Key Insights

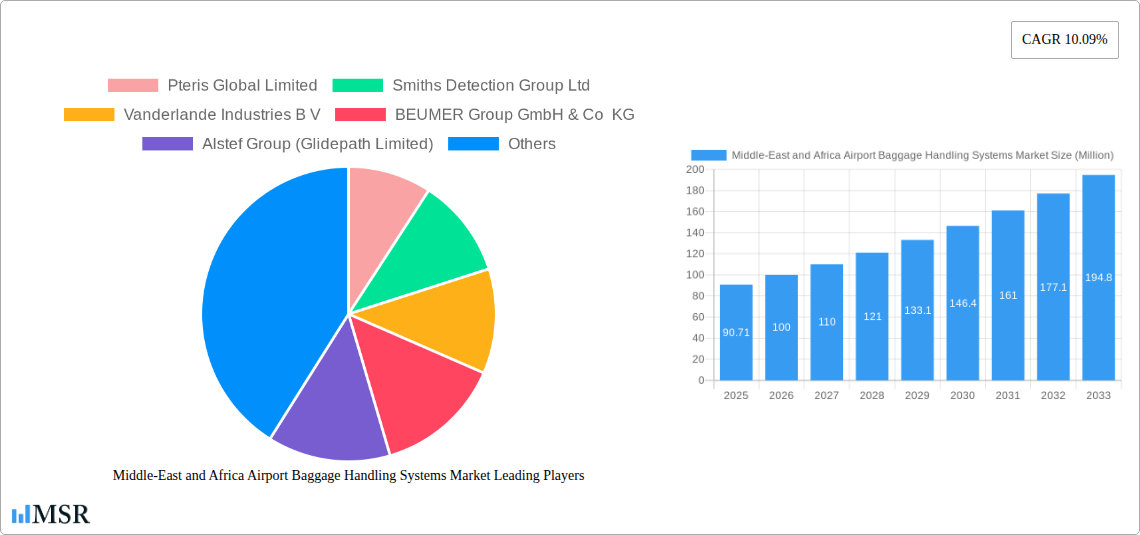

The Middle East and Africa Airport Baggage Handling Systems market is experiencing robust growth, projected to reach $90.71 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.09% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, increasing air passenger traffic across the region necessitates upgrades and expansions to existing airport infrastructure, driving demand for efficient baggage handling solutions. Secondly, the rising adoption of automated baggage handling systems, offering improved speed, accuracy, and security, is a significant market driver. Furthermore, a growing focus on optimizing operational efficiency and reducing costs within airports is pushing adoption of advanced technologies. Finally, government initiatives supporting airport modernization and expansion projects in key African and Middle Eastern nations contribute significantly to market growth. The market is segmented based on airport capacity, catering to various airport sizes and their specific needs. Companies like Pteris Global Limited, Smiths Detection, and Vanderlande Industries are key players, competing on technology advancements, service offerings, and geographic reach. The African sub-region, particularly South Africa and Kenya, presents significant growth opportunities, driven by infrastructure development and rising tourism.

Middle-East and Africa Airport Baggage Handling Systems Market Market Size (In Million)

The market's growth, however, faces some challenges. High initial investment costs associated with advanced baggage handling systems can be a barrier for smaller airports. Furthermore, the need for skilled technical personnel to operate and maintain these sophisticated systems may present a hurdle. Despite these constraints, the long-term outlook remains positive. Continued investment in airport infrastructure, technological advancements, and a focus on enhancing passenger experience are expected to sustain the market's expansion throughout the forecast period (2025-2033). The diverse needs of various airport sizes, from smaller regional airports to large international hubs, create opportunities for specialized solutions and continuous market innovation. The ongoing expansion of low-cost carriers and a rising middle class in many African countries also contributes to the increased passenger volumes fueling the demand for efficient baggage handling.

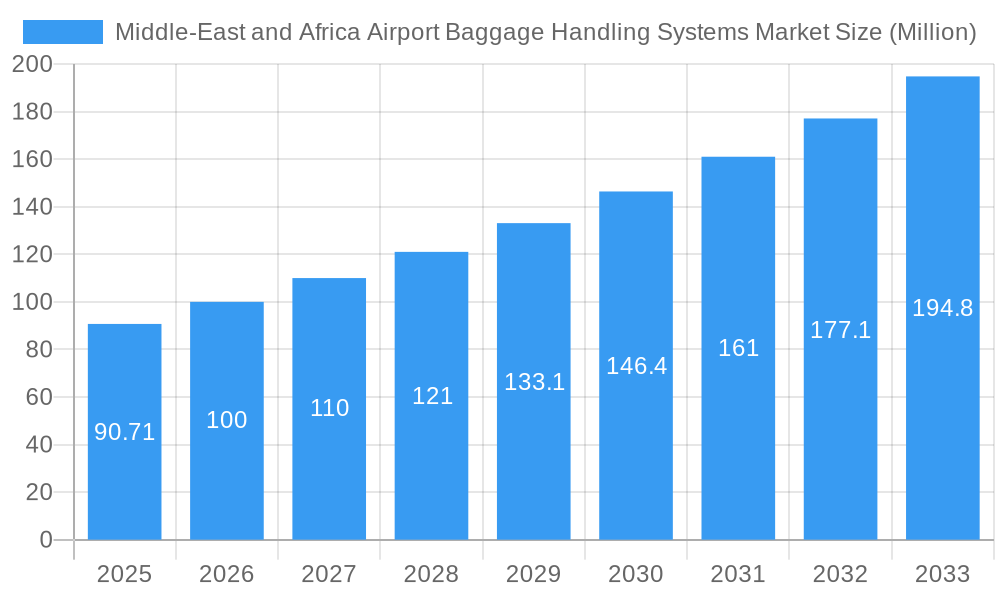

Middle-East and Africa Airport Baggage Handling Systems Market Company Market Share

Middle East and Africa Airport Baggage Handling Systems Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East and Africa Airport Baggage Handling Systems Market, offering invaluable insights for industry stakeholders. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, and opportunities across various segments. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. Key players profiled include Pteris Global Limited, Smiths Detection Group Ltd, Vanderlande Industries B V, BEUMER Group GmbH & Co KG, Alstef Group (Glidepath Limited), Daifuku Co Ltd, ADB SAFEGATE, SITA, Siemens Logistics GmbH, and dnat.

Middle East and Africa Airport Baggage Handling Systems Market Concentration & Dynamics

The Middle East and Africa Airport Baggage Handling Systems market exhibits a moderately concentrated landscape, with a few major players holding significant market share. The market share of the top five players is estimated at xx%. Innovation in baggage handling technology, driven by factors such as automation and AI, is a key dynamic. Regulatory frameworks, particularly concerning security and safety, significantly influence market operations. Substitute products, such as manual baggage handling, are limited due to efficiency and scalability considerations. End-user trends, including increasing passenger volume and demand for seamless travel experiences, fuel market growth. Mergers and acquisitions (M&A) activity in the sector has been moderate over the historical period (2019-2024), with approximately xx M&A deals recorded.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share.

- Innovation Ecosystem: Strong focus on automation, AI, and improved security technologies.

- Regulatory Landscape: Stringent security and safety regulations impacting market operations.

- Substitute Products: Limited viable substitutes due to efficiency and scalability issues.

- End-User Trends: Rising passenger numbers and demand for improved passenger experience.

- M&A Activity: Approximately xx M&A deals recorded between 2019 and 2024.

Middle East and Africa Airport Baggage Handling Systems Market Industry Insights & Trends

The Middle East and Africa Airport Baggage Handling Systems market is experiencing robust growth, driven by several factors. Significant investments in airport infrastructure development across the region, coupled with the increasing passenger traffic, are key drivers. Technological advancements, including the adoption of automated baggage handling systems (ABHS) and self-service kiosks, are transforming the industry. Evolving consumer behaviors, prioritizing speed and convenience, are further accelerating market expansion. The market size is expected to grow from xx Million in 2025 to xx Million by 2033, driven by a robust CAGR. The rising adoption of advanced technologies, such as RFID tagging and intelligent baggage sorting systems, is also contributing to this growth. The increasing focus on improving operational efficiency and reducing baggage mishandling incidents within airports is another significant factor. Furthermore, the growing demand for enhanced security measures in airports is another crucial driver.

Key Markets & Segments Leading Middle East and Africa Airport Baggage Handling Systems Market

The report identifies key markets and segments within the Middle East and Africa region. While specific country-level dominance requires detailed analysis within the full report, the segment of airports with capacity above 40 million passengers annually is expected to be the fastest growing. This is due to the significant investments in infrastructure and expansion plans in major hubs across the region.

- Airport Capacity Segments:

- Up to 15 Million: Driven by increasing regional airports and growth of low-cost carriers.

- 15 to 25 Million: Moderate growth due to expansion of existing facilities and infrastructure upgrades.

- 25 to 40 Million: Significant growth potential due to increased passenger volume and hub expansion.

- Above 40 Million: Fastest-growing segment, fueled by major hub expansions and investments in advanced technology.

- Key Market Drivers: Significant airport infrastructure investments, rising passenger traffic, government initiatives promoting aviation, and tourism growth.

Middle East and Africa Airport Baggage Handling Systems Market Product Developments

Recent product developments focus on enhanced automation, improved baggage tracking capabilities, and increased security features. The integration of Artificial Intelligence (AI) and machine learning algorithms for optimized baggage routing and real-time monitoring is a significant trend. These innovations offer airports increased efficiency, improved passenger experience, and enhanced security measures. Companies are focusing on developing modular and scalable systems to cater to the diverse needs of airports, enhancing their competitive edge.

Challenges in the Middle East and Africa Airport Baggage Handling Systems Market

The market faces several challenges, including the high initial investment costs associated with ABHS implementation, particularly for smaller airports. Supply chain disruptions and the need for skilled labor can also hinder market growth. Furthermore, intense competition among established players and regulatory hurdles related to security and data privacy pose considerable challenges. The overall impact of these challenges can reduce market growth by approximately xx% annually.

Forces Driving Middle East and Africa Airport Baggage Handling Systems Market Growth

Key growth drivers include the ongoing expansion of airport infrastructure, the surging passenger numbers, and the increasing focus on enhancing operational efficiency. Government support for aviation infrastructure development and the rising adoption of advanced technologies contribute to market growth. The continuous expansion of low-cost carriers in the region further stimulates demand for efficient baggage handling systems.

Long-Term Growth Catalysts in Middle East and Africa Airport Baggage Handling Systems Market

Long-term growth will be driven by technological innovations in baggage handling, strategic partnerships between airports and system providers, and expansion into new markets within the region. Investments in next-generation technologies such as AI-powered baggage sorting and improved data analytics for predictive maintenance will be crucial for sustained growth.

Emerging Opportunities in Middle East and Africa Airport Baggage Handling Systems Market

Emerging opportunities include the adoption of self-service technologies for baggage check-in, the increasing demand for integrated security solutions, and the expansion of ABHS in smaller and regional airports. The growing focus on sustainability and the development of eco-friendly baggage handling solutions presents further opportunities for innovation and growth.

Leading Players in the Middle East and Africa Airport Baggage Handling Systems Market Sector

Key Milestones in Middle East and Africa Airport Baggage Handling Systems Market Industry

- 2021: Significant investment in ABHS announced by Dubai International Airport.

- 2022: Launch of a new baggage handling system incorporating AI by Vanderlande Industries at an airport in South Africa.

- 2023: Strategic partnership between a major airport in Kenya and a leading baggage handling system provider.

- 2024: Implementation of advanced baggage tracking technology at several airports across the Middle East.

Strategic Outlook for Middle East and Africa Airport Baggage Handling Systems Market Market

The future of the Middle East and Africa Airport Baggage Handling Systems market is bright, with significant growth potential driven by continuous infrastructure development, rising passenger traffic, and technological advancements. Strategic opportunities exist for companies focusing on innovation, partnerships, and expansion into underserved markets. Companies that can effectively address the challenges related to cost, security, and sustainability will be best positioned for success.

Middle-East and Africa Airport Baggage Handling Systems Market Segmentation

-

1. Airport Capacity

- 1.1. Up to 15 million

- 1.2. 15 to 25 million

- 1.3. 25 to 40 million

- 1.4. Above 40 million

-

2. Geography

- 2.1. Saudi Arabia

- 2.2. United Arab Emirates

- 2.3. Qatar

- 2.4. Egypt

- 2.5. Turkey

- 2.6. South Africa

- 2.7. Rest of Middle-East and Africa

Middle-East and Africa Airport Baggage Handling Systems Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Qatar

- 4. Egypt

- 5. Turkey

- 6. South Africa

- 7. Rest of Middle East and Africa

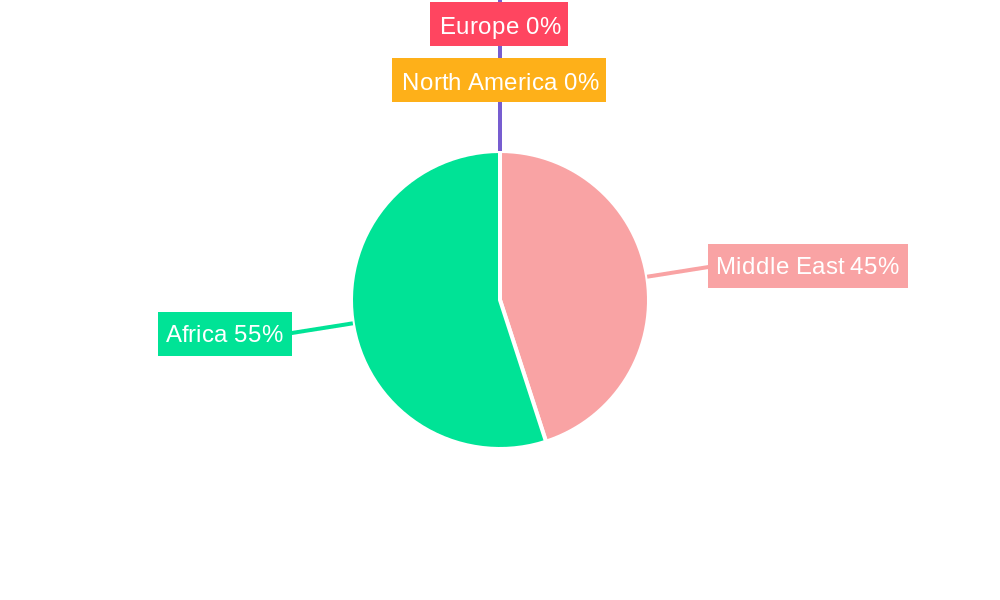

Middle-East and Africa Airport Baggage Handling Systems Market Regional Market Share

Geographic Coverage of Middle-East and Africa Airport Baggage Handling Systems Market

Middle-East and Africa Airport Baggage Handling Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Above 40 Million Segment is Anticipated to Grow with the Highest CAGR During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 5.1.1. Up to 15 million

- 5.1.2. 15 to 25 million

- 5.1.3. 25 to 40 million

- 5.1.4. Above 40 million

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Saudi Arabia

- 5.2.2. United Arab Emirates

- 5.2.3. Qatar

- 5.2.4. Egypt

- 5.2.5. Turkey

- 5.2.6. South Africa

- 5.2.7. Rest of Middle-East and Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Qatar

- 5.3.4. Egypt

- 5.3.5. Turkey

- 5.3.6. South Africa

- 5.3.7. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 6. Saudi Arabia Middle-East and Africa Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 6.1.1. Up to 15 million

- 6.1.2. 15 to 25 million

- 6.1.3. 25 to 40 million

- 6.1.4. Above 40 million

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Saudi Arabia

- 6.2.2. United Arab Emirates

- 6.2.3. Qatar

- 6.2.4. Egypt

- 6.2.5. Turkey

- 6.2.6. South Africa

- 6.2.7. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 7. United Arab Emirates Middle-East and Africa Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 7.1.1. Up to 15 million

- 7.1.2. 15 to 25 million

- 7.1.3. 25 to 40 million

- 7.1.4. Above 40 million

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Saudi Arabia

- 7.2.2. United Arab Emirates

- 7.2.3. Qatar

- 7.2.4. Egypt

- 7.2.5. Turkey

- 7.2.6. South Africa

- 7.2.7. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 8. Qatar Middle-East and Africa Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 8.1.1. Up to 15 million

- 8.1.2. 15 to 25 million

- 8.1.3. 25 to 40 million

- 8.1.4. Above 40 million

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Saudi Arabia

- 8.2.2. United Arab Emirates

- 8.2.3. Qatar

- 8.2.4. Egypt

- 8.2.5. Turkey

- 8.2.6. South Africa

- 8.2.7. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 9. Egypt Middle-East and Africa Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 9.1.1. Up to 15 million

- 9.1.2. 15 to 25 million

- 9.1.3. 25 to 40 million

- 9.1.4. Above 40 million

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Saudi Arabia

- 9.2.2. United Arab Emirates

- 9.2.3. Qatar

- 9.2.4. Egypt

- 9.2.5. Turkey

- 9.2.6. South Africa

- 9.2.7. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 10. Turkey Middle-East and Africa Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 10.1.1. Up to 15 million

- 10.1.2. 15 to 25 million

- 10.1.3. 25 to 40 million

- 10.1.4. Above 40 million

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Saudi Arabia

- 10.2.2. United Arab Emirates

- 10.2.3. Qatar

- 10.2.4. Egypt

- 10.2.5. Turkey

- 10.2.6. South Africa

- 10.2.7. Rest of Middle-East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 11. South Africa Middle-East and Africa Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 11.1.1. Up to 15 million

- 11.1.2. 15 to 25 million

- 11.1.3. 25 to 40 million

- 11.1.4. Above 40 million

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Saudi Arabia

- 11.2.2. United Arab Emirates

- 11.2.3. Qatar

- 11.2.4. Egypt

- 11.2.5. Turkey

- 11.2.6. South Africa

- 11.2.7. Rest of Middle-East and Africa

- 11.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 12. Rest of Middle East and Africa Middle-East and Africa Airport Baggage Handling Systems Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 12.1.1. Up to 15 million

- 12.1.2. 15 to 25 million

- 12.1.3. 25 to 40 million

- 12.1.4. Above 40 million

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. Saudi Arabia

- 12.2.2. United Arab Emirates

- 12.2.3. Qatar

- 12.2.4. Egypt

- 12.2.5. Turkey

- 12.2.6. South Africa

- 12.2.7. Rest of Middle-East and Africa

- 12.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Pteris Global Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Smiths Detection Group Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Vanderlande Industries B V

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 BEUMER Group GmbH & Co KG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Alstef Group (Glidepath Limited)

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Daifuku Co Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 ADB SAFEGATE

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 SITA

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Siemens Logistics GmbH

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 dnat

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Pteris Global Limited

List of Figures

- Figure 1: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Airport Baggage Handling Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 2: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 5: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 8: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 11: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 14: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 17: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 20: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 21: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 23: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Middle-East and Africa Airport Baggage Handling Systems Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Airport Baggage Handling Systems Market?

The projected CAGR is approximately 10.09%.

2. Which companies are prominent players in the Middle-East and Africa Airport Baggage Handling Systems Market?

Key companies in the market include Pteris Global Limited, Smiths Detection Group Ltd, Vanderlande Industries B V, BEUMER Group GmbH & Co KG, Alstef Group (Glidepath Limited), Daifuku Co Ltd, ADB SAFEGATE, SITA, Siemens Logistics GmbH, dnat.

3. What are the main segments of the Middle-East and Africa Airport Baggage Handling Systems Market?

The market segments include Airport Capacity, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 90.71 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Above 40 Million Segment is Anticipated to Grow with the Highest CAGR During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Airport Baggage Handling Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Airport Baggage Handling Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Airport Baggage Handling Systems Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Airport Baggage Handling Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence