Key Insights

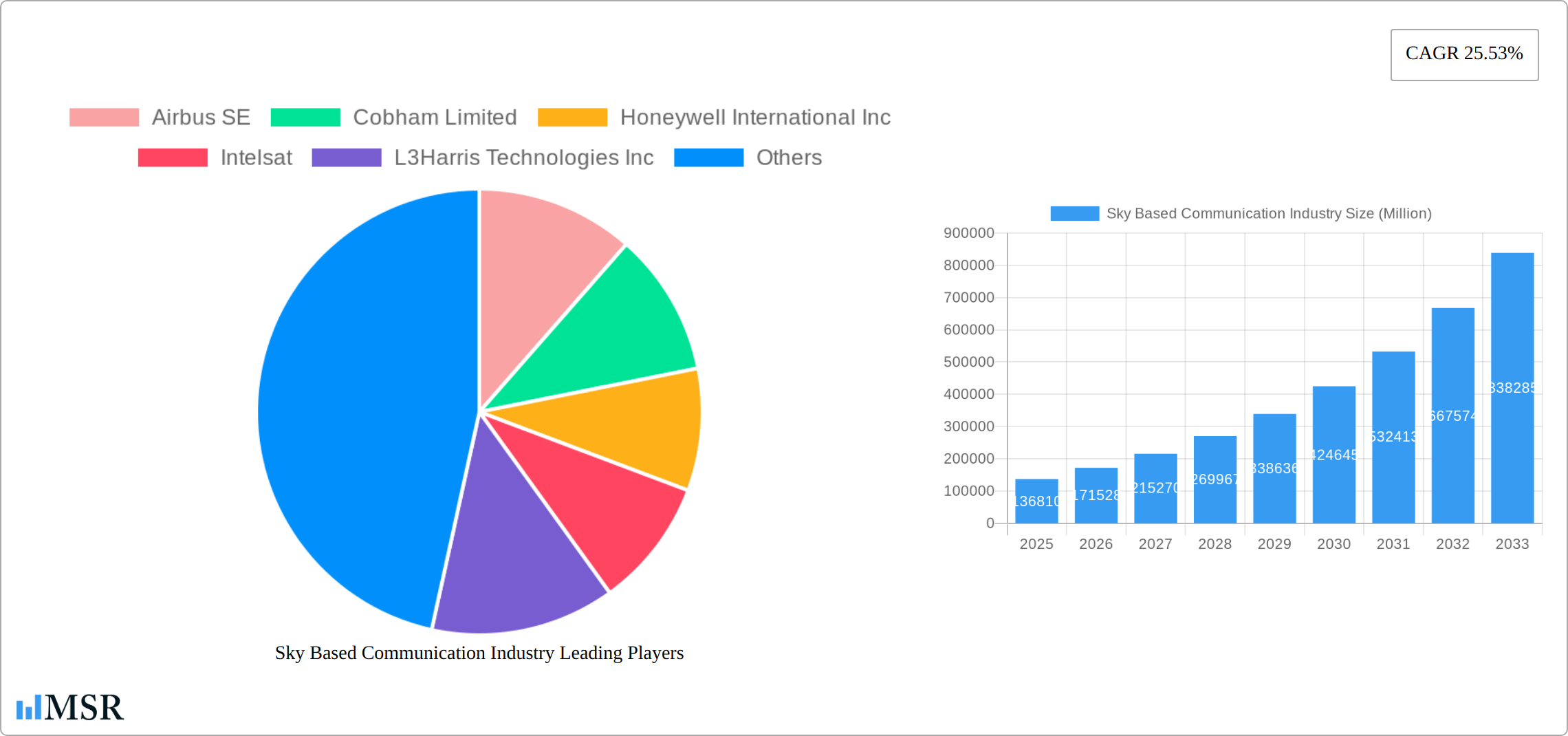

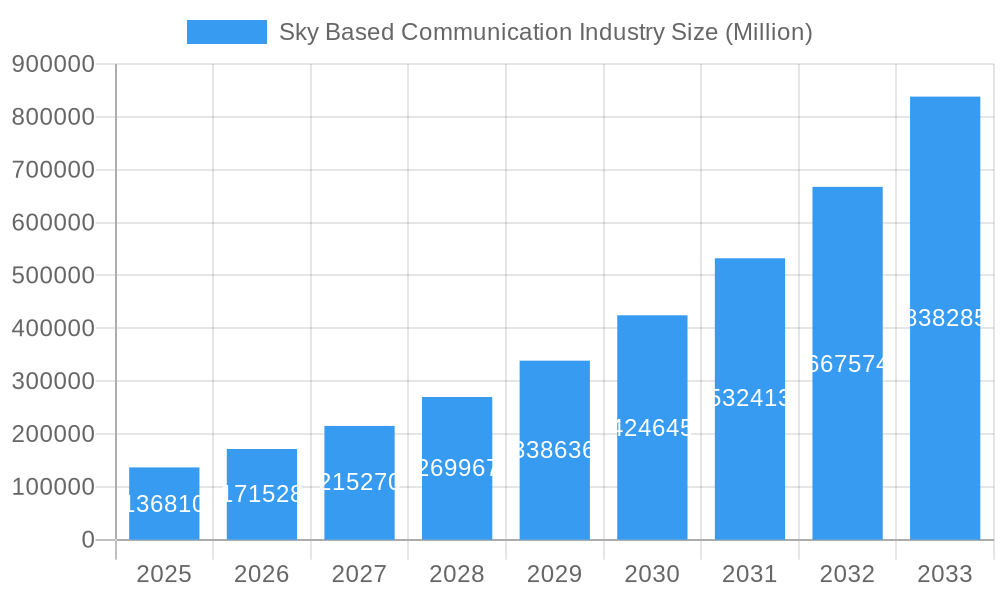

The sky-based communication industry is experiencing robust growth, projected to reach a market size of $136.81 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 25.53% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing demand for high-speed, reliable connectivity across various sectors, including aviation, maritime, and remote areas, is a primary catalyst. Technological advancements in satellite technology, such as the development of low earth orbit (LEO) constellations and advancements in High Throughput Satellites (HTS), are significantly improving network capacity and latency, making sky-based communication more competitive with terrestrial networks. Furthermore, the growing adoption of Internet of Things (IoT) devices and the need for seamless global connectivity are further propelling market growth. Government initiatives to improve communication infrastructure in underserved regions and increasing investments in research and development are also contributing factors.

Sky Based Communication Industry Market Size (In Billion)

Major players like Airbus SE, Cobham Limited, Honeywell International Inc, Intelsat, and others are actively shaping the industry through strategic partnerships, mergers and acquisitions, and the launch of innovative products and services. Competitive pressures will remain high as companies invest heavily in improving network performance and expanding service offerings. While challenges like regulatory hurdles and the high cost of satellite deployment exist, the overall outlook remains extremely positive, driven by the ever-increasing demand for reliable global connectivity across diverse applications. The forecast period (2025-2033) anticipates substantial market expansion, presenting lucrative opportunities for companies operating within this dynamic sector.

Sky Based Communication Industry Company Market Share

Sky Based Communication Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Sky Based Communication Industry, covering market dynamics, key players, emerging trends, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry stakeholders, investors, and strategic decision-makers. The report projects a market size of xx Million USD by 2033, representing a CAGR of xx% during the forecast period.

Sky Based Communication Industry Market Concentration & Dynamics

The Sky Based Communication Industry is characterized by a moderately concentrated market structure, with a handful of major players holding significant market share. While precise market share figures for individual companies remain proprietary, estimates suggest that the top 5 players collectively account for approximately 60-70% of the global revenue. The industry landscape is dynamic, marked by continuous innovation, strategic mergers and acquisitions (M&A), and evolving regulatory frameworks.

- Market Concentration: High, with a few dominant players.

- Innovation Ecosystems: Robust, driven by advancements in satellite technology, network optimization, and data analytics.

- Regulatory Frameworks: Complex and vary significantly across geographies, impacting market access and operational costs.

- Substitute Products: Terrestrial communication networks and fiber optics present some level of substitution, although satellite communication offers unique advantages in remote or geographically challenging areas.

- End-User Trends: Increasing demand for high-bandwidth, low-latency communication across various sectors like defense, aviation, maritime, and broadband internet access.

- M&A Activities: Frequent M&A activity points to ongoing consolidation within the industry, with a projected xx number of deals during the forecast period. These activities largely aim to expand service offerings, geographical reach, and technological capabilities.

Sky Based Communication Industry Industry Insights & Trends

The Sky Based Communication Industry is experiencing robust growth, driven by several key factors. The proliferation of low-earth orbit (LEO) satellites is revolutionizing satellite communication, offering improved coverage, reduced latency, and increased bandwidth. This technological disruption is fueling a surge in demand for high-speed internet connectivity, particularly in underserved regions. Furthermore, the increasing integration of satellite communication with other technologies, such as IoT (Internet of Things) and AI (Artificial Intelligence), is opening up new possibilities for various applications. Governments worldwide are investing heavily in strengthening their space-based communication infrastructure, further driving market expansion. The market size is estimated at xx Million USD in 2025, with a projected growth to xx Million USD by 2033.

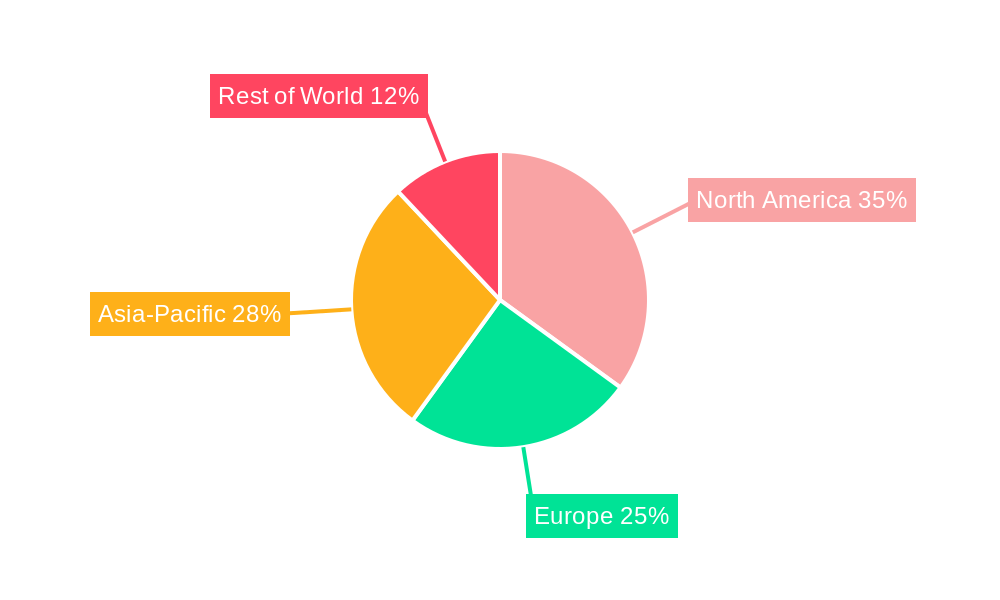

Key Markets & Segments Leading Sky Based Communication Industry

The global Sky Based Communication Industry is experiencing dynamic shifts, with North America currently maintaining a leading position, closely followed by Europe and the Asia-Pacific region. This dominance is underpinned by a confluence of strategic factors:

- Robust Government Support: Significant and sustained investments in national security, space exploration, and advanced defense programs are a primary catalyst, driving substantial demand for satellite-enabled communication solutions.

- Pioneering Technological Advancements: A concentrated hub of cutting-edge research and development activities fosters a culture of innovation, leading to the continuous evolution of satellite technology, from miniaturization to enhanced data transmission capabilities.

- Mature and Integrated Infrastructure: The presence of well-established terrestrial and aerial communication networks facilitates the seamless integration and deployment of advanced satellite technologies, enabling hybrid communication solutions.

- Surge in Consumer and Enterprise Adoption: A growing appetite for high-bandwidth, reliable connectivity across both consumer and enterprise sectors, particularly for applications demanding consistent and extensive coverage, is fueling market expansion.

The defense and aerospace sectors remain pivotal revenue generators. In 2025, these segments are projected to account for approximately 65-70% of the total market revenue, a testament to the increasing reliance of modern military operations on secure, resilient, and high-performance satellite communication systems for global reach and command and control.

Sky Based Communication Industry Product Developments

Recent product innovations focus on improving bandwidth, latency, and efficiency. Advancements in satellite technology, including the development of high-throughput satellites (HTS) and LEO constellations, have significantly enhanced the capabilities of satellite communication systems. This provides a competitive edge for companies offering innovative solutions with superior performance characteristics.

Challenges in the Sky Based Communication Industry Market

The Sky Based Communication Industry faces various challenges, including regulatory complexities impacting international operations and high initial investment costs associated with satellite development and deployment. Furthermore, intense competition among established players and the emergence of new entrants pose considerable pressure on profitability and market share. Supply chain disruptions and the need for skilled workforce also affect production timelines. These challenges, if not addressed effectively, could impede the industry's long-term growth potential.

Forces Driving Sky Based Communication Industry Growth

The Sky Based Communication Industry is experiencing a period of accelerated growth, propelled by a multifaceted set of drivers. Foremost among these is the relentless expansion of global broadband internet access, crucial for bridging the digital divide and connecting underserved populations. Governments worldwide are actively supporting this expansion through significant investments in space exploration initiatives and the development of national space capabilities. Simultaneously, rapid technological advancements are reshaping the industry landscape. The proliferation of smaller, more cost-effective, and highly capable satellites, coupled with the transformative potential of 5G and future generations of mobile networks, is unlocking unprecedented opportunities for enhanced performance, lower latency, and a wider array of innovative applications.

Challenges in the Sky Based Communication Industry Market

Long-term growth hinges on continuous innovation in satellite technology and partnerships to share infrastructure costs and enhance global reach. Strategic market expansions into underserved regions and establishing robust supply chains are crucial for sustained growth.

Emerging Opportunities in Sky Based Communication Industry

The Sky Based Communication Industry is ripe with burgeoning opportunities, particularly in leveraging the expansive capabilities of the Internet of Things (IoT). Satellite technology is poised to play a critical role in facilitating massive IoT deployments for enhanced global data collection, real-time monitoring, and advanced analytics across various sectors. Furthermore, the intrinsic resilience and broad coverage of satellite systems present invaluable applications in disaster management and emergency response, ensuring critical communication lines remain open when terrestrial infrastructure fails. The industry is also set to capitalize on expanding into new, underserved geographic markets and developing novel, sector-specific applications for industries such as precision agriculture, autonomous transportation, and remote healthcare delivery, promising substantial revenue growth and societal impact.

Leading Players in the Sky Based Communication Industry Sector

Key Milestones in Sky Based Communication Industry Industry

- October 2023: Honeywell was awarded a significant USD 900 Million contract by the US Space Force for its Proliferated Low Earth Orbit (LEO) program. This landmark agreement underscores the escalating commitment of governmental bodies to advanced space-based communication infrastructure and highlights the strategic importance of LEO constellations.

- February 2024: Northrop Grumman selected Viasat Inc. to integrate its high-capacity Viasat-3 Satellite Communications Network with key US Air Force assets. This collaboration signifies the increasing reliance on advanced, high-bandwidth satellite internet access for sophisticated military applications, enabling enhanced operational capabilities and data throughput.

Strategic Outlook for Sky Based Communication Industry Market

The Sky Based Communication Industry is poised for significant growth, driven by technological innovations, increasing government investment, and expanding applications across various sectors. Strategic partnerships and targeted investments in R&D will be essential for players to capitalize on future market opportunities and maintain a competitive edge in this rapidly evolving landscape.

Sky Based Communication Industry Segmentation

-

1. Application

- 1.1. Telecommunication

- 1.2. Broadband

- 1.3. Navigation

- 1.4. Remote Sensing

- 1.5. Broadcasting

- 1.6. Other Applications

-

2. Type

- 2.1. Low Earth Orbit (LEO)

- 2.2. Medium Earth Orbit (MEO)

-

3. End User

- 3.1. Military and Government

- 3.2. Commercial

Sky Based Communication Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Israel

- 5.4. Rest of Middle East and Africa

Sky Based Communication Industry Regional Market Share

Geographic Coverage of Sky Based Communication Industry

Sky Based Communication Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Low Earth Orbit (LEO) Segment is Expected to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sky Based Communication Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Telecommunication

- 5.1.2. Broadband

- 5.1.3. Navigation

- 5.1.4. Remote Sensing

- 5.1.5. Broadcasting

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Low Earth Orbit (LEO)

- 5.2.2. Medium Earth Orbit (MEO)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Military and Government

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Sky Based Communication Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Telecommunication

- 6.1.2. Broadband

- 6.1.3. Navigation

- 6.1.4. Remote Sensing

- 6.1.5. Broadcasting

- 6.1.6. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Low Earth Orbit (LEO)

- 6.2.2. Medium Earth Orbit (MEO)

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Military and Government

- 6.3.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Sky Based Communication Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Telecommunication

- 7.1.2. Broadband

- 7.1.3. Navigation

- 7.1.4. Remote Sensing

- 7.1.5. Broadcasting

- 7.1.6. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Low Earth Orbit (LEO)

- 7.2.2. Medium Earth Orbit (MEO)

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Military and Government

- 7.3.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Sky Based Communication Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Telecommunication

- 8.1.2. Broadband

- 8.1.3. Navigation

- 8.1.4. Remote Sensing

- 8.1.5. Broadcasting

- 8.1.6. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Low Earth Orbit (LEO)

- 8.2.2. Medium Earth Orbit (MEO)

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Military and Government

- 8.3.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Sky Based Communication Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Telecommunication

- 9.1.2. Broadband

- 9.1.3. Navigation

- 9.1.4. Remote Sensing

- 9.1.5. Broadcasting

- 9.1.6. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Low Earth Orbit (LEO)

- 9.2.2. Medium Earth Orbit (MEO)

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Military and Government

- 9.3.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Sky Based Communication Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Telecommunication

- 10.1.2. Broadband

- 10.1.3. Navigation

- 10.1.4. Remote Sensing

- 10.1.5. Broadcasting

- 10.1.6. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Low Earth Orbit (LEO)

- 10.2.2. Medium Earth Orbit (MEO)

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Military and Government

- 10.3.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Airbus SE

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cobham Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Honeywell International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Intelsat

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 L3Harris Technologies Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Maxar Technologies Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 THALES

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Viasat Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Inmarsat Global Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Iridium Communications Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Airbus SE

List of Figures

- Figure 1: Global Sky Based Communication Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Sky Based Communication Industry Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Sky Based Communication Industry Revenue (Million), by Application 2025 & 2033

- Figure 4: North America Sky Based Communication Industry Volume (Billion), by Application 2025 & 2033

- Figure 5: North America Sky Based Communication Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Sky Based Communication Industry Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Sky Based Communication Industry Revenue (Million), by Type 2025 & 2033

- Figure 8: North America Sky Based Communication Industry Volume (Billion), by Type 2025 & 2033

- Figure 9: North America Sky Based Communication Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Sky Based Communication Industry Volume Share (%), by Type 2025 & 2033

- Figure 11: North America Sky Based Communication Industry Revenue (Million), by End User 2025 & 2033

- Figure 12: North America Sky Based Communication Industry Volume (Billion), by End User 2025 & 2033

- Figure 13: North America Sky Based Communication Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Sky Based Communication Industry Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Sky Based Communication Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Sky Based Communication Industry Volume (Billion), by Country 2025 & 2033

- Figure 17: North America Sky Based Communication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Sky Based Communication Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Sky Based Communication Industry Revenue (Million), by Application 2025 & 2033

- Figure 20: Europe Sky Based Communication Industry Volume (Billion), by Application 2025 & 2033

- Figure 21: Europe Sky Based Communication Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Sky Based Communication Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Sky Based Communication Industry Revenue (Million), by Type 2025 & 2033

- Figure 24: Europe Sky Based Communication Industry Volume (Billion), by Type 2025 & 2033

- Figure 25: Europe Sky Based Communication Industry Revenue Share (%), by Type 2025 & 2033

- Figure 26: Europe Sky Based Communication Industry Volume Share (%), by Type 2025 & 2033

- Figure 27: Europe Sky Based Communication Industry Revenue (Million), by End User 2025 & 2033

- Figure 28: Europe Sky Based Communication Industry Volume (Billion), by End User 2025 & 2033

- Figure 29: Europe Sky Based Communication Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Sky Based Communication Industry Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Sky Based Communication Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Sky Based Communication Industry Volume (Billion), by Country 2025 & 2033

- Figure 33: Europe Sky Based Communication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Sky Based Communication Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Sky Based Communication Industry Revenue (Million), by Application 2025 & 2033

- Figure 36: Asia Pacific Sky Based Communication Industry Volume (Billion), by Application 2025 & 2033

- Figure 37: Asia Pacific Sky Based Communication Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Asia Pacific Sky Based Communication Industry Volume Share (%), by Application 2025 & 2033

- Figure 39: Asia Pacific Sky Based Communication Industry Revenue (Million), by Type 2025 & 2033

- Figure 40: Asia Pacific Sky Based Communication Industry Volume (Billion), by Type 2025 & 2033

- Figure 41: Asia Pacific Sky Based Communication Industry Revenue Share (%), by Type 2025 & 2033

- Figure 42: Asia Pacific Sky Based Communication Industry Volume Share (%), by Type 2025 & 2033

- Figure 43: Asia Pacific Sky Based Communication Industry Revenue (Million), by End User 2025 & 2033

- Figure 44: Asia Pacific Sky Based Communication Industry Volume (Billion), by End User 2025 & 2033

- Figure 45: Asia Pacific Sky Based Communication Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Sky Based Communication Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Sky Based Communication Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Sky Based Communication Industry Volume (Billion), by Country 2025 & 2033

- Figure 49: Asia Pacific Sky Based Communication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Sky Based Communication Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Sky Based Communication Industry Revenue (Million), by Application 2025 & 2033

- Figure 52: Latin America Sky Based Communication Industry Volume (Billion), by Application 2025 & 2033

- Figure 53: Latin America Sky Based Communication Industry Revenue Share (%), by Application 2025 & 2033

- Figure 54: Latin America Sky Based Communication Industry Volume Share (%), by Application 2025 & 2033

- Figure 55: Latin America Sky Based Communication Industry Revenue (Million), by Type 2025 & 2033

- Figure 56: Latin America Sky Based Communication Industry Volume (Billion), by Type 2025 & 2033

- Figure 57: Latin America Sky Based Communication Industry Revenue Share (%), by Type 2025 & 2033

- Figure 58: Latin America Sky Based Communication Industry Volume Share (%), by Type 2025 & 2033

- Figure 59: Latin America Sky Based Communication Industry Revenue (Million), by End User 2025 & 2033

- Figure 60: Latin America Sky Based Communication Industry Volume (Billion), by End User 2025 & 2033

- Figure 61: Latin America Sky Based Communication Industry Revenue Share (%), by End User 2025 & 2033

- Figure 62: Latin America Sky Based Communication Industry Volume Share (%), by End User 2025 & 2033

- Figure 63: Latin America Sky Based Communication Industry Revenue (Million), by Country 2025 & 2033

- Figure 64: Latin America Sky Based Communication Industry Volume (Billion), by Country 2025 & 2033

- Figure 65: Latin America Sky Based Communication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Latin America Sky Based Communication Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Sky Based Communication Industry Revenue (Million), by Application 2025 & 2033

- Figure 68: Middle East and Africa Sky Based Communication Industry Volume (Billion), by Application 2025 & 2033

- Figure 69: Middle East and Africa Sky Based Communication Industry Revenue Share (%), by Application 2025 & 2033

- Figure 70: Middle East and Africa Sky Based Communication Industry Volume Share (%), by Application 2025 & 2033

- Figure 71: Middle East and Africa Sky Based Communication Industry Revenue (Million), by Type 2025 & 2033

- Figure 72: Middle East and Africa Sky Based Communication Industry Volume (Billion), by Type 2025 & 2033

- Figure 73: Middle East and Africa Sky Based Communication Industry Revenue Share (%), by Type 2025 & 2033

- Figure 74: Middle East and Africa Sky Based Communication Industry Volume Share (%), by Type 2025 & 2033

- Figure 75: Middle East and Africa Sky Based Communication Industry Revenue (Million), by End User 2025 & 2033

- Figure 76: Middle East and Africa Sky Based Communication Industry Volume (Billion), by End User 2025 & 2033

- Figure 77: Middle East and Africa Sky Based Communication Industry Revenue Share (%), by End User 2025 & 2033

- Figure 78: Middle East and Africa Sky Based Communication Industry Volume Share (%), by End User 2025 & 2033

- Figure 79: Middle East and Africa Sky Based Communication Industry Revenue (Million), by Country 2025 & 2033

- Figure 80: Middle East and Africa Sky Based Communication Industry Volume (Billion), by Country 2025 & 2033

- Figure 81: Middle East and Africa Sky Based Communication Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Sky Based Communication Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sky Based Communication Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Sky Based Communication Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 3: Global Sky Based Communication Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Sky Based Communication Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Global Sky Based Communication Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Sky Based Communication Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 7: Global Sky Based Communication Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Sky Based Communication Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Sky Based Communication Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Sky Based Communication Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Global Sky Based Communication Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Sky Based Communication Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 13: Global Sky Based Communication Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Sky Based Communication Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 15: Global Sky Based Communication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Sky Based Communication Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States Sky Based Communication Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Sky Based Communication Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada Sky Based Communication Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Sky Based Communication Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Global Sky Based Communication Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Sky Based Communication Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 23: Global Sky Based Communication Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global Sky Based Communication Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 25: Global Sky Based Communication Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 26: Global Sky Based Communication Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 27: Global Sky Based Communication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Sky Based Communication Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 29: United Kingdom Sky Based Communication Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Sky Based Communication Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: France Sky Based Communication Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: France Sky Based Communication Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Germany Sky Based Communication Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Germany Sky Based Communication Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Russia Sky Based Communication Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Sky Based Communication Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Rest of Europe Sky Based Communication Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Europe Sky Based Communication Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Global Sky Based Communication Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Global Sky Based Communication Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 41: Global Sky Based Communication Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 42: Global Sky Based Communication Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 43: Global Sky Based Communication Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 44: Global Sky Based Communication Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 45: Global Sky Based Communication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Global Sky Based Communication Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 47: India Sky Based Communication Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: India Sky Based Communication Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: China Sky Based Communication Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: China Sky Based Communication Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Japan Sky Based Communication Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Japan Sky Based Communication Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: South Korea Sky Based Communication Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: South Korea Sky Based Communication Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Rest of Asia Pacific Sky Based Communication Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of Asia Pacific Sky Based Communication Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Global Sky Based Communication Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 58: Global Sky Based Communication Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 59: Global Sky Based Communication Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 60: Global Sky Based Communication Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 61: Global Sky Based Communication Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 62: Global Sky Based Communication Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 63: Global Sky Based Communication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Global Sky Based Communication Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 65: Brazil Sky Based Communication Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Brazil Sky Based Communication Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: Rest of Latin America Sky Based Communication Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Rest of Latin America Sky Based Communication Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: Global Sky Based Communication Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 70: Global Sky Based Communication Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 71: Global Sky Based Communication Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 72: Global Sky Based Communication Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 73: Global Sky Based Communication Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 74: Global Sky Based Communication Industry Volume Billion Forecast, by End User 2020 & 2033

- Table 75: Global Sky Based Communication Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 76: Global Sky Based Communication Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 77: United Arab Emirates Sky Based Communication Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: United Arab Emirates Sky Based Communication Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 79: Saudi Arabia Sky Based Communication Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Saudi Arabia Sky Based Communication Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: Israel Sky Based Communication Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Israel Sky Based Communication Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: Rest of Middle East and Africa Sky Based Communication Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Rest of Middle East and Africa Sky Based Communication Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sky Based Communication Industry?

The projected CAGR is approximately 25.53%.

2. Which companies are prominent players in the Sky Based Communication Industry?

Key companies in the market include Airbus SE, Cobham Limited, Honeywell International Inc, Intelsat, L3Harris Technologies Inc, Maxar Technologies Inc, THALES, Viasat Inc, Inmarsat Global Limited, Iridium Communications Inc.

3. What are the main segments of the Sky Based Communication Industry?

The market segments include Application, Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 136.81 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Low Earth Orbit (LEO) Segment is Expected to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2024: Northrop Grumman awarded Viasat Inc. a contract to bolster the US Air Force Research Laboratory (AFRL) initiative. Under this agreement, Viasat will deploy its ViaSat-3 Satellite Communications Network, facilitating seamless, high-bandwidth satellite internet access for military personnel aboard USAF aircraft and ground vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sky Based Communication Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sky Based Communication Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sky Based Communication Industry?

To stay informed about further developments, trends, and reports in the Sky Based Communication Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence