Key Insights

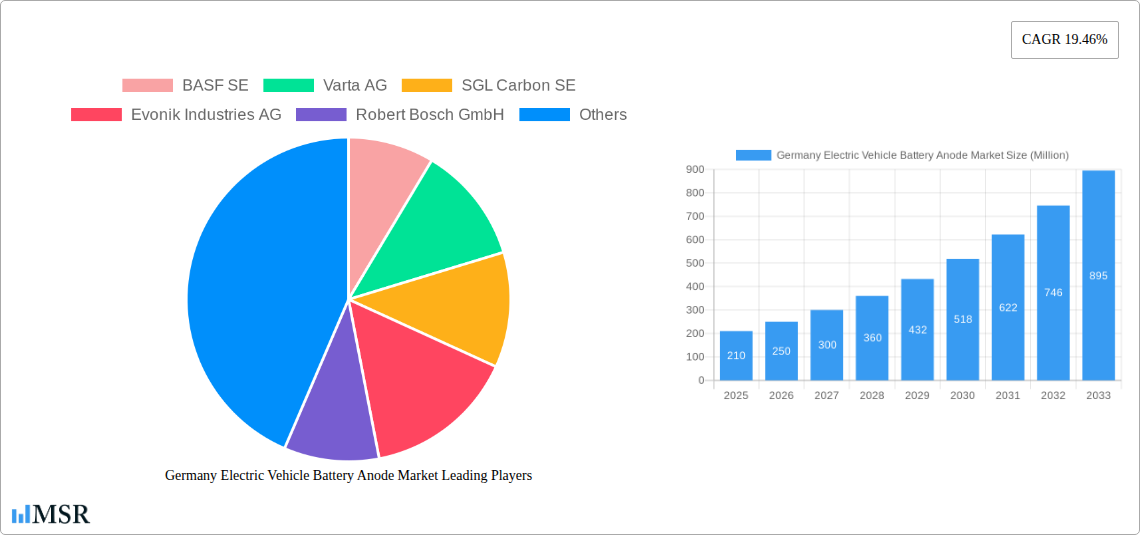

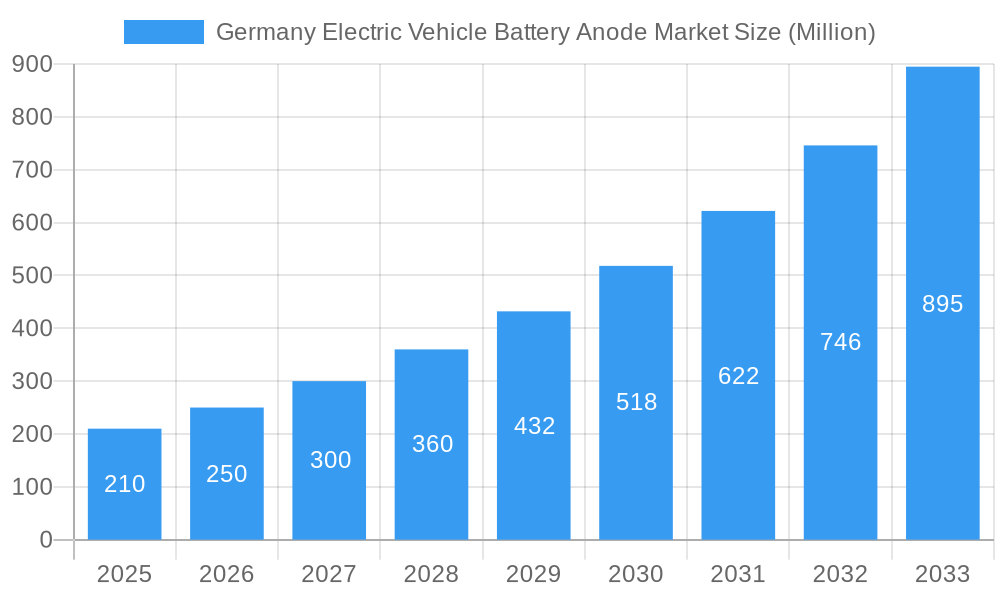

The German electric vehicle (EV) battery anode market, currently valued at €210 million (estimated based on a 0.21 market size in unspecified units, assuming "Million" refers to millions of Euros), is experiencing robust growth. A compound annual growth rate (CAGR) of 19.46% from 2019-2024 projects significant expansion through 2033. This growth is primarily driven by the accelerating adoption of EVs in Germany, spurred by government incentives, stringent emission regulations, and increasing consumer demand for sustainable transportation. The rising popularity of high-energy-density batteries, particularly those utilizing advanced anode materials like graphite and silicon-based composites, further fuels market expansion. Key players such as BASF SE, Varta AG, and SGL Carbon SE are leading this innovation, investing heavily in research and development to improve battery performance, lifespan, and safety. However, challenges such as raw material price volatility and the need for efficient and sustainable battery recycling processes pose potential restraints to market growth. Future growth will depend on continued technological advancements, supportive government policies promoting domestic battery production, and the establishment of a robust recycling infrastructure to address environmental concerns.

Germany Electric Vehicle Battery Anode Market Market Size (In Million)

The forecast for the German EV battery anode market indicates a continued upward trajectory. By 2033, significant expansion is anticipated, driven by advancements in battery technology leading to higher energy density and improved performance. The increasing penetration of EVs across diverse vehicle segments, including passenger cars, commercial vehicles, and two-wheelers, will further stimulate demand. Furthermore, the development and implementation of sophisticated battery management systems will enhance the overall efficiency and longevity of EV batteries, contributing to stronger market growth. While competition is intensifying with more companies entering the market, the established players are leveraging their expertise and technological advancements to maintain their market leadership. Strategic partnerships and collaborations aimed at optimizing the entire EV battery supply chain are also becoming more prevalent.

Germany Electric Vehicle Battery Anode Market Company Market Share

Germany Electric Vehicle Battery Anode Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Germany Electric Vehicle Battery Anode Market, offering crucial insights for stakeholders across the automotive, energy storage, and materials sectors. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, leading players, and future growth trajectories. Expect detailed analysis of market size (in Millions), CAGR, key segments, and emerging trends, equipping you with actionable intelligence for strategic decision-making.

Germany Electric Vehicle Battery Anode Market Market Concentration & Dynamics

The German electric vehicle battery anode market exhibits a moderately concentrated landscape, with several established players holding significant market share. Key factors influencing market dynamics include:

- Market Concentration: BASF SE, Varta AG, SGL Carbon SE, Evonik Industries AG, and Robert Bosch GmbH are prominent players, although the exact market share distribution requires further proprietary analysis. We estimate the top 5 players hold approximately xx% of the market in 2025.

- Innovation Ecosystem: Germany benefits from a strong R&D ecosystem, driving innovation in silicon-based anodes and other advanced materials. Collaboration between automotive manufacturers, battery producers, and materials suppliers is a key catalyst.

- Regulatory Framework: Government incentives for EV adoption and stringent emission regulations create a favorable environment for battery anode market growth. However, complex regulatory requirements related to material sourcing and safety standards present challenges.

- Substitute Products: Competition from alternative anode materials, such as lithium titanate and graphene, is emerging, though graphite remains dominant in 2025.

- End-User Trends: The rising demand for EVs with extended range and improved performance is a major driver. Growing consumer awareness of environmental concerns further fuels the market.

- M&A Activities: The market has witnessed a moderate level of mergers and acquisitions in recent years (xx deals in the past 5 years), indicating consolidation and strategic expansion among industry players.

Germany Electric Vehicle Battery Anode Market Industry Insights & Trends

The German EV battery anode market is experiencing robust growth, driven by the burgeoning EV sector and increasing demand for high-performance batteries. The market size in 2025 is estimated at xx Million, exhibiting a CAGR of xx% during the forecast period (2025-2033). Several factors contribute to this growth trajectory:

- Government Support: Significant government investments in EV infrastructure and supportive policies are stimulating market expansion.

- Technological Advancements: The ongoing development of high-energy-density anode materials, particularly silicon-based anodes, is driving performance improvements and cost reductions.

- Evolving Consumer Behavior: A shift towards eco-friendly transportation and increased consumer acceptance of EVs fuels demand for advanced battery technologies.

- Supply Chain Developments: Efforts to establish resilient and secure supply chains for crucial raw materials are essential for long-term market stability.

Key Markets & Segments Leading Germany Electric Vehicle Battery Anode Market

While a detailed regional breakdown requires further proprietary research, the automotive sector is the dominant segment, accounting for the vast majority of the demand for battery anodes in Germany.

- Drivers for Automotive Segment Dominance:

- Strong domestic automotive industry.

- Government incentives for EV adoption.

- Increasing consumer demand for electric vehicles.

- Expansion of charging infrastructure.

- Detailed Dominance Analysis: The automotive segment’s dominance is rooted in Germany's strong automotive manufacturing base and the country's ambitious targets for EV adoption. The increasing electrification of the transportation sector is a primary factor driving growth in the anode market. The trend is expected to continue throughout the forecast period.

Germany Electric Vehicle Battery Anode Market Product Developments

Significant advancements in anode materials are reshaping the market. Silicon-based anodes, offering higher energy density compared to traditional graphite, are gaining traction. Companies are focusing on improving the cycle life and manufacturing processes of these advanced materials to enhance their competitiveness. The integration of these advanced anodes into next-generation batteries is a key driver of innovation within the industry.

Challenges in the Germany Electric Vehicle Battery Anode Market Market

The German EV battery anode market faces several challenges, including:

- Raw Material Supply: Securing a stable supply of high-quality raw materials, particularly lithium and graphite, poses a significant challenge.

- High Production Costs: The manufacturing of advanced anode materials can be expensive, impacting the overall cost of EV batteries.

- Intense Competition: The market is characterized by intense competition among established and emerging players.

Forces Driving Germany Electric Vehicle Battery Anode Market Growth

Key growth drivers include:

- Government Policies: Incentives and regulations aimed at promoting EV adoption in Germany are pivotal for market growth.

- Technological Innovation: The continuous development of advanced anode materials with enhanced performance characteristics is crucial.

- Expanding EV Market: The increasing demand for electric vehicles is the primary driver for anode market growth.

Challenges in the Germany Electric Vehicle Battery Anode Market Market

Long-term growth will be fueled by:

- Strategic Partnerships: Collaborations between materials suppliers, battery manufacturers, and automakers will drive innovation and market expansion.

- Technological Breakthroughs: Developments in solid-state batteries and other advanced battery technologies hold significant long-term potential.

- Sustainable Supply Chains: The development of sustainable and ethical supply chains for raw materials will enhance long-term market stability.

Emerging Opportunities in Germany Electric Vehicle Battery Anode Market

Emerging opportunities include:

- Next-Generation Anode Materials: Further development and commercialization of advanced anode materials like silicon-carbon composites.

- Recycling and Second-Life Applications: Developing efficient and cost-effective battery recycling technologies to recover valuable materials.

- Market Expansion in Emerging Economies: Exploring opportunities in expanding markets globally.

Leading Players in the Germany Electric Vehicle Battery Anode Market Sector

- BASF SE

- Varta AG

- SGL Carbon SE

- Evonik Industries AG

- Robert Bosch GmbH

- Innolith AG

- Leclanché GmbH

- Heraeus Holding GmbH

- List Not Exhaustive

Key Milestones in Germany Electric Vehicle Battery Anode Market Industry

- July 2024: Group14 secures a USD 300 Million deal with CustomCells for silicon anode supply, signifying growing demand for advanced anode materials.

- January 2024: GDI receives a EUR 20 Million loan from the EIB to advance its next-generation silicon anode technology, highlighting the investment in innovative battery technologies.

Strategic Outlook for Germany Electric Vehicle Battery Anode Market Market

The German EV battery anode market presents significant growth potential, driven by the increasing adoption of electric vehicles and ongoing technological advancements. Strategic partnerships, investments in R&D, and the development of sustainable supply chains will be key to capturing this market opportunity. The focus on high-energy density, cost-effective, and environmentally friendly anode materials will continue to shape the market's future.

Germany Electric Vehicle Battery Anode Market Segmentation

-

1. Battery Type

- 1.1. Lithium-Ion Batteries

- 1.2. Lead-Acid Batteries

- 1.3. Others

-

2. Material Type

- 2.1. Lithium

- 2.2. Graphite

- 2.3. Silicon

- 2.4. Others

Germany Electric Vehicle Battery Anode Market Segmentation By Geography

- 1. Germany

Germany Electric Vehicle Battery Anode Market Regional Market Share

Geographic Coverage of Germany Electric Vehicle Battery Anode Market

Germany Electric Vehicle Battery Anode Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Adoption of Electric Vehicles4.; Advancements in Anode Materials

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Adoption of Electric Vehicles4.; Advancements in Anode Materials

- 3.4. Market Trends

- 3.4.1. Lithium-Ion Battery Type to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Electric Vehicle Battery Anode Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lithium-Ion Batteries

- 5.1.2. Lead-Acid Batteries

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Lithium

- 5.2.2. Graphite

- 5.2.3. Silicon

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BASF SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Varta AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SGL Carbon SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Evonik Industries AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Robert Bosch GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Innolith AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Leclanché GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Heraeus Holding GmbH*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking Analysi

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 BASF SE

List of Figures

- Figure 1: Germany Electric Vehicle Battery Anode Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Electric Vehicle Battery Anode Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Electric Vehicle Battery Anode Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 2: Germany Electric Vehicle Battery Anode Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 3: Germany Electric Vehicle Battery Anode Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 4: Germany Electric Vehicle Battery Anode Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 5: Germany Electric Vehicle Battery Anode Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Germany Electric Vehicle Battery Anode Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Germany Electric Vehicle Battery Anode Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 8: Germany Electric Vehicle Battery Anode Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 9: Germany Electric Vehicle Battery Anode Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 10: Germany Electric Vehicle Battery Anode Market Volume Billion Forecast, by Material Type 2020 & 2033

- Table 11: Germany Electric Vehicle Battery Anode Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Electric Vehicle Battery Anode Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Electric Vehicle Battery Anode Market?

The projected CAGR is approximately 19.46%.

2. Which companies are prominent players in the Germany Electric Vehicle Battery Anode Market?

Key companies in the market include BASF SE, Varta AG, SGL Carbon SE, Evonik Industries AG, Robert Bosch GmbH, Innolith AG, Leclanché GmbH, Heraeus Holding GmbH*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking Analysi.

3. What are the main segments of the Germany Electric Vehicle Battery Anode Market?

The market segments include Battery Type, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.21 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Adoption of Electric Vehicles4.; Advancements in Anode Materials.

6. What are the notable trends driving market growth?

Lithium-Ion Battery Type to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Growing Adoption of Electric Vehicles4.; Advancements in Anode Materials.

8. Can you provide examples of recent developments in the market?

July 2024: Group14, a manufacturer of next-gen battery materials, struck a deal with CustomCells, a German battery cell company. CustomCells is set to purchase USD 300 million worth of Group14's silicon anode product. This product, named SCC55, will be integrated into CustomCells' battery cells, aiming to boost their performance.January 2024: GDI secured a EUR 20 million (USD 22.16 billion) quasi-equity loan from the European Investment Bank (EIB) to advance its next-generation silicon anode technology. This technology aims to power electric vehicles and reduce reliance on graphite. The InvestEU programme backs this agreement, with a goal of catalyzing over EUR 372 billion (USD 412 billion) in investments for new technologies by 2027.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Electric Vehicle Battery Anode Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Electric Vehicle Battery Anode Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Electric Vehicle Battery Anode Market?

To stay informed about further developments, trends, and reports in the Germany Electric Vehicle Battery Anode Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence