Key Insights

Saudi Arabia's industrial electrical components market is experiencing substantial growth, driven by Vision 2030 initiatives and significant infrastructure investments in power utilities, oil & gas, and construction. The market projects a compound annual growth rate (CAGR) of 11.7%. This expansion is fueled by increasing electricity demand, infrastructure modernization, and surging industrial activities. Key market segments include switchgears, transformers, and electric motors & starters, with a growing demand for automation solutions and energy-efficient LED lighting. The adoption of smart grid technologies and automation systems further propels market growth. The current market size is valued at $1.81 billion, with a base year of 2023.

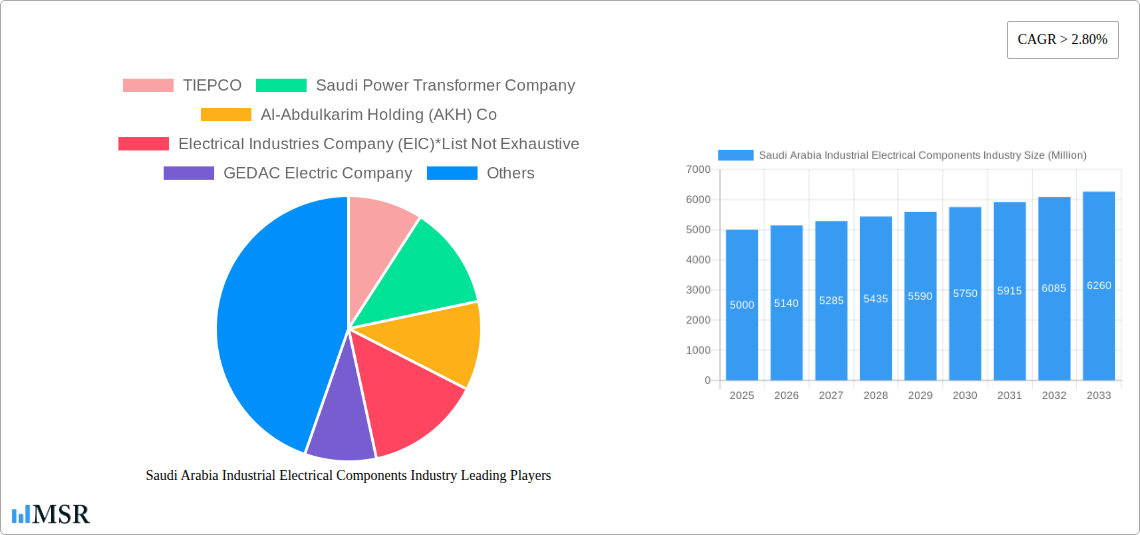

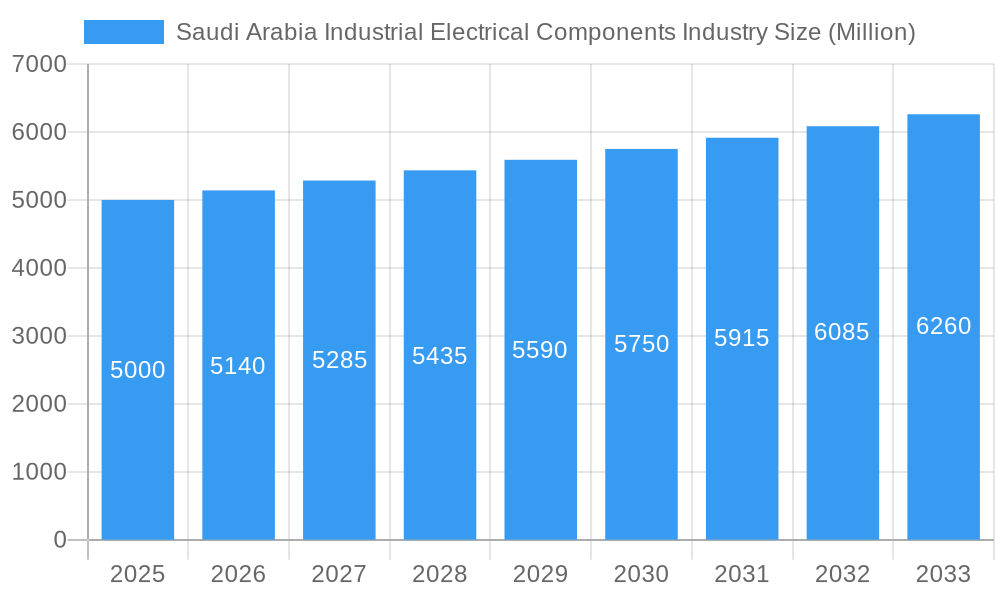

Saudi Arabia Industrial Electrical Components Industry Market Size (In Billion)

Competition is dynamic, featuring both local and international players such as TIEPCO, Saudi Power Transformer Company, Al-Abdulkarim Holding (AKH) Co, Electrical Industries Company (EIC), GEDAC Electric Company, and Saudi Electric Supply Company Limited (SESCO).

Saudi Arabia Industrial Electrical Components Industry Company Market Share

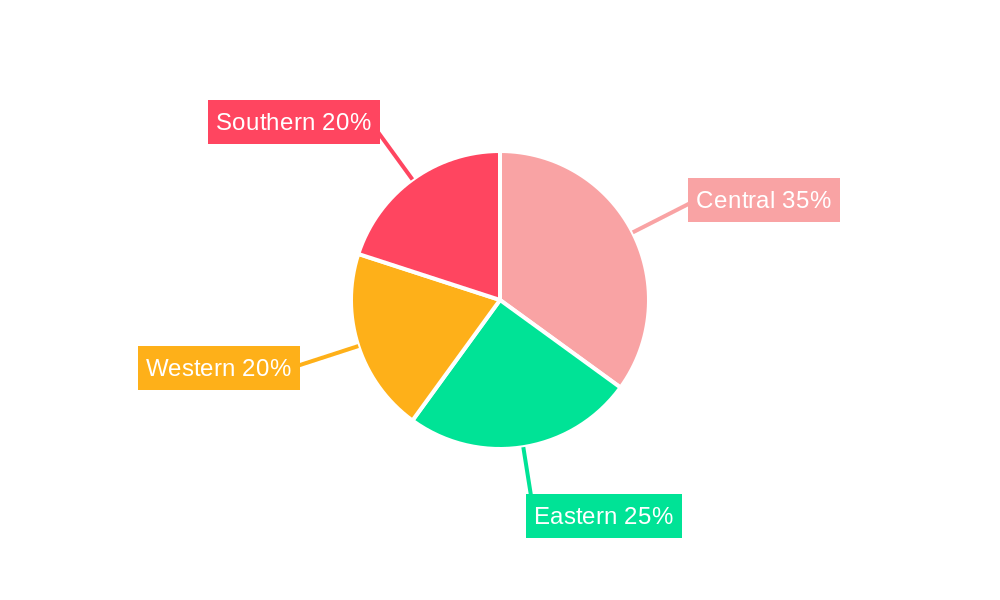

Regional market distribution across Saudi Arabia (Central, Eastern, Western, Southern) aligns with varying industrial development and infrastructure investment levels. Sustained government support and robust private sector investment are critical growth enablers. However, potential challenges include global economic fluctuations and supply chain disruptions impacting raw material costs and component availability.

Saudi Arabia Industrial Electrical Components Market Analysis: 2023-2033

This comprehensive report offers detailed insights into Saudi Arabia's industrial electrical components market from 2023 to 2033. It is an essential resource for industry stakeholders, investors, and businesses seeking to understand market dynamics, growth opportunities, and the competitive landscape. The report analyzes market concentration, key segments, leading players, and future trends to provide actionable intelligence for informed decision-making. Focusing on critical components like switchgears, transformers, and automation systems, this report is vital for navigating this dynamic market.

Saudi Arabia Industrial Electrical Components Industry Market Concentration & Dynamics

The Saudi Arabian industrial electrical components market exhibits a moderately concentrated structure, with a few major players holding significant market share. While precise market share figures for individual companies are xx, key players such as TIEPCO, Saudi Power Transformer Company, and Al-Abdulkarim Holding (AKH) Co. command substantial portions. The market displays a dynamic ecosystem characterized by innovation, particularly in areas like smart grids and renewable energy integration. The regulatory framework, overseen by bodies like the Saudi Electricity Company (SEC), influences market dynamics, promoting standardization and safety compliance. Substitute products, such as those based on alternative energy sources, pose a growing challenge. End-user trends, particularly in the booming infrastructure sector and the expansion of the renewable energy market, are strong drivers of growth. M&A activity has been moderate, with xx deals recorded between 2019 and 2024, primarily focused on consolidating market positions and expanding technological capabilities.

Saudi Arabia Industrial Electrical Components Industry Industry Insights & Trends

The Saudi Arabian industrial electrical components market is experiencing robust growth, driven by substantial investments in infrastructure development, the expansion of the oil and gas sector, and the Kingdom's Vision 2030 initiatives emphasizing diversification and technological advancement. The market size was estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. This growth is fueled by several factors:

- Government Investments: Significant government spending on infrastructure projects, including power grids and transportation networks, is a major catalyst.

- Oil & Gas Expansion: Continued expansion in the oil and gas sector necessitates robust electrical infrastructure and components.

- Renewable Energy Growth: The increasing adoption of renewable energy sources, like solar and wind power, creates demand for specialized components and smart grid technologies.

- Technological Advancements: The integration of smart technologies, such as IoT sensors and advanced automation systems, is transforming the industry.

- Digital Transformation: The increasing adoption of digital technologies across various industries is driving demand for advanced components and systems.

Key Markets & Segments Leading Saudi Arabia Industrial Electrical Components Industry

The Power Utility sector represents the largest segment of the Saudi Arabian industrial electrical components market, accounting for xx% of the total market value in 2025. The Oil and Gas sector holds significant share too, followed by the Infrastructure sector, which is experiencing rapid growth.

Dominant Segments:

- End-User: Power Utility, Oil and Gas, Infrastructure Sector.

- Components: Switchgears, Transformers, Electric Motors and Starters, Monitoring and Controlling Devices, Automation (Feeder Automation and Substation Automation), LED Lighting, Other Components (Switches, MCB, Panelboards, Pushbuttons, Fuses, Sockets, Circuit Breakers, etc.).

Growth Drivers:

- Economic Growth: Saudi Arabia's overall economic growth fuels demand for industrial components.

- Infrastructure Development: Large-scale infrastructure projects significantly boost demand.

- Industrialization: Increased industrial activity necessitates upgraded electrical infrastructure.

- Technological Advancements: Demand for advanced components like those for smart grids and renewable energy projects is growing.

Saudi Arabia Industrial Electrical Components Industry Product Developments

Recent years have witnessed significant product innovation in the Saudi Arabian industrial electrical components market, driven by a focus on efficiency, safety, and smart technology integration. Manufacturers are increasingly introducing energy-efficient components, advanced automation solutions, and smart grid technologies to meet evolving market needs. This includes the development of compact switchgears, digital transformers with advanced monitoring capabilities, and smart motor starters that optimize energy consumption. The emphasis on enhancing reliability and reducing maintenance costs is also driving innovation.

Challenges in the Saudi Arabia Industrial Electrical Components Industry Market

Several challenges impede the growth of the Saudi Arabian industrial electrical components market. These include regulatory hurdles related to product approvals and certifications, leading to delays and increased costs for companies. Supply chain disruptions, both global and domestic, can impact the availability of components and increase prices. Furthermore, intense competition among both domestic and international players exerts significant pressure on profit margins and market share. These factors collectively impact overall market expansion.

Forces Driving Saudi Arabia Industrial Electrical Components Industry Growth

The Saudi Arabia industrial electrical components market is propelled by several key growth factors: the substantial government investment in infrastructure projects (like Vision 2030 initiatives), the ongoing expansion of the oil and gas sector, and a growing emphasis on renewable energy sources. Technological advancements, such as smart grid technologies and the increasing adoption of automation systems, further fuel market expansion. Finally, supportive government policies aimed at promoting industrial development and attracting foreign investment play a crucial role.

Challenges in the Saudi Arabia Industrial Electrical Components Industry Market

Long-term growth in the Saudi Arabian industrial electrical components market hinges on strategic partnerships between domestic and international players, fostering technology transfer and local capacity building. Continued investments in research and development will be vital for innovating new energy-efficient and smart solutions. Furthermore, adapting to evolving market needs and embracing sustainable practices are crucial for sustained growth in this competitive landscape.

Emerging Opportunities in Saudi Arabia Industrial Electrical Components Industry

Emerging opportunities reside in the growing adoption of smart grid technologies, increased demand for renewable energy components, and the expansion of the industrial automation sector. The government's focus on digital transformation offers significant opportunities for companies providing smart components and solutions. The market presents significant potential for companies focused on energy efficiency, safety, and reliable operation.

Leading Players in the Saudi Arabia Industrial Electrical Components Industry Sector

- TIEPCO

- Saudi Power Transformer Company

- Al-Abdulkarim Holding (AKH) Co

- Electrical Industries Company (EIC)

- GEDAC Electric Company

- Saudi Electric Supply Company Limited (SESCO)

Key Milestones in Saudi Arabia Industrial Electrical Components Industry Industry

- August 2021: Larsen & Toubro secures a turnkey order for a 380 kV gas-insulated switchgear (GIS) substation, highlighting growth in power transmission infrastructure.

- February 2020: R&S Rauscher & Stoecklin receives an order for industrial plugs and sockets for a 5G telecommunication project, demonstrating the expanding role of industrial components in telecommunications.

Strategic Outlook for Saudi Arabia Industrial Electrical Components Industry Market

The future of the Saudi Arabian industrial electrical components market is promising, driven by sustained government investment, continued expansion of key sectors, and a strong emphasis on technological advancement. Strategic opportunities lie in capitalizing on the growing demand for smart grid technologies, renewable energy components, and industrial automation solutions. Companies focusing on innovation, sustainability, and strategic partnerships are well-positioned to capture significant market share and contribute to the nation's economic diversification goals.

Saudi Arabia Industrial Electrical Components Industry Segmentation

-

1. End-User

- 1.1. Power Utility

- 1.2. Oil and Gas

- 1.3. Infrastructure Sector

-

2. Component

- 2.1. Switchgears

- 2.2. Transformers

- 2.3. Electric Motors and Starters

- 2.4. Monitoring and Controlling Devices

- 2.5. Automative

- 2.6. LED Lighting

- 2.7. Others

Saudi Arabia Industrial Electrical Components Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Industrial Electrical Components Industry Regional Market Share

Geographic Coverage of Saudi Arabia Industrial Electrical Components Industry

Saudi Arabia Industrial Electrical Components Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Improved Viability Of Offshore Oil And Gas Projects

- 3.3. Market Restrains

- 3.3.1. Ban On Offshore Exploration And Production Activities In Multiple Regions

- 3.4. Market Trends

- 3.4.1. Electric Motors and Starters Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Industrial Electrical Components Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Power Utility

- 5.1.2. Oil and Gas

- 5.1.3. Infrastructure Sector

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Switchgears

- 5.2.2. Transformers

- 5.2.3. Electric Motors and Starters

- 5.2.4. Monitoring and Controlling Devices

- 5.2.5. Automative

- 5.2.6. LED Lighting

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 TIEPCO

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Saudi Power Transformer Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Al-Abdulkarim Holding (AKH) Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Electrical Industries Company (EIC)*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GEDAC Electric Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Saudi Electric Supply Company Limited (SESCO)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 TIEPCO

List of Figures

- Figure 1: Saudi Arabia Industrial Electrical Components Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Industrial Electrical Components Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Industrial Electrical Components Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 2: Saudi Arabia Industrial Electrical Components Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 3: Saudi Arabia Industrial Electrical Components Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Industrial Electrical Components Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 5: Saudi Arabia Industrial Electrical Components Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 6: Saudi Arabia Industrial Electrical Components Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Industrial Electrical Components Industry?

The projected CAGR is approximately 11.7%.

2. Which companies are prominent players in the Saudi Arabia Industrial Electrical Components Industry?

Key companies in the market include TIEPCO, Saudi Power Transformer Company, Al-Abdulkarim Holding (AKH) Co, Electrical Industries Company (EIC)*List Not Exhaustive, GEDAC Electric Company, Saudi Electric Supply Company Limited (SESCO).

3. What are the main segments of the Saudi Arabia Industrial Electrical Components Industry?

The market segments include End-User, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.81 billion as of 2022.

5. What are some drivers contributing to market growth?

Improved Viability Of Offshore Oil And Gas Projects.

6. What are the notable trends driving market growth?

Electric Motors and Starters Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Ban On Offshore Exploration And Production Activities In Multiple Regions.

8. Can you provide examples of recent developments in the market?

In August 2021, Larsen & Toubro has bagged a turnkey order for construction of a power substation in Saudi Arabia. The company stated that the scope of the gas insulated switchgear (GIS) substation involves four different voltages up to 380 kV. The scope of works entails associated control, protection, automation, telecommunication systems, apart from civil and electromechanical works. The order will be executed by the power transmission and distribution business of L&T Construction - the construction-related arm of Larsen & Toubro Ltd.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Industrial Electrical Components Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Industrial Electrical Components Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Industrial Electrical Components Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Industrial Electrical Components Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence