Key Insights

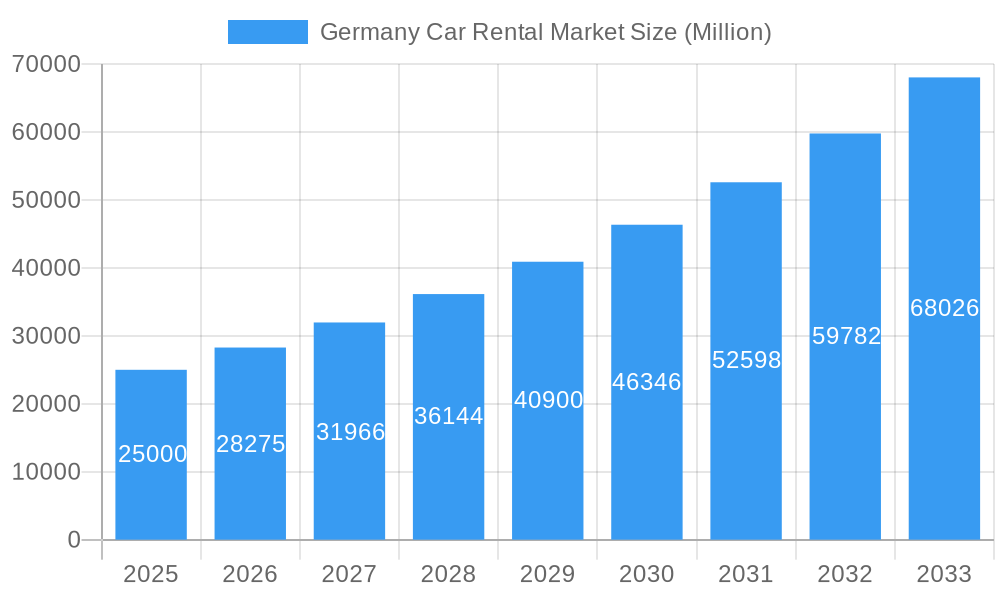

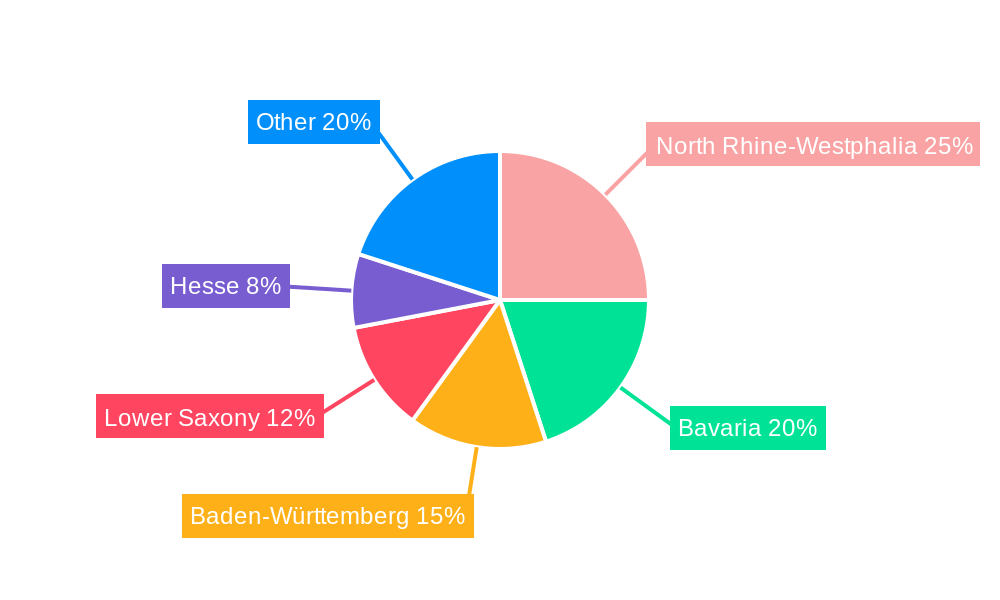

The German car rental market is poised for significant expansion, driven by resurgent domestic and international travel, a growing middle class, and increased business mobility. With an estimated market size of 30.9 billion in the base year 2025, the sector is projected to achieve a Compound Annual Growth Rate (CAGR) of 4.8% through 2033. Key growth catalysts include the convenience of online bookings, the rising demand for short-term rentals for leisure, and persistent business travel needs. Major economic hubs and tourist destinations such as North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse are expected to lead this growth. The market is predominantly segmented by leisure and tourism, underscoring Germany's appeal as a travel destination. While traditional booking methods persist, the rapid adoption of online platforms is accelerating market development.

Germany Car Rental Market Market Size (In Billion)

Potential market restraints include economic volatility impacting consumer spending, fluctuating fuel costs, and intense competition from established providers like Europcar, Hertz, Sixt, and Avis Budget Group. Evolving environmental regulations and a shift towards sustainable fleet options will also shape industry strategies. Although short-term rentals dominate, the long-term rental segment is exhibiting steady growth, suggesting evolving demand for extended vehicle usage. Technological advancements in autonomous driving and shared mobility present both opportunities and challenges, emphasizing the need for continuous innovation and adaptation to consumer preferences for sustained success in this dynamic market.

Germany Car Rental Market Company Market Share

Germany Car Rental Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Germany car rental market, encompassing market dynamics, industry trends, key segments, competitive landscape, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study is essential for industry stakeholders, investors, and strategic decision-makers seeking to navigate this dynamic market. The report leverages extensive data and insights to provide actionable intelligence, enabling informed strategies and optimized market positioning. The market size in 2025 is estimated at xx Million, with a CAGR of xx% projected for 2025-2033.

Germany Car Rental Market Concentration & Dynamics

The German car rental market exhibits a moderately concentrated landscape, with key players like Europcar International, The Hertz Corporation, Alamo (Enterprise Holdings Inc), Thrifty Car Rental Inc, SIXT SE, Buchbinder, and Avis Budget Group Inc holding significant market shares. However, the market also accommodates numerous smaller regional players and independent operators. Market share data for 2025 indicates that the top five players collectively account for approximately xx% of the market.

Innovation in the sector includes the rise of mobile-first booking platforms, the integration of advanced technologies like telematics and AI for fleet management and customer service optimization, and the emergence of subscription-based rental models. The regulatory framework, encompassing licensing, insurance, and environmental regulations, significantly influences market operations. Substitute products, such as ride-hailing services and public transportation, pose competitive challenges. End-user trends indicate a growing preference for online bookings and flexible rental options, particularly among younger demographics. M&A activity in the period 2019-2024 witnessed xx deals, largely driven by consolidation efforts and expansion strategies.

- Market Share (2025): Top 5 players - xx%

- M&A Deal Count (2019-2024): xx

- Key Innovation Areas: Mobile bookings, telematics, AI, subscription models.

Germany Car Rental Market Industry Insights & Trends

The German car rental market's growth is fueled by several factors. The robust tourism sector, especially inbound tourism, consistently drives demand for short-term rentals. Business travel and corporate requirements contribute significantly to long-term rental demand. Increasing disposable incomes and a growing preference for personal mobility options among consumers also boost market expansion. Technological advancements, particularly in online booking and fleet management systems, enhance operational efficiency and customer experience.

Evolving consumer behavior, such as the rising adoption of online platforms and mobile apps for booking, presents both opportunities and challenges for rental companies. The market has witnessed increased adoption of sustainable practices, with a push towards electric and hybrid vehicle fleets. The impact of COVID-19 initially disrupted the market, but recovery has been strong, driven by pent-up demand and renewed travel activity. The market size grew from xx Million in 2019 to xx Million in 2024, reflecting the overall dynamic nature of this sector.

Key Markets & Segments Leading Germany Car Rental Market

The German car rental market is broadly segmented by application type (leisure/tourism, business), booking type (offline, online), and rental length type (short-term, long-term). While data on precise regional dominance within Germany is limited, urban centers and major tourist destinations experience higher demand across all segments.

- Application Type: Leisure/tourism consistently holds the largest market share, owing to Germany's strong tourist appeal. Business travel contributes substantially, especially in metropolitan areas.

- Booking Type: Online bookings show significant growth, surpassing offline bookings in recent years. This is driven by convenience and increased internet penetration.

- Rental Length Type: Short-term rentals remain dominant, aligned with the prominence of leisure travel. Long-term rentals hold a notable share, primarily driven by business requirements and relocation services.

Drivers for segment growth:

- Leisure/Tourism: Strong tourism sector, improved infrastructure, promotional campaigns.

- Business: Economic growth, expansion of corporate sectors, increased business travel.

- Online Booking: Increased internet penetration, convenience, competitive pricing.

- Short-Term Rentals: Popularity of leisure travel, weekend getaways, ease of access.

- Long-Term Rentals: Business relocation, expatriate assignments, vehicle subscription services.

Germany Car Rental Market Product Developments

Recent product innovations focus on enhancing customer experience and operational efficiency. This includes the integration of mobile apps for seamless booking and management, the deployment of telematics for improved fleet tracking and maintenance, and the introduction of electric and hybrid vehicles to cater to environmentally conscious consumers. These developments offer significant competitive advantages, allowing rental companies to differentiate themselves and attract a wider customer base.

Challenges in the Germany Car Rental Market Market

The German car rental market faces several challenges, including intense competition, fluctuating fuel prices impacting operational costs, and stringent regulations related to vehicle emissions and safety standards. Supply chain disruptions can also affect vehicle availability, particularly during peak seasons. The impact of these challenges varies, but collectively they contribute to reduced profitability and constrain market expansion. For example, increased fuel prices in 2022 resulted in a xx% increase in operating costs for many rental companies.

Forces Driving Germany Car Rental Market Growth

Key growth drivers include rising disposable incomes and increased tourism, leading to higher demand for rental vehicles. Technological advancements in online booking and fleet management optimize efficiency and customer satisfaction. Government initiatives promoting sustainable transportation indirectly support the adoption of electric vehicles within the rental fleet, creating new market segments.

Challenges in the Germany Car Rental Market Market

Long-term growth hinges on adapting to changing consumer preferences, including increased demand for electric vehicles and flexible rental options. Strategic partnerships with hotels, airlines, and tourism agencies can expand market reach. Expanding into underserved regions and offering specialized rental packages can also enhance market penetration.

Emerging Opportunities in Germany Car Rental Market

Emerging opportunities include the expansion of subscription-based rental models, catering to the growing preference for flexible mobility solutions. The integration of autonomous driving technologies into rental fleets offers the potential for future innovation and enhanced customer experience. Targeting niche markets with specialized vehicles, such as campervans or luxury cars, can provide further growth avenues.

Leading Players in the Germany Car Rental Market Sector

Key Milestones in Germany Car Rental Market Industry

- 2020: Several rental companies implemented enhanced hygiene protocols in response to the COVID-19 pandemic.

- 2021: Increased investment in electric vehicle fleets by major players.

- 2022: Significant rise in fuel prices impacting operating costs.

- 2023: Launch of several new mobile booking apps and loyalty programs.

Strategic Outlook for Germany Car Rental Market Market

The German car rental market is poised for continued growth, driven by robust tourism, business travel, and the evolving needs of consumers. Strategic investments in technology, sustainable practices, and diversified service offerings will be crucial for maintaining a competitive edge. Companies that proactively adapt to emerging trends and leverage innovative solutions will be best positioned to capitalize on the significant opportunities within this dynamic market.

Germany Car Rental Market Segmentation

-

1. Application Type

- 1.1. Leisure/Tourism

- 1.2. Business

-

2. Booking Type

- 2.1. Offline

- 2.2. Online

-

3. Rental Length Type

- 3.1. Short-Term

- 3.2. Long-Term

Germany Car Rental Market Segmentation By Geography

- 1. Germany

Germany Car Rental Market Regional Market Share

Geographic Coverage of Germany Car Rental Market

Germany Car Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for ADAS likely Drive the Market

- 3.3. Market Restrains

- 3.3.1. Lower efficiency in bad weather conditions

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Online Car Rental Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Car Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Leisure/Tourism

- 5.1.2. Business

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Offline

- 5.2.2. Online

- 5.3. Market Analysis, Insights and Forecast - by Rental Length Type

- 5.3.1. Short-Term

- 5.3.2. Long-Term

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Europcar International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Hertz Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alamo (Enterprise Holdings Inc )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Thrifty Car Rental Inc*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SIXT SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Buchbinder

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Avis Budget Group Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Europcar International

List of Figures

- Figure 1: Germany Car Rental Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Car Rental Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Car Rental Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 2: Germany Car Rental Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 3: Germany Car Rental Market Revenue billion Forecast, by Rental Length Type 2020 & 2033

- Table 4: Germany Car Rental Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Germany Car Rental Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: Germany Car Rental Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 7: Germany Car Rental Market Revenue billion Forecast, by Rental Length Type 2020 & 2033

- Table 8: Germany Car Rental Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Car Rental Market?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Germany Car Rental Market?

Key companies in the market include Europcar International, The Hertz Corporation, Alamo (Enterprise Holdings Inc ), Thrifty Car Rental Inc*List Not Exhaustive, SIXT SE, Buchbinder, Avis Budget Group Inc.

3. What are the main segments of the Germany Car Rental Market?

The market segments include Application Type, Booking Type, Rental Length Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for ADAS likely Drive the Market.

6. What are the notable trends driving market growth?

Increasing Demand for Online Car Rental Services.

7. Are there any restraints impacting market growth?

Lower efficiency in bad weather conditions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Car Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Car Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Car Rental Market?

To stay informed about further developments, trends, and reports in the Germany Car Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence