Key Insights

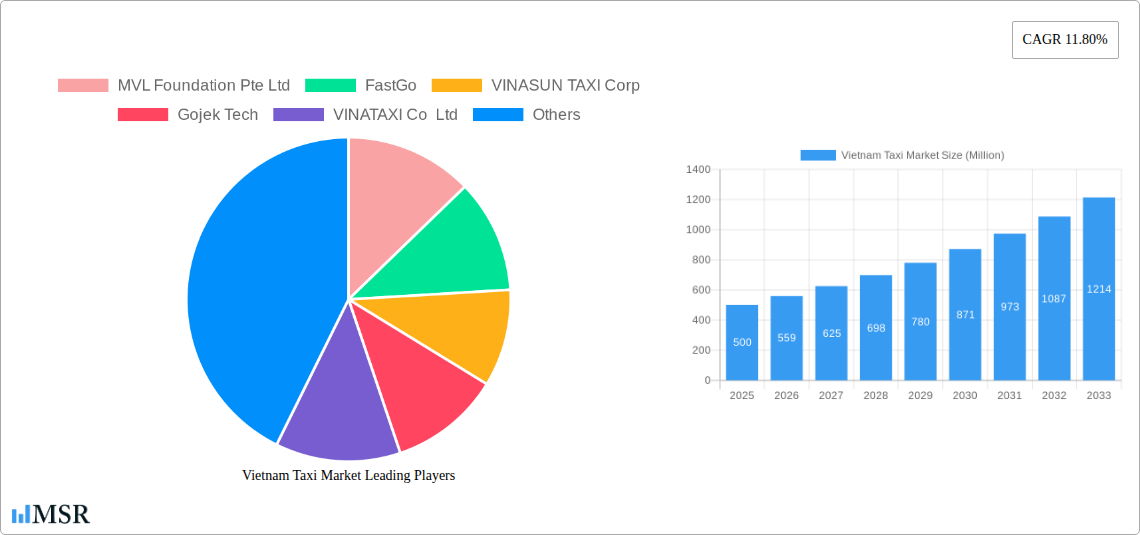

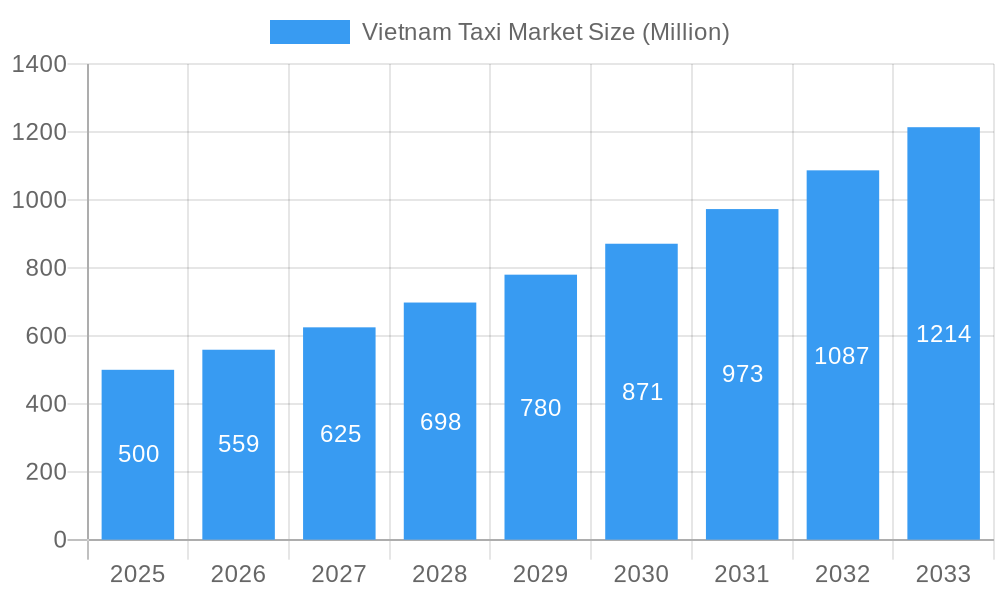

The Vietnam taxi market, valued at $0.5 billion in 2025, is projected to experience robust growth, driven by increasing urbanization, rising disposable incomes, and the expanding adoption of ride-hailing apps. The market's Compound Annual Growth Rate (CAGR) of 11.80% from 2025 to 2033 indicates a significant expansion over the forecast period. Key growth drivers include the increasing popularity of online booking platforms, offering convenience and transparency, and the diversification of vehicle types catering to diverse passenger needs, including motorcycles, cars, and vans. The dominance of major players like Grab Holdings Inc and Gojek Tech, alongside local competitors such as Vinasun Taxi Corp and Mai Linh Group, fuels competition and innovation. However, challenges such as traffic congestion in major cities, regulatory hurdles, and the need for continuous investment in technology and driver training could potentially moderate growth. The market segmentation, encompassing offline and online booking types and varying vehicle options, presents opportunities for targeted marketing and service differentiation. Future growth hinges on technological advancements, strategic partnerships, and addressing infrastructural limitations.

Vietnam Taxi Market Market Size (In Million)

The significant CAGR suggests that the market will likely reach approximately $1.3 billion by 2033, assuming consistent growth. This growth trajectory will be influenced by factors such as government policies promoting sustainable transportation, improvements in technological infrastructure enabling smoother ride-hailing operations, and the evolving preferences of consumers who prioritize convenience, safety, and affordability. The competitive landscape necessitates continuous adaptation and innovation from existing players and potential new entrants, fostering a dynamic and evolving market. Understanding consumer behavior and proactively adapting to changing market demands will be crucial for sustained success within this expanding sector.

Vietnam Taxi Market Company Market Share

Vietnam Taxi Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Vietnam taxi market, offering invaluable insights for industry stakeholders, investors, and strategic planners. With a focus on market dynamics, key players, and future trends, this report covers the period from 2019 to 2033, utilizing data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market growth until 2033. The report segments the market by booking type (offline, online), service type (ride-hailing, ride-sharing), and vehicle type (motorcycle, cars, other vehicle types). Key players analyzed include MVL Foundation Pte Ltd, FastGo, VINASUN TAXI Corp, Gojek Tech, VINATAXI Co Ltd, Kyyti Group, Mai Linh Group, and Grab Holdings Inc. Expect to uncover crucial data on market size (in Millions), CAGR, and market share, providing actionable intelligence to navigate this dynamic market.

Vietnam Taxi Market Concentration & Dynamics

The Vietnam taxi market exhibits a dynamic interplay of established players and emerging competitors, shaping its concentration and overall dynamics. While a few major players like Grab Holdings Inc. and Mai Linh Group command significant market share (estimated at xx% and xx% respectively in 2025), the market is far from saturated. The rise of online booking platforms has intensified competition, fostering innovation and influencing market concentration.

- Market Share (2025): Grab Holdings Inc. (xx%), Mai Linh Group (xx%), VINASUN TAXI Corp (xx%), Others (xx%)

- M&A Activity (2019-2024): xx deals, indicating a consolidation trend within the sector. This activity is driven by the desire to expand market reach and leverage technological advantages.

- Innovation Ecosystem: The market is characterized by a vibrant innovation ecosystem, fueled by technological advancements in ride-hailing apps, GPS technology, and payment systems.

- Regulatory Framework: Government regulations concerning licensing, pricing, and safety standards significantly impact market operations. Evolving regulations often necessitate strategic adaptations by market participants.

- Substitute Products: Private car ownership and public transportation present alternative options for commuters, influencing the market's overall demand.

- End-User Trends: Increasing smartphone penetration and a growing preference for convenient and cashless transactions are key drivers of market growth.

Vietnam Taxi Market Industry Insights & Trends

The Vietnam taxi market is experiencing robust growth, driven by several key factors. The market size in 2025 is estimated at USD xx Million, with a projected CAGR of xx% from 2025 to 2033. This growth is fueled by a rapidly expanding urban population, rising disposable incomes, and increasing reliance on on-demand transportation services. Technological disruptions, particularly the proliferation of ride-hailing apps and the integration of GPS technology, are transforming the industry. Consumer behaviors are shifting towards online booking, cashless payments, and heightened expectations for safety and reliability. These trends are reshaping the competitive landscape, forcing traditional taxi operators to adapt or risk losing market share. Increased adoption of electric vehicles within the taxi fleet is also a notable trend, driven by environmental concerns and government incentives. The evolving regulatory environment, aiming to improve safety and standardize service quality, also plays a crucial role in shaping industry trends.

Key Markets & Segments Leading Vietnam Taxi Market

The online booking segment is rapidly dominating the Vietnam taxi market, fueled by the convenience and accessibility offered by smartphone apps. Major cities such as Ho Chi Minh City and Hanoi are key market hubs, benefiting from higher population density and greater demand for transportation services.

- Dominant Segment: Online Booking

- Dominant Vehicle Type: Cars

- Dominant Service Type: Ride-hailing

- Key Market Drivers:

- Rapid urbanization and population growth in major cities.

- Rising disposable incomes and increased spending power.

- Improved infrastructure, including road networks and telecommunications.

- Government initiatives promoting digitalization and technological adoption.

Vietnam Taxi Market Product Developments

Recent years have witnessed significant product innovations within the Vietnam taxi market, primarily driven by technological advancements. Ride-hailing apps have become increasingly sophisticated, incorporating features such as real-time tracking, fare estimation, multiple payment options, and integrated rating systems. The introduction of electric and hybrid vehicles is also gaining traction, improving environmental sustainability and reducing operational costs for operators. These innovations are enhancing customer experience and fostering greater competition among providers.

Challenges in the Vietnam Taxi Market Market

The Vietnam taxi market faces several challenges, including intense competition from numerous ride-hailing apps, stringent regulatory requirements, traffic congestion in major cities, and fluctuating fuel prices. These factors impact profitability and operational efficiency, requiring operators to employ efficient cost management strategies and adapt to evolving market conditions. The high initial investment required for acquiring vehicles and obtaining licenses also presents a barrier to entry for new players. Furthermore, ensuring driver safety and security remains a key concern.

Forces Driving Vietnam Taxi Market Growth

Several factors contribute to the long-term growth of the Vietnam taxi market. Technological advancements, including the development of more efficient and user-friendly ride-hailing apps, are key drivers. Continued economic growth and rising disposable incomes lead to increased demand for convenient transportation services. Government support for digitalization and infrastructure development also play a crucial role. Finally, the expanding middle class and growing tourism sector contribute significantly to the market's overall growth.

Long-Term Growth Catalysts in Vietnam Taxi Market

Long-term growth in the Vietnam taxi market hinges on continued technological innovation, strategic partnerships, and market expansion into underserved areas. The development of autonomous vehicles and the integration of advanced technologies such as artificial intelligence and big data analytics will reshape the industry. Partnerships between ride-hailing platforms and transportation authorities can improve regulatory compliance and enhance service quality. Expanding into less-developed regions of the country will unlock new opportunities for growth.

Emerging Opportunities in Vietnam Taxi Market

Emerging opportunities include the growth of specialized services, such as airport transfers and delivery services, integrated with ride-hailing platforms. The integration of sustainable transportation options, like electric vehicles, presents significant opportunities for environmentally conscious operators. Focusing on enhanced customer service features, including personalized experiences and loyalty programs, can further differentiate players in the competitive market.

Leading Players in the Vietnam Taxi Market Sector

- Grab Holdings Inc.

- Mai Linh Group

- VINASUN TAXI Corp

- Gojek Tech

- VINATAXI Co Ltd

- Kyyti Group

- FastGo

- MVL Foundation Pte Ltd

Key Milestones in Vietnam Taxi Market Industry

- June 2022: Grab Holdings Inc. launched GrabMaps, a mapping and location-based service, aiming to capitalize on a USD 1 Billion market opportunity in Southeast Asia. This strategic move strengthens Grab's position in the market by enhancing its operational efficiency and service capabilities.

Strategic Outlook for Vietnam Taxi Market Market

The Vietnam taxi market presents a promising outlook for future growth, driven by a combination of factors including technological advancements, economic expansion, and evolving consumer preferences. Strategic opportunities lie in leveraging technological innovations to enhance operational efficiency, improving customer experience through personalized services, and exploring new market segments like logistics and last-mile delivery. Companies that successfully adapt to evolving regulatory landscapes and effectively manage operational challenges will be best positioned to capture significant market share and drive sustainable growth in this dynamic market.

Vietnam Taxi Market Segmentation

-

1. Booking Type

- 1.1. Offline

- 1.2. Online

-

2. Service Type

- 2.1. Ride-hailing

- 2.2. Ride-sharing

-

3. Vehicle Type

- 3.1. Motorcycles

- 3.2. Cars

- 3.3. Other Vehicle Types (Vans)

Vietnam Taxi Market Segmentation By Geography

- 1. Vietnam

Vietnam Taxi Market Regional Market Share

Geographic Coverage of Vietnam Taxi Market

Vietnam Taxi Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Urbanization and Demand for Convinient Transportation

- 3.3. Market Restrains

- 3.3.1. Traffic Congestion in Major Cities

- 3.4. Market Trends

- 3.4.1. Ride-hailing Services Anticipated to Play Key role in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Taxi Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 5.1.1. Offline

- 5.1.2. Online

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Ride-hailing

- 5.2.2. Ride-sharing

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Motorcycles

- 5.3.2. Cars

- 5.3.3. Other Vehicle Types (Vans)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 MVL Foundation Pte Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FastGo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 VINASUN TAXI Corp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gojek Tech

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 VINATAXI Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kyyti Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mai Linh Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Grab Holdings Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 MVL Foundation Pte Ltd

List of Figures

- Figure 1: Vietnam Taxi Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam Taxi Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Taxi Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 2: Vietnam Taxi Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Vietnam Taxi Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Vietnam Taxi Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Vietnam Taxi Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 6: Vietnam Taxi Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Vietnam Taxi Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Vietnam Taxi Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Taxi Market?

The projected CAGR is approximately 11.80%.

2. Which companies are prominent players in the Vietnam Taxi Market?

Key companies in the market include MVL Foundation Pte Ltd, FastGo, VINASUN TAXI Corp, Gojek Tech, VINATAXI Co Ltd, Kyyti Group, Mai Linh Group, Grab Holdings Inc.

3. What are the main segments of the Vietnam Taxi Market?

The market segments include Booking Type, Service Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Urbanization and Demand for Convinient Transportation.

6. What are the notable trends driving market growth?

Ride-hailing Services Anticipated to Play Key role in the Market.

7. Are there any restraints impacting market growth?

Traffic Congestion in Major Cities.

8. Can you provide examples of recent developments in the market?

In June 2022, Grab Holdings Inc. announced the launch of GrabMaps, a new enterprise service that will enable the company to capitalize on the USD 1 billion market opportunity for mapping and location-based services in Southeast Asia each year. GrabMaps was initially created for internal use to address Grab's need for a more hyperlocal solution to power its services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Taxi Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Taxi Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Taxi Market?

To stay informed about further developments, trends, and reports in the Vietnam Taxi Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence