Key Insights

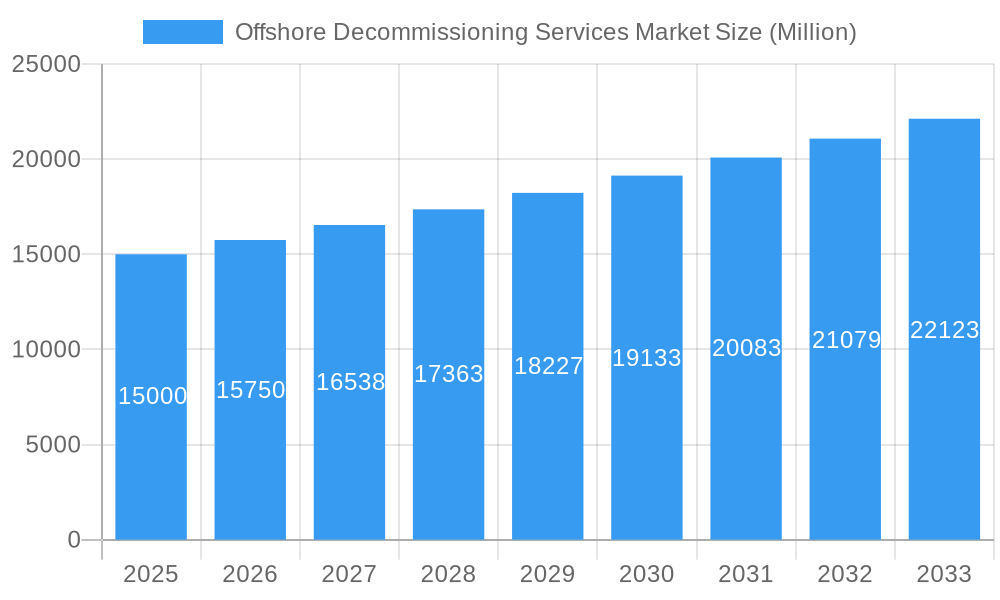

The offshore decommissioning services market is poised for substantial expansion, propelled by aging offshore oil and gas infrastructure and intensified regulatory mandates for responsible asset retirement. With a projected Compound Annual Growth Rate (CAGR) of 6.5%, the market is anticipated to reach a valuation of 11.1 billion by 2025. Key growth drivers include stringent environmental regulations aimed at minimizing ecological impact, escalating maintenance costs for aging platforms, and a rising number of assets nearing the end of their operational lifespan. Market segmentation by water depth (shallow, deepwater, ultra-deepwater) highlights the diverse complexities and associated costs, with deepwater and ultra-deepwater projects demanding specialized expertise and advanced technologies. Leading market participants, including Aker Solutions ASA, DNV GL, Heerema Marine Contractors, and TechnipFMC, are actively investing in innovative solutions and expanding service portfolios to meet escalating demand. Geographically, significant activity is observed in North America (particularly the US), Europe (notably the North Sea), and Asia-Pacific, reflecting the concentration of mature oil and gas fields. Future growth will be further fueled by technological advancements in decommissioning techniques, enhanced efficiency and safety standards, and an ongoing commitment to reducing the environmental footprint of offshore operations.

Offshore Decommissioning Services Market Market Size (In Billion)

The adoption of sustainable decommissioning practices and the development of innovative, resource-optimizing technologies are further stimulating market growth. Collaborative efforts among governments, regulatory bodies, and industry stakeholders are vital for establishing best practices and ensuring safe, efficient asset decommissioning. The growing emphasis on renewable energy development also contributes to market expansion, as the decommissioning of older platforms creates opportunities for offshore wind farms and other renewable energy installations. Despite potential challenges such as economic volatility impacting capital expenditure, technological complexities in intricate decommissioning projects, and evolving regulatory landscapes, the overall market outlook remains robust, driven by sustained asset retirement and continuous investment in advanced decommissioning technologies, ensuring long-term market sustainability and growth.

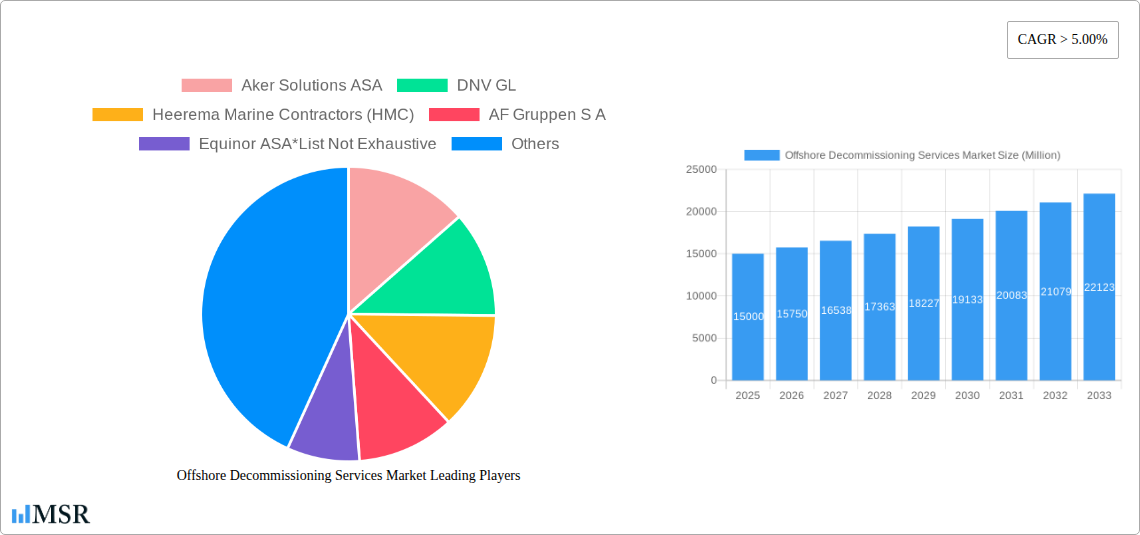

Offshore Decommissioning Services Market Company Market Share

Offshore Decommissioning Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Offshore Decommissioning Services Market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The report delves into market dynamics, key segments (shallow water, deepwater, and ultra-deepwater), leading players, and emerging opportunities, providing a 360-degree view of this rapidly evolving market. The global market size in 2025 is estimated at $XX Million.

Offshore Decommissioning Services Market Concentration & Dynamics

The Offshore Decommissioning Services market exhibits a moderately concentrated structure, with several large players holding significant market share. Aker Solutions ASA, DNV GL, Heerema Marine Contractors (HMC), AF Gruppen S A, and Equinor ASA are among the key players, though the market is not exhaustive and includes several other notable participants like Able UK, John Wood Group PLC, DeepOcean Group Holding B V, TechnipFMC PLC, and Allseas Group. Market share fluctuates based on project wins and technological advancements. M&A activity in the sector has been relatively low in recent years with an estimated xx deals concluded between 2019 and 2024. However, the increasing number of decommissioning projects globally may stimulate future consolidation.

The industry is characterized by a dynamic innovation ecosystem, with continuous advancements in technologies for subsea intervention, remotely operated vehicles (ROVs), and automated decommissioning processes. Stringent regulatory frameworks, varying by region, influence operational procedures and investment decisions. Substitute products are limited, but efficient and cost-effective alternatives are constantly emerging. End-user trends towards sustainability and environmentally responsible decommissioning practices are shaping industry standards.

Offshore Decommissioning Services Market Industry Insights & Trends

The Offshore Decommissioning Services market is witnessing robust growth, driven by the aging offshore oil and gas infrastructure and the increasing emphasis on environmental compliance. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated value of $XX Million by 2033. Several factors fuel this expansion, including stricter government regulations mandating decommissioning, the rising number of aging offshore assets requiring removal, and continuous technological advancements leading to cost-effective and safer decommissioning processes. The growing awareness of environmental concerns further accelerates market growth by encouraging environmentally sound decommissioning methods. Technological disruptions, such as the adoption of advanced robotics and AI-powered solutions, are revolutionizing operational efficiency and minimizing environmental impact. Changing consumer behavior, with a greater emphasis on corporate social responsibility (CSR), is also pushing companies towards sustainable decommissioning practices.

Key Markets & Segments Leading Offshore Decommissioning Services Market

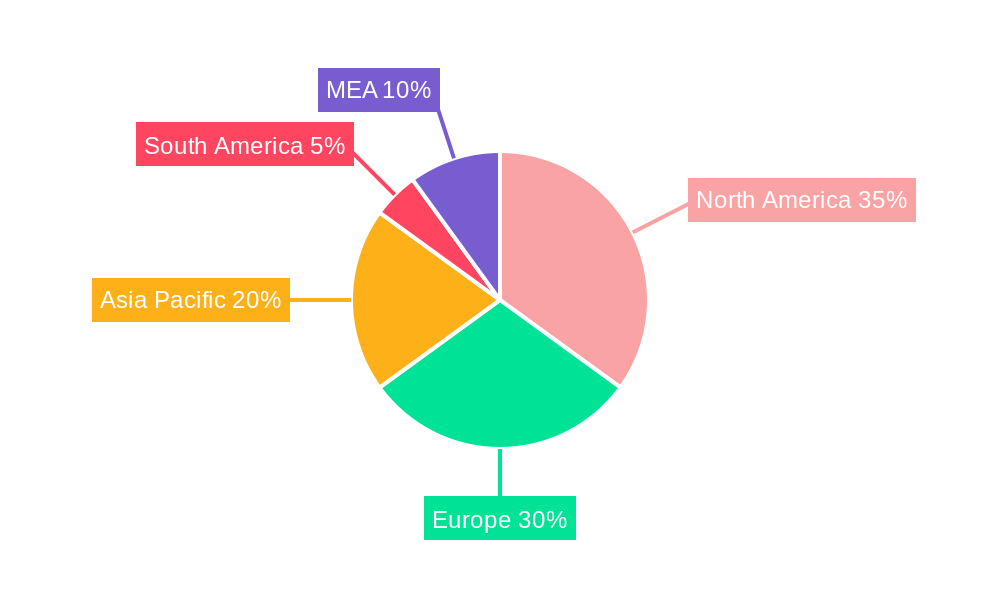

The North Sea region currently dominates the Offshore Decommissioning Services market, driven by a high concentration of aging offshore platforms and stringent environmental regulations. Other significant regions include the Gulf of Mexico and the Asia-Pacific.

- Drivers in the North Sea: High concentration of aging assets, strict regulatory framework, extensive experience in decommissioning, and substantial government funding for environmentally friendly projects.

- Drivers in the Gulf of Mexico: Significant number of maturing oil and gas fields, government incentives for decommissioning, and availability of specialized service providers.

- Drivers in the Asia-Pacific: Rapid growth in offshore oil and gas exploration and production in recent years leading to an increasing number of aging assets that will soon need decommissioning.

Deepwater and ultra-deepwater segments hold significant potential for future growth due to the complexities and associated costs of decommissioning in these challenging environments. Technological advancements are crucial in making these operations more cost-effective and safe, and increasing the demand for skilled professionals specialized in such deepwater and ultra-deepwater decommissioning projects further drives the growth in this segment.

Offshore Decommissioning Services Market Product Developments

Recent product innovations include advanced ROVs capable of performing complex tasks, improved subsea cutting and lifting equipment, and software solutions for planning and managing decommissioning projects. These advancements have significantly enhanced operational efficiency, safety, and environmental responsibility. The development of specialized vessels and equipment designed specifically for decommissioning activities provides a competitive edge, while the integration of automation and AI is streamlining operations and reducing costs.

Challenges in the Offshore Decommissioning Services Market Market

The Offshore Decommissioning Services market faces challenges including stringent regulatory requirements, which can increase costs and timelines for projects. Supply chain constraints for specialized equipment and skilled personnel can also lead to delays. Intense competition among service providers puts pressure on pricing and profit margins, especially with an increase in the number of companies entering the market. These factors can collectively impact project feasibility and profitability by an estimated xx% in certain projects.

Forces Driving Offshore Decommissioning Services Market Growth

Several factors drive growth, including increasing numbers of aging offshore installations requiring decommissioning, stricter environmental regulations demanding responsible asset removal, and rising investments in innovative decommissioning technologies. Government incentives and supportive policies also play a crucial role, along with advancements in ROVs, subsea cutting, and remote operations. The growing demand for sustainable practices further fuels market expansion.

Long-Term Growth Catalysts in the Offshore Decommissioning Services Market

Long-term growth will be fueled by continuous innovation in decommissioning technologies, strategic partnerships among service providers and oil and gas companies, and expansion into new geographical markets with significant decommissioning needs. Collaboration between industry players will lead to improved solutions and more efficient operational strategies. Exploring new and innovative technologies, including AI and robotics will lead to further cost optimization and environmental improvements.

Emerging Opportunities in Offshore Decommissioning Services Market

Emerging opportunities lie in the development of advanced recycling technologies for recovered materials, expansion into renewable energy decommissioning services, and the provision of integrated decommissioning solutions that encompass planning, execution, and waste management. The use of sustainable materials and environmentally sound practices will also help increase opportunities in the future.

Leading Players in the Offshore Decommissioning Services Market Sector

- Aker Solutions ASA

- DNV GL

- Heerema Marine Contractors (HMC)

- AF Gruppen S A

- Equinor ASA

- Able UK

- John Wood Group PLC

- DeepOcean Group Holding B V

- TechnipFMC PLC

- Allseas Group

Key Milestones in Offshore Decommissioning Services Market Industry

- 2020: Increased focus on sustainable decommissioning practices driven by stricter environmental regulations.

- 2021: Several significant decommissioning projects awarded in the North Sea.

- 2022: Introduction of advanced robotics and AI-powered solutions in decommissioning operations.

- 2023: Several mergers and acquisitions among service providers to consolidate market share.

- 2024: Growing emphasis on circular economy approaches in decommissioning projects.

Strategic Outlook for Offshore Decommissioning Services Market Market

The Offshore Decommissioning Services market holds significant long-term growth potential driven by the continued aging of offshore oil and gas infrastructure globally. Strategic opportunities exist for companies to invest in innovative technologies, expand geographically, and build strong partnerships to capitalize on this growing demand. Focusing on sustainable and environmentally responsible practices will be crucial for long-term success, attracting environmentally-conscious customers. The market's future hinges on the industry's adoption of efficient, cost-effective, and sustainable solutions.

Offshore Decommissioning Services Market Segmentation

-

1. Water Depth

- 1.1. Shallow Water

- 1.2. Deepwater and Ultra-Deepwater

Offshore Decommissioning Services Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Offshore Decommissioning Services Market Regional Market Share

Geographic Coverage of Offshore Decommissioning Services Market

Offshore Decommissioning Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Demand for Secure

- 3.2.2 Sustainable

- 3.2.3 and Clean Energy

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Production of Biofuels

- 3.4. Market Trends

- 3.4.1. Shallow Water to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Offshore Decommissioning Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Water Depth

- 5.1.1. Shallow Water

- 5.1.2. Deepwater and Ultra-Deepwater

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Water Depth

- 6. North America Offshore Decommissioning Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Water Depth

- 6.1.1. Shallow Water

- 6.1.2. Deepwater and Ultra-Deepwater

- 6.1. Market Analysis, Insights and Forecast - by Water Depth

- 7. Europe Offshore Decommissioning Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Water Depth

- 7.1.1. Shallow Water

- 7.1.2. Deepwater and Ultra-Deepwater

- 7.1. Market Analysis, Insights and Forecast - by Water Depth

- 8. Asia Pacific Offshore Decommissioning Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Water Depth

- 8.1.1. Shallow Water

- 8.1.2. Deepwater and Ultra-Deepwater

- 8.1. Market Analysis, Insights and Forecast - by Water Depth

- 9. South America Offshore Decommissioning Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Water Depth

- 9.1.1. Shallow Water

- 9.1.2. Deepwater and Ultra-Deepwater

- 9.1. Market Analysis, Insights and Forecast - by Water Depth

- 10. Middle East and Africa Offshore Decommissioning Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Water Depth

- 10.1.1. Shallow Water

- 10.1.2. Deepwater and Ultra-Deepwater

- 10.1. Market Analysis, Insights and Forecast - by Water Depth

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Aker Solutions ASA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DNV GL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Heerema Marine Contractors (HMC)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AF Gruppen S A

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Equinor ASA*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Able UK

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 John Wood Group PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DeepOcean Group Holding B V

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TechnipFMC PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Allseas Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Aker Solutions ASA

List of Figures

- Figure 1: Global Offshore Decommissioning Services Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Offshore Decommissioning Services Market Revenue (billion), by Water Depth 2025 & 2033

- Figure 3: North America Offshore Decommissioning Services Market Revenue Share (%), by Water Depth 2025 & 2033

- Figure 4: North America Offshore Decommissioning Services Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Offshore Decommissioning Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Offshore Decommissioning Services Market Revenue (billion), by Water Depth 2025 & 2033

- Figure 7: Europe Offshore Decommissioning Services Market Revenue Share (%), by Water Depth 2025 & 2033

- Figure 8: Europe Offshore Decommissioning Services Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Offshore Decommissioning Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Offshore Decommissioning Services Market Revenue (billion), by Water Depth 2025 & 2033

- Figure 11: Asia Pacific Offshore Decommissioning Services Market Revenue Share (%), by Water Depth 2025 & 2033

- Figure 12: Asia Pacific Offshore Decommissioning Services Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Offshore Decommissioning Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Offshore Decommissioning Services Market Revenue (billion), by Water Depth 2025 & 2033

- Figure 15: South America Offshore Decommissioning Services Market Revenue Share (%), by Water Depth 2025 & 2033

- Figure 16: South America Offshore Decommissioning Services Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Offshore Decommissioning Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Offshore Decommissioning Services Market Revenue (billion), by Water Depth 2025 & 2033

- Figure 19: Middle East and Africa Offshore Decommissioning Services Market Revenue Share (%), by Water Depth 2025 & 2033

- Figure 20: Middle East and Africa Offshore Decommissioning Services Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Offshore Decommissioning Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Offshore Decommissioning Services Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 2: Global Offshore Decommissioning Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Offshore Decommissioning Services Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 4: Global Offshore Decommissioning Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Offshore Decommissioning Services Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 6: Global Offshore Decommissioning Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Offshore Decommissioning Services Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 8: Global Offshore Decommissioning Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Offshore Decommissioning Services Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 10: Global Offshore Decommissioning Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Offshore Decommissioning Services Market Revenue billion Forecast, by Water Depth 2020 & 2033

- Table 12: Global Offshore Decommissioning Services Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Offshore Decommissioning Services Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Offshore Decommissioning Services Market?

Key companies in the market include Aker Solutions ASA, DNV GL, Heerema Marine Contractors (HMC), AF Gruppen S A, Equinor ASA*List Not Exhaustive, Able UK, John Wood Group PLC, DeepOcean Group Holding B V, TechnipFMC PLC, Allseas Group.

3. What are the main segments of the Offshore Decommissioning Services Market?

The market segments include Water Depth.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.1 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Secure. Sustainable. and Clean Energy.

6. What are the notable trends driving market growth?

Shallow Water to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Cost of Production of Biofuels.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Offshore Decommissioning Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Offshore Decommissioning Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Offshore Decommissioning Services Market?

To stay informed about further developments, trends, and reports in the Offshore Decommissioning Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence