Key Insights

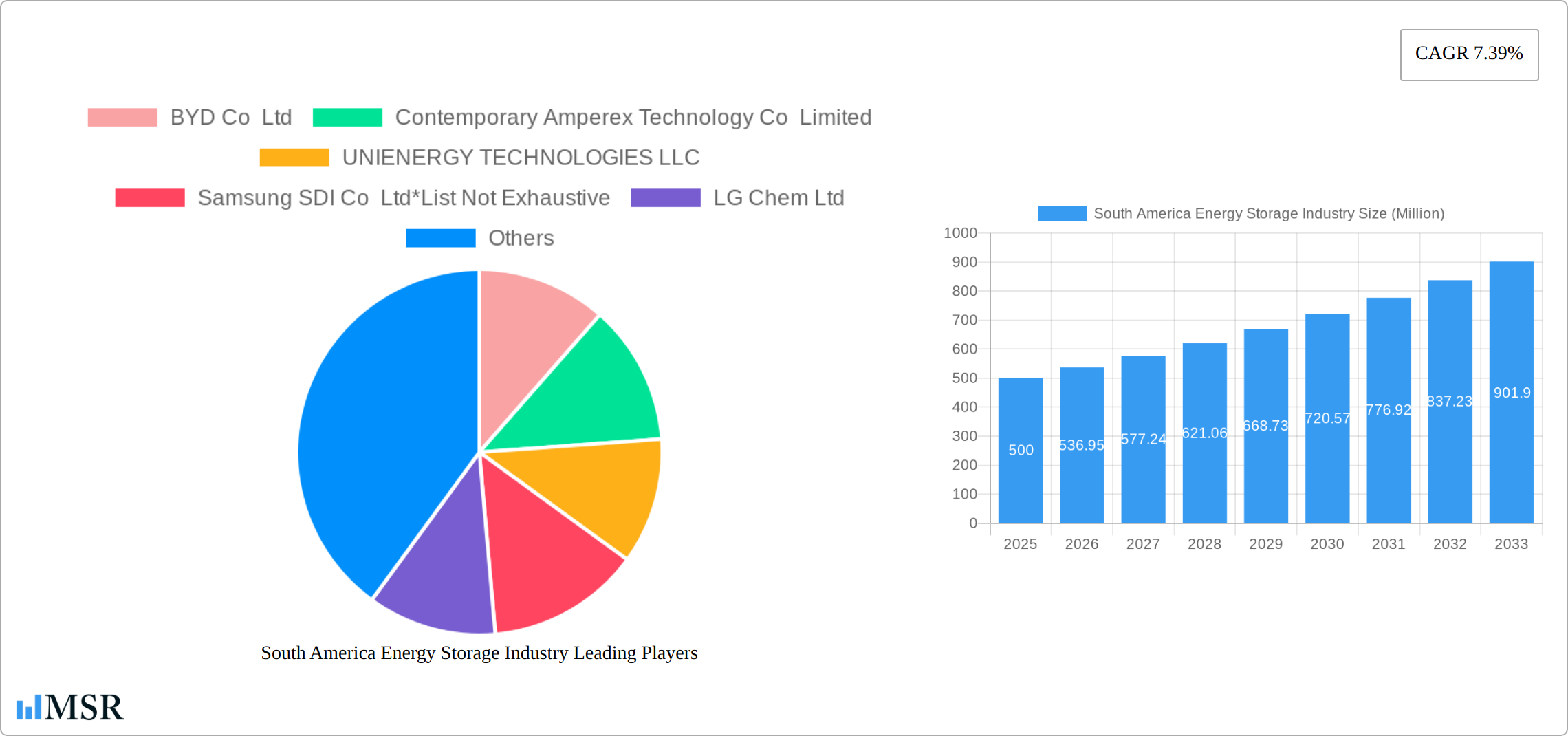

The South American energy storage market, projected to be worth [Estimate based on provided CAGR and market size. For example, if the market size in 2025 is XX million and the CAGR is 7.39%, a reasonable estimate for a larger market size in 2033 could be calculated. Assume a 2025 value of $500 million for the example below], is experiencing robust growth fueled by increasing renewable energy integration and the need for grid stability. Drivers include government initiatives promoting clean energy adoption, rising electricity demand in burgeoning economies like Brazil and Argentina, and the escalating cost of fossil fuels. The market is segmented by energy storage type (Batteries, Pumped-Storage Hydroelectricity (PSH), Thermal Energy Storage (TES), Flywheel Energy Storage (FES)) and application (Residential, Commercial & Industrial). Batteries currently dominate the market share due to their versatility and technological advancements, but PSH remains significant due to existing infrastructure in certain regions. Residential adoption is gradually increasing, driven by the falling prices of home energy storage systems and increasing awareness of renewable energy benefits. However, challenges persist, including high initial investment costs, limited grid infrastructure in some areas, and a lack of standardized regulations hindering wider adoption.

South America Energy Storage Industry Market Size (In Million)

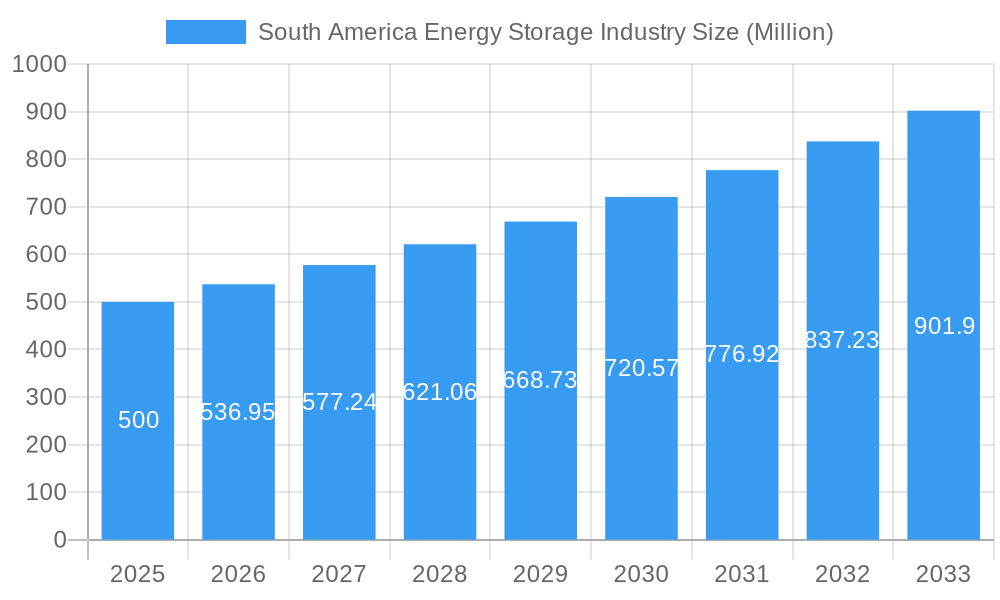

Growth is anticipated to accelerate in the coming years, with the industrial sector expected to drive substantial demand as companies strive to increase energy efficiency and reduce reliance on volatile energy sources. The market will likely witness increased competition among key players, including BYD, CATL, UNIENERGY, Samsung SDI, LG Chem, NGK Insulators, Clarios, and GS Yuasa. These companies are likely to focus on developing innovative storage solutions tailored to the specific needs of the South American market, fostering strategic partnerships and collaborations to expand their market reach. Specific regional focus on Brazil and Argentina will be crucial due to their larger economies and energy demands. Continued government support and technological advancements in energy storage technology will be vital in ensuring sustainable market growth throughout the forecast period (2025-2033).

South America Energy Storage Industry Company Market Share

South America Energy Storage Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America energy storage industry, offering invaluable insights for stakeholders, investors, and industry professionals. Spanning the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study meticulously examines market dynamics, growth drivers, and emerging opportunities across various segments. The report reveals a market poised for significant expansion, driven by technological advancements, supportive government policies, and increasing demand for renewable energy integration. The total market size is estimated at $XX Million in 2025 and is projected to reach $XX Million by 2033, exhibiting a CAGR of XX%.

South America Energy Storage Industry Market Concentration & Dynamics

The South American energy storage market presents a moderately concentrated landscape, dominated by several key players commanding significant market share. Prominent among them are BYD Co Ltd, Contemporary Amperex Technology Co Limited, UNIENERGY TECHNOLOGIES LLC, Samsung SDI Co Ltd, LG Chem Ltd, NGK Insulators Ltd, Clarios (formerly Johnson Controls International PLC), and GS Yuasa Corporation. While these companies hold substantial influence, a vibrant ecosystem of smaller, specialized firms also contributes to the market's dynamism. While precise figures for 2025 are unavailable at this time, analysis suggests the top five players likely hold a significant portion of the overall market share.

Market dynamics are influenced by a complex interplay of factors:

- Innovation Ecosystems: Robust R&D investments in cutting-edge battery technologies, such as lithium-ion and flow batteries, are fueling continuous innovation and improvement in energy storage capacity and efficiency.

- Regulatory Frameworks & Government Incentives: Supportive government policies and regulations aimed at accelerating renewable energy integration are creating a favorable environment for market expansion. Incentives such as tax breaks, subsidies, and streamlined permitting processes are playing a crucial role.

- Competitive Landscape & Substitute Products: The market faces competition from alternative energy storage solutions, notably pumped-storage hydroelectricity (PSH), which remains a strong contender, particularly in regions with suitable geographical conditions. This competitive pressure fosters innovation and drives down costs across the board.

- Evolving End-User Demands: The increasing adoption of energy storage across residential, commercial, and industrial sectors is a primary growth driver. This surge in demand is underpinned by factors such as rising electricity costs, increasing awareness of sustainability, and the need for reliable backup power.

- Strategic Consolidation & M&A Activity: Significant mergers and acquisitions (M&A) activity within the South American energy storage sector reflects a trend of strategic consolidation and expansion among key players. This activity signals confidence in future market growth and potential for enhanced operational efficiency.

South America Energy Storage Industry Industry Insights & Trends

The South American energy storage market is experiencing robust growth, driven by various factors. The increasing penetration of renewable energy sources, such as solar and wind power, necessitates efficient energy storage solutions to address intermittency challenges. Furthermore, rising electricity prices and growing concerns about climate change are pushing both governments and consumers toward energy-efficient technologies, boosting demand for energy storage systems. Technological advancements are also significantly impacting the market, with improvements in battery efficiency, lifespan, and cost driving wider adoption. Consumer behavior is shifting towards environmentally friendly solutions, creating a conducive environment for the growth of energy storage. The market's growth is further supported by supportive government policies, including subsidies and tax incentives, aimed at promoting renewable energy integration and energy independence. This market expansion is evident in the rising market size and projected CAGR.

Key Markets & Segments Leading South America Energy Storage Industry

Brazil currently leads the South American energy storage market, driven by a strong economy and proactive government policies focused on strengthening energy infrastructure. Other key markets exhibiting significant growth potential include Chile, Argentina, and Colombia, each presenting unique opportunities and challenges.

Dominant Segments:

- Storage Technology Type: Batteries currently dominate, owing to their versatility and relatively lower costs compared to other technologies. However, PSH continues to play a significant role, particularly in regions with suitable geography. Thermal Energy Storage (TES) and Flow Energy Storage (FES) technologies are still in early stages of development and adoption within South America.

- Application Segment: The commercial and industrial segment commands the largest market share, driven by the demand for reliable power backup and grid stabilization. The residential segment exhibits substantial growth potential, fueled by the increasing popularity of solar rooftop systems and continuous reductions in battery costs.

Key Growth Drivers:

- Sustained Economic Growth: The ongoing economic expansion in several South American countries fuels investments in infrastructure development, including energy storage solutions.

- Modernizing Energy Infrastructure: Government initiatives aimed at modernizing and upgrading power grids are creating significant opportunities for integrating energy storage technologies.

- Renewable Energy Integration Imperative: The rapid growth of renewable energy sources necessitates efficient energy storage solutions to effectively manage power fluctuations and ensure grid stability.

South America Energy Storage Industry Product Developments

Significant progress has been made in improving battery technology, with advancements in lithium-ion battery chemistry resulting in higher energy density, longer lifespan, and faster charging capabilities. This has broadened the applications of energy storage, from residential and commercial use to large-scale grid applications. New developments in thermal and flywheel energy storage are also emerging, though they are still at early stages of adoption in the South American context. Competition is intensifying, with companies vying to offer superior products with improved cost-effectiveness and performance.

Challenges in the South America Energy Storage Industry Market

Despite significant potential, the South American energy storage market faces notable challenges. High upfront capital costs and limited consumer awareness represent significant barriers to entry and widespread adoption. Inadequate infrastructure in certain regions and potential supply chain vulnerabilities add complexity. Furthermore, inconsistencies in regulatory frameworks and policies across different countries can hinder market development. The competitive landscape, marked by both established players and emerging entrants, creates pressure on profitability and market share. These combined factors contribute to a complex and dynamic market environment. While precise figures are unavailable, analysts predict that these challenges may somewhat dampen growth in the near future.

Forces Driving South America Energy Storage Industry Growth

Several factors are driving the growth of South America's energy storage market:

- Technological Advancements: Innovations in battery technology, lowering costs and improving performance.

- Economic Growth: Increased investment in infrastructure and renewable energy projects.

- Regulatory Support: Government policies promoting renewable energy and energy efficiency.

- Environmental Concerns: Growing awareness of climate change and the need for sustainable energy solutions.

Long-Term Growth Catalysts in the South America Energy Storage Industry

Long-term growth is fueled by continuous innovation in battery technology leading to increased energy density and lower costs. Strategic partnerships between energy storage companies and renewable energy developers are expanding market reach. Government support through subsidies and tax incentives is crucial. Furthermore, the exploration of new applications in sectors like transportation and grid stabilization expands market potential. These developments underpin the industry's sustained growth trajectory.

Emerging Opportunities in South America Energy Storage Industry

Significant opportunities exist in expanding energy storage solutions to remote areas lacking reliable electricity access. The integration of energy storage with smart grids and microgrids offers vast potential. Emerging technologies like flow batteries are presenting new options for large-scale energy storage. Finally, the growth of electric vehicle adoption opens new avenues for battery storage applications.

Leading Players in the South America Energy Storage Industry Sector

- BYD Co Ltd

- Contemporary Amperex Technology Co Limited

- UNIENERGY TECHNOLOGIES LLC

- Samsung SDI Co Ltd

- LG Chem Ltd

- NGK Insulators Ltd

- Clarios (Formerly Johnson Controls International PLC)

- GS Yuasa Corporation

Key Milestones in South America Energy Storage Industry Industry

- 2020: Brazilian government launches a significant initiative to support renewable energy integration, including energy storage projects.

- 2022: A major lithium-ion battery manufacturing plant opens in Chile.

- 2023: Several large-scale energy storage projects commence operation in Brazil and Argentina.

- 2024: A significant M&A transaction takes place within the South American energy storage industry.

Strategic Outlook for South America Energy Storage Market

The South American energy storage market exhibits immense potential for future growth. Continued technological advancements, supportive government policies, and increasing demand for renewable energy integration will fuel expansion. Strategic partnerships, investments in infrastructure, and addressing existing challenges are crucial for unlocking the market's full potential. The future is bright for this sector.

South America Energy Storage Industry Segmentation

-

1. Type

- 1.1. Batteries

- 1.2. Pumped-Storage Hydroelectricity (PSH)

- 1.3. Thermal Energy Storage (TES)

- 1.4. Fywheel Energy Storage (FES)

-

2. Application

- 2.1. Residential

- 2.2. Commercial & Indsutrial

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Energy Storage Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Energy Storage Industry Regional Market Share

Geographic Coverage of South America Energy Storage Industry

South America Energy Storage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Supporting Government Policies for Solar Energy in South Africa4.; Increasing Investment in Renewable Energy Such as Solar

- 3.2.2 Wind

- 3.2.3 and Others

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Alternate Renewable Technologies Such as Wind

- 3.4. Market Trends

- 3.4.1. Batteries Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Batteries

- 5.1.2. Pumped-Storage Hydroelectricity (PSH)

- 5.1.3. Thermal Energy Storage (TES)

- 5.1.4. Fywheel Energy Storage (FES)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial & Indsutrial

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Batteries

- 6.1.2. Pumped-Storage Hydroelectricity (PSH)

- 6.1.3. Thermal Energy Storage (TES)

- 6.1.4. Fywheel Energy Storage (FES)

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Commercial & Indsutrial

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Batteries

- 7.1.2. Pumped-Storage Hydroelectricity (PSH)

- 7.1.3. Thermal Energy Storage (TES)

- 7.1.4. Fywheel Energy Storage (FES)

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Commercial & Indsutrial

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of South America South America Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Batteries

- 8.1.2. Pumped-Storage Hydroelectricity (PSH)

- 8.1.3. Thermal Energy Storage (TES)

- 8.1.4. Fywheel Energy Storage (FES)

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Commercial & Indsutrial

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 BYD Co Ltd

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Contemporary Amperex Technology Co Limited

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 UNIENERGY TECHNOLOGIES LLC

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Samsung SDI Co Ltd*List Not Exhaustive

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 LG Chem Ltd

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 NGK Insulators Ltd

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Clarios (Formerly Johnson Controls International PLC)

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 GS Yuasa Corporation

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 BYD Co Ltd

List of Figures

- Figure 1: South America Energy Storage Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Energy Storage Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Energy Storage Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: South America Energy Storage Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: South America Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: South America Energy Storage Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: South America Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: South America Energy Storage Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: South America Energy Storage Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: South America Energy Storage Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: South America Energy Storage Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: South America Energy Storage Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: South America Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: South America Energy Storage Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: South America Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: South America Energy Storage Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: South America Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: South America Energy Storage Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: South America Energy Storage Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: South America Energy Storage Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 19: South America Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: South America Energy Storage Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 21: South America Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: South America Energy Storage Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: South America Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: South America Energy Storage Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: South America Energy Storage Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: South America Energy Storage Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: South America Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: South America Energy Storage Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: South America Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: South America Energy Storage Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 31: South America Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: South America Energy Storage Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Energy Storage Industry?

The projected CAGR is approximately 18.9%.

2. Which companies are prominent players in the South America Energy Storage Industry?

Key companies in the market include BYD Co Ltd, Contemporary Amperex Technology Co Limited, UNIENERGY TECHNOLOGIES LLC, Samsung SDI Co Ltd*List Not Exhaustive, LG Chem Ltd, NGK Insulators Ltd, Clarios (Formerly Johnson Controls International PLC), GS Yuasa Corporation.

3. What are the main segments of the South America Energy Storage Industry?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Supporting Government Policies for Solar Energy in South Africa4.; Increasing Investment in Renewable Energy Such as Solar. Wind. and Others.

6. What are the notable trends driving market growth?

Batteries Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Adoption of Alternate Renewable Technologies Such as Wind.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Energy Storage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Energy Storage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Energy Storage Industry?

To stay informed about further developments, trends, and reports in the South America Energy Storage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence