Key Insights

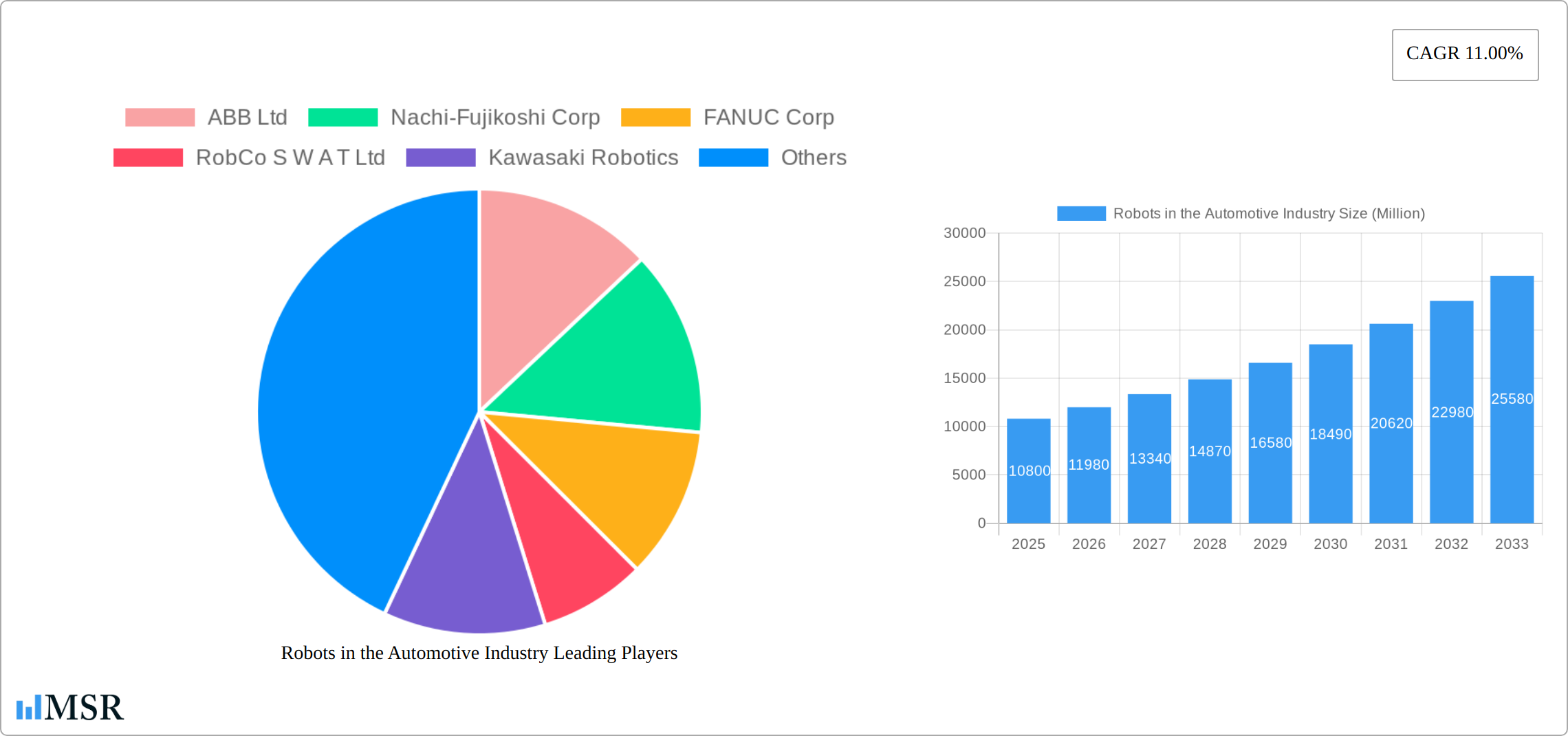

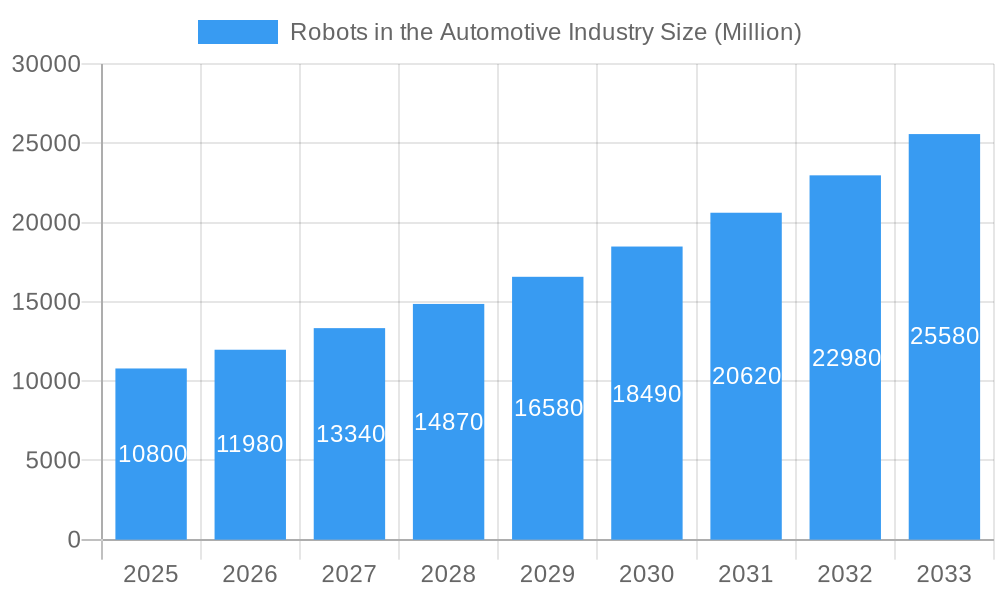

The automotive robotics market is experiencing robust growth, projected to reach \$10.80 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 11% through 2033. This expansion is driven by several key factors. Increasing automation in automotive manufacturing to enhance production efficiency and reduce labor costs is a major driver. The rising demand for electric vehicles (EVs) and the consequent need for specialized robots in battery production and assembly further fuels market growth. Advancements in robotics technology, such as the development of collaborative robots (cobots) and improved sensor technology, are also contributing to market expansion. While supply chain disruptions and the high initial investment costs associated with robotic integration represent potential restraints, the long-term benefits in terms of improved quality, speed, and flexibility outweigh these challenges. The market is segmented by component type (controllers, robotic arms, end effectors, drives, and sensors), product type (Cartesian, SCARA, articulated, and other robots), function type (welding, painting, assembly, cutting, and milling), and end-user type (vehicle and component manufacturers). The Asia-Pacific region, particularly China and Japan, is expected to dominate the market due to significant automotive manufacturing activity and substantial government investment in automation. North America and Europe also contribute significantly, driven by technological advancements and the presence of major automotive manufacturers.

Robots in the Automotive Industry Market Size (In Billion)

The competitive landscape is characterized by the presence of several established players, including ABB, FANUC, KUKA, Yaskawa, and others. These companies are constantly innovating to offer advanced robotic solutions tailored to the specific needs of the automotive industry. Strategic partnerships, mergers, and acquisitions are common strategies employed to expand market share and enhance technological capabilities. The focus on developing customized robotic solutions for specific automotive applications, such as lightweighting of vehicles and the integration of autonomous driving systems, is shaping future market trends. The ongoing evolution towards Industry 4.0 and the increasing adoption of smart factories will further accelerate the growth of the automotive robotics market in the coming years. This trend towards intelligent, connected robots capable of data analysis and self-optimization will significantly impact manufacturing processes and productivity.

Robots in the Automotive Industry Company Market Share

Robots in the Automotive Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Robots in the Automotive Industry market, offering invaluable insights for stakeholders across the automotive value chain. From market size and CAGR projections to key players and emerging trends, this report is your essential guide to navigating this rapidly evolving sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report features detailed segmentation by component type (Controllers, Robotic Arms, End Effectors, Drive and Sensors), product type (Cartesian Robots, SCARA Robots, Articulated Robots, Other Product Types), function type (Welding Robots, Painting Robots, Assembling and Disassembling Robots, Cutting and Milling Robots), and end-user type (Vehicle Manufacturers, Automotive Component Manufacturers). The total market value is projected to reach xx Million by 2033.

Robots in the Automotive Industry Market Concentration & Dynamics

The competitive landscape of the automotive robotics market is dynamic and evolving, characterized by a blend of established global leaders and agile, specialized robotics innovators. Market share is significantly concentrated among key players such as ABB, FANUC, and KUKA, who consistently drive advancements and large-scale deployments. However, a burgeoning ecosystem of smaller, forward-thinking companies is injecting fresh innovation and intensifying competition across various segments. The industry is also witnessing robust Mergers and Acquisitions (M&A) activity, as major corporations strategically acquire capabilities, expand their product portfolios, and enhance their market reach to meet the accelerating demands of automotive manufacturing.

- Market Concentration: The top 5 players are projected to command approximately 60-65% of the market share in 2025, underscoring the significant influence of dominant entities while acknowledging room for growth among emerging contenders.

- Innovation Ecosystems: A vibrant network of collaborative partnerships between automotive manufacturers, dedicated robotics solution providers, and cutting-edge technology developers is the engine behind the rapid evolution and sophistication of robotics in automotive applications.

- Regulatory Frameworks: Stringent government regulations concerning operational safety, environmental emissions, and the ethical integration of automation are pivotal in shaping the adoption trajectory of robotics within the automotive sector. Navigating and adhering to these compliance requirements can present notable cost considerations for industry participants.

- Substitute Products: While the efficiency and precision of robotic systems continue to advance, traditional manual labor persists as a potential, albeit less cost-effective and quality-consistent, alternative for certain tasks. The economic and qualitative advantages of robotics increasingly outweigh manual processes for most automotive manufacturing operations.

- End-User Trends: The relentless pursuit of enhanced operational efficiency, superior product quality, and the escalating demand for advanced automation are the primary catalysts for robot adoption in automotive manufacturing. The transformative shift towards Electric Vehicles (EVs) and the burgeoning development of autonomous driving technologies are poised to further accelerate this trend, creating new opportunities and demands for robotic solutions.

- M&A Activity: Spanning the historical period from 2019 to 2024, an estimated 40-50 M&A deals were executed within the automotive robotics sector. The aggregate value of these strategic transactions is estimated to have reached approximately $500-700 Million, highlighting significant consolidation and strategic investment.

Robots in the Automotive Industry Industry Insights & Trends

The global automotive robotics market is experiencing robust growth, driven by several key factors. The increasing demand for automation in automotive manufacturing processes is a major catalyst. This is complemented by technological advancements leading to increased efficiency, precision, and flexibility of robots. Furthermore, the growing adoption of Industry 4.0 principles, particularly in areas like predictive maintenance and AI-driven process optimization, is significantly impacting market expansion. The global market size was valued at xx Million in 2024, and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is attributed to factors such as the increasing adoption of automation in automotive manufacturing, advancements in robotics technology, and the growing demand for electric vehicles (EVs).

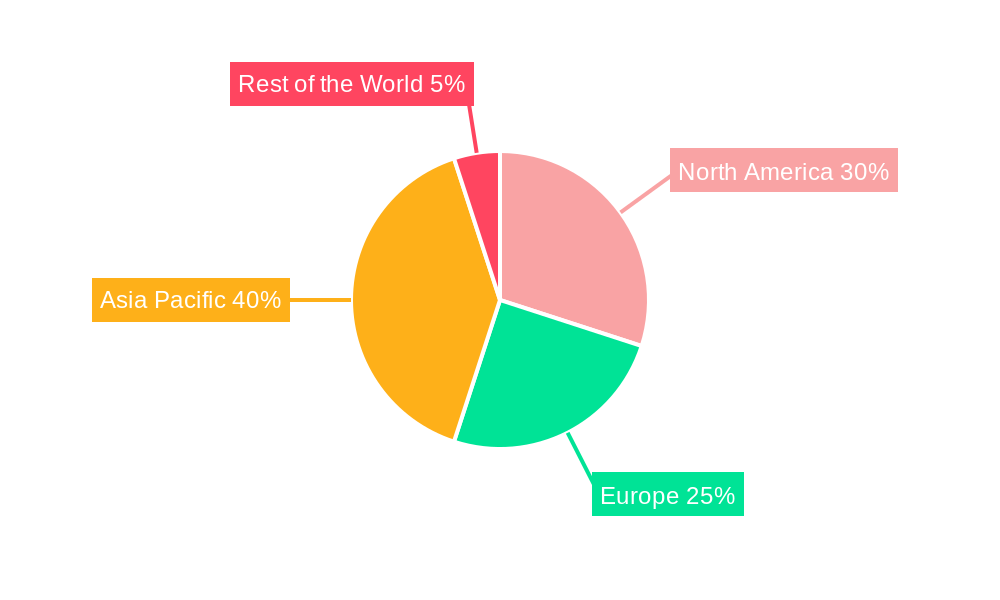

Key Markets & Segments Leading Robots in the Automotive Industry

The Asia-Pacific region stands as the undisputed leader in the automotive robotics market, propelled by robust economic expansion, substantial investments in state-of-the-art automotive manufacturing infrastructure, and the concentrated presence of both global automotive giants and leading robotics developers. Within this dominant region, China emerges as the largest individual market, fueled by its unparalleled automotive production volume and strong governmental backing for technological innovation and automation.

- By Component Type: Robotic arms continue to represent the largest and most crucial segment of the market, followed closely by sophisticated controllers and versatile end-effectors, which are essential for task-specific robotic functionality.

- By Product Type: Articulated robots maintain a commanding market share due to their flexibility and wide range of applications, with SCARA and Cartesian robots also demonstrating significant adoption for specific assembly and material handling tasks.

- By Function Type: Welding robots remain the dominant application, essential for vehicle body construction. Assembly and disassembly robots are also experiencing robust growth as manufacturers seek to automate more complex production processes.

- By End-user Type: Direct vehicle manufacturers constitute the largest segment of end-users, with automotive component manufacturers following closely as key adopters of robotic technologies to enhance their production lines.

- Drivers for Growth:

- The escalating demand for advanced automation solutions in all facets of vehicle manufacturing.

- The accelerating adoption of Electric Vehicles (EVs) and autonomous driving technologies, which necessitate new and specialized robotic capabilities.

- Substantial investments in upgrading and expanding advanced manufacturing infrastructure across the globe.

- Favorable government incentives and supportive policies designed to encourage automation and technological advancement in the automotive sector.

Robots in the Automotive Industry Product Developments

Recent product innovations include the introduction of collaborative robots (cobots) that can work safely alongside human workers, improving manufacturing flexibility. Advancements in artificial intelligence (AI) and machine learning (ML) are enabling robots to perform more complex tasks and adapt to changing environments. The development of lightweight and high-precision robots is also enhancing their applicability in various automotive manufacturing processes. Companies like ABB with their IRB 930 SCARA robot are leading this innovation, emphasizing speed and payload capacity.

Challenges in the Robots in the Automotive Industry Market

Sustained long-term growth in the automotive robotics sector is intrinsically linked to successfully addressing several key challenges. The ongoing need for a skilled workforce adept at managing advanced robotic technologies, coupled with the high initial investment costs, remains critical. The increasing interconnectedness of robotic systems also introduces growing cybersecurity risks that demand robust protective measures. Continuous innovation, particularly in areas like collaborative robots (cobots) designed for safe human-robot interaction and the development of AI-driven autonomous systems, will be paramount for maintaining market expansion and unlocking new potential.

Forces Driving Robots in the Automotive Industry Growth

Technological advancements, such as improved sensors, AI-powered control systems, and advanced vision systems, are major drivers of market growth. The increasing demand for higher efficiency, precision, and flexibility in automotive manufacturing processes also fuels adoption. Government initiatives promoting automation and Industry 4.0 adoption further accelerate market expansion.

Challenges in the Robots in the Automotive Industry Market

Sustained long-term growth in the automotive robotics sector is intrinsically linked to successfully addressing several key challenges. The ongoing need for a skilled workforce adept at managing advanced robotic technologies, coupled with the high initial investment costs, remains critical. The increasing interconnectedness of robotic systems also introduces growing cybersecurity risks that demand robust protective measures. Continuous innovation, particularly in areas like collaborative robots (cobots) designed for safe human-robot interaction and the development of AI-driven autonomous systems, will be paramount for maintaining market expansion and unlocking new potential.

Emerging Opportunities in Robots in the Automotive Industry

The automotive robotics market is ripe with emerging opportunities. A significant growth area lies in the increasing integration of specialized robots within the battery production processes for Electric Vehicles (EVs), a critical component of the automotive industry's future. The rise of mobile robots for efficient and flexible material handling within factory environments offers substantial operational improvements. Furthermore, the ongoing development of more sophisticated Artificial Intelligence (AI) capabilities is paving the way for robots with enhanced autonomous navigation and complex task execution. The growing needs of the rapidly expanding EV and autonomous vehicle sectors present entirely new market avenues for innovative robotic solutions.

Leading Players in the Robots in the Automotive Industry Sector

- ABB Ltd

- Nachi-Fujikoshi Corp

- FANUC Corp

- RobCo S W A T Ltd

- Kawasaki Robotics

- Omron Adept Robotics

- KUKA Robotics

- Honda Motor Co Ltd

- Harmonic Drive System

- Yaskawa Electric Corporation

Key Milestones in Robots in the Automotive Industry Industry

- November 2023: ABB Robotics launched the IRB 930 SCARA robot, expanding its portfolio and addressing growth opportunities.

- August 2023: Kia announced plans to launch a new automotive robot in 2024, in collaboration with Boston Dynamics.

- September 2023: OTTO Motors unveiled the OTTO 1200, a high-performing heavy-duty mobile robot for compact environments.

Strategic Outlook for Robots in the Automotive Industry Market

The automotive robotics market presents significant growth potential driven by ongoing technological advancements and the increasing need for automation across the automotive value chain. Strategic opportunities exist for companies that can innovate in areas such as AI, collaborative robots, and mobile robots, catering to the evolving demands of electric vehicle and autonomous vehicle production. Focusing on integration and service capabilities will be critical for success.

Robots in the Automotive Industry Segmentation

-

1. End-user Type

- 1.1. Vehicle Manufacturers

- 1.2. Automotive Component Manufacturers

-

2. Component Type

- 2.1. Controllers

- 2.2. Robotic Arms

- 2.3. End Effectors

- 2.4. Drive and Sensors

-

3. Product Type

- 3.1. Cartesian Robots

- 3.2. SCARA Robots

- 3.3. Articulated Robots

- 3.4. Other Product Types

-

4. Function Type

- 4.1. Welding Robots

- 4.2. Painting Robots

- 4.3. Assembling and Disassembling Robots

- 4.4. Cutting and Milling Robots

Robots in the Automotive Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Robots in the Automotive Industry Regional Market Share

Geographic Coverage of Robots in the Automotive Industry

Robots in the Automotive Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation Related to Industrial Robots

- 3.4. Market Trends

- 3.4.1. Welding Robots Hold the Highest Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Robots in the Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Type

- 5.1.1. Vehicle Manufacturers

- 5.1.2. Automotive Component Manufacturers

- 5.2. Market Analysis, Insights and Forecast - by Component Type

- 5.2.1. Controllers

- 5.2.2. Robotic Arms

- 5.2.3. End Effectors

- 5.2.4. Drive and Sensors

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Cartesian Robots

- 5.3.2. SCARA Robots

- 5.3.3. Articulated Robots

- 5.3.4. Other Product Types

- 5.4. Market Analysis, Insights and Forecast - by Function Type

- 5.4.1. Welding Robots

- 5.4.2. Painting Robots

- 5.4.3. Assembling and Disassembling Robots

- 5.4.4. Cutting and Milling Robots

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by End-user Type

- 6. North America Robots in the Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Type

- 6.1.1. Vehicle Manufacturers

- 6.1.2. Automotive Component Manufacturers

- 6.2. Market Analysis, Insights and Forecast - by Component Type

- 6.2.1. Controllers

- 6.2.2. Robotic Arms

- 6.2.3. End Effectors

- 6.2.4. Drive and Sensors

- 6.3. Market Analysis, Insights and Forecast - by Product Type

- 6.3.1. Cartesian Robots

- 6.3.2. SCARA Robots

- 6.3.3. Articulated Robots

- 6.3.4. Other Product Types

- 6.4. Market Analysis, Insights and Forecast - by Function Type

- 6.4.1. Welding Robots

- 6.4.2. Painting Robots

- 6.4.3. Assembling and Disassembling Robots

- 6.4.4. Cutting and Milling Robots

- 6.1. Market Analysis, Insights and Forecast - by End-user Type

- 7. Europe Robots in the Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Type

- 7.1.1. Vehicle Manufacturers

- 7.1.2. Automotive Component Manufacturers

- 7.2. Market Analysis, Insights and Forecast - by Component Type

- 7.2.1. Controllers

- 7.2.2. Robotic Arms

- 7.2.3. End Effectors

- 7.2.4. Drive and Sensors

- 7.3. Market Analysis, Insights and Forecast - by Product Type

- 7.3.1. Cartesian Robots

- 7.3.2. SCARA Robots

- 7.3.3. Articulated Robots

- 7.3.4. Other Product Types

- 7.4. Market Analysis, Insights and Forecast - by Function Type

- 7.4.1. Welding Robots

- 7.4.2. Painting Robots

- 7.4.3. Assembling and Disassembling Robots

- 7.4.4. Cutting and Milling Robots

- 7.1. Market Analysis, Insights and Forecast - by End-user Type

- 8. Asia Pacific Robots in the Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Type

- 8.1.1. Vehicle Manufacturers

- 8.1.2. Automotive Component Manufacturers

- 8.2. Market Analysis, Insights and Forecast - by Component Type

- 8.2.1. Controllers

- 8.2.2. Robotic Arms

- 8.2.3. End Effectors

- 8.2.4. Drive and Sensors

- 8.3. Market Analysis, Insights and Forecast - by Product Type

- 8.3.1. Cartesian Robots

- 8.3.2. SCARA Robots

- 8.3.3. Articulated Robots

- 8.3.4. Other Product Types

- 8.4. Market Analysis, Insights and Forecast - by Function Type

- 8.4.1. Welding Robots

- 8.4.2. Painting Robots

- 8.4.3. Assembling and Disassembling Robots

- 8.4.4. Cutting and Milling Robots

- 8.1. Market Analysis, Insights and Forecast - by End-user Type

- 9. Rest of the World Robots in the Automotive Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Type

- 9.1.1. Vehicle Manufacturers

- 9.1.2. Automotive Component Manufacturers

- 9.2. Market Analysis, Insights and Forecast - by Component Type

- 9.2.1. Controllers

- 9.2.2. Robotic Arms

- 9.2.3. End Effectors

- 9.2.4. Drive and Sensors

- 9.3. Market Analysis, Insights and Forecast - by Product Type

- 9.3.1. Cartesian Robots

- 9.3.2. SCARA Robots

- 9.3.3. Articulated Robots

- 9.3.4. Other Product Types

- 9.4. Market Analysis, Insights and Forecast - by Function Type

- 9.4.1. Welding Robots

- 9.4.2. Painting Robots

- 9.4.3. Assembling and Disassembling Robots

- 9.4.4. Cutting and Milling Robots

- 9.1. Market Analysis, Insights and Forecast - by End-user Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ABB Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nachi-Fujikoshi Corp

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 FANUC Corp

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 RobCo S W A T Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kawasaki Robotics

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Omron Adept Robotics

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 KUKA Robotics

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Honda Motor Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Harmonic Drive System

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Yaskawa Electric Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 ABB Ltd

List of Figures

- Figure 1: Global Robots in the Automotive Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Robots in the Automotive Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 3: North America Robots in the Automotive Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 4: North America Robots in the Automotive Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 5: North America Robots in the Automotive Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 6: North America Robots in the Automotive Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 7: North America Robots in the Automotive Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 8: North America Robots in the Automotive Industry Revenue (Million), by Function Type 2025 & 2033

- Figure 9: North America Robots in the Automotive Industry Revenue Share (%), by Function Type 2025 & 2033

- Figure 10: North America Robots in the Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Robots in the Automotive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Robots in the Automotive Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 13: Europe Robots in the Automotive Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 14: Europe Robots in the Automotive Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 15: Europe Robots in the Automotive Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 16: Europe Robots in the Automotive Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 17: Europe Robots in the Automotive Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Robots in the Automotive Industry Revenue (Million), by Function Type 2025 & 2033

- Figure 19: Europe Robots in the Automotive Industry Revenue Share (%), by Function Type 2025 & 2033

- Figure 20: Europe Robots in the Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Robots in the Automotive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Robots in the Automotive Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 23: Asia Pacific Robots in the Automotive Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 24: Asia Pacific Robots in the Automotive Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 25: Asia Pacific Robots in the Automotive Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 26: Asia Pacific Robots in the Automotive Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Asia Pacific Robots in the Automotive Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Robots in the Automotive Industry Revenue (Million), by Function Type 2025 & 2033

- Figure 29: Asia Pacific Robots in the Automotive Industry Revenue Share (%), by Function Type 2025 & 2033

- Figure 30: Asia Pacific Robots in the Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Robots in the Automotive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Robots in the Automotive Industry Revenue (Million), by End-user Type 2025 & 2033

- Figure 33: Rest of the World Robots in the Automotive Industry Revenue Share (%), by End-user Type 2025 & 2033

- Figure 34: Rest of the World Robots in the Automotive Industry Revenue (Million), by Component Type 2025 & 2033

- Figure 35: Rest of the World Robots in the Automotive Industry Revenue Share (%), by Component Type 2025 & 2033

- Figure 36: Rest of the World Robots in the Automotive Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 37: Rest of the World Robots in the Automotive Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Rest of the World Robots in the Automotive Industry Revenue (Million), by Function Type 2025 & 2033

- Figure 39: Rest of the World Robots in the Automotive Industry Revenue Share (%), by Function Type 2025 & 2033

- Figure 40: Rest of the World Robots in the Automotive Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Rest of the World Robots in the Automotive Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Robots in the Automotive Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 2: Global Robots in the Automotive Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 3: Global Robots in the Automotive Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: Global Robots in the Automotive Industry Revenue Million Forecast, by Function Type 2020 & 2033

- Table 5: Global Robots in the Automotive Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Robots in the Automotive Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 7: Global Robots in the Automotive Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 8: Global Robots in the Automotive Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 9: Global Robots in the Automotive Industry Revenue Million Forecast, by Function Type 2020 & 2033

- Table 10: Global Robots in the Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Robots in the Automotive Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 15: Global Robots in the Automotive Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 16: Global Robots in the Automotive Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Robots in the Automotive Industry Revenue Million Forecast, by Function Type 2020 & 2033

- Table 18: Global Robots in the Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Germany Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Robots in the Automotive Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 24: Global Robots in the Automotive Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 25: Global Robots in the Automotive Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Global Robots in the Automotive Industry Revenue Million Forecast, by Function Type 2020 & 2033

- Table 27: Global Robots in the Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: China Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: India Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Japan Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: South Korea Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Robots in the Automotive Industry Revenue Million Forecast, by End-user Type 2020 & 2033

- Table 34: Global Robots in the Automotive Industry Revenue Million Forecast, by Component Type 2020 & 2033

- Table 35: Global Robots in the Automotive Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 36: Global Robots in the Automotive Industry Revenue Million Forecast, by Function Type 2020 & 2033

- Table 37: Global Robots in the Automotive Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South America Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Middle East and Africa Robots in the Automotive Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Robots in the Automotive Industry?

The projected CAGR is approximately 11.00%.

2. Which companies are prominent players in the Robots in the Automotive Industry?

Key companies in the market include ABB Ltd, Nachi-Fujikoshi Corp, FANUC Corp, RobCo S W A T Ltd, Kawasaki Robotics, Omron Adept Robotics, KUKA Robotics, Honda Motor Co Ltd, Harmonic Drive System, Yaskawa Electric Corporation.

3. What are the main segments of the Robots in the Automotive Industry?

The market segments include End-user Type, Component Type, Product Type, Function Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

Welding Robots Hold the Highest Share.

7. Are there any restraints impacting market growth?

High Cost of Installation Related to Industrial Robots.

8. Can you provide examples of recent developments in the market?

September 2023: OTTO Motors announced the OTTO 1200, which it claimed is the highest-performing, heavy-duty mobile robot for compact environments. It can safely move payloads of up to 1,200 kg (2,650 lb). The autonomous mobile robot (AMR) is equipped with patented adaptive fieldset technology to quickly and safely maneuver around people in narrow spaces, as claimed by OTTO Motors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Robots in the Automotive Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Robots in the Automotive Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Robots in the Automotive Industry?

To stay informed about further developments, trends, and reports in the Robots in the Automotive Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence