Key Insights

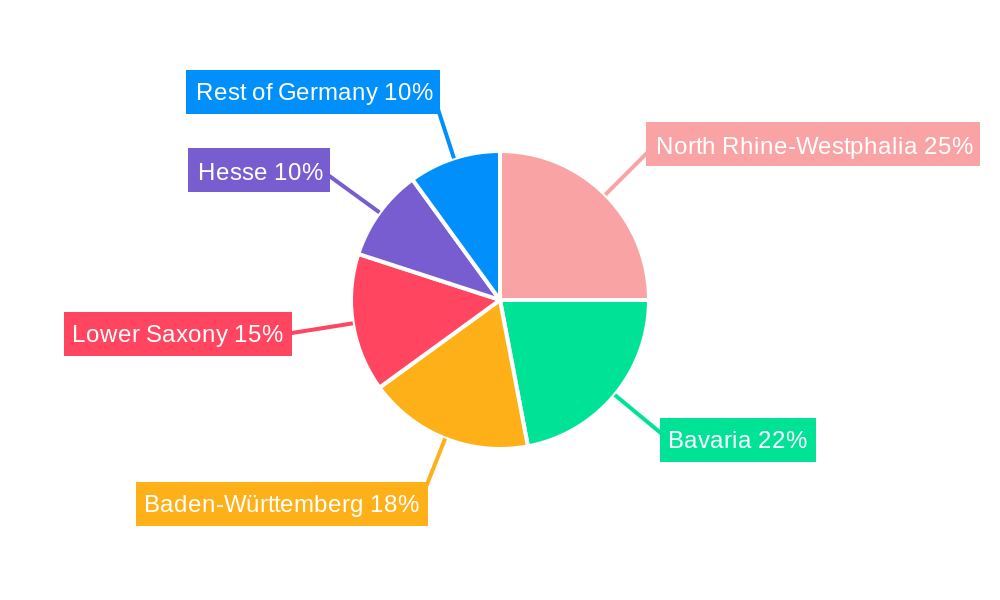

Germany's high-performance electric vehicle market, encompassing PHEVs and BEVs, is poised for substantial expansion. Driven by stringent environmental regulations, escalating consumer demand for sustainable mobility, and robust government incentives, the market is projected to achieve a Compound Annual Growth Rate (CAGR) of 45%. The market size, currently valued at $55.6 billion in the base year 2025, is expected to reach significant heights by 2033. Key growth catalysts include advancements in battery technology, enhancing range and performance, coupled with the expansion of charging infrastructure and increasing adoption of high-performance EVs by affluent consumers. Major automotive players, including Tesla, Volkswagen, BMW, and Daimler, are making significant investments in research and development to secure market share in this dynamic segment. The competitive landscape features established manufacturers and innovative entrants, underscoring the sector's vitality. Germany's strong automotive manufacturing heritage and commitment to green technologies solidify its position as a global leader in the high-performance EV market. Regional economic hubs like Bavaria, Baden-Württemberg, and North Rhine-Westphalia are at the forefront of production and adoption, further shaping market dynamics. Segmentation across passenger and commercial vehicles highlights diverse applications and opportunities.

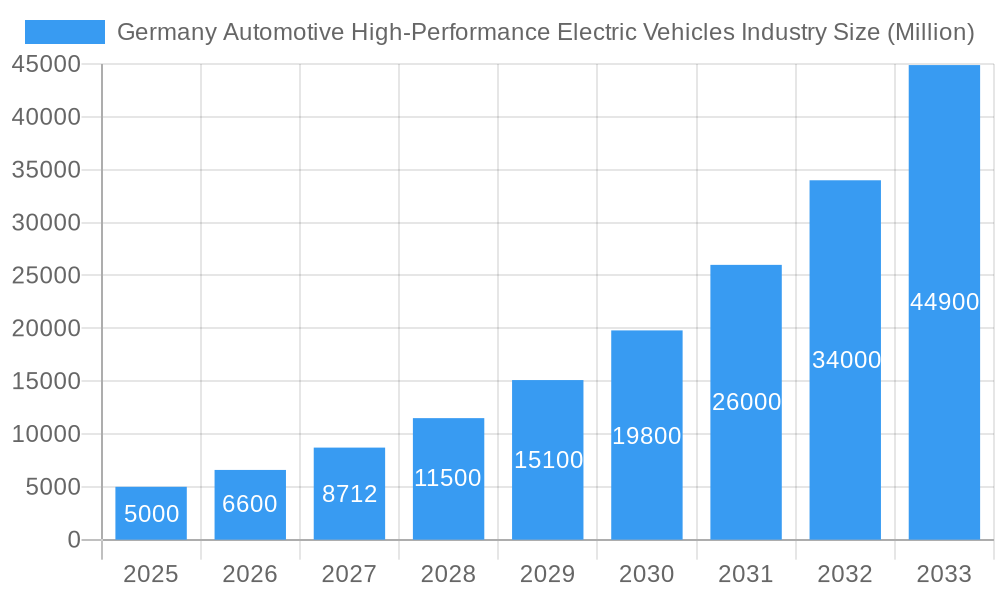

Germany Automotive High-Performance Electric Vehicles Industry Market Size (In Billion)

The market's upward trajectory through 2033 will be further fueled by technological innovations such as faster charging and improved battery density, heightened consumer environmental awareness, and supportive government policies. Potential challenges include supply chain disruptions, the initial high cost of performance EVs, and the continued development of charging infrastructure, particularly in rural areas. Despite these hurdles, the long-term outlook is exceptionally positive, with increasing affordability, technological maturity, and sustained government backing expected to drive significant growth in the German high-performance electric vehicle sector. The inclusion of both plug-in hybrid and fully electric vehicles ensures broad market appeal and caters to evolving consumer preferences.

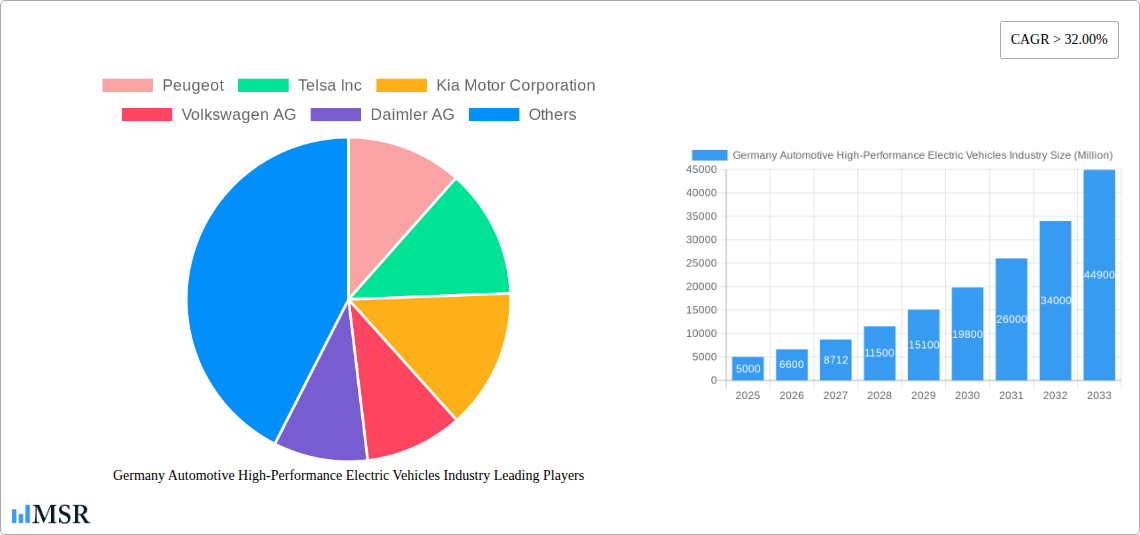

Germany Automotive High-Performance Electric Vehicles Industry Company Market Share

Germany Automotive High-Performance Electric Vehicles Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the German automotive high-performance electric vehicle (EV) industry, covering market dynamics, key players, technological advancements, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for industry stakeholders, investors, and strategic decision-makers seeking actionable insights into this rapidly evolving sector. The German market, a powerhouse in automotive engineering, is experiencing significant shifts towards high-performance EVs, presenting both challenges and significant opportunities. This report meticulously dissects the landscape, delivering crucial data points and predictions. Expect in-depth analyses of market concentration, segment-wise performance (Battery Electric, Plug-in Hybrid, Passenger Cars, Commercial Vehicles), leading companies (including Tesla Inc, Volkswagen AG, BMW Group, and Daimler AG), and impactful industry developments. The report forecasts a xx Million market value by 2033, showcasing strong Compound Annual Growth Rate (CAGR).

Germany Automotive High-Performance Electric Vehicles Industry Market Concentration & Dynamics

The German automotive high-performance electric vehicle market exhibits a moderately concentrated landscape, dominated by established automotive giants like Volkswagen AG, BMW Group, and Daimler AG. However, the emergence of new entrants like Rimac Automobili and Tesla Inc. is disrupting the traditional structure, driving innovation and competition. The market concentration ratio (CRx) for the top 5 players is estimated at xx% in 2025.

Innovation Ecosystems: Germany benefits from a robust research and development ecosystem, fostering technological advancements in battery technology, electric motors, and charging infrastructure. Collaborative efforts between OEMs, research institutions, and startups are accelerating innovation.

Regulatory Frameworks: Stringent emission regulations and government incentives are driving the adoption of high-performance EVs. However, complexities surrounding charging infrastructure development and grid stability present challenges.

Substitute Products: Competition from conventional internal combustion engine (ICE) vehicles and hybrid vehicles remains a factor, especially within the high-performance segment where performance expectations are high.

End-User Trends: Demand for high-performance EVs is growing steadily, driven by increasing environmental awareness, technological advancements offering superior performance, and the desire for luxury and cutting-edge features.

M&A Activities: The industry has witnessed several mergers and acquisitions (M&As) in recent years, particularly in the area of battery technology and electric powertrain components. Over the period 2019-2024, approximately xx M&A deals were recorded in the high-performance EV sector in Germany.

Germany Automotive High-Performance Electric Vehicles Industry Industry Insights & Trends

The German automotive high-performance EV market is experiencing robust growth, driven by several factors. Government initiatives promoting electric mobility, coupled with increasing consumer preference for sustainable transportation and technological advancements, are key drivers. The market size reached xx Million in 2024 and is projected to reach xx Million in 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, particularly in battery technology and charging infrastructure, are significantly influencing market dynamics. Evolving consumer behaviors, focusing on performance, range, and technological features, are shaping product development strategies and influencing market segmentation. The increasing affordability of high-performance EVs and improved charging infrastructure are also contributing to the accelerated growth.

Key Markets & Segments Leading Germany Automotive High-Performance Electric Vehicles Industry

The German domestic market is the key driver for high-performance EV sales, although exports contribute significantly. Battery Electric Vehicles (BEVs) currently represent the largest segment within the drive type category, although Plug-in Hybrid Electric Vehicles (PHEVs) also hold a substantial market share. Within vehicle types, Passenger Cars dominate the high-performance EV market.

Drivers for Passenger Car Segment:

- Strong domestic demand fueled by government incentives and environmental awareness.

- Technological advancements offering improved performance and range.

- Increasing availability of charging infrastructure.

Drivers for Commercial Vehicle Segment:

- Growing demand from logistics and transportation sectors for efficient and sustainable vehicles.

- Government regulations promoting the adoption of EVs in commercial fleets.

- Development of specialized high-performance EV solutions for commercial applications.

The dominance of the Passenger Car segment stems from higher consumer affordability and broader adoption rates, while the Commercial Vehicle segment is witnessing steady growth driven by industry-specific regulations and efficiency gains.

Germany Automotive High-Performance Electric Vehicles Industry Product Developments

Recent product developments focus on enhancing performance, range, and charging capabilities. Key advancements include the development of 800V electric compressors (Mahle Holding Co.), superior continuous torque (SCT) E-motors (MAHLE GmbH), and high-performance batteries with improved energy density (Mercedes-Benz). These innovations are aimed at improving vehicle efficiency and enhancing the overall driving experience, establishing strong competitive edges in the market.

Challenges in the Germany Automotive High-Performance Electric Vehicles Industry Market

The German automotive high-performance EV market faces several challenges. High initial purchase prices remain a barrier to wider adoption. Supply chain disruptions, particularly concerning battery materials and semiconductor components, impact production capacity and cause price fluctuations. Furthermore, the expansion of charging infrastructure needs significant investment and coordination to meet growing demand. Competition from established players and emerging new entrants puts constant pressure on pricing and innovation. These factors collectively result in an estimated xx% reduction in projected market growth by 2030.

Forces Driving Germany Automotive High-Performance Electric Vehicles Industry Growth

Several factors are driving the growth of the German high-performance EV market. Government subsidies and tax incentives significantly reduce the cost of EV ownership. Technological advancements, such as improved battery technology and faster charging solutions, are enhancing the appeal and practicality of high-performance EVs. Furthermore, increasing environmental awareness among consumers is driving demand for sustainable transportation alternatives. These combined factors are projected to fuel market growth by xx% annually between 2025 and 2033.

Long-Term Growth Catalysts in the Germany Automotive High-Performance Electric Vehicles Industry

Long-term growth will be driven by continued innovation in battery technology, leading to increased range and reduced charging times. Strategic partnerships between automakers and battery manufacturers will secure reliable supply chains. The expansion of charging infrastructure, both public and private, will improve consumer confidence and accessibility. Furthermore, the integration of advanced driver-assistance systems (ADAS) and autonomous driving technologies will enhance the value proposition of high-performance EVs.

Emerging Opportunities in Germany Automotive High-Performance Electric Vehicles Industry

Emerging opportunities lie in the development of high-performance EVs specifically designed for niche markets, such as sports cars and luxury vehicles. The integration of advanced connectivity features and digital services will enhance customer experiences. Exploring new battery technologies, such as solid-state batteries, will offer greater energy density and safety. The expansion into new markets, both domestically and internationally, presents significant growth potential.

Leading Players in the Germany Automotive High-Performance Electric Vehicles Industry Sector

Key Milestones in Germany Automotive High-Performance Electric Vehicles Industry Industry

- May 2022: Meritor, Inc. acquired Siemens' Commercial Vehicles business, strengthening its position in high-performance electric drive systems.

- July 2022: MAHLE GmbH announced the development of a superior continuous torque (SCT) E-motor, advancing electric motor technology.

- December 2022: Mercedes-Benz launched the Mercedes-AMG S 63 E PERFORMANCE, showcasing advancements in high-performance hybrid powertrains and battery technology.

- December 2022: Mahle Holding Co., Ltd. secured new orders for its 800V electric compressor, indicating growing demand for high-end EV components.

Strategic Outlook for Germany Automotive High-Performance Electric Vehicles Industry Market

The German automotive high-performance EV market holds significant growth potential. Continued investment in research and development, coupled with supportive government policies and evolving consumer preferences, will drive market expansion. Strategic partnerships, focusing on battery technology and charging infrastructure development, will play a vital role in shaping the future of this dynamic sector. The market is expected to witness substantial growth driven by technological innovations, improved charging infrastructure, and increasing consumer demand for sustainable and high-performance vehicles.

Germany Automotive High-Performance Electric Vehicles Industry Segmentation

-

1. Drive Type

- 1.1. Plug-in Hybrid

- 1.2. Battery or Pure Electric

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

Germany Automotive High-Performance Electric Vehicles Industry Segmentation By Geography

- 1. Germany

Germany Automotive High-Performance Electric Vehicles Industry Regional Market Share

Geographic Coverage of Germany Automotive High-Performance Electric Vehicles Industry

Germany Automotive High-Performance Electric Vehicles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Commercial Vehicle Sales

- 3.3. Market Restrains

- 3.3.1. The Rise in demand for Electric Vehicle Sale Will Hinder the Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Popularity of Electric Vehicles in Germany will Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Automotive High-Performance Electric Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drive Type

- 5.1.1. Plug-in Hybrid

- 5.1.2. Battery or Pure Electric

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Drive Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Peugeot

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Telsa Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kia Motor Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Volkswagen AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Daimler AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nissan Motor Company Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Renault

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BMW Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mitsubishi Motors Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rimac Automobili

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ford Motor Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Peugeot

List of Figures

- Figure 1: Germany Automotive High-Performance Electric Vehicles Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Automotive High-Performance Electric Vehicles Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Automotive High-Performance Electric Vehicles Industry Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 2: Germany Automotive High-Performance Electric Vehicles Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Germany Automotive High-Performance Electric Vehicles Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Automotive High-Performance Electric Vehicles Industry Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 5: Germany Automotive High-Performance Electric Vehicles Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Germany Automotive High-Performance Electric Vehicles Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Automotive High-Performance Electric Vehicles Industry?

The projected CAGR is approximately 45%.

2. Which companies are prominent players in the Germany Automotive High-Performance Electric Vehicles Industry?

Key companies in the market include Peugeot, Telsa Inc, Kia Motor Corporation, Volkswagen AG, Daimler AG, Nissan Motor Company Ltd, Renault, BMW Group, Mitsubishi Motors Corporation, Rimac Automobili, Ford Motor Company.

3. What are the main segments of the Germany Automotive High-Performance Electric Vehicles Industry?

The market segments include Drive Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 55.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Commercial Vehicle Sales.

6. What are the notable trends driving market growth?

Increasing Popularity of Electric Vehicles in Germany will Drive the Market.

7. Are there any restraints impacting market growth?

The Rise in demand for Electric Vehicle Sale Will Hinder the Market Growth.

8. Can you provide examples of recent developments in the market?

December 2022: Mahle Holding Co., Ltd. announced that it had received new orders for its 800V electric compressor from multiple international customers (including Germany). It will be applied to high-end intelligent electric vehicle (EV) and high-performance EV brands and is expected to reach mass production in 2023 and 2024, respectively.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Automotive High-Performance Electric Vehicles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Automotive High-Performance Electric Vehicles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Automotive High-Performance Electric Vehicles Industry?

To stay informed about further developments, trends, and reports in the Germany Automotive High-Performance Electric Vehicles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence