Key Insights

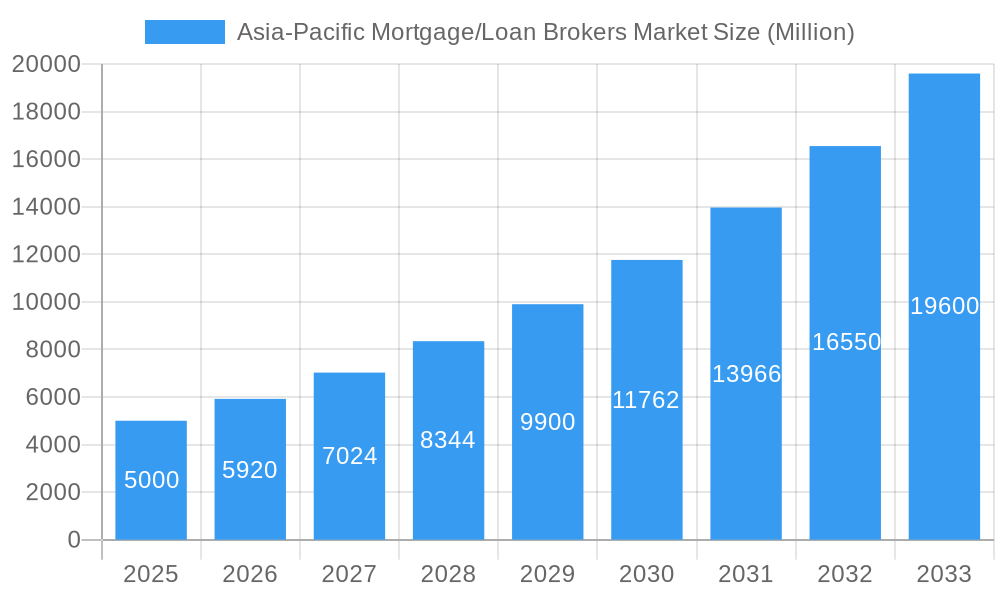

The Asia-Pacific mortgage and loan broker market is experiencing significant expansion, driven by a growing middle class, increasing urbanization, and supportive government initiatives promoting homeownership. The market's Compound Annual Growth Rate (CAGR) is projected at 14.2%, with the market size expected to reach 319.39 billion by the base year 2025. This sustained growth is attributed to rising disposable incomes, improved access to financing, and escalating demand for both residential and commercial properties. The market is characterized by fragmentation with established players alongside emerging entrants leveraging technological innovations like online platforms and data analytics to enhance efficiency and customer experience.

Asia-Pacific Mortgage/Loan Brokers Market Market Size (In Billion)

Future growth in the Asia-Pacific mortgage and loan broker market is expected to continue, fueled by a wider array of mortgage products, increased adoption of digital channels, and expanded service reach. Despite potential challenges from regulatory complexities and interest rate volatility, the market outlook remains favorable. The presence of leading financial institutions and growing demand for financial advisory services underscore the market's dynamism. Key success factors will include strategic alliances, technological integration, and penetration into under-served regions, with regional market dominance varying based on economic and regulatory landscapes.

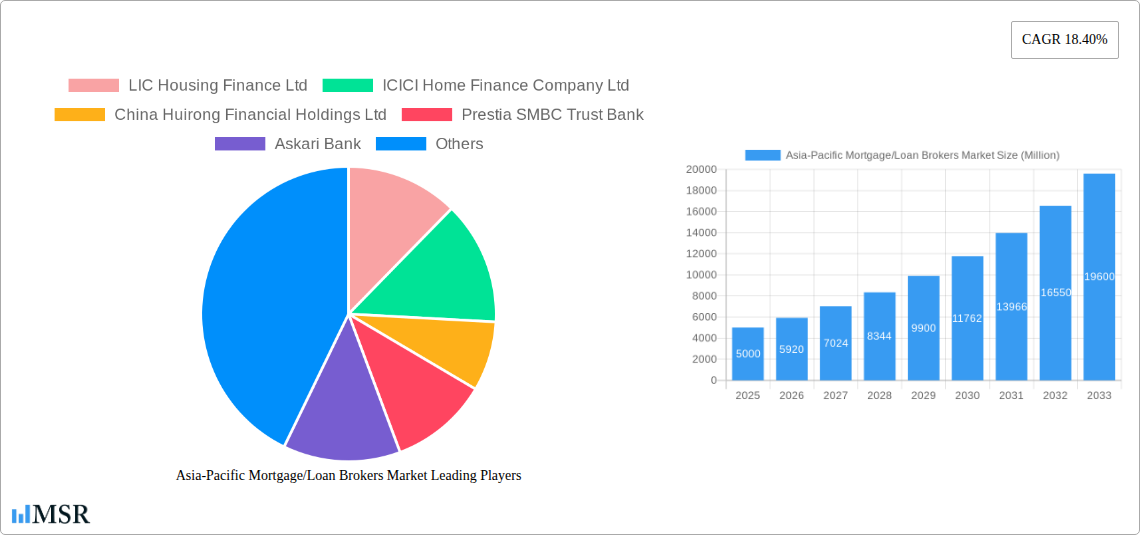

Asia-Pacific Mortgage/Loan Brokers Market Company Market Share

Asia-Pacific Mortgage/Loan Brokers Market Report: 2019-2033 Forecast

Uncover lucrative opportunities and navigate the complexities of the rapidly evolving Asia-Pacific mortgage and loan brokers market with this comprehensive report. This in-depth analysis provides a detailed overview of market dynamics, key players, emerging trends, and future growth prospects across the region. Covering the period from 2019 to 2033, with a focus on 2025, this report is an invaluable resource for industry stakeholders, investors, and strategic planners. The market is projected to reach xx Million by 2033, showcasing significant growth potential.

Asia-Pacific Mortgage/Loan Brokers Market Market Concentration & Dynamics

The Asia-Pacific mortgage and loan brokers market exhibits a moderately concentrated landscape, with several large players holding significant market share. However, a growing number of smaller, specialized brokers are also emerging, creating a dynamic competitive environment. The market's innovative ecosystem is driven by technological advancements, such as fintech solutions and online platforms, which are streamlining processes and improving efficiency. Regulatory frameworks vary across countries, influencing market access and operational practices. Substitute products, such as peer-to-peer lending platforms and direct lender options, are increasingly challenging traditional brokers. End-user trends show a preference for digital channels and personalized services. M&A activity is moderate, with a predicted xx number of deals in 2025, driven by consolidation and expansion strategies.

- Market Share: Top 5 players hold approximately xx% of the market.

- M&A Deal Count (2019-2024): xx

- Projected M&A Deal Count (2025-2033): xx

- Key Regulatory Factors: Varying licensing requirements and compliance standards across countries.

Asia-Pacific Mortgage/Loan Brokers Market Industry Insights & Trends

The Asia-Pacific mortgage and loan brokers market is experiencing robust growth, driven by factors such as increasing urbanization, rising disposable incomes, and favorable government policies. Technological disruptions, particularly the adoption of fintech solutions, are transforming the industry by enhancing efficiency, transparency, and customer experience. Evolving consumer behaviors, including a preference for digital channels and personalized financial advice, are shaping market demand. The market size was valued at xx Million in 2024 and is projected to reach xx Million by 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth trajectory is expected to continue, fueled by ongoing economic expansion and technological advancements across the region. The market is further segmented by loan type, customer segment, and geographic location, each with its own growth drivers and challenges.

Key Markets & Segments Leading Asia-Pacific Mortgage/Loan Brokers Market

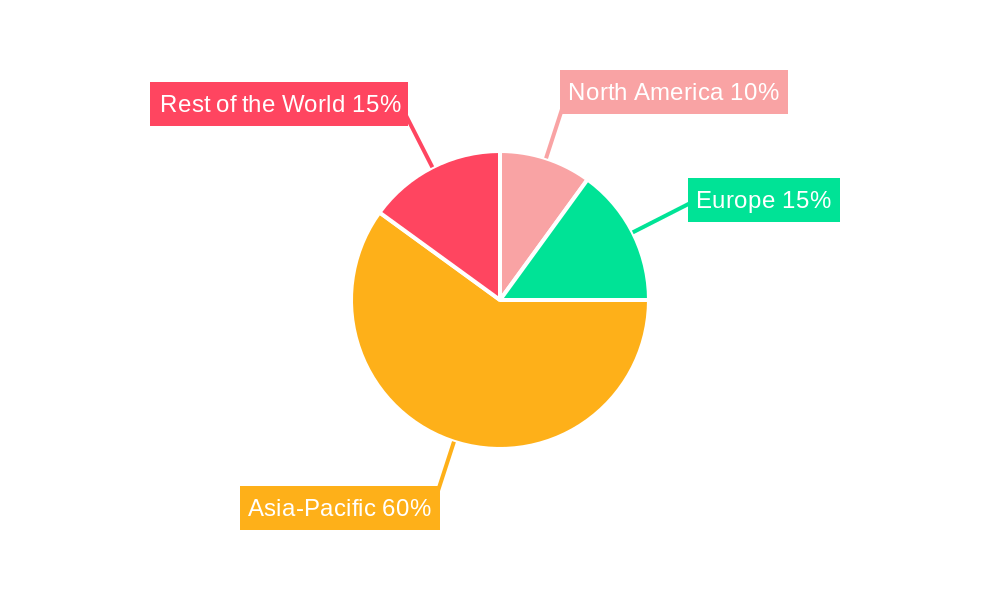

The Asia-Pacific mortgage and loan brokers market is experiencing strong growth across several key regions and segments. China and India are dominant markets, driven by factors such as rapid economic growth, expanding middle class, and supportive government initiatives. The residential mortgage segment holds the largest market share, with significant potential for future growth in commercial and other loan types.

- Dominant Regions: China, India, Australia, Japan, Singapore.

- Drivers in China: Rapid urbanization, increasing homeownership rates, government-backed housing schemes.

- Drivers in India: Growing middle class, government infrastructure projects, increasing access to credit.

- Segment Dominance: Residential mortgages.

Asia-Pacific Mortgage/Loan Brokers Market Product Developments

Recent product innovations include the integration of AI-powered platforms for credit scoring and risk assessment, personalized financial planning tools, and mobile-first applications offering streamlined loan applications. These advancements enhance efficiency, improve customer experience, and strengthen competitive advantages. The increasing use of blockchain technology for secure and transparent transactions is also gaining traction.

Challenges in the Asia-Pacific Mortgage/Loan Brokers Market Market

Significant challenges include stringent regulatory compliance requirements across diverse jurisdictions, varying levels of financial literacy among consumers, intense competition from established financial institutions and new fintech players, and potential economic volatility impacting consumer borrowing confidence. These factors can significantly affect profitability and market penetration. For example, high regulatory compliance costs can reduce profit margins by an estimated xx%.

Forces Driving Asia-Pacific Mortgage/Loan Brokers Market Growth

The market's growth is propelled by factors including rising disposable incomes, increasing urbanization, supportive government policies promoting homeownership, technological advancements streamlining processes, and the rising adoption of digital channels among consumers. These factors collectively contribute to a favorable environment for increased demand for mortgage and loan brokerage services.

Long-Term Growth Catalysts in Asia-Pacific Mortgage/Loan Brokers Market

Long-term growth hinges on strategic partnerships with technology providers to enhance digital capabilities, expansion into underserved markets, and the development of innovative financial products tailored to evolving consumer needs. Furthermore, regulatory changes promoting financial inclusion can significantly stimulate growth.

Emerging Opportunities in Asia-Pacific Mortgage/Loan Brokers Market

Emerging opportunities lie in leveraging fintech solutions for enhanced efficiency and customer experience, expanding into under-served rural markets, and catering to the growing demand for personalized financial planning and wealth management services. The adoption of open banking technologies also presents significant opportunities for innovation and partnership.

Leading Players in the Asia-Pacific Mortgage/Loan Brokers Market Sector

- LIC Housing Finance Ltd

- ICICI Home Finance Company Ltd

- China Huirong Financial Holdings Ltd

- Prestia SMBC Trust Bank

- Askari Bank

- CNFinance Holdings Limited

- Shinsei Bank

- Tokyo Star Bank

- PNB Housing Finance Ltd

- Can Fin Homes Ltd

Key Milestones in Asia-Pacific Mortgage/Loan Brokers Market Industry

- March 2023: All Fleet Mortgages reduced two- and five-year fixed-rate packages by 20 basis points across various loan types, indicating a shift in interest rate dynamics.

- February 2023: The State Bank of India raised USD 1 Billion in syndicated social funds, highlighting a growing emphasis on ESG (Environmental, Social, and Governance) investments within the financial sector.

Strategic Outlook for Asia-Pacific Mortgage/Loan Brokers Market Market

The Asia-Pacific mortgage and loan brokers market holds significant growth potential, driven by a confluence of factors. Strategic initiatives focused on technological innovation, expansion into new markets, and the development of value-added financial services will be key to capturing this potential and achieving sustained success in the years to come. The market's future trajectory will heavily rely on adapting to shifting regulatory landscapes, evolving consumer preferences, and advancements in technology.

Asia-Pacific Mortgage/Loan Brokers Market Segmentation

-

1. Enterprise

- 1.1. Large

- 1.2. Small

- 1.3. Mid-sized

-

2. Applications

- 2.1. Home Loans

- 2.2. Commercial and Industrial Loans

- 2.3. Vehicle Loans

- 2.4. Loans to Governments

- 2.5. Others

-

3. End- User

- 3.1. Businesses

- 3.2. Individuals

Asia-Pacific Mortgage/Loan Brokers Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Mortgage/Loan Brokers Market Regional Market Share

Geographic Coverage of Asia-Pacific Mortgage/Loan Brokers Market

Asia-Pacific Mortgage/Loan Brokers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growth in Demand for Personalized Financial Guidance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Mortgage/Loan Brokers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Enterprise

- 5.1.1. Large

- 5.1.2. Small

- 5.1.3. Mid-sized

- 5.2. Market Analysis, Insights and Forecast - by Applications

- 5.2.1. Home Loans

- 5.2.2. Commercial and Industrial Loans

- 5.2.3. Vehicle Loans

- 5.2.4. Loans to Governments

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End- User

- 5.3.1. Businesses

- 5.3.2. Individuals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Enterprise

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LIC Housing Finance Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ICICI Home Finance Company Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China Huirong Financial Holdings Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Prestia SMBC Trust Bank

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Askari Bank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CNFinance Holdings Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Shinsei Bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tokyo Star Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PNB Housing Finance Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Can Fin Homes Ltd **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 LIC Housing Finance Ltd

List of Figures

- Figure 1: Asia-Pacific Mortgage/Loan Brokers Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Mortgage/Loan Brokers Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Mortgage/Loan Brokers Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 2: Asia-Pacific Mortgage/Loan Brokers Market Revenue billion Forecast, by Applications 2020 & 2033

- Table 3: Asia-Pacific Mortgage/Loan Brokers Market Revenue billion Forecast, by End- User 2020 & 2033

- Table 4: Asia-Pacific Mortgage/Loan Brokers Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Mortgage/Loan Brokers Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 6: Asia-Pacific Mortgage/Loan Brokers Market Revenue billion Forecast, by Applications 2020 & 2033

- Table 7: Asia-Pacific Mortgage/Loan Brokers Market Revenue billion Forecast, by End- User 2020 & 2033

- Table 8: Asia-Pacific Mortgage/Loan Brokers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Mortgage/Loan Brokers Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Mortgage/Loan Brokers Market?

The projected CAGR is approximately 14.2%.

2. Which companies are prominent players in the Asia-Pacific Mortgage/Loan Brokers Market?

Key companies in the market include LIC Housing Finance Ltd, ICICI Home Finance Company Ltd, China Huirong Financial Holdings Ltd, Prestia SMBC Trust Bank, Askari Bank, CNFinance Holdings Limited, Shinsei Bank, Tokyo Star Bank, PNB Housing Finance Ltd, Can Fin Homes Ltd **List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Mortgage/Loan Brokers Market?

The market segments include Enterprise, Applications, End- User.

4. Can you provide details about the market size?

The market size is estimated to be USD 319.39 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growth in Demand for Personalized Financial Guidance.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: All Fleet Mortgages' two- and five-year fixed-rate packages had their rates reduced. The buy-to-let lender claims a 20 basis point reduction in its standard, limited company, residences in multiple occupations, and multi-unit freehold block loans in these term ranges.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Mortgage/Loan Brokers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Mortgage/Loan Brokers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Mortgage/Loan Brokers Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Mortgage/Loan Brokers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence