Key Insights

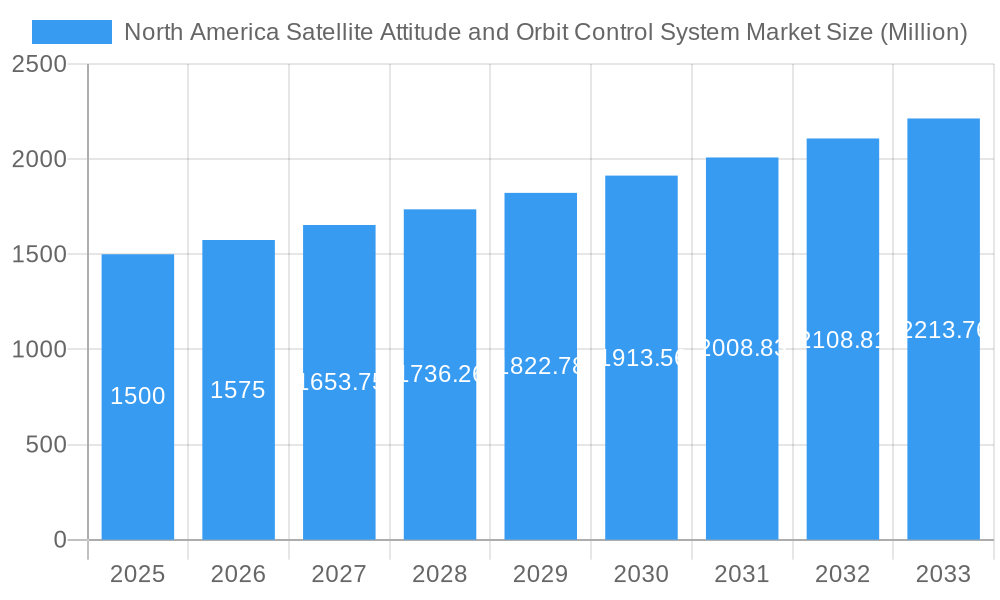

The North American Satellite Attitude and Orbit Control System (AOCS) market is poised for significant expansion, driven by escalating demand for sophisticated satellite technologies across diverse sectors. With a projected CAGR of 10.94%, the market is estimated at $0.96 billion in the base year 2025, with robust growth anticipated through 2033. This expansion is primarily propelled by the dynamic commercial space industry, particularly in communication and Earth observation. Government and military entities also contribute substantially, increasingly leveraging advanced satellite systems for surveillance, navigation, and strategic communication.

North America Satellite Attitude and Orbit Control System Market Market Size (In Million)

The United States commands the largest market share within North America, attributed to its advanced technological infrastructure, substantial investments in space exploration, and a thriving private space sector. Canada and Mexico, while smaller contributors, are experiencing growth fueled by increasing domestic requirements and international space collaborations. Market segmentation indicates a strong preference for AOCS systems designed for satellites within the 100-500kg mass range, balancing payload capacity with launch cost-effectiveness. The communication application segment leads, driven by the growing need for high-bandwidth satellite networks.

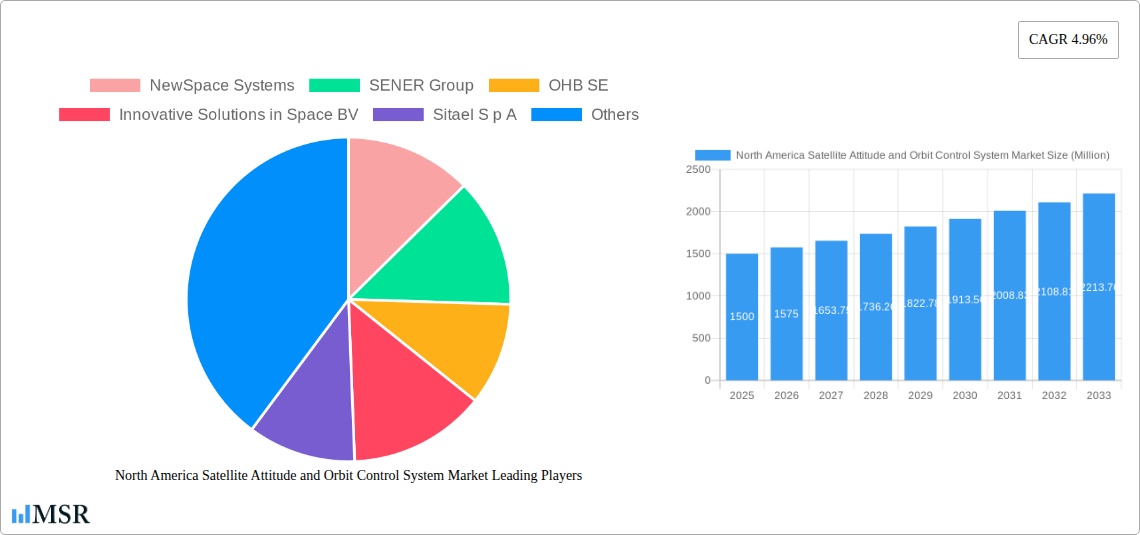

North America Satellite Attitude and Orbit Control System Market Company Market Share

Technological innovations, including enhanced control algorithms, component miniaturization, and advanced sensor technologies, are accelerating market growth. However, challenges such as substantial initial investment costs for AOCS, stringent regulatory compliance, and potential supply chain disruptions persist. Despite these obstacles, the long-term outlook remains optimistic, supported by continuous innovation, increasing satellite deployments, and the broadening scope of space-based applications. Miniaturization and cost reduction in AOCS systems will be crucial for market penetration across various satellite classes (GEO, LEO, MEO) and user segments (commercial, military & government). The proliferation of small satellite constellations is also expected to stimulate demand for smaller, lighter, and more cost-effective AOCS solutions.

North America Satellite Attitude and Orbit Control System Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America Satellite Attitude and Orbit Control System (AOCS) market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The report segments the market by orbit class (GEO, LEO, MEO), end-user (Commercial, Military & Government, Other), application (Communication, Earth Observation, Navigation, Space Observation, Others), and satellite mass (Below 10 Kg, 10-100kg, 100-500kg, 500-1000kg, above 1000kg). Key players analyzed include NewSpace Systems, SENER Group, OHB SE, Innovative Solutions in Space BV, Sitael S p A, Thales, Jena-Optronik, and AAC Clyde Space. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

North America Satellite Attitude and Orbit Control System Market Concentration & Dynamics

The North American AOCS market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the emergence of innovative startups and increased M&A activity are shaping the competitive dynamics. Regulatory frameworks, particularly those concerning space debris mitigation and cybersecurity, are increasingly influencing market behavior. Substitute products, while limited, are emerging in specific niche applications. End-user trends, driven by growing demand for advanced satellite-based services across commercial and government sectors, are a key growth driver.

- Market Share: The top 5 players collectively hold approximately xx% of the market share in 2025.

- M&A Activity: The number of M&A deals within the AOCS sector in North America averaged xx per year between 2019 and 2024. This activity is anticipated to increase in the coming years driven by consolidation and technological integration needs.

- Innovation Ecosystems: Collaboration between universities, research institutions, and private companies fuels ongoing technological advancements within the AOCS sector, driving innovation in areas like miniaturization and improved accuracy.

- Regulatory Frameworks: Stringent regulations concerning orbital debris and data security impose challenges and opportunities for market participants. Companies are compelled to invest in technologies which mitigate these challenges.

North America Satellite Attitude and Orbit Control System Market Industry Insights & Trends

The North American Satellite AOCS market is experiencing robust growth, driven primarily by the increasing demand for high-quality satellite imagery for various applications, including communication, navigation, earth observation, and national security. Technological advancements, such as the development of more efficient and precise AOCS technologies, including miniaturization of components, are accelerating market expansion. The growing adoption of small satellites (CubeSats and nanosats) is fueling demand for compact and cost-effective AOCS solutions. Furthermore, government initiatives aimed at enhancing space-based infrastructure and strengthening national security further propel market growth. The market size was estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Key Markets & Segments Leading North America Satellite Attitude and Orbit Control System Market

The LEO segment dominates the North American AOCS market, driven by the proliferation of small satellite constellations for various applications. The commercial sector is the largest end-user segment, followed by the military and government sector. The communication application segment holds the largest market share, due to the rising demand for high-bandwidth communication networks.

Dominant Segments:

- Orbit Class: LEO

- End User: Commercial

- Application: Communication

- Satellite Mass: 10-100kg and 100-500kg segments hold a significant market share.

Growth Drivers:

- Increased Demand for High-Bandwidth Communication Networks: The increasing demand for faster internet speeds, especially in remote areas, fuels the growth of communication satellites.

- Government Investments in Space Exploration and National Security: Government funding for space exploration missions and national security initiatives boosts the demand for sophisticated AOCS systems.

- Advancements in Sensor Technology: Improved sensors lead to enhanced accuracy and performance of AOCS systems.

- Miniaturization of AOCS Components: This factor enables the integration of AOCS systems into smaller and lighter satellites.

North America Satellite Attitude and Orbit Control System Market Product Developments

Recent advancements in AOCS technologies include the development of more efficient and precise star trackers, gyroscopes, and reaction wheels. These innovations enhance satellite accuracy, reduce fuel consumption, and extend mission lifespans. The integration of advanced algorithms and AI-powered control systems also optimizes AOCS performance. This continuous improvement in system performance and smaller form factors create a competitive edge in the industry.

Challenges in the North America Satellite Attitude and Orbit Control System Market

The North American AOCS market faces challenges such as the high cost of development and manufacturing, stringent regulatory compliance requirements, and intense competition among established players and new entrants. Supply chain disruptions and the increasing complexity of AOCS systems also pose significant hurdles. These factors can lead to delays in project timelines and increased production costs.

Forces Driving North America Satellite Attitude and Orbit Control System Market Growth

Several factors drive the growth of the North American AOCS market. These include technological advancements resulting in smaller, more efficient, and cost-effective AOCS systems, increased government spending on space exploration and national security, and rising commercial demand for satellite-based services. The growing adoption of small satellites also fuels the market.

Challenges in the North America Satellite Attitude and Orbit Control System Market

Long-term growth hinges on continued technological innovation and strategic partnerships to reduce costs and accelerate development. Expanding into new markets and applications, such as Earth observation and space tourism, will further stimulate market expansion.

Emerging Opportunities in North America Satellite Attitude and Orbit Control System Market

Emerging opportunities include the development of more resilient and autonomous AOCS systems, the integration of AI and machine learning for improved control and predictive maintenance, and the expansion into new application areas such as space debris removal and in-space servicing.

Leading Players in the North America Satellite Attitude and Orbit Control System Market Sector

- NewSpace Systems

- SENER Group

- OHB SE

- Innovative Solutions in Space BV

- Sitael S p A

- Thales

- Jena-Optronik

- AAC Clyde Space

Key Milestones in North America Satellite Attitude and Orbit Control System Market Industry

- November 2022: Jena-Optronik GmbH's star sensors were used in NASA's Artemis I mission, demonstrating the reliability and precision of their technology.

- December 2022: Jena-Optronik's ASTRO CL star trackers were selected for Maxar's new LEO satellite platform, highlighting the growing demand for miniaturized AOCS solutions.

- February 2023: Jena-Optronik secured a contract with Airbus OneWeb Satellites to provide AOCS sensors for their ARROW family of small satellites, underscoring their market leadership in this segment.

Strategic Outlook for North America Satellite Attitude and Orbit Control System Market Market

The future of the North American AOCS market looks bright, with strong growth potential driven by continued technological innovation, increasing demand for satellite services, and government investment. Companies focusing on miniaturization, enhanced accuracy, and cost reduction will gain a competitive edge. Strategic partnerships and collaborations will be crucial for navigating the complexities of the market and accelerating growth.

North America Satellite Attitude and Orbit Control System Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Satellite Mass

- 2.1. 10-100kg

- 2.2. 100-500kg

- 2.3. 500-1000kg

- 2.4. Below 10 Kg

- 2.5. above 1000kg

-

3. Orbit Class

- 3.1. GEO

- 3.2. LEO

- 3.3. MEO

-

4. End User

- 4.1. Commercial

- 4.2. Military & Government

- 4.3. Other

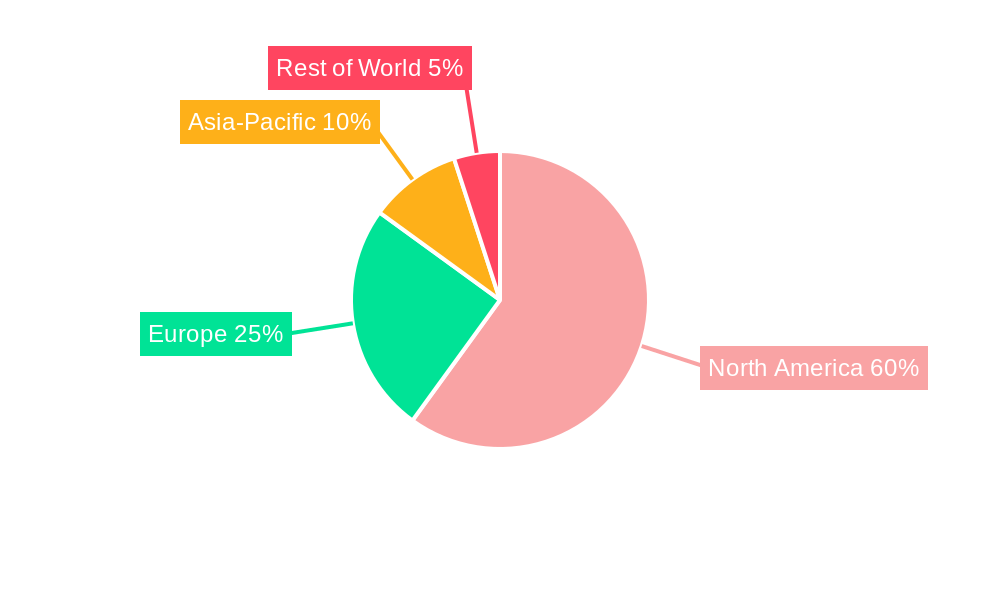

North America Satellite Attitude and Orbit Control System Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Satellite Attitude and Orbit Control System Market Regional Market Share

Geographic Coverage of North America Satellite Attitude and Orbit Control System Market

North America Satellite Attitude and Orbit Control System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Satellite Attitude and Orbit Control System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.2.1. 10-100kg

- 5.2.2. 100-500kg

- 5.2.3. 500-1000kg

- 5.2.4. Below 10 Kg

- 5.2.5. above 1000kg

- 5.3. Market Analysis, Insights and Forecast - by Orbit Class

- 5.3.1. GEO

- 5.3.2. LEO

- 5.3.3. MEO

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Commercial

- 5.4.2. Military & Government

- 5.4.3. Other

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NewSpace Systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SENER Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 OHB SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Innovative Solutions in Space BV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sitael S p A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Thale

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jena-Optronik

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AAC Clyde Space

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 NewSpace Systems

List of Figures

- Figure 1: North America Satellite Attitude and Orbit Control System Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Satellite Attitude and Orbit Control System Market Share (%) by Company 2025

List of Tables

- Table 1: North America Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: North America Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 3: North America Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 4: North America Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by End User 2020 & 2033

- Table 5: North America Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: North America Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 8: North America Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 9: North America Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: North America Satellite Attitude and Orbit Control System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Satellite Attitude and Orbit Control System Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Satellite Attitude and Orbit Control System Market?

The projected CAGR is approximately 10.94%.

2. Which companies are prominent players in the North America Satellite Attitude and Orbit Control System Market?

Key companies in the market include NewSpace Systems, SENER Group, OHB SE, Innovative Solutions in Space BV, Sitael S p A, Thale, Jena-Optronik, AAC Clyde Space.

3. What are the main segments of the North America Satellite Attitude and Orbit Control System Market?

The market segments include Application, Satellite Mass, Orbit Class, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.96 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Jena-Optronik announced that it has been selected by satellite constellation manufacturer Airbus OneWeb Satellites to provide the ASTRO CL a Attitude and Orbit Control Systems (AOCS) sensor for the ARROW family of small satellites.December 2022: ASTRO CL, the smallest member of Jena-Optronik's ASTRO star tracker family, has been chosen to support the new proliferated LEO satellite platform at Maxar. Each satellite will carry two ASTRO CL star trackers to enable its guidance, navigation and control.November 2022: NASA's mission Artemis I was equipped with two star sensors by Jena-Optronik GmbH, which would ensure the precise alignment of the spaceship on its way to the Moon.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Satellite Attitude and Orbit Control System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Satellite Attitude and Orbit Control System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Satellite Attitude and Orbit Control System Market?

To stay informed about further developments, trends, and reports in the North America Satellite Attitude and Orbit Control System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence