Key Insights

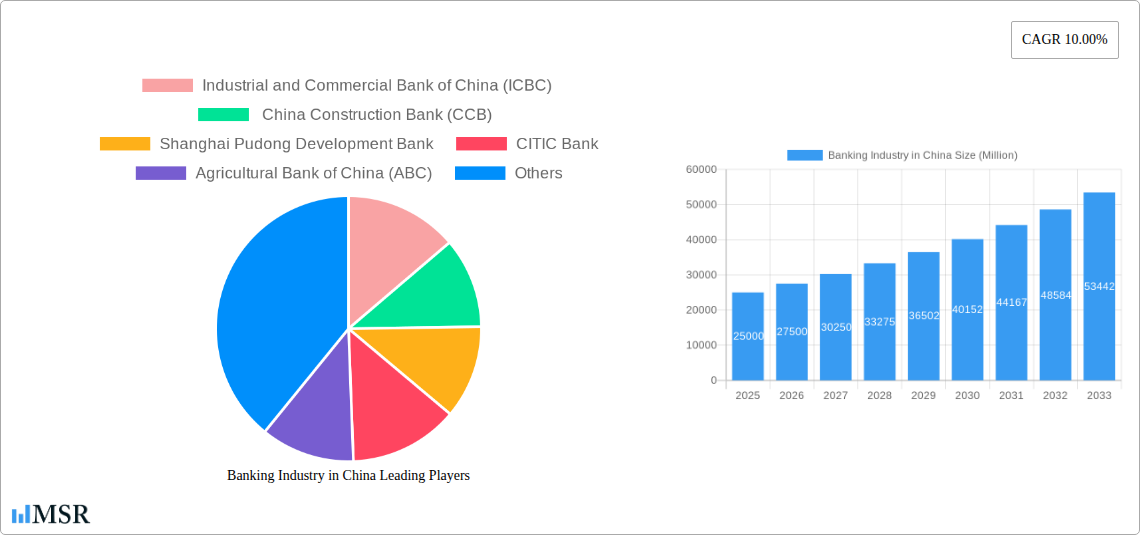

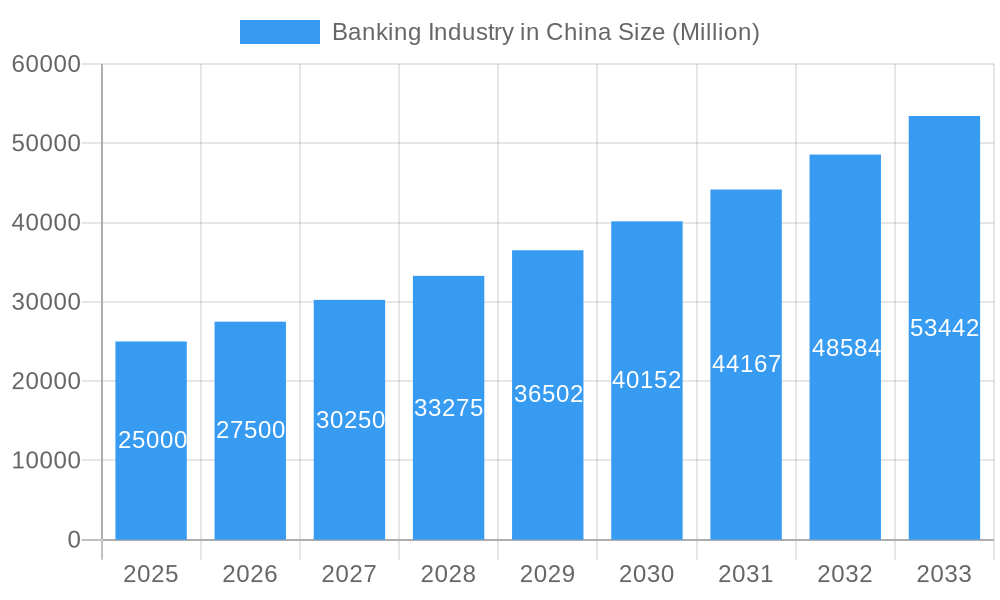

The Chinese banking industry, a cornerstone of the world's second-largest economy, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 10% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, China's burgeoning middle class and increasing financial inclusion are driving demand for diverse financial products, from transactional accounts and debit cards to credit cards and loans. Secondly, technological advancements, including fintech innovations and digital banking solutions, are transforming the industry landscape, enhancing efficiency and accessibility. This digitalization is particularly impactful in reaching underserved rural populations and promoting financial literacy. Thirdly, government initiatives aimed at supporting economic growth and infrastructure development are indirectly boosting the banking sector through increased lending and investment opportunities. However, challenges remain. Stringent regulatory oversight and potential economic fluctuations pose risks to sustained growth. Competition amongst major players, including Industrial and Commercial Bank of China (ICBC), China Construction Bank (CCB), and others, is fierce, necessitating strategic innovation and differentiation.

Banking Industry in China Market Size (In Billion)

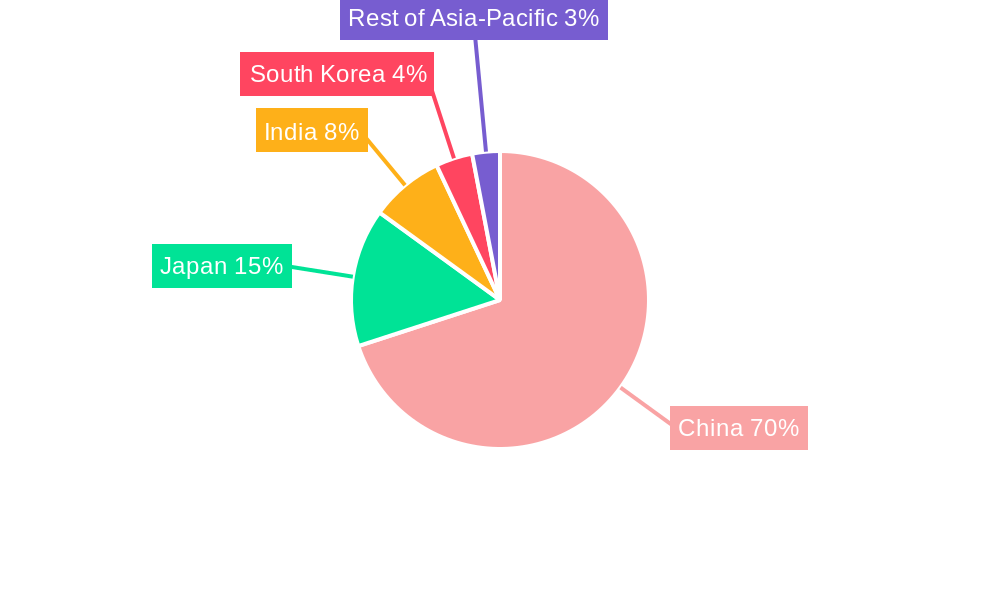

The segmentation of the market reveals further insights. The transactional accounts and loans segments are significant drivers of revenue, reflecting the high demand for everyday banking services and business financing. The rapid adoption of digital channels, including mobile banking and online platforms, is reshaping the distribution landscape, with direct sales and potentially distributor networks playing a crucial role. The industry's geographic spread showcases significant concentration in the Asia-Pacific region, with China, Japan, India, and South Korea as key markets. Looking forward, the Chinese banking sector's continued growth trajectory hinges on successfully navigating regulatory changes, technological disruptions, and managing risks effectively while capitalizing on the immense opportunities presented by a rapidly evolving economic and digital environment. The focus will increasingly be on personalized financial services, enhanced risk management, and the development of sustainable and inclusive banking practices.

Banking Industry in China Company Market Share

Banking Industry in China: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Chinese banking industry, encompassing market dynamics, key players, emerging trends, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry stakeholders, investors, and strategic decision-makers. The report leverages extensive data analysis to provide actionable insights and forecasts, utilizing millions as the unit for all financial figures.

Banking Industry in China Market Concentration & Dynamics

The Chinese banking sector is dominated by a few large state-owned banks, exhibiting high market concentration. Industrial and Commercial Bank of China (ICBC), China Construction Bank (CCB), and Agricultural Bank of China (ABC) collectively hold a significant market share, exceeding xx Million in 2024. This concentration stems from historical government policies and deep-rooted relationships with state-owned enterprises.

- Market Share (2024): ICBC (xx%), CCB (xx%), ABC (xx%), BOC (xx%), others (xx%).

- Innovation Ecosystem: While innovation is growing, it's largely driven by the larger banks, with fintech startups facing hurdles in accessing capital and regulatory approvals.

- Regulatory Framework: The China Banking and Insurance Regulatory Commission (CBIRC) plays a significant role in shaping the industry landscape through its stringent regulations and licensing requirements.

- Substitute Products: The rise of fintech and mobile payment platforms like Alipay and WeChat Pay presents a growing challenge to traditional banking services, particularly in the transactional accounts segment.

- End-User Trends: Increasing digital adoption among consumers fuels demand for mobile banking, online lending, and digital financial management tools.

- M&A Activities: The number of M&A deals in the banking sector has seen a decline in recent years, reaching xx Million in 2024, largely driven by regulatory scrutiny and economic slowdown.

Banking Industry in China Industry Insights & Trends

The Chinese banking industry experienced substantial growth in the historical period (2019-2024), with a market size exceeding xx Million in 2024. This growth was fueled by robust economic expansion, increasing financial inclusion, and government initiatives promoting financial development. However, the pace of growth is expected to moderate in the forecast period (2025-2033), with a projected CAGR of xx%. Technological disruptions, particularly the rise of fintech and Big Data analytics, are reshaping the competitive landscape. Evolving consumer behaviors, marked by a preference for digital banking and personalized financial services, are driving banks to invest heavily in digital transformation. The regulatory environment, while supportive of financial stability, also poses challenges to rapid expansion and innovation.

Key Markets & Segments Leading Banking Industry in China

The Chinese banking market is geographically diverse, with significant variations in penetration and growth across different regions. While specific regional dominance data is unavailable, we can analyze key segments.

By Product:

- Loans: The loan segment remains the largest contributor to banking revenues, fueled by strong demand from businesses and consumers. Growth is driven by infrastructure projects, economic development, and expanding credit availability for SMEs.

- Transactional Accounts: Digitalization is driving a shift towards mobile and online banking, fueling a rapid increase in transactional account numbers.

- Savings Accounts: This segment shows relatively steady growth, driven by a large population with growing savings habits.

By Industry: The Services sector is the most significant banking client, followed by the Hardware and Software sectors.

By Channel:

- Direct Sales: Direct sales through physical branches remain dominant in many regions, especially for higher-value products.

- Distributor: While digital channels are rapidly expanding, distributors, such as financial advisors and agents, still play a significant role in marketing and distribution.

Banking Industry in China Product Developments

The Chinese banking sector is witnessing rapid innovation in product development, driven by technological advancements and competition from fintech players. New products include AI-powered risk assessment tools, personalized financial management apps, and blockchain-based payment solutions. These innovations enhance customer experience, improve operational efficiency, and create new revenue streams. The ability to leverage Big Data and AI for customer segmentation and targeted offerings is proving to be a significant competitive advantage.

Challenges in the Banking Industry in China Market

The Chinese banking industry faces several challenges, including stringent regulatory oversight, increasing non-performing loans (NPLs) reaching xx Million in 2024, and intense competition from fintech companies. Regulatory hurdles create delays in product launches and expansion. The rising prevalence of fraudulent activities poses a significant threat to customer trust and financial security. Supply chain disruptions, though impacting the broader economy, also indirectly affect the banking sector.

Forces Driving Banking Industry in China Growth

Key growth drivers include China's continued economic expansion, rising disposable incomes, increasing financial inclusion efforts, government initiatives promoting digital finance, and technological advancements such as AI and Big Data analytics. The government's Belt and Road Initiative is also generating significant opportunities for Chinese banks involved in international trade financing.

Long-Term Growth Catalysts in Banking Industry in China

Long-term growth will be driven by continuous innovation in digital banking, strategic partnerships with fintech firms, and expansion into new market segments, particularly in underserved rural areas. The strategic focus on enhancing customer experience through AI-powered personalization and frictionless digital channels will be crucial for sustained growth.

Emerging Opportunities in Banking Industry in China

Emerging opportunities include leveraging AI for risk management and fraud detection, expanding into green finance, developing innovative financial products for the growing middle class, and capitalizing on the burgeoning wealth management market. The increasing demand for cross-border financial services also offers lucrative opportunities for Chinese banks.

Leading Players in the Banking Industry in China Sector

- Industrial and Commercial Bank of China (ICBC)

- China Construction Bank (CCB)

- Shanghai Pudong Development Bank

- CITIC Bank

- Agricultural Bank of China (ABC)

- China Everbright Bank

- Bank of China (BOC)

- Ping An Bank

- Bank of Communications

- China Merchants Bank

Key Milestones in Banking Industry in China Industry

- 2020: Launch of several digital banking platforms by major banks.

- 2021: Increased regulatory scrutiny on fintech companies.

- 2022: Significant rise in digital payments adoption.

- 2023: Implementation of new data privacy regulations.

- 2024: Focus on green finance initiatives.

Strategic Outlook for Banking Industry in China Market

The future of the Chinese banking industry hinges on its ability to embrace digital transformation, adapt to evolving consumer preferences, and navigate the complex regulatory environment. Banks that can effectively leverage technology, build robust risk management frameworks, and foster strategic partnerships with fintech companies are poised for sustained growth in the coming decade. The market presents significant opportunities for both established players and innovative startups, though regulatory considerations remain a critical factor for all.

Banking Industry in China Segmentation

-

1. Product

- 1.1. Transactional Accounts

- 1.2. Savings Accounts

- 1.3. Debit Cards

- 1.4. Credit Cards

- 1.5. Loans

- 1.6. Other Products

-

2. Industry

- 2.1. Hardware

- 2.2. Software

- 2.3. Services

-

3. Channel

- 3.1. Direct Sales

- 3.2. Distributor

Banking Industry in China Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Banking Industry in China Regional Market Share

Geographic Coverage of Banking Industry in China

Banking Industry in China REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Guaranteed Protection Drives The Market

- 3.3. Market Restrains

- 3.3.1. Long and Costly Legal Procedures

- 3.4. Market Trends

- 3.4.1. Technology and Digitalization Trends are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Banking Industry in China Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Transactional Accounts

- 5.1.2. Savings Accounts

- 5.1.3. Debit Cards

- 5.1.4. Credit Cards

- 5.1.5. Loans

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Hardware

- 5.2.2. Software

- 5.2.3. Services

- 5.3. Market Analysis, Insights and Forecast - by Channel

- 5.3.1. Direct Sales

- 5.3.2. Distributor

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Banking Industry in China Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Transactional Accounts

- 6.1.2. Savings Accounts

- 6.1.3. Debit Cards

- 6.1.4. Credit Cards

- 6.1.5. Loans

- 6.1.6. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Industry

- 6.2.1. Hardware

- 6.2.2. Software

- 6.2.3. Services

- 6.3. Market Analysis, Insights and Forecast - by Channel

- 6.3.1. Direct Sales

- 6.3.2. Distributor

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Banking Industry in China Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Transactional Accounts

- 7.1.2. Savings Accounts

- 7.1.3. Debit Cards

- 7.1.4. Credit Cards

- 7.1.5. Loans

- 7.1.6. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Industry

- 7.2.1. Hardware

- 7.2.2. Software

- 7.2.3. Services

- 7.3. Market Analysis, Insights and Forecast - by Channel

- 7.3.1. Direct Sales

- 7.3.2. Distributor

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Banking Industry in China Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Transactional Accounts

- 8.1.2. Savings Accounts

- 8.1.3. Debit Cards

- 8.1.4. Credit Cards

- 8.1.5. Loans

- 8.1.6. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Industry

- 8.2.1. Hardware

- 8.2.2. Software

- 8.2.3. Services

- 8.3. Market Analysis, Insights and Forecast - by Channel

- 8.3.1. Direct Sales

- 8.3.2. Distributor

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Banking Industry in China Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Transactional Accounts

- 9.1.2. Savings Accounts

- 9.1.3. Debit Cards

- 9.1.4. Credit Cards

- 9.1.5. Loans

- 9.1.6. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Industry

- 9.2.1. Hardware

- 9.2.2. Software

- 9.2.3. Services

- 9.3. Market Analysis, Insights and Forecast - by Channel

- 9.3.1. Direct Sales

- 9.3.2. Distributor

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Banking Industry in China Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Transactional Accounts

- 10.1.2. Savings Accounts

- 10.1.3. Debit Cards

- 10.1.4. Credit Cards

- 10.1.5. Loans

- 10.1.6. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Industry

- 10.2.1. Hardware

- 10.2.2. Software

- 10.2.3. Services

- 10.3. Market Analysis, Insights and Forecast - by Channel

- 10.3.1. Direct Sales

- 10.3.2. Distributor

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Industrial and Commercial Bank of China (ICBC)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 China Construction Bank (CCB)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shanghai Pudong Development Bank

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CITIC Bank

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Agricultural Bank of China (ABC)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 China Everbright Bank

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bank of China (BOC)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ping An Bank

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bank of Communications

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 China Merchants Bank

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Industrial and Commercial Bank of China (ICBC)

List of Figures

- Figure 1: Global Banking Industry in China Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Banking Industry in China Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Banking Industry in China Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Banking Industry in China Revenue (Million), by Industry 2025 & 2033

- Figure 5: North America Banking Industry in China Revenue Share (%), by Industry 2025 & 2033

- Figure 6: North America Banking Industry in China Revenue (Million), by Channel 2025 & 2033

- Figure 7: North America Banking Industry in China Revenue Share (%), by Channel 2025 & 2033

- Figure 8: North America Banking Industry in China Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Banking Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Banking Industry in China Revenue (Million), by Product 2025 & 2033

- Figure 11: South America Banking Industry in China Revenue Share (%), by Product 2025 & 2033

- Figure 12: South America Banking Industry in China Revenue (Million), by Industry 2025 & 2033

- Figure 13: South America Banking Industry in China Revenue Share (%), by Industry 2025 & 2033

- Figure 14: South America Banking Industry in China Revenue (Million), by Channel 2025 & 2033

- Figure 15: South America Banking Industry in China Revenue Share (%), by Channel 2025 & 2033

- Figure 16: South America Banking Industry in China Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Banking Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Banking Industry in China Revenue (Million), by Product 2025 & 2033

- Figure 19: Europe Banking Industry in China Revenue Share (%), by Product 2025 & 2033

- Figure 20: Europe Banking Industry in China Revenue (Million), by Industry 2025 & 2033

- Figure 21: Europe Banking Industry in China Revenue Share (%), by Industry 2025 & 2033

- Figure 22: Europe Banking Industry in China Revenue (Million), by Channel 2025 & 2033

- Figure 23: Europe Banking Industry in China Revenue Share (%), by Channel 2025 & 2033

- Figure 24: Europe Banking Industry in China Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Banking Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Banking Industry in China Revenue (Million), by Product 2025 & 2033

- Figure 27: Middle East & Africa Banking Industry in China Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East & Africa Banking Industry in China Revenue (Million), by Industry 2025 & 2033

- Figure 29: Middle East & Africa Banking Industry in China Revenue Share (%), by Industry 2025 & 2033

- Figure 30: Middle East & Africa Banking Industry in China Revenue (Million), by Channel 2025 & 2033

- Figure 31: Middle East & Africa Banking Industry in China Revenue Share (%), by Channel 2025 & 2033

- Figure 32: Middle East & Africa Banking Industry in China Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Banking Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Banking Industry in China Revenue (Million), by Product 2025 & 2033

- Figure 35: Asia Pacific Banking Industry in China Revenue Share (%), by Product 2025 & 2033

- Figure 36: Asia Pacific Banking Industry in China Revenue (Million), by Industry 2025 & 2033

- Figure 37: Asia Pacific Banking Industry in China Revenue Share (%), by Industry 2025 & 2033

- Figure 38: Asia Pacific Banking Industry in China Revenue (Million), by Channel 2025 & 2033

- Figure 39: Asia Pacific Banking Industry in China Revenue Share (%), by Channel 2025 & 2033

- Figure 40: Asia Pacific Banking Industry in China Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Banking Industry in China Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Banking Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Banking Industry in China Revenue Million Forecast, by Industry 2020 & 2033

- Table 3: Global Banking Industry in China Revenue Million Forecast, by Channel 2020 & 2033

- Table 4: Global Banking Industry in China Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Banking Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 6: Global Banking Industry in China Revenue Million Forecast, by Industry 2020 & 2033

- Table 7: Global Banking Industry in China Revenue Million Forecast, by Channel 2020 & 2033

- Table 8: Global Banking Industry in China Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Banking Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 13: Global Banking Industry in China Revenue Million Forecast, by Industry 2020 & 2033

- Table 14: Global Banking Industry in China Revenue Million Forecast, by Channel 2020 & 2033

- Table 15: Global Banking Industry in China Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Banking Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 20: Global Banking Industry in China Revenue Million Forecast, by Industry 2020 & 2033

- Table 21: Global Banking Industry in China Revenue Million Forecast, by Channel 2020 & 2033

- Table 22: Global Banking Industry in China Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Banking Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 33: Global Banking Industry in China Revenue Million Forecast, by Industry 2020 & 2033

- Table 34: Global Banking Industry in China Revenue Million Forecast, by Channel 2020 & 2033

- Table 35: Global Banking Industry in China Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Banking Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 43: Global Banking Industry in China Revenue Million Forecast, by Industry 2020 & 2033

- Table 44: Global Banking Industry in China Revenue Million Forecast, by Channel 2020 & 2033

- Table 45: Global Banking Industry in China Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Banking Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Banking Industry in China?

The projected CAGR is approximately 10.00%.

2. Which companies are prominent players in the Banking Industry in China?

Key companies in the market include Industrial and Commercial Bank of China (ICBC) , China Construction Bank (CCB) , Shanghai Pudong Development Bank , CITIC Bank, Agricultural Bank of China (ABC) , China Everbright Bank , Bank of China (BOC) , Ping An Bank , Bank of Communications , China Merchants Bank .

3. What are the main segments of the Banking Industry in China?

The market segments include Product, Industry, Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Guaranteed Protection Drives The Market.

6. What are the notable trends driving market growth?

Technology and Digitalization Trends are Driving the Market.

7. Are there any restraints impacting market growth?

Long and Costly Legal Procedures.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Banking Industry in China," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Banking Industry in China report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Banking Industry in China?

To stay informed about further developments, trends, and reports in the Banking Industry in China, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence