Key Insights

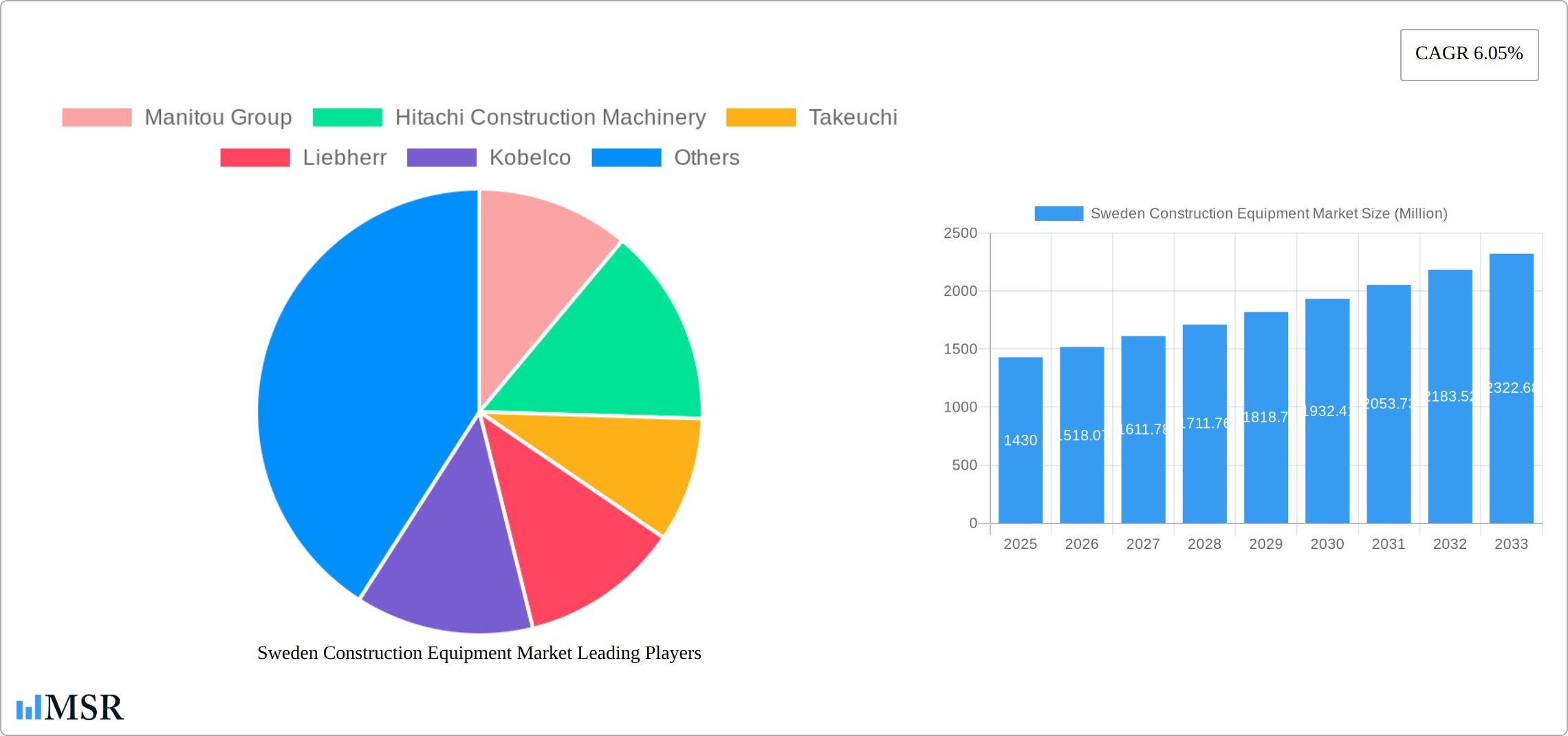

The Sweden construction equipment market, valued at approximately $1.43 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.05% from 2025 to 2033. This expansion is fueled by several key factors. Increased government investments in infrastructure projects, particularly road construction and building renovations, are stimulating demand for earthmoving equipment, asphalt pavers, and material handling solutions. Furthermore, a growing focus on sustainable construction practices is driving adoption of electric/hybrid drive types, presenting opportunities for manufacturers offering eco-friendly technologies. The rising urbanization rate within Sweden contributes to the increasing need for efficient construction equipment, thereby bolstering market growth. However, challenges such as potential fluctuations in raw material prices and the overall economic climate could exert some restraining influence on market expansion. The market segmentation reveals a strong demand for earthmoving equipment, followed by road construction equipment and material handling equipment. The hydraulic drive type currently dominates the market, although electric/hybrid options are gaining traction due to sustainability concerns. Key players such as Caterpillar, Volvo Construction Equipment, and Hitachi Construction Machinery are shaping the market landscape through technological advancements and strategic partnerships. The competitive landscape is characterized by both established international players and local companies vying for market share.

Sweden Construction Equipment Market Market Size (In Billion)

The projected growth trajectory indicates a significant expansion in the Swedish construction equipment market over the next decade. Continued infrastructural development coupled with the increasing adoption of advanced technologies will play a critical role in shaping the future of this sector. The presence of major global players underscores the significance of the Swedish market within the larger European construction equipment landscape. Ongoing government policies that support sustainable construction practices will further accelerate the shift toward electric and hybrid construction equipment, influencing market dynamics in the years to come. The market's segmental composition and technological trends signify promising avenues for both established and emerging market participants.

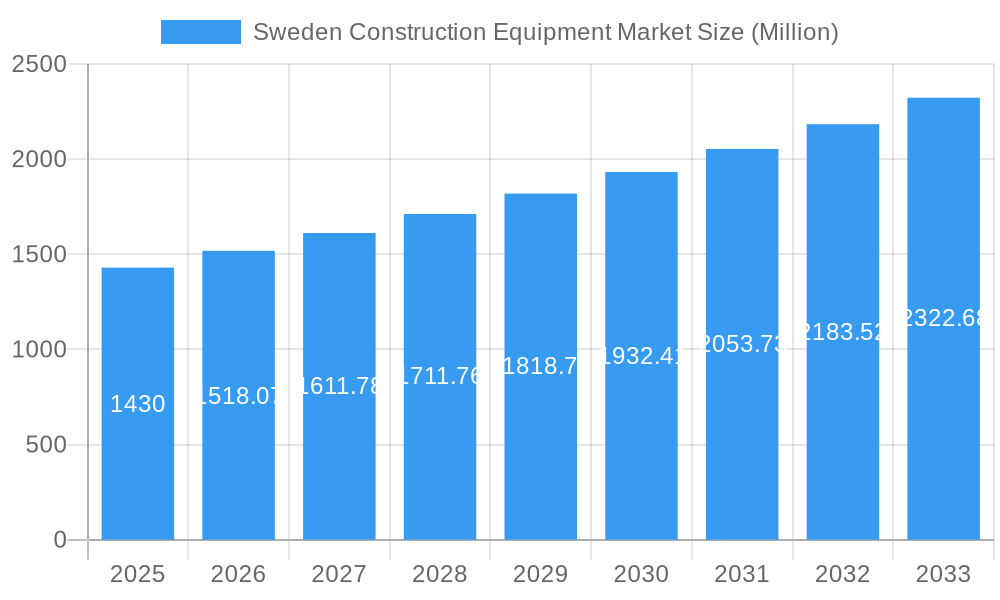

Sweden Construction Equipment Market Company Market Share

Sweden Construction Equipment Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Sweden construction equipment market, covering market dynamics, industry trends, key segments, leading players, and future outlook. The report utilizes data from 2019-2024 (historical period), with the base year set at 2025 and a forecast period spanning 2025-2033. The market size is projected at xx Million in 2025 and is expected to grow at a CAGR of xx% during the forecast period. This report is invaluable for industry stakeholders, investors, and businesses seeking to understand and capitalize on opportunities within this dynamic market.

Sweden Construction Equipment Market Concentration & Dynamics

The Sweden construction equipment market exhibits a moderately concentrated landscape, dominated by global giants like Volvo Construction Equipment and complemented by regional and niche players. Market share data reveals Volvo CE holds a significant portion, estimated at xx%, followed by other major players such as Caterpillar, Hitachi Construction Machinery, and Komatsu, each with market shares ranging between xx% and xx%. The market is characterized by a strong innovation ecosystem fostered by collaborations between manufacturers, research institutions (like Malardalen University's partnership with Volvo CE), and government initiatives supporting sustainable construction practices.

Regulatory frameworks, including those focused on environmental sustainability and worker safety, influence market dynamics. Substitute products, particularly those driven by alternative energy sources, present both challenges and opportunities. End-user trends, such as a growing preference for electric and hybrid equipment, are shaping product development and market demand. The M&A activity in the sector has been relatively moderate in recent years, with xx deals recorded between 2019 and 2024. This signifies strategic consolidation and expansion efforts.

- Market Concentration: Moderately concentrated, with Volvo CE holding a significant share.

- Innovation Ecosystem: Strong, driven by collaborations and research initiatives.

- Regulatory Framework: Stringent regulations impacting environmental sustainability and safety.

- Substitute Products: Growing presence of electric and alternative-powered equipment.

- End-User Trends: Shift towards sustainable and efficient equipment.

- M&A Activity: Moderate activity in recent years with xx deals recorded between 2019 and 2024.

Sweden Construction Equipment Market Industry Insights & Trends

The Sweden construction equipment market is experiencing steady growth driven by factors such as infrastructure development projects, increasing urbanization, and government investments in public works. The market size in 2024 was estimated at xx Million, demonstrating robust growth over the historical period. Technological advancements, such as the integration of digital technologies (e.g., telematics) and the rise of electric and hybrid equipment, are reshaping the industry. Consumer behavior is evolving towards a greater emphasis on sustainability and equipment efficiency, impacting demand for eco-friendly products. Furthermore, price fluctuations in raw materials and global economic conditions influence the market’s overall growth trajectory. The predicted CAGR for the forecast period indicates continued expansion, reflecting positive economic trends and investment in infrastructure projects. Specific industry reports highlight the increasing adoption of electric excavators, like Volvo CE's EC230 Electric, reflecting a significant market trend.

Key Markets & Segments Leading Sweden Construction Equipment Market

The Sweden construction equipment market is characterized by a dynamic interplay of equipment types and drive technologies. Currently, earthmoving equipment dominates the market share, largely propelled by significant ongoing and planned infrastructure development projects, including urban expansion and public works. Road construction and material handling equipment also represent substantial segments. In terms of drive technology, hydraulic systems remain the prevalent choice due to their established performance and reliability. However, a discernible and accelerating shift towards electric and hybrid powertrains is underway. This transition is significantly influenced by Sweden's ambitious sustainability goals, stringent environmental regulations, and a growing demand for eco-friendly construction solutions. Key growth drivers include government investments in smart city initiatives, renewable energy infrastructure, and the modernization of existing transportation networks.

-

Key Growth Drivers:

- Continued substantial infrastructure development projects, including high-speed rail, renewable energy installations, and urban regeneration.

- Increasing adoption of sustainable building practices and the demand for low-emission construction machinery.

- Government incentives and funding for green infrastructure and digitalization in construction.

- Technological advancements leading to more efficient, safer, and connected construction equipment.

- Growth in residential and commercial construction driven by urbanization and evolving housing needs.

-

Dominant Segments:

- By Equipment Type: Earthmoving equipment remains the largest segment, followed by road construction and material handling equipment. Specialized equipment for demolition and recycling is also seeing increased demand.

- By Drive Type: While hydraulic drive equipment currently holds the majority share, the electric/hybrid segment is experiencing rapid growth, driven by environmental consciousness and regulatory pressures.

Sweden Construction Equipment Market Product Developments

Recent years have witnessed significant product innovations, focusing on enhanced efficiency, improved safety features, and the incorporation of sustainable technologies. Manufacturers are increasingly integrating advanced telematics systems for remote monitoring and diagnostics. The introduction of electric and hybrid models marks a crucial shift towards environmentally friendly solutions. These advancements are pivotal in shaping competitiveness and catering to the evolving needs of customers prioritizing sustainability and operational efficiency.

Challenges in the Sweden Construction Equipment Market

The long-term growth trajectory of the Sweden construction equipment market will be significantly influenced by continuous technological innovation, leading to the development of more efficient, productive, and environmentally sustainable machinery. Strategic partnerships and collaborations between equipment manufacturers, research institutions, and leading construction firms are crucial for accelerating the adoption of cutting-edge technologies and innovative construction practices. Furthermore, the expansion into emerging market segments, such as specialized equipment tailored for the burgeoning renewable energy sector (e.g., wind turbine installation and maintenance) and the circular economy (e.g., advanced recycling and demolition machinery), presents substantial untapped opportunities.

Forces Driving Sweden Construction Equipment Market Growth

Several powerful forces are shaping and propelling the growth of the Sweden construction equipment market. Proactive government initiatives aimed at bolstering infrastructure development, particularly in areas like renewable energy and sustainable transportation, are creating a fertile ground for investment. Simultaneously, rapid technological advancements, especially in the realm of electrified and autonomous construction equipment, promise to enhance operational efficiency, reduce labor costs, and significantly minimize environmental impact. Favorable macroeconomic conditions, including a robust economy and sustained urbanization trends, further amplify the demand for construction machinery. The increasing integration of digitalization and smart technologies, such as IoT-enabled predictive maintenance and advanced telematics, is optimizing equipment utilization and operational performance, adding significant momentum to the sector's positive growth outlook.

Challenges in the Sweden Construction Equipment Market Market

Long-term growth will be fueled by ongoing technological innovations, resulting in more efficient and sustainable equipment. Strategic partnerships and collaborations between manufacturers, research institutions, and construction firms will accelerate the adoption of new technologies and practices. Expansion into new market segments, such as specialized construction equipment for renewable energy projects, presents additional opportunities.

Emerging Opportunities in Sweden Construction Equipment Market

Emerging trends in the Swedish construction landscape point towards significant opportunities for market players. The burgeoning demand for electric and hybrid construction equipment presents a substantial avenue for manufacturers who are actively investing in and developing sustainable powertrain solutions. The widespread integration of digital technologies, encompassing advanced telematics, IoT sensors, and AI-powered analytics, offers considerable potential for optimizing equipment fleet management, enhancing operational efficiency, and improving predictive maintenance strategies. A strong emphasis on sustainable construction practices and the imperative to reduce carbon emissions are fundamentally reshaping market demand, creating robust opportunities to supply eco-friendly equipment and innovative solutions that align with Sweden's green agenda.

Leading Players in the Sweden Construction Equipment Market Sector

Key Milestones in Sweden Construction Equipment Market Industry

- November 2022: Volvo Construction Equipment partners with Skanska on a Stockholm urban development project, supplying its EC230 Electric excavator. This highlights the market shift towards sustainable construction practices and electric equipment.

- February 2023: Hitachi Construction Machinery announces an 8% price increase across its equipment range, including in Sweden, reflecting rising material costs and supply chain pressures.

- June 2023: Volvo CE relocates its global headquarters within Sweden to Eskilstuna, a move aimed at fostering innovation and collaboration with local institutions. This underscores the company's commitment to long-term growth and development in the Swedish market.

- August 2023: Volvo Construction Equipment launches updated Volvo Service Contracts, offering improved repair and maintenance solutions for customers, enhancing customer satisfaction and service efficiency.

Strategic Outlook for Sweden Construction Equipment Market Market

The Sweden construction equipment market demonstrates strong growth potential, driven by continuous infrastructure development, technological advancements in electric and autonomous equipment, and a focus on sustainable construction. Strategic opportunities exist for companies investing in innovative technologies, forming strategic partnerships, and targeting niche market segments within the expanding renewable energy sector. The market's future hinges on embracing sustainable solutions and adapting to evolving regulatory landscapes.

Sweden Construction Equipment Market Segmentation

-

1. Equipment Type

-

1.1. Earthmoving Equipment

- 1.1.1. Excavators

- 1.1.2. Backhoe Loaders

- 1.1.3. Motor Graders

- 1.1.4. Other Earthmoving Equipment (Bull Dozers, etc.)

-

1.2. Road Construction Equipment

- 1.2.1. Road Rollers

- 1.2.2. Asphalt Pavers

-

1.3. Material Handling Equipment

- 1.3.1. Cranes

- 1.3.2. Forklift & Telescopic Handlers

- 1.3.3. Other Ma

- 1.4. Other Co

-

1.1. Earthmoving Equipment

-

2. Drive Type

- 2.1. Hydraulic

- 2.2. Electric/Hybrid

Sweden Construction Equipment Market Segmentation By Geography

- 1. Sweden

Sweden Construction Equipment Market Regional Market Share

Geographic Coverage of Sweden Construction Equipment Market

Sweden Construction Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Government Spending on Construction

- 3.2.2 Infrastructure

- 3.2.3 and Mining Sector

- 3.3. Market Restrains

- 3.3.1. High Cost of Replacement and Maintenance

- 3.4. Market Trends

- 3.4.1 Increasing Government Spending on Construction

- 3.4.2 Infrastructure

- 3.4.3 and Mining Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Earthmoving Equipment

- 5.1.1.1. Excavators

- 5.1.1.2. Backhoe Loaders

- 5.1.1.3. Motor Graders

- 5.1.1.4. Other Earthmoving Equipment (Bull Dozers, etc.)

- 5.1.2. Road Construction Equipment

- 5.1.2.1. Road Rollers

- 5.1.2.2. Asphalt Pavers

- 5.1.3. Material Handling Equipment

- 5.1.3.1. Cranes

- 5.1.3.2. Forklift & Telescopic Handlers

- 5.1.3.3. Other Ma

- 5.1.4. Other Co

- 5.1.1. Earthmoving Equipment

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Hydraulic

- 5.2.2. Electric/Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Manitou Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hitachi Construction Machinery

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Takeuchi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Liebherr

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kobelco

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JCB

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Volvo Construction Equipment

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kubota

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hyundai Construction Equipment

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Komatsu

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Yanmar

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Konecrane

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Caterpillar

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Manitou Group

List of Figures

- Figure 1: Sweden Construction Equipment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Sweden Construction Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: Sweden Construction Equipment Market Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 2: Sweden Construction Equipment Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 3: Sweden Construction Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Sweden Construction Equipment Market Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 5: Sweden Construction Equipment Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 6: Sweden Construction Equipment Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Construction Equipment Market?

The projected CAGR is approximately 6.05%.

2. Which companies are prominent players in the Sweden Construction Equipment Market?

Key companies in the market include Manitou Group, Hitachi Construction Machinery, Takeuchi, Liebherr, Kobelco, JCB, Volvo Construction Equipment, Kubota, Hyundai Construction Equipment, Komatsu, Yanmar, Konecrane, Caterpillar.

3. What are the main segments of the Sweden Construction Equipment Market?

The market segments include Equipment Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.43 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Government Spending on Construction. Infrastructure. and Mining Sector.

6. What are the notable trends driving market growth?

Increasing Government Spending on Construction. Infrastructure. and Mining Sector.

7. Are there any restraints impacting market growth?

High Cost of Replacement and Maintenance.

8. Can you provide examples of recent developments in the market?

August 2023: Volvo Construction Equipment, a Sweden-based manufacturer of construction equipment, unveiled an updated range of Volvo Service Contracts as a pivotal part of its post-sales division. These contracts are a rebranding of the previous Customer Services Agreements and offer valuable solutions for customers in managing the repair and maintenance needs of their Volvo machinery. The newly introduced service agreements consist of three tiers: the Blue Contract, which covers preventive maintenance and servicing, and the Gold Contract, which encompasses comprehensive machine repairs and preventive maintenance to maximize equipment uptime.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Construction Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Construction Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Construction Equipment Market?

To stay informed about further developments, trends, and reports in the Sweden Construction Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence