Key Insights

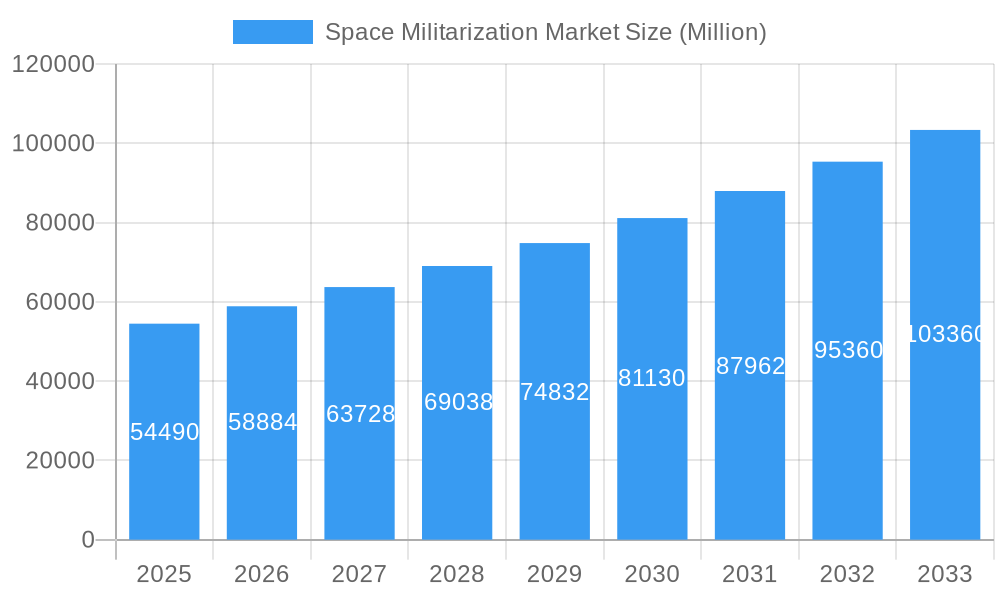

The global space militarization market, valued at $54.49 billion in 2025, is projected to experience robust growth, driven by escalating geopolitical tensions, the increasing need for enhanced national security, and advancements in space-based technologies. The Compound Annual Growth Rate (CAGR) of 8.02% from 2025 to 2033 indicates a significant expansion of this market over the forecast period. Key drivers include the development of anti-satellite weapons, the deployment of space-based surveillance systems for intelligence gathering, and the growing reliance on resilient satellite communication networks for military operations. The market is segmented by capability (defense and support) and mode of operation (space-based and ground-based), reflecting the diverse applications of space-based military technologies. Leading companies like Lockheed Martin, Boeing, Northrop Grumman, and Thales are heavily invested in research and development, contributing to the market's rapid growth. Government funding for space-related military programs and private sector investments in space technology further fuel this expansion.

Space Militarization Market Market Size (In Billion)

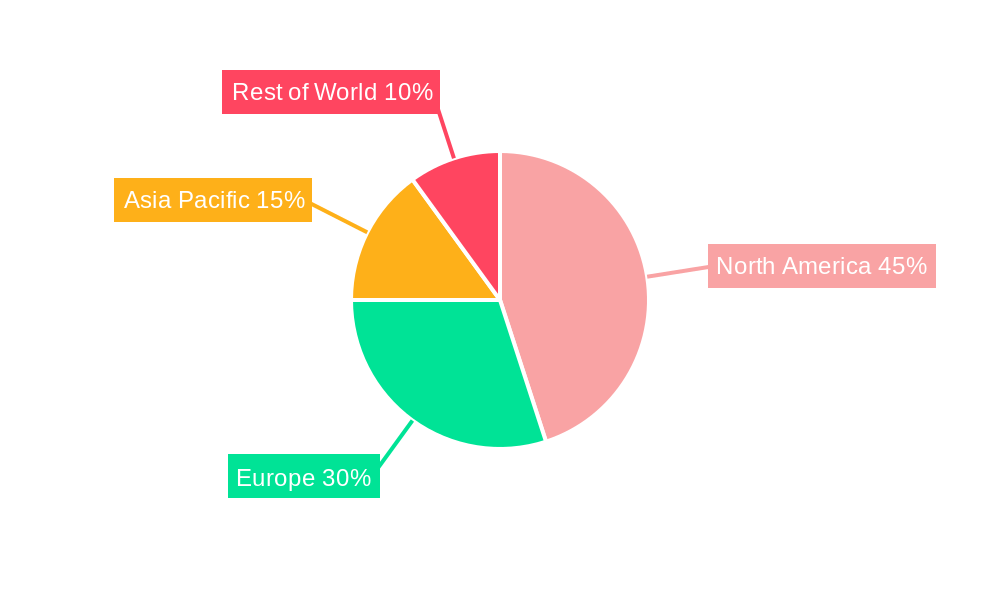

Regional variations are expected, with North America and Europe likely maintaining significant market shares due to their advanced technological capabilities and substantial defense budgets. However, the Asia-Pacific region is also poised for significant growth, driven by increased military spending and the ambition of several nations to develop their own space capabilities. Despite the growth potential, certain restraints exist. These include the high cost of space-based assets, the challenges associated with developing and deploying resilient space systems, and the potential for increased space debris, which could impact the operational effectiveness of existing and future space-based military assets. Furthermore, international space law and treaties will continue to shape the market's trajectory and impact the development and deployment of military technologies in space. Overall, the market is expected to show consistent expansion driven by continuous technological advancements, increasing military expenditure, and the growing recognition of the strategic importance of space.

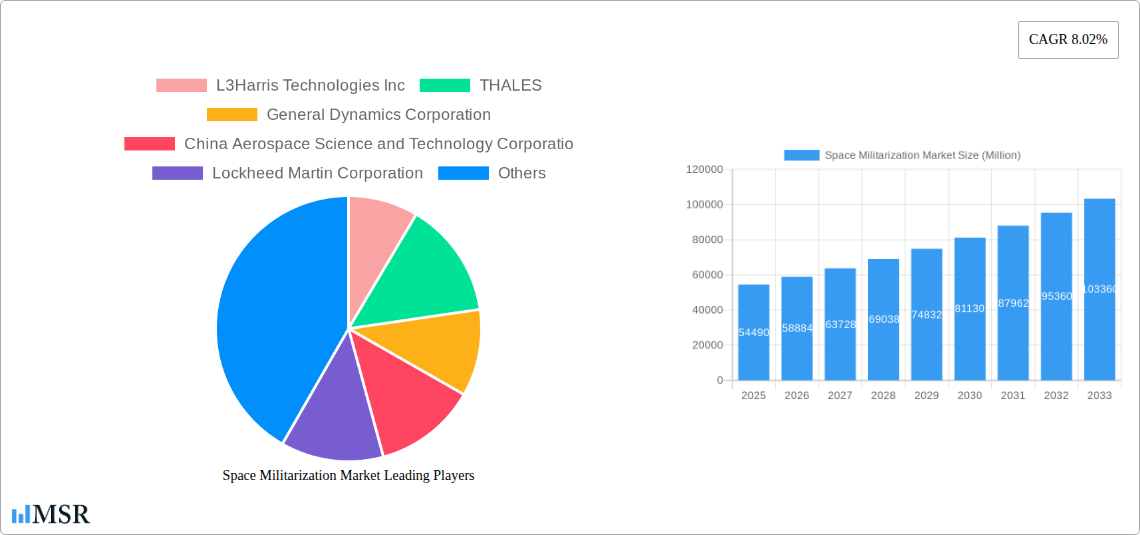

Space Militarization Market Company Market Share

Unlock the Secrets to the Booming Space Militarization Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Space Militarization Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a meticulous study period spanning 2019-2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033, Historical Period: 2019-2024), this report dissects market dynamics, technological advancements, and key players shaping the future of space-based defense. Discover actionable intelligence on market size, CAGR, and emerging opportunities. The report's findings are supported by rigorous data analysis and expert insights, providing a clear path to navigate this rapidly evolving landscape.

Space Militarization Market Concentration & Dynamics

The Space Militarization Market exhibits a moderately concentrated structure, with key players like L3Harris Technologies Inc, THALES, General Dynamics Corporation, China Aerospace Science and Technology Corporation, Lockheed Martin Corporation, Airbus SE, RTX Corporation, BAE Systems plc, Northrop Grumman Corporation, Saab AB, and The Boeing Company commanding significant market share. The combined market share of the top five players is estimated at xx%.

- Market Share: Precise market share distribution varies across segments (Defense vs. Support; Space-based vs. Ground-based) and is detailed within the full report.

- Innovation Ecosystems: Significant R&D investments drive innovation across various technologies, including advanced sensors, AI-powered systems, and directed energy weapons. Collaboration between government agencies and private companies fuels this ecosystem.

- Regulatory Frameworks: International treaties and national regulations influence the development and deployment of space-based military assets. Navigating these complex frameworks is crucial for market participants.

- Substitute Products: While limited direct substitutes exist, alternative technologies such as cyber warfare and advanced ground-based systems compete for defense budgets.

- End-User Trends: Growing geopolitical tensions and the increasing reliance on space-based assets for critical infrastructure protection are driving demand.

- M&A Activities: The number of M&A deals in the space militarization sector has increased significantly in recent years. Over the period 2019-2024, approximately xx deals were recorded, reflecting industry consolidation and the pursuit of technological synergies.

Space Militarization Market Industry Insights & Trends

The global Space Militarization Market is experiencing robust growth, driven by escalating geopolitical tensions, the increasing reliance on space-based assets for military operations, and continuous advancements in space technology. The market size reached approximately $xx Million in 2024 and is projected to reach $xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Key growth drivers include:

- Increased Defense Budgets: Nations globally are increasing defense spending, allocating significant portions to space-based capabilities.

- Technological Advancements: Miniaturization, AI, and improved sensor technologies are making space-based systems more effective and cost-efficient.

- Evolving Geopolitical Landscape: The growing competition among major powers is pushing the development and deployment of advanced space-based military assets.

- Commercialization of Space: The lowering cost of space access is opening new opportunities for private companies and increasing overall market activity.

Key Markets & Segments Leading Space Militarization Market

The North American region, specifically the United States, currently dominates the Space Militarization Market. This dominance is primarily due to:

- High Defense Spending: The US boasts the world's largest defense budget, allocating substantial resources to space-based military technologies.

- Advanced Technological Capabilities: The US possesses a highly developed aerospace and defense industrial base, providing a competitive edge in technological innovation.

- Well-Established Infrastructure: Robust space infrastructure, including launch facilities and ground control systems, supports the development and deployment of space-based assets.

Segment Analysis:

- Capability: The Defense segment holds a larger market share compared to the Support segment due to the high demand for advanced weaponry and surveillance systems. This segment is expected to maintain its dominance throughout the forecast period, showing substantial growth.

- Mode of Operation: Space-based systems currently dominate the market owing to their strategic advantages. However, ground-based systems supporting space-based operations are also experiencing growth, representing a significant supporting infrastructure element.

Drivers:

- Economic Growth (US): Robust economic growth in the US provides resources for sustained investment in space-based defense technologies.

- Technological Advancements: Continual technological advancements in areas like satellite technology and AI are pushing forward the capabilities and desirability of space-based defense systems.

- Geopolitical Instability: The complex geopolitical landscape necessitates continuous upgrades and expansion of space-based defense and surveillance.

Space Militarization Market Product Developments

Recent product developments focus on miniaturized satellites, advanced sensor systems, and AI-powered intelligence gathering capabilities. These innovations enhance situational awareness, improve targeting accuracy, and enhance communication systems in space, driving a competitive edge and improved operational efficiency for military applications. The integration of AI and machine learning into space-based systems offers potential for autonomous operation and improved decision-making capabilities.

Challenges in the Space Militarization Market

Significant challenges include:

- High Development Costs: The development and deployment of space-based systems involve substantial upfront investment.

- Regulatory Hurdles: International space law and national regulations create barriers for market entry and expansion.

- Supply Chain Vulnerabilities: The dependence on specialized components and materials poses risks to supply chain stability and resilience.

- Space Debris: The increasing amount of space debris presents risks for the functionality and longevity of space-based assets.

Forces Driving Space Militarization Market Growth

- Technological advancements: Miniaturization, AI, improved sensors, and directed energy weapons fuel demand.

- Economic factors: Increased defense spending by major global powers significantly influences market expansion.

- Geopolitical factors: Growing international tensions necessitate advanced space-based surveillance and defense systems.

- Regulatory changes: evolving national and international regulations may both hinder and stimulate industry activity.

Long-Term Growth Catalysts in Space Militarization Market

Continued innovation in satellite technology, the emergence of new space-based capabilities, and expanding partnerships between government agencies and private sector companies promise to propel long-term market growth. The potential for commercial applications of space-based technologies will create synergies and contribute to market expansion.

Emerging Opportunities in Space Militarization Market

The growing use of commercial launch vehicles is reducing the cost of deploying space-based assets, creating new opportunities for market entrants. The development of advanced anti-satellite weapons and countermeasures presents both challenges and opportunities for technological advancement. The focus on resilient space architecture to combat threats will open numerous opportunities.

Leading Players in the Space Militarization Market Sector

- L3Harris Technologies Inc

- THALES

- General Dynamics Corporation

- China Aerospace Science and Technology Corporation

- Lockheed Martin Corporation

- Airbus SE

- RTX Corporation

- BAE Systems plc

- Northrop Grumman Corporation

- Saab AB

- The Boeing Company

Key Milestones in Space Militarization Market Industry

- 2020: Increased investment in space-based missile defense systems by several nations.

- 2021: Launch of several advanced reconnaissance satellites equipped with AI-powered image analysis capabilities.

- 2022: Successful testing of a directed energy weapon in space.

- 2023: Significant M&A activity within the sector, highlighting industry consolidation.

- 2024: Announced development of new generation of space-based communication systems focused on enhanced security and resilience.

Strategic Outlook for Space Militarization Market

The Space Militarization Market is poised for significant growth, driven by technological advancements and evolving geopolitical dynamics. Strategic partnerships and investment in research and development will play a crucial role in shaping the future of this market. Companies that successfully navigate the challenges of regulatory compliance, supply chain management, and technological disruption will be well-positioned to capture significant market share.

Space Militarization Market Segmentation

-

1. Capability

- 1.1. Defense

- 1.2. Support

-

2. Mode of Operation

- 2.1. Space-based

- 2.2. Ground-based

Space Militarization Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Space Militarization Market Regional Market Share

Geographic Coverage of Space Militarization Market

Space Militarization Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. The Defense Segment will Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Space Militarization Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Capability

- 5.1.1. Defense

- 5.1.2. Support

- 5.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 5.2.1. Space-based

- 5.2.2. Ground-based

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Capability

- 6. North America Space Militarization Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Capability

- 6.1.1. Defense

- 6.1.2. Support

- 6.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 6.2.1. Space-based

- 6.2.2. Ground-based

- 6.1. Market Analysis, Insights and Forecast - by Capability

- 7. Europe Space Militarization Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Capability

- 7.1.1. Defense

- 7.1.2. Support

- 7.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 7.2.1. Space-based

- 7.2.2. Ground-based

- 7.1. Market Analysis, Insights and Forecast - by Capability

- 8. Asia Pacific Space Militarization Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Capability

- 8.1.1. Defense

- 8.1.2. Support

- 8.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 8.2.1. Space-based

- 8.2.2. Ground-based

- 8.1. Market Analysis, Insights and Forecast - by Capability

- 9. Rest of the World Space Militarization Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Capability

- 9.1.1. Defense

- 9.1.2. Support

- 9.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 9.2.1. Space-based

- 9.2.2. Ground-based

- 9.1. Market Analysis, Insights and Forecast - by Capability

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 L3Harris Technologies Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 THALES

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 General Dynamics Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 China Aerospace Science and Technology Corporatio

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Lockheed Martin Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Airbus SE

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 RTX Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 BAE Systems plc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Northrop Grumman Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Saab AB

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 The Boeing Company

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global Space Militarization Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Space Militarization Market Revenue (Million), by Capability 2025 & 2033

- Figure 3: North America Space Militarization Market Revenue Share (%), by Capability 2025 & 2033

- Figure 4: North America Space Militarization Market Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 5: North America Space Militarization Market Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 6: North America Space Militarization Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Space Militarization Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Space Militarization Market Revenue (Million), by Capability 2025 & 2033

- Figure 9: Europe Space Militarization Market Revenue Share (%), by Capability 2025 & 2033

- Figure 10: Europe Space Militarization Market Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 11: Europe Space Militarization Market Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 12: Europe Space Militarization Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Space Militarization Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Space Militarization Market Revenue (Million), by Capability 2025 & 2033

- Figure 15: Asia Pacific Space Militarization Market Revenue Share (%), by Capability 2025 & 2033

- Figure 16: Asia Pacific Space Militarization Market Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 17: Asia Pacific Space Militarization Market Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 18: Asia Pacific Space Militarization Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Space Militarization Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Space Militarization Market Revenue (Million), by Capability 2025 & 2033

- Figure 21: Rest of the World Space Militarization Market Revenue Share (%), by Capability 2025 & 2033

- Figure 22: Rest of the World Space Militarization Market Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 23: Rest of the World Space Militarization Market Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 24: Rest of the World Space Militarization Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Space Militarization Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Space Militarization Market Revenue Million Forecast, by Capability 2020 & 2033

- Table 2: Global Space Militarization Market Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 3: Global Space Militarization Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Space Militarization Market Revenue Million Forecast, by Capability 2020 & 2033

- Table 5: Global Space Militarization Market Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 6: Global Space Militarization Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Space Militarization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Space Militarization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Space Militarization Market Revenue Million Forecast, by Capability 2020 & 2033

- Table 10: Global Space Militarization Market Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 11: Global Space Militarization Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Space Militarization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Space Militarization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany Space Militarization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Space Militarization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Space Militarization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Space Militarization Market Revenue Million Forecast, by Capability 2020 & 2033

- Table 18: Global Space Militarization Market Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 19: Global Space Militarization Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Space Militarization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Space Militarization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Space Militarization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Space Militarization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Space Militarization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Space Militarization Market Revenue Million Forecast, by Capability 2020 & 2033

- Table 26: Global Space Militarization Market Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 27: Global Space Militarization Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Space Militarization Market?

The projected CAGR is approximately 8.02%.

2. Which companies are prominent players in the Space Militarization Market?

Key companies in the market include L3Harris Technologies Inc, THALES, General Dynamics Corporation, China Aerospace Science and Technology Corporatio, Lockheed Martin Corporation, Airbus SE, RTX Corporation, BAE Systems plc, Northrop Grumman Corporation, Saab AB, The Boeing Company.

3. What are the main segments of the Space Militarization Market?

The market segments include Capability, Mode of Operation.

4. Can you provide details about the market size?

The market size is estimated to be USD 54.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

The Defense Segment will Dominate the Market.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Space Militarization Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Space Militarization Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Space Militarization Market?

To stay informed about further developments, trends, and reports in the Space Militarization Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence