Key Insights

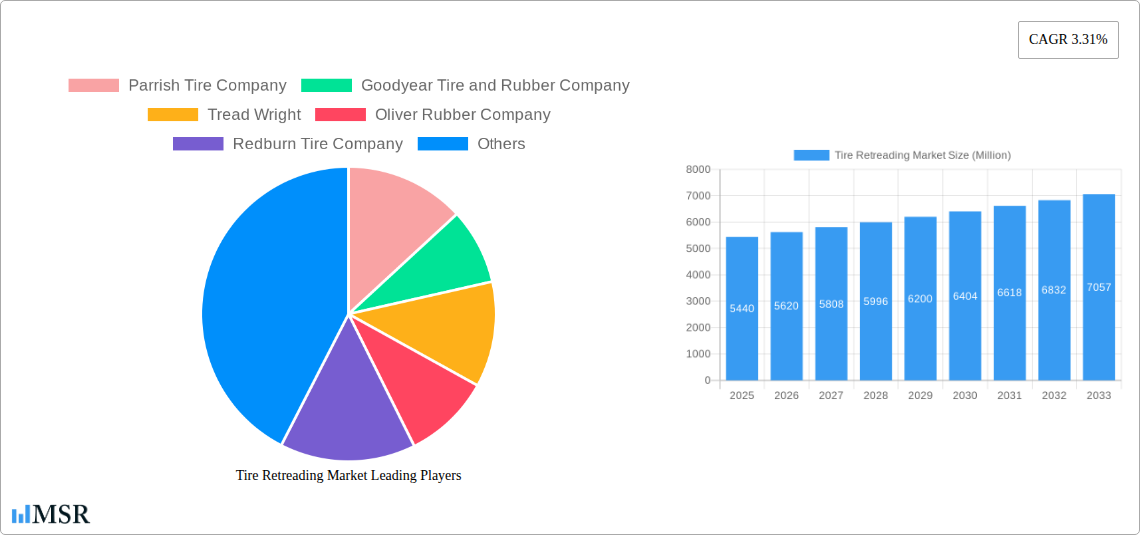

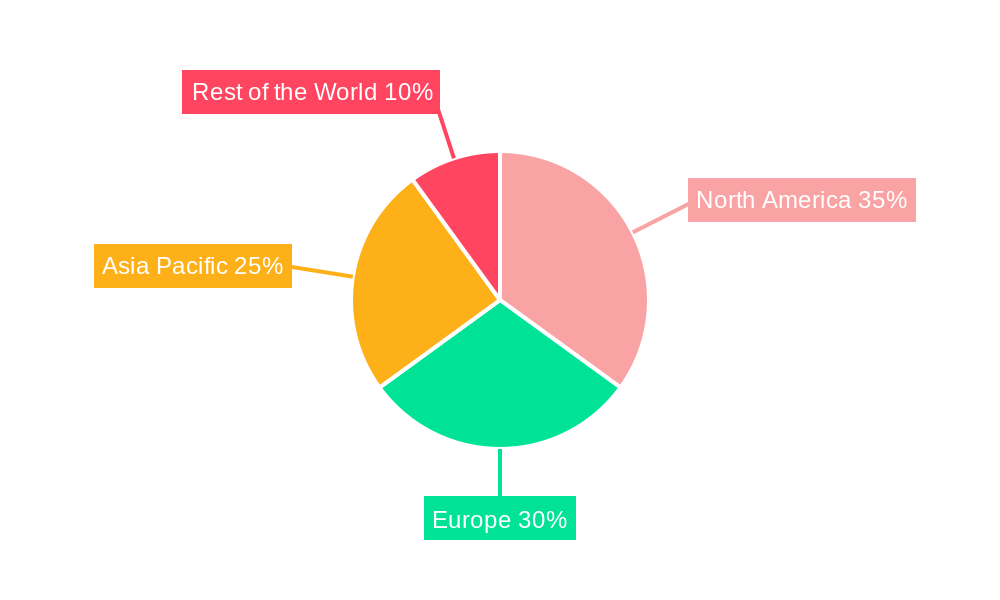

The global tire retreading market, valued at $5.44 billion in 2025, is projected to experience steady growth, driven by increasing demand for cost-effective tire solutions and growing environmental concerns. The market's Compound Annual Growth Rate (CAGR) of 3.31% from 2025 to 2033 indicates a consistent expansion, fueled by factors such as rising fuel prices, stricter environmental regulations promoting sustainable tire management, and the increasing adoption of retreading in commercial vehicle fleets seeking to reduce operational costs. The passenger car segment is expected to witness significant growth due to rising private vehicle ownership globally, while the commercial vehicle segment will continue to be a major contributor due to the high volume of tires used in trucking and logistics. Pre-cure retreading, offering better quality and durability, is anticipated to maintain a larger market share compared to mold cure methods. Key players like Bridgestone, Michelin, and Goodyear are strategically investing in advanced retreading technologies and expanding their global presence to capture market share. Regional growth will be diverse, with North America and Europe maintaining substantial market shares due to established infrastructure and stringent environmental regulations. However, rapidly developing economies in Asia-Pacific, particularly India and China, are anticipated to show significant growth potential due to increasing vehicle ownership and infrastructural development.

Tire Retreading Market Market Size (In Billion)

The competitive landscape is characterized by both large multinational corporations and regional players. The presence of established brands ensures quality control and technological advancements within the industry. However, smaller, regional companies often offer more competitive pricing and localized services. This dynamic necessitates strategic partnerships and technological innovation to maintain a competitive edge. Future growth will depend on continued technological improvements in retreading processes, stricter environmental regulations incentivizing retreading, and the overall growth of the automotive industry globally. Factors like fluctuations in raw material prices and the availability of skilled labor could pose potential restraints to market growth. Therefore, companies are focusing on optimizing their operations and investing in advanced technologies to ensure efficient and sustainable retreading practices.

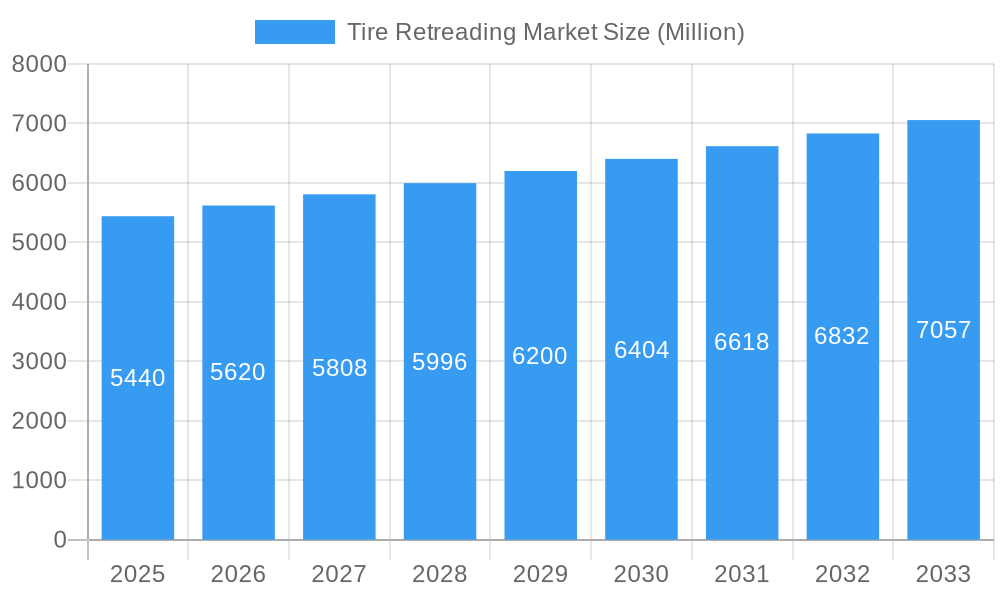

Tire Retreading Market Company Market Share

Tire Retreading Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global tire retreading market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, and future projections. The report leverages extensive data analysis to deliver actionable intelligence, enabling informed strategic planning and investment decisions within this dynamic sector. The global market size is estimated to reach xx Million by 2025, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033.

Tire Retreading Market Market Concentration & Dynamics

The tire retreading market exhibits a moderately consolidated structure, with key players like Goodyear Tire and Rubber Company, Bridgestone Corporation, Michelin SCA, and Marangoni SpA holding significant market share. However, a number of regional players and smaller independent retreaders also contribute to the overall market dynamics. Market concentration is influenced by factors such as economies of scale in production, access to raw materials, and technological capabilities.

Innovation Ecosystems: The market is characterized by ongoing innovation in retreading technologies, including advancements in pre-cure and mold cure methods, and the development of more sustainable and environmentally friendly retreading processes.

Regulatory Frameworks: Government regulations concerning tire disposal and environmental protection significantly influence the market. Stringent regulations drive the adoption of retreading as a sustainable alternative to tire disposal, while conversely, lenient regulations might hamper growth.

Substitute Products: The primary substitute for retreaded tires is the purchase of new tires, which are often preferred for their perceived higher performance and reliability. However, the cost advantage of retreading remains a compelling factor for many customers.

End-User Trends: The increasing demand for cost-effective transportation solutions, particularly in the commercial vehicle segment, is fueling market growth. Furthermore, the growing awareness of environmental sustainability promotes the adoption of retreaded tires as a greener alternative.

M&A Activities: The number of M&A deals in the tire retreading sector has remained relatively stable in recent years, with an estimated xx deals concluded annually in the period 2019-2024. These deals typically involve larger companies acquiring smaller retreaders to expand their geographic reach or technological capabilities. Market share among the leading players is expected to remain relatively stable, with minor shifts due to M&A activity.

Tire Retreading Market Industry Insights & Trends

The tire retreading market is experiencing steady growth driven by multiple factors. The rising demand for cost-effective transportation solutions, especially in the commercial vehicle segment, significantly contributes to market expansion. Furthermore, escalating environmental concerns are pushing towards the adoption of sustainable tire solutions, where retreading offers a significant advantage over new tire production. The increasing fuel costs and stricter emission regulations are driving the adoption of fuel-efficient retreaded tires for commercial vehicles.

Technological advancements in retreading processes, such as improved adhesion techniques and the use of high-performance materials, are enhancing the quality and performance of retreaded tires, further strengthening market demand. Evolving consumer behaviors, particularly a growing focus on cost savings and environmentally conscious decisions, are also bolstering the market's growth trajectory. The global tire retreading market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033.

Key Markets & Segments Leading Tire Retreading Market

The commercial vehicle segment is currently the dominant segment in the tire retreading market, accounting for approximately xx% of the overall market share in 2024. This dominance is driven by factors such as higher tire replacement frequency and greater cost sensitivity compared to the passenger car segment. The pre-cure method represents the larger share of the production method, mostly because it is less expensive and generally faster.

Drivers for Commercial Vehicle Segment Dominance:

- Higher tire replacement frequency due to intensive usage.

- Significant cost savings compared to purchasing new tires.

- Strong focus on operational efficiency in the logistics and transportation sectors.

Drivers for Pre-cure Method Dominance:

- Lower initial investment costs compared to mold cure methods.

- Faster production cycle times.

- Suitability for a broader range of tire sizes and types.

Regional Dominance: [Insert dominant region and country analysis. Include data on market size and growth rates for the leading regions. For example: "North America currently holds the largest market share, driven by robust economic growth and a well-established transportation infrastructure. However, the Asia-Pacific region is expected to witness the fastest growth rate over the forecast period, fueled by rapid industrialization and increasing vehicle ownership."]

Tire Retreading Market Product Developments

Recent innovations include the development of new materials and processes that enhance the durability, performance, and longevity of retreaded tires. This includes advancements in tread rubber compounds, improved bonding techniques, and the application of advanced manufacturing technologies. These technological improvements enable retreaded tires to compete more effectively with new tires in terms of quality and performance, thereby broadening their appeal to a wider range of users. The introduction of retread technologies that cater to the demands of EVs is also gaining traction.

Challenges in the Tire Retreading Market Market

The tire retreading market faces several challenges, including the perception of lower quality compared to new tires and the challenges of maintaining consistent quality across different retreading facilities. Fluctuations in raw material prices and supply chain disruptions can also impact profitability. Further, stringent environmental regulations and compliance costs can add to operational expenses. These challenges collectively represent a constraint on market growth. The estimated financial impact of these challenges on market growth amounts to a reduction of approximately xx Million by 2033.

Forces Driving Tire Retreading Market Growth

The primary growth drivers include the increasing demand for cost-effective transportation solutions, especially in the commercial vehicle sector. Rising fuel prices and environmental concerns further augment this demand. Governments worldwide are increasingly implementing policies and regulations that encourage sustainable practices, such as tire retreading. Technological advancements in retreading processes and the improved quality of retreaded tires also contributes to market growth.

Long-Term Growth Catalysts in the Tire Retreading Market

Long-term growth will be fueled by continuous technological innovations in retreading processes, resulting in improved tire performance and durability. Strategic partnerships between tire manufacturers and retreaders will play a crucial role in expanding market reach and enhancing supply chain efficiency. Expanding into new geographical markets, particularly in developing economies with high vehicle ownership growth, presents significant opportunities.

Emerging Opportunities in Tire Retreading Market

Emerging opportunities lie in the development of specialized retread technologies for electric vehicles and other niche applications. The exploration of sustainable and environmentally friendly retreading processes using recycled materials further presents significant growth avenues. Expansion into new geographical markets with emerging economies and growing vehicle populations represents a substantial opportunity.

Leading Players in the Tire Retreading Market Sector

- Parrish Tire Company

- Goodyear Tire and Rubber Company

- Tread Wright

- Oliver Rubber Company

- Redburn Tire Company

- Southern Tire Mart

- Michelin SCA

- Southern Tire Mar

- Marangoni SpA

- Bridgestone Corporation

Key Milestones in Tire Retreading Market Industry

- July 2022: Hankook Tire announced a significant investment to expand its Alphatread retreading factory in Germany, increasing production capacity to 200,000 tires annually. This signals a strong commitment to the retreading market and indicates future growth potential.

- February 2022: Bridgestone Corporation launched a joint R&D program to develop chemical recycling technologies for used tires, aiming to produce isoprene, a key synthetic rubber material. This initiative highlights the industry's commitment to sustainability and resource optimization.

- February 2022: Bridgestone's ALENZA 001 tire was selected as original equipment for Nissan's Ariya EV, demonstrating the increasing acceptance of advanced tire technologies in the electric vehicle market.

Strategic Outlook for Tire Retreading Market Market

The tire retreading market is poised for sustained growth driven by increasing demand for cost-effective and environmentally friendly tire solutions. Strategic investments in technological advancements, expansion into new markets, and partnerships across the value chain will be key to capturing market share and maximizing future growth potential. The market's long-term prospects remain positive, reflecting a growing awareness of sustainability and the cost-effectiveness of retreaded tires.

Tire Retreading Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Production Method

- 2.1. Pre-cure

- 2.2. Mold Cure

Tire Retreading Market Segmentation By Geography

-

1. North America

- 1.1. United State

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Mexico

- 4.3. United Arab Emirates

- 4.4. Other Countries

Tire Retreading Market Regional Market Share

Geographic Coverage of Tire Retreading Market

Tire Retreading Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Environmental Benefits Driving Growth

- 3.3. Market Restrains

- 3.3.1. Decreasing Rubber Production And Volatile Raw Material Cost

- 3.4. Market Trends

- 3.4.1. Overall positive outlook toward Retreading

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tire Retreading Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Production Method

- 5.2.1. Pre-cure

- 5.2.2. Mold Cure

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Tire Retreading Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Production Method

- 6.2.1. Pre-cure

- 6.2.2. Mold Cure

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Tire Retreading Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Production Method

- 7.2.1. Pre-cure

- 7.2.2. Mold Cure

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Tire Retreading Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Production Method

- 8.2.1. Pre-cure

- 8.2.2. Mold Cure

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Tire Retreading Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Cars

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Production Method

- 9.2.1. Pre-cure

- 9.2.2. Mold Cure

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Parrish Tire Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Goodyear Tire and Rubber Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Tread Wright

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Oliver Rubber Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Redburn Tire Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Southern Tire Mart

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Michelin SCA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Southern Tire Mar

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Marangoni SpA

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Bridgestone Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Parrish Tire Company

List of Figures

- Figure 1: Global Tire Retreading Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Tire Retreading Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Tire Retreading Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Tire Retreading Market Revenue (Million), by Production Method 2025 & 2033

- Figure 5: North America Tire Retreading Market Revenue Share (%), by Production Method 2025 & 2033

- Figure 6: North America Tire Retreading Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Tire Retreading Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Tire Retreading Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 9: Europe Tire Retreading Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: Europe Tire Retreading Market Revenue (Million), by Production Method 2025 & 2033

- Figure 11: Europe Tire Retreading Market Revenue Share (%), by Production Method 2025 & 2033

- Figure 12: Europe Tire Retreading Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Tire Retreading Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Tire Retreading Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Asia Pacific Tire Retreading Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Asia Pacific Tire Retreading Market Revenue (Million), by Production Method 2025 & 2033

- Figure 17: Asia Pacific Tire Retreading Market Revenue Share (%), by Production Method 2025 & 2033

- Figure 18: Asia Pacific Tire Retreading Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Tire Retreading Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Tire Retreading Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Rest of the World Tire Retreading Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Rest of the World Tire Retreading Market Revenue (Million), by Production Method 2025 & 2033

- Figure 23: Rest of the World Tire Retreading Market Revenue Share (%), by Production Method 2025 & 2033

- Figure 24: Rest of the World Tire Retreading Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Tire Retreading Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Tire Retreading Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Tire Retreading Market Revenue Million Forecast, by Production Method 2020 & 2033

- Table 3: Global Tire Retreading Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Tire Retreading Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Tire Retreading Market Revenue Million Forecast, by Production Method 2020 & 2033

- Table 6: Global Tire Retreading Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United State Tire Retreading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Tire Retreading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Tire Retreading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Tire Retreading Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global Tire Retreading Market Revenue Million Forecast, by Production Method 2020 & 2033

- Table 12: Global Tire Retreading Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Tire Retreading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Tire Retreading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Tire Retreading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Tire Retreading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Tire Retreading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Tire Retreading Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 19: Global Tire Retreading Market Revenue Million Forecast, by Production Method 2020 & 2033

- Table 20: Global Tire Retreading Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: India Tire Retreading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: China Tire Retreading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Tire Retreading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Tire Retreading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Tire Retreading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Tire Retreading Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 27: Global Tire Retreading Market Revenue Million Forecast, by Production Method 2020 & 2033

- Table 28: Global Tire Retreading Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Tire Retreading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Mexico Tire Retreading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: United Arab Emirates Tire Retreading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Other Countries Tire Retreading Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tire Retreading Market?

The projected CAGR is approximately 3.31%.

2. Which companies are prominent players in the Tire Retreading Market?

Key companies in the market include Parrish Tire Company, Goodyear Tire and Rubber Company, Tread Wright, Oliver Rubber Company, Redburn Tire Company, Southern Tire Mart, Michelin SCA, Southern Tire Mar, Marangoni SpA, Bridgestone Corporation.

3. What are the main segments of the Tire Retreading Market?

The market segments include Vehicle Type, Production Method.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Environmental Benefits Driving Growth.

6. What are the notable trends driving market growth?

Overall positive outlook toward Retreading.

7. Are there any restraints impacting market growth?

Decreasing Rubber Production And Volatile Raw Material Cost.

8. Can you provide examples of recent developments in the market?

July 2022: Hankook Tire & Technology Co., Ltd. (Hankook Tire) announced an investment to extend the Alphatread retreading factory in Hammelburg, Germany, for the first time. With investments in the high millions, the combined production capacity of hot and cold retreaded tires is up to 200,000 per year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tire Retreading Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tire Retreading Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tire Retreading Market?

To stay informed about further developments, trends, and reports in the Tire Retreading Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence