Key Insights

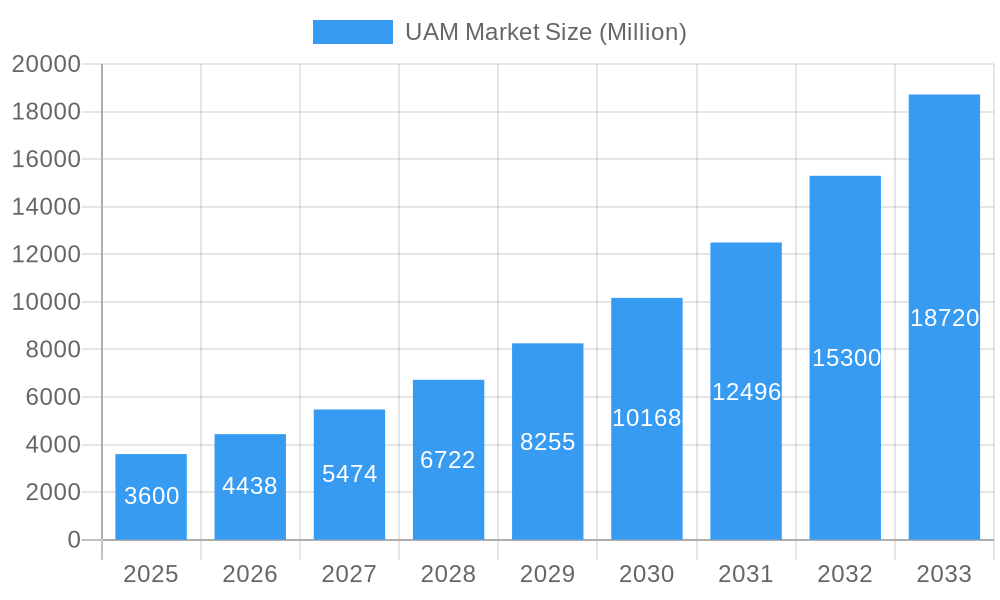

The Urban Air Mobility (UAM) market is poised for explosive growth, projected to reach a substantial market size driven by increasing urbanization, traffic congestion in major cities, and the need for efficient and sustainable transportation solutions. The current market size in 2025 is estimated at $3.60 billion, exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 23.54% from 2025 to 2033. This rapid expansion is fueled by several key factors. Technological advancements in electric vertical takeoff and landing (eVTOL) aircraft, improved battery technology, and the development of advanced air traffic management (ATM) systems are significantly reducing the barriers to entry and accelerating market adoption. Furthermore, the rising investments from both established aerospace giants and innovative startups are driving innovation and competition, fostering rapid technological advancements. Strong government support and regulatory frameworks, particularly in North America and Europe, are also paving the way for the commercialization and deployment of UAM solutions. The market segmentation reveals strong growth potential across various vehicle types, including piloted and autonomous aircraft, and applications such as passenger transport and cargo delivery (freighters). However, challenges remain, such as the need for robust safety regulations, public acceptance, and addressing the infrastructure requirements needed to support widespread UAM operations.

UAM Market Market Size (In Billion)

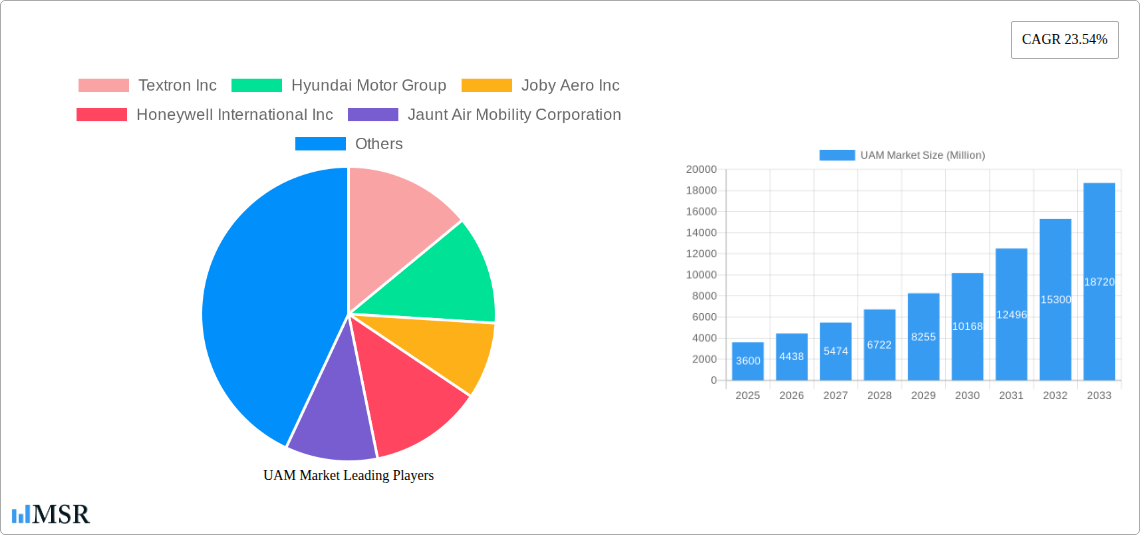

The key players in this burgeoning market, including Textron Inc, Hyundai Motor Group, Joby Aero Inc, and Airbus SE, are actively engaged in developing and deploying innovative UAM solutions. Competition is intensifying, leading to a focus on developing cost-effective and efficient aircraft designs. The geographical distribution of the market shows significant growth potential across different regions, with North America and Europe leading the initial stages of market adoption due to established regulatory frameworks and robust technological infrastructure. However, the Asia-Pacific region is expected to experience substantial growth in the coming years due to its high population density and expanding urban areas. The forecast period of 2025-2033 suggests a significant increase in market capitalization driven by the continued technological advancements, regulatory developments, and growing consumer demand for faster and more efficient urban transportation solutions. The market's sustained high growth trajectory necessitates ongoing monitoring of technological advancements, regulatory changes, and emerging market trends to ensure accurate forecasting and strategic planning.

UAM Market Company Market Share

Unlocking the Skies: A Comprehensive Report on the Urban Air Mobility (UAM) Market (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning Urban Air Mobility (UAM) market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a focus on market dynamics, technological advancements, and future growth trajectories, this report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. The report meticulously analyzes key market segments, including piloted and autonomous vehicles, passenger transport and freighter applications, and highlights the contributions of leading players like Textron Inc, Hyundai Motor Group, and Airbus SE, among others. Projected market values reach into the Billions, representing a significant investment opportunity.

UAM Market Concentration & Dynamics

The UAM market is characterized by a dynamic interplay of established aerospace giants and innovative startups. Market concentration is currently moderate, with a few major players holding significant shares, but the landscape is rapidly evolving due to continuous innovation and mergers and acquisitions (M&A) activity. The xx Million market size in 2025 is expected to experience substantial growth over the forecast period, driven by technological advancements and increasing demand.

- Market Share: Airbus SE and Boeing Company currently hold xx% and xx% respectively of the market share, while other major players such as Textron Inc and Hyundai Motor Group hold a combined xx%. Startups like Joby Aero and Volocopter are rapidly gaining traction.

- M&A Activity: The UAM sector has witnessed a significant number of M&A deals in recent years, totaling xx deals in the past five years, as established players seek to expand their portfolio and acquire cutting-edge technologies.

- Innovation Ecosystems: A thriving network of research institutions, startups, and government agencies actively support innovation in eVTOL technology, materials science, and airspace management.

- Regulatory Frameworks: While regulatory frameworks are still evolving, various governments are actively developing policies to facilitate safe and efficient UAM operations. This includes certification processes for eVTOL aircraft and airspace management systems.

- Substitute Products: While currently limited, alternatives like high-speed rail and advanced road networks could compete for passengers within certain urban contexts.

- End-User Trends: Growing urbanization, increasing traffic congestion, and demand for faster, more efficient transportation are key factors driving consumer interest in UAM solutions.

UAM Market Industry Insights & Trends

The Urban Air Mobility (UAM) market is poised for unprecedented expansion, with projections indicating a market size of approximately [XX] Million by 2033, demonstrating a robust Compound Annual Growth Rate (CAGR) of [XX]% over the forecast period. This significant growth trajectory is underpinned by a confluence of critical factors:

- Market Valuation and Trajectory: The global UAM market was valued at an estimated [XX] Million in 2024 and is forecast to escalate to [XX] Million by 2033, reflecting substantial investor confidence and market maturation.

- Catalytic Technological Advancements: The relentless pace of innovation in areas such as advanced battery technology, highly efficient electric propulsion systems, sophisticated autonomous flight control algorithms, and cutting-edge sensor technologies are fundamental pillars enabling the widespread adoption and operational viability of the UAM industry.

- Shifting Consumer Paradigms: The increasing comfort and widespread acceptance of on-demand, app-based ride-sharing services, coupled with a growing societal preference for efficient, time-optimized transportation solutions, are powerfully fueling the demand for UAM services as a premier alternative.

- Key Growth Accelerators: Intensifying urbanization and the resultant traffic congestion in megacities worldwide, coupled with proactive government initiatives championing sustainable urban mobility solutions and the accelerating adoption of electric Vertical Take-Off and Landing (eVTOL) aircraft, are acting as potent catalysts for UAM market expansion.

Key Markets & Segments Leading UAM Market

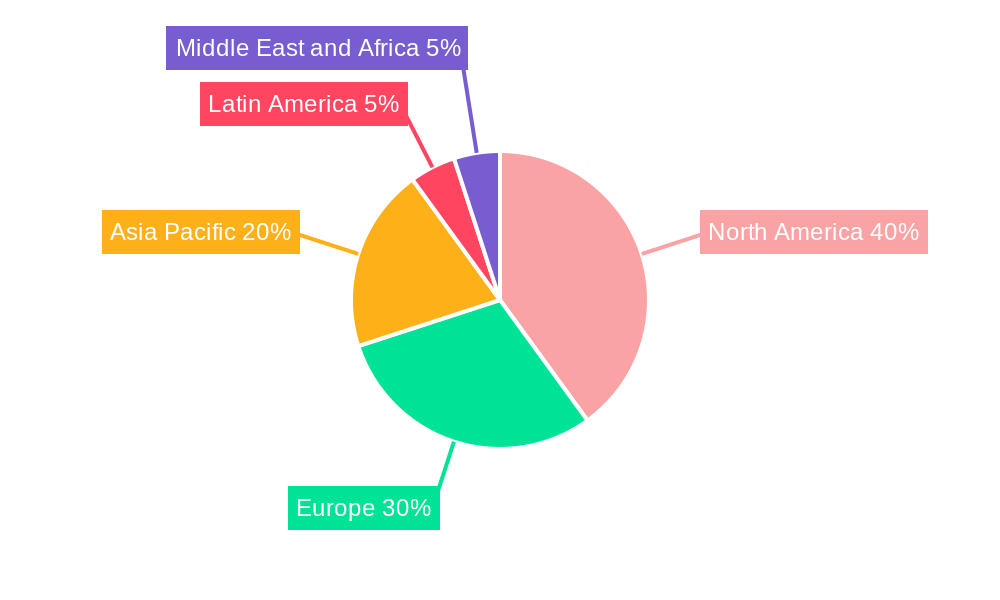

The UAM market exhibits strong regional variations, with North America and Europe currently leading in terms of market adoption and technological advancements. However, Asia-Pacific is poised for significant growth in the coming years due to high population density and increasing investment in infrastructure.

- Dominant Regions: North America holds the largest market share due to robust technological infrastructure and early adoption of UAM solutions. Europe is following closely behind, with significant investments in research and development.

- Vehicle Type: The market is segmented into piloted and autonomous vehicles. Currently, piloted vehicles dominate due to safety considerations and regulatory approvals; however, autonomous vehicles are expected to gain significant traction in the coming years.

- Application: Passenger transport holds the largest market share, with the freighter segment expected to gain momentum as the technology matures and regulatory frameworks develop.

- Drivers for Growth:

- Economic Growth: Strong economic growth in developed and developing countries fuels the demand for UAM services.

- Infrastructure Development: Investments in charging infrastructure, vertiports, and air traffic management systems are essential for UAM adoption.

- Government Support: Government policies, incentives, and regulations significantly influence market growth.

UAM Market Product Developments

Current product development in the UAM sector is sharply focused on enhancing the core performance and passenger experience of aerial vehicles. Key areas of advancement include extending battery longevity for increased range and operational efficiency, integrating state-of-the-art safety features to meet rigorous aviation standards, and refining autonomous flight capabilities for seamless and secure operations. Manufacturers are aggressively innovating designs that prioritize passenger comfort through ergonomic interiors and smooth flight profiles, while simultaneously focusing on streamlining operational logistics and mitigating noise pollution to ensure urban integration. Critical to widespread adoption is the seamless integration of UAM services with existing public and private transportation networks, alongside the development of sophisticated, next-generation air traffic management (ATM) systems designed for high-density, low-altitude operations.

Challenges in the UAM Market Market

The accelerated growth of the UAM market is not without its hurdles. Significant challenges include navigating complex and time-consuming regulatory approval processes, the imperative to establish and uphold unwavering safety standards that instill public confidence, and the critical need to build resilient and dependable supply chains for specialized components. Furthermore, the substantial initial capital investment required for infrastructure development and fleet acquisition, alongside the potential for intense competition from other evolving transportation modalities, present formidable obstacles. Collectively, these factors are estimated to exert a moderating influence on market growth, potentially impacting it by approximately [XX]% over the next five years.

Forces Driving UAM Market Growth

The burgeoning UAM market is propelled by a powerful synergy of technological innovation and supportive environmental and urban planning trends. Core to this momentum are breakthroughs in electric propulsion systems, the maturation of autonomous flight control technologies, and significant advancements in battery energy density and management. Complementing these technical leaps are governmental mandates and incentives prioritizing sustainable urban transportation solutions, amplified by the relentless trends of global urbanization and the ever-increasing burden of traffic congestion in major metropolitan areas. The strategic formation of collaborative partnerships between established aerospace giants, agile technology firms, and forward-thinking city administrations is also instrumental in forging the essential infrastructure and regulatory pathways necessary for UAM's successful deployment.

Long-Term Growth Catalysts in the UAM Market

Sustained long-term growth hinges on continued technological innovation, including advancements in battery technology, materials science, and flight control systems. The formation of strategic alliances and partnerships between various stakeholders, such as aerospace companies, technology providers, and infrastructure developers, will accelerate market penetration and adoption. Expansion into new geographic markets and the development of new applications, such as emergency medical services and cargo delivery, will further enhance market potential.

Emerging Opportunities in UAM Market

The UAM market presents several opportunities, including the development of new business models for air taxi services, the integration of UAM into broader mobility solutions, and the exploration of new applications beyond passenger transport, such as delivery and emergency services. Furthermore, advancements in vertical takeoff and landing (VTOL) technologies and the expansion of supportive regulatory frameworks will create new opportunities for market entry and growth.

Leading Players in the UAM Market Sector

- Textron Inc

- Hyundai Motor Group

- Joby Aero Inc

- Honeywell International Inc

- Jaunt Air Mobility Corporation

- Airbus SE

- Karem Aircraft Inc

- Guangzhou EHang Intelligent Technology Co Lt

- Safran SA

- PIPISTREL d o o

- Volocopter GmbH

- Embraer SA

- Opener Inc

- The Boeing Company

Key Milestones in UAM Market Industry

- August 2022: Geely Aerofugia unveils a full-size demonstrator for its TF-2 five-seater eVTOL.

- January 2023: Geely Aerofugia completes the test flight of its prototype flying car AE200.

- February 2022: Eve UAM LLC partners with Skyports Pte Ltd to develop a Concept of Operations (CONOPS) for Advanced Air Mobility (AAM) in Japan.

Strategic Outlook for UAM Market Market

The UAM market stands at the precipice of transformative potential, promising to reshape urban mobility as we know it. To fully harness this potential, sustained investment in pioneering technological advancements, the cultivation of strategic alliances across diverse industry sectors, and the establishment of agile and supportive regulatory environments are paramount. The strategic expansion of UAM services into novel markets and the exploration of applications extending beyond traditional passenger transport will further diversify revenue streams and accelerate market penetration. Crucially, the development and implementation of efficient, scalable, and interconnected infrastructure—encompassing vertiports, charging solutions, and integrated operational management systems—will be indispensable for facilitating the widespread and seamless adoption of UAM solutions globally.

UAM Market Segmentation

-

1. Vehicle Type

- 1.1. Piloted

- 1.2. Autonomous

-

2. Application

- 2.1. Passenger Transport

- 2.2. Freighter

UAM Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

UAM Market Regional Market Share

Geographic Coverage of UAM Market

UAM Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Autonomous Segment is Projected to Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAM Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Piloted

- 5.1.2. Autonomous

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Passenger Transport

- 5.2.2. Freighter

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America UAM Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Piloted

- 6.1.2. Autonomous

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Passenger Transport

- 6.2.2. Freighter

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe UAM Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Piloted

- 7.1.2. Autonomous

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Passenger Transport

- 7.2.2. Freighter

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific UAM Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Piloted

- 8.1.2. Autonomous

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Passenger Transport

- 8.2.2. Freighter

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Latin America UAM Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Piloted

- 9.1.2. Autonomous

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Passenger Transport

- 9.2.2. Freighter

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Middle East and Africa UAM Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Piloted

- 10.1.2. Autonomous

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Passenger Transport

- 10.2.2. Freighter

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Textron Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hyundai Motor Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Joby Aero Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Jaunt Air Mobility Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Airbus SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Karem Aircraft Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Guangzhou EHang Intelligent Technology Co Lt

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Safran SA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PIPISTREL d o o

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Volocopter GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Embraer SA

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Opener Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 The Boeing Company

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Textron Inc

List of Figures

- Figure 1: Global UAM Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America UAM Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America UAM Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America UAM Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America UAM Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America UAM Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America UAM Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe UAM Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 9: Europe UAM Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: Europe UAM Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe UAM Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe UAM Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe UAM Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific UAM Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Asia Pacific UAM Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Asia Pacific UAM Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific UAM Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific UAM Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific UAM Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America UAM Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Latin America UAM Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Latin America UAM Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Latin America UAM Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America UAM Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America UAM Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa UAM Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Middle East and Africa UAM Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Middle East and Africa UAM Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa UAM Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa UAM Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa UAM Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAM Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global UAM Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global UAM Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global UAM Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global UAM Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global UAM Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global UAM Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global UAM Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global UAM Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global UAM Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global UAM Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global UAM Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global UAM Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 14: Global UAM Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global UAM Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global UAM Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 17: Global UAM Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global UAM Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAM Market?

The projected CAGR is approximately 23.54%.

2. Which companies are prominent players in the UAM Market?

Key companies in the market include Textron Inc, Hyundai Motor Group, Joby Aero Inc, Honeywell International Inc, Jaunt Air Mobility Corporation, Airbus SE, Karem Aircraft Inc, Guangzhou EHang Intelligent Technology Co Lt, Safran SA, PIPISTREL d o o, Volocopter GmbH, Embraer SA, Opener Inc, The Boeing Company.

3. What are the main segments of the UAM Market?

The market segments include Vehicle Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.60 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Autonomous Segment is Projected to Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In January 2023, Geely Aerofugia, a subsidiary of the Chinese automaker Geely, announced that it completed the test flight of its prototype flying car AE200, taking a step closer to its goal of delivering electric vertical take-off and landing (eVTOL) vehicles to market. This company first unveiled a full-size demonstrator for its TF-2 five-seater eVTOL in August 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAM Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAM Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAM Market?

To stay informed about further developments, trends, and reports in the UAM Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence