Key Insights

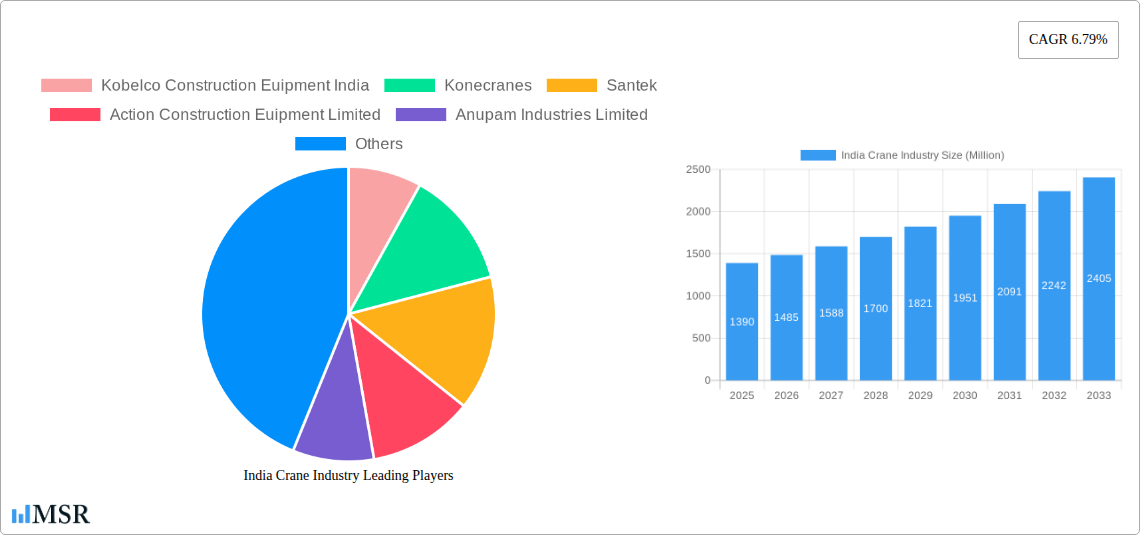

The Indian crane industry, valued at $1.39 billion in 2025, is poised for robust growth, projected to expand at a compound annual growth rate (CAGR) of 6.79% from 2025 to 2033. This expansion is fueled by significant infrastructure development initiatives across India, including the ongoing expansion of ports, roads, and railways, coupled with a surge in construction activities driven by both residential and commercial real estate projects. The rising demand for efficient material handling solutions in sectors like mining, manufacturing, and energy further contributes to the market's upward trajectory. Mobile cranes currently dominate the market share due to their versatility and adaptability to diverse construction sites, while the fixed crane segment experiences steady growth owing to its application in large-scale industrial projects. The industry witnesses increasing adoption of technologically advanced cranes incorporating features such as automation, improved safety mechanisms, and remote monitoring capabilities. However, factors such as high initial investment costs, stringent safety regulations, and potential supply chain disruptions present challenges to market growth.

India Crane Industry Market Size (In Billion)

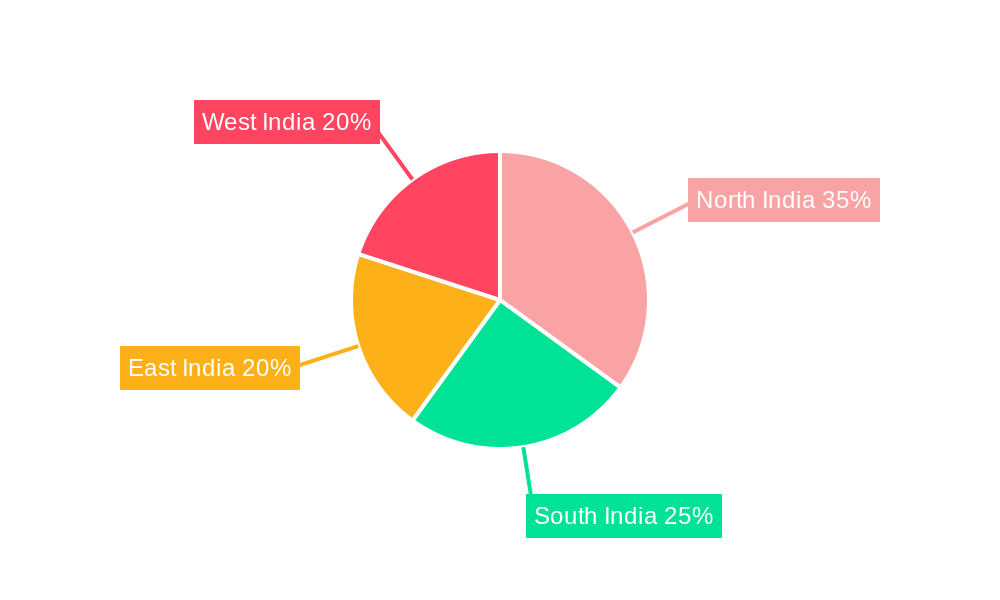

Regional disparities exist within the Indian market, with significant growth anticipated in regions experiencing rapid urbanization and industrialization. North and West India, being hubs of industrial activity and infrastructure development, are likely to witness higher market penetration than the East and South, although all regions are expected to contribute to the overall growth. Key players such as Kobelco, Konecranes, Liebherr, and SANY are aggressively competing to capture market share through product innovation, strategic partnerships, and expansion of their distribution networks. The future growth of the Indian crane industry is contingent on continued government investment in infrastructure projects, the pace of industrial growth across sectors, and the successful implementation of industry-wide safety standards. The evolving regulatory landscape and the increasing demand for sustainable and environmentally friendly crane technologies will also shape the trajectory of the market in the coming years.

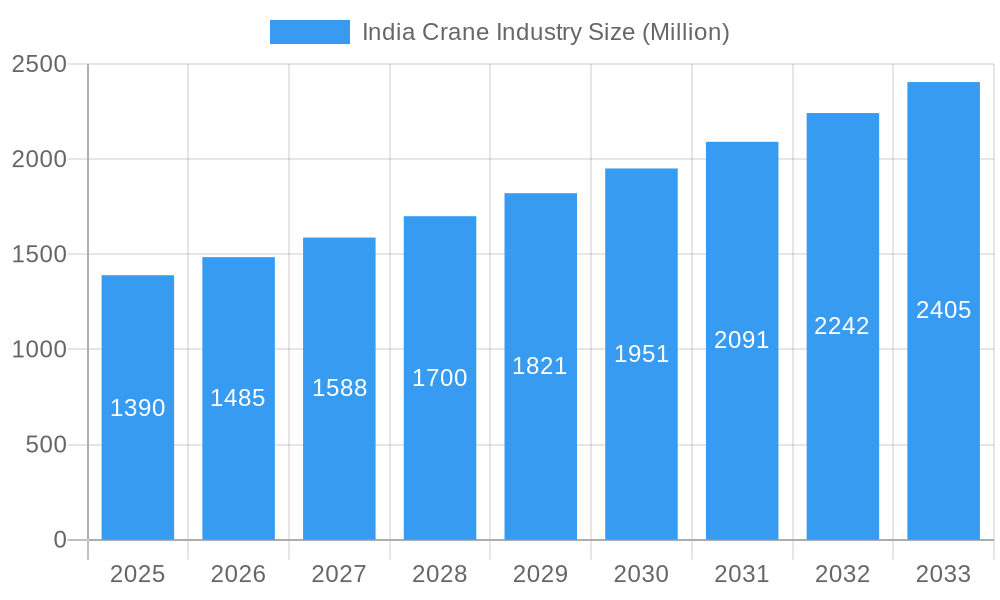

India Crane Industry Company Market Share

This comprehensive report provides an in-depth analysis of the India crane industry, covering market dynamics, key segments, leading players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. This report is essential for industry stakeholders, investors, and anyone seeking to understand the complexities and opportunities within this dynamic sector. The report unveils key insights into market size, CAGR, technological advancements, and competitive landscapes, offering actionable intelligence for informed decision-making.

India Crane Industry Market Concentration & Dynamics

The Indian crane industry exhibits a moderately concentrated market structure, with a few major players holding significant market share. However, the presence of numerous smaller players fosters competition and innovation. The market is characterized by a dynamic interplay of factors, including:

- Market Share: While precise market share figures for individual companies are unavailable, we estimate that the top 5 players account for approximately xx% of the total market value (estimated at xx Million in 2025).

- Innovation Ecosystems: The industry shows increasing adoption of advanced technologies, particularly in mobile cranes and electric solutions. Collaborative partnerships and R&D initiatives are driving innovation.

- Regulatory Frameworks: Government regulations concerning safety standards, emissions, and infrastructure development significantly influence the industry. Compliance requirements shape investment decisions and operational strategies.

- Substitute Products: Alternative lifting equipment and methods present some level of competition, although cranes maintain dominance for heavy lifting.

- End-User Trends: The construction, mining, and port sectors are the primary end users, driving demand for cranes across various applications. Growing infrastructure projects and industrial development consistently fuel growth.

- M&A Activities: The past five years have witnessed a moderate number of mergers and acquisitions (M&A) deals in the industry (estimated xx deals between 2019 and 2024). These activities are often driven by the need for expansion, technological integration, and access to new markets.

India Crane Industry Industry Insights & Trends

The Indian crane industry is experiencing robust growth, driven by a combination of factors. The market size, estimated at xx Million in 2025, is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. This growth is fueled by:

- Infrastructure Development: India’s large-scale infrastructure projects, including roads, railways, ports, and power generation, represent a significant driver of demand.

- Industrial Expansion: The ongoing industrialization and expansion of manufacturing sectors contribute to the demand for cranes across various industries.

- Technological Advancements: The introduction of electric cranes, remote-controlled systems, and advanced safety features enhances operational efficiency and productivity.

- Government Initiatives: Government support for infrastructure development and 'Make in India' initiatives have a positive impact on industry growth.

- Evolving Consumer Behaviors: Emphasis on safety, efficiency, and cost-effectiveness influences customer preferences, leading to increased adoption of advanced technologies and rental services.

Key Markets & Segments Leading India Crane Industry

The Indian crane market is segmented by machine type (mobile, fixed, marine/port) and application (construction, mining, marine/offshore, industrial, other). While precise data is unavailable for precise dominance allocation, the construction sector dominates applications.

- Construction: This segment accounts for the largest share of crane demand, driven by numerous large-scale construction projects and real estate development activities across the country. Key drivers include:

- Rapid urbanization and population growth

- Government infrastructure investments

- Increasing private sector participation in construction.

- Mobile Cranes: This machine type is widely used across all applications. The advantages of versatility and maneuverability make it the dominant machine type.

- Geographic Dominance: Major metropolitan areas and regions experiencing rapid infrastructure development (e.g., Maharashtra, Gujarat, Tamil Nadu) show high demand.

India Crane Industry Product Developments

Recent years have witnessed significant product innovations in the Indian crane industry. The launch of India’s first fully electric mobile crane by Action Construction Equipment (ACE) in February 2023 exemplifies this trend. This development, along with other introductions like self-propelled aerial work platforms, signals a clear shift towards environmentally friendly and technologically advanced solutions, offering manufacturers a competitive edge in the marketplace. Furthermore, Manitowoc's launch of the Potain MCH 175 luffing crane at CII Excon 2023 demonstrates the ongoing focus on advanced luffing crane designs, reflecting industry demands for efficient and high-performance equipment.

Challenges in the India Crane Industry Market

The Indian crane industry faces several challenges, including:

- High Import Dependency: A significant portion of high-capacity cranes are imported, increasing dependence on global supply chains.

- Regulatory Compliance: Meeting stringent safety and environmental regulations can increase operational costs and complexity.

- Competitive Pressure: Intense competition from both domestic and international players requires continuous innovation and cost management.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the timely delivery of components and equipment.

Forces Driving India Crane Industry Growth

Several factors contribute to the long-term growth of the India crane industry:

- Government Infrastructure Push: Government initiatives focusing on infrastructure development and smart city projects continue to stimulate industry growth.

- Rising Industrialization: Increasing industrial activities fuel demand for material handling solutions.

- Technological Innovation: Ongoing technological advancements in crane design, safety, and efficiency enhance market attractiveness.

Challenges in the India Crane Industry Market

Sustained growth in the Indian crane market hinges on addressing several challenges including overcoming supply chain disruptions, navigating complex regulatory landscapes, and ensuring affordable access to financing for smaller players. However, the long-term outlook remains positive given the government's continued investment in infrastructure and industrial growth.

Emerging Opportunities in India Crane Industry

Several emerging opportunities exist within the Indian crane industry. These include:

- Demand for Specialized Cranes: Growing demand for specialized cranes used in renewable energy projects and other niche applications.

- Adoption of Rental Services: The rising popularity of crane rental services offers growth potential for companies providing equipment rental and maintenance.

- Technological Integration: Integrating advanced technologies like IoT and AI can enhance operational efficiency and safety.

Leading Players in the India Crane Industry Sector

- Kobelco Construction Equipment India

- Konecranes

- Santek

- Action Construction Equipment Limited

- Anupam Industries Limited

- Liebherr Group

- Palfinger AG

- Meltech Cranes Pvt Ltd

- TIL Ltd

- SANY Group

- Escorts Ltd

- Tata Hitachi Construction Machinery

Key Milestones in India Crane Industry Industry

- December 2023: Manitowoc unveils Potain MCH 175 luffing cranes at CII Excon.

- September 2023: MyCrane initiates fully owned operations in India.

- February 2023: Action Construction Equipment (ACE) introduces India's first fully electric mobile crane at Bauma Conexpo 2023.

Strategic Outlook for India Crane Industry Market

The future of the India crane industry is bright, fueled by sustained infrastructure development, rising industrialization, and technological advancements. Strategic partnerships, investments in research and development, and a focus on sustainable solutions will be crucial for success in this growing market. Companies that can adapt to evolving regulatory landscapes and effectively address supply chain challenges will be best positioned for long-term growth.

India Crane Industry Segmentation

-

1. Machine Type

- 1.1. Mobile Cranes

- 1.2. Fixed Cranes

- 1.3. Marine and Port Cranes

-

2. Application

- 2.1. Contruction

- 2.2. Mining and Excavation

- 2.3. Marine and Offshore

- 2.4. Industrial

- 2.5. Other Applications

India Crane Industry Segmentation By Geography

- 1. India

India Crane Industry Regional Market Share

Geographic Coverage of India Crane Industry

India Crane Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Investment in Smart Cities and Housing Is Likely To Drive The Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Operators Is Anticipate To Restrict The Market Growth

- 3.4. Market Trends

- 3.4.1. Mobile Cranes to Boost the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Crane Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 5.1.1. Mobile Cranes

- 5.1.2. Fixed Cranes

- 5.1.3. Marine and Port Cranes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Contruction

- 5.2.2. Mining and Excavation

- 5.2.3. Marine and Offshore

- 5.2.4. Industrial

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kobelco Construction Euipment India

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Konecranes

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Santek

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Action Construction Euipment Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Anupam Industries Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Liebherr Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Palfinger A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Meltech Cranes Pvt Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TIL Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SANY Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Escorts Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Tata Hitachi Construciton Machinery

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Kobelco Construction Euipment India

List of Figures

- Figure 1: India Crane Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Crane Industry Share (%) by Company 2025

List of Tables

- Table 1: India Crane Industry Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 2: India Crane Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: India Crane Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Crane Industry Revenue Million Forecast, by Machine Type 2020 & 2033

- Table 5: India Crane Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: India Crane Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Crane Industry?

The projected CAGR is approximately 6.79%.

2. Which companies are prominent players in the India Crane Industry?

Key companies in the market include Kobelco Construction Euipment India, Konecranes, Santek, Action Construction Euipment Limited, Anupam Industries Limited, Liebherr Group, Palfinger A, Meltech Cranes Pvt Ltd, TIL Ltd, SANY Group, Escorts Ltd, Tata Hitachi Construciton Machinery.

3. What are the main segments of the India Crane Industry?

The market segments include Machine Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Investment in Smart Cities and Housing Is Likely To Drive The Market Growth.

6. What are the notable trends driving market growth?

Mobile Cranes to Boost the Market Growth.

7. Are there any restraints impacting market growth?

Lack of Skilled Operators Is Anticipate To Restrict The Market Growth.

8. Can you provide examples of recent developments in the market?

In December 2023 Manitowoc Company unveiled its latest Potain MCH 175 luffing cranes at the CII Excon Event one of the leading construction equipment exhibition in South Asia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Crane Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Crane Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Crane Industry?

To stay informed about further developments, trends, and reports in the India Crane Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence