Key Insights

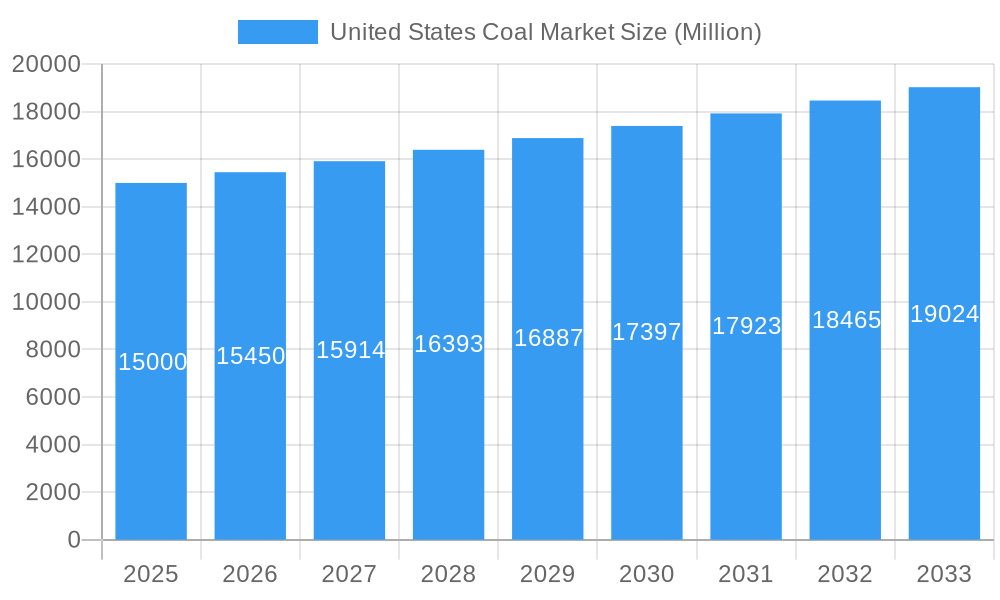

The United States coal market, while facing persistent headwinds, demonstrates a resilient trajectory projected through 2033. The market, valued at approximately $15 billion in 2025, is anticipated to experience a compound annual growth rate (CAGR) exceeding 3%, driven primarily by consistent demand from the power generation sector, particularly in regions with limited access to renewable energy sources. Metallurgical coal, used in steel production, also contributes significantly, albeit with fluctuations influenced by global steel manufacturing trends. While environmental regulations and the growing adoption of renewable energy sources pose significant challenges, the relatively low cost of coal compared to other energy sources, especially in the short-term, continues to support its continued use. Furthermore, ongoing investments in coal mine efficiency and safety improvements contribute to a degree of market stability.

United States Coal Market Market Size (In Billion)

However, the market faces considerable restraints. Stringent environmental regulations aimed at reducing greenhouse gas emissions are continually increasing operational costs and limiting coal production. The transition towards cleaner energy sources, such as solar and wind power, poses a long-term threat to coal demand, particularly in the power generation segment. The fluctuating global energy prices and geopolitical events can also influence the demand for U.S. coal in both domestic and international markets. Companies operating within the sector are actively diversifying their portfolios and investing in cleaner energy technologies to adapt to the changing market dynamics. The growth within the "Others" application segment will likely be driven by niche industrial uses where coal's properties remain unmatched by alternatives. Despite the challenges, the ongoing demand, albeit at a slower pace, from traditional sectors and the potential for innovative applications, suggests a sustained, albeit moderate, expansion of the US coal market over the forecast period.

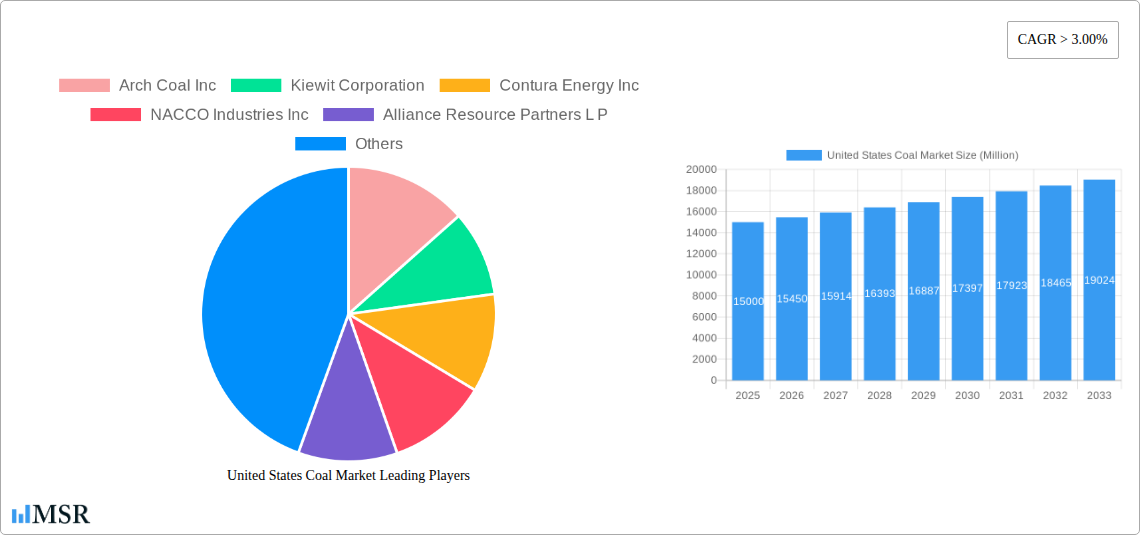

United States Coal Market Company Market Share

United States Coal Market: Comprehensive Report 2019-2033

This in-depth report provides a comprehensive analysis of the United States Coal Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, trends, key players, and future growth prospects. The report leverages extensive data analysis and expert insights to present a clear and actionable understanding of this evolving market.

United States Coal Market Market Concentration & Dynamics

This section analyzes the competitive landscape of the US coal market, examining market concentration, innovation, regulatory frameworks, substitute products, end-user trends, and M&A activities. The historical period (2019-2024) reveals a moderately concentrated market, with the top five players (Arch Coal Inc, Peabody Energy Corp, Contura Energy Inc, Alliance Resource Partners L P, and NACCO Industries Inc) holding an estimated xx% market share in 2024. The forecast period (2025-2033) anticipates a xx% increase in market concentration due to ongoing consolidation and strategic acquisitions.

- Market Share Dynamics: The market share of major players is expected to fluctuate based on production levels, pricing strategies, and the impact of environmental regulations.

- M&A Activity: The number of M&A deals within the sector during the historical period averaged xx per year, driven by efforts to achieve economies of scale and secure access to key resources. This trend is predicted to continue with a projected xx deals per year during the forecast period.

- Regulatory Framework: Stringent environmental regulations continue to significantly impact the industry, forcing companies to invest in cleaner technologies and potentially leading to market consolidation.

- Substitute Products: The increasing adoption of renewable energy sources like solar and wind power represents a major challenge to coal's market share, driving a need for innovative solutions and diversification strategies among coal producers.

- Innovation Ecosystem: Investment in carbon capture and storage (CCS) technologies and advanced coal gasification techniques is growing, albeit slowly, influencing the long-term viability of certain coal operations.

United States Coal Market Industry Insights & Trends

The US coal market experienced a contraction during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of -xx%. This decline is primarily attributed to the decreasing demand from the power generation sector due to the rise of renewable energy and stricter environmental regulations. However, the market size in 2024 is estimated at $xx Million. The forecast period (2025-2033) projects a more moderate CAGR of xx%, driven by increased demand for metallurgical coal in steel production and certain niche industrial applications. This growth will be significantly influenced by global economic conditions, infrastructure development, and government policies. Technological disruptions are forcing adaptation with innovation in coal extraction methods and efficiency improvements to remain competitive. Consumer behavior changes towards environmentally friendly energy sources remain a headwind.

Key Markets & Segments Leading United States Coal Market

The power generation sector historically dominated the US coal market, accounting for approximately xx% of total consumption in 2024. However, the metallurgical segment is poised for growth during the forecast period, fueled by steel production needs. The "Others" segment represents a relatively smaller but steadily growing portion of the market, primarily driven by industrial applications.

Dominant Segment: Power Generation (2024)

- Drivers: Existing coal-fired power plants, although facing increasing pressure to retire, continue to provide significant demand.

- Challenges: Stringent emissions regulations, high capital costs for emission control technologies, and competition from renewable energy sources are major challenges.

Emerging Segment: Metallurgy (2025-2033)

- Drivers: Growing steel production, particularly for infrastructure development projects, is bolstering demand for metallurgical coal.

- Challenges: Competition from alternative iron-making technologies, fluctuating steel prices, and reliance on global trade patterns.

Other Segments: These segments are expected to exhibit moderate growth, influenced by specific industrial applications and regional economic developments.

United States Coal Market Product Developments

Recent innovations include improvements in mining techniques, increasing efficiency and reducing environmental impact. Furthermore, advancements in coal gasification and carbon capture technologies are gaining traction, though still in their early stages of commercial deployment. These innovations aim to improve the competitiveness of coal in a changing energy landscape, particularly through reducing greenhouse gas emissions and improving overall efficiency.

Challenges in the United States Coal Market Market

The US coal market faces numerous challenges including increasingly stringent environmental regulations leading to high compliance costs, a volatile global market impacting price stability, and intense competition from renewable energy sources. These factors contribute to reduced profitability and threaten long-term market viability for some players. Supply chain disruptions, though not as prevalent as in other sectors, still pose occasional challenges impacting production and pricing.

Forces Driving United States Coal Market Growth

Despite the challenges, several factors could drive future growth. The enduring need for steel in infrastructure development continues to provide a steady demand for metallurgical coal. Technological innovations in coal gasification and carbon capture technologies, if successful in becoming cost-effective, could lead to increased market share. Furthermore, certain regions might experience a temporary surge in coal use due to gaps in renewable energy infrastructure capacity.

Long-Term Growth Catalysts in United States Coal Market

Long-term growth relies heavily on technological advancements that mitigate environmental concerns. Strategic partnerships focusing on carbon capture and utilization projects and diversification into related industries could unlock new growth opportunities. Expanding into international markets with less stringent regulations could also offer avenues for growth.

Emerging Opportunities in United States Coal Market

Opportunities exist in developing and deploying advanced coal technologies, such as carbon capture and storage (CCS) and gasification, which offer the potential to reduce emissions and make coal a more sustainable energy source. Furthermore, exploring niche industrial applications beyond power generation and metallurgy could uncover new market segments.

Leading Players in the United States Coal Market Sector

Key Milestones in United States Coal Market Industry

- 2020: Increased focus on ESG (Environmental, Social, and Governance) reporting and investment strategies by major players.

- 2022: Several coal-fired power plants announced retirement plans due to economic and regulatory pressures.

- 2023: Significant investments in carbon capture and storage pilot projects by some companies.

- Further milestones will be added in the full report.

Strategic Outlook for United States Coal Market Market

The future of the US coal market hinges on its ability to adapt to a changing energy landscape. Companies that invest in innovative technologies, diversify their product offerings, and effectively manage environmental regulations are more likely to thrive. The long-term potential lies in niche applications and the development of sustainable coal technologies, but the market's overall size is expected to remain relatively stable or decline slightly over the forecast period.

United States Coal Market Segmentation

-

1. Application

- 1.1. Metallurgy

- 1.2. Power Generation

- 1.3. Others

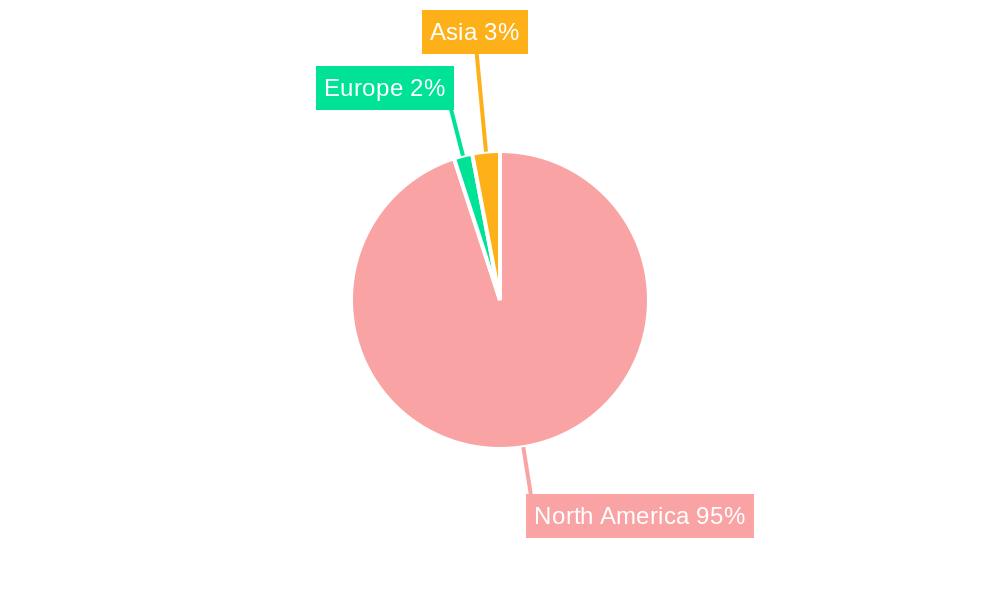

United States Coal Market Segmentation By Geography

- 1. United States

United States Coal Market Regional Market Share

Geographic Coverage of United States Coal Market

United States Coal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. Metallurgy Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Coal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Metallurgy

- 5.1.2. Power Generation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arch Coal Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kiewit Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Contura Energy Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NACCO Industries Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alliance Resource Partners L P

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Peabody Energy Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vistra Corp*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Arch Coal Inc

List of Figures

- Figure 1: United States Coal Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United States Coal Market Share (%) by Company 2025

List of Tables

- Table 1: United States Coal Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: United States Coal Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: United States Coal Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: United States Coal Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: United States Coal Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: United States Coal Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 7: United States Coal Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: United States Coal Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Coal Market?

The projected CAGR is approximately 0.8%.

2. Which companies are prominent players in the United States Coal Market?

Key companies in the market include Arch Coal Inc, Kiewit Corporation, Contura Energy Inc, NACCO Industries Inc, Alliance Resource Partners L P, Peabody Energy Corp, Vistra Corp*List Not Exhaustive.

3. What are the main segments of the United States Coal Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas.

6. What are the notable trends driving market growth?

Metallurgy Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Coal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Coal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Coal Market?

To stay informed about further developments, trends, and reports in the United States Coal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence