Key Insights

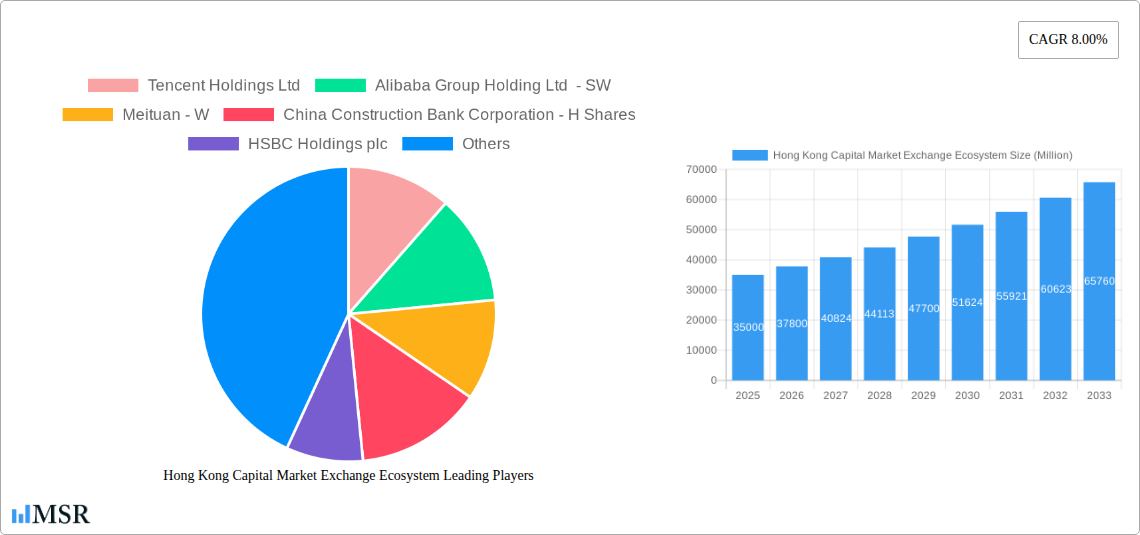

The Hong Kong Capital Market Exchange ecosystem, encompassing equities, bonds, and derivatives, demonstrates robust growth potential. While the precise market size in 2025 is not provided, a reasonable estimation, considering a CAGR of 8% from a base year (likely 2019 or 2020, necessitating an assumption of a hypothetical base year for illustrative purposes) and the presence of major players like Tencent, Alibaba, and HSBC, suggests a market value exceeding $X billion USD (replace X with a reasonable estimate based on available market data for similar exchanges, adjusting for Hong Kong's unique market characteristics). This growth is fueled by several key drivers: increasing foreign investment attracted by Hong Kong's strategic location and established regulatory framework, a thriving fintech sector driving innovation and accessibility, and the continuous expansion of China's economy, resulting in substantial capital flows. However, global economic uncertainty, geopolitical risks, and regulatory changes pose potential restraints. The market segmentation is likely diversified across different asset classes, with equities potentially dominating, followed by bonds and derivatives. The strong presence of leading financial institutions mentioned ensures fierce competition while simultaneously fostering market dynamism and innovation.

Hong Kong Capital Market Exchange Ecosystem Market Size (In Billion)

Looking forward to 2033, the sustained CAGR of 8% projects a significant increase in market value, implying a considerably larger market capitalization. Growth will likely be driven by technological advancements that streamline trading processes, enhanced investor access via digital platforms, and the increasing integration of the Hong Kong market with other Asian financial hubs. Continued efforts to enhance Hong Kong's regulatory environment and investor protections will be crucial in mitigating risks and sustaining long-term growth. Furthermore, the ongoing development of sustainable finance initiatives and the growing emphasis on ESG investing offer opportunities for specialized segments to emerge and contribute to the overall market expansion. Analyzing this growth will necessitate constant monitoring of economic and political factors influencing investment flows and overall market sentiment.

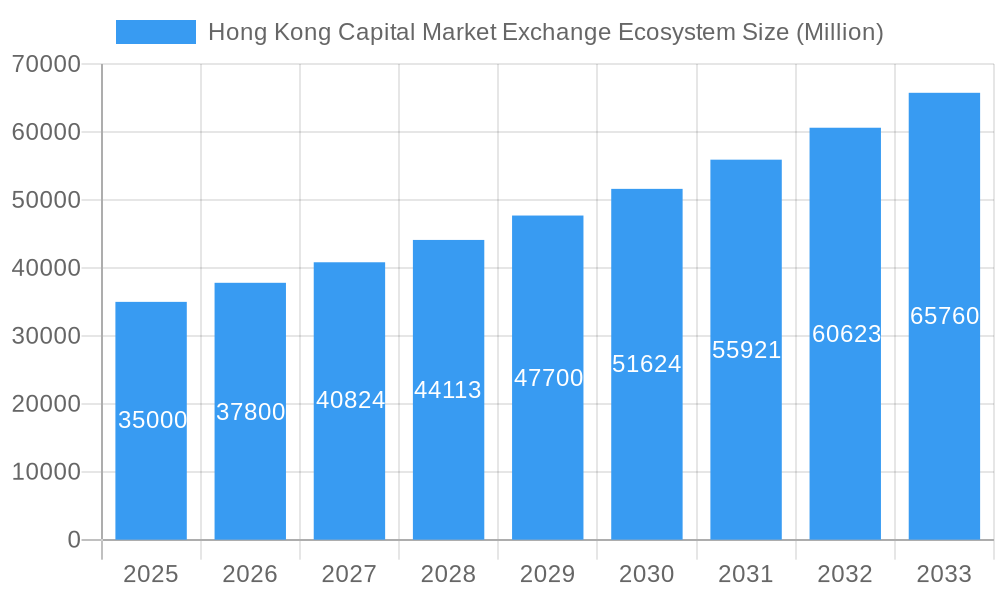

Hong Kong Capital Market Exchange Ecosystem Company Market Share

Hong Kong Capital Market Exchange Ecosystem: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Hong Kong Capital Market Exchange Ecosystem, covering market dynamics, industry trends, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The forecast period extends from 2025 to 2033, while the historical period encompasses 2019-2024. This report is crucial for investors, industry stakeholders, and policymakers seeking to understand and navigate this dynamic market. Key companies analyzed include Tencent Holdings Ltd, Alibaba Group Holding Ltd - SW, Meituan - W, China Construction Bank Corporation - H Shares, HSBC Holdings plc, China Mobile Ltd, AIA Group Ltd, JD.com Inc - SW, Hong Kong Exchanges and Clearing Ltd, and NetEase Inc. (List not exhaustive).

Hong Kong Capital Market Exchange Ecosystem Market Concentration & Dynamics

This section assesses the concentration of the Hong Kong capital market, analyzing its innovation ecosystem, regulatory framework, substitute products, end-user trends, and merger & acquisition (M&A) activity. The Hong Kong market exhibits a high degree of concentration, with a few major players holding significant market share. However, the ecosystem is dynamic, with considerable innovation driven by Fintech advancements and evolving regulatory landscapes.

- Market Share: Tencent Holdings and Alibaba Group collectively hold an estimated xx% market share in the online brokerage segment in 2024. Precise figures are difficult to determine due to the diverse nature of market participants.

- M&A Activity: The historical period (2019-2024) witnessed approximately xx M&A deals, indicating a moderate level of consolidation. The forecast period (2025-2033) projects an increase to approximately xx deals, driven by the desire to expand market share and gain technological advantages.

- Regulatory Framework: The Hong Kong Monetary Authority (HKMA) plays a crucial role in shaping the market's regulatory environment, which impacts innovation and competition.

- Substitute Products: The rise of decentralized finance (DeFi) presents a potential challenge, though its adoption in Hong Kong remains relatively limited as of 2024.

- End-User Trends: Increasing digital adoption and demand for sophisticated investment tools drive market growth.

Hong Kong Capital Market Exchange Ecosystem Industry Insights & Trends

This section delves into market growth drivers, technological disruptions, and evolving consumer behavior. The Hong Kong capital market’s growth is fuelled by robust economic activity, increasing foreign investment, and government initiatives to enhance its global competitiveness. The market size in 2024 is estimated at US$ xx Million, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching US$ xx Million by 2033. Technological advancements, particularly in fintech, are significantly disrupting traditional brokerage models. This includes the adoption of algorithmic trading, blockchain technology, and mobile-first platforms, fostering increased efficiency and accessibility. Growing investor sophistication and demand for personalized financial services are shaping consumer behavior.

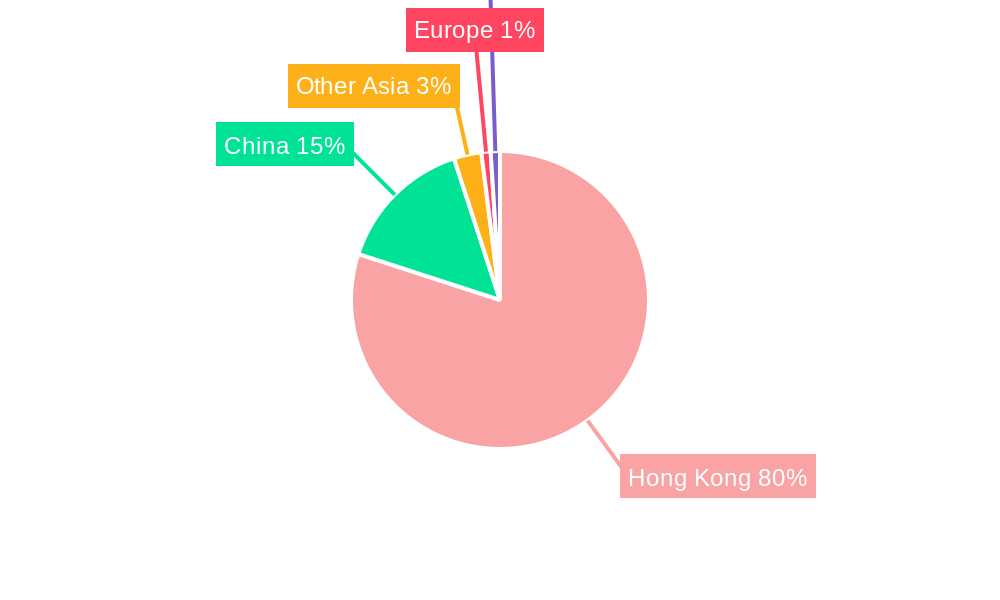

Key Markets & Segments Leading Hong Kong Capital Market Exchange Ecosystem

This section identifies the dominant regions, countries, or segments within the Hong Kong capital market ecosystem. Hong Kong itself is the dominant market, benefiting from its strategic location, robust legal framework, and well-developed infrastructure.

- Drivers of Dominance:

- Strong Economic Fundamentals: Hong Kong's robust economy and its position as a major financial hub attract substantial investment.

- Supportive Government Policies: Government initiatives aimed at promoting the financial services sector further strengthen the market's position.

- Sophisticated Infrastructure: Well-developed infrastructure and advanced technology support the efficient operation of the market.

The detailed dominance analysis highlights Hong Kong’s role as a key financial center in Asia, attracting both local and international players.

Hong Kong Capital Market Exchange Ecosystem Product Developments

The Hong Kong capital market has witnessed significant product innovations, particularly in the realm of digital financial services. These include the development of advanced trading platforms, mobile investment apps, and robo-advisory services. These advancements enhance accessibility, efficiency, and personalization, providing competitive advantages for market participants. The integration of AI and machine learning is further driving product innovation, enhancing risk management and investment strategies.

Challenges in the Hong Kong Capital Market Exchange Ecosystem Market

The Hong Kong capital market faces several challenges, including increased competition from regional markets, regulatory hurdles, and the evolving geopolitical landscape. These factors could potentially impact market growth and profitability. The ongoing global economic uncertainty also poses a risk. The quantifiable impact of these challenges is difficult to pinpoint precisely but will likely impact the CAGR in the forecast period.

Forces Driving Hong Kong Capital Market Exchange Ecosystem Growth

Several factors are driving the growth of the Hong Kong capital market, including technological advancements in fintech, increasing foreign investment, supportive government policies, and the expansion of the middle class, which are boosting retail investment. Furthermore, Hong Kong's status as a global financial center attracts significant capital inflows.

Long-Term Growth Catalysts in the Hong Kong Capital Market Exchange Ecosystem

Long-term growth in the Hong Kong capital market will be driven by continuous innovation in financial technology, strategic partnerships between established players and fintech startups, and market expansions into new product segments and geographic areas. Continued government support and regulatory clarity will further fuel the long-term growth.

Emerging Opportunities in Hong Kong Capital Market Exchange Ecosystem

Emerging opportunities include the expansion of digital asset trading, the adoption of blockchain technology for improved security and transparency, and growth in areas such as sustainable finance and green investments. The increasing demand for personalized financial services also offers significant opportunities for market players.

Leading Players in the Hong Kong Capital Market Exchange Ecosystem Sector

Key Milestones in Hong Kong Capital Market Exchange Ecosystem Industry

- March 2023: Credit Suisse reopened its Hong Kong branch following UBS's takeover, demonstrating resilience in the face of global financial events.

- March 2022: AIA Group announced a US$10 billion share repurchase program, indicating confidence in its future prospects and injecting significant capital into the market.

Strategic Outlook for Hong Kong Capital Market Exchange Ecosystem Market

The Hong Kong capital market is poised for continued growth, driven by technological innovation, regulatory support, and its strategic location. The market's future potential is significant, presenting numerous strategic opportunities for investors and businesses alike. Strategic alliances, diversification of offerings, and the adoption of cutting-edge technologies will be key factors determining future success.

Hong Kong Capital Market Exchange Ecosystem Segmentation

-

1. Type of Market

- 1.1. Primary Market

- 1.2. Secondary Market

-

2. Financial Product

- 2.1. Debt

- 2.2. Equity

-

3. Investors

- 3.1. Retail Investors

- 3.2. Institutional Investors

Hong Kong Capital Market Exchange Ecosystem Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hong Kong Capital Market Exchange Ecosystem Regional Market Share

Geographic Coverage of Hong Kong Capital Market Exchange Ecosystem

Hong Kong Capital Market Exchange Ecosystem REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1 Investment and Holding

- 3.4.2 Real Estate

- 3.4.3 Professional and Business Services are Major FDIs in Hong Kong

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hong Kong Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 5.1.1. Primary Market

- 5.1.2. Secondary Market

- 5.2. Market Analysis, Insights and Forecast - by Financial Product

- 5.2.1. Debt

- 5.2.2. Equity

- 5.3. Market Analysis, Insights and Forecast - by Investors

- 5.3.1. Retail Investors

- 5.3.2. Institutional Investors

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 6. North America Hong Kong Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Market

- 6.1.1. Primary Market

- 6.1.2. Secondary Market

- 6.2. Market Analysis, Insights and Forecast - by Financial Product

- 6.2.1. Debt

- 6.2.2. Equity

- 6.3. Market Analysis, Insights and Forecast - by Investors

- 6.3.1. Retail Investors

- 6.3.2. Institutional Investors

- 6.1. Market Analysis, Insights and Forecast - by Type of Market

- 7. South America Hong Kong Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Market

- 7.1.1. Primary Market

- 7.1.2. Secondary Market

- 7.2. Market Analysis, Insights and Forecast - by Financial Product

- 7.2.1. Debt

- 7.2.2. Equity

- 7.3. Market Analysis, Insights and Forecast - by Investors

- 7.3.1. Retail Investors

- 7.3.2. Institutional Investors

- 7.1. Market Analysis, Insights and Forecast - by Type of Market

- 8. Europe Hong Kong Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Market

- 8.1.1. Primary Market

- 8.1.2. Secondary Market

- 8.2. Market Analysis, Insights and Forecast - by Financial Product

- 8.2.1. Debt

- 8.2.2. Equity

- 8.3. Market Analysis, Insights and Forecast - by Investors

- 8.3.1. Retail Investors

- 8.3.2. Institutional Investors

- 8.1. Market Analysis, Insights and Forecast - by Type of Market

- 9. Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Market

- 9.1.1. Primary Market

- 9.1.2. Secondary Market

- 9.2. Market Analysis, Insights and Forecast - by Financial Product

- 9.2.1. Debt

- 9.2.2. Equity

- 9.3. Market Analysis, Insights and Forecast - by Investors

- 9.3.1. Retail Investors

- 9.3.2. Institutional Investors

- 9.1. Market Analysis, Insights and Forecast - by Type of Market

- 10. Asia Pacific Hong Kong Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Market

- 10.1.1. Primary Market

- 10.1.2. Secondary Market

- 10.2. Market Analysis, Insights and Forecast - by Financial Product

- 10.2.1. Debt

- 10.2.2. Equity

- 10.3. Market Analysis, Insights and Forecast - by Investors

- 10.3.1. Retail Investors

- 10.3.2. Institutional Investors

- 10.1. Market Analysis, Insights and Forecast - by Type of Market

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tencent Holdings Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Alibaba Group Holding Ltd - SW

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Meituan - W

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Construction Bank Corporation - H Shares

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 HSBC Holdings plc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 China Mobile Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AIA Group Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 JD com Inc - SW

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hong Kong Exchanges and Clearing Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 NetEase Inc **List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Tencent Holdings Ltd

List of Figures

- Figure 1: Global Hong Kong Capital Market Exchange Ecosystem Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Type of Market 2025 & 2033

- Figure 3: North America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Type of Market 2025 & 2033

- Figure 4: North America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Financial Product 2025 & 2033

- Figure 5: North America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Financial Product 2025 & 2033

- Figure 6: North America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Investors 2025 & 2033

- Figure 7: North America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Investors 2025 & 2033

- Figure 8: North America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Type of Market 2025 & 2033

- Figure 11: South America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Type of Market 2025 & 2033

- Figure 12: South America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Financial Product 2025 & 2033

- Figure 13: South America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Financial Product 2025 & 2033

- Figure 14: South America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Investors 2025 & 2033

- Figure 15: South America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Investors 2025 & 2033

- Figure 16: South America Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Type of Market 2025 & 2033

- Figure 19: Europe Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Type of Market 2025 & 2033

- Figure 20: Europe Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Financial Product 2025 & 2033

- Figure 21: Europe Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Financial Product 2025 & 2033

- Figure 22: Europe Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Investors 2025 & 2033

- Figure 23: Europe Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Investors 2025 & 2033

- Figure 24: Europe Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Type of Market 2025 & 2033

- Figure 27: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Type of Market 2025 & 2033

- Figure 28: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Financial Product 2025 & 2033

- Figure 29: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Financial Product 2025 & 2033

- Figure 30: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Investors 2025 & 2033

- Figure 31: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Investors 2025 & 2033

- Figure 32: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Type of Market 2025 & 2033

- Figure 35: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Type of Market 2025 & 2033

- Figure 36: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Financial Product 2025 & 2033

- Figure 37: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Financial Product 2025 & 2033

- Figure 38: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Investors 2025 & 2033

- Figure 39: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Investors 2025 & 2033

- Figure 40: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 2: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Financial Product 2020 & 2033

- Table 3: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Investors 2020 & 2033

- Table 4: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 6: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Financial Product 2020 & 2033

- Table 7: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Investors 2020 & 2033

- Table 8: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 13: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Financial Product 2020 & 2033

- Table 14: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Investors 2020 & 2033

- Table 15: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 20: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Financial Product 2020 & 2033

- Table 21: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Investors 2020 & 2033

- Table 22: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 33: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Financial Product 2020 & 2033

- Table 34: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Investors 2020 & 2033

- Table 35: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Type of Market 2020 & 2033

- Table 43: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Financial Product 2020 & 2033

- Table 44: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Investors 2020 & 2033

- Table 45: Global Hong Kong Capital Market Exchange Ecosystem Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Hong Kong Capital Market Exchange Ecosystem Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hong Kong Capital Market Exchange Ecosystem?

The projected CAGR is approximately 8.00%.

2. Which companies are prominent players in the Hong Kong Capital Market Exchange Ecosystem?

Key companies in the market include Tencent Holdings Ltd, Alibaba Group Holding Ltd - SW, Meituan - W, China Construction Bank Corporation - H Shares, HSBC Holdings plc, China Mobile Ltd, AIA Group Ltd, JD com Inc - SW, Hong Kong Exchanges and Clearing Ltd, NetEase Inc **List Not Exhaustive.

3. What are the main segments of the Hong Kong Capital Market Exchange Ecosystem?

The market segments include Type of Market, Financial Product, Investors.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Investment and Holding. Real Estate. Professional and Business Services are Major FDIs in Hong Kong.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In March 2023, In Hong Kong, Credit Suisse reopened as usual following UBS's US$3.25 billion takeover. Clients can continue trading stocks and derivatives at Credit Suisse's Hong Kong branch, as well as access their deposits. With assets of HK$100 billion (US$12.74 billion), or roughly 0.5 percent of the city's total banking assets, Credit Suisse operates just one branch in Hong Kong.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hong Kong Capital Market Exchange Ecosystem," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hong Kong Capital Market Exchange Ecosystem report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hong Kong Capital Market Exchange Ecosystem?

To stay informed about further developments, trends, and reports in the Hong Kong Capital Market Exchange Ecosystem, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence