Key Insights

The Middle East and Africa (MEA) Advanced Driver-Assistance Systems (ADAS) market is experiencing robust growth, driven by rising vehicle sales, increasing government investments in infrastructure development, and a growing focus on road safety. The region's burgeoning automotive industry, coupled with a rising middle class possessing greater disposable income, fuels demand for vehicles equipped with advanced safety features. Technological advancements in ADAS, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) for improved accuracy and functionality, further propel market expansion. Key segments driving growth include passenger cars, which account for a significant portion of the market, and systems like parking assist, adaptive front-lighting, and lane departure warnings, reflecting a prioritization of convenience and safety features among consumers. While the market faces challenges like high initial investment costs for ADAS technology and varying levels of technological infrastructure across the region, the long-term growth prospects remain exceptionally promising. Government regulations aimed at improving road safety and mandating ADAS features in new vehicles also contribute positively to market expansion. Countries like the UAE and Saudi Arabia, with their advanced infrastructure and commitment to technological innovation, lead the regional market, followed by other countries steadily adopting ADAS technology.

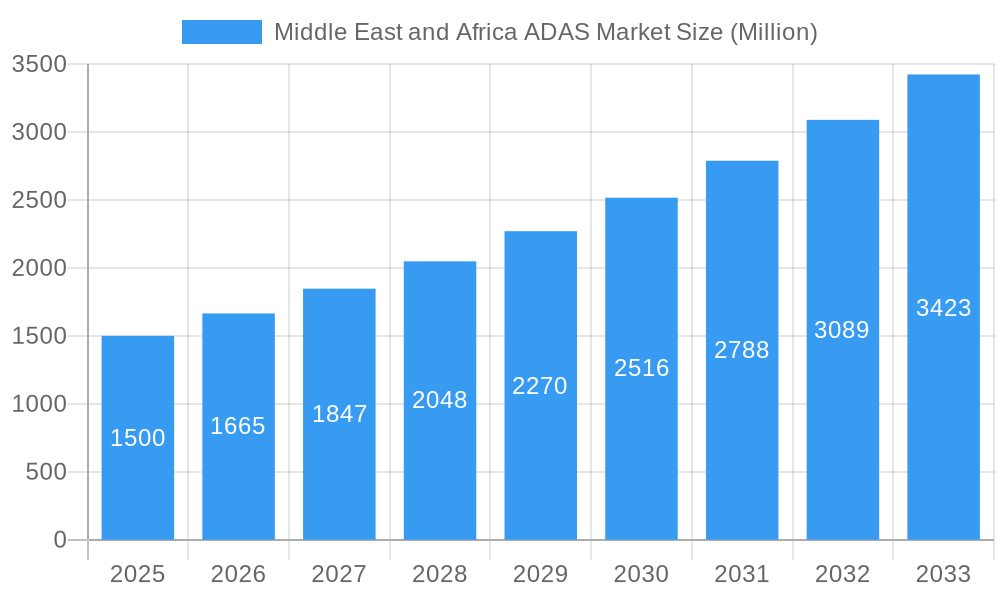

Middle East and Africa ADAS Market Market Size (In Billion)

The MEA ADAS market's segmentation by technology (radar, LiDAR, camera) reveals a strong preference for camera-based systems due to their cost-effectiveness and widespread availability. However, LiDAR technology is gaining traction, particularly in higher-end vehicles, driven by its superior precision in various weather and lighting conditions. The commercial vehicle segment is expected to witness significant growth, fuelled by increasing adoption of ADAS for fleet management and enhanced safety in transportation logistics. Significant opportunities exist in expanding ADAS penetration across various vehicle types and developing cost-effective solutions to cater to different price segments. The focus on regional customization and addressing specific challenges related to infrastructure and climatic conditions are key to unlocking the market's full potential in the coming years. The forecast period of 2025-2033 projects substantial growth, driven by the factors mentioned above and the increasing awareness of road safety among consumers and governments.

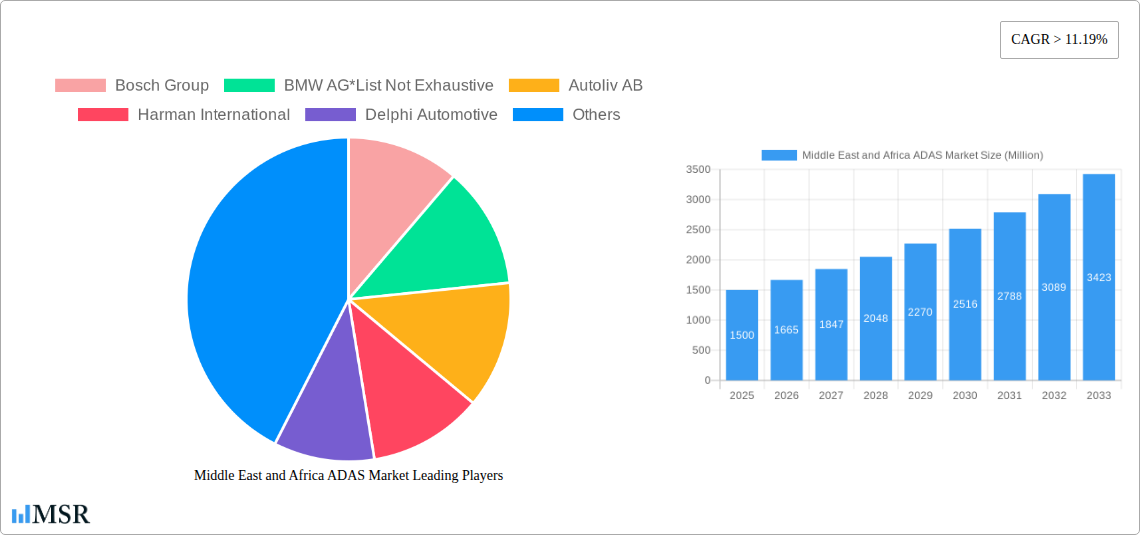

Middle East and Africa ADAS Market Company Market Share

Middle East & Africa ADAS Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the burgeoning Middle East and Africa Advanced Driver-Assistance Systems (ADAS) market, offering invaluable insights for stakeholders across the automotive and technology sectors. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, key trends, leading players, and future growth prospects. The study meticulously examines market segmentation by technology (Radar, LiDAR, Camera), vehicle type (Passenger Cars, Commercial Vehicles), country (Qatar, United Arab Emirates, Saudi Arabia, Egypt, South Africa, Rest of Middle East & Africa), and ADAS type (Parking Assist System, Adaptive Front-lighting, Night Vision System, Blind Spot Detection, Lane Departure Warning, Others).

Middle East and Africa ADAS Market Market Concentration & Dynamics

This section analyzes the competitive landscape, innovation, regulatory aspects, and market activity within the Middle East and Africa ADAS market. The market exhibits a moderately concentrated structure, with key players like Bosch Group, Bosch Group, BMW AG, Autoliv AB, Harman International, Delphi Automotive, Continental AG, Hyundai Mobi, and Hella KGaA Hueck & Co holding significant market share. However, the presence of several regional players and emerging startups indicates a dynamic competitive environment.

- Market Share: Bosch Group and Continental AG are estimated to hold a combined xx% market share in 2025, while other players such as Autoliv AB and Harman International individually hold xx% and xx% respectively.

- M&A Activity: The number of M&A deals in the region has shown a steady increase from xx in 2019 to an estimated xx in 2024, driven by the need for technological integration and expansion into new markets. These deals largely involved collaborations between established ADAS providers and local automotive manufacturers.

- Innovation Ecosystem: While the region is witnessing a rise in automotive technology startups, established players continue to drive innovation through R&D investment and strategic partnerships with universities and research institutions.

- Regulatory Framework: Government initiatives promoting road safety and autonomous driving are creating a favorable regulatory environment, although standardization across different countries remains a challenge.

- Substitute Products: While no direct substitutes exist for core ADAS functionalities, advancements in alternative safety technologies could influence market growth.

- End-User Trends: Growing consumer awareness of safety features and rising disposable incomes are key drivers of ADAS adoption in the region.

Middle East and Africa ADAS Market Industry Insights & Trends

The Middle East and Africa ADAS market is experiencing robust growth, driven by increasing vehicle production, rising demand for enhanced safety features, and supportive government regulations. The market size was valued at approximately $xx Million in 2024 and is projected to reach $xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological advancements like the integration of AI and machine learning in ADAS systems are further accelerating market expansion. Consumer preferences are shifting towards vehicles equipped with advanced safety features, boosting demand for higher-level ADAS systems. This trend is particularly strong in the passenger car segment, while the commercial vehicle sector is also showing strong growth due to increasing freight transportation and fleet safety requirements. Furthermore, infrastructure development and rising urbanization are fueling the demand for ADAS, particularly in major cities across the region.

Key Markets & Segments Leading Middle East and Africa ADAS Market

The passenger car segment currently dominates the market, accounting for approximately xx% of the total revenue in 2025. However, the commercial vehicle segment is projected to experience significant growth due to increasing focus on fleet safety and driver assistance.

- By Technology: The camera-based ADAS systems currently hold the largest market share, owing to their cost-effectiveness and wide application. However, the LiDAR segment is expected to witness strong growth due to increasing demand for higher-level autonomous driving features.

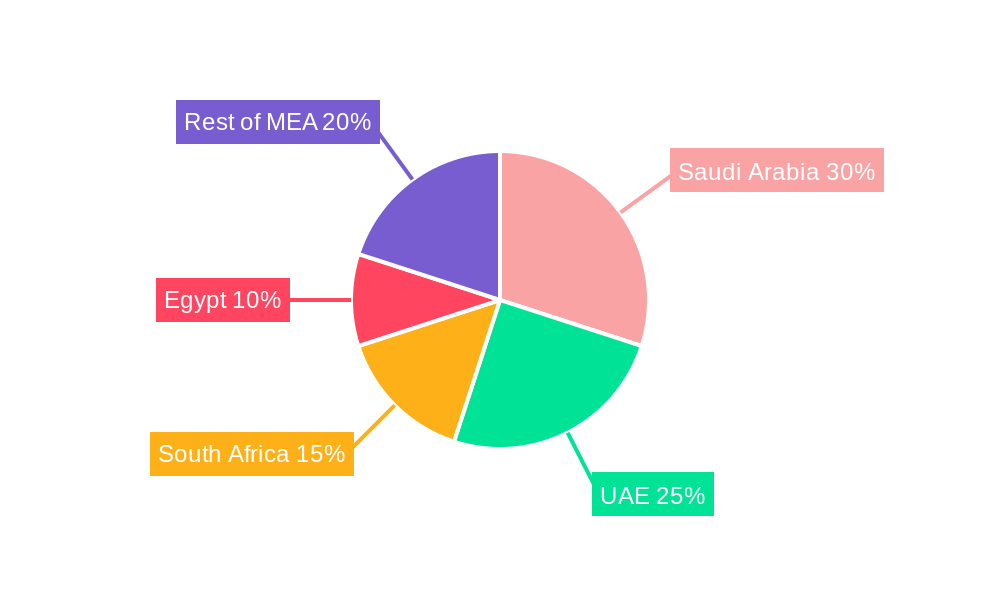

- By Country: The UAE and Saudi Arabia are the leading markets within the region, driven by high vehicle ownership rates and substantial investments in infrastructure development. Egypt and South Africa also represent significant growth opportunities.

Drivers:

- Rapid economic growth in several countries.

- Investments in infrastructure development, including smart city initiatives.

- Increasing government regulations promoting road safety.

- Growing consumer awareness of advanced safety features.

Middle East and Africa ADAS Market Product Developments

Recent advancements in ADAS technology include the integration of AI and machine learning for improved object detection and decision-making, the development of more sophisticated sensor fusion techniques, and the incorporation of V2X (Vehicle-to-Everything) communication capabilities. These innovations enhance safety and driver assistance, providing a competitive edge for manufacturers. The integration of cloud-based data analytics enables continuous improvement and personalization of ADAS features.

Challenges in the Middle East and Africa ADAS Market Market

The Middle East and Africa ADAS market faces challenges including the high initial cost of ADAS technologies, which limits accessibility in certain segments. Supply chain disruptions and the lack of skilled labor for installation and maintenance pose further obstacles. Moreover, varying regulatory standards across different countries can create fragmentation in the market and increase implementation costs. The intense competition amongst established players and new entrants also creates price pressures. These factors are estimated to negatively impact market growth by approximately xx% in 2025.

Forces Driving Middle East and Africa ADAS Market Growth

Key growth drivers include supportive government regulations promoting vehicle safety standards, investments in intelligent transportation systems, and rising consumer demand for enhanced safety features. Technological advancements like improved sensor technology, AI-powered algorithms, and V2X communication are further fueling market expansion. Economic growth in key markets and increasing vehicle ownership rates contribute significantly to overall growth.

Challenges in the Middle East and Africa ADAS Market Market (Long-Term Growth Catalysts)

Long-term growth will be fueled by ongoing technological innovations, strategic partnerships between automotive manufacturers and technology companies, and expansion into new market segments. The development of more affordable and accessible ADAS technologies is crucial for driving wider adoption, particularly in the commercial vehicle segment.

Emerging Opportunities in Middle East and Africa ADAS Market

Emerging opportunities lie in the development and adoption of advanced autonomous driving features, the integration of ADAS with other vehicle systems (e.g., infotainment), and the expansion into new market segments like agricultural vehicles and public transportation. The rising demand for connected car technologies presents opportunities for integration with ADAS systems. The focus on enhanced cybersecurity for ADAS systems will also drive innovation and investment.

Leading Players in the Middle East and Africa ADAS Market Sector

- Bosch Group

- BMW AG

- Autoliv AB

- Harman International

- Delphi Automotive

- Continental AG

- Hyundai Mobi

- Hella KGaA Hueck & Co

Key Milestones in Middle East and Africa ADAS Market Industry

- 2020: Several countries in the region implemented stricter vehicle safety regulations, mandating certain ADAS features.

- 2022: Significant investments in R&D were made by major players to develop next-generation ADAS technologies.

- 2023: Launch of several new ADAS-equipped vehicles by major automotive manufacturers operating within the region.

- 2024: A significant number of partnerships and collaborations between ADAS providers and automotive manufacturers were established to accelerate market penetration.

Strategic Outlook for Middle East and Africa ADAS Market Market

The Middle East and Africa ADAS market presents significant opportunities for growth over the next decade. Strategic investments in technological advancements, strategic partnerships, and expansion into untapped markets are vital for success. The focus on affordability, reliability, and local adaptation will be crucial for driving wider adoption of ADAS technologies across the region. The market's future success hinges on addressing challenges related to infrastructure development, regulatory harmonization, and skilled workforce development.

Middle East and Africa ADAS Market Segmentation

-

1. Type

- 1.1. Parking Assist System

- 1.2. Adaptive Front-lighting

- 1.3. Night Vision System

- 1.4. Blind Spot Detection

- 1.5. Lane Departure Warning

- 1.6. Others

-

2. Technology

- 2.1. Radar

- 2.2. Li-Dar

- 2.3. Camera

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicle

Middle East and Africa ADAS Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa ADAS Market Regional Market Share

Geographic Coverage of Middle East and Africa ADAS Market

Middle East and Africa ADAS Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 11.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Car Financing To Continue Solving Consumer Challenges In Indonesia

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. Government Regulations And Stricter Policies For Safety Roads

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa ADAS Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Parking Assist System

- 5.1.2. Adaptive Front-lighting

- 5.1.3. Night Vision System

- 5.1.4. Blind Spot Detection

- 5.1.5. Lane Departure Warning

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Radar

- 5.2.2. Li-Dar

- 5.2.3. Camera

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bosch Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BMW AG*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Autoliv AB

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Harman International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Delphi Automotive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Continental AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hyundai Mobi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hella KGaA Hueck & Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Bosch Group

List of Figures

- Figure 1: Middle East and Africa ADAS Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa ADAS Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa ADAS Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle East and Africa ADAS Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Middle East and Africa ADAS Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Middle East and Africa ADAS Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa ADAS Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Middle East and Africa ADAS Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 7: Middle East and Africa ADAS Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Middle East and Africa ADAS Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle East and Africa ADAS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle East and Africa ADAS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Israel Middle East and Africa ADAS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Qatar Middle East and Africa ADAS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Kuwait Middle East and Africa ADAS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Oman Middle East and Africa ADAS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bahrain Middle East and Africa ADAS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Jordan Middle East and Africa ADAS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Lebanon Middle East and Africa ADAS Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa ADAS Market?

The projected CAGR is approximately > 11.19%.

2. Which companies are prominent players in the Middle East and Africa ADAS Market?

Key companies in the market include Bosch Group, BMW AG*List Not Exhaustive, Autoliv AB, Harman International, Delphi Automotive, Continental AG, Hyundai Mobi, Hella KGaA Hueck & Co.

3. What are the main segments of the Middle East and Africa ADAS Market?

The market segments include Type, Technology , Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Used Car Financing To Continue Solving Consumer Challenges In Indonesia.

6. What are the notable trends driving market growth?

Government Regulations And Stricter Policies For Safety Roads.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa ADAS Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa ADAS Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa ADAS Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa ADAS Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence