Key Insights

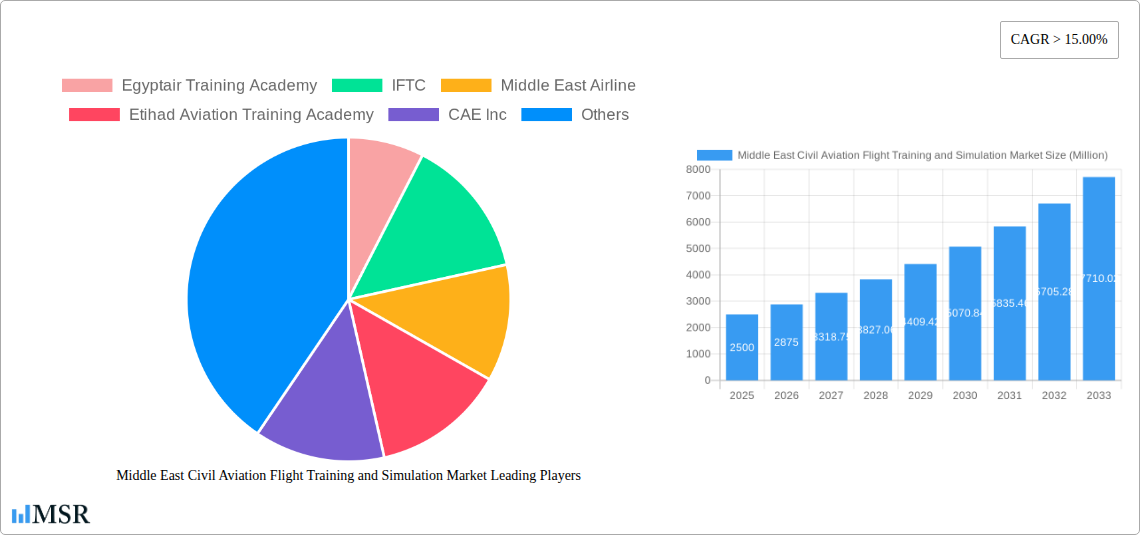

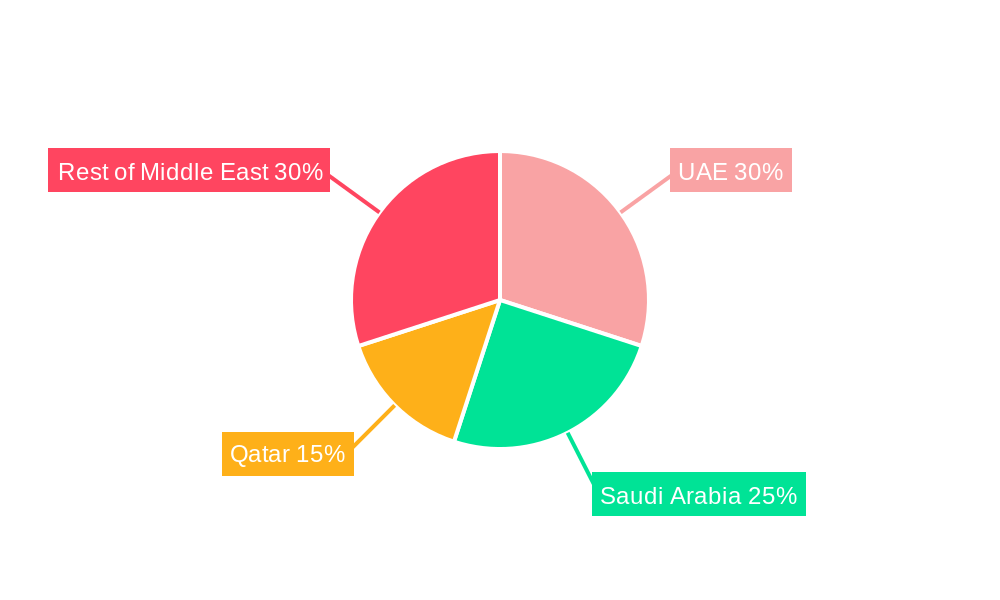

The Middle East Civil Aviation Flight Training and Simulation market is experiencing robust growth, driven by a surge in air passenger traffic, the expansion of regional airline fleets, and increasing government investment in aviation infrastructure. The market's Compound Annual Growth Rate (CAGR) exceeding 15% from 2019 to 2024 indicates a significant upward trajectory. This expansion is fueled by the region's burgeoning tourism sector and the rising demand for skilled pilots and aviation professionals. Key growth segments include flight school and ground school training, with simulation training witnessing particularly rapid adoption due to its cost-effectiveness and ability to replicate real-world scenarios. Leading players like Egyptair Training Academy, IFTC, and Emirates Flight Training Academy are strategically investing in advanced training technologies and expanding their capacity to meet the growing demand. The UAE, Saudi Arabia, and Qatar are major market contributors, reflecting their significant airline industries and commitment to aviation development. However, potential restraints include fluctuating oil prices (which can impact airline profitability and training budgets), the ongoing impact of geopolitical events, and competition from established training centers in other regions. Despite these challenges, the long-term outlook for the market remains highly positive, with sustained growth projected through 2033.

Middle East Civil Aviation Flight Training and Simulation Market Market Size (In Billion)

The market segmentation reveals a strong emphasis on both flight and ground school training, with the latter encompassing theoretical knowledge and regulatory compliance aspects. The integration of sophisticated simulation technologies is crucial, offering realistic training experiences for pilots at various stages of their careers. This simulation training segment exhibits a high growth rate, reflecting the industry's increasing reliance on cost-effective and efficient training methods. The regional distribution of the market highlights the dominance of the UAE, Saudi Arabia, and Qatar, although other nations in the Middle East are also witnessing increasing participation in this sector. This growth is likely to attract further investment in training infrastructure and the development of specialized training programs to meet the diverse needs of the regional airline industry. The overall market size, while not explicitly stated, can be estimated based on the CAGR and the assumption of a considerable market value in 2019, given the region's established aviation sector. This estimate would then be extrapolated to project market size in 2025 and beyond, providing a robust outlook for market participants.

Middle East Civil Aviation Flight Training and Simulation Market Company Market Share

Middle East Civil Aviation Flight Training and Simulation Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East Civil Aviation Flight Training and Simulation Market, covering the period 2019-2033. It offers invaluable insights for airlines, training academies, simulation technology providers, and investors seeking to understand market dynamics, growth opportunities, and competitive landscapes in this rapidly evolving sector. The report leverages rigorous data analysis, incorporating key market trends and forecasts to provide actionable intelligence. The study period encompasses historical data (2019-2024), a base year of 2025, and a forecast period extending to 2033.

Middle East Civil Aviation Flight Training and Simulation Market Market Concentration & Dynamics

The Middle East Civil Aviation Flight Training and Simulation Market exhibits a moderately concentrated landscape, with key players like Emirates Flight Training Academy, Qatar Airways Group, and CAE Inc. holding significant market share. However, the market also features several regional players, contributing to a dynamic competitive environment. The market share distribution among the top five players is estimated at xx% in 2025. Innovation in simulation technology, particularly VR/AR integration, is a significant driver, alongside regulatory frameworks that mandate specific training hours and simulator usage. Substitute products are limited, but advancements in e-learning and online training modules represent a growing alternative, albeit a niche one. End-user trends show a strong preference for high-fidelity simulators and comprehensive training programs that integrate both flight school/ground school and simulation training. The market has witnessed xx M&A deals in the historical period (2019-2024), primarily focused on expanding training capabilities and geographical reach.

- Market Share (2025): Top 5 players hold xx%

- M&A Deal Count (2019-2024): xx deals

- Key Innovation Areas: VR/AR integration, e-learning platforms

- Regulatory Focus: Mandatory training hours, simulator usage requirements

Middle East Civil Aviation Flight Training and Simulation Market Industry Insights & Trends

The Middle East Civil Aviation Flight Training and Simulation Market is experiencing robust growth, driven by the region's expanding airline industry and increasing passenger traffic. The market size is estimated at $xx Million in 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). Key growth drivers include rising demand for skilled pilots and air traffic controllers, government investments in aviation infrastructure, and the adoption of advanced simulation technologies. Technological disruptions, such as the introduction of AI-powered training tools and cloud-based simulation platforms, are reshaping training methodologies and enhancing efficiency. Consumer behavior is shifting towards personalized learning experiences and flexible training schedules, prompting training academies to adapt their offerings accordingly. The market is witnessing increased investment in pilot training programs to meet the growing demand.

Key Markets & Segments Leading Middle East Civil Aviation Flight Training and Simulation Market

The UAE and Saudi Arabia are the dominant markets within the Middle East, driven by the presence of major airlines and substantial investments in aviation infrastructure. Within training types, Simulation Training is the leading segment, accounting for xx% of the market in 2025, driven by the advantages of cost-effectiveness, safety, and the ability to replicate diverse flight scenarios.

Drivers for Growth in UAE and Saudi Arabia:

- Economic Growth: Strong GDP growth fuels investment in aviation.

- Infrastructure Development: New airports and expanded facilities enhance training capacity.

- Airline Expansion: Major airlines increase pilot training requirements.

Dominance Analysis:

The UAE's dominance stems from the large presence of Emirates Flight Training Academy and other significant training providers, supported by substantial government investment and the presence of large airlines like Emirates. Saudi Arabia's growth is fueled by the Kingdom's Vision 2030 initiatives, aimed at expanding the aviation sector and developing national capabilities.

- Market Share by Segment (2025): Simulation Training - xx%, Flight School/Ground School - xx%

- Dominant Regions: UAE, Saudi Arabia

Middle East Civil Aviation Flight Training and Simulation Market Product Developments

Recent product innovations include the integration of artificial intelligence (AI) in flight simulators to create more realistic and challenging training scenarios. The market also witnesses an increasing adoption of virtual reality (VR) and augmented reality (AR) technologies to enhance immersive learning experiences. These advancements provide competitive edges by offering superior training quality and cost-effectiveness compared to traditional methods.

Challenges in the Middle East Civil Aviation Flight Training and Simulation Market Market

The market faces challenges such as high initial investment costs for simulator acquisition and maintenance, regulatory complexities related to simulator certification, and a potential shortage of qualified instructors. The fluctuating oil prices also impact the economic viability of airline investments in training. These factors can create significant financial pressure on smaller players.

Forces Driving Middle East Civil Aviation Flight Training and Simulation Market Growth

Technological advancements, particularly in simulation technology, are a primary growth driver. Government initiatives to boost the aviation sector, coupled with increased investment from airlines, are also contributing factors. The growing demand for skilled aviation professionals further fuels the market expansion.

Long-Term Growth Catalysts in Middle East Civil Aviation Flight Training and Simulation Market

Long-term growth hinges on continuous technological innovation, strategic partnerships between training academies and airlines, and the expansion of training programs to encompass emerging areas like drone operations and urban air mobility. The adoption of sophisticated training methodologies and the diversification of training services will play crucial roles.

Emerging Opportunities in Middle East Civil Aviation Flight Training and Simulation Market

The integration of advanced technologies like AI and VR/AR is creating new training opportunities. The demand for specialized training in areas such as low-cost carrier operations and sustainable aviation practices is also presenting promising avenues. The market is also poised to benefit from increasing demand for pilot and maintenance training programs in the rapidly growing drone sector.

Leading Players in the Middle East Civil Aviation Flight Training and Simulation Market Sector

- Egyptair Training Academy

- IFTC

- Middle East Airline

- Etihad Aviation Training Academy

- CAE Inc

- Oman Air

- Emirates Flight Training Academy

- Qatar Airways Group

- Jordan Airline Training and Simulation

- Gulf Aviation Academy

- Prince Sultan Aviation Academy

- Turkish Airlines Flight Training

Key Milestones in Middle East Civil Aviation Flight Training and Simulation Market Industry

- 2020: Introduction of advanced flight simulators with AI capabilities by CAE Inc.

- 2022: Emirates Flight Training Academy expands its training capacity to meet rising demand.

- 2023: Qatar Airways Group invests in new simulation technology.

- 2024: Several M&A activities consolidate market players. (Further details would be included in the full report)

Strategic Outlook for Middle East Civil Aviation Flight Training and Simulation Market Market

The Middle East Civil Aviation Flight Training and Simulation Market is poised for continued expansion, driven by technological advancements, infrastructure development, and the region's growing aviation sector. Strategic partnerships, investments in innovative training technologies, and expansion into new training areas will shape future market leaders. The focus on delivering high-quality, cost-effective training solutions, tailored to the specific needs of airlines and pilots, will be crucial for long-term success.

Middle East Civil Aviation Flight Training and Simulation Market Segmentation

-

1. Training Type

- 1.1. Flight School/Ground School

-

1.2. Simulation Training

- 1.2.1. Full Flight Simulator (FFS)

- 1.2.2. Fixed Training Devices (FTD)

- 1.2.3. Other Simulator Types

-

2. Geography

- 2.1. United Arab Emirates

- 2.2. Saudi Arabia

- 2.3. Qatar

- 2.4. Bahrain

- 2.5. Oman

- 2.6. Kuwait

- 2.7. Rest of Middle East

Middle East Civil Aviation Flight Training and Simulation Market Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. Qatar

- 4. Bahrain

- 5. Oman

- 6. Kuwait

- 7. Rest of Middle East

Middle East Civil Aviation Flight Training and Simulation Market Regional Market Share

Geographic Coverage of Middle East Civil Aviation Flight Training and Simulation Market

Middle East Civil Aviation Flight Training and Simulation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 15.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Simulator Training Segment held the Largest Share in 2021

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Training Type

- 5.1.1. Flight School/Ground School

- 5.1.2. Simulation Training

- 5.1.2.1. Full Flight Simulator (FFS)

- 5.1.2.2. Fixed Training Devices (FTD)

- 5.1.2.3. Other Simulator Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United Arab Emirates

- 5.2.2. Saudi Arabia

- 5.2.3. Qatar

- 5.2.4. Bahrain

- 5.2.5. Oman

- 5.2.6. Kuwait

- 5.2.7. Rest of Middle East

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. Qatar

- 5.3.4. Bahrain

- 5.3.5. Oman

- 5.3.6. Kuwait

- 5.3.7. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Training Type

- 6. United Arab Emirates Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Training Type

- 6.1.1. Flight School/Ground School

- 6.1.2. Simulation Training

- 6.1.2.1. Full Flight Simulator (FFS)

- 6.1.2.2. Fixed Training Devices (FTD)

- 6.1.2.3. Other Simulator Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United Arab Emirates

- 6.2.2. Saudi Arabia

- 6.2.3. Qatar

- 6.2.4. Bahrain

- 6.2.5. Oman

- 6.2.6. Kuwait

- 6.2.7. Rest of Middle East

- 6.1. Market Analysis, Insights and Forecast - by Training Type

- 7. Saudi Arabia Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Training Type

- 7.1.1. Flight School/Ground School

- 7.1.2. Simulation Training

- 7.1.2.1. Full Flight Simulator (FFS)

- 7.1.2.2. Fixed Training Devices (FTD)

- 7.1.2.3. Other Simulator Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United Arab Emirates

- 7.2.2. Saudi Arabia

- 7.2.3. Qatar

- 7.2.4. Bahrain

- 7.2.5. Oman

- 7.2.6. Kuwait

- 7.2.7. Rest of Middle East

- 7.1. Market Analysis, Insights and Forecast - by Training Type

- 8. Qatar Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Training Type

- 8.1.1. Flight School/Ground School

- 8.1.2. Simulation Training

- 8.1.2.1. Full Flight Simulator (FFS)

- 8.1.2.2. Fixed Training Devices (FTD)

- 8.1.2.3. Other Simulator Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United Arab Emirates

- 8.2.2. Saudi Arabia

- 8.2.3. Qatar

- 8.2.4. Bahrain

- 8.2.5. Oman

- 8.2.6. Kuwait

- 8.2.7. Rest of Middle East

- 8.1. Market Analysis, Insights and Forecast - by Training Type

- 9. Bahrain Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Training Type

- 9.1.1. Flight School/Ground School

- 9.1.2. Simulation Training

- 9.1.2.1. Full Flight Simulator (FFS)

- 9.1.2.2. Fixed Training Devices (FTD)

- 9.1.2.3. Other Simulator Types

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. United Arab Emirates

- 9.2.2. Saudi Arabia

- 9.2.3. Qatar

- 9.2.4. Bahrain

- 9.2.5. Oman

- 9.2.6. Kuwait

- 9.2.7. Rest of Middle East

- 9.1. Market Analysis, Insights and Forecast - by Training Type

- 10. Oman Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Training Type

- 10.1.1. Flight School/Ground School

- 10.1.2. Simulation Training

- 10.1.2.1. Full Flight Simulator (FFS)

- 10.1.2.2. Fixed Training Devices (FTD)

- 10.1.2.3. Other Simulator Types

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. United Arab Emirates

- 10.2.2. Saudi Arabia

- 10.2.3. Qatar

- 10.2.4. Bahrain

- 10.2.5. Oman

- 10.2.6. Kuwait

- 10.2.7. Rest of Middle East

- 10.1. Market Analysis, Insights and Forecast - by Training Type

- 11. Kuwait Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Training Type

- 11.1.1. Flight School/Ground School

- 11.1.2. Simulation Training

- 11.1.2.1. Full Flight Simulator (FFS)

- 11.1.2.2. Fixed Training Devices (FTD)

- 11.1.2.3. Other Simulator Types

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. United Arab Emirates

- 11.2.2. Saudi Arabia

- 11.2.3. Qatar

- 11.2.4. Bahrain

- 11.2.5. Oman

- 11.2.6. Kuwait

- 11.2.7. Rest of Middle East

- 11.1. Market Analysis, Insights and Forecast - by Training Type

- 12. Rest of Middle East Middle East Civil Aviation Flight Training and Simulation Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Training Type

- 12.1.1. Flight School/Ground School

- 12.1.2. Simulation Training

- 12.1.2.1. Full Flight Simulator (FFS)

- 12.1.2.2. Fixed Training Devices (FTD)

- 12.1.2.3. Other Simulator Types

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. United Arab Emirates

- 12.2.2. Saudi Arabia

- 12.2.3. Qatar

- 12.2.4. Bahrain

- 12.2.5. Oman

- 12.2.6. Kuwait

- 12.2.7. Rest of Middle East

- 12.1. Market Analysis, Insights and Forecast - by Training Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Egyptair Training Academy

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 IFTC

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Middle East Airline

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Etihad Aviation Training Academy

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 CAE Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Oman Air

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Emirates Flight Training Academy

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Qatar Airways Group

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Jordan Airline Training and Simulation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Gulf Aviation Academy

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Prince Sultan Aviation Academy

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Turkish Airlines Flight Training

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Egyptair Training Academy

List of Figures

- Figure 1: Middle East Civil Aviation Flight Training and Simulation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East Civil Aviation Flight Training and Simulation Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Training Type 2020 & 2033

- Table 2: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Training Type 2020 & 2033

- Table 5: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Training Type 2020 & 2033

- Table 8: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Training Type 2020 & 2033

- Table 11: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Training Type 2020 & 2033

- Table 14: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Training Type 2020 & 2033

- Table 17: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Training Type 2020 & 2033

- Table 20: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 21: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Training Type 2020 & 2033

- Table 23: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Middle East Civil Aviation Flight Training and Simulation Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Civil Aviation Flight Training and Simulation Market?

The projected CAGR is approximately > 15.00%.

2. Which companies are prominent players in the Middle East Civil Aviation Flight Training and Simulation Market?

Key companies in the market include Egyptair Training Academy, IFTC, Middle East Airline, Etihad Aviation Training Academy, CAE Inc, Oman Air, Emirates Flight Training Academy, Qatar Airways Group, Jordan Airline Training and Simulation, Gulf Aviation Academy, Prince Sultan Aviation Academy, Turkish Airlines Flight Training.

3. What are the main segments of the Middle East Civil Aviation Flight Training and Simulation Market?

The market segments include Training Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Simulator Training Segment held the Largest Share in 2021.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Civil Aviation Flight Training and Simulation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Civil Aviation Flight Training and Simulation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Civil Aviation Flight Training and Simulation Market?

To stay informed about further developments, trends, and reports in the Middle East Civil Aviation Flight Training and Simulation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence