Key Insights

The European remote sensing satellite market is projected for substantial expansion, driven by escalating demand for high-resolution imagery across diverse industries. An estimated CAGR of 11.5% forecasts significant growth from 2024 to 2033. Key applications fueling this trajectory include environmental monitoring, precision agriculture, urban development, defense, and intelligence operations. The market is segmented by satellite subsystem (propulsion, bus & subsystems, solar arrays, structures, harness & mechanisms), end-user (commercial, military & government, others), satellite mass (below 10kg to above 1000kg), and orbit class (GEO, LEO, MEO). The Low Earth Orbit (LEO) segment is anticipated to dominate due to its optimal configuration for Earth observation. Leading companies such as Airbus SE, Lockheed Martin Corporation, and Maxar Technologies Inc. are spearheading innovation, complemented by emerging agile players like GomSpace ApS and Planet Labs Inc., fostering a competitive landscape. Europe, with its advanced technological infrastructure and robust government support for space initiatives in nations like Germany, France, and the UK, represents a critical market region. Growth is expected to be particularly pronounced in the commercial sector, facilitated by enhanced accessibility and affordability of satellite data and analytics.

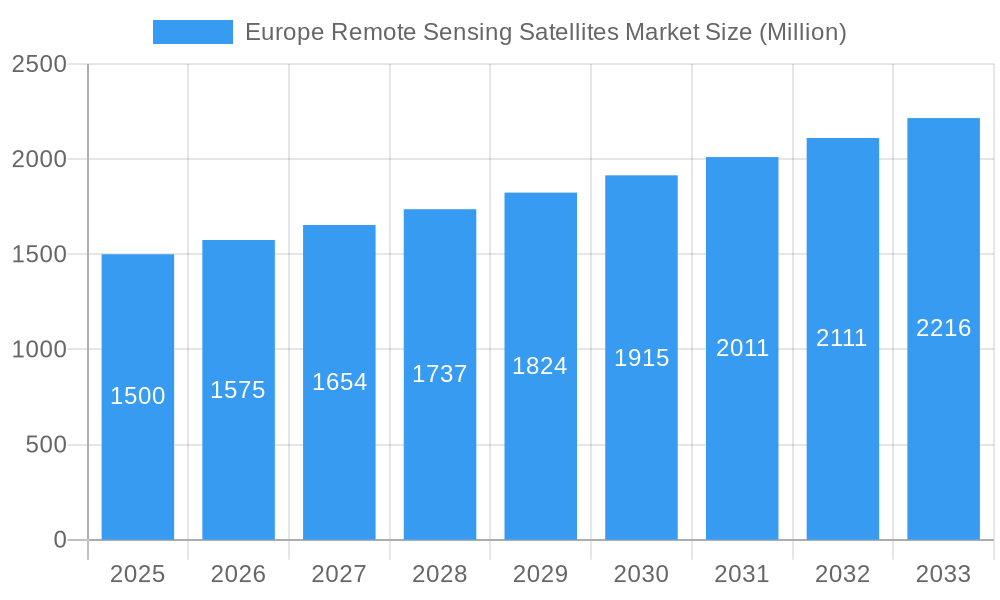

Europe Remote Sensing Satellites Market Market Size (In Billion)

Deeper analysis indicates that high-resolution imagery and data analytics segments are experiencing accelerated growth, meeting the demand for precise and timely information. The proliferation of novel applications in precision agriculture and disaster management further contributes to market expansion. While regulatory complexities and substantial initial investments pose potential challenges, the long-term strategic advantages and the indispensable nature of remote sensing data are expected to surmount these obstacles. The market is poised for increased consolidation via mergers and acquisitions, as major players seek to broaden their technological capabilities and market dominance. Continuous advancements in satellite technology, including miniaturization and enhanced sensor performance, will serve as key drivers for sustained market growth.

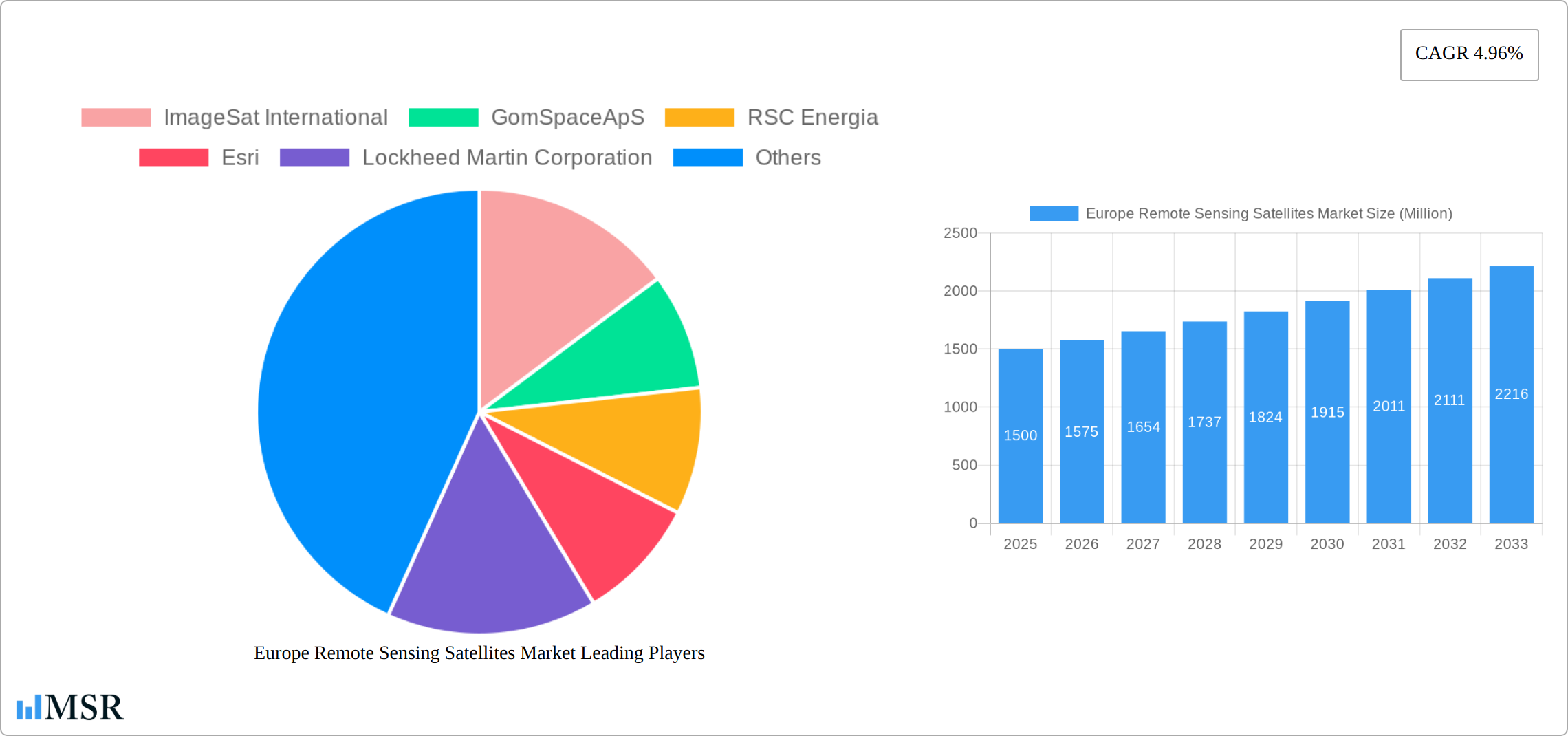

Europe Remote Sensing Satellites Market Company Market Share

Europe Remote Sensing Satellites Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Remote Sensing Satellites Market, covering market dynamics, industry trends, key segments, leading players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report offers actionable insights for industry stakeholders, investors, and strategic decision-makers seeking to navigate this dynamic market. The market is segmented by satellite subsystem, end-user, satellite mass, and orbit class, providing a granular understanding of market opportunities. The report also highlights key milestones and emerging trends, including recent collaborations and satellite launches, offering a future-oriented perspective on market growth. The projected market value for 2033 is estimated at xx Million.

Europe Remote Sensing Satellites Market Market Concentration & Dynamics

The Europe Remote Sensing Satellites Market is characterized by a dynamic and evolving landscape. While a few established players command a significant portion of the market, the surge of innovative startups and the growing integration of remote sensing technologies are fostering a highly competitive environment. The market's trajectory is influenced by a confluence of factors:

- Market Concentration: While precise, publicly disclosed market share data for every entity is not universally available, leading players such as Airbus SE, Maxar Technologies Inc., and Lockheed Martin Corporation are recognized as major contributors, collectively estimated to hold a substantial market share in the coming years. Emerging and smaller companies are carving out their presence by specializing in niche applications or pioneering advanced technological solutions.

- Innovation Ecosystems: A robust innovation ecosystem is fueled by substantial government funding, pioneering research endeavors, particularly through agencies like the European Space Agency (ESA), and synergistic collaborations between academic institutions, research bodies, and the private sector. These partnerships are instrumental in driving advancements in satellite miniaturization, the development of next-generation sensors, and sophisticated data analytics platforms.

- Regulatory Frameworks: The European Union's comprehensive regulatory landscape, encompassing data privacy, cybersecurity protocols, and the critical management of space debris, exerts a significant influence on market operations and strategic investment decisions. Adherence to these regulations, while contributing to operational expenditures, also creates lucrative avenues for specialized service providers who can ensure compliance and offer innovative solutions.

- Substitute Products: While alternative Earth observation technologies like aerial photography and LiDAR offer valuable capabilities, remote sensing satellites provide unparalleled advantages in terms of expansive coverage, superior resolution, and unparalleled data acquisition frequency, making them indispensable for many applications.

- End-User Trends: The escalating demand for high-resolution imagery across a diverse range of sectors, including precision agriculture, sophisticated urban planning, and comprehensive environmental monitoring, stands as a primary growth catalyst. Concurrently, government and military requirements for advanced intelligence gathering continue to represent a substantial market segment.

- M&A Activities: The European remote sensing satellite market has witnessed a consistent trend of Mergers & Acquisitions (M&A) over the past five years, averaging a notable number of deals annually. These strategic transactions are primarily driven by companies seeking to enhance their technological capabilities, gain access to novel technologies, and consolidate their market positions in an increasingly competitive arena.

Europe Remote Sensing Satellites Market Industry Insights & Trends

The European Remote Sensing Satellites Market is experiencing remarkable expansion, propelled by relentless technological innovation, augmented government investments in defense and space exploration initiatives, and a burgeoning array of commercial applications. The market's valuation in 2024 was significant, and projections indicate substantial growth by 2033, with a strong Compound Annual Growth Rate (CAGR) anticipated throughout the forecast period (2025-2033).

This sustained growth is underpinned by several key factors:

- Technological Disruptions: Groundbreaking advancements in sensor technology, the trend towards satellite miniaturization, and sophisticated data processing techniques are collectively contributing to enhanced image resolution, reduced operational costs, and greatly improved data accessibility. The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) for data analysis is further amplifying the market's value proposition and unlocking new analytical possibilities.

- Market Growth Drivers: The ascendance of the "NewSpace" movement, characterized by increased private sector investment and innovation, coupled with a heightened demand for real-time geospatial intelligence, are pivotal market drivers. Furthermore, government-led initiatives focused on bolstering national space capabilities play an equally critical role in shaping market expansion.

- Evolving Consumer Behaviors: The growing accessibility of satellite data through user-friendly cloud-based platforms and Application Programming Interfaces (APIs) is democratizing access to vital remote sensing information. This broader accessibility is fostering wider adoption across a multitude of sectors and applications, thereby expanding the market's reach and impact.

Key Markets & Segments Leading Europe Remote Sensing Satellites Market

The Low Earth Orbit (LEO) segment stands out as the dominant force within the Europe Remote Sensing Satellites Market. This dominance is attributed to LEO's inherent suitability for capturing high-resolution imagery and enabling frequent revisits of Earth's surface. Within the satellite subsystems category, the Satellite Bus & Subsystems segment commands the largest share, underscoring the critical importance of robust and efficient satellite platforms. The commercial sector represents the most significant end-user segment, reaping the benefits of increasingly accessible and affordable remote sensing data.

-

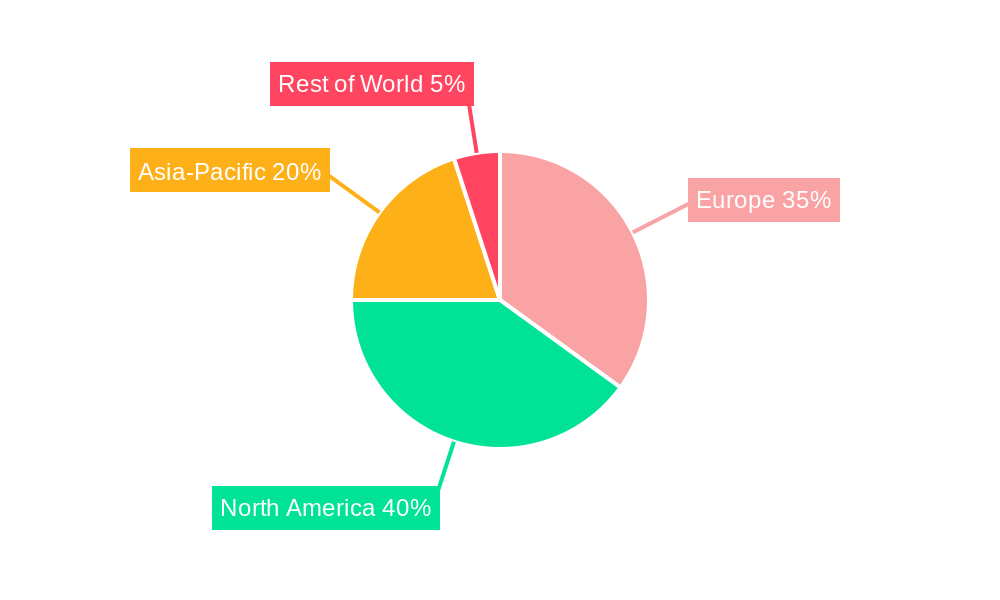

Dominant Region/Country: Western European nations, including France, Germany, and the United Kingdom, are identified as key markets. This prominence is due to their well-established space industries, advanced research infrastructure, and substantial government investments in space technologies.

-

Dominant Segments:

- Satellite Subsystem: The Satellite Bus & Subsystems segment leads, followed closely by Solar Array & Power Hardware.

- End User: The Commercial sector is the largest end-user, with the Military & Government sector following as a significant user.

- Satellite Mass: The 100-500kg segment holds a substantial market share, offering a compelling balance between cost-effectiveness and operational capability.

- Orbit Class: The LEO segment experiences significant dominance due to its optimal suitability for a wide range of remote sensing applications.

-

Key Growth Drivers:

- Economic Growth: Increased economic activity across various sectors directly fuels the demand for remote sensing data, enabling improved decision-making processes and more effective resource management.

- Infrastructure Development: Remote sensing technologies play a pivotal role in the planning, monitoring, and maintenance of critical infrastructure, thereby acting as a significant driver of market demand.

- Government Initiatives: National space programs and strategic investments in research and development are crucial contributors to the overall expansion of the market.

Europe Remote Sensing Satellites Market Product Developments

Recent product innovations include the development of smaller, more affordable nanosatellites and CubeSats, expanding access to remote sensing technology. Advancements in sensor technology are leading to higher resolution images and improved spectral capabilities. New data processing and analytics techniques are improving the value and usability of satellite data for a broader range of applications. These developments offer competitive advantages by providing enhanced data quality, reduced operational costs, and expanded market reach.

Challenges in the Europe Remote Sensing Satellites Market Market

Long-term market expansion is intrinsically linked to continuous innovation in sensor technology, the ongoing trend of satellite miniaturization, and advancements in data analytics capabilities. Strategic alliances forged between private enterprises and governmental agencies are instrumental in facilitating technology transfer and fostering broader market penetration. The exploration and development of novel applications, particularly in areas such as environmental monitoring and climate change studies, present significant additional avenues for growth and market diversification.

Forces Driving Europe Remote Sensing Satellites Market Growth

Technological advancements, increased private investment, and supportive government policies are key growth drivers. The growing demand for high-resolution imagery across diverse sectors—from precision agriculture to disaster response—is further fueling market expansion. The development of innovative data analytics tools that facilitate easier interpretation and utilization of satellite imagery enhances market appeal.

Challenges in the Europe Remote Sensing Satellites Market Market

Long-term market expansion is intrinsically linked to continuous innovation in sensor technology, the ongoing trend of satellite miniaturization, and advancements in data analytics capabilities. Strategic alliances forged between private enterprises and governmental agencies are instrumental in facilitating technology transfer and fostering broader market penetration. The exploration and development of novel applications, particularly in areas such as environmental monitoring and climate change studies, present significant additional avenues for growth and market diversification.

Emerging Opportunities in Europe Remote Sensing Satellites Market

The integration of AI and machine learning into data processing and analysis opens up new opportunities. The expansion of the market into new applications, such as autonomous driving and smart city development, is driving demand. The increasing demand for high-quality data in emerging economies creates a significant growth potential.

Leading Players in the Europe Remote Sensing Satellites Market Sector

- ImageSat International

- GomSpace ApS

- RSC Energia

- Esri

- Lockheed Martin Corporation

- Airbus SE

- Maxar Technologies Inc

- NPO Lavochkin

- ROSCOSMOS

- IHI Corp

- Thale

- Planet Labs Inc

- Northrop Grumman Corporation

- Spire Global Inc

Key Milestones in Europe Remote Sensing Satellites Market Industry

- November 2022: The successful launch of Kosmos 2563 (Tundra 16L, Kupol 16L, EKS #6) by Russia's Soyuz into orbit, serving as a replacement for early warning satellites, underscores the sustained investment in satellite technology despite ongoing geopolitical complexities.

- January 2023: Airbus Defence and Space secured a significant contract with Poland for the provision of two high-performance optical Earth observation satellites. This milestone highlights the escalating demand for sophisticated geospatial intelligence capabilities within the European region.

- February 2023: The establishment of a NASA-Esri Space Act Agreement significantly expanded access to NASA's extensive geospatial data resources. This initiative is expected to stimulate advanced research and foster innovation by enhancing the availability of critical data for both the commercial and research sectors.

Strategic Outlook for Europe Remote Sensing Satellites Market Market

The Europe Remote Sensing Satellites Market is poised for sustained growth, driven by technological innovation, expanding applications, and increased private and public investment. Strategic opportunities exist in developing advanced data analytics capabilities, expanding into new markets, and fostering collaborations to enhance market competitiveness. The focus on sustainability and environmental monitoring will further drive market expansion, creating promising opportunities for specialized satellite technology and data services.

Europe Remote Sensing Satellites Market Segmentation

-

1. Satellite Mass

- 1.1. 10-100kg

- 1.2. 100-500kg

- 1.3. 500-1000kg

- 1.4. Below 10 Kg

- 1.5. above 1000kg

-

2. Orbit Class

- 2.1. GEO

- 2.2. LEO

- 2.3. MEO

-

3. Satellite Subsystem

- 3.1. Propulsion Hardware and Propellant

- 3.2. Satellite Bus & Subsystems

- 3.3. Solar Array & Power Hardware

- 3.4. Structures, Harness & Mechanisms

-

4. End User

- 4.1. Commercial

- 4.2. Military & Government

- 4.3. Other

Europe Remote Sensing Satellites Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Remote Sensing Satellites Market Regional Market Share

Geographic Coverage of Europe Remote Sensing Satellites Market

Europe Remote Sensing Satellites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Remote Sensing Satellites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.1.1. 10-100kg

- 5.1.2. 100-500kg

- 5.1.3. 500-1000kg

- 5.1.4. Below 10 Kg

- 5.1.5. above 1000kg

- 5.2. Market Analysis, Insights and Forecast - by Orbit Class

- 5.2.1. GEO

- 5.2.2. LEO

- 5.2.3. MEO

- 5.3. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 5.3.1. Propulsion Hardware and Propellant

- 5.3.2. Satellite Bus & Subsystems

- 5.3.3. Solar Array & Power Hardware

- 5.3.4. Structures, Harness & Mechanisms

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Commercial

- 5.4.2. Military & Government

- 5.4.3. Other

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ImageSat International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GomSpaceApS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RSC Energia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Esri

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lockheed Martin Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Airbus SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Maxar Technologies Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NPO Lavochkin

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ROSCOSMOS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 IHI Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Thale

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Planet Labs Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Northrop Grumman Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Spire Global Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 ImageSat International

List of Figures

- Figure 1: Europe Remote Sensing Satellites Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Remote Sensing Satellites Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 2: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 3: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 4: Europe Remote Sensing Satellites Market Revenue billion Forecast, by End User 2020 & 2033

- Table 5: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 7: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 8: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 9: Europe Remote Sensing Satellites Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: France Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Remote Sensing Satellites Market?

The projected CAGR is approximately 11.5%.

2. Which companies are prominent players in the Europe Remote Sensing Satellites Market?

Key companies in the market include ImageSat International, GomSpaceApS, RSC Energia, Esri, Lockheed Martin Corporation, Airbus SE, Maxar Technologies Inc, NPO Lavochkin, ROSCOSMOS, IHI Corp, Thale, Planet Labs Inc, Northrop Grumman Corporation, Spire Global Inc.

3. What are the main segments of the Europe Remote Sensing Satellites Market?

The market segments include Satellite Mass, Orbit Class, Satellite Subsystem, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.8 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: NASA and geographic information service provider Esri will grant wider access to the space agency's geospatial content for research and exploration purposes through the Space Act Agreement.January 2023: Airbus Defence and Space has signed a contract with Poland to provide a geospatial intelligence system including the development, manufacture, launch and delivery in orbit of two high-performance optical Earth observation satellites.November 2022: Russian Soyuz launched Kosmos 2563 (Tundra 16L, Kupol 16L, EKS #6) into orbit to replace the US-K and US-KMO early warning satellites of the Oko-1 system.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Remote Sensing Satellites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Remote Sensing Satellites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Remote Sensing Satellites Market?

To stay informed about further developments, trends, and reports in the Europe Remote Sensing Satellites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence