Key Insights

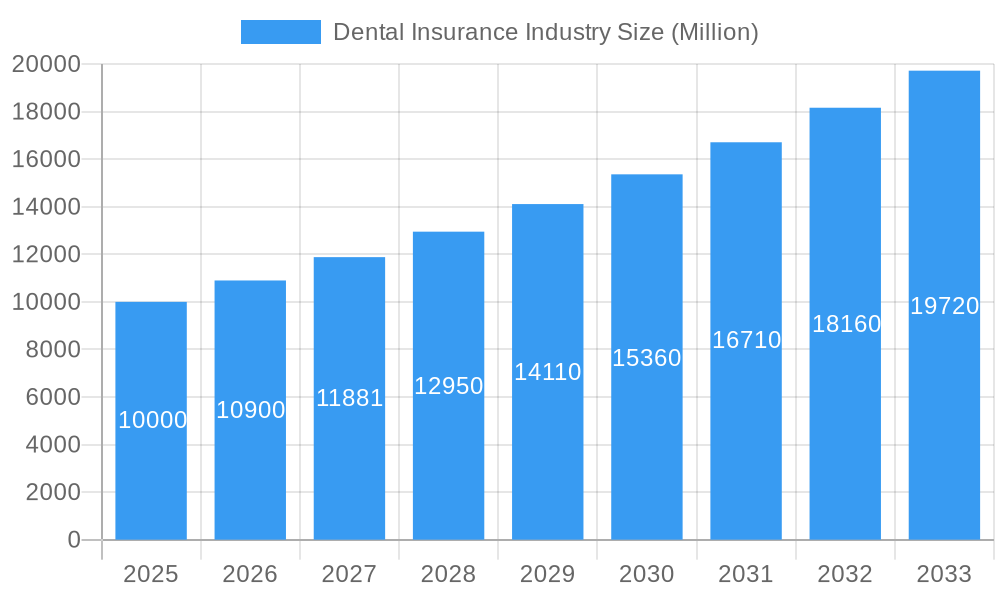

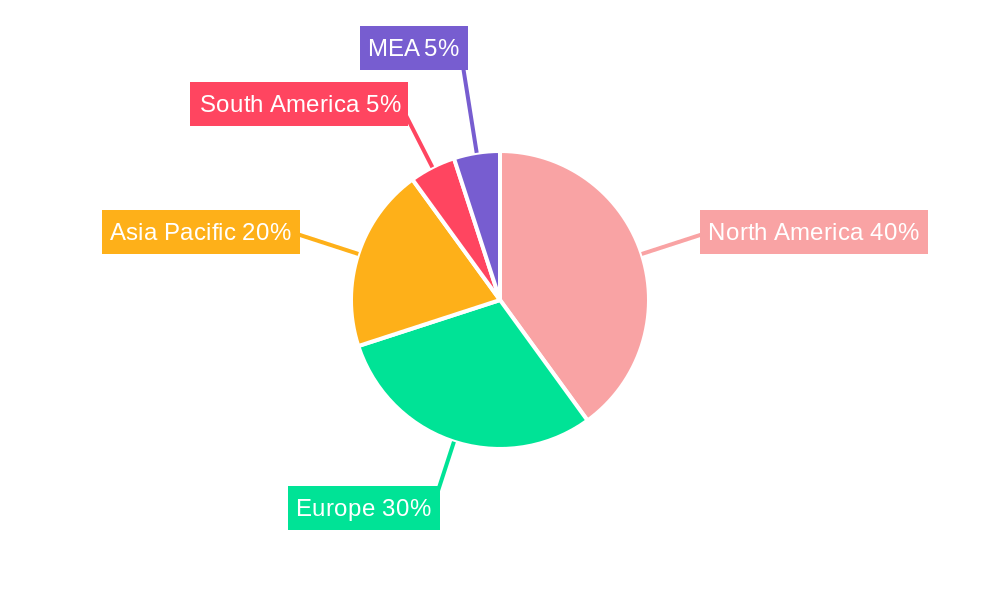

The global dental insurance market is poised for significant expansion, projected to reach $117.7 billion by 2033. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 5.2% from 2025 to 2033. Key drivers include heightened oral health awareness, the rising incidence of dental conditions, and expanding coverage from both public and private healthcare providers. An aging global population further fuels demand for comprehensive dental care and associated insurance solutions. Innovations in dental procedures and increased affordability of services also contribute to market momentum. Diverse plan structures, such as DHMOs, PPOs, and Indemnity plans, cater to varied consumer requirements, stimulating market development. Geographically, North America and Europe currently dominate market share due to robust healthcare infrastructure and high insurance penetration. However, emerging economies in Asia-Pacific and other regions present substantial growth opportunities. Intense competition among key players including United Concordia, Aetna, Delta Dental, and MetLife, alongside specialized providers, fosters innovation and competitive pricing strategies.

Dental Insurance Industry Market Size (In Billion)

Despite a positive trajectory, the market confronts hurdles such as high premiums and out-of-pocket expenses, potentially limiting access for lower-income demographics. Evolving regulatory landscapes and disparate reimbursement policies across regions can also influence market dynamics. Nevertheless, the long-term outlook remains optimistic, driven by increasing demand for preventive dental care and the introduction of novel insurance products. Future market performance will be shaped by evolving healthcare policies, advancements in dental technology, and enhanced consumer affordability. Strategic expansion into emerging markets, alongside key partnerships and product diversification, will be critical for sustained success in this dynamic sector.

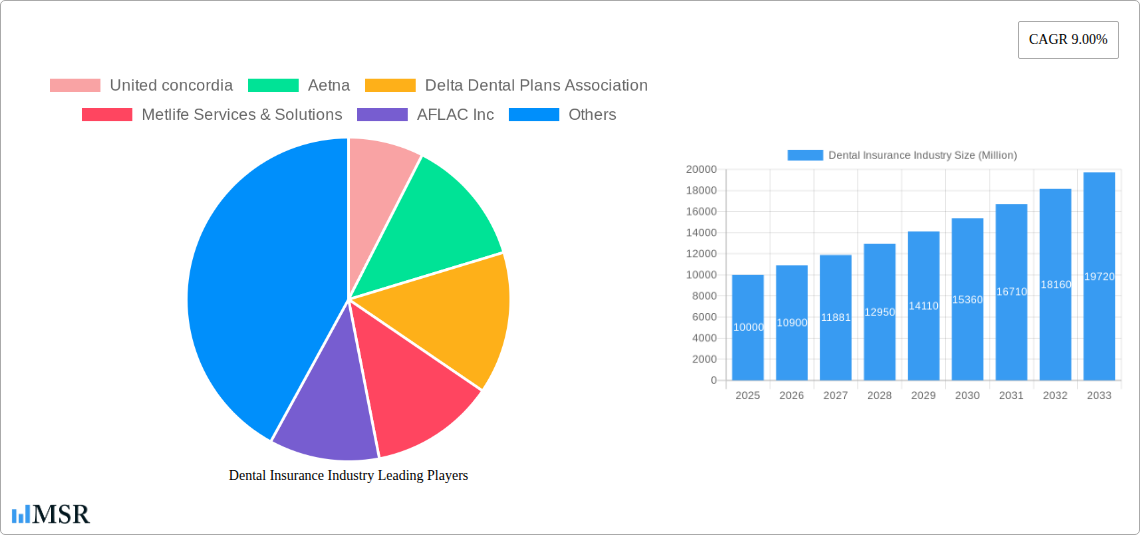

Dental Insurance Industry Company Market Share

Dental Insurance Industry Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the global dental insurance industry, offering crucial insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report analyzes market dynamics, key segments, leading players, and future growth prospects. The report projects a xx Million market size by 2033, with a CAGR of xx% during the forecast period (2025-2033). This analysis includes detailed segmentation by demographics (senior citizens, adults, minors), coverage type (DHMO, DPPO, DIP, DEPO, DPS), procedure (preventive, major, basic), and end-user (individuals, corporates). Leading companies such as Aetna, Delta Dental Plans Association, Metlife, and more are profiled, providing a competitive landscape overview.

Dental Insurance Industry Market Concentration & Dynamics

The dental insurance market exhibits a moderately concentrated structure, with a few major players holding significant market share. While precise market share figures for each company vary and are constantly shifting due to M&A activity and competitive pressures, companies like Aetna, Delta Dental Plans Association, and Metlife consistently rank among the top players globally. The industry’s innovation ecosystem is characterized by the development of digital platforms for claims processing, telehealth integration for dental consultations, and the introduction of new dental benefit plans catering to specific demographic needs.

Regulatory frameworks vary significantly across different geographies, influencing pricing, coverage, and the overall operational landscape for insurers. Substitute products, such as standalone dental procedures paid out-of-pocket, exist but remain a smaller segment compared to the market dominance of insurance coverage. End-user trends are showing increasing demand for comprehensive dental coverage, particularly amongst senior citizens. M&A activity remains significant, with xx major deals recorded during the historical period (2019-2024). These deals were largely driven by a desire to expand market reach, diversify product portfolios, and enhance technological capabilities.

- Market Concentration: Moderately Concentrated

- M&A Deal Count (2019-2024): xx

- Key Players: Aetna, Delta Dental Plans Association, Metlife Services & Solutions, AFLAC Inc, Allianz SE, United HealthCare Services Inc, AXA, HDFC Ergo Health Insurance Ltd, Cigna, Ameritas Life Insurance Corp, United Concordia

Dental Insurance Industry Insights & Trends

The global dental insurance market is experiencing robust growth driven by several factors. Rising awareness of oral health, coupled with an aging global population increasing the demand for dental care, are major contributors. Technological advancements, like telehealth dentistry and AI-powered diagnostic tools, are streamlining processes and improving efficiency. Evolving consumer behaviors reflect a preference for comprehensive plans offering broader coverage and greater flexibility in choosing dentists. The increasing prevalence of chronic diseases linked to poor oral hygiene further fuels demand. Government initiatives promoting oral health and affordable dental care are creating additional opportunities. Market growth is further influenced by the rise in dental tourism and the increasing adoption of dental insurance by corporates as part of their employee benefits packages. The market size was valued at approximately xx Million in 2024, and is projected to reach xx Million by 2033.

Key Markets & Segments Leading Dental Insurance Industry

The North American market holds a dominant position in the dental insurance industry. Within this region, the United States displays significant market strength due to its large population and well-established private insurance sector. However, growth opportunities are evident across other regions, particularly in developing economies experiencing rising disposable incomes and a growing awareness of oral health.

Key Market Drivers:

- Economic Growth: Rising disposable incomes lead to increased spending on healthcare, including dental insurance.

- Aging Population: Senior citizens represent a significant segment with high demand for dental care.

- Technological Advancements: Telehealth and AI enhance access and efficiency.

- Government Initiatives: Public health campaigns and subsidies increase affordability and accessibility.

Dominant Segments:

- By Demographics: Adults form the largest segment, followed by senior citizens. Demand from minors is also substantial, driven by parental concerns and preventative care.

- By Coverage: Dental Preferred Provider Organizations (DPPOs) and Dental Health Maintenance Organizations (DHMOs) hold significant market share, reflecting the preferences for cost-effectiveness and network access.

- By Procedure: Preventive care dominates, driven by increased awareness of oral hygiene and the cost-effectiveness of preventative treatments.

- By End-users: Corporates are a significant customer base, providing dental insurance as an employee benefit.

Dental Insurance Industry Product Developments

Recent innovations in the dental insurance sector include the development of AI-powered diagnostic tools to improve the accuracy of dental assessments, the introduction of teledentistry platforms for remote consultations and monitoring, and personalized dental insurance plans tailored to specific age groups and health needs. These developments enhance efficiency and improve access to quality dental care, enhancing the competitive edge of insurers.

Challenges in the Dental Insurance Industry Market

The dental insurance market faces several challenges including stringent regulatory requirements that vary across different regions, impacting operational costs and coverage options. The industry also faces pressure from rising healthcare costs, leading to increased premiums and potentially impacting affordability for consumers. Competition from other insurance providers and alternative dental care models is also a considerable factor. Finally, the need to invest in advanced technologies and data analytics to remain competitive adds further pressure to the industry. These factors collectively contribute to xx% reduction in profitability for some insurance providers.

Forces Driving Dental Insurance Industry Growth

Technological advancements such as AI-driven diagnostics and teledentistry are revolutionizing access to dental care and driving down costs. Economic growth, particularly in emerging markets, increases disposable income and demand for healthcare services, including dental insurance. Government initiatives like subsidies and public health campaigns promote preventative oral care, contributing to industry growth. For example, the increase in Medicare Advantage plans by Aetna added 1 Million beneficiaries to the system.

Long-Term Growth Catalysts in the Dental Insurance Industry

Long-term growth will be fueled by strategic partnerships between insurance companies and dental providers, resulting in improved coordination of care and reduced costs. Further innovation in dental technology, such as 3D printing for prosthetics, will drive efficiency and create new revenue streams. Expansion into underserved markets and the development of personalized dental insurance plans will open new avenues for growth.

Emerging Opportunities in Dental Insurance Industry

The increasing adoption of telehealth for dental consultations presents significant growth opportunities. Personalized plans, specifically tailored to individual needs and risk profiles, are also creating demand. Expansion into emerging markets with growing middle classes and limited access to dental care presents untapped potential. Finally, incorporating wearable technology for oral health monitoring will improve preventative care and create opportunities for data-driven insurance models.

Leading Players in the Dental Insurance Industry Sector

- United Concordia

- Aetna

- Delta Dental Plans Association

- Metlife Services & Solutions

- AFLAC Inc

- Allianz SE

- United HealthCare Services Inc

- AXA

- HDFC Ergo Health Insurance Ltd

- Cigna

- Ameritas Life Insurance Corp

Key Milestones in Dental Insurance Industry

- June 2022: Bajaj Allianz and Allianz Partners launch Global Health Care, offering international health coverage with sum insured ranging from USD 100,000 to USD 1,000,000.

- January 2022: Aetna expands its Medicare Advantage Prescription Drug (MAPD) plans to 1,875 counties, providing access to 53.2 Million Medicare beneficiaries, a net increase of 1 Million beneficiaries.

Strategic Outlook for Dental Insurance Industry Market

The dental insurance market holds significant future potential, driven by technological advancements, demographic shifts, and increasing awareness of oral health. Strategic partnerships and expansion into new markets will be key growth accelerators. The focus on preventative care, personalized plans, and digital platforms will shape the future of this dynamic industry, fostering ongoing growth and innovation.

Dental Insurance Industry Segmentation

-

1. Coverage

- 1.1. Dental health maintenance organizations (DHMO)

- 1.2. Dental preferred provider organizations (DPPO)

- 1.3. Dental Indemnity plans (DIP)

- 1.4. Dental exclusive provider organizations (DEPO)

- 1.5. Dental point of service (DPS)

-

2. Procedure

- 2.1. Preventive

- 2.2. Major

- 2.3. Basic

-

3. End-users

- 3.1. Individuals

- 3.2. Corporates

-

4. Demographics

- 4.1. Senior citizens

- 4.2. Adults

- 4.3. Minors

Dental Insurance Industry Segmentation By Geography

- 1. North America

- 2. South America

- 3. Asia Pacific

- 4. Europe

- 5. Middle East and Africa

Dental Insurance Industry Regional Market Share

Geographic Coverage of Dental Insurance Industry

Dental Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Efficient and Cost-Effective Healthcare Services

- 3.3. Market Restrains

- 3.3.1. Increasing Regulatory Scrutiny and Compliance Requirements

- 3.4. Market Trends

- 3.4.1. Rising Awareness about Oral Health is Expected to boost growth of Dental Insurance Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dental Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 5.1.1. Dental health maintenance organizations (DHMO)

- 5.1.2. Dental preferred provider organizations (DPPO)

- 5.1.3. Dental Indemnity plans (DIP)

- 5.1.4. Dental exclusive provider organizations (DEPO)

- 5.1.5. Dental point of service (DPS)

- 5.2. Market Analysis, Insights and Forecast - by Procedure

- 5.2.1. Preventive

- 5.2.2. Major

- 5.2.3. Basic

- 5.3. Market Analysis, Insights and Forecast - by End-users

- 5.3.1. Individuals

- 5.3.2. Corporates

- 5.4. Market Analysis, Insights and Forecast - by Demographics

- 5.4.1. Senior citizens

- 5.4.2. Adults

- 5.4.3. Minors

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Asia Pacific

- 5.5.4. Europe

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 6. North America Dental Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Coverage

- 6.1.1. Dental health maintenance organizations (DHMO)

- 6.1.2. Dental preferred provider organizations (DPPO)

- 6.1.3. Dental Indemnity plans (DIP)

- 6.1.4. Dental exclusive provider organizations (DEPO)

- 6.1.5. Dental point of service (DPS)

- 6.2. Market Analysis, Insights and Forecast - by Procedure

- 6.2.1. Preventive

- 6.2.2. Major

- 6.2.3. Basic

- 6.3. Market Analysis, Insights and Forecast - by End-users

- 6.3.1. Individuals

- 6.3.2. Corporates

- 6.4. Market Analysis, Insights and Forecast - by Demographics

- 6.4.1. Senior citizens

- 6.4.2. Adults

- 6.4.3. Minors

- 6.1. Market Analysis, Insights and Forecast - by Coverage

- 7. South America Dental Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Coverage

- 7.1.1. Dental health maintenance organizations (DHMO)

- 7.1.2. Dental preferred provider organizations (DPPO)

- 7.1.3. Dental Indemnity plans (DIP)

- 7.1.4. Dental exclusive provider organizations (DEPO)

- 7.1.5. Dental point of service (DPS)

- 7.2. Market Analysis, Insights and Forecast - by Procedure

- 7.2.1. Preventive

- 7.2.2. Major

- 7.2.3. Basic

- 7.3. Market Analysis, Insights and Forecast - by End-users

- 7.3.1. Individuals

- 7.3.2. Corporates

- 7.4. Market Analysis, Insights and Forecast - by Demographics

- 7.4.1. Senior citizens

- 7.4.2. Adults

- 7.4.3. Minors

- 7.1. Market Analysis, Insights and Forecast - by Coverage

- 8. Asia Pacific Dental Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Coverage

- 8.1.1. Dental health maintenance organizations (DHMO)

- 8.1.2. Dental preferred provider organizations (DPPO)

- 8.1.3. Dental Indemnity plans (DIP)

- 8.1.4. Dental exclusive provider organizations (DEPO)

- 8.1.5. Dental point of service (DPS)

- 8.2. Market Analysis, Insights and Forecast - by Procedure

- 8.2.1. Preventive

- 8.2.2. Major

- 8.2.3. Basic

- 8.3. Market Analysis, Insights and Forecast - by End-users

- 8.3.1. Individuals

- 8.3.2. Corporates

- 8.4. Market Analysis, Insights and Forecast - by Demographics

- 8.4.1. Senior citizens

- 8.4.2. Adults

- 8.4.3. Minors

- 8.1. Market Analysis, Insights and Forecast - by Coverage

- 9. Europe Dental Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Coverage

- 9.1.1. Dental health maintenance organizations (DHMO)

- 9.1.2. Dental preferred provider organizations (DPPO)

- 9.1.3. Dental Indemnity plans (DIP)

- 9.1.4. Dental exclusive provider organizations (DEPO)

- 9.1.5. Dental point of service (DPS)

- 9.2. Market Analysis, Insights and Forecast - by Procedure

- 9.2.1. Preventive

- 9.2.2. Major

- 9.2.3. Basic

- 9.3. Market Analysis, Insights and Forecast - by End-users

- 9.3.1. Individuals

- 9.3.2. Corporates

- 9.4. Market Analysis, Insights and Forecast - by Demographics

- 9.4.1. Senior citizens

- 9.4.2. Adults

- 9.4.3. Minors

- 9.1. Market Analysis, Insights and Forecast - by Coverage

- 10. Middle East and Africa Dental Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Coverage

- 10.1.1. Dental health maintenance organizations (DHMO)

- 10.1.2. Dental preferred provider organizations (DPPO)

- 10.1.3. Dental Indemnity plans (DIP)

- 10.1.4. Dental exclusive provider organizations (DEPO)

- 10.1.5. Dental point of service (DPS)

- 10.2. Market Analysis, Insights and Forecast - by Procedure

- 10.2.1. Preventive

- 10.2.2. Major

- 10.2.3. Basic

- 10.3. Market Analysis, Insights and Forecast - by End-users

- 10.3.1. Individuals

- 10.3.2. Corporates

- 10.4. Market Analysis, Insights and Forecast - by Demographics

- 10.4.1. Senior citizens

- 10.4.2. Adults

- 10.4.3. Minors

- 10.1. Market Analysis, Insights and Forecast - by Coverage

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 United concordia

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aetna

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Delta Dental Plans Association

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Metlife Services & Solutions

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AFLAC Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Allianz SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 United HealthCare Services Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AXA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 HDFC Ergo Health Insurance Ltd**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cigna

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ameritas Life Insurance Corp

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 United concordia

List of Figures

- Figure 1: Global Dental Insurance Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Dental Insurance Industry Revenue (billion), by Coverage 2025 & 2033

- Figure 3: North America Dental Insurance Industry Revenue Share (%), by Coverage 2025 & 2033

- Figure 4: North America Dental Insurance Industry Revenue (billion), by Procedure 2025 & 2033

- Figure 5: North America Dental Insurance Industry Revenue Share (%), by Procedure 2025 & 2033

- Figure 6: North America Dental Insurance Industry Revenue (billion), by End-users 2025 & 2033

- Figure 7: North America Dental Insurance Industry Revenue Share (%), by End-users 2025 & 2033

- Figure 8: North America Dental Insurance Industry Revenue (billion), by Demographics 2025 & 2033

- Figure 9: North America Dental Insurance Industry Revenue Share (%), by Demographics 2025 & 2033

- Figure 10: North America Dental Insurance Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Dental Insurance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Dental Insurance Industry Revenue (billion), by Coverage 2025 & 2033

- Figure 13: South America Dental Insurance Industry Revenue Share (%), by Coverage 2025 & 2033

- Figure 14: South America Dental Insurance Industry Revenue (billion), by Procedure 2025 & 2033

- Figure 15: South America Dental Insurance Industry Revenue Share (%), by Procedure 2025 & 2033

- Figure 16: South America Dental Insurance Industry Revenue (billion), by End-users 2025 & 2033

- Figure 17: South America Dental Insurance Industry Revenue Share (%), by End-users 2025 & 2033

- Figure 18: South America Dental Insurance Industry Revenue (billion), by Demographics 2025 & 2033

- Figure 19: South America Dental Insurance Industry Revenue Share (%), by Demographics 2025 & 2033

- Figure 20: South America Dental Insurance Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: South America Dental Insurance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Dental Insurance Industry Revenue (billion), by Coverage 2025 & 2033

- Figure 23: Asia Pacific Dental Insurance Industry Revenue Share (%), by Coverage 2025 & 2033

- Figure 24: Asia Pacific Dental Insurance Industry Revenue (billion), by Procedure 2025 & 2033

- Figure 25: Asia Pacific Dental Insurance Industry Revenue Share (%), by Procedure 2025 & 2033

- Figure 26: Asia Pacific Dental Insurance Industry Revenue (billion), by End-users 2025 & 2033

- Figure 27: Asia Pacific Dental Insurance Industry Revenue Share (%), by End-users 2025 & 2033

- Figure 28: Asia Pacific Dental Insurance Industry Revenue (billion), by Demographics 2025 & 2033

- Figure 29: Asia Pacific Dental Insurance Industry Revenue Share (%), by Demographics 2025 & 2033

- Figure 30: Asia Pacific Dental Insurance Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Dental Insurance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Europe Dental Insurance Industry Revenue (billion), by Coverage 2025 & 2033

- Figure 33: Europe Dental Insurance Industry Revenue Share (%), by Coverage 2025 & 2033

- Figure 34: Europe Dental Insurance Industry Revenue (billion), by Procedure 2025 & 2033

- Figure 35: Europe Dental Insurance Industry Revenue Share (%), by Procedure 2025 & 2033

- Figure 36: Europe Dental Insurance Industry Revenue (billion), by End-users 2025 & 2033

- Figure 37: Europe Dental Insurance Industry Revenue Share (%), by End-users 2025 & 2033

- Figure 38: Europe Dental Insurance Industry Revenue (billion), by Demographics 2025 & 2033

- Figure 39: Europe Dental Insurance Industry Revenue Share (%), by Demographics 2025 & 2033

- Figure 40: Europe Dental Insurance Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Europe Dental Insurance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Dental Insurance Industry Revenue (billion), by Coverage 2025 & 2033

- Figure 43: Middle East and Africa Dental Insurance Industry Revenue Share (%), by Coverage 2025 & 2033

- Figure 44: Middle East and Africa Dental Insurance Industry Revenue (billion), by Procedure 2025 & 2033

- Figure 45: Middle East and Africa Dental Insurance Industry Revenue Share (%), by Procedure 2025 & 2033

- Figure 46: Middle East and Africa Dental Insurance Industry Revenue (billion), by End-users 2025 & 2033

- Figure 47: Middle East and Africa Dental Insurance Industry Revenue Share (%), by End-users 2025 & 2033

- Figure 48: Middle East and Africa Dental Insurance Industry Revenue (billion), by Demographics 2025 & 2033

- Figure 49: Middle East and Africa Dental Insurance Industry Revenue Share (%), by Demographics 2025 & 2033

- Figure 50: Middle East and Africa Dental Insurance Industry Revenue (billion), by Country 2025 & 2033

- Figure 51: Middle East and Africa Dental Insurance Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Dental Insurance Industry Revenue billion Forecast, by Coverage 2020 & 2033

- Table 2: Global Dental Insurance Industry Revenue billion Forecast, by Procedure 2020 & 2033

- Table 3: Global Dental Insurance Industry Revenue billion Forecast, by End-users 2020 & 2033

- Table 4: Global Dental Insurance Industry Revenue billion Forecast, by Demographics 2020 & 2033

- Table 5: Global Dental Insurance Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Dental Insurance Industry Revenue billion Forecast, by Coverage 2020 & 2033

- Table 7: Global Dental Insurance Industry Revenue billion Forecast, by Procedure 2020 & 2033

- Table 8: Global Dental Insurance Industry Revenue billion Forecast, by End-users 2020 & 2033

- Table 9: Global Dental Insurance Industry Revenue billion Forecast, by Demographics 2020 & 2033

- Table 10: Global Dental Insurance Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Dental Insurance Industry Revenue billion Forecast, by Coverage 2020 & 2033

- Table 12: Global Dental Insurance Industry Revenue billion Forecast, by Procedure 2020 & 2033

- Table 13: Global Dental Insurance Industry Revenue billion Forecast, by End-users 2020 & 2033

- Table 14: Global Dental Insurance Industry Revenue billion Forecast, by Demographics 2020 & 2033

- Table 15: Global Dental Insurance Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Dental Insurance Industry Revenue billion Forecast, by Coverage 2020 & 2033

- Table 17: Global Dental Insurance Industry Revenue billion Forecast, by Procedure 2020 & 2033

- Table 18: Global Dental Insurance Industry Revenue billion Forecast, by End-users 2020 & 2033

- Table 19: Global Dental Insurance Industry Revenue billion Forecast, by Demographics 2020 & 2033

- Table 20: Global Dental Insurance Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Dental Insurance Industry Revenue billion Forecast, by Coverage 2020 & 2033

- Table 22: Global Dental Insurance Industry Revenue billion Forecast, by Procedure 2020 & 2033

- Table 23: Global Dental Insurance Industry Revenue billion Forecast, by End-users 2020 & 2033

- Table 24: Global Dental Insurance Industry Revenue billion Forecast, by Demographics 2020 & 2033

- Table 25: Global Dental Insurance Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Dental Insurance Industry Revenue billion Forecast, by Coverage 2020 & 2033

- Table 27: Global Dental Insurance Industry Revenue billion Forecast, by Procedure 2020 & 2033

- Table 28: Global Dental Insurance Industry Revenue billion Forecast, by End-users 2020 & 2033

- Table 29: Global Dental Insurance Industry Revenue billion Forecast, by Demographics 2020 & 2033

- Table 30: Global Dental Insurance Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dental Insurance Industry?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Dental Insurance Industry?

Key companies in the market include United concordia, Aetna, Delta Dental Plans Association, Metlife Services & Solutions, AFLAC Inc, Allianz SE, United HealthCare Services Inc, AXA, HDFC Ergo Health Insurance Ltd**List Not Exhaustive, Cigna, Ameritas Life Insurance Corp.

3. What are the main segments of the Dental Insurance Industry?

The market segments include Coverage, Procedure, End-users, Demographics.

4. Can you provide details about the market size?

The market size is estimated to be USD 117.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Efficient and Cost-Effective Healthcare Services.

6. What are the notable trends driving market growth?

Rising Awareness about Oral Health is Expected to boost growth of Dental Insurance Industry.

7. Are there any restraints impacting market growth?

Increasing Regulatory Scrutiny and Compliance Requirements.

8. Can you provide examples of recent developments in the market?

In June 2022, Bajaj Allianz collaborated with Allianz Partners to launch Global Health Care, to provide health coverage across the world. Global Health Care product offers one of the widest Sum Insured ranges available in the Indian market, which starts from USD 100,000 to USD 1,000,000. The product is available with two plans, namely 'Imperial Plan' and 'Imperial Plus Plan', which offer both International and Domestic Covers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dental Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dental Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dental Insurance Industry?

To stay informed about further developments, trends, and reports in the Dental Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence