Key Insights

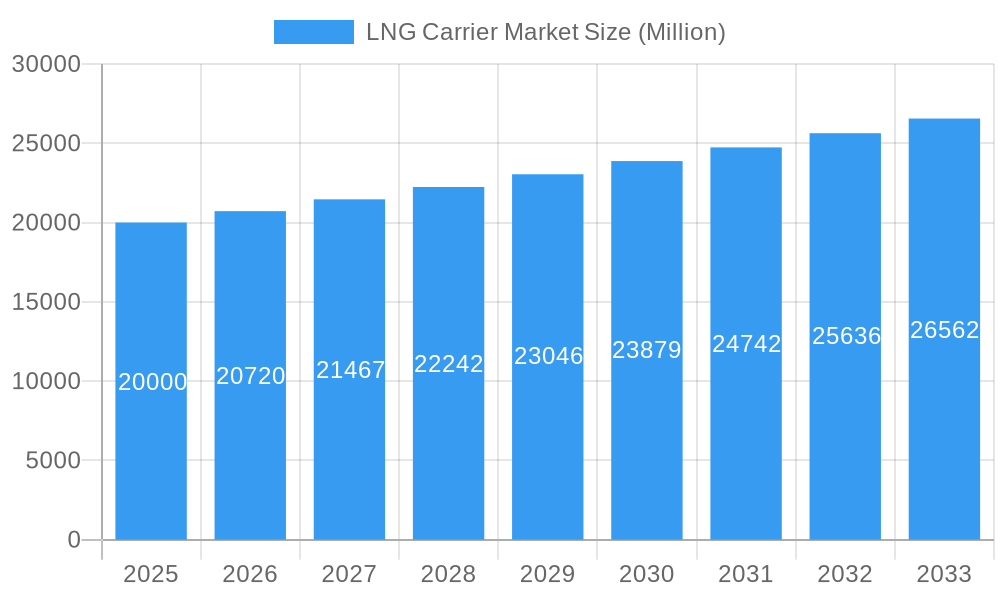

The LNG carrier market, valued at approximately $XX million in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) exceeding 3.60% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing global demand for liquefied natural gas (LNG) as a cleaner-burning alternative to traditional fossil fuels is a primary catalyst. Governments worldwide are implementing stricter emission regulations, incentivizing the shift towards LNG as a marine fuel and for power generation, fueling demand for LNG carriers. Secondly, the growth of LNG import terminals and infrastructure in various regions, particularly in Asia and Europe, facilitates efficient transportation and distribution, further stimulating market growth. Technological advancements in vessel design, such as the adoption of ME-GI engines for enhanced efficiency and reduced emissions, also contribute to the market's positive outlook. While potential restraints like fluctuating LNG prices and geopolitical uncertainties exist, the long-term prospects remain strong, particularly given the ongoing investments in LNG infrastructure and the commitment to decarbonizing the energy sector.

LNG Carrier Market Market Size (In Billion)

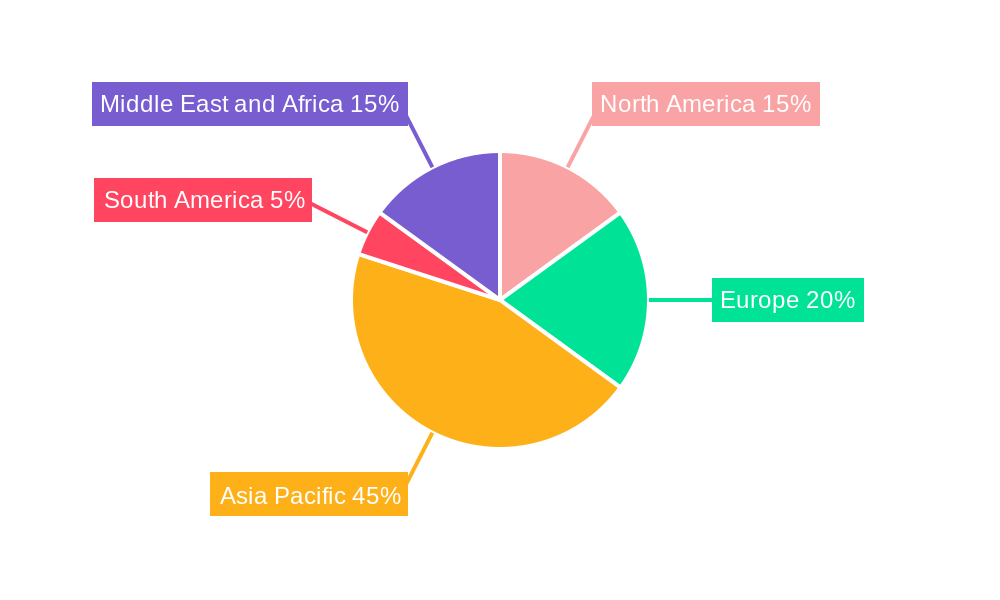

The market segmentation reveals diverse propulsion and containment technologies influencing the market dynamics. Steam turbines, while established, are gradually being replaced by more efficient and environmentally friendly options like ME-GI engines and Dual Fuel/Tri-Fuel Diesel engines. Similarly, Moss and Membrane containment systems dominate, but innovations in containment technology will likely shape the market landscape in the coming years. The competitive landscape is characterized by major players including shipbuilders like Samsung Heavy Industries, Daewoo Shipbuilding, and Kawasaki Heavy Industries, as well as prominent ship operators and energy companies. Regional growth will be significantly influenced by the expansion of LNG import terminals and infrastructure development in different parts of the world. Asia-Pacific, particularly China and India, are expected to be key contributors to market expansion due to increasing energy demand and supportive government policies. North America and Europe will also witness substantial growth, driven by rising LNG imports and an emphasis on environmental sustainability.

LNG Carrier Market Company Market Share

LNG Carrier Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the LNG Carrier market, encompassing market dynamics, industry trends, key segments, leading players, and future growth prospects. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is crucial for industry stakeholders, investors, and businesses seeking to navigate the complexities and capitalize on opportunities within this dynamic market.

LNG Carrier Market Market Concentration & Dynamics

The LNG carrier market exhibits a moderately concentrated structure, with a handful of major players dominating shipbuilding and operation. Market share is influenced by factors such as vessel capacity, technological advancements, and strategic partnerships. The landscape is characterized by ongoing mergers and acquisitions (M&A) activity, reflecting the consolidation trend within the industry. Over the historical period (2019-2024), approximately xx M&A deals were recorded, primarily focused on expanding fleet size and geographical reach.

Key Dynamics:

- Innovation Ecosystem: Significant R&D investment drives innovation in propulsion systems (ME-GI, DFDE/TFDE, SSD) and containment technologies (Moss, Membrane), enhancing efficiency and reducing emissions.

- Regulatory Frameworks: International Maritime Organization (IMO) regulations on emissions and safety standards significantly impact vessel design and operations, driving adoption of cleaner technologies.

- Substitute Products: While LNG remains the dominant fuel for long-haul transportation, the emergence of alternative fuels presents a long-term competitive threat.

- End-User Trends: Increasing demand for natural gas, particularly in Asia, fuels market growth. The expansion of LNG import terminals further stimulates demand for LNG carriers.

- M&A Activities: Strategic acquisitions and mergers are expected to continue, facilitating market consolidation and expansion of market share among major players. The total value of these deals is estimated at xx Million during the historical period, and xx Million is expected in the forecast period.

LNG Carrier Market Industry Insights & Trends

The global LNG carrier market witnessed robust growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033, driven by several factors. The increasing demand for natural gas as a cleaner-burning fossil fuel is a primary growth driver. Furthermore, investments in LNG infrastructure, including new import terminals and pipelines, are fueling demand for LNG carrier services. Technological advancements, including the development of more efficient and environmentally friendly vessel designs, are also contributing to market expansion. Shifting global energy demands and geopolitical factors influence trade routes and vessel deployment patterns.

Key Markets & Segments Leading LNG Carrier Market

The Asia-Pacific region dominates the LNG carrier market, driven by the rapid growth in LNG demand from countries like China, Japan, South Korea, and India. Europe and North America also represent significant markets.

Dominant Segments:

- Propulsion Type: Slow-Speed Diesel (SSD) and M-type Electronically Controlled Gas Injection (ME-GI) engines hold significant market share due to their efficiency and environmental benefits.

- Containment Type: Moss-type containment systems maintain a substantial market share owing to their established reliability and widespread adoption.

Drivers for Market Dominance:

- Economic Growth: Strong economic growth in Asia-Pacific fuels LNG demand, directly impacting carrier utilization.

- Infrastructure Development: Expansion of LNG import terminals and pipeline networks in key regions creates a substantial need for LNG carrier services.

- Government Policies: Supportive government policies promoting the use of natural gas as a transition fuel are driving market growth.

LNG Carrier Market Product Developments

Recent advancements in LNG carrier technology are revolutionizing the industry, focusing on enhanced fuel efficiency, reduced emissions, and improved safety features. New vessel designs incorporate innovative propulsion systems, such as ME-GI engines and dual-fuel engines, utilizing LNG itself as fuel, to significantly optimize fuel consumption and minimize the environmental impact. The development of advanced containment systems, including membrane and prismatic designs, improves cargo handling, reduces boil-off gas (BOG) losses, and enhances overall operational efficiency. Furthermore, the integration of smart technologies, such as predictive maintenance systems and digital twin models, is optimizing vessel operations, reducing downtime, and improving decision-making. These innovations provide significant competitive advantages by lowering operational costs, enhancing environmental performance, and improving overall vessel reliability.

Challenges in the LNG Carrier Market Market

The LNG carrier market faces challenges including volatile freight rates, fluctuations in LNG demand, and the high capital expenditure associated with vessel construction. Stringent environmental regulations and the need for continuous technological upgrades also present hurdles. Supply chain disruptions, particularly during periods of high vessel demand, can further impact market dynamics. These factors can affect profitability and hinder market growth. Approximately xx Million of losses are estimated due to supply chain issues in the last year.

Forces Driving LNG Carrier Market Growth

Several factors drive the growth of the LNG carrier market. Rising global demand for natural gas, spurred by energy security concerns and a shift toward cleaner fuels, is a key driver. Government incentives and policies supporting LNG infrastructure development further stimulate market expansion. Technological advancements in vessel design and operational efficiency also play a crucial role. The expansion of LNG trading routes and the development of new LNG import and export terminals worldwide contribute to market growth.

Long-Term Growth Catalysts in the LNG Carrier Market

Long-term growth is fueled by ongoing investments in new LNG production facilities and infrastructure, coupled with the increasing adoption of LNG as a marine fuel. Strategic partnerships between shipbuilders, operators, and energy companies drive innovation and expansion. The exploration of new LNG trade routes and the development of innovative technologies such as LNG bunkering infrastructure will continue to shape the market landscape and provide growth opportunities in the coming decade.

Emerging Opportunities in LNG Carrier Market

Emerging opportunities include the growth of small-scale LNG carriers serving niche markets and the increasing adoption of LNG as a marine fuel. Technological advancements in automation and digitalization offer potential for enhanced operational efficiency and cost reduction. Furthermore, the development of innovative financing models and insurance solutions can unlock further market growth. The exploration of alternative fuels, while presenting a long-term competitive challenge, also creates opportunities for LNG carrier operators to diversify their offerings and adapt to evolving market dynamics.

Leading Players in the LNG Carrier Market Sector

- MISC Berhad

- Japan Marine United Corporation

- GasLog Ltd

- Mitsui OSK Lines Ltd

- BW LPG

- STX Offshore and Shipbuilding CO LTD

- Daewoo Shipbuilding and Marine Engineering Co Ltd

- Kawasaki Heavy Industries Ltd

- Royal Dutch Shell PLC

- Nippon Yusen Kabushiki Kaisha

- Maran Gas Maritime Inc

- Seapeak

- Samsung Heavy Industries Co Ltd

- China Shipbuilding Trading Co Ltd

- Mitsubishi Heavy Industries Ltd

- Golar LNG

- Kawasaki Kisen Kaisha Ltd

- Hyundai Samho Heavy Industries Co Ltd

- HJ Shipbuilding & Construction Company Ltd

Key Milestones in LNG Carrier Market Industry

- December 2022: GAIL (India) Ltd chartered a new LNG carrier from Mitsui O.S.K. Lines Ltd (MOL), built by Daewoo Shipbuilding & Marine Engineering Co Ltd. This significant event underscores the burgeoning LNG demand in India and strengthens MOL's prominent position within the expanding market.

- October 2022: GTT's innovative three-tank LNG carrier design received Approval in Principle (AiPs), a crucial step signifying its viability. This achievement has the potential to substantially reduce construction costs and drive further innovation in the industry, potentially leading to wider adoption of this design and increased efficiency gains.

- [Add more recent milestones here with dates and brief descriptions. Include details on new vessel orders, technological breakthroughs, or significant market transactions.]

Strategic Outlook for LNG Carrier Market Market

The LNG carrier market presents significant growth potential driven by increasing global LNG demand and the ongoing expansion of LNG infrastructure. Strategic partnerships, technological advancements, and a focus on sustainability will be crucial for success. Companies that proactively adapt to evolving regulations, invest in efficient technologies, and diversify their operations are poised to capture substantial market share and thrive in this dynamic sector.

LNG Carrier Market Segmentation

-

1. Containment Type

- 1.1. Moss

- 1.2. Membrane

-

2. Propulsion Type

- 2.1. Steam Turbines

- 2.2. Dual Fue

- 2.3. Slow-Speed Diesel (SSD)

- 2.4. M-type E

- 2.5. XDF Two-stroke Engine

- 2.6. Steam Re-heat and Stage

LNG Carrier Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of the North America

-

2. Asia Pacific

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Rest of the Asia Pacific

-

3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. Spain

- 3.4. United Kingdom

- 3.5. Rest of the Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of the South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Nigeria

- 5.3. Saudi Arabia

- 5.4. Rest of the Middle East and Africa

LNG Carrier Market Regional Market Share

Geographic Coverage of LNG Carrier Market

LNG Carrier Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Shift toward Renewable Energy

- 3.4. Market Trends

- 3.4.1. Membrane-Type Containment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LNG Carrier Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Containment Type

- 5.1.1. Moss

- 5.1.2. Membrane

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. Steam Turbines

- 5.2.2. Dual Fue

- 5.2.3. Slow-Speed Diesel (SSD)

- 5.2.4. M-type E

- 5.2.5. XDF Two-stroke Engine

- 5.2.6. Steam Re-heat and Stage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Asia Pacific

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Containment Type

- 6. North America LNG Carrier Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Containment Type

- 6.1.1. Moss

- 6.1.2. Membrane

- 6.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.2.1. Steam Turbines

- 6.2.2. Dual Fue

- 6.2.3. Slow-Speed Diesel (SSD)

- 6.2.4. M-type E

- 6.2.5. XDF Two-stroke Engine

- 6.2.6. Steam Re-heat and Stage

- 6.1. Market Analysis, Insights and Forecast - by Containment Type

- 7. Asia Pacific LNG Carrier Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Containment Type

- 7.1.1. Moss

- 7.1.2. Membrane

- 7.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.2.1. Steam Turbines

- 7.2.2. Dual Fue

- 7.2.3. Slow-Speed Diesel (SSD)

- 7.2.4. M-type E

- 7.2.5. XDF Two-stroke Engine

- 7.2.6. Steam Re-heat and Stage

- 7.1. Market Analysis, Insights and Forecast - by Containment Type

- 8. Europe LNG Carrier Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Containment Type

- 8.1.1. Moss

- 8.1.2. Membrane

- 8.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.2.1. Steam Turbines

- 8.2.2. Dual Fue

- 8.2.3. Slow-Speed Diesel (SSD)

- 8.2.4. M-type E

- 8.2.5. XDF Two-stroke Engine

- 8.2.6. Steam Re-heat and Stage

- 8.1. Market Analysis, Insights and Forecast - by Containment Type

- 9. South America LNG Carrier Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Containment Type

- 9.1.1. Moss

- 9.1.2. Membrane

- 9.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.2.1. Steam Turbines

- 9.2.2. Dual Fue

- 9.2.3. Slow-Speed Diesel (SSD)

- 9.2.4. M-type E

- 9.2.5. XDF Two-stroke Engine

- 9.2.6. Steam Re-heat and Stage

- 9.1. Market Analysis, Insights and Forecast - by Containment Type

- 10. Middle East and Africa LNG Carrier Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Containment Type

- 10.1.1. Moss

- 10.1.2. Membrane

- 10.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 10.2.1. Steam Turbines

- 10.2.2. Dual Fue

- 10.2.3. Slow-Speed Diesel (SSD)

- 10.2.4. M-type E

- 10.2.5. XDF Two-stroke Engine

- 10.2.6. Steam Re-heat and Stage

- 10.1. Market Analysis, Insights and Forecast - by Containment Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ship Builders

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 4 MISC Berhad

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 8 Japan Marine United Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 9 GasLog Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3 Mitsui OSK Lines Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 8 BW LPG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ship Operators

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 4 STX Offshore and Shipbuilding CO LTD

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 3 Daewoo Shipbuilding and Marine Engineering Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 6 Kawasaki Heavy Industries Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 1 Royal Dutch Shell PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 2 Nippon Yusen Kabushiki Kaisha

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 6 Maran Gas Maritime Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 5 Seapeak

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 1 Samsung Heavy Industries Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 7 China Shipbuilding Trading Co Ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 5 Mitsubishi Heavy Industries Ltd

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 7 Golar LNG

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 10 Kawasaki Kisen Kaisha Ltd *List Not Exhaustive

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 2 Hyundai Samho Heavy Industries Co Ltd

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 9 HJ Shipbuilding & Construction Company Ltd

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.1 Ship Builders

List of Figures

- Figure 1: Global LNG Carrier Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America LNG Carrier Market Revenue (undefined), by Containment Type 2025 & 2033

- Figure 3: North America LNG Carrier Market Revenue Share (%), by Containment Type 2025 & 2033

- Figure 4: North America LNG Carrier Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 5: North America LNG Carrier Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 6: North America LNG Carrier Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America LNG Carrier Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Asia Pacific LNG Carrier Market Revenue (undefined), by Containment Type 2025 & 2033

- Figure 9: Asia Pacific LNG Carrier Market Revenue Share (%), by Containment Type 2025 & 2033

- Figure 10: Asia Pacific LNG Carrier Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 11: Asia Pacific LNG Carrier Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 12: Asia Pacific LNG Carrier Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific LNG Carrier Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe LNG Carrier Market Revenue (undefined), by Containment Type 2025 & 2033

- Figure 15: Europe LNG Carrier Market Revenue Share (%), by Containment Type 2025 & 2033

- Figure 16: Europe LNG Carrier Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 17: Europe LNG Carrier Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 18: Europe LNG Carrier Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe LNG Carrier Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America LNG Carrier Market Revenue (undefined), by Containment Type 2025 & 2033

- Figure 21: South America LNG Carrier Market Revenue Share (%), by Containment Type 2025 & 2033

- Figure 22: South America LNG Carrier Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 23: South America LNG Carrier Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 24: South America LNG Carrier Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America LNG Carrier Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa LNG Carrier Market Revenue (undefined), by Containment Type 2025 & 2033

- Figure 27: Middle East and Africa LNG Carrier Market Revenue Share (%), by Containment Type 2025 & 2033

- Figure 28: Middle East and Africa LNG Carrier Market Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 29: Middle East and Africa LNG Carrier Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 30: Middle East and Africa LNG Carrier Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa LNG Carrier Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global LNG Carrier Market Revenue undefined Forecast, by Containment Type 2020 & 2033

- Table 2: Global LNG Carrier Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 3: Global LNG Carrier Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global LNG Carrier Market Revenue undefined Forecast, by Containment Type 2020 & 2033

- Table 5: Global LNG Carrier Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 6: Global LNG Carrier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of the North America LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global LNG Carrier Market Revenue undefined Forecast, by Containment Type 2020 & 2033

- Table 11: Global LNG Carrier Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 12: Global LNG Carrier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: China LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: India LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Japan LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: South Korea LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Rest of the Asia Pacific LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global LNG Carrier Market Revenue undefined Forecast, by Containment Type 2020 & 2033

- Table 19: Global LNG Carrier Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 20: Global LNG Carrier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: France LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: United Kingdom LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of the Europe LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global LNG Carrier Market Revenue undefined Forecast, by Containment Type 2020 & 2033

- Table 27: Global LNG Carrier Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 28: Global LNG Carrier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of the South America LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global LNG Carrier Market Revenue undefined Forecast, by Containment Type 2020 & 2033

- Table 33: Global LNG Carrier Market Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 34: Global LNG Carrier Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: United Arab Emirates LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Nigeria LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Saudi Arabia LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of the Middle East and Africa LNG Carrier Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LNG Carrier Market?

The projected CAGR is approximately 6.56%.

2. Which companies are prominent players in the LNG Carrier Market?

Key companies in the market include Ship Builders, 4 MISC Berhad, 8 Japan Marine United Corporation, 9 GasLog Ltd, 3 Mitsui OSK Lines Ltd, 8 BW LPG, Ship Operators, 4 STX Offshore and Shipbuilding CO LTD, 3 Daewoo Shipbuilding and Marine Engineering Co Ltd, 6 Kawasaki Heavy Industries Ltd, 1 Royal Dutch Shell PLC, 2 Nippon Yusen Kabushiki Kaisha, 6 Maran Gas Maritime Inc, 5 Seapeak, 1 Samsung Heavy Industries Co Ltd, 7 China Shipbuilding Trading Co Ltd, 5 Mitsubishi Heavy Industries Ltd, 7 Golar LNG, 10 Kawasaki Kisen Kaisha Ltd *List Not Exhaustive, 2 Hyundai Samho Heavy Industries Co Ltd, 9 HJ Shipbuilding & Construction Company Ltd.

3. What are the main segments of the LNG Carrier Market?

The market segments include Containment Type, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development.

6. What are the notable trends driving market growth?

Membrane-Type Containment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Shift toward Renewable Energy.

8. Can you provide examples of recent developments in the market?

December 2022: GAIL (India) Ltd agreed to time charter a new liquefied natural gas (LNG) carrier with Japan's Mitsui O. S. K. Lines Ltd (MOL) and acquired a stake in an existing LNG carrier. The new LNG carrier, built by South Korea's Daewoo Shipbuilding & Marine Engineering Co Ltd, will be the second MOL Group LNG ship to serve GAIL and will commence time chartering in 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LNG Carrier Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LNG Carrier Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LNG Carrier Market?

To stay informed about further developments, trends, and reports in the LNG Carrier Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence