Key Insights

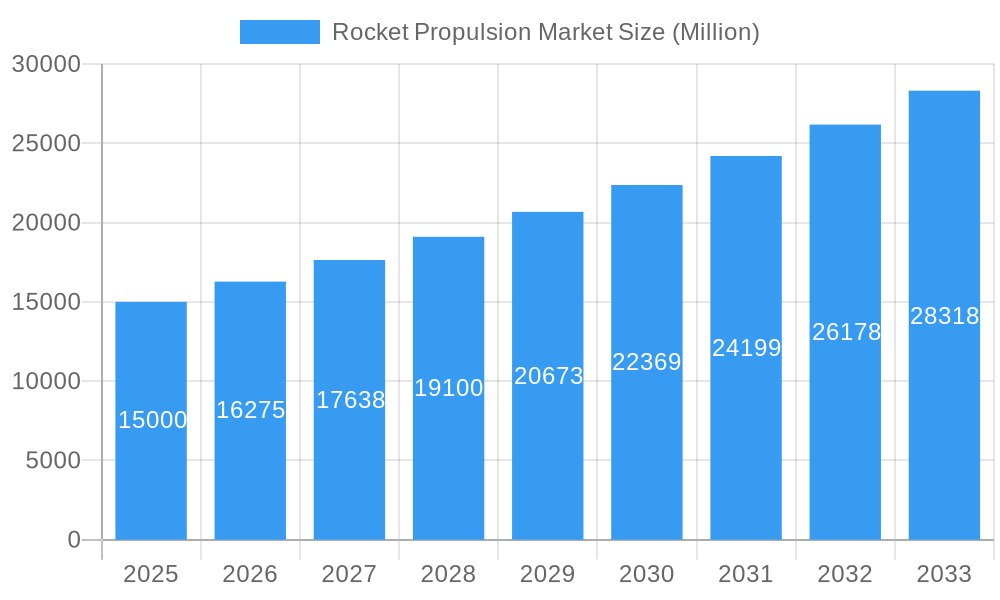

The global rocket propulsion market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 8.5% from 2025 to 2033. This expansion is fueled by several key factors. Increased space exploration activities, both governmental and commercial, are driving significant demand for advanced propulsion systems. The rising popularity of satellite constellations for communication, navigation, and Earth observation necessitates a higher launch frequency, further boosting market growth. Technological advancements in propulsion technology, such as the development of reusable rockets and more efficient engine designs, are also contributing to market expansion. Furthermore, the increasing adoption of electric propulsion systems for satellite maneuvering and station-keeping presents a lucrative segment within the market. Competition among major players like SpaceX, Blue Origin, and established aerospace companies is fostering innovation and driving down costs, making space access more affordable and fueling further market expansion. Solid propulsion systems currently dominate the market due to their established reliability and relative cost-effectiveness, but liquid and hybrid propulsion systems are gaining traction due to their enhanced performance characteristics. The civil and commercial sectors lead in terms of end-user applications, however, the military and defense sectors are showing significant growth with investments in advanced missile and defense technologies.

Rocket Propulsion Market Market Size (In Billion)

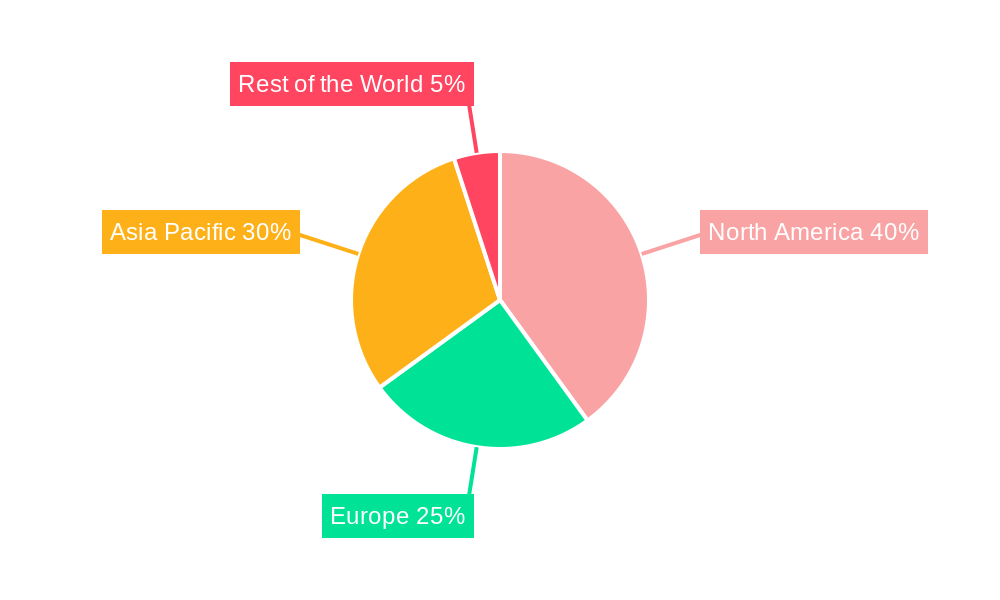

Segment-wise, while precise market segmentation data is unavailable, a logical estimation based on industry trends suggests solid propellants currently hold the largest market share, followed by liquid and then hybrid propellants. The civil and commercial sectors are larger than the military sector, reflecting the increased private investment in space exploration and satellite technology. Geographic distribution likely shows North America and Asia Pacific leading the market, driven by significant space programs and private sector investment in both regions. Europe is expected to maintain a substantial presence, while the Rest of the World segment, encompassing developing nations, represents a promising, albeit smaller, market with significant growth potential. The forecast period of 2025-2033 offers considerable opportunities for players in the rocket propulsion market to capitalize on technological advancements and rising demand for space-based services.

Rocket Propulsion Market Company Market Share

Rocket Propulsion Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Rocket Propulsion Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report meticulously examines market dynamics, key players, technological advancements, and future growth potential. The global market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Rocket Propulsion Market Market Concentration & Dynamics

The Rocket Propulsion market exhibits a moderately concentrated landscape, with key players like Space Exploration Technologies Corp, Blue Origin Federation LLC, and Aerojet Rocketdyne holding significant market share. The market share of the top 5 players is estimated at xx%. However, the emergence of innovative startups and increased government investment in space exploration is fostering a more dynamic and competitive environment.

Key Market Dynamics:

- Innovation Ecosystems: Robust R&D investments and collaborations between public and private entities are driving innovation in propulsion technologies, particularly in areas like reusable rockets and advanced materials.

- Regulatory Frameworks: Stringent safety regulations and environmental concerns influence market growth, particularly regarding the disposal of spent propellants. The evolving regulatory landscape presents both challenges and opportunities for industry participants.

- Substitute Products: While traditional chemical propellants dominate, research into alternative propulsion systems, such as electric propulsion and nuclear thermal propulsion, presents potential substitutes, although they are currently in early stages of development.

- End-User Trends: The increasing demand for satellite launches, both commercial and governmental, is a major driver of market growth. Furthermore, the growing interest in space tourism is also expected to fuel market expansion.

- M&A Activities: The past five years (2019-2024) witnessed xx M&A deals in the Rocket Propulsion sector, primarily driven by consolidation efforts and the acquisition of specialized technologies.

Rocket Propulsion Market Industry Insights & Trends

The global Rocket Propulsion market is experiencing substantial growth, driven by several factors. The increasing demand for satellite launches to support various applications (communication, navigation, Earth observation) has fueled significant market expansion. Furthermore, the rising popularity of space tourism and the development of reusable launch systems are also contributing to market growth.

The market size in 2025 is estimated at xx Million and is projected to reach xx Million by 2033. Technological advancements such as the development of more efficient and environmentally friendly propellants are reshaping the competitive landscape. Evolving consumer behaviors, including a growing awareness of sustainability, are pushing the industry towards cleaner propulsion technologies. The market's growth is also influenced by governmental policies and incentives promoting space exploration and technological advancements.

Key Markets & Segments Leading Rocket Propulsion Market

The North American region currently dominates the global Rocket Propulsion market, driven by significant investments in space exploration programs and a strong private space industry. Europe follows as a key market, owing to the presence of major aerospace companies and substantial government funding. Asia-Pacific is witnessing rapid growth due to increasing investments in space infrastructure and rising demand from commercial applications.

Dominant Segments:

- Type: Liquid propellants currently hold the largest market share, driven by their high performance and established technology. However, the solid propellant segment is also experiencing growth, particularly in smaller launch vehicles and military applications. Hybrid propulsion systems are emerging as a promising alternative, offering improved safety and performance characteristics.

- End User: The military segment is a significant consumer of rocket propulsion systems, followed by the civil and commercial sectors, with growth driven by increasing demand for satellite launches and space exploration.

Regional Drivers:

- North America: Strong government funding, robust private sector involvement, and technological advancements.

- Europe: Established aerospace industries, skilled workforce, and collaborative research initiatives.

- Asia-Pacific: Rapid economic growth, increasing investments in space infrastructure, and burgeoning commercial space sector.

Rocket Propulsion Market Product Developments

Recent years have witnessed significant advancements in rocket propulsion technology, including the development of greener propellants, enhanced combustion chambers, and more efficient nozzle designs. These innovations have resulted in increased payload capacity, reduced emissions, and improved overall system performance. The focus on reusable rocket stages is also driving innovation, aiming to reduce launch costs and enhance sustainability. These technological advancements are giving companies a significant competitive edge, allowing them to offer superior products and services to a broader market.

Challenges in the Rocket Propulsion Market Market

The Rocket Propulsion market faces several challenges, including stringent regulatory compliance requirements for propellant handling and disposal. Supply chain disruptions and the availability of rare earth elements used in some propellant formulations also pose significant risks. Furthermore, intense competition from established players and new entrants creates considerable pressure on margins and market share. These factors contribute to a complex and dynamic market landscape.

Forces Driving Rocket Propulsion Market Growth

The market's growth is fueled by several factors. Governmental investments in space exploration initiatives and commercial satellite deployment are key drivers. Technological advancements in propulsion systems, such as reusable rockets and advanced materials, offer improved efficiency and reduced costs. Furthermore, the growing demand for satellite-based services across various sectors, including telecommunications, navigation, and Earth observation, significantly contributes to market expansion.

Long-Term Growth Catalysts in the Rocket Propulsion Market

The long-term growth of the Rocket Propulsion market hinges on continued technological innovation, strategic partnerships between public and private entities, and expansion into new markets. The development of next-generation propulsion systems like electric and nuclear thermal propulsion, along with the increasing adoption of reusable launch vehicles, will play crucial roles in shaping future market trends.

Emerging Opportunities in Rocket Propulsion Market

Emerging opportunities include the development of more sustainable and environmentally friendly propellants, miniaturized propulsion systems for smaller satellites, and the expansion into new markets such as space debris removal and in-space transportation. Advancements in additive manufacturing techniques for propulsion components offer potential for cost reduction and customization.

Leading Players in the Rocket Propulsion Market Sector

- Space Exploration Technologies Corp

- Land Space Technology Co Ltd

- Antrix Corporation Limited

- Aerojet Rocketdyne

- Safran SA

- NPO Energomash

- IHI Corporation

- Rocket Lab USA Inc

- Blue Origin Federation LLC

- Northrop Grumman Corporation

- Mitsubishi Heavy Industries Ltd

Key Milestones in Rocket Propulsion Market Industry

- 2020: Successful launch of SpaceX's Starship prototype, marking significant progress in reusable launch vehicle technology.

- 2021: Announcement of a major joint venture between two leading players in the market to develop a new generation of hybrid rocket engines.

- 2022: Regulatory approvals granted for a new, environmentally friendly propellant, boosting market interest.

- 2023: Launch of a new commercial satellite using a novel propulsion system, demonstrating technological advancements.

- 2024: Successful test of a reusable rocket engine, significantly reducing launch costs.

Strategic Outlook for Rocket Propulsion Market Market

The future of the Rocket Propulsion market appears promising, with substantial growth potential driven by technological advancements, increased government spending on space exploration, and rising demand for satellite-based services. Strategic partnerships and acquisitions will play a crucial role in shaping the market landscape, leading to increased innovation and market consolidation. Companies that can adapt to changing regulatory frameworks and invest in sustainable technologies will be well-positioned for success in this dynamic market.

Rocket Propulsion Market Segmentation

-

1. Type

- 1.1. Solid

- 1.2. Liquid

- 1.3. Hybrid

-

2. End User

- 2.1. Civil and Commercial

- 2.2. Military

Rocket Propulsion Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Rocket Propulsion Market Regional Market Share

Geographic Coverage of Rocket Propulsion Market

Rocket Propulsion Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Enhanced Expenditure on Space Exploration Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rocket Propulsion Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solid

- 5.1.2. Liquid

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Civil and Commercial

- 5.2.2. Military

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Rocket Propulsion Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Solid

- 6.1.2. Liquid

- 6.1.3. Hybrid

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Civil and Commercial

- 6.2.2. Military

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Rocket Propulsion Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Solid

- 7.1.2. Liquid

- 7.1.3. Hybrid

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Civil and Commercial

- 7.2.2. Military

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Rocket Propulsion Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Solid

- 8.1.2. Liquid

- 8.1.3. Hybrid

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Civil and Commercial

- 8.2.2. Military

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Rocket Propulsion Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Solid

- 9.1.2. Liquid

- 9.1.3. Hybrid

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Civil and Commercial

- 9.2.2. Military

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Space Exploration Technologies Corp

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Land Space Technology Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Antrix Corporation Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Aerojet Rocketdyne

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Safran SA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 NPO Energomash

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 IHI Corporatio

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Rocket Lab USA Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Blue Origin Federation LLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Northrop Grumman Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Mitsubishi Heavy Industries Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: Global Rocket Propulsion Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Rocket Propulsion Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Rocket Propulsion Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Rocket Propulsion Market Revenue (undefined), by End User 2025 & 2033

- Figure 5: North America Rocket Propulsion Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Rocket Propulsion Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Rocket Propulsion Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Rocket Propulsion Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Rocket Propulsion Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Rocket Propulsion Market Revenue (undefined), by End User 2025 & 2033

- Figure 11: Europe Rocket Propulsion Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Rocket Propulsion Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Rocket Propulsion Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Rocket Propulsion Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Rocket Propulsion Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Rocket Propulsion Market Revenue (undefined), by End User 2025 & 2033

- Figure 17: Asia Pacific Rocket Propulsion Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Rocket Propulsion Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Rocket Propulsion Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Rocket Propulsion Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: Rest of the World Rocket Propulsion Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Rocket Propulsion Market Revenue (undefined), by End User 2025 & 2033

- Figure 23: Rest of the World Rocket Propulsion Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Rest of the World Rocket Propulsion Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Rocket Propulsion Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Rocket Propulsion Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Rocket Propulsion Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global Rocket Propulsion Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Rocket Propulsion Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Rocket Propulsion Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Rocket Propulsion Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Rocket Propulsion Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Global Rocket Propulsion Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 9: Global Rocket Propulsion Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Rocket Propulsion Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global Rocket Propulsion Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: Global Rocket Propulsion Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Rocket Propulsion Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Rocket Propulsion Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Global Rocket Propulsion Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rocket Propulsion Market?

The projected CAGR is approximately 7.06%.

2. Which companies are prominent players in the Rocket Propulsion Market?

Key companies in the market include Space Exploration Technologies Corp, Land Space Technology Co Ltd, Antrix Corporation Limited, Aerojet Rocketdyne, Safran SA, NPO Energomash, IHI Corporatio, Rocket Lab USA Inc, Blue Origin Federation LLC, Northrop Grumman Corporation, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Rocket Propulsion Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Enhanced Expenditure on Space Exploration Activities.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rocket Propulsion Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rocket Propulsion Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rocket Propulsion Market?

To stay informed about further developments, trends, and reports in the Rocket Propulsion Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence