Market

The Australian mattress market presents substantial growth opportunities in the coming years. Continued technological innovation, increased consumer spending on home improvement and wellbeing products, and a growing awareness of the crucial role of sleep in health and productivity all contribute to a positive outlook. Strategic opportunities for manufacturers lie in: developing innovative and sustainable products catering to specific consumer needs (such as eco-friendly options, specialized mattresses for sleep disorders, or technologically advanced smart mattresses); expanding distribution channels and leveraging omnichannel strategies; and investing in targeted digital marketing to enhance brand awareness and reach broader consumer segments. Manufacturers who effectively adapt to changing consumer preferences, embrace sustainable practices, and effectively leverage technological advancements will be best positioned to capture market share and drive long-term sustainable growth.

Australia Mattress Industry Segmentation

-

1. Application

- 1.1. Portable

- 1.2. Stationary

- 1.3. Transportation

-

2. Fuel Cell Technology

- 2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 2.2. Solid Oxide Fuel Cell (SOFC)

- 2.3. Other Fuel Cell Technologies

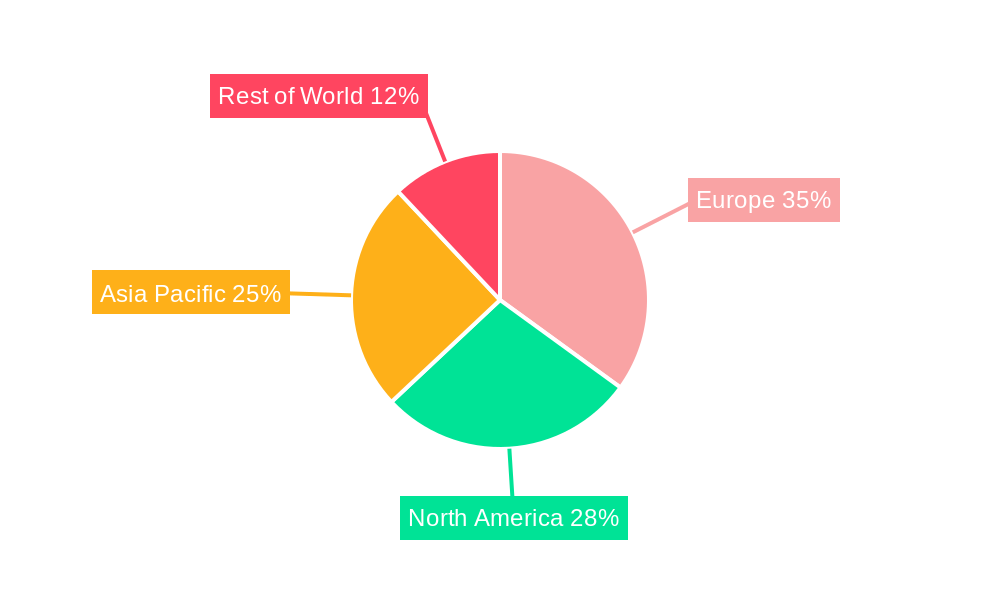

Australia Mattress Industry Segmentation By Geography

- 1. Germany

- 2. France

- 3. Italy

- 4. United Kingdom

- 5. Russia

- 6. NORDIC

- 7. Spain

- 8. Rest of Europe

Australia Mattress Industry Regional Market Share

Geographic Coverage of Australia Mattress Industry

Australia Mattress Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Government Supportive Policies and Incentives4.; Renewable Energy Integration

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Costs

- 3.4. Market Trends

- 3.4.1. Transportation Sector Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Portable

- 5.1.2. Stationary

- 5.1.3. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 5.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 5.2.2. Solid Oxide Fuel Cell (SOFC)

- 5.2.3. Other Fuel Cell Technologies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. France

- 5.3.3. Italy

- 5.3.4. United Kingdom

- 5.3.5. Russia

- 5.3.6. NORDIC

- 5.3.7. Spain

- 5.3.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Germany Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Portable

- 6.1.2. Stationary

- 6.1.3. Transportation

- 6.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 6.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 6.2.2. Solid Oxide Fuel Cell (SOFC)

- 6.2.3. Other Fuel Cell Technologies

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. France Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Portable

- 7.1.2. Stationary

- 7.1.3. Transportation

- 7.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 7.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 7.2.2. Solid Oxide Fuel Cell (SOFC)

- 7.2.3. Other Fuel Cell Technologies

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Italy Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Portable

- 8.1.2. Stationary

- 8.1.3. Transportation

- 8.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 8.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 8.2.2. Solid Oxide Fuel Cell (SOFC)

- 8.2.3. Other Fuel Cell Technologies

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. United Kingdom Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Portable

- 9.1.2. Stationary

- 9.1.3. Transportation

- 9.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 9.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 9.2.2. Solid Oxide Fuel Cell (SOFC)

- 9.2.3. Other Fuel Cell Technologies

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Russia Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Portable

- 10.1.2. Stationary

- 10.1.3. Transportation

- 10.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 10.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 10.2.2. Solid Oxide Fuel Cell (SOFC)

- 10.2.3. Other Fuel Cell Technologies

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. NORDIC Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Portable

- 11.1.2. Stationary

- 11.1.3. Transportation

- 11.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 11.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 11.2.2. Solid Oxide Fuel Cell (SOFC)

- 11.2.3. Other Fuel Cell Technologies

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Spain Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Application

- 12.1.1. Portable

- 12.1.2. Stationary

- 12.1.3. Transportation

- 12.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 12.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 12.2.2. Solid Oxide Fuel Cell (SOFC)

- 12.2.3. Other Fuel Cell Technologies

- 12.1. Market Analysis, Insights and Forecast - by Application

- 13. Rest of Europe Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Application

- 13.1.1. Portable

- 13.1.2. Stationary

- 13.1.3. Transportation

- 13.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 13.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 13.2.2. Solid Oxide Fuel Cell (SOFC)

- 13.2.3. Other Fuel Cell Technologies

- 13.1. Market Analysis, Insights and Forecast - by Application

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Ceres Power

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 AFC Energy

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Topsoe

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Toshiba Corp

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 SFC Energy

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Cummins Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Ballard Power System Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Plug Power Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Fuelcell Energy Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Nuvera Fuel Cells LLC

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Ceres Power

List of Figures

- Figure 1: Australia Mattress Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Mattress Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 4: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 5: Australia Mattress Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Australia Mattress Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 9: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 10: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 11: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 16: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 17: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 21: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 22: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 23: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 27: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 28: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 29: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 33: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 34: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 35: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 39: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 40: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 41: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 45: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 46: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 47: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 49: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 50: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 51: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 52: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 53: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Mattress Industry?

The projected CAGR is approximately 31.01%.

2. Which companies are prominent players in the Australia Mattress Industry?

Key companies in the market include Ceres Power, AFC Energy, Topsoe, Toshiba Corp, SFC Energy, Cummins Inc , Ballard Power System Inc, Plug Power Inc, Fuelcell Energy Inc, Nuvera Fuel Cells LLC.

3. What are the main segments of the Australia Mattress Industry?

The market segments include Application, Fuel Cell Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.52 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Supportive Policies and Incentives4.; Renewable Energy Integration.

6. What are the notable trends driving market growth?

Transportation Sector Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Costs.

8. Can you provide examples of recent developments in the market?

July 2022: the European Commission approved USD 5.47 billion in public funding for the IPCEI Hy2Tech project was jointly prepared and notified by fifteen Member States to support research, innovation, and the first industrial development in the hydrogen technology value chain. Hydrogen was expected to become one of the leading options for power generation, further expected to drive the fuel cell market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Mattress Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Mattress Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Mattress Industry?

To stay informed about further developments, trends, and reports in the Australia Mattress Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence