Key Insights

The Middle East and Africa (MEA) Aircraft Maintenance, Repair, and Overhaul (MRO) market is poised for significant expansion. Driven by a surge in air travel and an expanding aircraft fleet, the market is projected to reach $3.72 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 14.46%. Key growth drivers include the expanding airline sectors in both the Middle East and Africa, demanding increased MRO services for fleet efficiency and safety. The aging aircraft demographic necessitates more frequent maintenance and upgrades, further boosting demand. Airlines' focus on cost optimization is leading to the outsourcing of MRO activities to specialized providers, fostering innovation and competition. Government initiatives to enhance aviation infrastructure and safety standards also contribute to a more favorable operating environment. Engine MRO and component and modifications MRO segments are particularly strong performers, reflecting the high-value nature of these services.

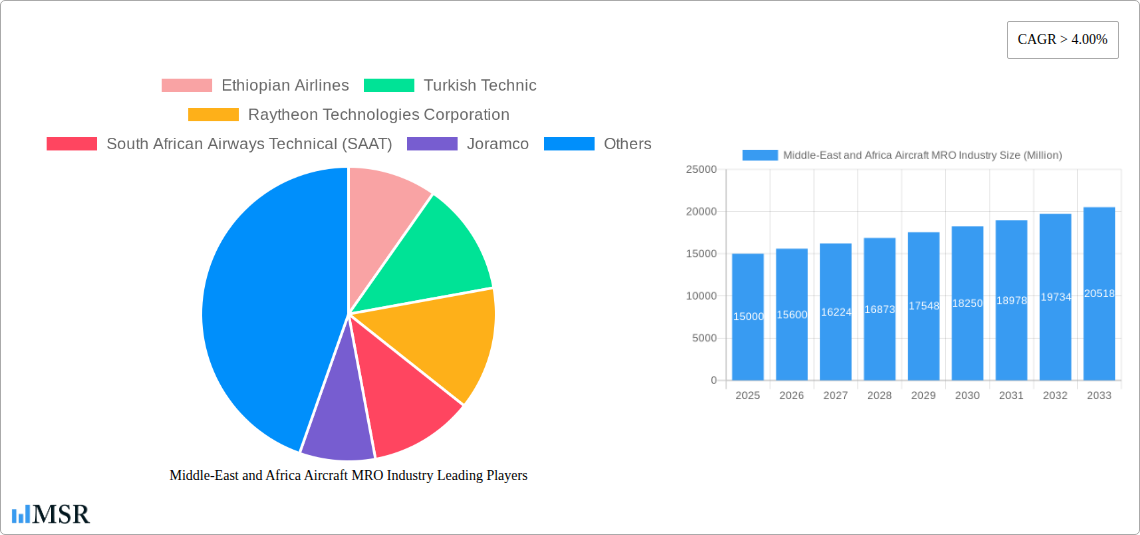

Middle-East and Africa Aircraft MRO Industry Market Size (In Billion)

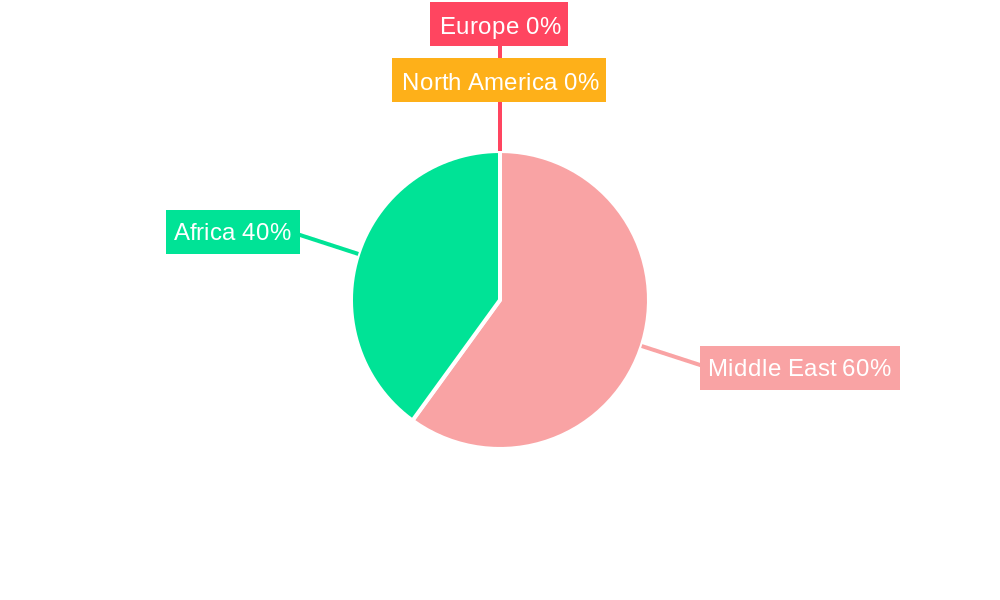

Geographic nuances characterize the MEA MRO landscape. The Middle East boasts established MRO hubs with advanced capabilities, while Africa's market is experiencing rapid growth, fueled by rising domestic air travel and foreign investment in aviation infrastructure. Prominent players, including Ethiopian Airlines and Turkish Technic, are actively engaged in this dynamic market. Challenges such as the need for skilled labor, harmonized regulatory frameworks across African nations, and infrastructural limitations require strategic attention. Despite these hurdles, the MEA Aircraft MRO industry maintains a positive trajectory, underpinned by sustained air travel growth and continuous fleet modernization. Future investments are anticipated to drive technological advancements and enhance service offerings.

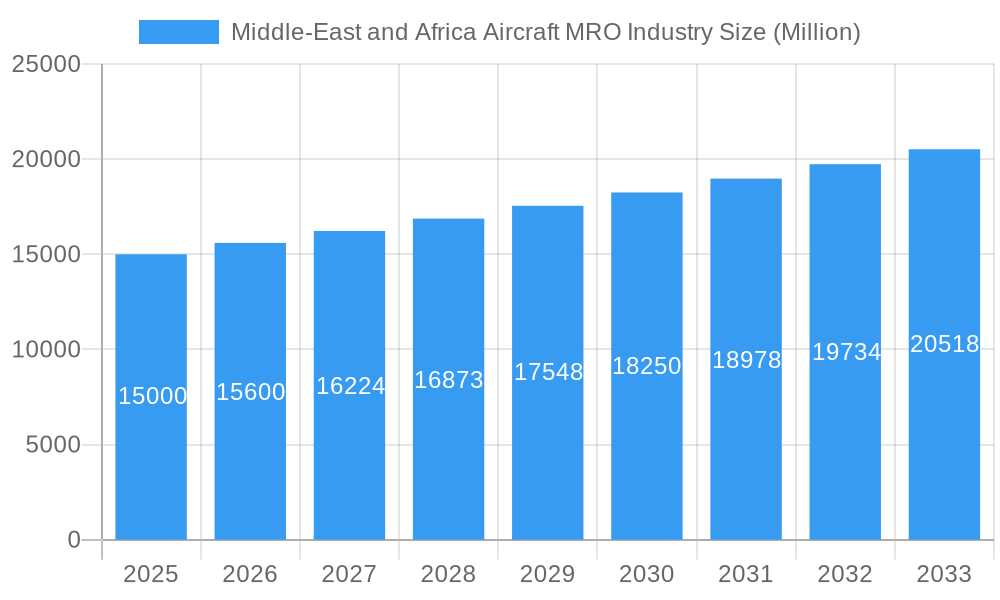

Middle-East and Africa Aircraft MRO Industry Company Market Share

Middle-East and Africa Aircraft MRO Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle-East and Africa Aircraft Maintenance, Repair, and Overhaul (MRO) industry, offering invaluable insights for stakeholders, investors, and industry professionals. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. It meticulously examines market dynamics, key segments, leading players, and future growth prospects, providing actionable intelligence to navigate this dynamic sector. The total market size is predicted to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Middle-East and Africa Aircraft MRO Industry Market Concentration & Dynamics

The Middle East and Africa Aircraft MRO market is characterized by a moderate level of concentration, with a few large players and several smaller, regional operators. Market share is primarily divided among established international players and regional MRO providers. Key players such as Lufthansa Technik AG and Safran SA hold significant market share due to their extensive global network and technological capabilities. However, regional players like Ethiopian Airlines and Saudia Aerospace Engineering Industries are increasingly gaining prominence due to strong local demand and government support. Innovation ecosystems are emerging, primarily driven by technological advancements in digitalization and predictive maintenance. Regulatory frameworks vary across countries, influencing operational costs and investment decisions. The substitution of traditional MRO services with advanced technological solutions is also impacting the market. End-user trends, primarily driven by fleet expansion and modernization, are pushing growth in the commercial aviation segment. Finally, mergers and acquisitions (M&A) activities, with an estimated xx M&A deals in the historical period (2019-2024), are consolidating market share and enhancing operational efficiencies. Specific M&A deal counts for the forecast period are unavailable and are denoted as xx.

- Market Concentration: Moderate, with a mix of large international and regional players.

- Innovation Ecosystem: Emerging, driven by digitalization and predictive maintenance.

- Regulatory Frameworks: Vary across countries, impacting operational costs.

- Substitute Products: Advanced technological solutions impacting traditional services.

- End-User Trends: Driven by fleet expansion and modernization, particularly in the commercial segment.

- M&A Activity: Consolidation of market share through mergers and acquisitions (xx deals from 2019-2024, xx projected for 2025-2033).

Middle-East and Africa Aircraft MRO Industry Industry Insights & Trends

The Middle East and Africa Aircraft MRO market is experiencing robust growth, propelled by a confluence of factors including escalating air passenger traffic, the continuous expansion of airline fleets across the region, and substantial government investment in enhancing aviation infrastructure. Technological disruptions are fundamentally transforming MRO operations. The adoption of big data analytics for predictive maintenance, the integration of artificial intelligence (AI) for optimized workflows, and the utilization of advanced composite materials are leading to significant improvements in efficiency, reduced turnaround times, and minimized aircraft downtime. Consumer behavior is increasingly prioritizing faster service delivery and a higher caliber of MRO services. The market size is projected to reach xx Million by 2025, indicating a trajectory of significant expansion throughout the forecast period. This growth is further amplified by a burgeoning demand for aircraft maintenance, repair, and overhaul services catering to both the dynamic commercial aviation sector and the critical military aviation segment. The increasing adoption of cutting-edge technologies like advanced predictive maintenance algorithms and digital twins is a key contributor to this market expansion. Moreover, proactive government initiatives and policies aimed at fostering regional aviation growth are cultivating a highly favorable ecosystem for MRO providers.

Key Markets & Segments Leading Middle-East and Africa Aircraft MRO Industry

The commercial aviation segment dominates the Middle East and Africa Aircraft MRO market, driven by robust air passenger traffic growth and expansion of airline fleets. The UAE and Saudi Arabia are leading regional markets owing to their large airline bases and extensive aviation infrastructure.

- Dominant Region: Middle East (UAE and Saudi Arabia)

- Dominant Segment (End-User): Commercial Aviation

- Dominant Segment (MRO Type): Airframe MRO

- Growth Drivers:

- Commercial Aviation: Rapid growth in air passenger traffic, fleet expansion of major airlines.

- Military Aviation: Government investment in defense modernization and fleet upgrades.

- General Aviation: Growth in business and private aviation.

- Airframe MRO: High demand for airframe maintenance and repairs due to aging fleets and stringent regulatory standards.

- Engine MRO: Increasing demand for engine maintenance and overhaul services due to technological advancements and growing fleet size.

- Component and Modifications MRO: Rising demand for component repair and modifications to enhance aircraft performance and extend lifespan.

- Line Maintenance: Continuous demand for quick turnaround and efficient line maintenance services due to high flight frequency.

Middle-East and Africa Aircraft MRO Industry Product Developments

Recent product innovations in the Middle East and Africa Aircraft MRO industry include the implementation of advanced diagnostic tools, predictive maintenance technologies, and the use of robotics and automation in maintenance processes. These advancements are enhancing efficiency, reducing operational costs, and improving aircraft availability. The adoption of digital twins for predictive maintenance and remote diagnostics is also gaining traction, providing a competitive edge for MRO providers.

Challenges in the Middle-East and Africa Aircraft MRO Industry Market

The long-term growth trajectory of the Middle East and Africa Aircraft MRO industry is expected to be shaped by the cultivation of strategic partnerships, the widespread adoption of transformative technological advancements such as enhanced predictive maintenance capabilities and comprehensive digitalization of processes, and the successful expansion into underserved or emerging markets within the region. This includes the dedicated development of specialized MRO capabilities to meet the increasingly complex and diverse demands of both the commercial and military aviation segments.

Forces Driving Middle-East and Africa Aircraft MRO Industry Growth

The expansion of the Middle East and Africa Aircraft MRO industry is primarily driven by significant capital injections into aviation infrastructure development, a remarkable surge in air travel demand propelled by growing economies and expanding middle classes, and the strategic expansion of airline fleets within the region. Government-backed initiatives specifically designed to bolster the aviation sector, coupled with rapid technological advancements that enhance the efficiency and cost-effectiveness of MRO operations, serve as powerful catalysts for sustained market growth.

Challenges in the Middle-East and Africa Aircraft MRO Industry Market

The long-term growth trajectory of the Middle East and Africa Aircraft MRO industry is expected to be shaped by the cultivation of strategic partnerships, the widespread adoption of transformative technological advancements such as enhanced predictive maintenance capabilities and comprehensive digitalization of processes, and the successful expansion into underserved or emerging markets within the region. This includes the dedicated development of specialized MRO capabilities to meet the increasingly complex and diverse demands of both the commercial and military aviation segments.

Emerging Opportunities in Middle-East and Africa Aircraft MRO Industry

Emerging opportunities include the growth of low-cost carriers, increasing demand for specialized MRO services for next-generation aircraft, and the expansion of MRO capabilities into smaller regional airports. The adoption of sustainable aviation fuels and the development of green technologies within MRO operations present additional avenues for growth.

Leading Players in the Middle-East and Africa Aircraft MRO Industry Sector

- Ethiopian Airlines

- Turkish Technic

- Raytheon Technologies Corporation

- South African Airways Technical (SAAT)

- Joramco

- AMMROC

- Egyptair Maintenance & Engineering

- Safran SA

- Etihad Airways Engineering LLC

- Air France Industries KLM Engineering & Maintenance

- Sanad Aerotech

- Lufthansa Technik AG

- General Electric Company

- Emirates Engineering

- Saudia Aerospace Engineering Industries

Key Milestones in Middle-East and Africa Aircraft MRO Industry Industry

- 2020: Several MRO providers invested heavily in digitalization initiatives.

- 2021: The impact of the COVID-19 pandemic caused temporary disruptions to the industry.

- 2022: Several key partnerships between MRO providers and airlines were formed.

- 2023: Significant investments were made in the development of sustainable aviation technologies.

- 2024: Increase in M&A activity. (Further milestones are unavailable and denoted as xx).

Strategic Outlook for Middle-East and Africa Aircraft MRO Industry Market

The Middle East and Africa Aircraft MRO market is strategically positioned for substantial and sustained growth. This expansion will be primarily fueled by the continued rise in air passenger traffic, aggressive fleet expansion by regional carriers, and the ongoing integration of transformative technological advancements. Key determinants for market leadership in the future will include the formation of robust strategic partnerships, significant investments in cutting-edge MRO technologies, and successful penetration into new and emerging markets within the region. Furthermore, a pronounced focus on environmental sustainability and the proactive adoption of green technologies will be instrumental in shaping the industry's long-term trajectory and competitive landscape.

Middle-East and Africa Aircraft MRO Industry Segmentation

-

1. MRO Type

- 1.1. Airframe MRO

- 1.2. Engine MRO

- 1.3. Component and Modifications MRO

- 1.4. Line Maintenance

-

2. End-User

- 2.1. Commercial

- 2.2. Military

- 2.3. General Aviation

-

3. Geography

-

3.1. Middle-East and Africa

- 3.1.1. Saudi Arabia

- 3.1.2. United Arab Emirates

- 3.1.3. Turkey

- 3.1.4. South Africa

- 3.1.5. Egypt

- 3.1.6. Rest of Middle-East and Africa

-

3.1. Middle-East and Africa

Middle-East and Africa Aircraft MRO Industry Segmentation By Geography

-

1. Middle East and Africa

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Turkey

- 1.4. South Africa

- 1.5. Egypt

- 1.6. Rest of Middle East and Africa

Middle-East and Africa Aircraft MRO Industry Regional Market Share

Geographic Coverage of Middle-East and Africa Aircraft MRO Industry

Middle-East and Africa Aircraft MRO Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Engine MRO Segment Held the Largest Market Share in 2021

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Aircraft MRO Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 5.1.1. Airframe MRO

- 5.1.2. Engine MRO

- 5.1.3. Component and Modifications MRO

- 5.1.4. Line Maintenance

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Commercial

- 5.2.2. Military

- 5.2.3. General Aviation

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Middle-East and Africa

- 5.3.1.1. Saudi Arabia

- 5.3.1.2. United Arab Emirates

- 5.3.1.3. Turkey

- 5.3.1.4. South Africa

- 5.3.1.5. Egypt

- 5.3.1.6. Rest of Middle-East and Africa

- 5.3.1. Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ethiopian Airlines

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Turkish Technic

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Raytheon Technologies Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 South African Airways Technical (SAAT)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Joramco

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AMMROC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Egyptair Maintenance & Engineering

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Safran SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Etihad Airways Engineering LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Air France Industries KLM Engineering & Maintenanc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sanad Aerotech

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Lufthansa Technik AG

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 General Electric Company

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Emirates Engineering

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Saudia Aerospace Engineering Industries

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Ethiopian Airlines

List of Figures

- Figure 1: Middle-East and Africa Aircraft MRO Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Aircraft MRO Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 2: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 6: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 7: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Middle-East and Africa Aircraft MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle-East and Africa Aircraft MRO Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle-East and Africa Aircraft MRO Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Turkey Middle-East and Africa Aircraft MRO Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: South Africa Middle-East and Africa Aircraft MRO Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Egypt Middle-East and Africa Aircraft MRO Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Rest of Middle East and Africa Middle-East and Africa Aircraft MRO Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Aircraft MRO Industry?

The projected CAGR is approximately 14.46%.

2. Which companies are prominent players in the Middle-East and Africa Aircraft MRO Industry?

Key companies in the market include Ethiopian Airlines, Turkish Technic, Raytheon Technologies Corporation, South African Airways Technical (SAAT), Joramco, AMMROC, Egyptair Maintenance & Engineering, Safran SA, Etihad Airways Engineering LLC, Air France Industries KLM Engineering & Maintenanc, Sanad Aerotech, Lufthansa Technik AG, General Electric Company, Emirates Engineering, Saudia Aerospace Engineering Industries.

3. What are the main segments of the Middle-East and Africa Aircraft MRO Industry?

The market segments include MRO Type, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.72 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Engine MRO Segment Held the Largest Market Share in 2021.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Aircraft MRO Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Aircraft MRO Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Aircraft MRO Industry?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Aircraft MRO Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence