Key Insights

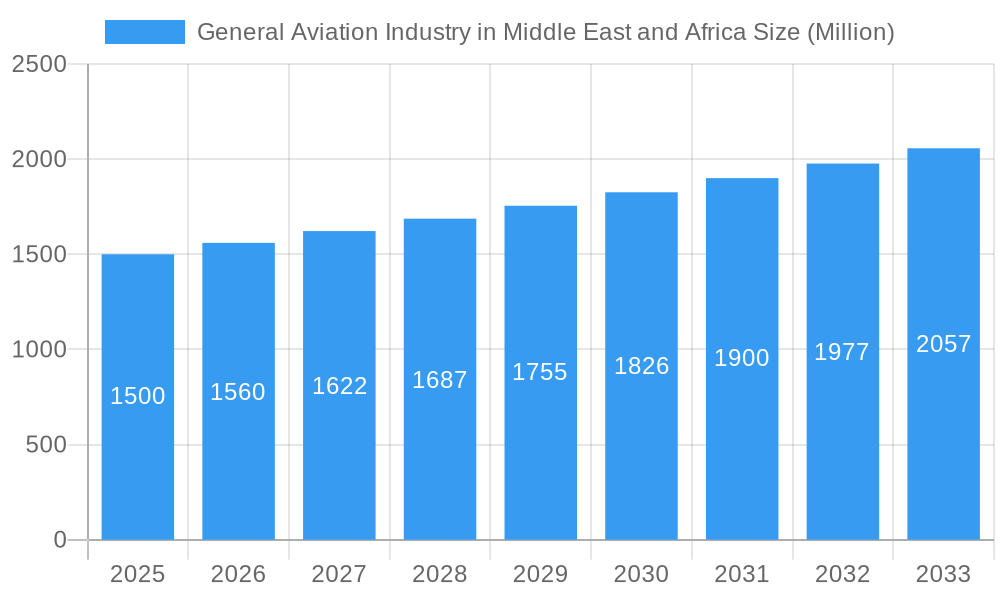

The Middle East and Africa (MEA) General Aviation (GA) market is poised for expansion, driven by robust growth in tourism, business travel, and the burgeoning air taxi sector. The market, valued at $23.7 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 5.4% from 2025 to 2033. Key growth enablers include a rising middle class, increased disposable income, and significant infrastructure development supporting GA operations in prominent nations such as the UAE, Saudi Arabia, Egypt, and South Africa. Challenges such as regulatory complexities, fuel price volatility, and regional economic conditions may influence the pace of expansion. Within GA sub-segments, business jets are anticipated to lead growth, mirroring the increasing demand for private and corporate air travel in rapidly developing MEA economies.

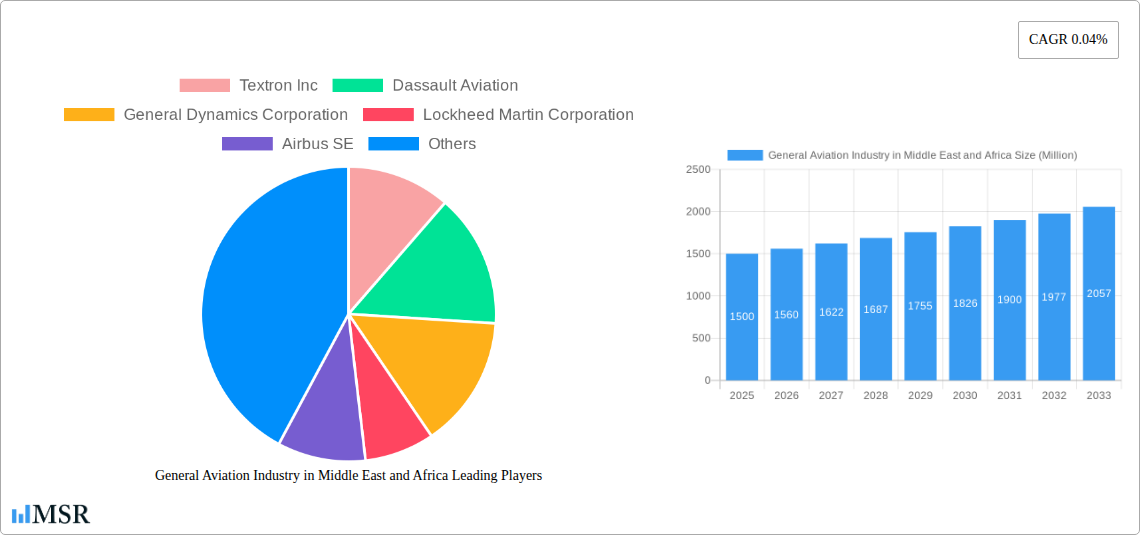

General Aviation Industry in Middle East and Africa Market Size (In Billion)

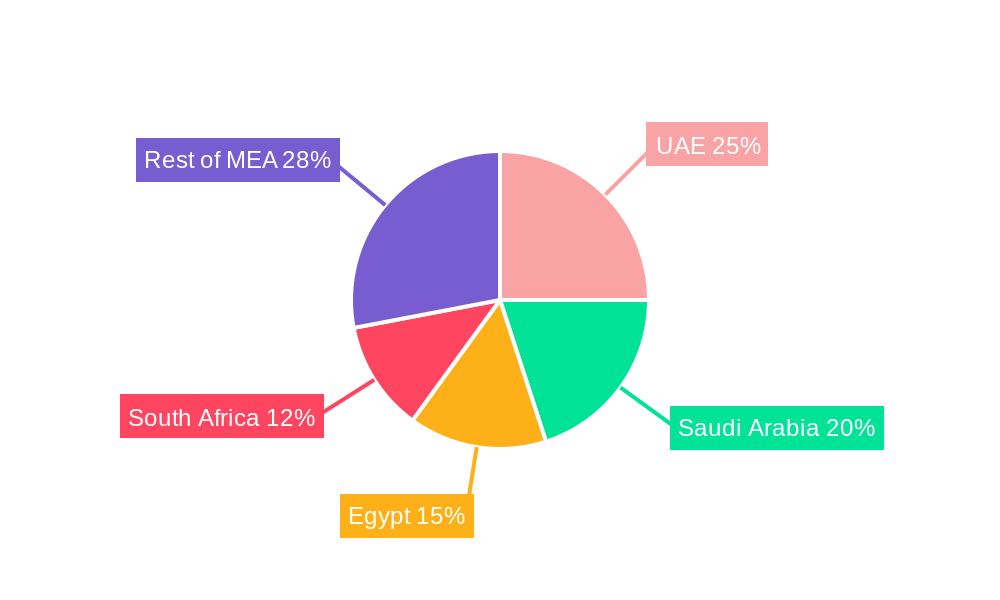

Market leadership within the MEA GA sector is expected to be concentrated in the United Arab Emirates, Saudi Arabia, and Egypt, attributed to substantial infrastructure investments, mature aviation ecosystems, and dynamic tourism sectors. While South Africa and other African regions will contribute to market growth, their expansion may be more gradual, influenced by ongoing infrastructure development and diverse economic trajectories. Leading global manufacturers including Textron, Dassault Aviation, Boeing, and Airbus are likely to maintain their market share, leveraging established brand equity, comprehensive product lines, and extensive distribution networks. The forecast period suggests continued advancements in GA services, propelled by technological innovation, the adoption of more fuel-efficient aircraft, and a growing emphasis on sustainable aviation solutions, supporting sustained moderate market growth across the MEA region.

General Aviation Industry in Middle East and Africa Company Market Share

General Aviation Industry in Middle East & Africa: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the General Aviation (GA) industry in the Middle East and Africa, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period extending to 2033. We delve into market dynamics, key trends, leading players, and future growth opportunities within this dynamic sector. Expect detailed analysis across key segments including Business Jets, Mid-Size Jets, Piston Fixed-Wing Aircraft, and other aircraft types, alongside regional breakdowns for Algeria, Egypt, Qatar, Saudi Arabia, South Africa, Turkey, the United Arab Emirates, and the Rest of Middle East and Africa. The report’s findings are supported by robust data analysis and include valuable market sizing information and compound annual growth rate (CAGR) projections. Expect to uncover crucial information regarding market concentration, technological advancements, and the competitive landscape shaping the future of GA in the region.

General Aviation Industry in Middle East and Africa Market Concentration & Dynamics

The Middle East and Africa General Aviation market exhibits a moderately concentrated landscape, with a handful of dominant players alongside numerous smaller operators. Key players such as Textron Inc, Dassault Aviation, and Airbus SE hold significant market share, largely driven by their established brand reputation, extensive product portfolios, and strong distribution networks. However, the market is witnessing increased competition from regional players and emerging innovative startups.

Market Concentration Metrics (2025 Estimates):

- Top 5 players account for xx% of the market.

- Market share fragmentation is xx%.

Innovation Ecosystems: The region's GA industry is characterized by a burgeoning innovation ecosystem, fueled by government initiatives focused on technological advancement and diversification of the economy. Several research and development centers are actively contributing to developing new technologies in aircraft design, manufacturing, and maintenance.

Regulatory Frameworks: Regulatory frameworks across the region vary, with some countries exhibiting more streamlined processes than others. This often impacts the ease of operation for GA companies, particularly regarding licensing, certification, and airspace management. Harmonization of regulations could significantly boost industry growth.

Substitute Products: While no direct substitutes exist for GA aircraft, alternative modes of transport like high-speed rail and private helicopters provide some level of competition, particularly in specific niche segments.

End-User Trends: The growth in high-net-worth individuals and business travelers in the region is a significant driver for increased demand for business jets and other GA aircraft. This trend is further fueled by developing tourism sectors and the need for rapid, convenient travel.

M&A Activities: The number of M&A deals in the GA sector in the MEA region has shown an upward trend, with xx deals recorded in the period 2019-2024. This activity is driven by companies seeking to expand their market reach, gain access to new technologies, or consolidate their position in the competitive landscape.

General Aviation Industry in Middle East and Africa Industry Insights & Trends

The MEA General Aviation market is projected to experience significant growth throughout the forecast period (2025-2033). The market size is estimated at USD xx Million in 2025 and is expected to reach USD xx Million by 2033, exhibiting a CAGR of xx%. Several factors are driving this growth: the rising disposable income among the affluent population, government initiatives supporting infrastructure development (including new airports and improved air navigation systems), the increasing popularity of business aviation for both business and leisure travel, and the ongoing efforts by governments to promote tourism. However, challenges such as fluctuating oil prices, regional political instability, and the ongoing global economic uncertainty can impact growth trajectories. Technological advancements such as the development of more fuel-efficient aircraft, improved avionics, and the integration of advanced flight management systems are also shaping the industry's trajectory. The adoption of sustainable aviation fuels (SAFs) is slowly gaining traction, driven by the increasing environmental concerns. Changing consumer behaviors are reflected in a growing preference for enhanced safety features, luxury interiors, and personalized travel experiences.

Key Markets & Segments Leading General Aviation Industry in Middle East and Africa

The United Arab Emirates and Saudi Arabia are the dominant markets for GA in the Middle East and Africa. Turkey and South Africa also show significant potential for growth. The Business Jet segment holds the largest market share, driven primarily by the high demand from high-net-worth individuals and corporations.

Dominant Regions & Segments:

- United Arab Emirates: Strong economic growth, well-developed infrastructure, and a large number of high-net-worth individuals.

- Saudi Arabia: Significant investments in infrastructure and tourism are boosting GA activities.

- Business Jets: Highest market share due to demand from high-net-worth individuals and businesses.

Key Drivers:

- Economic Growth: Rapid economic expansion in several MEA countries fuels demand for private aviation.

- Infrastructure Development: Investments in airports and air navigation systems support industry growth.

- Tourism: The growing tourism sector drives demand for charter and private aviation services.

- Government Initiatives: Support for aviation development encourages market expansion.

General Aviation Industry in Middle East and Africa Product Developments

Recent product innovations within the MEA GA market include the introduction of more fuel-efficient aircraft, enhanced safety features, and advanced avionics systems. These developments are crucial for enhancing operational efficiency, reducing environmental impact, and improving passenger experience. Manufacturers are also focusing on offering customized aircraft configurations to cater to specific customer requirements and preferences. This intense focus on innovation and customer-centricity is shaping the competitive edge within the market.

Challenges in the General Aviation Industry in Middle East and Africa Market

The MEA GA market faces significant challenges, including the high cost of aircraft acquisition and maintenance, regulatory hurdles impacting operational efficiency, and fluctuating fuel prices influencing operational costs. Supply chain disruptions and skilled labor shortages further complicate the sector. The impact of these challenges can be seen in increased operational costs and delayed project implementation.

Forces Driving General Aviation Industry in Middle East and Africa Growth

The MEA GA market's growth is driven by several factors: increasing affluence, government support for infrastructure development (including new airports and improved air navigation systems), and a growing demand for efficient private travel. Technological innovations, such as the development of more fuel-efficient aircraft and improved avionics, further contribute to growth.

Challenges in the General Aviation Industry in Middle East and Africa Market

Long-term growth is reliant on addressing regulatory barriers, fostering strategic partnerships between local and international operators, and proactively engaging in infrastructure development. Market expansion into underserved regions and continued investment in technological advancements are critical for sustained growth.

Emerging Opportunities in General Aviation Industry in Middle East and Africa

Emerging opportunities include tapping into underserved markets within the region, focusing on sustainable aviation fuels to reduce environmental impact, and exploring partnerships to enhance technological advancement. Developing specialized services like air ambulance and aerial tourism also presents potential avenues for expansion.

Leading Players in the General Aviation Industry in Middle East and Africa Sector

Key Milestones in General Aviation Industry in Middle East and Africa Industry

- October 2023: Textron Aviation secured a deal with Fly Alliance for up to 20 Cessna Citation business jets, signifying growth in the business aviation segment.

- June 2023: Gulfstream Aerospace Corp. invested USD 28.5 Million in expanding its completions and outfitting operations, indicating confidence in future market demand.

- June 2023: Gulfstream Aerospace Corp. announced further expansion of its completions and outfitting operations at St. Louis Downtown Airport. This expansion, representing a total capital investment of USD 28.5 million, signals growth and modernization within the industry.

Strategic Outlook for General Aviation Industry in Middle East and Africa Market

The future of the MEA GA market is promising, with substantial growth potential fueled by ongoing economic expansion, strategic infrastructure development, and the increasing demand for efficient private air travel. Companies focusing on innovation, customer-centricity, and sustainability will be best positioned to capitalize on emerging opportunities and navigate the industry’s evolving dynamics.

General Aviation Industry in Middle East and Africa Segmentation

-

1. Sub Aircraft Type

-

1.1. Business Jets

- 1.1.1. Large Jet

- 1.1.2. Light Jet

- 1.1.3. Mid-Size Jet

- 1.2. Piston Fixed-Wing Aircraft

- 1.3. Others

-

1.1. Business Jets

General Aviation Industry in Middle East and Africa Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

General Aviation Industry in Middle East and Africa Regional Market Share

Geographic Coverage of General Aviation Industry in Middle East and Africa

General Aviation Industry in Middle East and Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. HNWIs emphasize growth of the market in the region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global General Aviation Industry in Middle East and Africa Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 5.1.1. Business Jets

- 5.1.1.1. Large Jet

- 5.1.1.2. Light Jet

- 5.1.1.3. Mid-Size Jet

- 5.1.2. Piston Fixed-Wing Aircraft

- 5.1.3. Others

- 5.1.1. Business Jets

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 6. North America General Aviation Industry in Middle East and Africa Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 6.1.1. Business Jets

- 6.1.1.1. Large Jet

- 6.1.1.2. Light Jet

- 6.1.1.3. Mid-Size Jet

- 6.1.2. Piston Fixed-Wing Aircraft

- 6.1.3. Others

- 6.1.1. Business Jets

- 6.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 7. South America General Aviation Industry in Middle East and Africa Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 7.1.1. Business Jets

- 7.1.1.1. Large Jet

- 7.1.1.2. Light Jet

- 7.1.1.3. Mid-Size Jet

- 7.1.2. Piston Fixed-Wing Aircraft

- 7.1.3. Others

- 7.1.1. Business Jets

- 7.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 8. Europe General Aviation Industry in Middle East and Africa Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 8.1.1. Business Jets

- 8.1.1.1. Large Jet

- 8.1.1.2. Light Jet

- 8.1.1.3. Mid-Size Jet

- 8.1.2. Piston Fixed-Wing Aircraft

- 8.1.3. Others

- 8.1.1. Business Jets

- 8.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 9. Middle East & Africa General Aviation Industry in Middle East and Africa Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 9.1.1. Business Jets

- 9.1.1.1. Large Jet

- 9.1.1.2. Light Jet

- 9.1.1.3. Mid-Size Jet

- 9.1.2. Piston Fixed-Wing Aircraft

- 9.1.3. Others

- 9.1.1. Business Jets

- 9.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 10. Asia Pacific General Aviation Industry in Middle East and Africa Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 10.1.1. Business Jets

- 10.1.1.1. Large Jet

- 10.1.1.2. Light Jet

- 10.1.1.3. Mid-Size Jet

- 10.1.2. Piston Fixed-Wing Aircraft

- 10.1.3. Others

- 10.1.1. Business Jets

- 10.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Textron Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dassault Aviation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Dynamics Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lockheed Martin Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Airbus SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Boeing Compan

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Robinson Helicopter Company Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pilatus Aircraft Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Leonardo S p A

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bombardier Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Textron Inc

List of Figures

- Figure 1: Global General Aviation Industry in Middle East and Africa Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America General Aviation Industry in Middle East and Africa Revenue (billion), by Sub Aircraft Type 2025 & 2033

- Figure 3: North America General Aviation Industry in Middle East and Africa Revenue Share (%), by Sub Aircraft Type 2025 & 2033

- Figure 4: North America General Aviation Industry in Middle East and Africa Revenue (billion), by Country 2025 & 2033

- Figure 5: North America General Aviation Industry in Middle East and Africa Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America General Aviation Industry in Middle East and Africa Revenue (billion), by Sub Aircraft Type 2025 & 2033

- Figure 7: South America General Aviation Industry in Middle East and Africa Revenue Share (%), by Sub Aircraft Type 2025 & 2033

- Figure 8: South America General Aviation Industry in Middle East and Africa Revenue (billion), by Country 2025 & 2033

- Figure 9: South America General Aviation Industry in Middle East and Africa Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe General Aviation Industry in Middle East and Africa Revenue (billion), by Sub Aircraft Type 2025 & 2033

- Figure 11: Europe General Aviation Industry in Middle East and Africa Revenue Share (%), by Sub Aircraft Type 2025 & 2033

- Figure 12: Europe General Aviation Industry in Middle East and Africa Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe General Aviation Industry in Middle East and Africa Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa General Aviation Industry in Middle East and Africa Revenue (billion), by Sub Aircraft Type 2025 & 2033

- Figure 15: Middle East & Africa General Aviation Industry in Middle East and Africa Revenue Share (%), by Sub Aircraft Type 2025 & 2033

- Figure 16: Middle East & Africa General Aviation Industry in Middle East and Africa Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa General Aviation Industry in Middle East and Africa Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific General Aviation Industry in Middle East and Africa Revenue (billion), by Sub Aircraft Type 2025 & 2033

- Figure 19: Asia Pacific General Aviation Industry in Middle East and Africa Revenue Share (%), by Sub Aircraft Type 2025 & 2033

- Figure 20: Asia Pacific General Aviation Industry in Middle East and Africa Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific General Aviation Industry in Middle East and Africa Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global General Aviation Industry in Middle East and Africa Revenue billion Forecast, by Sub Aircraft Type 2020 & 2033

- Table 2: Global General Aviation Industry in Middle East and Africa Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global General Aviation Industry in Middle East and Africa Revenue billion Forecast, by Sub Aircraft Type 2020 & 2033

- Table 4: Global General Aviation Industry in Middle East and Africa Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global General Aviation Industry in Middle East and Africa Revenue billion Forecast, by Sub Aircraft Type 2020 & 2033

- Table 9: Global General Aviation Industry in Middle East and Africa Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global General Aviation Industry in Middle East and Africa Revenue billion Forecast, by Sub Aircraft Type 2020 & 2033

- Table 14: Global General Aviation Industry in Middle East and Africa Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global General Aviation Industry in Middle East and Africa Revenue billion Forecast, by Sub Aircraft Type 2020 & 2033

- Table 25: Global General Aviation Industry in Middle East and Africa Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global General Aviation Industry in Middle East and Africa Revenue billion Forecast, by Sub Aircraft Type 2020 & 2033

- Table 33: Global General Aviation Industry in Middle East and Africa Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific General Aviation Industry in Middle East and Africa Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the General Aviation Industry in Middle East and Africa?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the General Aviation Industry in Middle East and Africa?

Key companies in the market include Textron Inc, Dassault Aviation, General Dynamics Corporation, Lockheed Martin Corporation, Airbus SE, The Boeing Compan, Robinson Helicopter Company Inc, Pilatus Aircraft Ltd, Leonardo S p A, Bombardier Inc.

3. What are the main segments of the General Aviation Industry in Middle East and Africa?

The market segments include Sub Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.7 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

HNWIs emphasize growth of the market in the region.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2023: Textron Aviation announced that it entered into a purchase agreement with Fly Alliance for up to 20 Cessna Citation business jets, four firms with options for 16 additional aircraft. Fly Alliance is expected to use the aircraft for its luxury private jet charter operations and is expected to take delivery of the first aircraft, an XLS Gen2, in 2023.June 2023: Gulfstream Aerospace Corp. announced further expansion of its completions and outfitting operations at the St. Louis Downtown Airport. With this latest expansion, Gulfstream is expected to increase completion operations at the site while modernizing its existing spaces by adding new, state-of-the-art equipment and tooling, representing a total capital investment of USD 28.5 million.June 2023: Gulfstream Aerospace Corp. announced today the further expansion of its completions and outfitting operations at St. Louis Downtown Airport. With this latest expansion, Gulfstream is expected to increase completion operations at the site while modernizing its existing spaces by adding new, state-of-the-art equipment and tooling, representing a total capital investment of USD 28.5 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "General Aviation Industry in Middle East and Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the General Aviation Industry in Middle East and Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the General Aviation Industry in Middle East and Africa?

To stay informed about further developments, trends, and reports in the General Aviation Industry in Middle East and Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence