Key Insights

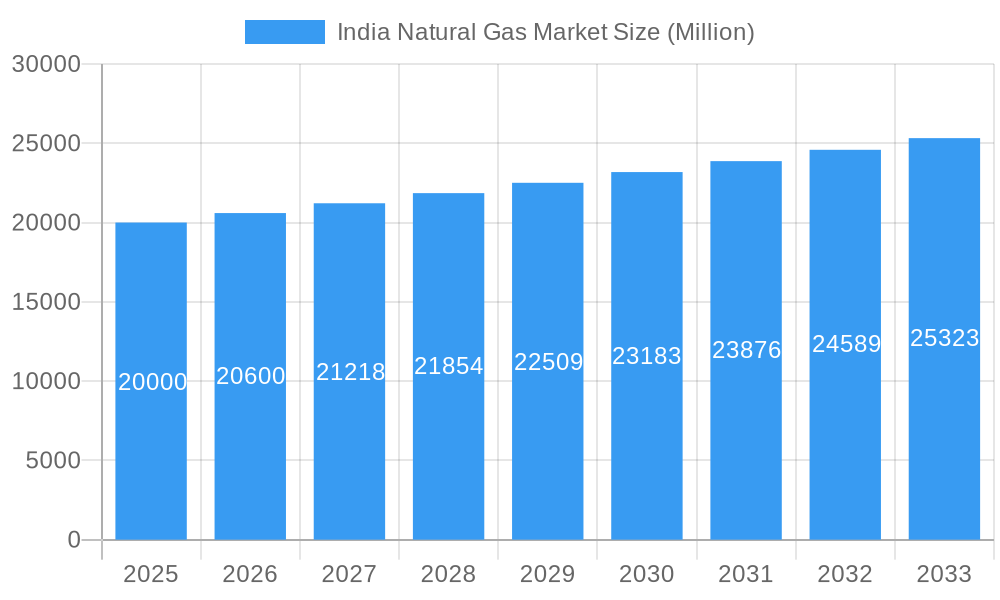

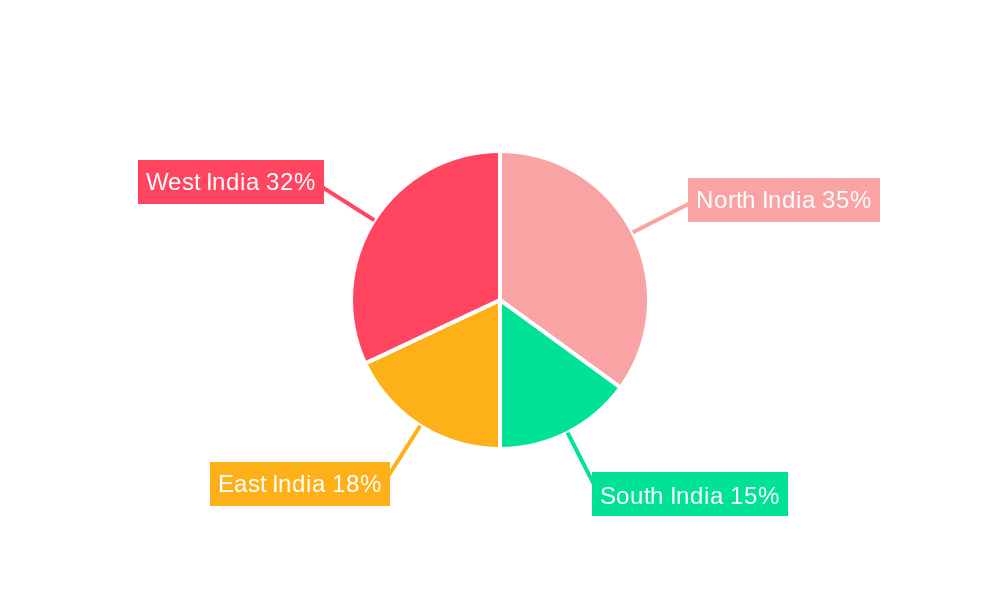

The India Natural Gas Market, valued at approximately 61.28 billion in 2024, is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of 3.62% from 2024 to 2033. This growth is driven by escalating government initiatives supporting cleaner energy alternatives, coupled with increasing industrialization and urbanization. Consequently, demand for natural gas is rising across key sectors including power generation, transportation, and industrial applications. The widespread adoption of Compressed Natural Gas (CNG) for vehicular use, particularly in urban centers, is a major growth catalyst. Furthermore, the ongoing development of extensive pipeline networks nationwide, especially in regions with established infrastructure like North and West India, is enhancing accessibility and distribution. Despite potential headwinds from volatile global pricing and regional infrastructural gaps, particularly in East and South India, the market trajectory remains robust. Substantial investments in pipeline expansion and supportive government policies are anticipated to overcome these challenges, fostering sustained market advancement. The market is segmented by product type into Compressed Natural Gas (CNG), Piped Natural Gas (PNG), and Liquified Petroleum Gas (LPG), with CNG and PNG demonstrating the highest growth potential.

India Natural Gas Market Market Size (In Billion)

Leading market participants including Oil and Natural Gas Corporation, Mahanagar Gas Limited, Reliance Industries, Indraprastha Gas Limited, Vedanta Limited, Adani Total Gas Limited, Indian Oil Corporation Limited, and Punj Lloyd Limited are actively influencing market dynamics through strategic expansions, technological innovation, and partnerships. While North and West India currently lead due to existing infrastructure, South and East India are expected to exhibit accelerated growth in the latter forecast period as infrastructure projects progress. The consistent CAGR underscores a sustained upward trend for the India Natural Gas Market throughout the forecast period (2024-2033).

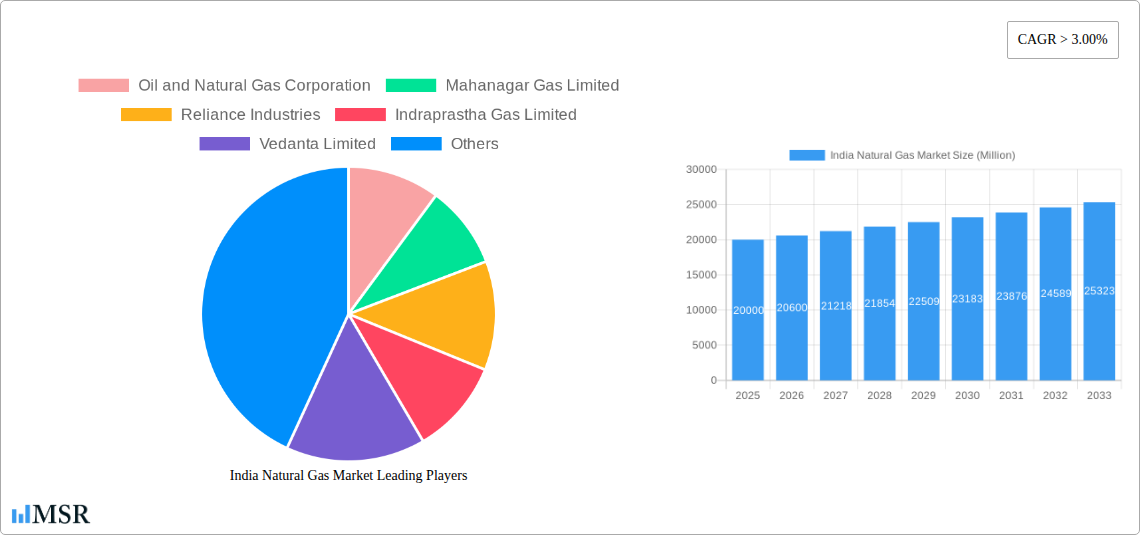

India Natural Gas Market Company Market Share

India Natural Gas Market: A Comprehensive Report (2019-2033)

This insightful report delivers a meticulous analysis of the burgeoning India Natural Gas Market, providing crucial data and forecasts from 2019 to 2033. Uncover key market trends, competitive dynamics, and growth opportunities within the Indian natural gas landscape. Ideal for investors, industry stakeholders, and strategic decision-makers, this report offers actionable insights to navigate the complexities of this rapidly evolving sector. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period extends from 2025-2033, and the historical period encompasses 2019-2024.

India Natural Gas Market Concentration & Dynamics

This section delves into the competitive landscape of the Indian natural gas market, examining market concentration, innovation, regulations, substitute products, end-user trends, and mergers & acquisitions (M&A) activity. The market is characterized by a mix of large, established players and emerging companies.

Market Share: Oil and Natural Gas Corporation (ONGC) and Reliance Industries hold a significant share, estimated at xx% and xx% respectively in 2025. Other key players include GAIL (xx%), Indraprastha Gas Limited (IGL) (xx%), and Adani Total Gas Limited (xx%). The remaining market share is distributed amongst several smaller players.

M&A Activity: The period 2019-2024 witnessed xx M&A deals in the Indian natural gas sector, primarily focused on expanding distribution networks and securing upstream resources. The forecast for 2025-2033 anticipates xx additional M&A deals, driven by consolidation and expansion strategies.

Innovation Ecosystem: The Indian natural gas sector is witnessing increasing innovation in areas such as pipeline technology, LNG import infrastructure, and the development of cleaner energy solutions. Government initiatives supporting renewable energy are driving innovation in this sector.

Regulatory Framework: The regulatory environment plays a crucial role, impacting market access, pricing, and investment decisions. Recent policy changes aimed at promoting natural gas usage are expected to further stimulate market growth.

Substitute Products: Competition from alternative fuels such as LPG and electricity needs to be considered. However, the cost-effectiveness and environmental benefits of natural gas are anticipated to maintain its market relevance.

End-User Trends: The increasing demand from the power generation, industrial, and transportation sectors is a key driver of market expansion. Growing urbanization and industrialization are significantly contributing to the rising demand for natural gas.

India Natural Gas Market Industry Insights & Trends

The India Natural Gas Market exhibits robust growth, fueled by rising energy demand, government initiatives, and infrastructure development. The market size is estimated at ₹xx Million in 2025, projected to reach ₹xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is propelled by several factors:

Increasing Energy Demand: India's rapidly expanding economy necessitates a surge in energy consumption, leading to increased reliance on natural gas as a cleaner and more efficient fuel source compared to traditional sources like coal.

Government Initiatives: Government policies aimed at promoting the use of natural gas, such as the development of city gas distribution (CGD) networks and initiatives promoting LNG imports, are strongly influencing market dynamics.

Infrastructure Development: Investments in pipeline infrastructure and LNG import terminals are enhancing the accessibility and distribution of natural gas, making it more widely available across the country.

Key Markets & Segments Leading India Natural Gas Market

The Indian Natural Gas Market is segmented by type: Compressed Natural Gas (CNG), Piped Natural Gas (PNG), and Liquified Petroleum Gas (LPG). Piped Natural Gas (PNG) currently dominates the market due to its increasing use in residential and industrial applications.

Piped Natural Gas (PNG): Drivers include:

- Rapid urbanization and expansion of city gas distribution networks.

- Increasing affordability and convenience for residential consumers.

- Growing demand from the industrial sector for cleaner fuel.

Compressed Natural Gas (CNG): This segment is witnessing significant growth, primarily driven by rising adoption in the transportation sector and its relative cost-effectiveness compared to other fuels.

Liquified Petroleum Gas (LPG): While LPG holds a substantial market share, PNG and CNG are expected to gradually capture a larger portion, driven by infrastructure development and environmental concerns.

Detailed analysis reveals that the northern and western regions of India demonstrate the strongest growth, driven by robust industrial activity and expanding city gas distribution networks.

India Natural Gas Market Product Developments

Technological advancements are transforming the natural gas sector. Innovations include improved pipeline technologies, enhanced LNG storage facilities, and the development of smart meters for efficient distribution and billing. These advancements enhance efficiency and reduce operational costs, providing a competitive edge for market players.

Challenges in the India Natural Gas Market

The Indian natural gas market faces several challenges:

- Regulatory Hurdles: Complex regulatory processes and obtaining necessary approvals can hinder project development and expansion.

- Supply Chain Issues: Ensuring a consistent supply of natural gas remains crucial, and disruptions in supply chains can impact market stability.

- Competitive Pressures: Competition from alternative fuels and the need to maintain price competitiveness are ongoing concerns.

Forces Driving India Natural Gas Market Growth

Several factors contribute to the long-term growth of the Indian natural gas market:

- Economic Growth: India's sustained economic growth fuels energy demand, creating a favorable environment for natural gas expansion.

- Environmental Concerns: The shift toward cleaner energy sources positions natural gas as an attractive alternative to fossil fuels.

- Government Support: Continued government support through policies and investments will further propel market expansion.

Long-Term Growth Catalysts in India Natural Gas Market

Long-term growth will be driven by strategic partnerships, investments in infrastructure development, and expansion into new markets. Innovations in gas exploration and production technologies will contribute significantly to sustained growth.

Emerging Opportunities in India Natural Gas Market

Emerging opportunities include the expansion of CNG use in transportation, the development of LNG bunkering infrastructure, and the exploration of natural gas in new geological areas. Technological advancements will create opportunities for increased efficiency and cost optimization.

Leading Players in the India Natural Gas Market Sector

- Oil and Natural Gas Corporation

- Mahanagar Gas Limited

- Reliance Industries

- Indraprastha Gas Limited

- Vedanta Limited

- Adani Total Gas Limited

- Indian Oil Corporation Limited

- Punj Lloyd Limited

Key Milestones in India Natural Gas Market Industry

January 2022: Indian Oil Corporation (IOC) secured nine licenses, and Bharat Petroleum Corporation Ltd (BPCL) six, in the 11th round of city gas distribution (CGD) bidding. This significantly expanded the distribution network.

May 2022: Adani Total Private Limited withdrew its Expression of Interest (EoI) for a natural gas pipeline project due to objections from other stakeholders. This highlights the competitive landscape and regulatory complexities.

Strategic Outlook for India Natural Gas Market

The Indian natural gas market exhibits tremendous growth potential, driven by strong economic growth, rising energy demand, and government support. Strategic opportunities exist for companies focusing on infrastructure development, technological advancements, and strategic partnerships to capture market share and drive future growth. The market is poised for significant expansion over the coming years.

India Natural Gas Market Segmentation

-

1. Type

- 1.1. Compressed Natural Gas

- 1.2. Piped Natural Gas

- 1.3. Liquified Petroleum Gas

India Natural Gas Market Segmentation By Geography

- 1. India

India Natural Gas Market Regional Market Share

Geographic Coverage of India Natural Gas Market

India Natural Gas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investment in the Upstream Sector4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Demand to Diversify the Power Generation Mix by Introducing Renewable Energy Sources

- 3.4. Market Trends

- 3.4.1. Piped Natural Gas (PNG) to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Natural Gas Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Compressed Natural Gas

- 5.1.2. Piped Natural Gas

- 5.1.3. Liquified Petroleum Gas

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Oil and Natural Gas Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mahanagar Gas Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Reliance Industries

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Indraprastha Gas Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vedanta Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Adani Total Gas Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indian Oil Corporation Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Punj Lloyd Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Oil and Natural Gas Corporation

List of Figures

- Figure 1: India Natural Gas Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Natural Gas Market Share (%) by Company 2025

List of Tables

- Table 1: India Natural Gas Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: India Natural Gas Market Volume Tonnes Forecast, by Type 2020 & 2033

- Table 3: India Natural Gas Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Natural Gas Market Volume Tonnes Forecast, by Region 2020 & 2033

- Table 5: India Natural Gas Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: India Natural Gas Market Volume Tonnes Forecast, by Type 2020 & 2033

- Table 7: India Natural Gas Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: India Natural Gas Market Volume Tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Natural Gas Market?

The projected CAGR is approximately 3.62%.

2. Which companies are prominent players in the India Natural Gas Market?

Key companies in the market include Oil and Natural Gas Corporation, Mahanagar Gas Limited, Reliance Industries, Indraprastha Gas Limited, Vedanta Limited, Adani Total Gas Limited, Indian Oil Corporation Limited, Punj Lloyd Limited.

3. What are the main segments of the India Natural Gas Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 61.28 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investment in the Upstream Sector4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Piped Natural Gas (PNG) to Grow Significantly.

7. Are there any restraints impacting market growth?

4.; Increasing Demand to Diversify the Power Generation Mix by Introducing Renewable Energy Sources.

8. Can you provide examples of recent developments in the market?

In January 2022, According to the results of the bid opening for the 11th round of city gas distribution (CGD) bidding, Indian Oil Corporation (IOC) stands to get nine licences and Bharat Petroleum Corporation Ltd (BPCL) 6.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Natural Gas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Natural Gas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Natural Gas Market?

To stay informed about further developments, trends, and reports in the India Natural Gas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence