Key Insights

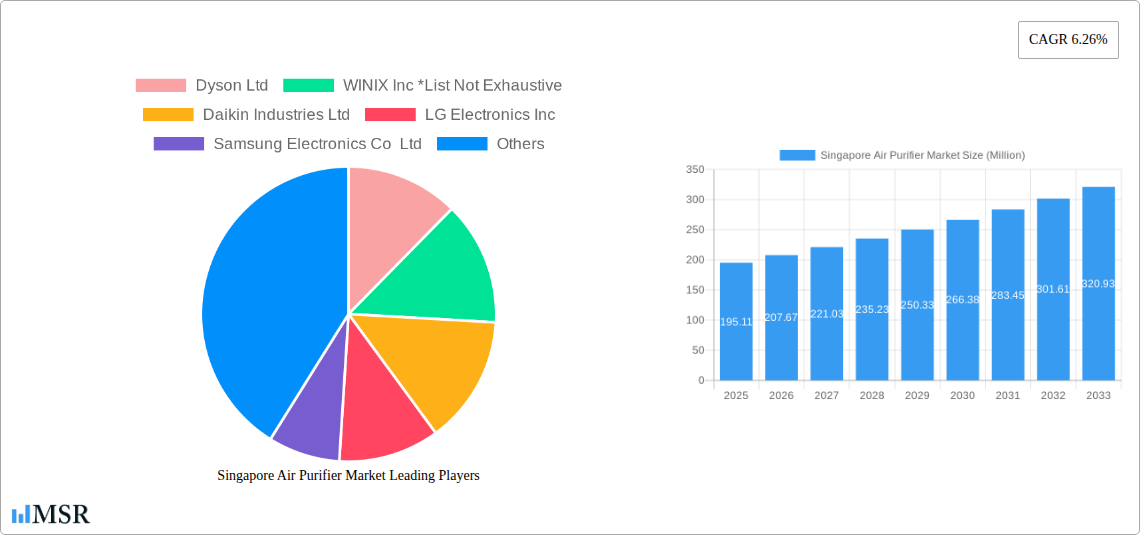

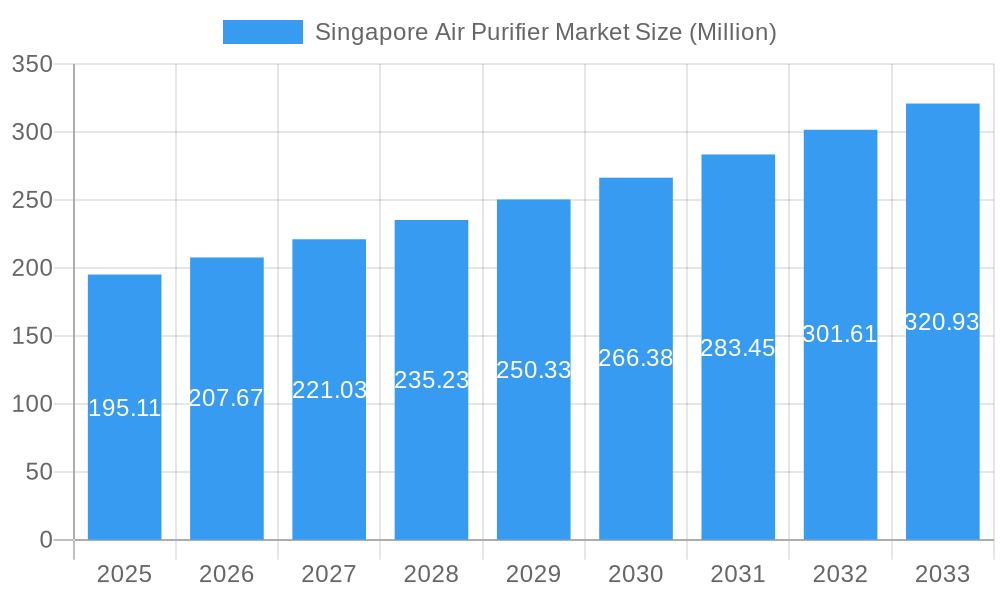

The Singapore air purifier market, valued at $195.11 million in 2025, is projected to experience robust growth, driven by rising air pollution concerns and increasing awareness of respiratory health. A Compound Annual Growth Rate (CAGR) of 6.26% from 2025 to 2033 indicates a significant market expansion, reaching an estimated value exceeding $300 million by 2033. Key growth drivers include escalating urbanization leading to higher pollution levels, a rising prevalence of respiratory illnesses like asthma and allergies, and increasing disposable incomes enabling consumers to invest in premium air purification solutions. The market segmentation reveals strong demand across residential, commercial, and industrial sectors, with HEPA filters dominating the filtration technology segment due to their high efficacy in removing airborne particulates. Stand-alone air purifiers are currently the most popular type, although integrated in-duct systems are gaining traction in commercial and industrial settings. Leading brands like Dyson, Winix, Daikin, LG, Samsung, and Philips are vying for market share, offering a diverse range of products catering to different needs and budgets. The competitive landscape is characterized by innovation in filtration technologies, smart features, and aesthetically pleasing designs.

Singapore Air Purifier Market Market Size (In Million)

The market's future growth trajectory is influenced by several factors. Government initiatives promoting clean air and public health awareness campaigns are expected to further stimulate demand. However, challenges such as the relatively high cost of premium air purifiers and the need for regular filter replacements could restrain market growth to some extent. Nevertheless, the ongoing focus on improving indoor air quality, coupled with technological advancements in air purification, positions the Singaporean air purifier market for sustained growth over the forecast period. Future trends point towards increasing demand for smart air purifiers with integrated air quality monitoring, app connectivity, and energy-efficient designs. The market will also see a rise in specialized air purifiers targeting specific pollutants, such as formaldehyde or volatile organic compounds.

Singapore Air Purifier Market Company Market Share

Singapore Air Purifier Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Singapore air purifier market, covering market size, segmentation, key players, and future growth opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry stakeholders, investors, and businesses seeking to understand this dynamic market. The report analyzes the market valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Singapore Air Purifier Market Concentration & Dynamics

The Singapore air purifier market exhibits a moderately concentrated landscape, with key players like Dyson Ltd, WINIX Inc, Daikin Industries Ltd, LG Electronics Inc, Samsung Electronics Co Ltd, Amway (Malaysia) Holdings Berhad, Koninklijke Philips NV, Sharp Corporation, Panasonic Corporation, and IQAir holding significant market share. However, the presence of numerous smaller players and the ongoing innovation in filtration technologies indicate a dynamic market structure. Market share analysis reveals that Dyson and LG combined hold approximately xx% of the market, while the remaining players share the remaining percentage.

The market’s growth is driven by several factors:

- Rising Air Pollution Concerns: Singapore faces increasing air pollution challenges, prompting higher demand for effective air purification solutions.

- Government Initiatives: Government regulations and awareness campaigns promoting cleaner air are influencing consumer preferences.

- Technological Advancements: Innovations in filtration technologies, such as HEPA filters and electrostatic precipitators, are creating more efficient and user-friendly products.

- Increasing Disposable Incomes: Rising disposable incomes among Singaporean households fuel demand for premium air purifiers.

- Mergers and Acquisitions (M&A): While the exact number of M&A deals in this sector in Singapore requires further research, the global trend indicates an increase, with larger companies acquiring smaller, innovative firms to expand their product portfolios and market reach. The number of reported M&A deals in the past five years is xx.

Singapore Air Purifier Market Industry Insights & Trends

The Singapore air purifier market has witnessed significant growth over the historical period (2019-2024), primarily driven by escalating air pollution levels, increasing health consciousness, and technological advancements. The market size increased from xx Million in 2019 to xx Million in 2024, demonstrating a robust growth trajectory. This upward trend is expected to continue during the forecast period (2025-2033), with the market projected to reach xx Million by 2033. This growth is primarily driven by rising disposable incomes, increased awareness about indoor air quality, and the introduction of advanced and aesthetically pleasing air purifier designs. Consumer preference is shifting towards smart and connected air purifiers, featuring real-time air quality monitoring and remote control capabilities. Technological advancements continue to shape the market, with innovations in filtration technologies and energy-efficient designs driving sales. The adoption of smart home technology is also influencing consumer choices, with many opting for air purifiers that can be integrated into their existing smart home ecosystems.

Key Markets & Segments Leading Singapore Air Purifier Market

The residential segment dominates the Singapore air purifier market, accounting for approximately xx% of the total market share. This is followed by the commercial and industrial segments, which are experiencing steady growth.

Drivers for each segment:

- Residential: Rising health consciousness, increasing disposable incomes, and the availability of a wide range of products contribute to significant growth.

- Commercial: Businesses are increasingly prioritizing indoor air quality to enhance employee well-being and productivity, leading to market expansion.

- Industrial: Specific industrial settings (e.g., manufacturing plants, hospitals) require specialized air purification systems to maintain controlled environments.

Dominance Analysis: The residential segment holds the largest market share due to its broad consumer base and the relatively higher affordability of residential air purifiers compared to their commercial and industrial counterparts.

Regarding filtration technology, HEPA filtration systems are the most prevalent, followed by other technologies such as electrostatic precipitators and ionizers. The demand for HEPA filters is high because of their efficiency in removing various pollutants. Stand-alone air purifiers currently hold the majority of the market share, yet the in-duct segment is expected to grow.

Singapore Air Purifier Market Product Developments

Recent product innovations have focused on enhancing filtration efficiency, integrating smart features (connectivity, air quality monitoring), and improving aesthetic appeal. Competitors are differentiating their offerings through unique designs, advanced sensor technologies, and improved energy efficiency. For example, the launch of LG PuriCare AeroFurniture showcases the trend towards integrating air purification with home furnishings. Dyson’s revamped air purifiers highlight the emphasis on advanced HEPA filtration systems capable of capturing a wider range of pollutants. These advancements showcase the industry's commitment to meeting evolving consumer needs and preferences.

Challenges in the Singapore Air Purifier Market Market

The Singapore air purifier market faces certain challenges. One significant challenge is intense competition among numerous players, leading to price wars and decreased profit margins. Supply chain disruptions, particularly those stemming from global events, could impact product availability and increase costs. The market is also subject to stringent regulatory frameworks that could affect the product compliance and market entry of new players. These challenges can collectively impact the overall market growth and profitability of individual companies.

Forces Driving Singapore Air Purifier Market Growth

Several factors are fueling the growth of the Singapore air purifier market. These include increasing awareness of air pollution's health impacts, rising disposable incomes allowing for increased spending on premium products, and the introduction of smart, aesthetically pleasing air purifiers. Government initiatives promoting clean air further incentivize consumers and businesses to invest in these solutions. Technological advancements in filtration and smart features also contribute to the growing market.

Long-Term Growth Catalysts in the Singapore Air Purifier Market

Long-term growth in the Singapore air purifier market will be driven by continued innovation in filtration technology, resulting in more efficient and targeted solutions for various pollutants. Strategic partnerships between air purifier manufacturers and smart home technology providers will enhance product integration and functionality, driving market expansion. Expansion into new market segments, such as specialized industrial applications, will further contribute to long-term growth.

Emerging Opportunities in Singapore Air Purifier Market

Emerging opportunities lie in developing specialized air purifiers tailored to specific needs (allergens, VOCs), incorporating advanced air quality monitoring with data analytics, and integrating air purifiers into larger building management systems. Growing consumer demand for sustainable and energy-efficient products presents an opportunity for manufacturers to highlight eco-friendly designs and features.

Leading Players in the Singapore Air Purifier Market Sector

- Dyson Ltd

- WINIX Inc

- Daikin Industries Ltd

- LG Electronics Inc

- Samsung Electronics Co Ltd

- Amway (Malaysia) Holdings Berhad

- Koninklijke Philips NV

- Sharp Corporation

- Panasonic Corporation

- IQAir

Key Milestones in Singapore Air Purifier Market Industry

- May 2023: LG Electronics Singapore launched the LG PuriCare AeroFurniture, a stylish air purifier integrated into furniture. This launch demonstrates a shift towards aesthetically pleasing and integrated air purification solutions.

- May 2023: Dyson Limited revamped its air purifiers and vacuum systems, incorporating advanced HEPA H13 filtration and intelligent sensing. This signifies a focus on enhancing filtration capabilities and user experience.

Strategic Outlook for Singapore Air Purifier Market Market

The Singapore air purifier market presents significant growth potential, driven by increasing health awareness, technological innovation, and supportive government policies. Strategic opportunities lie in developing specialized solutions, focusing on sustainability, and leveraging smart home integration. Companies that successfully adapt to changing consumer needs and technological advancements are poised for significant growth in this dynamic market.

Singapore Air Purifier Market Segmentation

-

1. Filtration Technology

- 1.1. High-efficiency Particulate Air (HEPA)

- 1.2. Other Fi

-

2. Type

- 2.1. Stand-alone

- 2.2. In-duct

-

3. End User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

Singapore Air Purifier Market Segmentation By Geography

- 1. Singapore

Singapore Air Purifier Market Regional Market Share

Geographic Coverage of Singapore Air Purifier Market

Singapore Air Purifier Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Airborne Diseases and Growing Health Consciousness4.; Increasing awareness among consumers about the importance of indoor air quality

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Increasing Airborne Diseases and Growing Health Consciousness Among Consumers are Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Air Purifier Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 5.1.1. High-efficiency Particulate Air (HEPA)

- 5.1.2. Other Fi

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Stand-alone

- 5.2.2. In-duct

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Filtration Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dyson Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 WINIX Inc *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Daikin Industries Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LG Electronics Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Samsung Electronics Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amway (Malaysia) Holdings Berhad

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Koninklijke Philips NV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sharp Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Panasonic Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 IQAir

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Dyson Ltd

List of Figures

- Figure 1: Singapore Air Purifier Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Singapore Air Purifier Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Air Purifier Market Revenue Million Forecast, by Filtration Technology 2020 & 2033

- Table 2: Singapore Air Purifier Market Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 3: Singapore Air Purifier Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Singapore Air Purifier Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 5: Singapore Air Purifier Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Singapore Air Purifier Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Singapore Air Purifier Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Singapore Air Purifier Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Singapore Air Purifier Market Revenue Million Forecast, by Filtration Technology 2020 & 2033

- Table 10: Singapore Air Purifier Market Volume K Unit Forecast, by Filtration Technology 2020 & 2033

- Table 11: Singapore Air Purifier Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Singapore Air Purifier Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 13: Singapore Air Purifier Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Singapore Air Purifier Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Singapore Air Purifier Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Singapore Air Purifier Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Air Purifier Market?

The projected CAGR is approximately 6.26%.

2. Which companies are prominent players in the Singapore Air Purifier Market?

Key companies in the market include Dyson Ltd, WINIX Inc *List Not Exhaustive, Daikin Industries Ltd, LG Electronics Inc, Samsung Electronics Co Ltd, Amway (Malaysia) Holdings Berhad, Koninklijke Philips NV, Sharp Corporation, Panasonic Corporation, IQAir.

3. What are the main segments of the Singapore Air Purifier Market?

The market segments include Filtration Technology, Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 195.11 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Airborne Diseases and Growing Health Consciousness4.; Increasing awareness among consumers about the importance of indoor air quality.

6. What are the notable trends driving market growth?

Increasing Airborne Diseases and Growing Health Consciousness Among Consumers are Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; High Installation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

May 2023: LG Electronics Singapore announced the launch of the LG PuriCare AeroFurniture. The LG PuriCare AeroFurniture sets to revolutionize how people view home appliances, especially air purifiers, and provide a sophisticated and effective solution for modern living. Featuring a chic design, it combines both style and functionality to bring fresh, clean air to users with its advanced air purification technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Air Purifier Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Air Purifier Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Air Purifier Market?

To stay informed about further developments, trends, and reports in the Singapore Air Purifier Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence