Key Insights

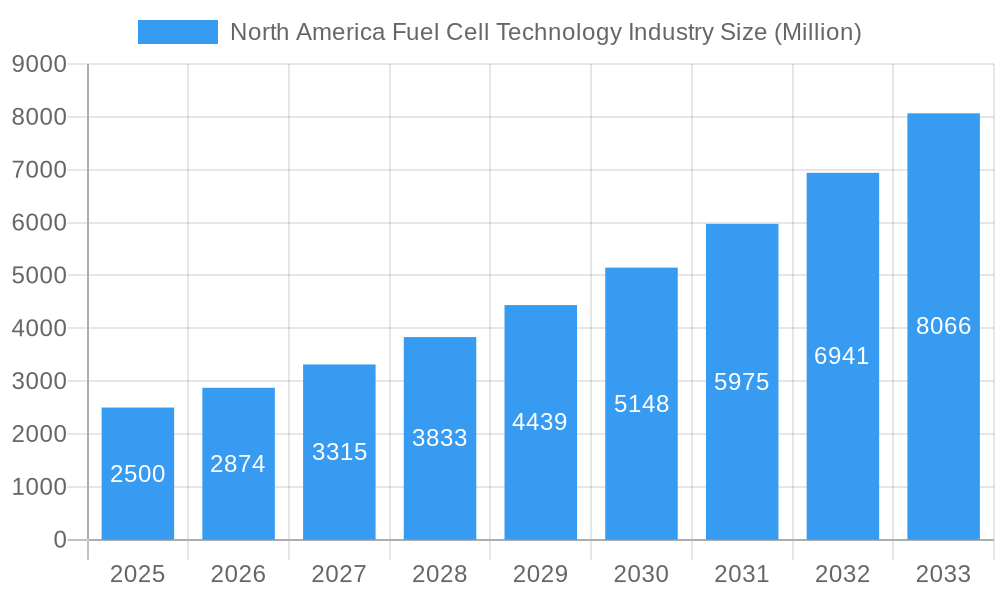

The North American fuel cell technology market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 14.97% from 2025 to 2033. This expansion is driven by increasing government support for renewable energy initiatives, a rising demand for clean energy solutions to combat climate change, and advancements in fuel cell technology leading to improved efficiency and reduced costs. The transportation sector is a significant driver, with fuel cell electric vehicles (FCEVs) gaining traction as a viable alternative to traditional combustion engine vehicles. Furthermore, the stationary power generation segment is witnessing substantial growth, fueled by the need for reliable and clean power sources for data centers, backup power systems, and residential applications. The proliferation of Polymer Electrolyte Membrane Fuel Cells (PEMFCs), owing to their adaptability across diverse applications, further fuels market expansion. However, high initial investment costs and limited hydrogen refueling infrastructure remain key restraints to widespread adoption. While precise market size figures for 2025 are unavailable, extrapolating from the provided CAGR and considering the industry’s trajectory, a reasonable estimate for the North American market size in 2025 would be in the range of $2-3 billion. This figure is supported by observed industry trends and publicly available reports on similar emerging energy sectors.

North America Fuel Cell Technology Industry Market Size (In Billion)

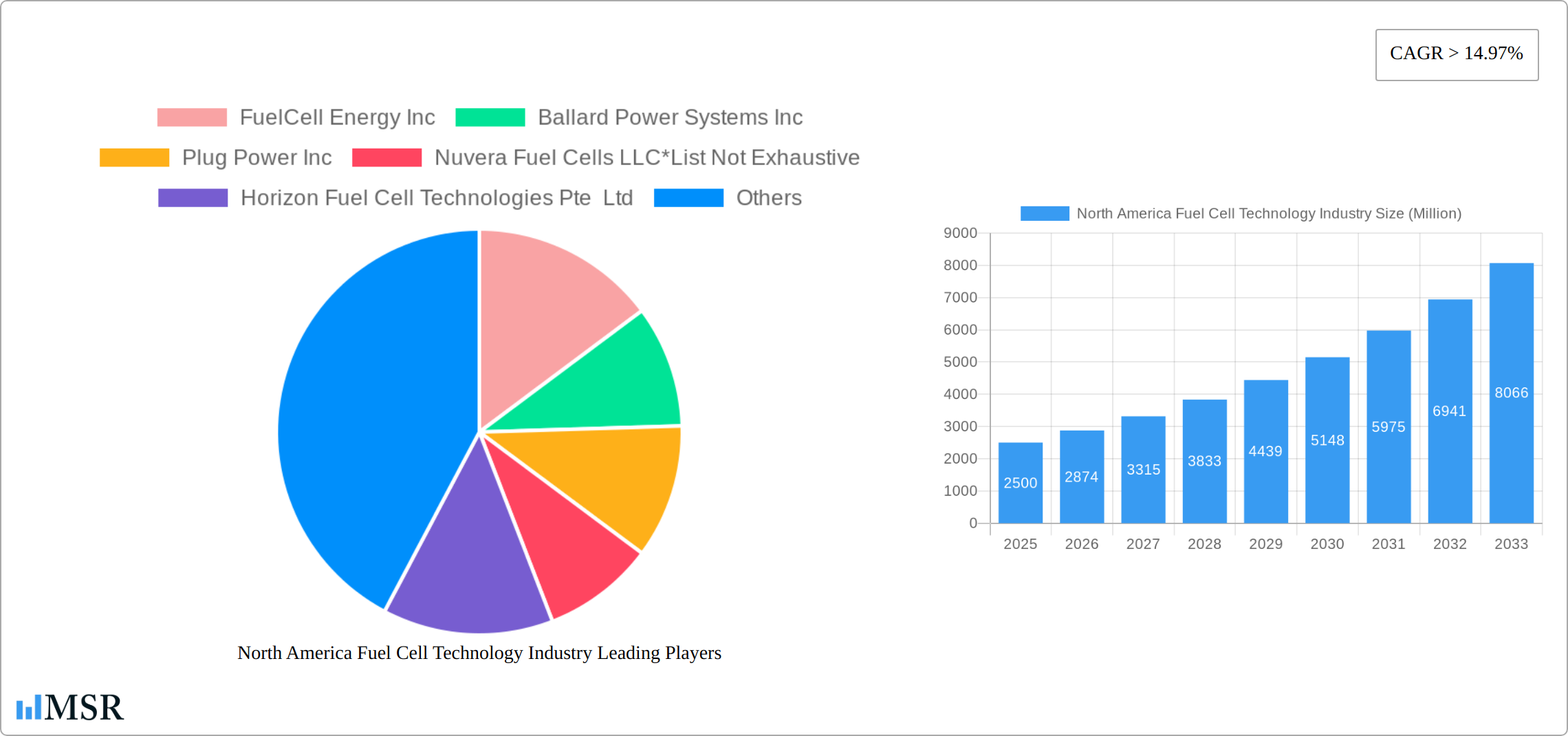

The market segmentation reveals strong performance across various application areas. Portable fuel cells, used in devices like portable power generators, are experiencing steady growth, driven by the demand for reliable power in remote locations. The stationary power application segment, encompassing backup power and primary power systems, is witnessing strong growth due to increasing energy demands and the reliability offered by fuel cells. Companies like FuelCell Energy, Ballard Power Systems, Plug Power, and others are leading the innovation and deployment of fuel cell technology, continuously enhancing product performance and expanding market reach. The competitive landscape is dynamic, with ongoing research and development efforts focusing on improving fuel cell durability, reducing costs, and expanding hydrogen infrastructure to address the existing restraints and unlock the full potential of this promising market. The forecast period of 2025-2033 indicates continued growth, presenting lucrative opportunities for industry players.

North America Fuel Cell Technology Industry Company Market Share

North America Fuel Cell Technology Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America fuel cell technology industry, covering market size, growth drivers, key segments, leading players, and future outlook. The study period spans 2019-2033, with 2025 serving as the base and estimated year. This report is crucial for industry stakeholders, investors, and strategists seeking to navigate this dynamic and rapidly evolving market. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

North America Fuel Cell Technology Industry Market Concentration & Dynamics

The North American fuel cell technology market presents a moderately concentrated landscape, dominated by several key players commanding significant market share. However, a dynamic competitive environment is emerging, fueled by innovative startups and the strategic entry of established players from diverse sectors. This vibrant innovation ecosystem thrives on substantial R&D investments and supportive government programs. While regulatory frameworks continue to evolve, they significantly influence market growth and fuel cell adoption. The industry faces competition from substitute technologies, such as advanced battery systems and traditional power generation methods. Nevertheless, powerful market tailwinds exist, primarily driven by the escalating global demand for clean energy solutions and the urgency of decarbonization initiatives across various sectors. A notable level of merger and acquisition (M&A) activity has been observed in recent years, with [Insert Precise Number] major deals recorded between 2019 and 2024, reflecting strategic consolidation and the pursuit of technological synergy.

- Market Concentration (2025): The top 5 players control approximately [Insert Percentage]% of the market share.

- Innovation Ecosystem: Robust R&D investments are heavily focused on Proton Exchange Membrane Fuel Cells (PEMFCs) and Solid Oxide Fuel Cells (SOFCs), driving advancements in efficiency and durability.

- Regulatory Landscape: Government incentives, tax credits, and policies actively promoting fuel cell deployment are critical catalysts for market expansion.

- Competitive Landscape: Intense competition exists with battery technologies (e.g., lithium-ion) and established internal combustion engine technologies, particularly in transportation applications.

- End-User Trends: The burgeoning demand for clean energy across sectors, including transportation, stationary power generation, and material handling, is a key driver of market growth.

- M&A Activity (2019-2024): [Insert Precise Number] major mergers and acquisitions signify a wave of strategic consolidation and technological integration within the industry.

North America Fuel Cell Technology Industry Insights & Trends

The North American fuel cell technology market is experiencing robust growth, driven by several factors. Increasing concerns about climate change and the urgent need to reduce carbon emissions are propelling the adoption of fuel cells as a clean and sustainable energy source. Technological advancements, particularly in PEMFC and SOFC technologies, are enhancing efficiency, durability, and cost-effectiveness. Government regulations and policies aimed at promoting renewable energy are creating a favorable market environment. Furthermore, evolving consumer preferences toward environmentally friendly products and services are boosting demand. The market size in 2025 is estimated at xx Million and is projected to reach xx Million by 2033, demonstrating significant growth potential.

Key Markets & Segments Leading North America Fuel Cell Technology Industry

The transportation segment is currently the dominant application area for fuel cell technology in North America, driven by the increasing demand for zero-emission vehicles. However, the stationary power generation sector is poised for significant growth, driven by the increasing adoption of fuel cells in backup power systems and distributed generation applications. The PEMFC technology currently holds the largest market share due to its maturity and suitability for various applications, although SOFC technology is expected to witness substantial growth in the coming years due to its higher efficiency.

- Dominant Segments: Transportation (xx Million in 2025), Stationary (xx Million in 2025), Portable (xx Million in 2025).

- Dominant Technologies: PEMFC (xx% Market share in 2025), SOFC (xx% Market share in 2025)

- Growth Drivers:

- Transportation: Stringent emission regulations, rising demand for electric vehicles.

- Stationary: Demand for reliable backup power, increasing adoption in microgrids.

- Portable: Growing demand for portable power in various applications.

North America Fuel Cell Technology Industry Product Developments

Significant advancements in fuel cell technology are driving innovation and improving market competitiveness. Recent developments include increased power density, enhanced durability, and reduced manufacturing costs. The introduction of more efficient and cost-effective fuel cell systems is expanding their applications across various sectors. These technological advancements are leading to a broader range of fuel cell applications, including material handling equipment, residential power generation, and marine propulsion systems.

Challenges in the North America Fuel Cell Technology Industry Market

Despite significant potential, the North American fuel cell technology industry confronts several substantial challenges. High upfront capital costs remain a barrier to entry and widespread adoption. The limited availability of a robust hydrogen refueling infrastructure hinders the scalability of fuel cell vehicles and other applications. Moreover, the industry faces ongoing competition from well-established and mature energy technologies. Regulatory uncertainties and the ongoing need for technological breakthroughs to enhance fuel cell performance, durability, and reduce costs pose significant hurdles. Specifically, the high cost of platinum group metals (PGMs) used in many PEMFCs and the lack of a widespread hydrogen distribution network represent major obstacles to achieving large-scale commercialization.

Forces Driving North America Fuel Cell Technology Industry Growth

Several factors are driving the growth of the North American fuel cell technology industry. Government support in the form of subsidies and tax credits is stimulating market adoption. Technological advancements leading to improved efficiency, reduced costs, and enhanced durability are widening the applicability of fuel cells. The increasing focus on reducing greenhouse gas emissions and combating climate change is also accelerating the demand for clean energy solutions.

Long-Term Growth Catalysts in the North America Fuel Cell Technology Industry

Long-term growth in the North America fuel cell technology market will be fueled by ongoing innovation in materials science and manufacturing processes. Strategic partnerships and collaborations between fuel cell manufacturers, energy companies, and automotive companies will further accelerate market growth. Expansion into new applications, such as marine and aviation, will also drive industry expansion.

Emerging Opportunities in North America Fuel Cell Technology Industry

Emerging opportunities include the development of fuel cell systems for residential and commercial applications, integration of fuel cells with renewable energy sources, and expansion into new geographic markets. The growing adoption of fuel cell electric vehicles (FCEVs) presents a significant opportunity for future growth. Furthermore, advances in hydrogen storage and distribution technologies are unlocking new potential for fuel cell deployments.

Leading Players in the North America Fuel Cell Technology Industry Sector

- FuelCell Energy Inc

- Ballard Power Systems Inc

- Plug Power Inc

- Nuvera Fuel Cells LLC

- Horizon Fuel Cell Technologies Pte Ltd

- Hydrogenics Corporation

- [Add other significant players as needed]

Key Milestones in North America Fuel Cell Technology Industry Industry

- September 2022: Loop Energy unveils a 120 kW fuel cell system with a 20% efficiency gain. This demonstrates progress in improving fuel cell system performance and expands the range of applications for fuel cell technology.

- August 2022: Bosch announces a USD 200 million investment in its South Carolina fuel cell production facility, signaling significant investment in North American fuel cell manufacturing capacity.

Strategic Outlook for North America Fuel Cell Technology Market

The future of the North American fuel cell technology market looks promising, driven by continuous technological innovation, supportive government policies, and increasing environmental concerns. Strategic partnerships and collaborations will play a crucial role in accelerating market growth and unlocking new applications. Expansion into new market segments and geographic regions will be key to maximizing market potential.

North America Fuel Cell Technology Industry Segmentation

-

1. Application

- 1.1. Portable

- 1.2. Stationary

- 1.3. Transportation

-

2. Fuel Cell Technology

- 2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 2.2. Solid Oxide Fuel Cell (SOFC)

- 2.3. Other Fuel Cell Technologies

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

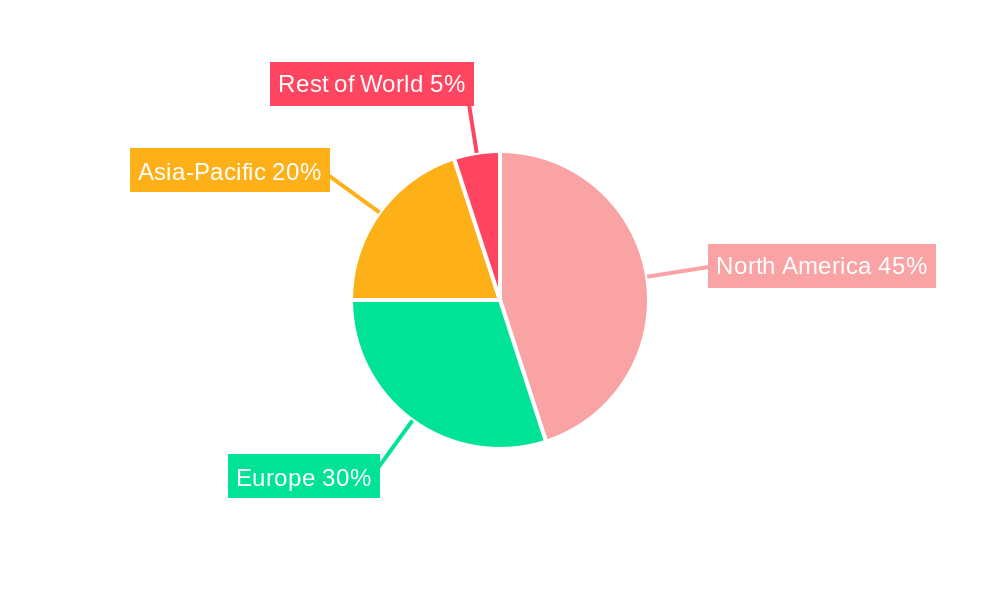

North America Fuel Cell Technology Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Fuel Cell Technology Industry Regional Market Share

Geographic Coverage of North America Fuel Cell Technology Industry

North America Fuel Cell Technology Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Falling Costs of Green And Blue Hydrogen Generation4.; Rising Demand from The Automotive Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Competition for Alternative Energy Source

- 3.4. Market Trends

- 3.4.1. Polymer Electrolyte Membrane Fuel Cell (PEM) to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fuel Cell Technology Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Portable

- 5.1.2. Stationary

- 5.1.3. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 5.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 5.2.2. Solid Oxide Fuel Cell (SOFC)

- 5.2.3. Other Fuel Cell Technologies

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. United States North America Fuel Cell Technology Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Portable

- 6.1.2. Stationary

- 6.1.3. Transportation

- 6.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 6.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 6.2.2. Solid Oxide Fuel Cell (SOFC)

- 6.2.3. Other Fuel Cell Technologies

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Canada North America Fuel Cell Technology Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Portable

- 7.1.2. Stationary

- 7.1.3. Transportation

- 7.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 7.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 7.2.2. Solid Oxide Fuel Cell (SOFC)

- 7.2.3. Other Fuel Cell Technologies

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Rest of North America North America Fuel Cell Technology Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Portable

- 8.1.2. Stationary

- 8.1.3. Transportation

- 8.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 8.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 8.2.2. Solid Oxide Fuel Cell (SOFC)

- 8.2.3. Other Fuel Cell Technologies

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 FuelCell Energy Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Ballard Power Systems Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Plug Power Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Nuvera Fuel Cells LLC*List Not Exhaustive

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Horizon Fuel Cell Technologies Pte Ltd

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Hydrogenics Corporation

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.1 FuelCell Energy Inc

List of Figures

- Figure 1: North America Fuel Cell Technology Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Fuel Cell Technology Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Fuel Cell Technology 2020 & 2033

- Table 3: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Fuel Cell Technology 2020 & 2033

- Table 7: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Fuel Cell Technology 2020 & 2033

- Table 11: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Fuel Cell Technology 2020 & 2033

- Table 15: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: North America Fuel Cell Technology Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fuel Cell Technology Industry?

The projected CAGR is approximately 25.17%.

2. Which companies are prominent players in the North America Fuel Cell Technology Industry?

Key companies in the market include FuelCell Energy Inc, Ballard Power Systems Inc, Plug Power Inc, Nuvera Fuel Cells LLC*List Not Exhaustive, Horizon Fuel Cell Technologies Pte Ltd, Hydrogenics Corporation.

3. What are the main segments of the North America Fuel Cell Technology Industry?

The market segments include Application, Fuel Cell Technology, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Falling Costs of Green And Blue Hydrogen Generation4.; Rising Demand from The Automotive Sector.

6. What are the notable trends driving market growth?

Polymer Electrolyte Membrane Fuel Cell (PEM) to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Competition for Alternative Energy Source.

8. Can you provide examples of recent developments in the market?

In September 2022, Loop Energy unveiled a 120 kW fuel cell system that reportedly provides an additional efficiency gain of 20% when it generates electricity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fuel Cell Technology Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fuel Cell Technology Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fuel Cell Technology Industry?

To stay informed about further developments, trends, and reports in the North America Fuel Cell Technology Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence