Key Insights

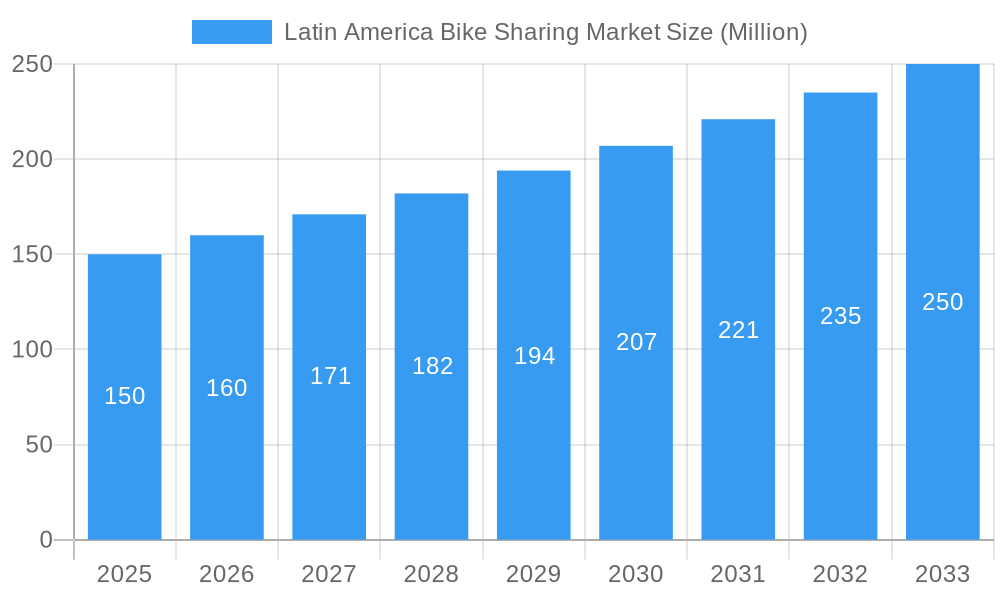

The Latin American bike-sharing market is poised for significant expansion, driven by increasing urbanization, a growing commitment to environmental sustainability, and the widespread adoption of efficient and economical mobility solutions. The market, currently valued at approximately $5.2 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 7.4% between 2025 and 2033. Key growth drivers include the burgeoning middle class in major urban centers, proactive government support for green transportation initiatives, and advancements in e-bike technology enhancing user experience. The increasing popularity of flexible, dockless systems further accelerates market growth, offering superior convenience over traditional docked models. However, challenges such as inconsistent infrastructure, safety concerns, and the need for refined regulatory frameworks persist.

Latin America Bike Sharing Market Market Size (In Billion)

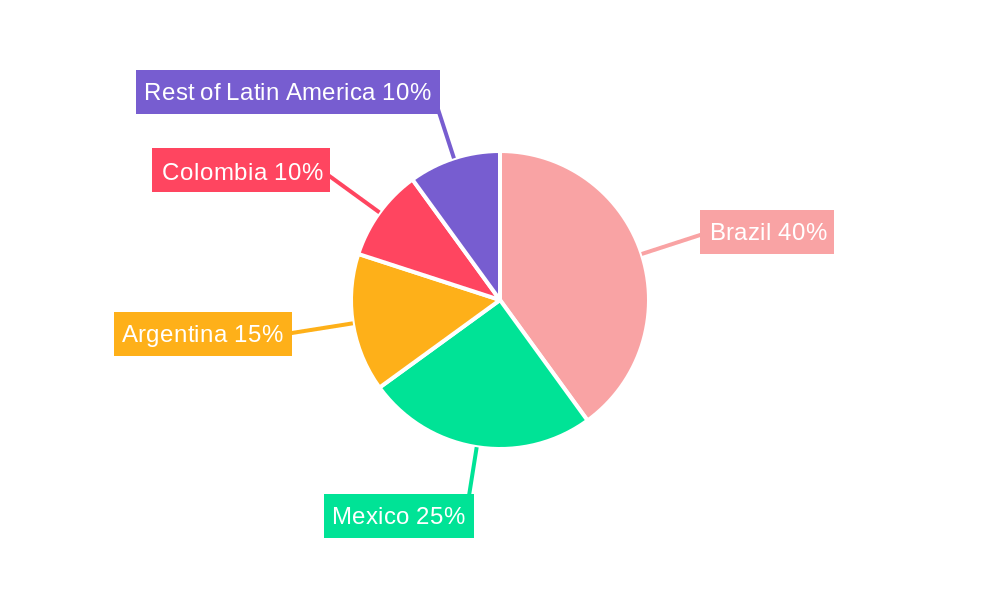

Market analysis indicates a strong consumer preference for e-bikes over traditional bicycles, underscoring the demand for advanced personal mobility. Brazil, Argentina, and Mexico are leading the market, contributing substantially to overall revenue. Emerging markets like Colombia and Peru present considerable growth potential, fueled by investments in urban infrastructure and rising bike-sharing service adoption. The competitive environment is vibrant, featuring both global leaders and agile local startups. Key players, including Mobike and Tembici, are at the forefront of innovation, adapting their services to meet evolving consumer demands. The outlook for the Latin American bike-sharing market is exceptionally positive, offering substantial investment opportunities, contingent on continued infrastructure development and regulatory advancement.

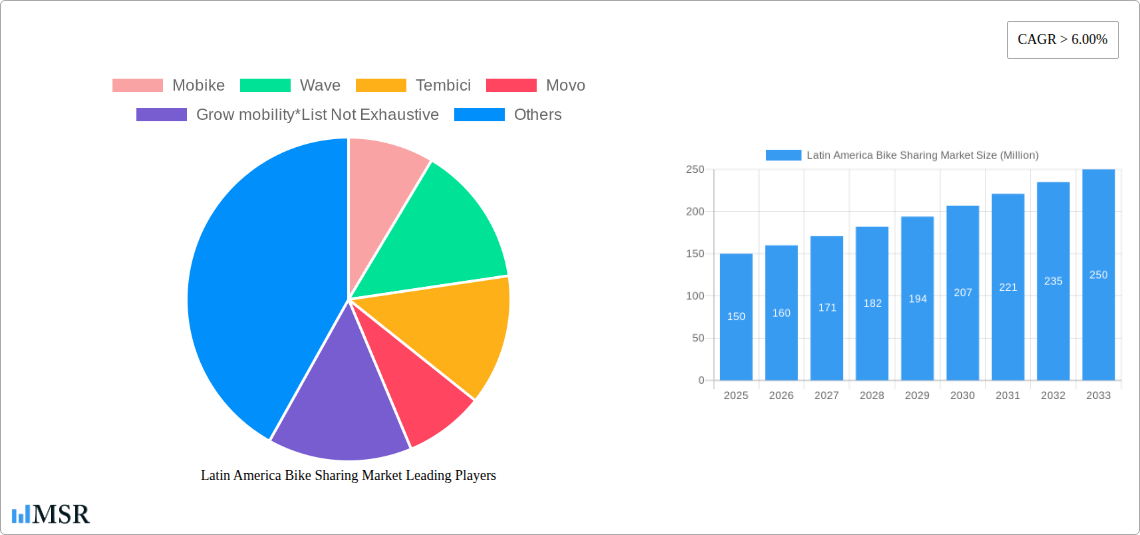

Latin America Bike Sharing Market Company Market Share

Latin America Bike Sharing Market: A Comprehensive Report 2019-2033

This in-depth report provides a comprehensive analysis of the Latin America bike-sharing market, offering invaluable insights for stakeholders across the industry. Covering the period 2019-2033, with a focus on 2025, this report delves into market dynamics, key players, emerging trends, and future growth projections, enabling informed strategic decision-making. The study examines various segments, including bike types (traditional/regular bikes and e-bikes), sharing system types (docked and dockless), and key countries (Brazil, Argentina, Mexico, Colombia, and the Rest of Latin America). The analysis incorporates data on market size, CAGR, market share, and M&A activity to provide a holistic view of this rapidly evolving sector. Key players like Mobike, Wave, Tembici, Movo, Grow mobility, Bird, Loop, and Bim Bim Bikes are profiled, among others. This report is essential for investors, entrepreneurs, and industry professionals seeking to understand and capitalize on the opportunities within the Latin American bike-sharing market.

Latin America Bike Sharing Market Concentration & Dynamics

The Latin American bike-sharing market exhibits a moderately concentrated landscape, with a few dominant players controlling a significant market share. However, the market is dynamic, with increasing competition from both established and emerging players. Innovation is driving market evolution, with technological advancements in e-bikes and smart docking systems shaping the competitive environment. Regulatory frameworks vary across countries, impacting operational costs and market entry barriers. Substitute products, such as ride-hailing services and public transportation, present ongoing competition. End-user preferences are shifting toward convenient, eco-friendly, and cost-effective transportation options, fueling market growth. M&A activities have played a role in market consolidation, with xx M&A deals recorded between 2019 and 2024. Market share data for 2025 estimates Tembici holding approximately xx%, followed by Mobike with xx%, and other players sharing the remaining xx%.

- Market Share Concentration: xx% by top 3 players in 2025

- M&A Deal Count (2019-2024): xx

- Key Regulatory Factors: Varying regulations across countries impacting operations.

- Substitute Product Competition: Strong competition from ride-hailing and public transport.

Latin America Bike Sharing Market Industry Insights & Trends

The Latin American bike-sharing market is experiencing robust growth, driven by increasing urbanization, rising environmental awareness, and the adoption of shared mobility solutions. The market size in 2025 is estimated at $xx Million, with a projected CAGR of xx% from 2025 to 2033. Technological disruptions, such as the introduction of e-bikes and improved app-based functionalities, are significantly enhancing user experience and market penetration. Evolving consumer behaviors reflect a preference for convenient, affordable, and sustainable transportation alternatives. The increasing adoption of cashless payment systems and integration with other mobility services are also fueling market expansion. Government initiatives promoting sustainable transportation are further bolstering market growth.

Key Markets & Segments Leading Latin America Bike Sharing Market

Brazil currently dominates the Latin American bike-sharing market, followed by Mexico and Argentina. This dominance is attributable to higher population density, a growing middle class with disposable income, and supportive government policies. The e-bike segment is experiencing rapid growth, driven by its convenience and increased range compared to traditional bikes. Dockless systems are gaining popularity due to their flexibility and user convenience.

Dominant Region/Country: Brazil

Dominant Segment:

- By Bike Type: E-bikes are experiencing the fastest growth.

- By Sharing System Type: Dockless systems are becoming increasingly popular.

Growth Drivers:

- Brazil: High population density, growing middle class, supportive government initiatives.

- Mexico: Increasing urbanization, rising environmental consciousness.

- Argentina: Growing adoption of shared mobility services.

- E-bikes: Convenience, increased range, and enhanced user experience.

- Dockless systems: Flexibility and ease of use.

Latin America Bike Sharing Market Product Developments

The Latin American bike-sharing market is witnessing continuous product innovations, focusing on enhancing user experience, safety, and operational efficiency. Technological advancements like improved battery technology for e-bikes, GPS tracking, and smart locking mechanisms are enhancing the reliability and security of these services. Companies are investing in durable and user-friendly bike designs optimized for diverse terrains. These innovations are not only boosting market penetration but also attracting new users, creating a competitive edge.

Challenges in the Latin America Bike Sharing Market Market

The Latin American bike-sharing market faces several challenges, including inconsistent regulatory frameworks across countries, leading to operational complexities and varying levels of market access. Supply chain disruptions can affect bike availability and maintenance. Intense competition among various players and the threat of substitute modes of transportation create additional market pressures. These factors can affect profitability and market growth if not effectively addressed. Estimates suggest that regulatory hurdles have impacted market expansion by xx% in certain regions.

Forces Driving Latin America Bike Sharing Market Growth

The Latin American bike-sharing market's growth is propelled by several factors. Technological advancements, such as the development of more efficient and reliable e-bikes and improved app functionalities, are enhancing user experience and expanding market reach. Favorable economic conditions in certain regions are increasing disposable income, making bike-sharing services more accessible. Government initiatives promoting sustainable transportation options further encourage market expansion.

Long-Term Growth Catalysts in Latin America Bike Sharing Market

Long-term growth in the Latin American bike-sharing market hinges on continuous innovation, strategic partnerships, and market expansion into underserved areas. Investing in advanced technologies, such as smart bike infrastructure and improved data analytics, will enhance operational efficiency and customer satisfaction. Collaborations with local governments and businesses can facilitate infrastructure development and expand service reach. Expanding into smaller cities and towns with growing populations will unlock significant market potential.

Emerging Opportunities in Latin America Bike Sharing Market

Emerging opportunities exist in integrating bike-sharing services with other forms of public transportation, creating seamless multi-modal travel options. Expansion into specialized bike-sharing programs, such as cargo bikes for deliveries or e-bikes tailored for tourism, will cater to specific market needs. Leveraging data analytics to personalize user experiences and optimize operational efficiency will be key for success.

Leading Players in the Latin America Bike Sharing Market Sector

- Mobike

- Wave

- Tembici

- Movo

- Grow mobility

- Bird

- Loop

- Bim Bim Bikes

Key Milestones in Latin America Bike Sharing Market Industry

- 2020: Launch of a government-sponsored bike-sharing program in Mexico City.

- 2021: Tembici expands operations into several new cities in Brazil.

- 2022: Major investment round for a leading Latin American bike-sharing company.

- 2023: Introduction of a new e-bike model with enhanced battery technology by Mobike.

Strategic Outlook for Latin America Bike Sharing Market Market

The Latin American bike-sharing market holds substantial growth potential, driven by continuous technological advancements, expanding urban populations, and growing environmental awareness. Strategic partnerships with governments and private entities, coupled with aggressive expansion into new markets, will be crucial for achieving long-term success. Companies that effectively address regulatory challenges and provide innovative solutions tailored to specific market needs will be well-positioned to capture significant market share.

Latin America Bike Sharing Market Segmentation

-

1. Bike Type

- 1.1. Traditional/Regular Bike

- 1.2. E-bike

-

2. Sharing System Type

- 2.1. Docked

- 2.2. Dockless

Latin America Bike Sharing Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Bike Sharing Market Regional Market Share

Geographic Coverage of Latin America Bike Sharing Market

Latin America Bike Sharing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing disposable income and Low-interest rates from lenders increase the market demand

- 3.3. Market Restrains

- 3.3.1. High initial costs may obstruct the growth

- 3.4. Market Trends

- 3.4.1. E-Bike Rental is providing the growth in Bike Sharing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Bike Sharing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Bike Type

- 5.1.1. Traditional/Regular Bike

- 5.1.2. E-bike

- 5.2. Market Analysis, Insights and Forecast - by Sharing System Type

- 5.2.1. Docked

- 5.2.2. Dockless

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Bike Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mobike

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wave

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tembici

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Movo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Grow mobility*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bird

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Loop

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bim Bim Bikes

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Mobike

List of Figures

- Figure 1: Latin America Bike Sharing Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Bike Sharing Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Bike Sharing Market Revenue billion Forecast, by Bike Type 2020 & 2033

- Table 2: Latin America Bike Sharing Market Revenue billion Forecast, by Sharing System Type 2020 & 2033

- Table 3: Latin America Bike Sharing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Latin America Bike Sharing Market Revenue billion Forecast, by Bike Type 2020 & 2033

- Table 5: Latin America Bike Sharing Market Revenue billion Forecast, by Sharing System Type 2020 & 2033

- Table 6: Latin America Bike Sharing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Bike Sharing Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Bike Sharing Market?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Latin America Bike Sharing Market?

Key companies in the market include Mobike, Wave, Tembici, Movo, Grow mobility*List Not Exhaustive, Bird, Loop, Bim Bim Bikes.

3. What are the main segments of the Latin America Bike Sharing Market?

The market segments include Bike Type, Sharing System Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing disposable income and Low-interest rates from lenders increase the market demand.

6. What are the notable trends driving market growth?

E-Bike Rental is providing the growth in Bike Sharing Market.

7. Are there any restraints impacting market growth?

High initial costs may obstruct the growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Bike Sharing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Bike Sharing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Bike Sharing Market?

To stay informed about further developments, trends, and reports in the Latin America Bike Sharing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence