Key Insights

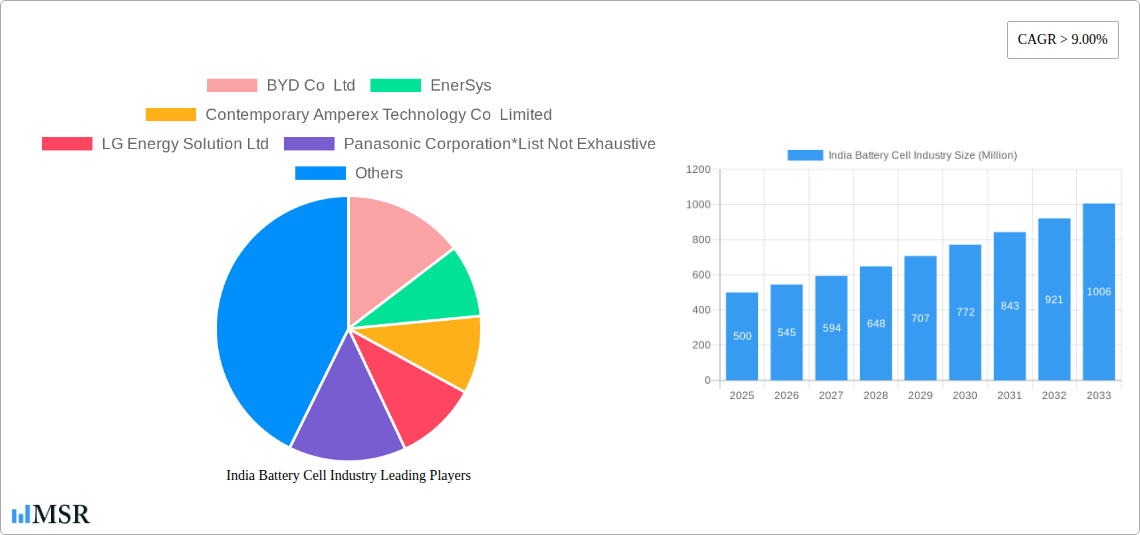

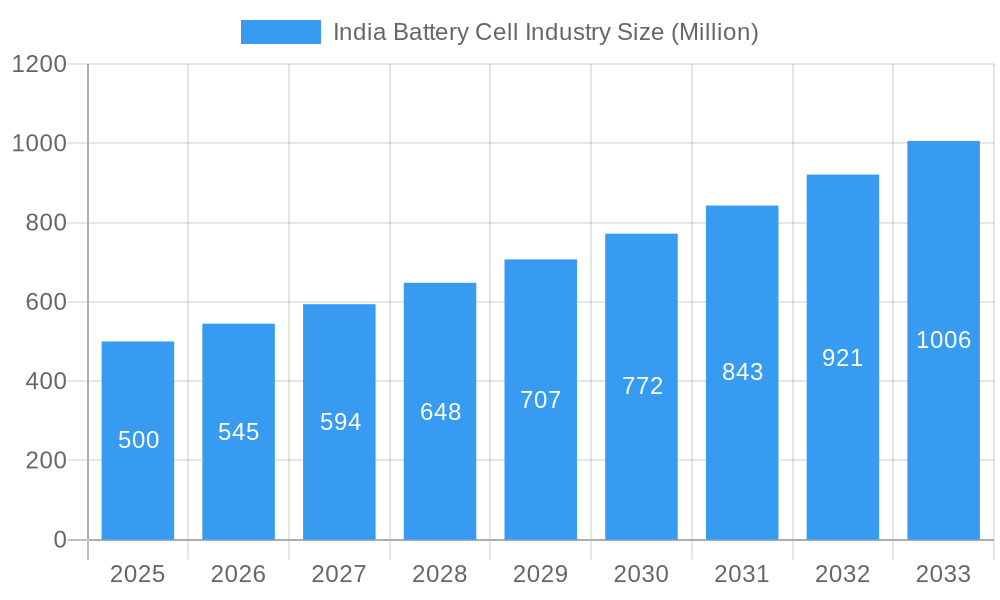

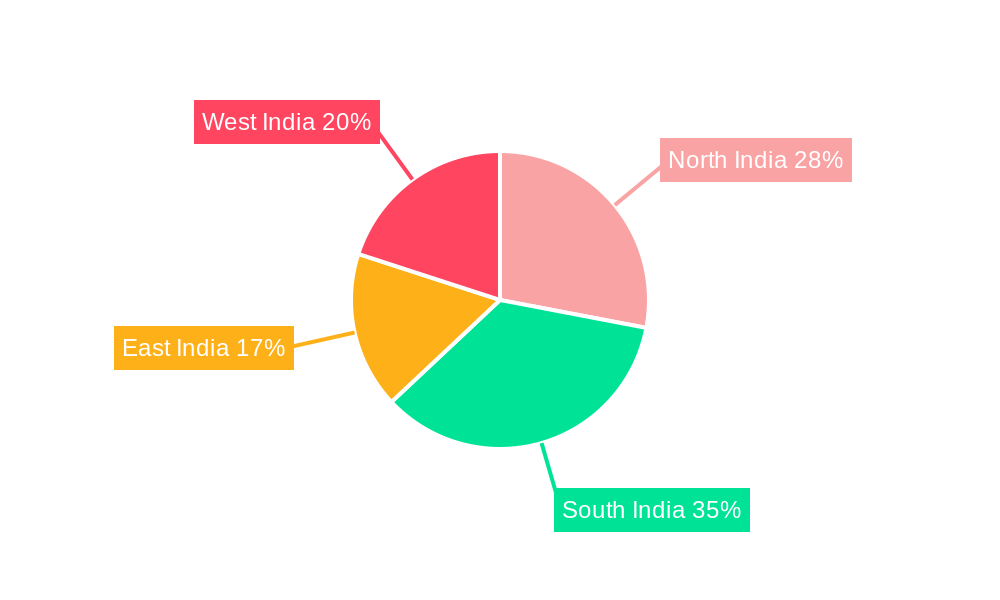

The Indian battery cell industry is poised for significant expansion, propelled by the rapid growth of the electric vehicle (EV) sector, escalating demand for energy storage, and proactive government support for renewable energy integration. With a projected Compound Annual Growth Rate (CAGR) of 11.48% and an estimated market size of 10.45 billion in the base year 2025, this dynamic market offers substantial investment prospects. Key growth accelerators include the widening EV infrastructure, the government's strategic focus on domestic battery manufacturing to reduce import dependency, and the increasing energy storage needs across diverse sectors like industrial applications and consumer electronics. The market is strategically segmented by battery chemistry (prismatic, cylindrical, pouch) and end-use applications (automotive, industrial, portable electronics, power tools, SLI, and others). While established global leaders such as BYD, EnerSys, and LG Energy Solution hold considerable market influence, emerging players can capitalize on niche segments and specialized battery chemistries. Regional market dynamics across North, South, East, and West India are shaped by localized infrastructure development and regional policy frameworks.

India Battery Cell Industry Market Size (In Billion)

The forecast period, spanning from 2025 to 2033, anticipates sustained industry growth driven by ongoing EV adoption and government initiatives fostering a robust domestic battery manufacturing ecosystem. Advancements in battery technology, leading to enhanced energy density, accelerated charging capabilities, and improved safety, will further fuel this expansion. Critical considerations include secure raw material sourcing, sustainable battery disposal practices, and the development of a skilled workforce to meet industry demands. Growth is expected to vary across segments, with automotive and industrial battery applications demonstrating particularly strong upward trends. Strategic manufacturing site selection and efficient distribution networks will be pivotal for market leadership. A granular analysis of regional market trends is imperative for companies aiming to optimize their market penetration strategies.

India Battery Cell Industry Company Market Share

India Battery Cell Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning India battery cell industry, covering market dynamics, key segments, leading players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for industry stakeholders, investors, and policymakers seeking to navigate this rapidly evolving landscape. With a focus on key segments like prismatic, cylindrical, and pouch cells, and applications including automotive, industrial, portable, and power tool batteries, this report is an essential resource for understanding the current state and future trajectory of the Indian battery cell market. The report utilizes data from various sources to provide a comprehensive analysis, using Million (M) for all values. Market values where data is unavailable are marked as xx.

India Battery Cell Industry Market Concentration & Dynamics

This section analyzes the competitive landscape of the Indian battery cell industry, examining market concentration, innovation, regulations, substitute products, end-user trends, and M&A activity. The report explores the market share of key players and the frequency of mergers and acquisitions. The xx M market shows a moderately concentrated structure, with a few dominant players and a growing number of smaller companies. Innovation is driven by both established players and emerging startups, leading to advancements in battery technology. The government's supportive policies are shaping the industry's growth, while the rise of alternative energy storage solutions poses a competitive threat. End-user trends show a shift towards electric vehicles (EVs) and energy storage systems (ESS), creating significant growth opportunities. M&A activity is accelerating, as larger companies seek to consolidate their market positions and gain access to new technologies.

- Market Share: Major players like BYD Co Ltd, EnerSys, Contemporary Amperex Technology Co Limited, LG Energy Solution Ltd, and Panasonic Corporation hold a significant portion (xx%) of the market. Other players such as GS Yuasa Corporation and Duracell Inc. contribute the remaining (xx%).

- M&A Deal Counts: A total of xx M&A deals were recorded between 2019 and 2024, indicating considerable consolidation within the industry.

India Battery Cell Industry Industry Insights & Trends

This section delves into the key drivers of market growth, technological disruptions, and evolving consumer preferences influencing the Indian battery cell industry. The report projects a market size of xx Million by 2025, growing at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Several factors contribute to this robust growth: the government's push for electric mobility, increasing demand for energy storage solutions, advancements in battery technologies, and a growing awareness of environmental sustainability. The emergence of alternative battery chemistries, such as sodium-ion batteries, presents further opportunities. Consumer behavior is shifting towards preference for longer lasting, safer, and more environmentally friendly batteries.

Key Markets & Segments Leading India Battery Cell Industry

This section identifies the dominant regions, countries, and segments within the Indian battery cell market. The automotive battery segment is currently the largest, driven by the increasing adoption of electric vehicles. However, the portable and industrial battery segments are also exhibiting substantial growth. The demand for prismatic and cylindrical cells dominates, although pouch cells are gaining traction due to their flexibility and higher energy density.

- Dominant Segments:

- Application: Automotive Batteries (xx M), Industrial Batteries (xx M), Portable Batteries (xx M), Power Tools Batteries (xx M), SLI Batteries (xx M), Others (xx M)

- Type: Prismatic (xx M), Cylindrical (xx M), Pouch (xx M)

- Growth Drivers: Economic growth, increasing industrialization, rising electricity demand, government incentives for electric vehicles, and the expansion of the renewable energy sector.

India Battery Cell Industry Product Developments

Recent product innovations demonstrate a strong focus on enhancing energy density, extending battery life, improving safety features, and reducing costs. The launch of aluminium-graphene pouch cell batteries by Nordische Technologies showcases advancements in material science and battery design. These innovations offer a competitive edge by improving performance and reducing reliance on conventional lithium-ion technology. The development of sodium-ion batteries is also gaining momentum, promising a cost-effective and safer alternative to lithium-ion batteries.

Challenges in the India Battery Cell Industry Market

The Indian battery cell industry faces several challenges, including regulatory hurdles in securing necessary approvals and permits, fluctuations in raw material prices affecting production costs, and the complexity of establishing a robust supply chain. Competition from established international players also presents a significant challenge, though it also drives innovation and efficiency. These obstacles could potentially limit market expansion and profit margins if not addressed proactively.

Forces Driving India Battery Cell Industry Growth

Several factors are driving the growth of the Indian battery cell industry, including government initiatives promoting electric mobility and renewable energy adoption, increasing investments in research and development, and the growing demand for energy storage solutions across various sectors. Technological advancements, like improved battery chemistries and enhanced energy density, are also key drivers. The availability of cheaper raw materials and increasing consumer awareness of sustainable products further accelerate market growth.

Long-Term Growth Catalysts in the India Battery Cell Industry

Long-term growth will be fueled by continuous technological innovation in battery chemistries, like solid-state batteries, and partnerships between domestic and international companies facilitating technology transfer and investment. Expansion into new markets, such as energy storage for renewable sources and grid-scale applications, will also create significant opportunities for growth.

Emerging Opportunities in India Battery Cell Industry

Emerging opportunities lie in developing specialized batteries for niche applications, such as drones and robotics. The growing demand for energy storage solutions in remote areas and microgrids represents another significant growth area. Further advancements in battery recycling technologies will create a circular economy, reducing environmental impact and resource dependence.

Leading Players in the India Battery Cell Industry Sector

- BYD Co Ltd

- EnerSys

- Contemporary Amperex Technology Co Limited

- LG Energy Solution Ltd

- Panasonic Corporation

- GS Yuasa Corporation

- Duracell Inc

Key Milestones in India Battery Cell Industry Industry

- May 2022: Nordische Technologies launched an Aluminium-Graphene pouch cell battery.

- Jan 2022: Reliance Industries acquired Faradion for USD 135 million, planning further investment of USD 35 million.

Strategic Outlook for India Battery Cell Industry Market

The future of the Indian battery cell industry looks promising, with substantial growth potential driven by government support, technological advancements, and increasing demand. Strategic partnerships and investments in research and development will be crucial for players to capitalize on emerging opportunities and remain competitive in this dynamic market. The focus on sustainability and innovation will be pivotal for long-term success.

India Battery Cell Industry Segmentation

-

1. Type

- 1.1. Prismatic

- 1.2. Cylindrical

- 1.3. Pouch

-

2. Application

- 2.1. Automotive Batteries

- 2.2. Industrial Batteries

- 2.3. Portable Batteries

- 2.4. Power Tools Batteries

- 2.5. SLI Batteries

- 2.6. Others

India Battery Cell Industry Segmentation By Geography

- 1. India

India Battery Cell Industry Regional Market Share

Geographic Coverage of India Battery Cell Industry

India Battery Cell Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Natural Gas and Developing Gas Infrastructure 4.; Increasing Offshore Oil & Gas Exploration Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Adoption of Cleaner Alternatives4.; High Volatility of Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Prismatic cell Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Battery Cell Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Prismatic

- 5.1.2. Cylindrical

- 5.1.3. Pouch

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive Batteries

- 5.2.2. Industrial Batteries

- 5.2.3. Portable Batteries

- 5.2.4. Power Tools Batteries

- 5.2.5. SLI Batteries

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BYD Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 EnerSys

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Contemporary Amperex Technology Co Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LG Energy Solution Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Panasonic Corporation*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GS Yuasa Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Duracell Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 BYD Co Ltd

List of Figures

- Figure 1: India Battery Cell Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Battery Cell Industry Share (%) by Company 2025

List of Tables

- Table 1: India Battery Cell Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: India Battery Cell Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: India Battery Cell Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Battery Cell Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: India Battery Cell Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: India Battery Cell Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Battery Cell Industry?

The projected CAGR is approximately 11.48%.

2. Which companies are prominent players in the India Battery Cell Industry?

Key companies in the market include BYD Co Ltd, EnerSys, Contemporary Amperex Technology Co Limited, LG Energy Solution Ltd, Panasonic Corporation*List Not Exhaustive, GS Yuasa Corporation, Duracell Inc.

3. What are the main segments of the India Battery Cell Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.45 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Natural Gas and Developing Gas Infrastructure 4.; Increasing Offshore Oil & Gas Exploration Activities.

6. What are the notable trends driving market growth?

Prismatic cell Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Adoption of Cleaner Alternatives4.; High Volatility of Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

In May 2022, India-based start-up, Nordische Technologies, have launched an Aluminium-Graphene pouch cell battery for consumer electronics, gadgets, and future EV technology in association with the Central Institute of Petrochemicals Engineering and Technology (CIPET), Bengaluru.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Battery Cell Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Battery Cell Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Battery Cell Industry?

To stay informed about further developments, trends, and reports in the India Battery Cell Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence