Key Insights

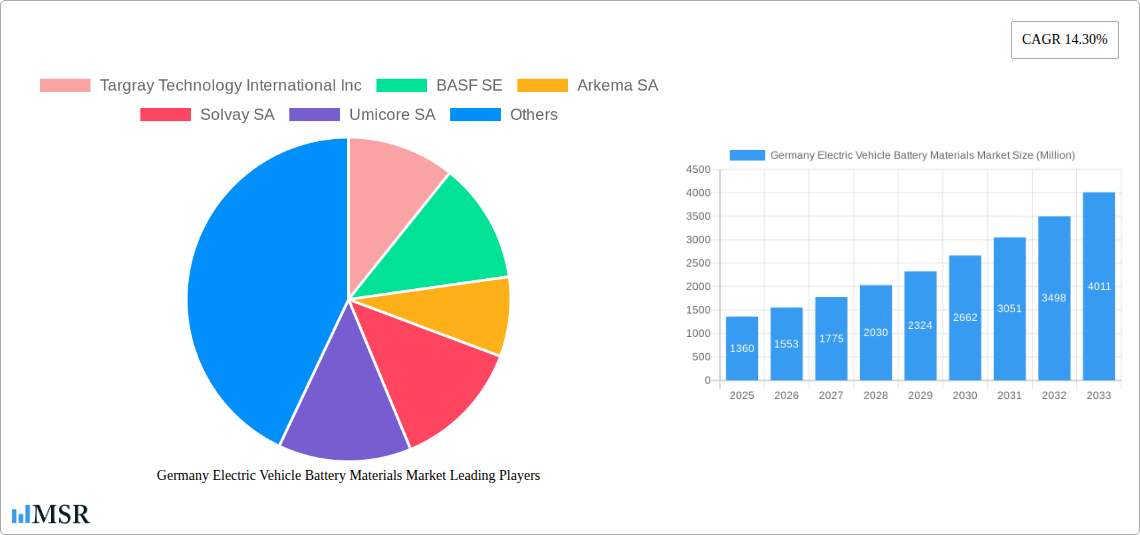

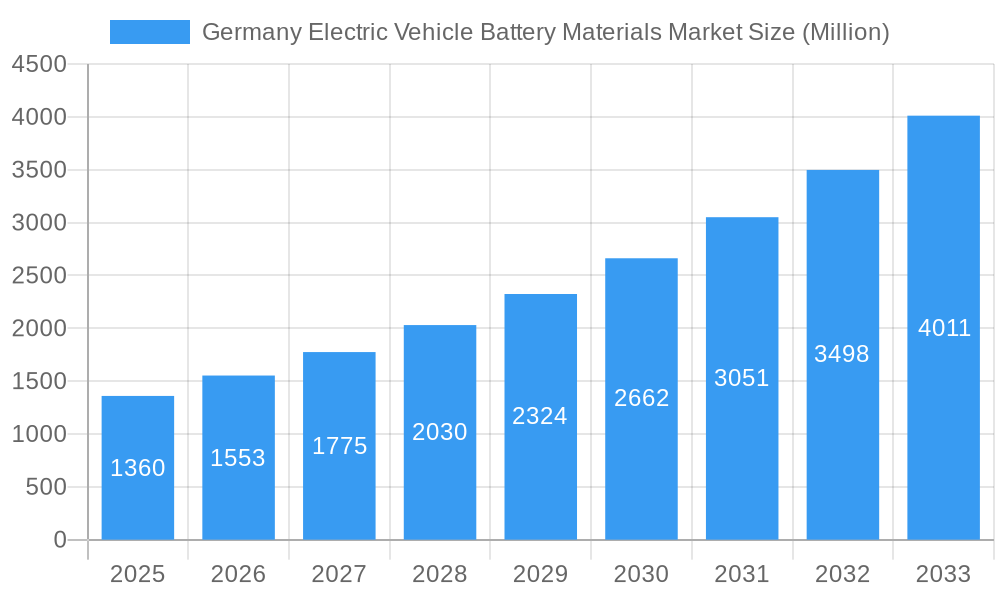

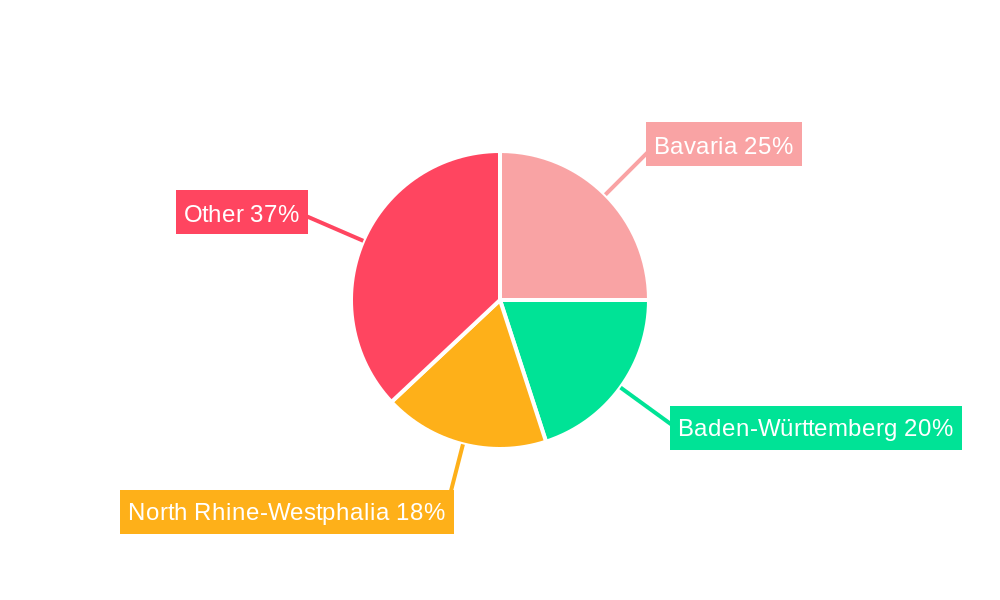

The German electric vehicle (EV) battery materials market is experiencing robust growth, projected to reach €1.36 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 14.30% from 2025 to 2033. This expansion is fueled by the German government's strong commitment to electrifying its transportation sector, coupled with increasing consumer demand for EVs and stringent emission regulations. Key drivers include substantial investments in domestic EV battery manufacturing, a burgeoning renewable energy sector supporting battery production, and a robust automotive industry actively integrating EVs into their production lines. Furthermore, ongoing technological advancements in battery chemistry, leading to higher energy density and longer lifespan batteries, are stimulating market growth. While challenges exist, such as securing a stable supply chain for critical raw materials and managing the environmental impact of battery production and disposal, the overall market outlook remains positive. Leading players like BASF SE, Solvay SA, and Umicore SA are strategically positioning themselves to capitalize on this growth, investing in research and development and expanding their production capacities to meet the rising demand. The market is segmented based on material type (e.g., cathode, anode, electrolyte), application (e.g., passenger vehicles, commercial vehicles), and region (e.g., Bavaria, Baden-Württemberg). The competitive landscape is characterized by both established chemical companies and specialized battery material suppliers vying for market share.

Germany Electric Vehicle Battery Materials Market Market Size (In Billion)

The forecast period of 2025-2033 presents significant opportunities for expansion, driven by the increasing penetration of EVs in the German automotive market and the ongoing development of next-generation battery technologies. However, maintaining a competitive edge will require companies to focus on innovation, cost optimization, and sustainable practices throughout the battery value chain. The market is expected to witness increasing consolidation, with larger players acquiring smaller companies to secure access to key technologies and raw materials. The German government’s policies supporting the domestic battery ecosystem will play a crucial role in shaping the market's future trajectory. While specific regional data is unavailable, it's reasonable to assume that regions with strong automotive manufacturing hubs and access to renewable energy will experience the highest growth within Germany.

Germany Electric Vehicle Battery Materials Market Company Market Share

Germany Electric Vehicle Battery Materials Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Germany electric vehicle (EV) battery materials market, offering valuable insights for stakeholders across the industry value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and opportunities. The report covers market size, CAGR, market share analysis, leading players, and key industry developments, providing actionable intelligence to inform strategic decision-making.

Germany Electric Vehicle Battery Materials Market Market Concentration & Dynamics

This section analyzes the competitive landscape of the German EV battery materials market, examining market concentration, innovation ecosystems, regulatory frameworks, substitute products, end-user trends, and mergers and acquisitions (M&A) activities. The market exhibits a moderately concentrated structure, with key players holding significant market share. Innovation is driven by both established players and emerging startups, leading to continuous technological advancements in battery materials. Germany’s robust regulatory framework supports the growth of the EV sector, while the increasing adoption of EVs fuels demand for high-performance battery materials. The competitive landscape is further shaped by the presence of substitute products and ongoing M&A activities, which are reshaping the industry dynamics.

- Market Concentration: xx% market share held by the top 5 players in 2024.

- M&A Activity: xx M&A deals recorded in the past 5 years.

- Innovation Ecosystem: Strong presence of research institutions and startups fostering innovation.

- Regulatory Landscape: Supportive policies incentivizing EV adoption and battery material production.

Germany Electric Vehicle Battery Materials Market Industry Insights & Trends

The German EV battery materials market is experiencing significant growth, driven by factors such as rising EV sales, government support for the electric mobility sector, and advancements in battery technology. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Technological advancements, such as the development of high-energy-density batteries and solid-state batteries, are transforming the industry. Furthermore, evolving consumer preferences towards sustainable and environmentally friendly vehicles are accelerating market growth. The increasing focus on reducing carbon emissions and improving energy efficiency is further propelling the demand for advanced battery materials in Germany.

Key Markets & Segments Leading Germany Electric Vehicle Battery Materials Market

The German EV battery materials market is segmented by material type (e.g., cathode materials, anode materials, electrolytes), application (e.g., passenger vehicles, commercial vehicles), and region. The dominant segment is currently [Insert dominant segment here, e.g., Cathode Materials], driven by [Insert reasons for dominance e.g., higher energy density requirements and ongoing research and development in this area]. Growth in this segment is further fuelled by the increasing penetration of electric vehicles in the passenger vehicle segment.

- Drivers for Dominant Segment:

- High demand from the automotive industry.

- Technological advancements leading to improved performance.

- Government incentives and subsidies.

- Investments in research and development.

Germany Electric Vehicle Battery Materials Market Product Developments

Significant advancements in battery materials technology are driving innovation within the German EV battery materials market. New materials with improved energy density, longer lifespan, and faster charging capabilities are continuously being developed. This includes the exploration of silicon-based anodes, solid-state electrolytes, and alternative cathode materials. These developments are enhancing the performance and efficiency of EV batteries, thus improving the overall driving experience and range. The increasing adoption of these advanced materials reflects the market's push towards higher performance and sustainability.

Challenges in the Germany Electric Vehicle Battery Materials Market Market

The German EV battery materials market faces challenges, including:

- Supply chain disruptions: Reliance on imports of raw materials creates vulnerability to geopolitical factors.

- Regulatory hurdles: Complex regulations surrounding battery production and waste management.

- High production costs: Advanced battery materials are often expensive to produce.

- Competition: Intense competition from established and new players. These factors present significant barriers to entry and sustained growth.

Forces Driving Germany Electric Vehicle Battery Materials Market Growth

The growth of the German EV battery materials market is being propelled by several factors:

- Government policies: Strong government support for the EV industry.

- Technological advancements: Continuous innovations in battery materials.

- Increasing EV sales: Rising demand for electric vehicles.

- Growing environmental concerns: Consumer preference for sustainable transportation.

Long-Term Growth Catalysts in the Germany Electric Vehicle Battery Materials Market

Long-term growth in the German EV battery materials market is expected to be fueled by continuous innovation in battery technology, strategic partnerships between materials suppliers and automotive manufacturers, and expansion into new applications beyond electric vehicles. Investments in research and development, particularly in areas such as solid-state batteries and next-generation materials, are poised to accelerate market growth over the coming decade. The rising adoption of electric vehicles worldwide presents a significant opportunity for German battery material manufacturers to expand their market reach.

Emerging Opportunities in Germany Electric Vehicle Battery Materials Market

Emerging opportunities include:

- Solid-state batteries: This technology offers the potential for higher energy density and improved safety.

- Recycled battery materials: Growing demand for sustainable and environmentally friendly practices.

- New market applications: Expansion into areas such as energy storage and grid applications.

Leading Players in the Germany Electric Vehicle Battery Materials Market Sector

Key Milestones in Germany Electric Vehicle Battery Materials Industry

- July 2024: Group 14 secures a USD 300 Million deal with CustomCells for silicon anode products, boosting EV battery performance.

- January 2024: EIT InnoEnergy and Demeter launch a EUR 500 Million (USD 544.5 Million) fund to bolster Europe's battery raw material supply chain.

Strategic Outlook for Germany Electric Vehicle Battery Materials Market Market

The German EV battery materials market is poised for significant growth, driven by continued technological advancements, supportive government policies, and the burgeoning electric vehicle market. Strategic opportunities exist for companies to invest in research and development, establish robust supply chains, and explore new applications for advanced battery materials. Companies that can effectively navigate the regulatory landscape, manage supply chain risks, and adapt to evolving consumer preferences will be well-positioned to capture significant market share in the years to come.

Germany Electric Vehicle Battery Materials Market Segmentation

-

1. Battery Type

- 1.1. Lithium-ion Battery

- 1.2. Lead-Acid Battery

- 1.3. Others

-

2. Material

- 2.1. Cathode

- 2.2. Anode

- 2.3. Electrolyte

- 2.4. Separator

- 2.5. Others

Germany Electric Vehicle Battery Materials Market Segmentation By Geography

- 1. Germany

Germany Electric Vehicle Battery Materials Market Regional Market Share

Geographic Coverage of Germany Electric Vehicle Battery Materials Market

Germany Electric Vehicle Battery Materials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations

- 3.4. Market Trends

- 3.4.1. Growing Electric Vehicle (EVs) Sales Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Electric Vehicle Battery Materials Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lithium-ion Battery

- 5.1.2. Lead-Acid Battery

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Cathode

- 5.2.2. Anode

- 5.2.3. Electrolyte

- 5.2.4. Separator

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Targray Technology International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BASF SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arkema SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Solvay SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Umicore SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Chemical Group Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UBE Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Johnson Matthey

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Henkel Adhesive Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Heraeus Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Wacker Chemie AG*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/ Share Analysi

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Targray Technology International Inc

List of Figures

- Figure 1: Germany Electric Vehicle Battery Materials Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Germany Electric Vehicle Battery Materials Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 2: Germany Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 3: Germany Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 4: Germany Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2020 & 2033

- Table 5: Germany Electric Vehicle Battery Materials Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Germany Electric Vehicle Battery Materials Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Germany Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 8: Germany Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 9: Germany Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 10: Germany Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2020 & 2033

- Table 11: Germany Electric Vehicle Battery Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Electric Vehicle Battery Materials Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Electric Vehicle Battery Materials Market?

The projected CAGR is approximately 14.30%.

2. Which companies are prominent players in the Germany Electric Vehicle Battery Materials Market?

Key companies in the market include Targray Technology International Inc, BASF SE, Arkema SA, Solvay SA, Umicore SA, Mitsubishi Chemical Group Corporation, UBE Corporation, Johnson Matthey, Henkel Adhesive Technologies, Heraeus Group, Wacker Chemie AG*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/ Share Analysi.

3. What are the main segments of the Germany Electric Vehicle Battery Materials Market?

The market segments include Battery Type, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.36 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations.

6. What are the notable trends driving market growth?

Growing Electric Vehicle (EVs) Sales Drives the Market.

7. Are there any restraints impacting market growth?

4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations.

8. Can you provide examples of recent developments in the market?

July 2024: Group 14, a Next-gen battery materials manufacturer, signed a deal with CustomCells, a German battery cell company, to purchase USD 300 million worth of Group 14’s silicon anode product. CustomCells is likely to incorporate Group14’s product into its battery cells to enhance battery performance for electric vehicles, aviation, and “e-mobility.January 2024: EIT InnoEnergy and Demeter Investment Managers announced the launch of a fund dedicated to developing a resilient and diverse battery raw material supply chain in Europe. With a target size of EUR 500 million (USD 544.5 million), the EBA Strategic Battery Materials Fund is building to boost domestic capacities for EV battery materials such as lithium, nickel, cobalt, manganese, and graphite.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Electric Vehicle Battery Materials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Electric Vehicle Battery Materials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Electric Vehicle Battery Materials Market?

To stay informed about further developments, trends, and reports in the Germany Electric Vehicle Battery Materials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence