Key Insights

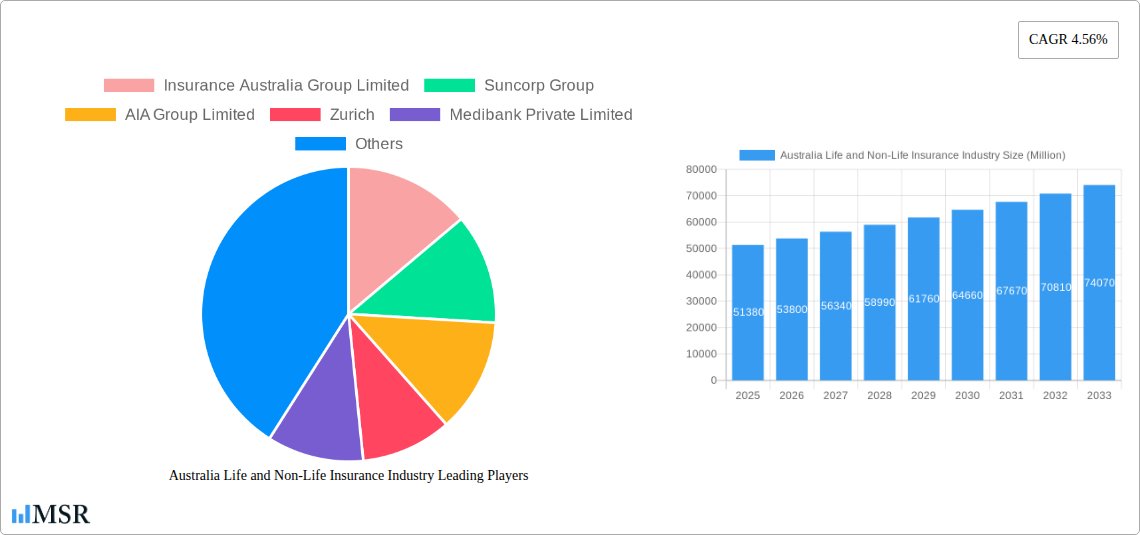

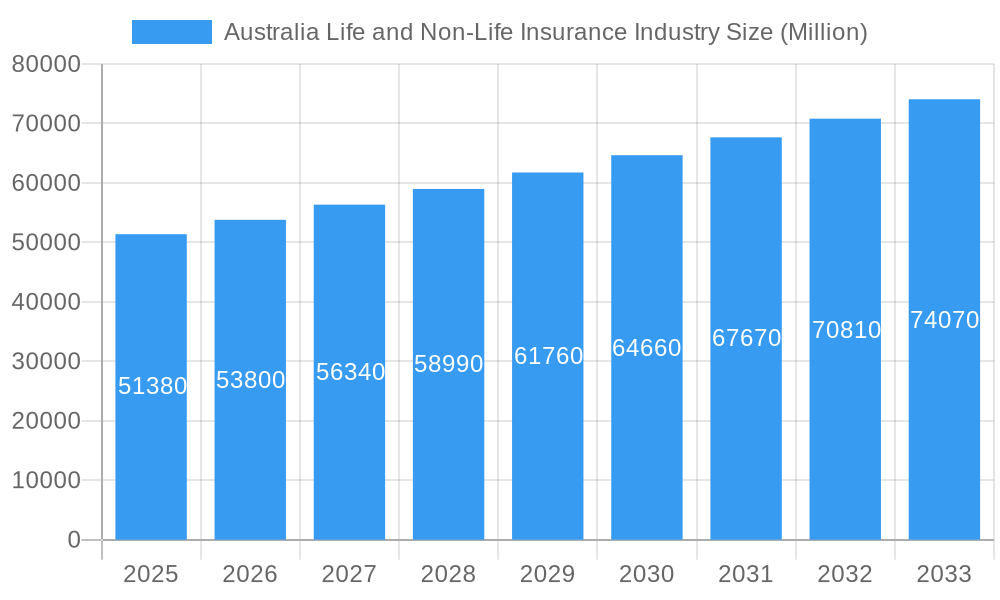

The Australian life and non-life insurance market, valued at $51.38 billion in 2025, is projected to experience steady growth, driven by a rising middle class with increased disposable income, a growing awareness of risk mitigation, and the increasing penetration of digital insurance solutions. The 4.56% CAGR indicates a robust expansion over the forecast period (2025-2033). Key drivers include government initiatives promoting financial inclusion, a burgeoning demand for health insurance due to an aging population and rising healthcare costs, and the increasing adoption of innovative insurance products such as parametric insurance and microinsurance to cater to diverse customer segments. However, challenges remain, including intense competition among established players and the emergence of InsurTech companies, regulatory changes impacting pricing and product offerings, and cyclical economic downturns that can impact consumer spending on insurance.

Australia Life and Non-Life Insurance Industry Market Size (In Billion)

The market segmentation reveals a dynamic landscape. While precise segment breakdowns are unavailable, we can infer significant shares held by life insurance (covering mortality, health, and retirement needs) and non-life insurance ( encompassing property, casualty, and motor vehicle coverage). Leading companies such as Insurance Australia Group, Suncorp Group, AIA Group, and Medibank Private hold substantial market share, indicating a consolidated yet competitive market structure. The historical period (2019-2024) likely exhibited varied performance depending on economic conditions and regulatory interventions. The forecast period projects continued market growth, albeit at a moderated pace due to potential economic headwinds and evolving consumer preferences. Strategic partnerships and technological advancements will be crucial for companies to maintain their competitive edge and cater to the evolving demands of the Australian insurance market.

Australia Life and Non-Life Insurance Industry Company Market Share

Australia Life and Non-Life Insurance Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australian life and non-life insurance industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, key players, emerging trends, and future growth potential. The study leverages extensive data analysis, encompassing historical data (2019-2024) and projected figures to provide a robust understanding of this dynamic sector. Download now to gain a competitive edge.

Australia Life and Non-Life Insurance Industry Market Concentration & Dynamics

This section assesses the competitive landscape, examining market concentration, innovation, regulation, substitute products, consumer trends, and M&A activity within the Australian life and non-life insurance market. The analysis covers the period 2019-2024 and projects trends through 2033.

Market Concentration: The Australian insurance market exhibits moderate concentration, with a few dominant players such as Insurance Australia Group Limited and Suncorp Group holding significant market share. Precise figures for market share are unavailable at this time, however, estimations suggest IAG holds approximately xx% and Suncorp holds approximately xx%. Smaller players, including niche insurers and those specializing in particular segments, make up the remaining share.

Innovation Ecosystems: Innovation is driven by technological advancements, particularly in areas like Insurtech and the increasing adoption of data analytics for risk assessment and customer relationship management.

Regulatory Frameworks: The Australian Prudential Regulation Authority (APRA) plays a crucial role in overseeing and regulating the insurance sector, impacting the market's stability and growth. Recent regulatory changes focused on consumer protection and financial stability have also shaped market dynamics.

Substitute Products: The emergence of alternative risk management solutions, like peer-to-peer insurance platforms, presents emerging competition to traditional players. However, their overall impact on the market remains limited as of 2024.

End-User Trends: Growing consumer awareness of insurance products and increasing demand for personalized services are driving market changes. Online channels are becoming increasingly important for sales and customer interactions.

M&A Activities: The number of M&A deals in the Australian insurance market has fluctuated between xx and xx per year during the historical period, reflecting consolidation and industry restructuring. The establishment of io. Insure in September 2022 points towards a trend of innovation within the M&A insurance space.

Australia Life and Non-Life Insurance Industry Industry Insights & Trends

This section delves into the key factors influencing the growth and evolution of the Australian life and non-life insurance market. It provides a detailed analysis of market size, compound annual growth rate (CAGR), market drivers, technological disruptions, and shifting consumer behaviors.

The Australian life and non-life insurance market experienced significant growth during the period 2019-2024, achieving a market size of approximately $xx Million in 2024. Driven by factors such as increasing household incomes, rising awareness of risk management needs and strong economic growth, the industry is projected to maintain a steady CAGR of xx% from 2025 to 2033, reaching an estimated market size of $xx Million by 2033. This growth is further supported by technological advancements in areas like artificial intelligence and the Internet of Things, streamlining processes and enhancing customer experiences. Changing consumer preferences, with a move toward more personalized and digital insurance solutions, are also contributing to market expansion. However, the industry must contend with intense competition and increasing regulatory scrutiny, as well as potential economic slowdowns that could impact insurance purchasing.

Key Markets & Segments Leading Australia Life and Non-Life Insurance Industry

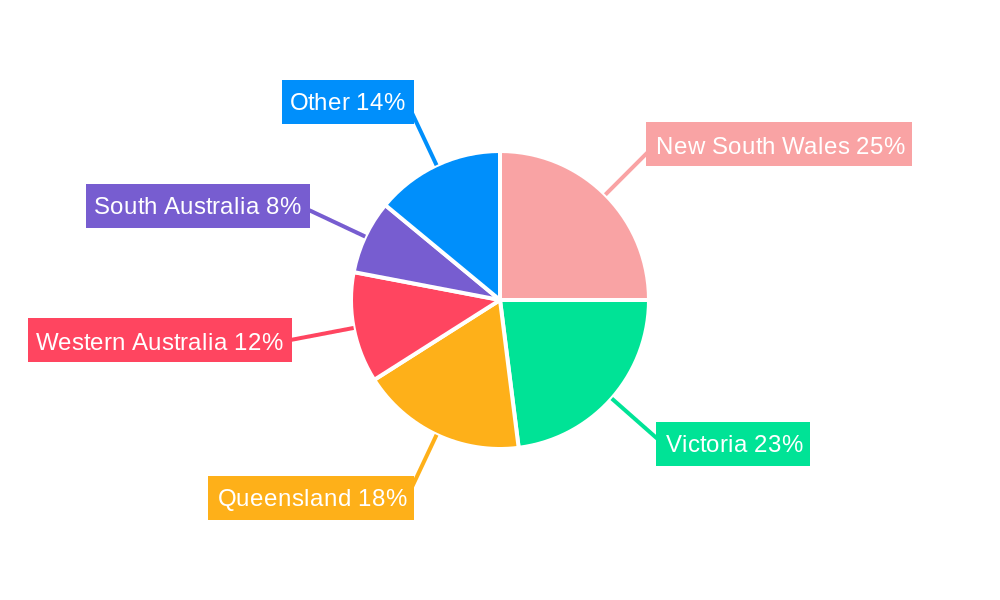

This section identifies the leading market segments and geographic areas within the Australian life and non-life insurance industry. It provides a detailed analysis of the drivers behind the dominance of these segments and explores the factors contributing to their continued success.

Dominant Segment: The general insurance segment currently dominates the market, driven by factors such as mandatory motor vehicle insurance and growing demand for home and business insurance. The life insurance segment, while smaller, is anticipated to experience significant growth propelled by rising health and retirement concerns.

Regional Variations: While data on regional variations is limited, urban centres tend to exhibit stronger growth due to higher population density and economic activity.

Drivers for Dominant Segments:

- Strong economic growth: Economic prosperity increases disposable income, making insurance purchase more likely.

- Government regulations: Mandatory insurance policies for certain segments (like motor vehicle insurance) significantly boost market size.

- Infrastructure development: Growth in infrastructure projects stimulates the construction sector, requiring significant property and liability insurance.

- Rising awareness of risk: Increasing consumer awareness of various risks (health, natural disasters, etc.) drives insurance uptake.

Australia Life and Non-Life Insurance Industry Product Developments

The Australian life and non-life insurance industry is witnessing significant product innovation. Technological advancements are driving the development of new products and services, enhancing customer experiences, and providing insurers with a competitive edge. For example, the use of telematics in motor insurance provides personalized premiums based on driving behaviour, while the integration of IoT devices offers risk management solutions for homeowners. These innovations are fostering increased competition and improving product affordability and accessibility, thereby driving market expansion.

Challenges in the Australia Life and Non-Life Insurance Industry Market

The Australian life and non-life insurance market faces several challenges. Regulatory hurdles, including compliance costs and evolving regulatory frameworks, pose significant operational burdens. Supply chain disruptions, exacerbated by global events, can affect claims processing and service delivery. Intense competition from both established players and Insurtech start-ups puts constant pressure on pricing and profitability. These combined factors can constrain market growth and profitability. The quantifiable impact of these challenges is difficult to pinpoint precisely but is reflected in reduced profit margins and increased operational costs for some companies.

Forces Driving Australia Life and Non-Life Insurance Industry Growth

Several factors are driving the growth of the Australian life and non-life insurance industry. Technological advancements, such as artificial intelligence (AI) and the Internet of Things (IoT), offer opportunities for efficiency gains and enhanced customer experiences. Favorable economic conditions, including steady GDP growth and increased disposable incomes, boost demand for insurance products. Supporting government policies promoting financial inclusion and risk mitigation further enhance market growth. IAG's investment in Myriota, for example, exemplifies the strategic use of technology to expand service offerings and increase customer engagement.

Long-Term Growth Catalysts in the Australia Life and Non-Life Insurance Industry Market

Long-term growth in the Australian life and non-life insurance sector is supported by the continuous development of innovative insurance products, strategic partnerships between traditional insurers and Insurtech firms, and the expansion into new market segments such as the SME M&A insurance market. These initiatives not only improve efficiency and profitability but also strengthen market competitiveness and drive overall growth.

Emerging Opportunities in Australia Life and Non-Life Insurance Industry

Emerging opportunities lie in the increasing adoption of Insurtech solutions, enabling personalized and data-driven insurance products. The expanding use of telematics and IoT devices allows for risk assessment and personalized pricing models. Furthermore, the penetration of insurance products in underserved populations and untapped geographical areas presents significant potential for expansion.

Leading Players in the Australia Life and Non-Life Insurance Industry Sector

- Insurance Australia Group Limited

- Suncorp Group

- AIA Group Limited

- Zurich

- Medibank Private Limited

- Genworth Mortgage Insurance Australia Limited

- ClearView Wealth Limited

- Cover-More Limited

- AMP Limited

- NIB Holdings Limited

List Not Exhaustive

Key Milestones in Australia Life and Non-Life Insurance Industry Industry

February 2023: Insurance Australia Group Limited (IAG) invested in Myriota, signifying a strategic move towards leveraging IoT for risk management and customer engagement. This investment demonstrates a proactive approach to technological innovation within the industry.

September 2022: The launch of io. Insure, the world's first online marketplace for SME M&A insurance, marks a significant development in the market. This highlights the growing role of technology and online platforms in streamlining insurance transactions and expanding access to specialized insurance products.

Strategic Outlook for Australia Life and Non-Life Insurance Industry Market

The future of the Australian life and non-life insurance market appears promising, driven by technological innovation, favorable economic conditions, and a supportive regulatory environment. The strategic focus on developing personalized products, expanding digital capabilities, and leveraging data analytics will be crucial for insurers to maintain a competitive edge. The continued adoption of Insurtech solutions and strategic partnerships will further contribute to the market's long-term growth potential.

Australia Life and Non-Life Insurance Industry Segmentation

-

1. Insurance Type

-

1.1. Life insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life Insurance

- 1.2.1. Fire

- 1.2.2. Motor

- 1.2.3. Marine

- 1.2.4. Health

- 1.2.5. Other Non-Life Insurance

-

1.1. Life insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Brokers

- 2.3. Banks

- 2.4. Other Distribution Channels

Australia Life and Non-Life Insurance Industry Segmentation By Geography

- 1. Australia

Australia Life and Non-Life Insurance Industry Regional Market Share

Geographic Coverage of Australia Life and Non-Life Insurance Industry

Australia Life and Non-Life Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Guaranteed Protection Drives The Market

- 3.3. Market Restrains

- 3.3.1. Guaranteed Protection Drives The Market

- 3.4. Market Trends

- 3.4.1. Motor Vehicle and Household Insurance has the Largest Shares

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Life and Non-Life Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Life insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life Insurance

- 5.1.2.1. Fire

- 5.1.2.2. Motor

- 5.1.2.3. Marine

- 5.1.2.4. Health

- 5.1.2.5. Other Non-Life Insurance

- 5.1.1. Life insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Brokers

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Insurance Australia Group Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Suncorp Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AIA Group Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zurich

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medibank Private Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Genworth Mortgage Insurance Australia Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ClearView Wealth Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cover-More Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AMP Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 NIB Holdings Limited**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Insurance Australia Group Limited

List of Figures

- Figure 1: Australia Life and Non-Life Insurance Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Life and Non-Life Insurance Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia Life and Non-Life Insurance Industry Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 2: Australia Life and Non-Life Insurance Industry Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 3: Australia Life and Non-Life Insurance Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Australia Life and Non-Life Insurance Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Australia Life and Non-Life Insurance Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Australia Life and Non-Life Insurance Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Australia Life and Non-Life Insurance Industry Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 8: Australia Life and Non-Life Insurance Industry Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 9: Australia Life and Non-Life Insurance Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Australia Life and Non-Life Insurance Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Australia Life and Non-Life Insurance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Australia Life and Non-Life Insurance Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Life and Non-Life Insurance Industry?

The projected CAGR is approximately 4.56%.

2. Which companies are prominent players in the Australia Life and Non-Life Insurance Industry?

Key companies in the market include Insurance Australia Group Limited, Suncorp Group, AIA Group Limited, Zurich, Medibank Private Limited, Genworth Mortgage Insurance Australia Limited, ClearView Wealth Limited, Cover-More Limited, AMP Limited, NIB Holdings Limited**List Not Exhaustive.

3. What are the main segments of the Australia Life and Non-Life Insurance Industry?

The market segments include Insurance Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 51.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Guaranteed Protection Drives The Market.

6. What are the notable trends driving market growth?

Motor Vehicle and Household Insurance has the Largest Shares.

7. Are there any restraints impacting market growth?

Guaranteed Protection Drives The Market.

8. Can you provide examples of recent developments in the market?

February 2023: Insurance Australia Group Limited (IAG), Australia's largest general insurer, invested in Myriota, a global pioneer in low-cost and low-power satellite connectivity for the Internet of Things (IoT). This aim was to explore how IoT devices can help insurance customers manage risk and safeguard their assets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Life and Non-Life Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Life and Non-Life Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Life and Non-Life Insurance Industry?

To stay informed about further developments, trends, and reports in the Australia Life and Non-Life Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence