Key Insights

The global vehicle security system market is poised for substantial expansion, driven by escalating vehicle theft, heightened consumer demand for advanced protection, and the widespread adoption of connected car technologies. The market, currently valued at $3.37 billion in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 11% through 2033. Key growth catalysts include the integration of sophisticated systems such as alarm systems, keyless entry, immobilizers, and central locking in both new vehicle production and aftermarket installations. Technological advancements, including biometric authentication, GPS tracking, and remote diagnostics, are further stimulating the demand for advanced, connected security solutions. The burgeoning electric vehicle (EV) sector also presents a considerable opportunity, necessitating specialized security measures. Despite potential challenges from economic downturns and supply chain volatility, the market trajectory remains strongly positive.

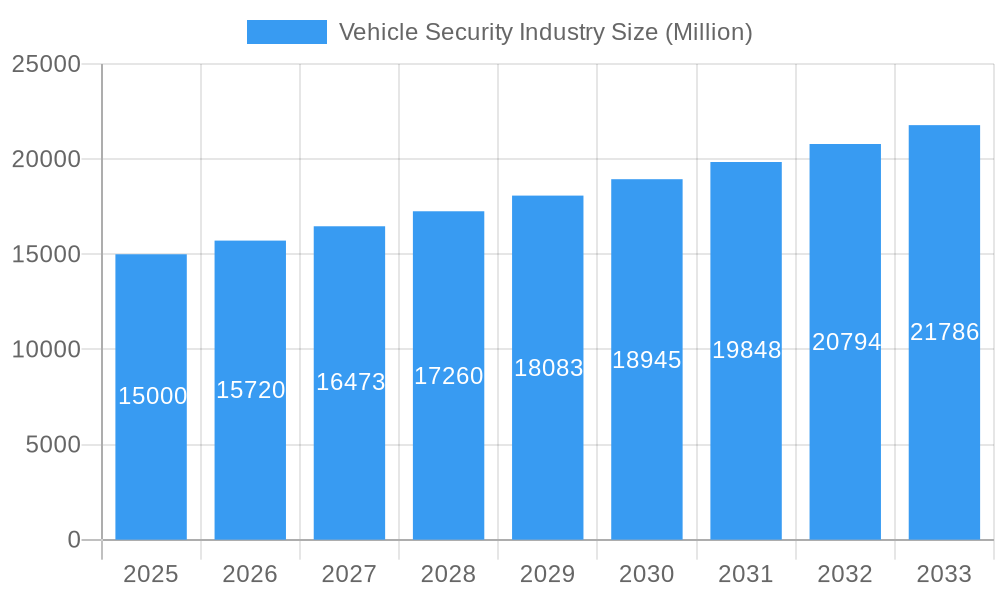

Vehicle Security Industry Market Size (In Billion)

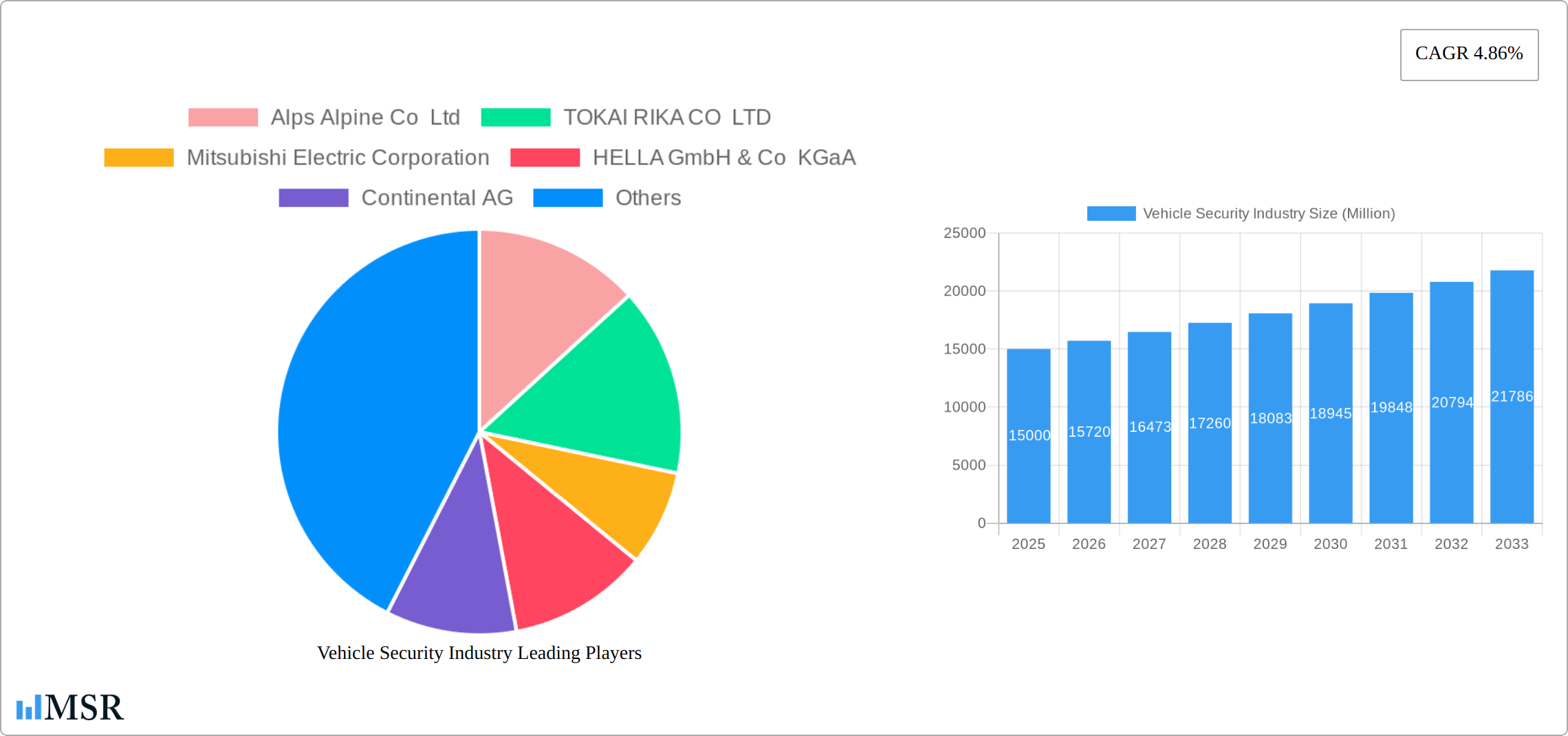

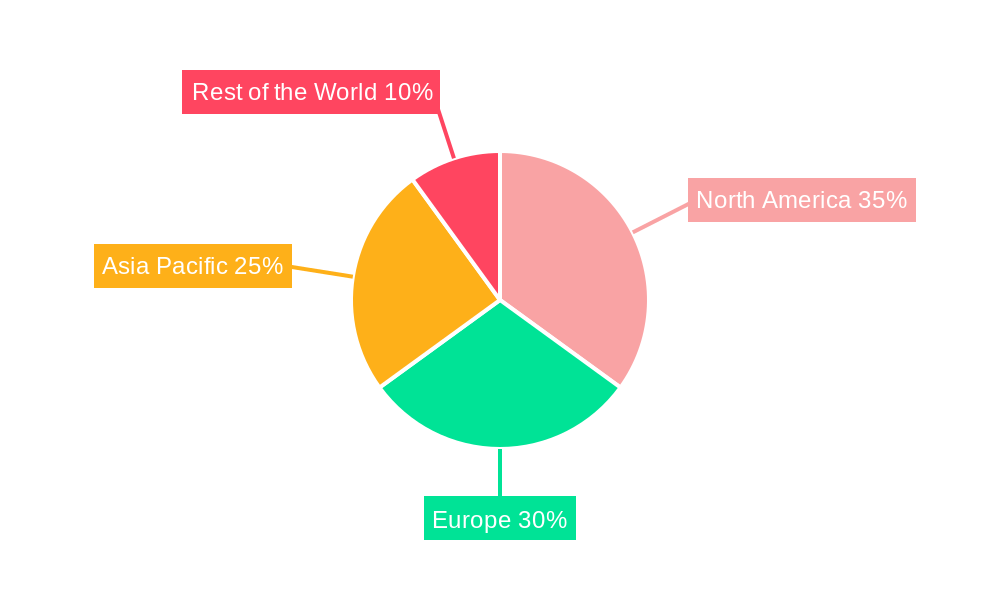

Market segmentation highlights alarm systems, keyless entry, and immobilizers as leading segments. Geographically, North America, Europe, and Asia Pacific are key growth regions. North America, characterized by high vehicle penetration and advanced technology adoption, is expected to retain a leading market position. Europe's market is propelled by stringent safety mandates and robust consumer awareness. The Asia-Pacific region is experiencing rapid expansion, largely due to burgeoning vehicle sales in major economies such as China and India. The competitive landscape features established automotive suppliers like Alps Alpine, Tokai Rika, Mitsubishi Electric, Hella, Continental, and Bosch, alongside specialized providers such as Viper and Clifford. Continuous innovation, focusing on integrated, user-friendly, and cost-effective solutions, will define future market development.

Vehicle Security Industry Company Market Share

Vehicle Security Industry Market Report: 2019-2033 Forecast

Unlocking the Future of Automotive Security: A Comprehensive Market Analysis

This comprehensive report provides an in-depth analysis of the global vehicle security industry, projecting a market valuation exceeding $XX Million by 2033. The study period covers 2019-2033, with 2025 as the base and estimated year. We delve into market dynamics, key players, technological advancements, and emerging opportunities, offering invaluable insights for stakeholders across the automotive security ecosystem. This report is essential for manufacturers, suppliers, investors, and researchers seeking to understand the evolving landscape of vehicle security and capitalize on future growth.

Vehicle Security Industry Market Concentration & Dynamics

The vehicle security market exhibits a moderately concentrated landscape, with key players like Continental AG, Robert Bosch GmbH, and HELLA GmbH & Co KGaA holding significant market share. However, the industry is witnessing increased competition from both established automotive suppliers and emerging technology companies.

Market Concentration Metrics (2024 Estimates):

- Top 5 players hold approximately XX% market share.

- Average market share of top 10 players: XX%.

Innovation Ecosystems & Regulatory Frameworks:

The industry is characterized by a dynamic innovation ecosystem, driven by advancements in areas such as cybersecurity, digital keys, and connected car technologies. Stringent regulatory frameworks, particularly concerning data privacy and vehicle security standards, are shaping industry practices. The increasing prevalence of connected vehicles and the rise in cyberattacks are accelerating the demand for robust security systems.

Substitute Products & End-User Trends:

While traditional mechanical security systems still exist, the market is rapidly shifting towards electronic and software-based solutions. End-user trends reveal a growing preference for convenient and technologically advanced security features, such as keyless entry and remote vehicle monitoring capabilities.

M&A Activities:

The number of M&A deals in the vehicle security industry has shown a steady increase over the past five years, with approximately XX deals recorded in 2024. These activities primarily focus on strengthening technological capabilities and expanding market reach.

Vehicle Security Industry Industry Insights & Trends

The global vehicle security market is experiencing robust and dynamic growth, driven by an accelerating Compound Annual Growth Rate (CAGR) of XX% projected from 2025 to 2033. This upward trajectory is underpinned by a confluence of critical factors:

- Surging Vehicle Production & Global Demand: The continuous increase in global vehicle production, particularly in burgeoning emerging economies, is directly translating into a heightened demand for sophisticated vehicle security systems.

- Pervasive Integration of Advanced Driver-Assistance Systems (ADAS): The widespread adoption of ADAS necessitates a corresponding escalation in advanced security measures. This integration is crucial for safeguarding sensitive vehicle data and rigorously preventing unauthorized access, both physical and digital.

- Heightened Consumer Vigilance and Security Consciousness: Consumers are increasingly cognizant of the evolving risks associated with vehicle theft, break-ins, and the growing threat of sophisticated cyberattacks. This heightened awareness is a significant catalyst for increased demand for cutting-edge and comprehensive security solutions.

- Evolving Regulatory Landscape & Mandates: Governments worldwide are progressively implementing and strengthening stringent regulations pertaining to vehicle security. These regulatory frameworks are compelling manufacturers to adopt and integrate advanced security technologies, ensuring a baseline level of protection.

The market size is estimated to reach $XX Million in 2025 and is poised for substantial expansion, projected to attain $XX Million by 2033. Technological advancements, such as the widespread introduction of digital keys and the relentless evolution of cyberattack methodologies, are continuously reshaping the industry's competitive landscape. Concurrently, consumer behavior is shifting towards an expectation of seamless, intuitive, and highly secure vehicle access and management, emphasizing the critical demand for user-centric and technologically superior solutions.

Key Markets & Segments Leading Vehicle Security Industry

The North American market currently holds the largest share of the vehicle security market. Strong economic growth, well-developed automotive infrastructure, and high consumer spending on advanced vehicle features contribute to this dominance. Europe follows as a key region, driven by stringent vehicle safety regulations and a high adoption rate of advanced security technologies. Asia Pacific is emerging as a significant market, fuelled by increasing vehicle sales and the growing adoption of connected vehicles.

Segment Analysis:

- Keyless Entry: This segment is experiencing significant growth, driven by increasing consumer preference for convenience and user-friendly features.

- Immobilizers: This segment remains essential for preventing vehicle theft and is expected to maintain steady growth.

- Alarm Systems: Although facing competition from more advanced systems, alarm systems still constitute a substantial market segment due to affordability and widespread applicability.

- Central Locking: This remains a fundamental vehicle security feature, integrated into most vehicles across various segments.

Drivers for Market Dominance:

- Strong Economic Growth: Robust economic growth in leading markets fuels consumer spending on automobiles and advanced security features.

- Favorable Government Policies: Supportive policies promoting vehicle safety and technological advancements stimulate industry development.

- Advanced Automotive Infrastructure: Well-established automotive industries and robust supply chains support market expansion.

Vehicle Security Industry Product Developments

The vehicle security sector has been a hotbed of innovation in recent years, with a constant stream of groundbreaking product developments. The advent of digital keys, leveraging secure system-on-chip (SoC) solutions, is revolutionizing vehicle access by offering unparalleled convenience and enhanced security, effectively moving beyond traditional key fobs. A paramount focus is being placed on integrating robust advanced cybersecurity measures directly into the core vehicle systems. This proactive approach aims to build resilient defenses against an ever-expanding array of cyber threats and potential data breaches. Furthermore, manufacturers are increasingly prioritizing the seamless integration of vehicle security systems with burgeoning connected car platforms. This integration unlocks powerful capabilities for remote monitoring, diagnostics, and management, offering greater control and peace of mind to vehicle owners. These advancements are not merely incremental; they are fundamentally redefining vehicle security and are creating significant competitive advantages for companies that can consistently deliver innovative, secure, and intuitively user-friendly solutions to the market.

Challenges in the Vehicle Security Industry Market

The vehicle security industry navigates a complex landscape fraught with significant challenges. The escalating intricacy of modern vehicle electronics and software architecture presents a formidable hurdle, demanding continuous adaptation and specialized expertise. The ever-growing sophistication and prevalence of cyber threats necessitate a perpetual arms race in developing countermeasures. Navigating and adhering to increasingly stringent regulatory compliance requirements adds another layer of complexity and cost. Furthermore, vulnerabilities within global supply chains can introduce substantial delays in manufacturing and product delivery, directly impacting profitability and market responsiveness. The intense nature of market competition, coupled with the imperative for continuous and rapid technological innovation, also poses considerable obstacles for established players and emerging entrants alike. It is estimated that the collective impact of these challenges could lead to an approximate XX% reduction in overall market growth in 2024.

Forces Driving Vehicle Security Industry Growth

Several factors drive growth in the vehicle security industry. These include technological advancements such as the development of digital keys, improved cybersecurity measures, and the integration of artificial intelligence. Growing consumer demand for advanced security features and rising concerns about vehicle theft and cyberattacks contribute significantly. Furthermore, government regulations that mandate enhanced vehicle security standards are creating substantial market opportunities.

Long-Term Growth Catalysts in the Vehicle Security Industry

Long-term growth will be driven by continuous innovation in areas such as biometrics, AI-powered threat detection, and advanced encryption techniques. Strategic partnerships between automotive manufacturers and technology companies will accelerate the development and deployment of cutting-edge security solutions. Expansion into new markets, particularly in developing economies, will also contribute to significant growth over the long term.

Emerging Opportunities in Vehicle Security Industry

The vehicle security industry is ripe with exciting and transformative emerging opportunities. A key area of growth lies in the synergistic integration of vehicle security with a broader ecosystem of connected car services, offering comprehensive safety and convenience features. The increasing adoption of flexible and scalable subscription-based security models presents a new revenue stream and enhances customer loyalty. The development of groundbreaking and highly specialized cybersecurity solutions tailored for autonomous vehicles is a critical and rapidly evolving frontier. Expansion into adjacent and underserved markets, such as robust security for commercial vehicles and specialized off-road equipment, presents substantial untapped growth potential. Moreover, the innovative application of blockchain technology for fortifying security protocols and enabling secure, transparent data management is opening up entirely new and compelling possibilities for the industry.

Leading Players in the Vehicle Security Industry Sector

- Alps Alpine Co Ltd

- TOKAI RIKA CO LTD

- Mitsubishi Electric Corporation

- HELLA GmbH & Co KGaA

- Continental AG

- Viper Security Systems (Directed Electronics)

- Robert Bosch GmbH

- Valeo SA

- Clifford (Directed Inc )

- Brogwarner Inc

- ZF Friedrichshafen AG

Key Milestones in Vehicle Security Industry Industry

- June 2022: STMicroelectronics unveiled a groundbreaking new system-on-chip (SoC) solution specifically designed for secure car access. This innovation is fully compliant with the CCC Digital Key release 3.0 standard, thereby significantly accelerating the industry's transition towards widespread adoption of digital car keys and directly impacting the keyless entry segment.

- May 2022: Alps Alpine Co., Ltd. announced a strategic partnership with Giesecke+Devrient GmbH. This collaboration is focused on the joint development of a CCC-compliant wireless digital key system, further bolstering the momentum and innovation within the burgeoning digital key market.

- July 2021: ZF launched its advanced ZF ProAI supercomputer, a significant development providing enhanced cybersecurity capabilities specifically engineered for software-defined vehicles. This initiative directly addresses the escalating global concerns surrounding sophisticated cyber threats and their potential impact on automotive systems.

- March 2021: Hella established a new, state-of-the-art development center in Craiova, Romania. This strategic expansion signifies a considerable investment in research and development (R&D) and enhanced product testing capabilities, thereby strengthening Hella's competitive position within the industry.

Strategic Outlook for Vehicle Security Industry Market

The future of the vehicle security industry is bright, driven by technological advancements and increasing consumer demand for advanced security features. Strategic partnerships, investments in R&D, and expansion into new markets will be crucial for success. The industry is poised for significant growth, with substantial opportunities for companies that can innovate, adapt, and offer secure, reliable, and user-friendly solutions to address evolving market needs.

Vehicle Security Industry Segmentation

-

1. Type

- 1.1. Alarm

- 1.2. Keyless Entry

- 1.3. Immobilizer

- 1.4. Central Locking

- 1.5. Other Types

Vehicle Security Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Vehicle Security Industry Regional Market Share

Geographic Coverage of Vehicle Security Industry

Vehicle Security Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Popularity of Sports Bike to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Premium Helmets Deter Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Number of Advanced Technologies to Boost the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vehicle Security Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Alarm

- 5.1.2. Keyless Entry

- 5.1.3. Immobilizer

- 5.1.4. Central Locking

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Vehicle Security Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Alarm

- 6.1.2. Keyless Entry

- 6.1.3. Immobilizer

- 6.1.4. Central Locking

- 6.1.5. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Vehicle Security Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Alarm

- 7.1.2. Keyless Entry

- 7.1.3. Immobilizer

- 7.1.4. Central Locking

- 7.1.5. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Vehicle Security Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Alarm

- 8.1.2. Keyless Entry

- 8.1.3. Immobilizer

- 8.1.4. Central Locking

- 8.1.5. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Vehicle Security Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Alarm

- 9.1.2. Keyless Entry

- 9.1.3. Immobilizer

- 9.1.4. Central Locking

- 9.1.5. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Alps Alpine Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 TOKAI RIKA CO LTD

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mitsubishi Electric Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 HELLA GmbH & Co KGaA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Continental AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Viper Security Systems (Directed Electronics

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Robert Bosch GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Valeo SA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Clifford (Directed Inc )

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Brogwarner Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 ZF Friedrichshafen AG

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Alps Alpine Co Ltd

List of Figures

- Figure 1: Global Vehicle Security Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Vehicle Security Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Vehicle Security Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Vehicle Security Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Vehicle Security Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Vehicle Security Industry Revenue (billion), by Type 2025 & 2033

- Figure 7: Europe Vehicle Security Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Vehicle Security Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Vehicle Security Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Vehicle Security Industry Revenue (billion), by Type 2025 & 2033

- Figure 11: Asia Pacific Vehicle Security Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Vehicle Security Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Vehicle Security Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Vehicle Security Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Rest of the World Vehicle Security Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Rest of the World Vehicle Security Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Rest of the World Vehicle Security Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Vehicle Security Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Vehicle Security Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Vehicle Security Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Global Vehicle Security Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Vehicle Security Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 9: Global Vehicle Security Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Germany Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: France Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Italy Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Spain Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Vehicle Security Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Vehicle Security Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: China Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Japan Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: South Korea Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global Vehicle Security Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 24: Global Vehicle Security Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 25: South America Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Middle East and Africa Vehicle Security Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vehicle Security Industry?

The projected CAGR is approximately 11%.

2. Which companies are prominent players in the Vehicle Security Industry?

Key companies in the market include Alps Alpine Co Ltd, TOKAI RIKA CO LTD, Mitsubishi Electric Corporation, HELLA GmbH & Co KGaA, Continental AG, Viper Security Systems (Directed Electronics, Robert Bosch GmbH, Valeo SA, Clifford (Directed Inc ), Brogwarner Inc, ZF Friedrichshafen AG.

3. What are the main segments of the Vehicle Security Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.37 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Popularity of Sports Bike to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

Increasing Number of Advanced Technologies to Boost the Market Growth.

7. Are there any restraints impacting market growth?

High Cost of Premium Helmets Deter Market Growth.

8. Can you provide examples of recent developments in the market?

June 2022: STMicroelectronics introduced a new system-on-chip solution for secure car access that is Car Connectivity Consortium (CCC) Digital Key release 3.0 compliant to accelerate the introduction of digital car keys, giving users keyless access to vehicles via their mobile devices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vehicle Security Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vehicle Security Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vehicle Security Industry?

To stay informed about further developments, trends, and reports in the Vehicle Security Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence