Key Insights

The North America Vehicles Tolling Systems Market is experiencing substantial expansion, propelled by escalating urban traffic congestion and a growing demand for efficient, automated toll collection solutions. The market's projected Compound Annual Growth Rate (CAGR) of 8.3% indicates a robust upward trend. This growth is primarily attributed to the widespread adoption of Electronic Toll Collection (ETC) systems, which enhance traffic flow, reduce congestion, and improve revenue collection efficiency. Government investments in infrastructure development and modernization, particularly for bridges and roads, further stimulate market growth. The shift from traditional barrier tolling to ETC systems offers a more streamlined and user-friendly experience for motorists. Advancements in AI-powered systems and data analytics are also contributing to enhanced system functionality and overall efficiency. The market is segmented by toll collection type (barrier, entry/exit, electronic) and application (bridges, roads, tunnels), presenting diverse opportunities across infrastructure projects.

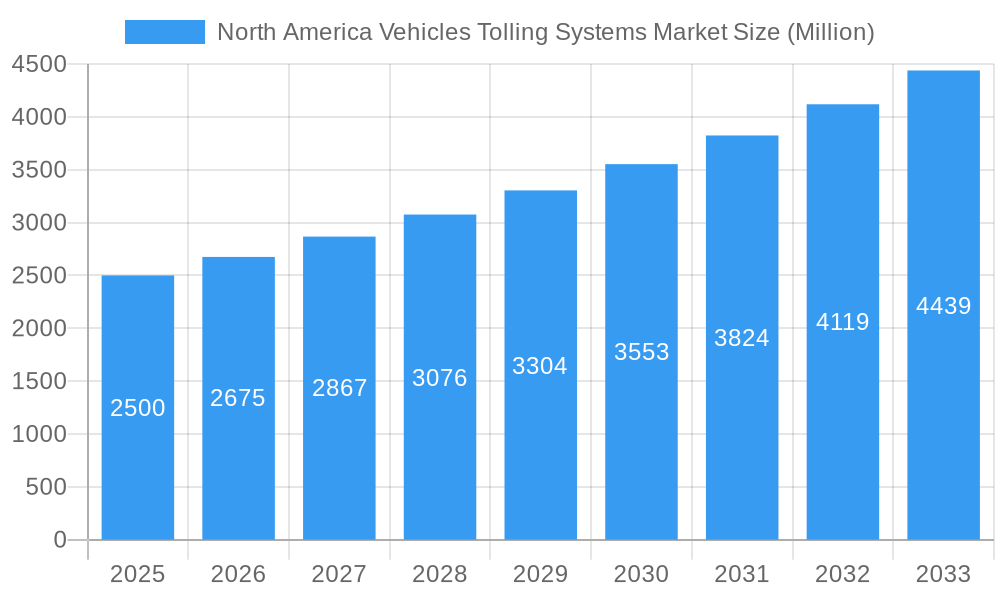

North America Vehicles Tolling Systems Market Market Size (In Billion)

Despite significant growth potential, challenges such as high initial investment costs for implementing and upgrading ETC systems, and concerns regarding data privacy and security, remain. However, the market is expected to maintain its upward trajectory, driven by the imperative for effective traffic management and the continuous development of advanced tolling technologies. Key market participants, including Mitsubishi Heavy Industries, International Road Dynamics, Emovis, Thales Group, and Nedap NV, are actively engaging in innovation and strategic collaborations. The North American region, led by the United States and Canada, is anticipated to lead market growth due to substantial investments in infrastructure and advanced transportation solutions. We project the 2025 market size to reach $10334.9 million.

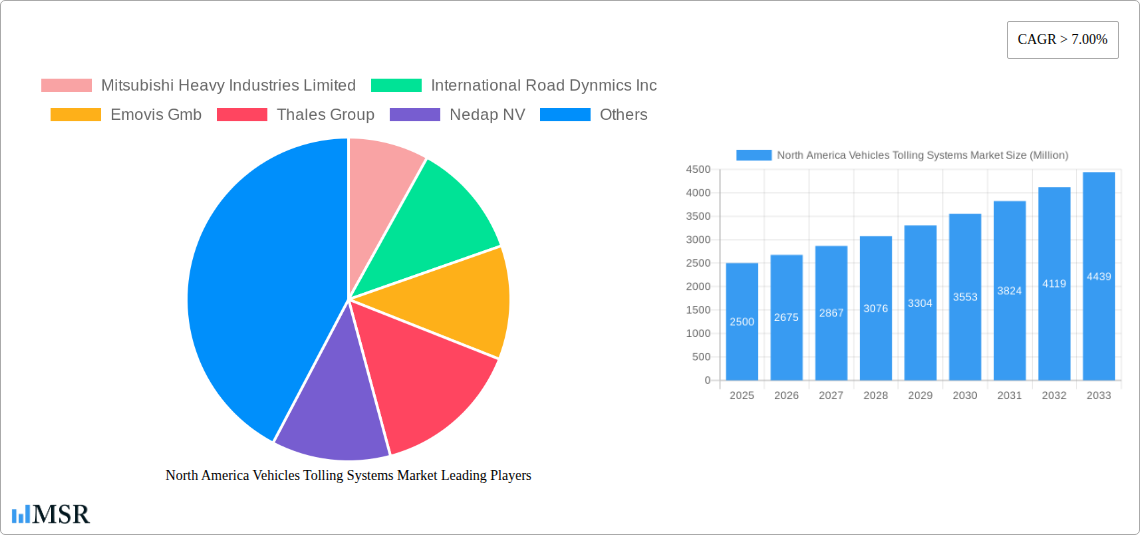

North America Vehicles Tolling Systems Market Company Market Share

North America Vehicles Tolling Systems Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Vehicles Tolling Systems Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key segments, leading players, and future growth prospects. The study encompasses various toll collection types (Barrier, Entry/Exit, Electronic) and application types (Bridges, Roads, Tunnels), offering a granular understanding of this rapidly evolving sector.

North America Vehicles Tolling Systems Market Market Concentration & Dynamics

The North American vehicles tolling systems market exhibits a moderately consolidated structure, with a handful of major players holding significant market share. Mitsubishi Heavy Industries Limited, International Road Dynamics Inc, Emovis GmbH, Thales Group, and Nedap NV are among the key players shaping the landscape. Market share estimations for 2025 indicate that the top five companies collectively account for approximately XX% of the total market revenue. The market is characterized by a dynamic innovation ecosystem, with ongoing research and development in areas such as AI-powered toll collection, advanced sensor technologies, and improved data analytics. Regulatory frameworks, varying across different states and provinces, play a crucial role, influencing the adoption of specific technologies and business models. Substitute products, such as alternative transportation systems and congestion pricing mechanisms, represent potential competitive challenges. End-user trends, including increasing preference for seamless and cashless payment options, fuel market growth. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with approximately XX M&A deals recorded between 2019 and 2024. Future M&A activity is anticipated to increase, driven by the need for companies to expand their geographical reach and technological capabilities.

- Market Concentration: Moderately consolidated, with top 5 players holding XX% market share (2025).

- Innovation: Focus on AI, advanced sensors, and data analytics.

- Regulatory Framework: Varies across regions, influencing technology adoption.

- Substitute Products: Alternative transportation, congestion pricing.

- End-User Trends: Growing preference for cashless and seamless tolling.

- M&A Activity: Approximately XX deals between 2019 and 2024.

North America Vehicles Tolling Systems Market Industry Insights & Trends

The North American vehicles tolling systems market is experiencing robust growth, driven by increasing urbanization, traffic congestion, and the need for efficient infrastructure management. The market size in 2025 is estimated at $XX Million, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). Technological disruptions, such as the widespread adoption of electronic toll collection (ETC) systems, are transforming the industry, leading to improved efficiency, reduced operational costs, and enhanced user experience. Evolving consumer behaviors, marked by a shift towards cashless payments and digital technologies, are further fueling market expansion. The increasing focus on interoperability between different tolling systems and the integration of tolling data with smart city initiatives represent key trends shaping the market's future trajectory. Government initiatives promoting public-private partnerships (PPPs) for infrastructure development are also bolstering market growth.

Key Markets & Segments Leading North America Vehicles Tolling Systems Market

The Electronic Toll Collection (ETC) segment dominates the North American vehicles tolling systems market, driven by its convenience, efficiency, and reduced reliance on manual toll collection processes. The Roads application type holds the largest market share, owing to the extensive road networks across North America requiring effective tolling solutions. The strongest regional markets are concentrated in the densely populated areas of the East Coast and West Coast of the United States and major metropolitan areas in Canada.

- Dominant Segment: Electronic Toll Collection (ETC)

- Dominant Application: Roads

- Key Regional Markets: East Coast & West Coast US, major Canadian cities.

Drivers for Growth:

- Increasing Urbanization and Congestion: Leading to higher demand for efficient tolling solutions.

- Government Initiatives: Investments in infrastructure development and PPPs.

- Technological Advancements: Enhanced ETC systems and data analytics capabilities.

- Economic Growth: Increased vehicle ownership and travel.

North America Vehicles Tolling Systems Market Product Developments

Recent product innovations focus on enhancing the accuracy and efficiency of toll collection systems. This includes the integration of advanced technologies like artificial intelligence (AI) and machine learning (ML) for improved vehicle identification and fraud detection. The development of multi-lane free-flow (MLFF) tolling systems is streamlining traffic flow and reducing congestion. These innovations are providing significant competitive advantages by enhancing operational efficiency and improving user experience.

Challenges in the North America Vehicles Tolling Systems Market Market

The North America Vehicles Tolling Systems Market faces several challenges, including regulatory hurdles in certain jurisdictions, supply chain disruptions affecting the procurement of essential components, and intense competition from both established and emerging players. These factors can impact project timelines, increase costs, and limit market penetration. Specifically, the high upfront investment needed for ETC system implementation poses a significant hurdle for smaller companies entering the market.

Forces Driving North America Vehicles Tolling Systems Market Growth

The market's growth is primarily driven by escalating traffic congestion in major metropolitan areas, coupled with government initiatives aimed at improving infrastructure and streamlining transportation systems. Further fueling this growth is the increased adoption of electronic tolling technologies, enhancing efficiency and reducing operational costs. The rising focus on smart city development and data analytics further bolsters market growth prospects.

Long-Term Growth Catalysts in the North America Vehicles Tolling Systems Market

Long-term growth is projected to be sustained by continuous technological innovations, strategic partnerships between system providers and infrastructure operators, and market expansion into new geographic regions. This includes the growing demand for interoperable tolling systems across state and provincial borders.

Emerging Opportunities in North America Vehicles Tolling Systems Market

Emerging opportunities lie in the development of integrated tolling solutions that incorporate functionalities such as real-time traffic management and dynamic pricing. The expansion of ETC systems to encompass broader transportation modes, beyond just automobiles, presents another significant opportunity. Furthermore, the integration of tolling data with other smart city initiatives creates avenues for enhanced data analysis and urban planning.

Leading Players in the North America Vehicles Tolling Systems Market Sector

- Mitsubishi Heavy Industries Limited

- International Road Dynamics Inc

- Emovis GmbH

- Thales Group

- Nedap NV

- TansCore Atlantic LLC

- Cintra

- Magnetic Autocontrol GmbH

Key Milestones in North America Vehicles Tolling Systems Market Industry

- 2020: Increased adoption of cashless tolling systems across multiple states.

- 2021: Several major infrastructure projects integrating advanced tolling technologies.

- 2022: Launch of new MLFF tolling systems in major metropolitan areas.

- 2023: Increased focus on interoperability between different tolling systems.

- 2024: Several M&A deals shaping the market landscape.

Strategic Outlook for North America Vehicles Tolling Systems Market Market

The North American vehicles tolling systems market presents substantial growth potential over the coming years. Strategic opportunities for market participants include focusing on developing innovative and interoperable systems, forging strategic partnerships, and expanding into emerging markets. The market is projected to experience sustained growth driven by technological advancements, rising infrastructure investments, and the increasing demand for efficient transportation solutions.

North America Vehicles Tolling Systems Market Segmentation

-

1. Toll Collection Type

- 1.1. Barrier Toll Collection

- 1.2. Entry/ExiT Toll Collection

- 1.3. Electronic Toll Collection

-

2. Application Type

- 2.1. Bridges

- 2.2. Roads

- 2.3. Tunnels

-

3. Geography

-

3.1. North America

- 3.1.1. United States Of America

- 3.1.2. Canada

- 3.1.3. Rest of North America

-

3.1. North America

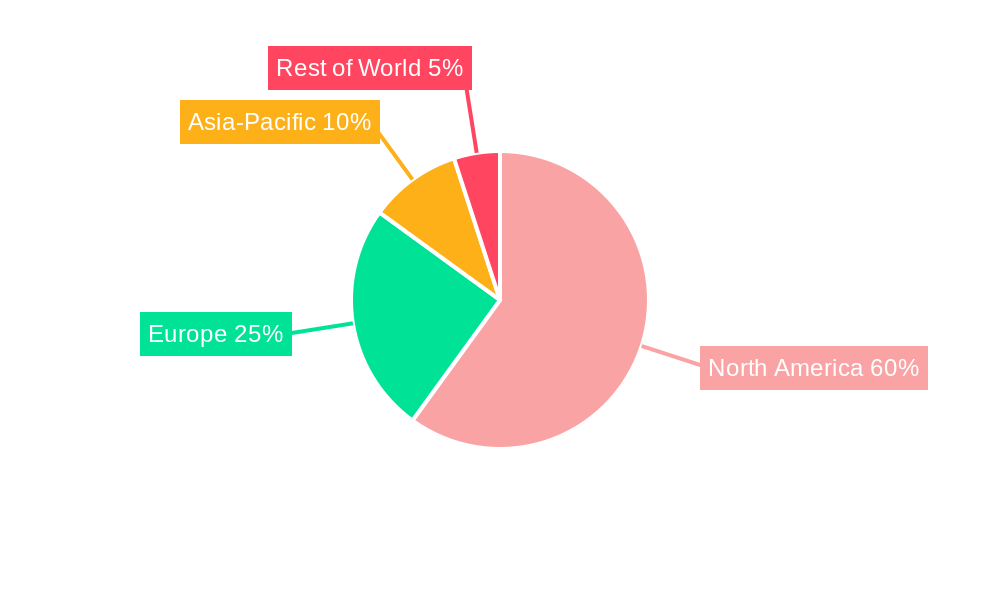

North America Vehicles Tolling Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States Of America

- 1.2. Canada

- 1.3. Rest of North America

North America Vehicles Tolling Systems Market Regional Market Share

Geographic Coverage of North America Vehicles Tolling Systems Market

North America Vehicles Tolling Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives to Promote Sales of Electric Vehicle

- 3.3. Market Restrains

- 3.3.1. High Initial Investment for Installing Electric Vehicle Charging Infrastructure

- 3.4. Market Trends

- 3.4.1. Electronic Toll Collection is Expected to Witness the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Vehicles Tolling Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Toll Collection Type

- 5.1.1. Barrier Toll Collection

- 5.1.2. Entry/ExiT Toll Collection

- 5.1.3. Electronic Toll Collection

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Bridges

- 5.2.2. Roads

- 5.2.3. Tunnels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States Of America

- 5.3.1.2. Canada

- 5.3.1.3. Rest of North America

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Toll Collection Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mitsubishi Heavy Industries Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 International Road Dynmics Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Emovis Gmb

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Thales Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nedap NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TansCore Atlantic LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cintra

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Magnetic Autocontrol GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Mitsubishi Heavy Industries Limited

List of Figures

- Figure 1: North America Vehicles Tolling Systems Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Vehicles Tolling Systems Market Share (%) by Company 2025

List of Tables

- Table 1: North America Vehicles Tolling Systems Market Revenue million Forecast, by Toll Collection Type 2020 & 2033

- Table 2: North America Vehicles Tolling Systems Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 3: North America Vehicles Tolling Systems Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: North America Vehicles Tolling Systems Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: North America Vehicles Tolling Systems Market Revenue million Forecast, by Toll Collection Type 2020 & 2033

- Table 6: North America Vehicles Tolling Systems Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 7: North America Vehicles Tolling Systems Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: North America Vehicles Tolling Systems Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Of America North America Vehicles Tolling Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Vehicles Tolling Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America North America Vehicles Tolling Systems Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Vehicles Tolling Systems Market?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the North America Vehicles Tolling Systems Market?

Key companies in the market include Mitsubishi Heavy Industries Limited, International Road Dynmics Inc, Emovis Gmb, Thales Group, Nedap NV, TansCore Atlantic LLC, Cintra, Magnetic Autocontrol GmbH.

3. What are the main segments of the North America Vehicles Tolling Systems Market?

The market segments include Toll Collection Type, Application Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 10334.9 million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives to Promote Sales of Electric Vehicle.

6. What are the notable trends driving market growth?

Electronic Toll Collection is Expected to Witness the Highest Growth Rate.

7. Are there any restraints impacting market growth?

High Initial Investment for Installing Electric Vehicle Charging Infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Vehicles Tolling Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Vehicles Tolling Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Vehicles Tolling Systems Market?

To stay informed about further developments, trends, and reports in the North America Vehicles Tolling Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence