Key Insights

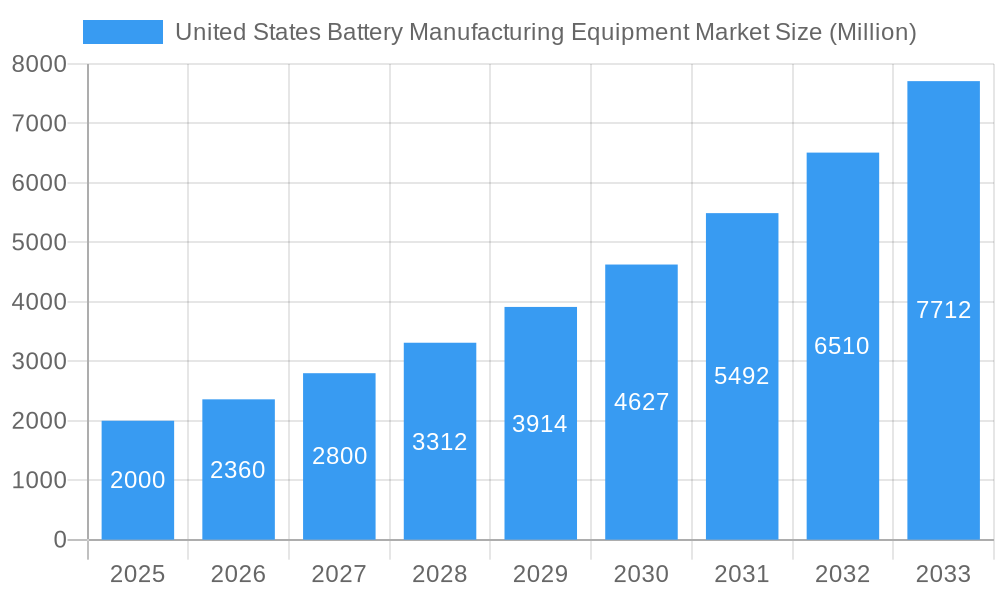

The United States battery manufacturing equipment market is experiencing significant expansion, driven by the robust growth of the electric vehicle (EV) sector and escalating demand for advanced energy storage solutions. While specific US market size data was not provided, an estimated $9.77 billion market size is projected for 2025, with a projected compound annual growth rate (CAGR) of 27.61% through 2033. This growth is underpinned by substantial investments in domestic battery production, incentivized by government support and the strategic imperative to strengthen national supply chains. Key growth catalysts include the expanding EV market, the increasing adoption of renewable energy sources necessitating effective energy storage, and stringent government regulations promoting clean energy technologies. Furthermore, breakthroughs in battery chemistries, such as solid-state batteries, are fueling demand for specialized and sophisticated manufacturing equipment. The market is segmented by machine type, including coating & drying, calendaring, slitting, mixing, electrode stacking, assembly & handling, and formation & testing. The primary end-users are automotive, industrial, and others. The automotive segment currently leads, with the industrial sector anticipated to experience substantial growth due to the rising deployment of battery storage in grid applications and other industrial processes. Potential market restraints include the considerable initial capital investment required for advanced equipment, persistent supply chain challenges for critical raw materials, and the continuous evolution of battery technologies necessitating frequent equipment upgrades.

United States Battery Manufacturing Equipment Market Market Size (In Billion)

The US market forecast from 2025 to 2033 indicates sustained high growth, with a projected CAGR likely exceeding 18%, reflecting ongoing investments in domestic manufacturing capacity and technological advancements. This growth trajectory will be further propelled by increasing demand from the EV sector, the expansion of grid-scale energy storage solutions, and the integration of batteries across various industrial applications. Despite intense competition from established players and emerging specialized equipment manufacturers, significant opportunities exist for companies demonstrating technological leadership and resilient supply chain capabilities to secure substantial market share. The dynamic nature of this market presents challenges related to technological obsolescence and maintaining a competitive edge, yet promises considerable rewards for agile and innovative enterprises.

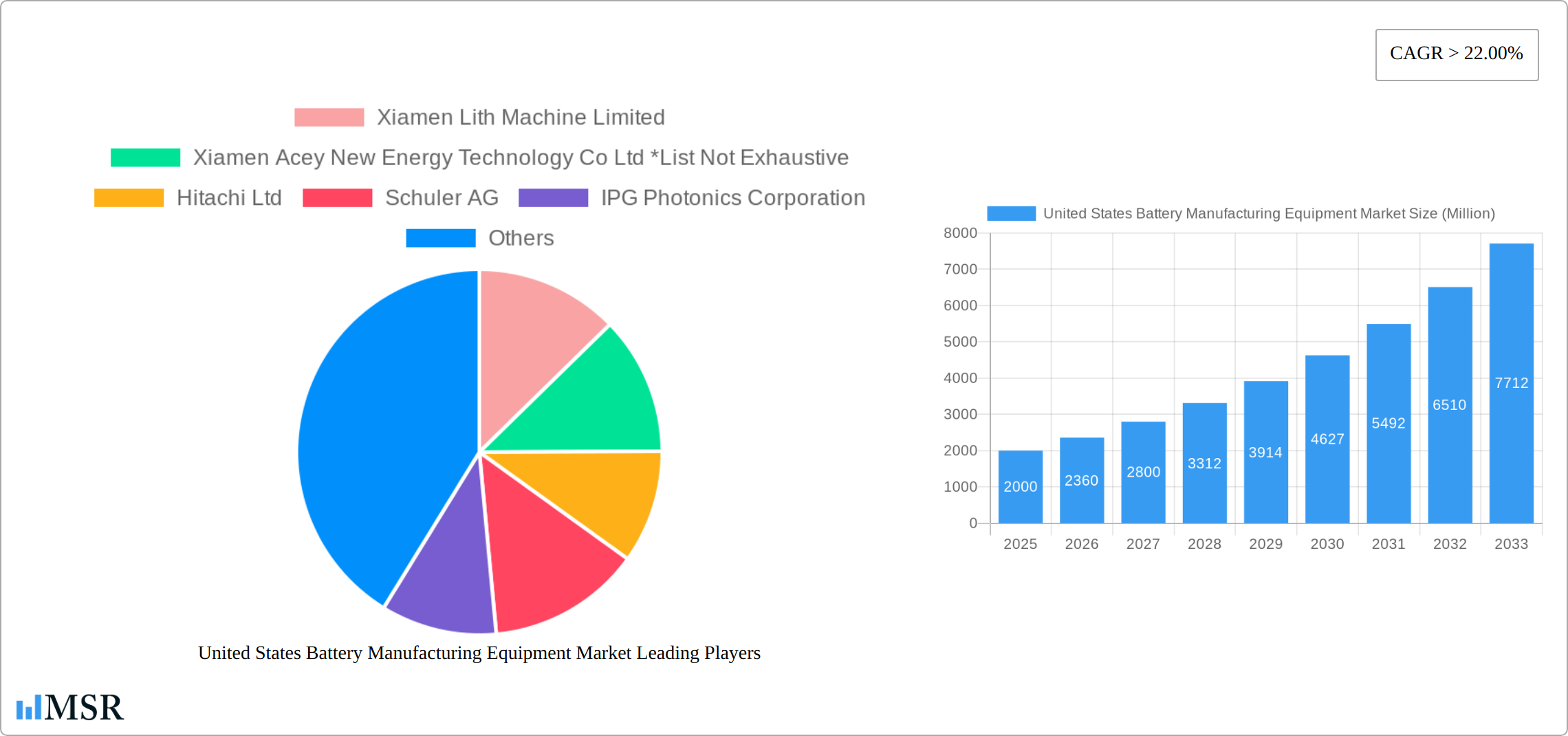

United States Battery Manufacturing Equipment Market Company Market Share

United States Battery Manufacturing Equipment Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States Battery Manufacturing Equipment market, offering valuable insights for stakeholders across the value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers crucial data on market size, growth drivers, and future trends. The report delves into market segmentation by machine type (Coating & Dryer, Calendaring, Slitting, Mixing, Electrode Stacking, Assembly & Handling Machines, Formation & Testing Machines) and end-user (Automotive, Industrial, Other End Users), offering a granular understanding of this dynamic market.

United States Battery Manufacturing Equipment Market Concentration & Dynamics

The United States battery manufacturing equipment market exhibits a moderately concentrated landscape, with several key players holding significant market share. However, the market is also characterized by a robust innovation ecosystem, fostering the entry of new players and technological advancements. Stringent regulatory frameworks surrounding environmental compliance and safety standards significantly impact market dynamics. Substitute products, while limited, pose a potential threat, particularly from emerging technologies. End-user trends, heavily influenced by the burgeoning electric vehicle (EV) sector and the growth of renewable energy storage solutions, are driving market expansion. Mergers and acquisitions (M&A) activity is relatively high, reflecting consolidation and strategic expansion within the industry.

- Market Share: The top five players collectively hold approximately xx% of the market share in 2025.

- M&A Deal Counts: An estimated xx M&A deals were recorded in the historical period (2019-2024).

- Key Regulatory Factors: EPA regulations on emissions and OSHA standards on workplace safety heavily influence equipment design and manufacturing processes.

United States Battery Manufacturing Equipment Market Industry Insights & Trends

The United States battery manufacturing equipment market is currently experiencing a period of significant expansion and transformation. This robust growth is primarily fueled by the accelerating demand for electric vehicles (EVs) and sophisticated energy storage systems (ESS). Market projections indicate a substantial increase, with the market size anticipated to reach USD [Insert Market Size Figure] Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of [Insert CAGR Figure]% during the forecast period (2025-2033). Key catalysts for this upward trajectory include ongoing technological advancements, particularly in the realms of industrial automation, precision engineering, and the development of advanced materials processing techniques. Furthermore, a palpable shift in consumer preferences towards sustainable and environmentally conscious energy solutions is providing a strong tailwind for market expansion. Crucially, proactive government incentives and supportive policies aimed at bolstering domestic battery manufacturing capabilities are playing a pivotal role in shaping and accelerating market growth. The increasing strategic investments being channeled by major automotive manufacturers and prominent energy corporations into the establishment and expansion of battery production facilities are directly translating into a heightened demand for state-of-the-art, high-throughput, and highly specialized manufacturing equipment.

Key Markets & Segments Leading United States Battery Manufacturing Equipment Market

The automotive sector stands out as the predominant end-user segment within the United States battery manufacturing equipment market, projected to command an estimated [Insert Automotive Segment Share]% of the total market share by 2033. Within the landscape of machine types, Assembly & Handling Machines and Formation & Testing Machines are recognized as the largest and most significant segments. This dominance stems from their indispensable role in ensuring the seamless integration of components and the rigorous quality assurance required throughout the intricate battery manufacturing lifecycle. The sustained and accelerated growth in the production of electric vehicles, coupled with the increasing adoption of advanced battery chemistries designed for higher performance and greater energy density, are the principal drivers behind the growth of these equipment segments.

- Automotive Segment Drivers:

- The rapid and ongoing expansion of the global and domestic electric vehicle market, driven by consumer demand and regulatory mandates.

- The proliferation of government incentives and subsidies aimed at promoting the adoption of EVs, thereby increasing the demand for batteries.

- Substantial and sustained investments by leading automotive manufacturers in establishing and scaling up their in-house battery production capabilities.

- Assembly & Handling Machines Dominance: Characterized by a substantial and increasing demand for highly automated, precise, and efficient material handling and assembly solutions essential for high-volume battery production lines.

- Formation & Testing Machines Growth: These machines are critical for the initial charging and discharging cycles (formation) and the subsequent comprehensive performance evaluation and quality control of manufactured batteries, ensuring optimal performance and safety.

United States Battery Manufacturing Equipment Market Product Developments

Recent and ongoing product developments within the United States battery manufacturing equipment market are sharply focused on achieving significant enhancements in operational efficiency, boosting production throughput, refining manufacturing precision, and ultimately reducing overall production costs. The integration of advanced robotic systems for intricate assembly tasks, the implementation of artificial intelligence (AI) powered solutions for sophisticated quality control and defect detection, and the deployment of high-speed processing technologies are collectively shaping a highly competitive and innovative landscape. These cutting-edge advancements not only contribute to substantial improvements in manufacturing efficiency but also critically enable the production of next-generation batteries that offer enhanced energy density, extended lifespan, and improved safety profiles. This continuous innovation is directly bolstering the global competitiveness of the United States battery manufacturing industry.

Challenges in the United States Battery Manufacturing Equipment Market

Despite the strong growth trajectory, the United States battery manufacturing equipment market is confronted by several significant challenges that require strategic attention and mitigation:

- Supply Chain Disruptions: The persistent volatility and fragility of global supply chains continue to pose a considerable challenge, impacting the timely availability of critical components and raw materials. This can lead to unforeseen production delays and escalations in manufacturing costs. Quantifiable impact: Industry reports indicate an estimated [Insert Supply Chain Cost Increase]% increase in production costs during 2024 directly attributable to persistent supply chain issues.

- Intense Competition: The market is characterized by a dynamic and often fierce competitive environment, with a substantial number of well-established industry players alongside emerging innovators vying for market share. This intense competition can exert downward pressure on pricing and necessitate continuous innovation to maintain differentiation.

- Regulatory Hurdles: Navigating the complex and evolving landscape of environmental regulations, safety standards, and permitting processes can present significant operational and financial challenges. Compliance with these stringent requirements can contribute to increased development timelines and elevated production costs for equipment manufacturers.

Forces Driving United States Battery Manufacturing Equipment Market Growth

Key growth drivers include:

- Government Support: Incentive programs and policies supporting domestic battery production stimulate investment in manufacturing equipment.

- Technological Advancements: Innovations in battery chemistry and manufacturing processes drive demand for new equipment.

- Rising Demand for EVs and ESS: The accelerating adoption of electric vehicles and energy storage systems fuels demand for battery manufacturing equipment.

Long-Term Growth Catalysts in the United States Battery Manufacturing Equipment Market

Long-term growth is fueled by continued innovation in battery technologies, strategic partnerships between equipment manufacturers and battery producers, and expansion into new geographic markets. The development of next-generation battery technologies, such as solid-state batteries, will create opportunities for specialized equipment.

Emerging Opportunities in United States Battery Manufacturing Equipment Market

Emerging opportunities lie in the development of sustainable and environmentally friendly manufacturing processes, the integration of advanced automation technologies, and the expansion into new energy storage applications beyond electric vehicles, such as grid-scale energy storage. The growing demand for advanced battery chemistries, such as lithium-sulfur and solid-state batteries, presents new market opportunities for specialized equipment manufacturers.

Leading Players in the United States Battery Manufacturing Equipment Sector

- Xiamen Lith Machine Limited

- Xiamen Acey New Energy Technology Co Ltd

- Hitachi Ltd

- Schuler AG

- IPG Photonics Corporation

- Durr AG

- Xiamen Tmax Battery Equipments Limited

Key Milestones in United States Battery Manufacturing Equipment Industry

- December 2022: General Motors and LG Energy Solution invest an additional USD 275 Million in their Tennessee battery plant, increasing production capacity by over 40%. This signifies significant expansion within the US battery manufacturing sector and increased demand for manufacturing equipment.

- November 2022: Hyundai Motor Group and SK On announce a USD 4-5 Billion investment in a new EV battery manufacturing facility in Georgia, slated to begin operations in 2025. This substantial investment underscores the growth potential and future demand for advanced battery manufacturing equipment in the US.

Strategic Outlook for United States Battery Manufacturing Equipment Market

The US battery manufacturing equipment market holds significant long-term growth potential, driven by the increasing demand for EVs and ESS, technological advancements, and supportive government policies. Strategic opportunities lie in developing innovative, sustainable, and cost-effective solutions, forging strategic partnerships, and expanding into new markets and applications. Companies focused on automation, advanced materials processing, and data analytics will likely gain a competitive advantage.

United States Battery Manufacturing Equipment Market Segmentation

-

1. Machine Type

- 1.1. Coating & Dryer

- 1.2. Calendaring

- 1.3. Slitting

- 1.4. Mixing

- 1.5. Electrode Stacking

- 1.6. Assembly & Handling Machines

- 1.7. Formation & Testing Machines

-

2. End User

- 2.1. Automotive

- 2.2. Industrial

- 2.3. Other End Users

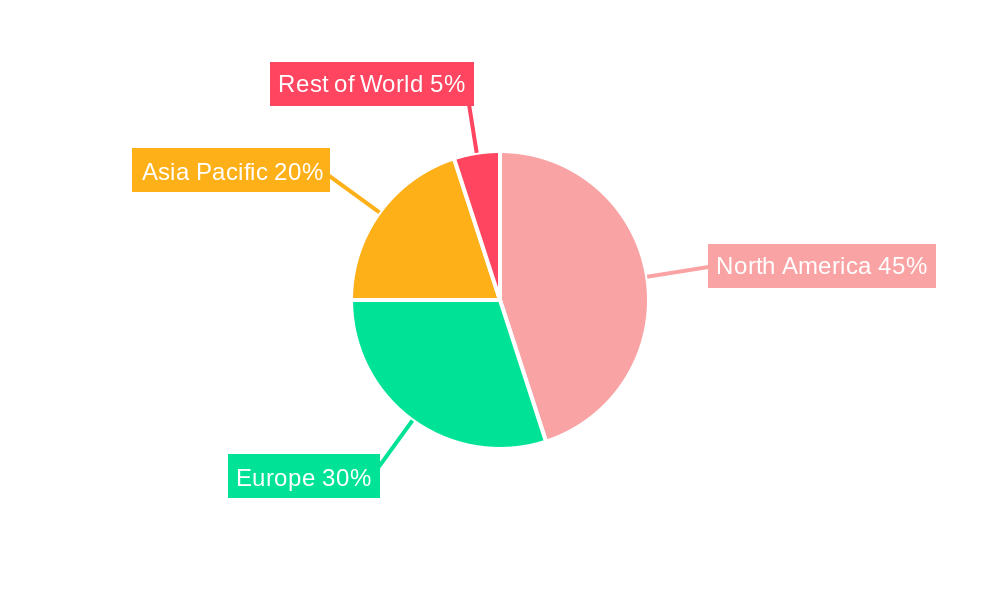

United States Battery Manufacturing Equipment Market Segmentation By Geography

- 1. United States

United States Battery Manufacturing Equipment Market Regional Market Share

Geographic Coverage of United States Battery Manufacturing Equipment Market

United States Battery Manufacturing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 27.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adopting of Alternative Clean Energy Sources (Ex

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 5.1.1. Coating & Dryer

- 5.1.2. Calendaring

- 5.1.3. Slitting

- 5.1.4. Mixing

- 5.1.5. Electrode Stacking

- 5.1.6. Assembly & Handling Machines

- 5.1.7. Formation & Testing Machines

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Automotive

- 5.2.2. Industrial

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Machine Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Xiamen Lith Machine Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xiamen Acey New Energy Technology Co Ltd *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schuler AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IPG Photonics Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Durr AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Xiamen Tmax Battery Equipments Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Xiamen Lith Machine Limited

List of Figures

- Figure 1: United States Battery Manufacturing Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Battery Manufacturing Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 2: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Machine Type 2020 & 2033

- Table 3: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by End User 2020 & 2033

- Table 5: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Machine Type 2020 & 2033

- Table 8: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Machine Type 2020 & 2033

- Table 9: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by End User 2020 & 2033

- Table 11: United States Battery Manufacturing Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United States Battery Manufacturing Equipment Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Battery Manufacturing Equipment Market?

The projected CAGR is approximately 27.61%.

2. Which companies are prominent players in the United States Battery Manufacturing Equipment Market?

Key companies in the market include Xiamen Lith Machine Limited, Xiamen Acey New Energy Technology Co Ltd *List Not Exhaustive, Hitachi Ltd, Schuler AG, IPG Photonics Corporation, Durr AG, Xiamen Tmax Battery Equipments Limited.

3. What are the main segments of the United States Battery Manufacturing Equipment Market?

The market segments include Machine Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.77 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Automotive Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adopting of Alternative Clean Energy Sources (Ex: Solar. Hydro).

8. Can you provide examples of recent developments in the market?

In December 2022, General Motors and LG Energy Solution will spend an additional USD 275 million in their joint venture battery plant in Tennessee to increase production by more than 40%. The joint venture, Ultium Cells LLC, announced that the new investment is in addition to the USD 2.3 billion announced in April 2021 to build the 2.8 million-square-foot facility. Production at the plant is expected to begin in late 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Battery Manufacturing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Battery Manufacturing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Battery Manufacturing Equipment Market?

To stay informed about further developments, trends, and reports in the United States Battery Manufacturing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence