Key Insights

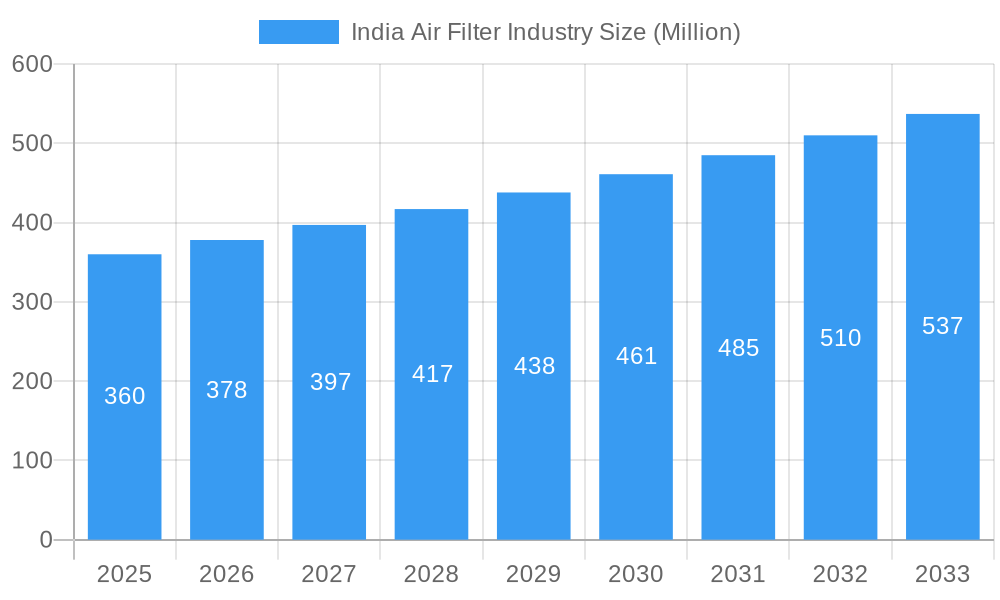

The Indian air filter market, projected at 579.06 million USD in 2025, is forecast to grow at a CAGR of 13.54% from 2025 to 2033. This substantial growth is attributed to rising air pollution in urban centers, increased health consciousness, and growing disposable incomes driving demand for air purification solutions. The market is segmented by filter type (stand-alone, in-duct), end-user (residential, commercial, industrial), and filtration technology (HEPA, others). The residential sector currently leads, bolstered by urbanization and a growing middle class prioritizing indoor air quality. However, commercial and industrial segments are expected to experience significant expansion due to stringent workplace air quality regulations and the adoption of advanced filtration in industrial applications. Product innovation, featuring smart functionalities, energy efficiency, and modern designs, further fuels market growth. Despite potential restraints such as high initial investment costs and regional awareness gaps, the market outlook remains highly positive.

India Air Filter Industry Market Size (In Million)

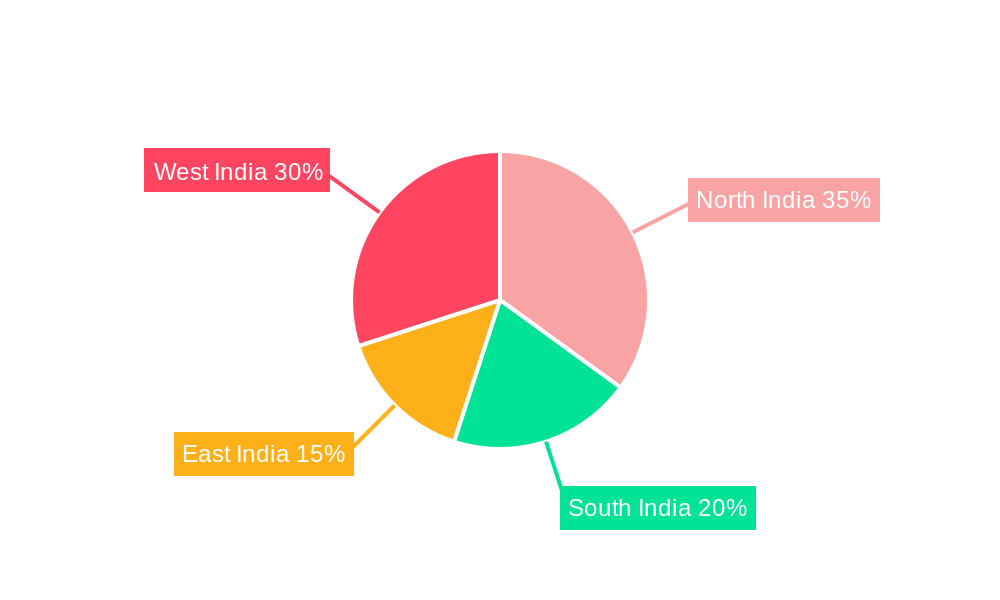

Geographically, North and West India currently dominate due to higher industrialization and urbanization. South and East India are poised for rapid growth, driven by increasing environmental awareness and government initiatives promoting cleaner air. Leading players include Dyson, Whirlpool, Unilever (BlueAir), Honeywell, Daikin, LG, Samsung, Xiaomi, Philips, and Panasonic, who are competing through brand reputation and extensive distribution. Future expansion will be supported by strategic partnerships, technological advancements in filtration, and targeted regional marketing strategies.

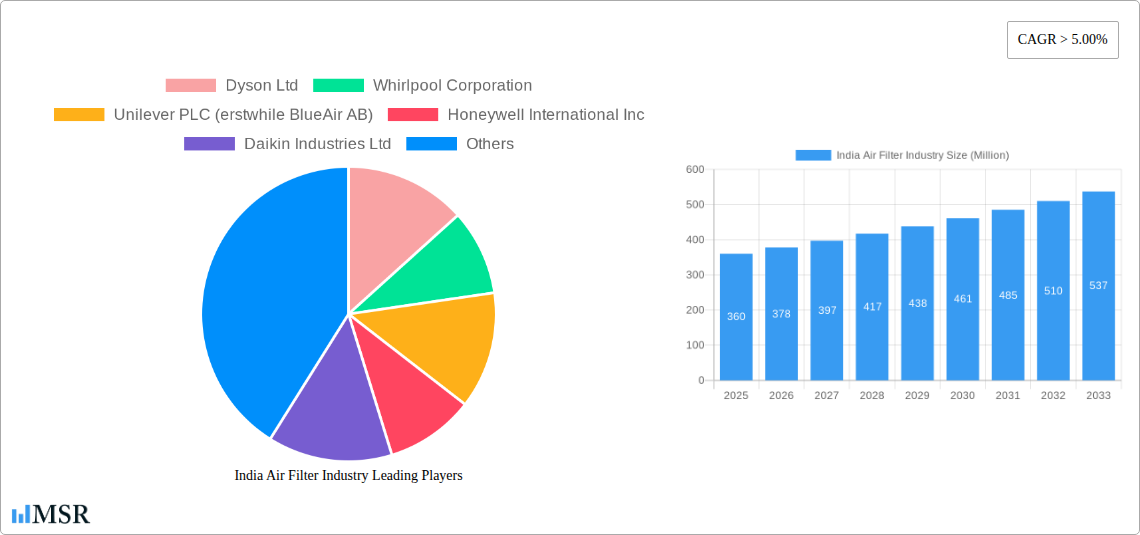

India Air Filter Industry Company Market Share

India Air Filter Market Analysis: 2025-2033 Outlook

This report offers a detailed analysis of the India air filter industry, providing strategic insights for stakeholders, investors, and professionals. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, key players, emerging trends, and future growth potential. The market size in 2025 is estimated at 579.06 million USD, exhibiting a CAGR of 13.54% during the forecast period.

India Air Filter Industry Market Concentration & Dynamics

The Indian air filter market is characterized by a moderate level of concentration, with a few multinational corporations and several domestic players vying for market share. Major players like Dyson Ltd, Whirlpool Corporation, Unilever PLC (erstwhile BlueAir AB), Honeywell International Inc, Daikin Industries Ltd, LG Electronics Inc, Samsung Electronics Co Ltd, Xiaomi Corp, Koninklijke Philips NV, Panasonic Corporation, and IQAir hold significant market share, but the landscape also includes numerous smaller, regional players. The market share of the top 5 players is estimated at xx% in 2025.

- Innovation Ecosystem: The industry is witnessing significant innovation in filtration technologies, with a focus on HEPA filters and other advanced solutions to combat air pollution.

- Regulatory Framework: Government regulations concerning air quality are increasingly stringent, driving demand for efficient air filtration systems.

- Substitute Products: While air filters are the primary solution, substitute products such as air purifiers with other technologies exist and compete within the larger clean air solutions market.

- End-User Trends: Growing awareness of air pollution's health effects is driving increased adoption of air filters across residential, commercial, and industrial sectors. Residential segment dominates, representing xx% of the market in 2025.

- M&A Activities: The number of M&A deals in the Indian air filter industry during the historical period (2019-2024) was approximately xx, indicating a moderate level of consolidation. This is expected to increase in the forecast period due to increasing market competitiveness.

India Air Filter Industry Industry Insights & Trends

The Indian air filter industry is experiencing robust growth fueled by several key factors. Rising urbanization, increasing air pollution levels, and heightened consumer awareness of respiratory health are major growth drivers. The market size is projected to reach xx Million USD by 2033. Technological advancements, particularly in HEPA filtration and other advanced technologies, are further boosting market expansion. Evolving consumer preferences towards smart home technologies and connected devices are also shaping the market landscape. The increasing adoption of air purifiers in commercial and industrial settings due to improved indoor air quality (IAQ) regulations and concerns contributes to market expansion.

Key Markets & Segments Leading India Air Filter Industry

The residential segment currently dominates the Indian air filter market, driven by rising disposable incomes and increasing awareness of air pollution's impact on health. However, the commercial and industrial segments are expected to experience significant growth in the coming years, driven by increasing government regulations and corporate social responsibility (CSR) initiatives.

- Dominant Segments:

- Type: Stand-alone air filters currently hold the largest market share, followed by in-duct systems.

- End-User: Residential remains the dominant end-user segment, followed by commercial and then industrial.

- Filtration Technology: HEPA filters are the most prevalent technology, but other technologies are gaining traction.

- Growth Drivers:

- Economic Growth: Rising disposable incomes are fueling demand, particularly in the residential sector.

- Infrastructure Development: Urbanization and infrastructure development are increasing air pollution, driving the need for air filtration solutions.

- Government Regulations: Stringent air quality regulations are promoting the adoption of air filters in commercial and industrial settings.

India Air Filter Industry Product Developments

Recent product innovations in the Indian air filter industry showcase a shift toward smart, energy-efficient, and high-performance solutions. Manufacturers are introducing air purifiers with advanced filtration technologies, integrated sensors for real-time air quality monitoring, and user-friendly interfaces for convenient operation. These advancements cater to evolving consumer preferences and enhance the overall user experience, creating competitive advantages.

Challenges in the India Air Filter Industry Market

The Indian air filter industry faces several challenges, including fluctuating raw material prices, the complexities of the supply chain, and intense competition from both domestic and international players. Regulatory hurdles and a lack of standardization in some segments also present barriers to entry and growth. These factors can lead to price volatility and affect the overall market growth trajectory, potentially impacting the market size by xx Million USD annually.

Forces Driving India Air Filter Industry Growth

Several factors are driving the growth of the Indian air filter industry. These include increasing awareness of air pollution's health impacts, the rising adoption of smart home technologies, and favorable government policies aimed at improving air quality. Technological advancements in filtration technology, such as the development of more effective and energy-efficient filters, are also contributing to growth. Government incentives and subsidies for energy-efficient appliances are further propelling market expansion.

Long-Term Growth Catalysts in India Air Filter Industry

Long-term growth will be driven by continued innovation in filtration technologies, strategic partnerships between manufacturers and technology providers, and expansion into new geographical markets within India. The growing focus on sustainable and eco-friendly manufacturing processes will also contribute to sustained growth.

Emerging Opportunities in India Air Filter Industry

Emerging opportunities include the expansion of the commercial and industrial segments, driven by stricter air quality standards. The development of customized solutions for specific industrial applications presents significant potential. Growth in the smart home and Internet of Things (IoT) sectors offers opportunities for integrating air filters into connected home ecosystems.

Leading Players in the India Air Filter Industry Sector

- Dyson Ltd

- Whirlpool Corporation

- Unilever PLC (erstwhile BlueAir AB)

- Honeywell International Inc

- Daikin Industries Ltd

- LG Electronics Inc

- Samsung Electronics Co Ltd

- Xiaomi Corp

- Koninklijke Philips NV

- Panasonic Corporation

- IQAir

Key Milestones in India Air Filter Industry Industry

- November 2022: Havells Studio launched the Meditate air purifier, verified by Equinox Lab for efficacy against gaseous pollutants and microorganisms.

- November 2022: Samsung launched the AX46 and AX32 air purifiers, claiming 99.97% removal of nano-sized particles, dust, bacteria, and allergens.

Strategic Outlook for India Air Filter Industry Market

The Indian air filter industry presents substantial growth opportunities driven by rising air pollution, technological advancements, and increasing consumer awareness. Strategic investments in research and development, expansion into untapped markets, and the development of innovative products tailored to specific consumer needs are crucial for success in this dynamic market. The future growth potential is significant, promising continued expansion in market size and market share for key players.

India Air Filter Industry Segmentation

-

1. Filtration Technology

- 1.1. High-efficiency Particulate Air (HEPA)

- 1.2. Other Technologies

-

2. Type

- 2.1. Stand-alone

- 2.2. In-duct

-

3. End-User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

India Air Filter Industry Segmentation By Geography

- 1. India

India Air Filter Industry Regional Market Share

Geographic Coverage of India Air Filter Industry

India Air Filter Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Number of Automobiles4.; The Government Policy Regarding Pollution Emission Control Parameters

- 3.3. Market Restrains

- 3.3.1. 4.; The Technological Limitations of Air Filters

- 3.4. Market Trends

- 3.4.1. High-Efficiency Particulate Air (HEPA) Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Air Filter Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 5.1.1. High-efficiency Particulate Air (HEPA)

- 5.1.2. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Stand-alone

- 5.2.2. In-duct

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dyson Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Whirlpool Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Unilever PLC (erstwhile BlueAir AB)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Honeywell International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Daikin Industries Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 LG Electronics Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Samsung Electronics Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Xiaomi Corp*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Koninklijke Philips NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 IQAir

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Dyson Ltd

List of Figures

- Figure 1: India Air Filter Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Air Filter Industry Share (%) by Company 2025

List of Tables

- Table 1: India Air Filter Industry Revenue million Forecast, by Filtration Technology 2020 & 2033

- Table 2: India Air Filter Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 3: India Air Filter Industry Revenue million Forecast, by Type 2020 & 2033

- Table 4: India Air Filter Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 5: India Air Filter Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 6: India Air Filter Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 7: India Air Filter Industry Revenue million Forecast, by Region 2020 & 2033

- Table 8: India Air Filter Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: India Air Filter Industry Revenue million Forecast, by Filtration Technology 2020 & 2033

- Table 10: India Air Filter Industry Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 11: India Air Filter Industry Revenue million Forecast, by Type 2020 & 2033

- Table 12: India Air Filter Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 13: India Air Filter Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 14: India Air Filter Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 15: India Air Filter Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: India Air Filter Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Air Filter Industry?

The projected CAGR is approximately 13.54%.

2. Which companies are prominent players in the India Air Filter Industry?

Key companies in the market include Dyson Ltd, Whirlpool Corporation, Unilever PLC (erstwhile BlueAir AB), Honeywell International Inc, Daikin Industries Ltd, LG Electronics Inc, Samsung Electronics Co Ltd, Xiaomi Corp*List Not Exhaustive, Koninklijke Philips NV, Panasonic Corporation, IQAir.

3. What are the main segments of the India Air Filter Industry?

The market segments include Filtration Technology, Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 579.06 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Number of Automobiles4.; The Government Policy Regarding Pollution Emission Control Parameters.

6. What are the notable trends driving market growth?

High-Efficiency Particulate Air (HEPA) Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Technological Limitations of Air Filters.

8. Can you provide examples of recent developments in the market?

November 2022: Havells Studio launched a new product, the Meditate air purifier. The company said the air purifier is tested and verified by Equinox Lab for efficacy against the removal of hazardous gaseous pollutants as well as microorganisms like bacteria, viruses, and fungal strains.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Air Filter Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Air Filter Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Air Filter Industry?

To stay informed about further developments, trends, and reports in the India Air Filter Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence